Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

International Business Transactions: Revere Copper Case

Caricato da

Tina HuDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

International Business Transactions: Revere Copper Case

Caricato da

Tina HuCopyright:

Formati disponibili

IBT Fall 2006 Professor Brand

INTERNATIONAL BUSINESS TRANSACTIONS

I. Introduction

Timeline of International Commercial Law Maritime laws recorded in tablets in Mediterranean Turn of 12th cent. Kings courts in UK claim jurisdiction over commercial law late 1600s Unsuccessful attempt at codified private intl law in the Netherlands 1874 South American Conference on Private International Law 1892 First Hague Conference on Private International Law 1893 UNIDROIT established by League of Nations 1926

1966 1975

Uniform laws on sale of goods and commercial contracts in 1964, 1994 UNCITRAL established by UN General Assembly Created CISG in 1980, effective 1988 Inter-American Conference on Private International Law (CIDIP)

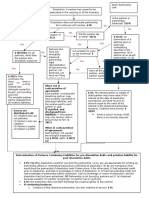

Transaction lawyer must identify, eliminate or reduce risks that occur due to: o Communication o Regulation o Transportation o fluctuation Types of protection from risk: o Institutional (national and international laws) US has 43 Friendship, Commerce & Navigation (FCN) Treaties; bilateral investment treaties in TOPCO case, recourse to international law in contract provided protection o Purchased (OPIC or Export-Import Bank insurance; Letter of credit) Revere Copper case o Negotiated (e.g. choice of law clause in contract)

II. Export-Import Transaction

A. Export-Import Contract Typical stages: 1. Seller delivers goods to carrier 2. Carrier gives seller bill of lading 3. S delivers bill of lading to Buyer 4. B pays S 5. B gives Carrier bill of lading 6. C delivers goods to B Documents in sales transaction: o Sales contract lists goods, price, estimated freight, insurance and customs clearance charges o Letter of credit lists documents seller must present to draw on account o Commercial invoice lists price-delivery term, goods (description & quantity) destination, price, all fees o Bill of lading 1

IBT Fall 2006 Professor Brand

o Insurance Policy or certificate o Draft prepared by seller, check written to seller which draws on letter of credit indicating amount to be paid to seller Incoterms 2000 Shipment Contracts: 1. ExWorks S places goods at Bs disposal at the factory/Ss premises o Buyer is both exporter and importer, responsible for freight, insurance, etc. 2. Free Alongside Ship (FAS) S delivers goods to quay; provides export license o this does create export-import contract o Risk passes when goods are placed alongside vessel o so if war breaks out and delivery costs rise, B assumes extra cost 3. Free on Board (FOB) S delivers goods on board vessel and obtains export docs o Risk passes when goods pass over ships rail o ONLY applies to sea-going vessels 4. Free Carrier (FCA) exactly like FOB term, but for non-sea transport 5. CIF S delivers goods on board vessel, pays freight & insurance o Risk passes when goods pass over ships rail; ONLY sea-going vessels o So if war breaks out and delivery costs rise, S absorbs extra cost 6. Carriage & Insurance Paid (CIP) exactly like CIF, but for non-sea transport o Risk passes when goods are placed in custody of carrier 7. Cost & Freight (CFR) S delivers goods on board and pays freight; B pays insurance o Risk passes when goods pass over ships rail 8. Carriage Paid To (CPT) exactly like CFR, but for non-sea transport Destination Contracts: 9. Delivered at Frontier (DAF) S places goods at Bs disposal at frontier o S responsible for discharging goods from vessel; B handles import docs o Designed for rail transport, but appropriate for ships and other forms 10. Delivered Ex Ship (DES) S delivers goods on board and pays freight & insurance o Risk passes when goods are on board ship when ship reaches usual unloading point o Only for sea transport 11. Delivered Ex Quay (DEQ) S delivers goods on board, pays freight & insurance o Risk passes when goods are placed at Bs disposal on quay; B is importer 12. Delivered Duty Paid (DDP) S does everything; risk passes when goods are placed at Bs disposal B. Documentary Sales Transaction Biddell Brothers v. E. Clemens Horst Co. (UK 1911) In a CIF contract, payment is due on delivery delivery of documents rather than goods Bs obligation to pay arises when S has fully performed in CIF contract, S has fully performed after delivering goods to carrier, paying for freight, buying insurance, and sending bill of lading to B o Property in goods passes when B has bill of lading o If goods are non-conforming, B can sue for breach of contract 2

