Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ji Ji Ji Ji Ji Ji Ji

Caricato da

Monika WadhelDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ji Ji Ji Ji Ji Ji Ji

Caricato da

Monika WadhelCopyright:

Formati disponibili

http://www.dnb.co.in/smes/future%20outlook.

asp

The division of production processes and outsourcing among global automobile manufacturers has led to a major reorganisation of the supply base within the automobile and auto component industry. This new business model being followed by global companies holds tremendous potential for the growth of small and medium enterprises (SMEs) in India. Defining SMEs A well-debated issue, the definition of small and medium enterprises in India was very recently ratified. The Micro, Small and Medium Enterprises Bill, 2006, which is likely to take effect from October 2006, define the segment on the basis of investments in plant and machinery. Small enterprises are those with an investment of not more than Rs 50 mn in plant and machinery, and medium enterprises with an investment of over Rs 50 mn but less than Rs 100 mn in plant and machinery. This definition has finally put the segment within a legal framework. The traditional small scale industries have been in focus since Independence. The medium enterprises are recent entrants, and part of governments policy focus lately. The small scale segment is a manifestation of Indias socio-economic development model and has met with the countrys long-term expectations in terms of contribution to GDP, industrial base, employment and exports. This segment forms a major part of Indias industrial base. Recognising the importance of SMEs in the industrial development of the country, the Government has initiated a range of programmes in diverse areas, viz. financing, technology, innovation, market information, technical training and developmental assistance. These initiatives are important in facilitating the growth of the SMEs. But it will be the internal dynamics of industries, and the path Indias industrial development takes, that will give a thrust to the emergence of SMEs. The auto component industry is one such sector that would give a major boost to SMEs. SMEs in Auto Components Auto component SMEs are one of the fastest growing within the SME category of industries. These units are key contributors to the total production of auto components and also have a significant share in the exports of the industry. As part of a highly fragmented industry, these companies mostly are part of the unorganised sector. They operate in a tier framework, and most of the companies in the SME segment are in the Tier II or below. Few of the suppliers to OEMs are medium scale enterprises. The SMEs are riding a boom phase, driven by demand from global auto manufacturers. The industry is undergoing a major restructuring and many existing companies are expected to move up in the value chain to a higher tier. Nevertheless, sustenance and survival still remains an issue of concern for these companies as they will have to absorb global best practices in this competitive environment.

Cost competitiveness, customer orientation, lead time, are some key factors the auto component SMEs will have to imbibe to survive in the new global set-up. At the same time, these companies face the limitations of being SMEs, like

y y y y y y y

Low capital base Limited generation of surplus funds for re-investment due to tight working capital cycle Lack of awareness of business opportunities Inadequate exposure to international environment Limited geographical diversity of markets Obsolete Technology Poor infrastructure facilities

Despite these limitations, the SMEs have managed to significantly contribute towards development of Indias industrial base. The key risks that the auto component SMEs faces include:

y y y y

Fluctuations in the cost of production; especially raw materials like steel, aluminium, polymers Poor negotiation powers due to fragmented nature of industry; which in turn limits their pricing power Dependence on traders and agents to access overseas markets which threatens their competitiveness Product substitutes due to fast-changing technology

Addressing these challenges and risks will be crucial to promoting SMEs in the auto component industry. The government has initiated cluster-based development geographical concentration of enterprises having similar lines of business which gives rise to external economies and favours emergence of specialised technical, administrative and financial services. This form of networking of small firms is a means of achieving economies of scale. Extending this intitiative further, the government is encouraging banks to adopt a cluster-based lending approach to ease availability of funds to SMEs.