IBT Fall 2006 Professor Brand

Majority in lower court cited common law ability to inspect goods before paying, holding B could pay on actual or constructive delivery o House of Lords relied on Kennedy dissent, which looked to English Sale of Goods Act Under UCC, payment is also required on delivery of documents o 2-320 for CIF; 2-319 for FOB and FAS Under CISG, most likely the same outcome (although UK isnt a party) o 58 says if B isnt bound to pay at a set time, he must pay for either goods or docs o Subsection (3) says B can inspect before paying, UNLESS procedures indicate otherwise CIF contract arguably indicates otherwise o Article 7 (2) allows principles of private international law to fill gaps o Article 9 deals with usage of trade How could B protect himself against non-conforming goods? o Require 3rd party inspector to provide certificate of quality o Write other provisions into contract (payment upon inspection) o Require sample sent in advance

Importance of document of title The Julia (UK 1949) Facts: Seller loads 1,200 tons of rye onto ship, obtains bill of lading, THEN makes CIF contract for 500 tons. B pays on receiving invoice and delivery order (b/c bill of lading wasnt appropriate here) which had to be signed and presented to various intermediaries before goods would be delivered. War breaks out and S redirects ship to Lisbon, sells rye there for lower price. B sues for breach of contract (failure of consideration), S says contract was frustrated. Rules: English Sale of Goods Act (contract made on London Corn Trade Assoc form) App: A document of title doesnt have to be a bill of lading, but in this case, B never received a real document of title. What they received didnt entitle them to possession of goods. If the delivery order could have been presented directly to captain in exchange for goods, it would have been a valid document of title. In this case, it offered neither actual nor symbolic delivery. Con: Buyer gets a full refund, because this was a destination contract rather than a CIF contract, and there was a total failure of consideration. Under CISG, Articles 67 (2) and 68 apply UCC 2-401 (2) title passes to B at time and place where S completes performance with reference to physical delivery of goods, even though document of title is delivered at a different time o (b) if contract requires delivery at destination, title passes on tender there o So consideration would have failed here, too

C. Consequences of Non-Performance 1. Excuse for Non-Performance

IBT Fall 2006 Professor Brand

ESGA 32(2): if seller doesnt make reasonable arrangements to deliver and goods are lost, buyer can refuse to pay or get damages from seller UCC 2-615: delay or non-delivery is not a breach if performance has been made impracticable by the occurrence of a contingency which was a basic assumption on which contract was made o Comment 4: increased cost alone doesnt excuse; severe shortage of raw materials or supplies due to war, etc. can be an excuse UCC 2-616: Buyer may terminate or modify contract if seller notifies him of delay CISG Art. 79: no liability for 1) impediment 2) beyond partys control 3) that he couldnt reasonably have been expected to take into account when K was made and 4) couldnt have overcome or avoided Tsakiroglou & Co. v. Noblee Thorl (HoL 1962) - breach of contract where occupation of Suez Canal caused seller to cancel CIF contract instead of shipping through Cape of Good Hope, even though it was 7,000 miles more (court uses ESGA) o Doctrine of frustration should be used in limited circumstances not in cases like this where performance was merely not profitable o No reason to conclude that delivery through Suez Canal was an implied term in the CIF contract Incoterms say sellers must contract by the usual route o As a CIF K, seller has already allocated for the risk by buying insurance and paying for freight Czarnikow v. Rolimpex (1979) acts of government were a force majeure that excused performance where Polish govt rescinded sugar sellers export license and prohibited export of sugar Berman strict construction approach: if parties want to be protected, they must write it into the contract o missing terms shouldnt be read into contract pursuant to liberalized excuse policy most transactions have already allocated the risk, even if not expressly o parties make contracts with open eyes and dont need the protection of a liberal excuse policy o when parties are from different legal systems, its better to rely on the contract Schlegel liberal excuse: parties often use form contracts that dont allocate risk, and they expect judges to be reasonable in dealing with terms they omitted o Narrow excuse policy keeps people out of international business o Most arbitrators prefer this approach

2. Damages for Breach Civil law looks to equity first, then to damages Volkswagen case UCC 2-708: sellers damages market price at time and place for tender UCC 2-713: buyers damages - market price at time buyer learned of breach, at place of tender market in which buyer would have obtained cover ESGA Art. 50: sellers damages when goods should have been accepted ESGA Art. 51: buyers damages when goods should have been delivered 4