Multinational automobile manufacturers like Magna International of Canada, Delphi and Ford of US and some European companies have announced plans to enter the Indian markets. This bodes well for the auto component industry as it would enable the collective development auto component SMEs. This will bring in better technology, skills, new products and an assured market. Strategic tie-ups and contract manufacturing is another way forward for SMEs in the auto component industry. Looking forward, it is the best of times for Indian auto component manufacturers. The outlook for the industry is bright and is expected to continue on a high-growth trajectory for the next 10 years. Capitalising on this growth prospect will mean keeping pace with global developments and imbibing capabilities that will give an edge to Indian SMEs in surviving this rapidly changing competitive environment. Auto Component Clusters in India State No. Andhra Pradesh 1 Delhi 1 Gujarat 5 Haryana 3 Jharkhand 1 Karnataka 2 Maharashtra 5 Madhya Pradesh 1 Punjab 4 Tamil Nadu 1

Overview of auto mobile industry

he Indian auto component industry has been navigating through a period of rapid changes with great lan. Driven by global competition and the recent shift in focus of global automobile manufacturers, business rules are changing and liberalisation has had sweeping ramifications for the industry. The global auto components industry is estimated at US$1.2 trillion. The Indian auto component sector has been growing at 20% per annum since 2000 and is projected to maintain the high-growth phase of 15-20% till 2015. The Indian auto component industry is one of the few sectors in the economy that has a distinct global competitive advantage in terms of cost and quality. The value in sourcing auto components from India includes low labour cost, raw material availability, technically skilled manpower and quality assurance. An average cost reduction of nearly 25-30% has attracted several global automobile manufacturers to set base since 1991. Indias process-engineering skills, applied to re-designing of production processes, have enabled reduction in manufacturing costs of components. Today, India has become the outsourcing hub for several global automobile manufacturers. Innovation and cost pruning hold the key to meeting the global challenge of rising demand from developed countries and competition from other emerging economies. Several large Indian auto component manufacturers are already gearing to this new reality and are in the process of substantially investing in capacity expansion, establishing partnerships in India and abroad, acquiring companies overseas and setting up greenfield ventures, R&D facilities and design capabilities. Some leading manufacturers of auto components in India include Motor Industries Company of India, Bharat Forge, Sundaram Fasteners, Wheels India, Amtek Auto, Motherson Sumi, Rico Auto and Subros. The Indias Top 500 Companies, published by Dun & Bradstreet in 2006, listed 22 auto component manufacturers as top companies in India with a total turnover of US$ 3 bn. These companies are in the process of making a mark on the global arena, and some have already acquired assets abroad. Industry Structure The total turnover of the Indian auto component industry is estimated at US$9 bn in 2006. The industry has the resources to manufacture the entire range of auto products required for vehicle manufacturing, approximately 20,000 components. The entry of global manufacturers into India during the 1990s enabled induction of new technologies, new products, improved quality and better efficiencies in operations. This in turn effectively acted as a catalyst to the local development of the component industry. The Indian auto component industry is extensive and highly fragmented. Estimates by the Department of Heavy Industries, Government of India, indicate there are over 400 large firms who are part of the organised sector and cater largely to the Original Equipment Manufacturers (OEMs). Another 10,000 firms exist in the unorganised sector that operates in a tier-format. The firms in this segment operate in low technology products and cater to Tier I and Tier II suppliers and also serve the replacement market Around 4% of the companies operating in the auto component segment cater to 80% of the demand emanating from OEMs. Within the unorganised segment, apart from supplying in the aftermarket, a number of players are also involved in job work and contract manufacturing.