IBT Fall 2006 Professor Brand

CISG Art. 76: market price at time of avoidance, at place where delivery of goods should have been made Seaver v. Lindsay Light Co. (NY 1922) in CIF London contract (from Chicago), damages determined by price of goods in the location where sellers performance was due here it was Chicago, where goods should have been given to carrier o Buyer argued it should have been at the same time but London price 3. Remedy for Breach Sharpe & Co. v. Nosawa & Co. (1917 KB) breach occurred when bill of lading/documents should have arrived, because its on that date that Ps would have learned of breach and purchased substitute goods o This case was under ESGA under CISG, it might have been determined by when goods would have arrived Seller should have required a letter of credit to determine where and when delivery occurred and performance was completed Cargill (10th Cir. 1977) damages measured at time performance is due, not when B learns of anticipatory repudiation UNCISG When does it apply? o Art 1: parties whose places of business are in 2 different states and (a) they are contracting states, OR (b) rules of private intl law lead to application of law of a contracting state Although UK isnt a party to CISG, CISG might govern contract between it and another state US has made an Art. 95 declaration not to be bound to Art. 1(b), preferring UCC Good choice of law clause: This K is governed by the CISG, to be supplemented by the PA UCC. o Art. 6: parties can exclude application by explicit statement: This K is governed by PA law and not the CISG. Otherwise, the CISG is part of PA law. o Art 10: if party has more than one place of business, place is that which has closest relation to contract or its performance o Art. 2: CISG doesnt apply to: goods for personal use stocks, shares, securities goods bought by auction ships, aircraft good bought on authority of law electricity Contract interpretation o Art. 8 (3): Parole Evidence Rule; reference to negotiations and practices which parties have established permissible o Art. 9: prior dealings and usage of trade relevant o Art. 11: no Statute of Frauds Art. 96: contracting state with SOF can declare that Art. 11 doesnt apply where any party has his place of business in that state o Art. 18(2): oral offer must be accepted immediately (unless circumstances indicate otherwise) 5

IBT Fall 2006 Professor Brand

Contract formation o Art. 14(1): Proposal is an offer if it indicates intent to be bound, indicates goods, and expressly or implicitly fixes or makes provision for determining quantity and price. o Mail Box Rule: Art 15 (1) offer effective when it reaches offeree; Art. 16 (1) offer revoked when revocation reaches offeree before offeree mails acceptance Art. 17: offer terminated when rejection reaches offeror Art. 18: acceptance effective when it reaches offeror Battle of the forms o Art. 19 (1): Reply that purports to be acceptance but contains additions, limitations or modifications is a counter-offer; o Art. 19(2) if different terms dont materially alter terms of offer, then its an acceptance Art. 19 (3): material terms relate to price, payment, quality and quantity of goods, place and time of delivery, extent of other partys liability to the other or settlement of dispute. Gap-Filling o Art. 7 (2): Questions not settled by UNCISG are settled by the law applicable by virtue of rules of private international law/ o Art. 9: reference to prior dealings and usage of trade. o Art. 55: When valid contract does not specify price then price generally charged at time of contract conclusion is implied. Remedies. o Art. 46: Specific Performance (limited by Art. 28); substitute goods; damages For damages, you must prove fundamental breach and notice of avoidance o Art. 49: avoidance (if theres a fundamental breach) o Art. 50: reduced price Delchi v. Rotorex (2d Cir. 1995) fundamental breach due to deliver of non-conforming goods justified damages of lost profits, expense of trying to fix product, cost of expediting replacement goods from 3rd party, cost of storage for rejected goods CISG applied b/c no choice of law clause o Art. 35(2): goods dont conform if they dont match sample o Art. 74: damages are losses suffered from breach American court decisions used to fill gaps

Letter of Credit Transaction Documentary Drafts exporter or rep. presents invoice w/ shipping documents attached to importer requesting payment of sum on presentation of draft (sight draft) or at particular time in future (time draft). o Clean draft no shipping documents attached to draft o UCC 3-104: must contain unconditional promise or order to pay sum to be valid Letter of credit protects seller against nonpayment and jurisdictional hassles o If buyer refuses to pay, its bank is a surety o After K is formed, B applies to bank for credit

IBT Fall 2006 Professor Brand

Bank investigates solvency, market for goods Asks sellers bank to notify seller of open credit

Seller (beneficiary)

Buyer (applicant)

Sellers bank (notifying bank) (confirming/advising)

Buyers bank (issuing/opening bank)

Confirmed LOC sellers bank is obligated to pay, even if buyer breaches revocable LOC opening bank can modify or cancel credit o under confirmed, irrevocable letter of credit, seller has virtually no credit risk LOC is assignable if it expressly states o S can also get second letter of credit drawing on first, prime LOC Standby LOC Buyer gets LOC to ensure Sellers performance (e.g. in a construction contract); non-performance lets B collect o Idea is that if contract is performed properly, B will never draw on it UCP - Uniform Customs & Practice for Documentary Credit (only applies if parties choose) o Art. 3: separate contract rule o Art. 6: if LOC doesnt indicate whether its revocable or irrevocable, presumption that it is irrevocable Art. 8: if LOC is revoked, issuing bank must reimburse another bank that has paid Art. 9(d): irrevocable LOC cant be amended or canceled w/o agreement between parties o Art. 7: advising bank shall take reasonable care to check the apparent authenticity of the Credit which it advises. o Art. 8: if LOC isnt confirmed, nominating bank has no liability Art. 14: if confirmed, issuing bank MUST PAY confirming bank that has paid o Art. 13: Strict compliance: docs that dont appear on their face to conform dont comply (bank has 7 days to examine) UCC is similar, but it favors buyers & sellers, where UCP favors banks o 5-301: separate contract rule o 5-106: presumption of irrevocability LOC expires after 1 year or after 5 years if perpetual 7

IBT Fall 2006 Professor Brand

o 5-108: issuer must honor presentation that appears on its face to strictly comply with terms of LOC strict compliance rather than substantial adopted Issuer shall observe standard practice of financial institutions Not responsible for usage of a particular trade (see comment 10) Judge determines whats standard practice Can dishonor for fraud or forgery Bank has reasonable time to examine documents (comm. 2) Issuer not responsible for underlying contract o 5-109: Fraud & forgery issuer shall honor presentation if made by a holder in due course Can dishonor acting in good faith Court can enjoin bank from honoring it o 5-111: Remedies Separate contract rule Urquhart Lindsay v. Eastern Bank, Ltd. Buyer told issuing bank not to pay increase in price, despite the fact that K and LOC provided for such an increase o It was an irrevocable LOC, and bank didnt have a legal choice to deny payment Maurice OMeara v. National Park Bank of NY absent provision in the LOC, bank didnt have the right to inspect goods before paying beneficiary Exception for fraud (common law) Sztejn v. Henry Schroeder Banking where the sellers fraud has been called to the banks attention before the drafts and documents have been presented for payment, the principle of the independence of the banks obligation under the LOC should not be extended to protect the unscrupulous seller. o Buyer sues its own bank to enjoin it from paying; court applies common law United Bank v. Cambridge Sporting Goods where fraud occurs, confirming bank that has already paid is entitled to payment if it is a holder in due course (no notice of fraud) Rockwell Intl. Systems v. Citibank (2d Cir. 1983) fraud exception applies to standby LOCs if party wanting to collect is holder in due course No explicit fraud exception in UCP NY has interpreted one o Some courts say separate contract rule is inviolate, w/ no fraud exceptions o CA rejected UCC provision authorizing a court to enjoin payment on LOC Strict Compliance o J.H. Rayner v. Hambros Bank (UK 1943) bank justified in refusing to honor sight draft b/c bills of lading described the nuts in a different way than contract did, even though everyone in the trade knew it was the same Bank has every right to demand strict compliance it doesnt know whether one term is equivalent to another Put risk on party best able to prevent it one who prepares bills of lading o Dixon, Irmaos & Cia v. Chase Natl Bank (2d Cir 1944) bank was wrong to refuse to pay b/c standard practice in financial institutions said discrepancies were okay Sight draft had almost expired and S didnt have all bills of lading, so it substituted with guarantee from another bank

IBT Fall 2006 Professor Brand

Didnt prepay freight, making it COD and subtracting price o Banco Espaol v. State Street Bank issuing bank was wrong to refuse to pay confirming bank on basis of certificates of inspection Inspectors practices were reasonable, and buyer shouldnt be able to whimsically destroy a transaction