Source: ACMA

The range of products manufactured, with each broad product segment having a different market structure and technology, has negated any possible concentration of the market in a few hands. The market is so large and diverse that a large number of players can be absorbed to accommodate buyer needs. However, there are a select few large companies that have integrated their operations across the value chain. The key to competing in this industry is through specialisation by product-type, and integrating operations across the related area of specialisation. An interesting insight provided by a study conducted by the National Council of Applied Economic Research revealed that the market segments for auto components included OEMs constituting 33%, local components having 25% with the balance 42% comprising of spurious market including re-conditioned parts. A large part of the spurious or grey market companies are in the unorganised sector. The regional base of auto component manufacturers is mostly concentrated in the West, North and South of India.This regional concentration of auto component manufacturers has been dictated by the emergence of automobile manufacturers in these regions. The set up of Tata Motors, Bajaj, Mahindra & Mahindra and TVS in the 1950s and 1960s laid the foundation for auto component manufacturers in the West and South, whilst the entry of Maruti during the 1980s created the base in the North. Industry Growth Production of auto ancillaries was estimated at US$10 bn in 2005-06 and has been growing at a robust 20% per annum since 2000. Exports of auto components have been strong growing at 24% per annum since 2000. This growth in exports if sustained for another five years will see Indias auto components exports will touch US$ 5 bn by 2011 from the US$ 2 bn at present. Till the 1990s, the auto component industry was solely dependent on the domestic automobile industry to drive the demand for ancillary products. This composition of the market however is undergoing radical changes with global outsourcing gaining momentum. In recent times, exports has emerged as a significant driver of growth, and the demand emanating from global OEMs and Tier I manufacturers has opened new opportunities for the auto component industry in India. At the same time, a bright outlook for the domestic automobile industry also offers significant growth potential, given the fast rising income levels with a rapidly growing middle and high income consumers. Share of exports in total production has risen from 10% in 1997 to 18% in 2006. The composition of exports in terms of the proportion of OEM and aftermarket has also undergone a sweeping change since the past decade. The ratio of OEM to aftermarket has changed from 35:65 in the 1990s to 75:25 in 2006. While exports have been booming, there has been a sharp rise in imports of auto components as well, especially in the last three years. From an import of US$ 250 mn in FY03, they have gone up to US$750 mn in FY06. This is a healthy trend, indicative of rising domestic demand.

Investments Since 2000, the auto component industry has recorded an investment level of Rs 18 bn and has attracted US$ 530 mn in terms of foreign direct investment. Investments in the sector have been growing at 14% per year. In 2005-06, investments touched US$ 4.4 bn, and are expected to grow significantly in future. The Investment Commission has set a target of attracting foreign investment worth US$ 5 bn for the next five years to increase Indias share in the global auto components market from the present 0.4% to 3-4%. This is a sizeable target considering the meagre amount of FDI currently coming into the industry. The changing perception of global auto makers is however fast altering this scenario. With less than 1% share in the global market, India has tremendous potential to emerge as a supply base. Several global giants like Ford and Toyota have already set up base in India to source auto components. Outsourcing is fast catching up with domestic OEMs as well, with most Indian OEMs today sourcing nearly 70-80% of their component requirements from vendors. This changing business scenario is leading to an inevitable outcome of consolidation within the industry. The takeover of Kar Mobiles by Rane Engine and of Gero Auto by Uma Precision are few instances. However, such mergers and takeovers will be few and far in between in the auto component industry, unlike the churn out anticipated in other emerging industries the principal factor being the vastness of the market and the range of products that need to be delivered. Rather than domestic consolidation, the general trend at present is for the large auto component manufacturers to establish a global presence. Top auto component manufacturers have already set up base in the global markets, especially in Europe. Overall, there have already been 16 acquisitions, with six made in 2005. The industry is the third highest among the Indian industries after IT and Pharma, in acquiring overseas assets. These acquisitions have largely been in Europe and the USA. This trend has been possible as the auto ancillary industry in these countries have been collapsing, thus making it affordable to acquire these companies. Nevertheless, this will provide a base for Indian companies to access the European and American markets. Indian auto component companies are also setting up bases in other emerging economies, who are potential competitors, for instance, Sundaram Fasteners greenfield facility in Zhejiang and Bharat Forges joint venture with the Chinese automotive major FAW Corporation. Another auto component manufacturer with plans to enter China is PMP Components, which intends to set up a sourcing base to establish itself as a low cost supplier. These trends are indicative of the changing business environment in the country. Top auto component manufacturers are gearing to take big risks. Their cross-border vision has established them as global companies. Though the going-global phenomenon is limited to a handful of companies, the smaller companies are also indirectly gearing to this trend by entering into formal manufacturing contracts and specialisation.