III. Government Regulation of International Trade A. Import Regulation

Constitution Articles IV and VI are foundation gave central govt power to collect taxes, set a common external tariff o Tariff Act of 1789 passed to protect infant manufacturing industry and raise revenue for government o Later 16th Amendment (1913) income tax gave federal govt principal source of revenue o Fordney-McCumber Tariff Act of 1922 gave president authority to raise or lower tariffs by 50% o Smoot-Hawley Tariff Act of 1930 set very high tariffs, other countries responded in kind o 1934 Reciprocal Trade Agreements Act has been updated, still in force; authorizes president to negotiate reciprocity and set tariffs accordingly Multilateral System and GATT developed in 1947 o 1994 Uruguay round took away the a la carte nature of international trade, so youre a member of all or nothing; created WTO Structure of GATT/WTO: o Art. I: Most favored nation treatment All countries to be treated the same if you negotiate a lower rate or special agreement with one country, all must benefit o Art. II: schedule of concessions, focus on reducing trade barriers o Art. III: non-discrimination in terms of products internal taxes on foreign goods cant be more than tax on domestic goods o Art. XI: no quantitative restrictions or quotas o Uruguay Round in 1994: created WTO, General Agreement on Trade in Services (GATS), Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), and new Understanding on Rules and Procedures Governing Settlement of Disputes. o GATTs aim . . . is to preserve the balance of concessions and the balance of advantage and obligations between member countries, and not to resort to sanctions whenever a country is in breach of the rules. Where Europeans view GATT/WTO as a forum for dispute settlement, US views it as an adjudicative mechanism with dispute settlement as litigation

IBT Fall 2006 Professor Brand

Trade relief mechanisms in US law: (Uruguay round authorized countries to take domestic measures to enforce WTO) o Anti-dumping law you can petition government if youve been harmed o Subsidies/ Countervailing duties law o Section 301 unfair trade practices Anyone can file a petition with the US Trade Rep. on behalf of an industry Mandatory retaliation where GATT has been breached (rights are denied or act unjustifiable) Discretionary retaliation where act is unreasonable or discriminatory and burdens or restricts US commerce o Section 201 escape clause Relief when article is imported into US at such great quantities as to cause serious injury domestically Harley Davidson got relief from govt here o Section 337 IP protection Infringement means US customs officials restrict entry at border Current defining characteristics of US trade law & policy o Multilateral framework o Tariffs no longer a primary source of revenue for govt o President sets tariffs now, no longer Congress o Multilateral reduction of tariffs thru GATT, leading to focus on non-tariff barriers to trade o Continuing ability to justify system through comparative advantage theory US Regulation of the Import Transaction: Incorporates GATT, Art. 2 re: Tariffs o Duty depends on: Classification: Duties assigned to different categories of goods under HTSUS Valuation Country of Origin Type of Entry

B. US Regulation of the Export Transaction o Export Administration Act of 1949: authorizes export controls for purposes of national security, foreign policy, short supply (often extended by Pres through IEEPA) Extraterritorial effect: Sections 5-7 cover re-exports of goods of US origin President can prohibit or curtail the export of any goods or technology subject to the jurisdiction of the United States or exported by any person subject to the jurisdiction of the United States. Bases of prescriptive jurisdiction: Territoriality principle: extended through effects test Nationality principle Protective principle protects espionage, counterfeiting Passive personality principle Universality principle

10

IBT Fall 2006 Professor Brand

Sensor Nederland case (1983) person subject to the jurisdiction of the US is 1) any citizen or resident of US; 2) any person within US; 3) any corporation organized under laws of US; 4) any legal person, wherever organized, that is owned or controlled by anyone specified in 1-3 Dutch subsidiary of US company invoked US embargo on Russia in refusing to sell restricted goods to French buyer who planned to resell to Russia Court looked to treaty between US & Netherlands, public intl law o Nationality under treaty, company is Dutch, so no o territoriality sufficient effect on US territory? No based on territoriality principle, Dutch company cant refuse sale this was ultimately settled politically, with US owner contacting govt, who pulled the EAR requirement o Export licensing process: Regulations revised in 1993 so that not every export needs a license Administered by Bureau of Export Administration of Dept commerce Commerce Control List: is the product controlled? If so, look to . . . Country Chart: if export (or re-export) to this country needs a license, license is required o Very little multilateral cooperation or agreement on export control

IV. Professional Responsibility in Transnational Transactions

ABA Model Rules of Professional Conduct: o Deal only with litigation, not with transactional lawyers Pro hac vice is available in a single case that is litigated, but nothing similar for transactions o Disciplinary authority (Rule 8.5): lawyer admitted to practice in this jurisdiction is subject to its disciplinary authority regardless of where conduct occurs Paragraph b gives choice of law rules for determining which law governs o Rule 1.1: Lawyer must provide competent representation, requiring legal knowledge, skill & preparation This rule provides the fundamental test for interpreting every other rule ultimate goal is proper representation of client, and ancillary goals cant subordinate this Comment 2: A lawyer can provide adequate representation in a wholly novel field through necessary study. Competent representation can also be provided through the association of a lawyer of established competence in the field in question. Rule 1.8(h) duty of competence cant be waived by client (except in very limited circumstances) o Rule 5.5: a lawyer shall not practice in a jurisdiction where he is not admitted o Test for the proper rules: What is the obligation of the government and the profession to a client?

11

IBT Fall 2006 Professor Brand

Appell v. Reiner (NJ 1964)- Strict adherence to rules prohibiting the unauthorized practice of law by out-of-state attorneys would be grossly impractical and inefficient. Birbrower v. Supeior Court (CA 1998) - [T]he legal profession should discourage regulation that unreasonably imposes territorial limitations upon the right of a lawyer to handle the legal affairs of his client or upon the opportunity of a client to obtain the services of a lawyer of his choice. The primary inquiry is whether the unlicensed lawyer engaged in sufficient activities in the state, or created a continuing relationship with the California client that included legal duties and obligations. o Determining proper nexus for pro hac vice representation: Birbrower - New York lawyer engaged in unauthorized practice by representing California client in arbitration in California Court focuses on where activity took place Estate of Condon (CA 1998) - Colorado lawyer was okay when representing Colorado client in probate matter in California Court looks at clients location Fought v. Steel Engineering (HI 1998) - Oregon lawyer was okay when providing assistance for Oregon client in Hawaii litigation Client looks to duty of competence o Brands conclusions: Focus on any inquiry should be on competent representation of client Focus on applicable law should be more important factor than a formalistic focus on location of client or lawyer Lawyer who can prove competence should be able to practice foreign law when representing clients from his state or foreign clients within his state When parties choose arbitration forum, location of tribunal shouldnt be relevant in judging conduct of lawyer o Bottom line no clear rules.

V. Dispute Resolution in International Trade

When a dispute occurs, major questions that arise are: o Where is there jurisdiction to sue? (Choice of forum clause preferable) o Which law applies? (Choice of law clause preferable) o Will there be recognition and enforcement of judgment or arbitration award? Secondary question: foreign currency liabilities? o What happens when fluctuations of currency impact the bottom line?

A. JURISDICTION First, is there legislative/prescriptive jurisdiction (can state exercise its authority over the parties)? Second, is there judicial jurisdiction? o Subject matter jurisdiction by statute

12

IBT Fall 2006 Professor Brand

o Personal jurisdiction by contacts, long-arm statute General vs. specific (Helicopteros) PA statute reflects US Supreme Court jurisprudence exactly o General jurisdiction part (5301) says PA residents can be sued in PA regardless of where the issue in the case took place o Specific jurisdiction part ( 5322) gives a list of activities under (a), but this basically means nothing, because (b) says jurisdiction exists if its constitutional All you have to do is constitutional analysis Every foreign corporation will ask you to ensure that theyre never subject to suit in US courts is this possible? o set up a local subsidiary, based in PA, and THAT is subject to suit while the parent corporation isnt

1. US Jurisdictional analysis 1. Is there purposeful availment of the privilege of conducting activities within the forum state, invoking the benefits and protections of its laws? (Hanson v. Deckla) 2. Does the claim arise out of those purposeful activities? 3. Is jurisdiction over the defendant reasonable? (Worldwide Volkswagen) o Extent to which Ds availed themselves of privileges of American law o Was litigation in the US foreseeable to them? o How inconvenient is litigation in the US? o Countervailing interests of the US in hearing the suit? Helicopteros and Asahi say a foreign company cant be sued in a state where it has limited activity unless cause of action is closely connected to that activity Out-of-state partys contract with an in-state party isnt enough to establish required minimum contacts alone Rule 4(k)(2) Federal long-arm statute authorizes jurisdiction over a defendant in a claim arising under federal law if the person isnt subject to jurisdiction in any state United States v. Swiss Bank Ltd. (1st Cir 1999) To sue under 4(k)(2), P must make a prima facie case of 3 elements: Claim arises under federal law Personal jurisdiction isnt available thru any situation-specific federal statute Ds contacts with nation as a whole suffice to satisfy constitutional requirements o If P makes prima facie case, burden shifts to D to prove: it could be sued in 1+ specific states, OR its contacts with the US as a whole are insufficient o If D proves the former, P has 3 choices: Transfer action to state that has jurisdiction over D Drop the suit Contest Ds case