Prospects Looking forward, the industry displays tremendous potential in generating employment and boosting entrepreneurship in the country. The spate of new investment plans announced by global and domestic automobile manufacturers promises the emergence of India as a global hub for auto components. The industry is transforming, and the boost in demand will see the emergence of several new players in the industry. The vast market for auto components, and the diverse products and technology involved ensures a place and role for many. At the same time, the entry of several global automobile manufacturers will bring in more regulation into the industry and see a pruning of the spurious market. Among the smaller players in the unorganised segment, this implies moving away from being standalone companies, to entering into either contract manufacturing or being ancillary units. The newly defined rules are specialisation, development and delivery that hold the key to success in the auto component industry. Foreign Acquisitions by Indian Companies Acquired Carl Dan Peddinghaus CDP Aluminiumtechnik Federal Forge Imatra Kilsta AB Scottish Stampings Ltd WOCO Group G&S Kunststofftechnik GmBH GWK New Smith Jones Inc Zelter Bleisthal Produktions GmBH Cramlington Forge CDP GmBH Shakespeare Forgings RBI Autoparts SND BHD Fuji Autotech

Indian Company

Country Germany Germany USA Sweden Scotland Germany Germany UK USA Germany Germany UK Germany UK Malaysia France

at Forge

erson Sumi

k Auto

aram Fasteners

rge Autolec Koyo

Source: Auto Component Manufacturers Association

Future Outlook

Current trends indicate a smooth run for the auto component industry. In fact, since 2000, this is one sector which has made a global mark and has been identified as a sunrise industry. The industry is transforming from being highly domestic-centric, to a force ready to face global competition.

The factors that will drive growth for the auto component industry are:

The growth expected in the domestic automobile industry will give a fillip to the auto component sector. The Indian automobile industry offers great potential considering the low penetration along with rising income levels and a rapidly growing middle class. These factors will see a boost in demand for vehicles, especially passenger cars and two wheelers. These two segments are estimated to grow at between 10-12% for at least the next five years. The entry of global OEMs, making India as their manufacturing base, has given a big boost to the industry. For instance, Skoda plans to source parts for its European operations from its Indian base and raise indigenisation level for Indian models to 70%. This trend has also enabled Indian companies to gain a competitive edge in the global market. Further, the model of cluster-based development prominent in this sector will provide economies of scale. Export of automobiles has also emerged as a key component of growth. Rising exports of Indian-made vehicles like M&Ms Scorpio model, Bajaj Autos Bikes, Tata Motors City Rover are indirectly increasing the demand for Indian auto components. Also, the export of India-made models of global OEMs like Hyundais Santro Xing and Suzukis Alto has given a boost to the industry. De-regulation and the Governments policy initiatives have facilitated growth and focus has now shifted towards attracting foreign direct investments. Also, the Governments initiative towards road development will give a boost to demand for vehicles and indirectly auto components. The Governments initiatives towards opening up channels of finance. Investments coming in for research and development will keep the industry abreast of the latest technology.

y y y

Entry of global OEMs has transformed the Indian automobile and auto components landscape. India is being perceived as a major market for cars and two wheelers by global OEMs. Before the end of 2006, at least 30 new car models are expected to be launched by foreign OEMs. These factors portend a robust auto ancillary industry in India and the overall expected good growth will provide several opportunities for the emergence of new enterprises. Extending their reach to global markets is the pre-dominant outlook among the top auto component manufacturers in the country. The vision to compete globally comes from the inherent strengths the Indian auto component industry possesses. Some features are:

y y y y y y y

Cost reduction of 25-30% in production in the domestic market compared to overseas Low labour costs Designing, engineering and technical skills Established quality systems Availability of raw materials Adaptability to new technology Investments in research and development, coming in from global OEMs. This stands out positively in favour of India. Key players are not only willing to invest in R&D but also in mechanical and engineering operations. These investments are expected to increase in the near future

Though India rides on these inherent strengths, a few risks exist that the auto component manufacturers may have to confront.

y y y y

A global slowdown can derail the prospects of the industry. Volatility in the prices of metals and other inputs could erode the industrys cost competitiveness. Further, global OEMs expect a commitment of 5-10% reduction in prices every year. Tier I manufacturers taking up greenfield projects overseas. Intense competition from counterparts in other emerging economies may add pressure on margins of manufacturers.

The Indian auto component industry is poised for robust growth till 2010. There is a perceptive exuberance in the industry and growth estimates indicate a booming industry. Going by current trends in production and exports of auto components, indicate a doubling of the domestic auto component industry by 2010. The production of auto components could grow to US$22 bn by 2010. Similarly, Indias exports of auto components could grow to US$4.5 bn as compared to US$1.8 bn in 2005. Expected growth in production and exports of auto components is shown in the graphs below.

This growth outlook implies opportunities for the small and medium enterprises. The overall trend is encouraging, but remaining competitive in this changing scenario will be the toughest challenge. The combination of low manufacturing costs along with quality systems would give an edge to companies in terms of pricing and quality. Expansion and diversification will help break into new markets. It would be imperative for these companies, which are largely based on traditional management practices, to imbibe technology in a big way. The SMEs can exploit these opportunities through joint ventures, collaboration and technical tie ups. Knowledge, specialisation, innovation and networking will determine the success of the SMEs in this globally competitive environment.

http://www.msmefoundation.org/DSR_temp/Diagnostic%20Study%20Report%20of%20Auto%20Comp onent%20Cluster%20Chennai.pdf http://acmainfo.com/pdf/Status_Indian_Auto_Industry.pdf http://acmainfo.com/pdf/Industry-Statistics_23092011.pdf http://www.indialawoffices.com/pdf/autocomponentsindustry.pdf http://www.ihdindia.org/Formal-and-Informal-Employment/Paper-6-The-Development-of-AutoComponent-Industry-in-India.pdf http://www.smera.in/smera_pdf/RATING%20CRITERIA%20FOR%20DIFFERENT%20INDUSTRY/RATING% 20CRITERIA%20FOR%20AUTO%20ANCILLARY%20INDUSTRY.pdf

Potrebbero piacerti anche

- Handstar Incl Case SolutionDocumento3 pagineHandstar Incl Case SolutionKundan Kumar100% (1)

- Case 2 Han-Solar-And-The-Green-Supply-Chain-CaseDocumento13 pagineCase 2 Han-Solar-And-The-Green-Supply-Chain-CaseGaurav Dm50% (2)

- HRM 4112 ReportDocumento31 pagineHRM 4112 Reportvijay_dalvoyNessuna valutazione finora

- RESEARCH-METHODOLOGY Tata Motors Assignment 1Documento15 pagineRESEARCH-METHODOLOGY Tata Motors Assignment 1Subham Chakraborty100% (1)

- Marketing Strategy of Maruti SuzukiDocumento87 pagineMarketing Strategy of Maruti SuzukiSaurabh Lohal82% (17)

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationDa EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationNessuna valutazione finora

- Kibor (Karachi Interbank Offered RateDocumento25 pagineKibor (Karachi Interbank Offered Ratemateenyunas100% (1)

- AutoDocumento5 pagineAutoVed PrakashNessuna valutazione finora

- Automobile SectorDocumento27 pagineAutomobile Sectorme_snowwhiteNessuna valutazione finora

- Research Paper On Automobile Industry in IndiaDocumento4 pagineResearch Paper On Automobile Industry in Indiac9spy2qz100% (1)

- Auto Ancilary Macro ReportDocumento88 pagineAuto Ancilary Macro ReportAdersh Ar Dahiya100% (1)