13

IBT Fall 2006 Professor Brand

2. Jurisdiction in EU Originally Brussels Convention, replaced in 2002 by Brussels Regulation US analysis focuses on relationship between forum state/court and D, while Brussels Convention analysis focuses on relationship between court and cause of action o Indirect jurisdiction approach when looking to enforce judgment that took place in another state, only question: was jurisdiction proper according to Convention or enforcing states standards? No question of whether jurisdiction was proper according to original courts standards o Direct jurisdiction approach; aka double treaty Treaty of Rome of EC, as part of four freedoms, said Member States would negotiate a treaty to enforce judgments across borders (present Article 293) o 1968 Brussels Convention was limited to judgments in civil and commercial matters (no arbitration) As a double convention, it included rules of direct jurisdiction o Treaty of Amsterdam amended Treaty of Rome to allow Council to adopt Regulations to this end (Article 63, 65) o Brussels Regulation of 2002 replaced Brussels Convention (although Iceland, Norway, Switzerland are still governed by a similar convention)

Brussels Regulation Chapter 2 Jurisdiction Article 2 General Jurisdiction: place of domicile determines o If US company is domiciled in EU, its subject, as citizenship isnt the key Section 2 Special Jurisdiction (specific) o Art 5 (1) - in matters relating to the contract, in the courts for the place of performance of the obligation in question ECJ says court where action is brought must 1) decide which law governs by applying its own rules of private international law and then 2) decide where place of performance is If multiple obligations, Court must choose most important Article 5 (1)(b) says place of performance is where goods are delivered/where payment occurs In a CIF contract, both sellers and buyers place of performance is in sellers country (delivering goods to ship) o Article 5(3) tort jurisdiction in matters relating to the tort . . . place where the harmful event occurred Bier v. Mines de Potasse dAlsace (ECJ 1976) held that this could be either the place where damaging act occurred or where it was felt Dutch company sued French company for polluting the Rhine in France, where the effects were felt downstream in the Netherlands Of most importance is the causal connection between the court and the claim the fact that either place (where event occurred or was felt) could establish this causal connection 14

IBT Fall 2006 Professor Brand

o o o

Under this analysis, there would have been jurisdiction in Worldwide Volkswagen Cases following Bier have sought greater protection for the defendant, with ECJ developing 3-part analysis: 1. General rule general jurisdiction in Ds state of domicile (Art 2) 2. Certain exorbitant, P-friendly jurisdictional statutes in Member states are not applicable in this treaty (Art 3) 3. All specific bases of jurisdiction must be restrictively construed Article 23: choice of forum honored (need not relate to dispute) Article 24: consent Compared to US rules: Focus on nexus between claim and court would violate Due Process in US courts, b/c Ds can be sued wherever court decides their performance was due Further reach on specific jurisdiction (where US law has further reach on general jurisdiction) No distinction between legal and natural persons in Brussels Regulation domicile is key No tag jurisdiction Brussels Reg protects 3 types of parties in terms of jurisdiction: Consumers (Art. 15-17) Insurers (Art. 8-14) Employees in individual employment contracts (Art. 18-21) Exclusive jurisdiction (Art. 22) When analyzing a case under the Brussels Regulation: Is there exclusive jurisdiction? (Art 22) Is Ds domicile in EU? (Art 3) Is the case an insurance, consumer contract or employer contract clause? Is there a prorogation clause (Art. 23, 13, 17, 21)? If none of the above, at Ps option apply: Art 2 suit a Ds domicile Art 5 rules of special jurisdiction Art 6 rules for multiple Ds

UK Long-arm statute jurisdiction when: D is domiciliary Ds acts have effects within jurisdiction D is a necessary or proper party to the case Case based on a contract made within jurisdiction, made by agent trading/residing in jurisdiction, or that is subject to English law In rem case deals with land in jurisdiction, deals with property in a will in jurisdiction Claim is brought to enforce a judgment Hague Convention on Choice of Court Agreements Drafted in 2005, US is considering ratification 3 basic rules: 15