- History and Development of Amul Indusries Pvt. Ltd.Documento79 pagineHistory and Development of Amul Indusries Pvt. Ltd.asn8136Nessuna valutazione finora

- Research Paper On Auto Component IndustryDocumento5 pagineResearch Paper On Auto Component Industryvevuf1zad1w2100% (1)

- Dissertation On Automobile Industry in IndiaDocumento6 pagineDissertation On Automobile Industry in IndiaCustomPaperWritingSingapore100% (1)

- Amtek India LTDDocumento8 pagineAmtek India LTDShochis NatrajanNessuna valutazione finora

- Project Final YearDocumento79 pagineProject Final YearTamil film zoneNessuna valutazione finora

- Auto Component Sector Report: Driving Out of Uncertain TimesDocumento24 pagineAuto Component Sector Report: Driving Out of Uncertain TimesAshwani PasrichaNessuna valutazione finora

- Indian Automobile Industry Research PaperDocumento8 pagineIndian Automobile Industry Research Paperjpccwecnd100% (1)

- Equity Valuation - Case Study 2Documento5 pagineEquity Valuation - Case Study 2sunjai100% (6)

- Automobile Industry in India Has Witnessed A Tremendous Growth in Recent Years and Is All Set To Carry On The Momentum in The Foreseeable FutureDocumento7 pagineAutomobile Industry in India Has Witnessed A Tremendous Growth in Recent Years and Is All Set To Carry On The Momentum in The Foreseeable FutureMohammad HasanNessuna valutazione finora

- Imperial Auto SoroutDocumento84 pagineImperial Auto SoroutGaurav100% (1)

- Auto#Documento7 pagineAuto#Amit BishtNessuna valutazione finora

- Porter's Five Forces Model On Automobile IndustryDocumento6 paginePorter's Five Forces Model On Automobile IndustryBhavinShankhalparaNessuna valutazione finora

- Customer Preference On Honda CarsDocumento74 pagineCustomer Preference On Honda Carsselvi abraham100% (1)

- Aditya NewDocumento72 pagineAditya NewShanthkumar Ramakrishnaiah100% (1)

- A Seminar Report On "Automobile Sector of India"Documento33 pagineA Seminar Report On "Automobile Sector of India"Mohammad Anwar Ali100% (1)

- S I: F C G C: Arindam Banerjee Muzaffar Jamal Dheeraj AwasthyDocumento31 pagineS I: F C G C: Arindam Banerjee Muzaffar Jamal Dheeraj AwasthyOsama AshrafNessuna valutazione finora

- Sector Has Registered A Steady Growth in The Past Few YearsDocumento13 pagineSector Has Registered A Steady Growth in The Past Few Yearsprasadpatil717466Nessuna valutazione finora

- Auto MobileDocumento44 pagineAuto MobileSanjay PatelNessuna valutazione finora

- Summer Project Report To CollegeDocumento52 pagineSummer Project Report To CollegeVenkatraman NarayananNessuna valutazione finora

- Tata Motors Analysis PDF NewDocumento23 pagineTata Motors Analysis PDF NewAlay Desai73% (11)

- Industry AnalysisDocumento38 pagineIndustry AnalysisIbrahim RaghibNessuna valutazione finora

- Literature Review of Automobile Industry in IndianDocumento8 pagineLiterature Review of Automobile Industry in Indiankikufevoboj2Nessuna valutazione finora

- 10 Chapter2 PDFDocumento54 pagine10 Chapter2 PDFModi HaniNessuna valutazione finora

- Company: BOSCH INDIA: STM Assignment WorkbookDocumento55 pagineCompany: BOSCH INDIA: STM Assignment WorkbookSiddharth SharmaNessuna valutazione finora

- Exide Industries Equity Research ReportDocumento9 pagineExide Industries Equity Research ReportAadith RamanNessuna valutazione finora

- Financial Analysis of Maruti Suzuki, Tata Motors and Mahindra and MahindraDocumento7 pagineFinancial Analysis of Maruti Suzuki, Tata Motors and Mahindra and MahindraGarry JosanNessuna valutazione finora

- Automobile Industry in India - Marketing ChallengesDocumento21 pagineAutomobile Industry in India - Marketing ChallengesAnkit VermaNessuna valutazione finora

- Customer Satisfaction at ToyotaDocumento65 pagineCustomer Satisfaction at ToyotaMahendra KotakondaNessuna valutazione finora

- Automobile Industies IndiaDocumento4 pagineAutomobile Industies IndiaSharath RaoNessuna valutazione finora

- Acma & KPMGDocumento28 pagineAcma & KPMGShivanshuNessuna valutazione finora

- Car Market in India - KPMGDocumento36 pagineCar Market in India - KPMGAvinash VermaNessuna valutazione finora

- The Major Players OF Automobile SectorDocumento10 pagineThe Major Players OF Automobile SectorAkash MalikNessuna valutazione finora

- Issues and Challenges in The Indian Auto Component Industry With Special Reference To Indo Thailand FtaDocumento12 pagineIssues and Challenges in The Indian Auto Component Industry With Special Reference To Indo Thailand Ftagurdishpal9275Nessuna valutazione finora

- Final ProjectDocumento37 pagineFinal ProjectAnmolDhillonNessuna valutazione finora

- Indian Forging Industry IframeDocumento6 pagineIndian Forging Industry IframeshwetabajpaiNessuna valutazione finora

- A Study of Organization at Supram Industries: Industry ProfileDocumento30 pagineA Study of Organization at Supram Industries: Industry Profilepradeep100% (1)

- Porter's Diamond ModelDocumento2 paginePorter's Diamond ModelRana ChowdhuryNessuna valutazione finora

- Hyundai SantroDocumento80 pagineHyundai Santrob6_50258983050% (2)

- Case Study - Business Economics Semester - 1Documento24 pagineCase Study - Business Economics Semester - 1bharti_26dubeyNessuna valutazione finora

- Report On Automobile IndustryDocumento16 pagineReport On Automobile IndustryDivyansh KaushikNessuna valutazione finora

- Vision 2020 Press ReleaseDocumento5 pagineVision 2020 Press Releaseabhi006iNessuna valutazione finora

- Market Adaptation of Volkswagen PoloDocumento36 pagineMarket Adaptation of Volkswagen PoloRohit Sopori100% (1)

- A Project Report On TaTa MotorsDocumento73 pagineA Project Report On TaTa Motorsrannvijay singh chauhanNessuna valutazione finora

- Automotive Perspective - 2012 and Beyond: The India OpportunityDocumento2 pagineAutomotive Perspective - 2012 and Beyond: The India OpportunitySameer SamNessuna valutazione finora

- Tata Motors Summer Training Report PDFDocumento98 pagineTata Motors Summer Training Report PDFMohd SalmanNessuna valutazione finora

- Project ReportDocumento69 pagineProject ReportAdnan MadiwaleNessuna valutazione finora

- Tata Motors (Futuristik Group 5 A)Documento23 pagineTata Motors (Futuristik Group 5 A)Deepak ThakurNessuna valutazione finora

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportDa EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNessuna valutazione finora

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItDa EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNessuna valutazione finora

- GPA Lecture 1 2023 PostDocumento56 pagineGPA Lecture 1 2023 PostLmv 2022Nessuna valutazione finora

- Irr - Ra 8800Documento37 pagineIrr - Ra 8800John Ramil RabeNessuna valutazione finora

- Solutions Manual Chapter Twenty-Three: Answers To Chapter 23 QuestionsDocumento12 pagineSolutions Manual Chapter Twenty-Three: Answers To Chapter 23 QuestionsBiloni KadakiaNessuna valutazione finora

- Introduction To Management AccountingDocumento14 pagineIntroduction To Management AccountingKabad SinghNessuna valutazione finora

- Coca Cola Beverages BotswanaDocumento8 pagineCoca Cola Beverages BotswanaTshepiso RankoNessuna valutazione finora

- Tourism Development Programme Until 20201f3cDocumento90 pagineTourism Development Programme Until 20201f3cToma Anca-AndreeaNessuna valutazione finora

- Perencanaan Peningkatan Produktivitas Dan Efisiensi Siklus Produksi Operasi Penambangan Dengan Time and Motion Sumberdaya Pandeglang BantenDocumento7 paginePerencanaan Peningkatan Produktivitas Dan Efisiensi Siklus Produksi Operasi Penambangan Dengan Time and Motion Sumberdaya Pandeglang BantenMichaelNessuna valutazione finora

- Transport BillDocumento4 pagineTransport Billprashil parmarNessuna valutazione finora

- Ms KQC 1 GYQnisr W6 WDocumento2 pagineMs KQC 1 GYQnisr W6 WajitendraNessuna valutazione finora

- Chapter-4 English Agricultural-MarketDocumento29 pagineChapter-4 English Agricultural-MarketThach Nguyen Thi ThienNessuna valutazione finora

- Heritage International Public SchoolDocumento13 pagineHeritage International Public SchoolBKP KA CHELANessuna valutazione finora

- Build Your StaxDocumento1 paginaBuild Your StaxdesignexampreparationNessuna valutazione finora

- Assignment No 1Documento8 pagineAssignment No 1manesh1234Nessuna valutazione finora

- Correction of ErrorsDocumento15 pagineCorrection of ErrorsEliyah Jhonson100% (1)

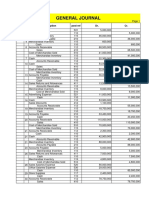

- General Journal: Description Post Ref Dr. Cr. DateDocumento14 pagineGeneral Journal: Description Post Ref Dr. Cr. DateRizki MuhammadNessuna valutazione finora

- CGQWDocumento29 pagineCGQWHemant SolankiNessuna valutazione finora

- Financial Statement Analysis Lenovo Final 1Documento18 pagineFinancial Statement Analysis Lenovo Final 1api-32197850550% (2)

- Amla PDFDocumento75 pagineAmla PDFKristine AbellaNessuna valutazione finora

- Cfa - 2020 - R22 - L2V3 - SS8 - Corporate Finance 2 - Corporate Governance and EsgDocumento32 pagineCfa - 2020 - R22 - L2V3 - SS8 - Corporate Finance 2 - Corporate Governance and EsgMarco RuizNessuna valutazione finora

- Iim Calcutta - Job Description Form: Name of The Firm ICICI Bank LTDDocumento2 pagineIim Calcutta - Job Description Form: Name of The Firm ICICI Bank LTDAmit KohadNessuna valutazione finora

- External Analysis: Customer AnalysisDocumento18 pagineExternal Analysis: Customer AnalysisSaron GebreNessuna valutazione finora

- Financial Markets AND Financial Services: Chapter-31Documento7 pagineFinancial Markets AND Financial Services: Chapter-31Dipali DavdaNessuna valutazione finora

- RT Unification Shareholder CircularDocumento357 pagineRT Unification Shareholder CircularLeon Vara brianNessuna valutazione finora

- Super Bowl LI - BDO Tax Impact AnalysisDocumento67 pagineSuper Bowl LI - BDO Tax Impact AnalysisLydia DePillisNessuna valutazione finora

- ACC 201 Cheat Sheet: by ViaDocumento1 paginaACC 201 Cheat Sheet: by ViaAnaze_hNessuna valutazione finora

- Financial Planning and Forecasting Due Apr 24Documento2 pagineFinancial Planning and Forecasting Due Apr 24ReyKarl CezarNessuna valutazione finora

- Make in India Advantages, Disadvantages and Impact On Indian EconomyDocumento8 pagineMake in India Advantages, Disadvantages and Impact On Indian EconomyAkanksha SinghNessuna valutazione finora