IBT Fall 2006 Professor Brand

o Art. 5: The court or courts of a Contracting State designated in an exclusive choice of court agreement shall have jurisdiction to decide a dispute to which the agreement applies, unless the agreement is null and void under the law of that State o Art. 6: a court of a Contracting state that wasnt designated should suspend proceedings, unless: Agreement is null & void under chosen courts state law Party lacked capacity to contract under law of state of court seised Injustice or bad public policy results Agreement cant be performed due to force majeure Chosen court has decided not to hear case o Art. 8: judgment by designated court of contracting state shall be enforced w/o examining merits o Optional 4th Rule: Art 22 reciprocal declarations on non-exclusive choice of court agreements Additional provisions: o Art. 1 Scope: 1) intl cases, 2) exclusive choice of ct agreements, 3) civil & commercial matters Case is NOT intl if parties are from same state and all elements of dispute are related to that state o Art. 3(b) designated court is deemed exclusive unless otherwise specified o Art. 9: recognition can be refused if: Same as Art. 6, plus 1) D didnt receive notice, 2) judgment obtained by fraud, 3) judgment inconsistent with one already given o Art. 19: court can refuse jurisdiction if it has no connection with case or parties (to protect certain countries for being dumping grounds for cases) o Art. 20: court can refuse to enforce judgment if case should have been brought there originally Party autonomy is the rule unless an exception is present (Arts. 5, 6, 9)

B. Choice of Law Party autonomy rule law chosen by the parties will usually be applied (with some limitations) o No scheme gives parties complete freedom to choose e.g. there must be a nexus between contract and law chosen o 2 problems with this: 1) parties may select a law that invalidates all or part of contract, 2) its not truly autonomous if theres always an unless Validation rule the law that validates will be applied unless . . . Tzortzis v. Monark Line (House of Lords 1968) if you choose an arbitration forum without choosing a law, court will imply that you chose the law of the place of arbitration Choice of law clauses in statutes UCC 1-105: when a transaction bears a reasonable relation to this state and also to another state or nation the parties may agree that the law either of this state or of such other state or nation shall govern their rights and duties 16

IBT Fall 2006 Professor Brand

o New 1-301 distinguishes between 1) merchant contracts and consumer contracts and between 2) domestic and international contracts o Gets rid of reasonable relationship test for business to business contracts, using a mandatory rule as default o Saves reasonable relationship test for consumer contracts so the distinction is important; consumers dont get as much protection as merchants Restatement of Conflict of Laws (Second) 187: parties choice will be respected unless 1) chosen state has no substantial relationship to the parties or transaction and theres no reasonable basis for this choice, or 2) application of that states law is contrary to public policy of a state with a greater interest EC Convention on Law Applicable to Contractual Obligations Article 3 mandatory rules doctrine if all elements relevant to situation are connected with one country, choice of law in another country wont preclude applying the mandatory rules of the country with the connection (cant contract out of mandatory rule) o Article 4 - Applicable Law in Absence of Choice: governed by law of country with which it is most closely connected; presumably where party who is to effect performance has principle place of business CISG: Article 1 (1)(b) means that if 2 parties from different states use the law of a contracting state as their governing law, CISG applies whether theyve mentioned it or not o CISG doesnt apply if: 1) Under Article 6, parties specifically exclude or vary its application. 2) Third noncontracting state takes jurisdiction and decides to use own domestic law. 3) Under 96, declares inapplicable, in accordance with Article 12, any provision of UNCISG that conflicts with its domestic law. 4) Goods in question were bought for immediate consumer use. 5) Not apparent from contract that parties have their places of business in different states. 6) Under Article 95, contracting state files reservation declaring that only domestic law applies when jurisdiction obtained through rules of private international law. Contract between private parties 2 states private party & state Law that governs national law international law party autonomy they can choose intl law (TOPCO) Even if they dont choose law, court can apply international law (Revere)

C. Choice of Forum Today you can always choose arbitration as an alternative to litigation o In deciding between the two, look at cost of arbitrating vs. litigating

17

IBT Fall 2006 Professor Brand

You often have to pay institutional fee, pay arbitrators fee often depends on amount in controversy Foreign courts sometimes have very high fees to litigate

Considerations in choosing a forum for dispute settlement: 1. Convenience of chosen forum 2. Familiarity with chosen forum 3. Possible bias with chosen forum 4. Influence of choice of forum on substantive law CISG Article 7 says a court can fill gaps by looking to its own private international law Article 28 says court doesnt have to give specific performance if its country doesnt like that 5. Predictability in contract performance 6. Availability of advantageous procedural laws In England, pre-trial procedures allow you to freeze some of Ds assets so he cant transfer them and avoid judgment US Supreme Court says US federal courts cant do that 7. Availability of transnational procedural assistance Foreign judgments are usually enforced in the US Courts in most US jurisdictions respect party autonomy and will uphold reasonable choice of forum clauses o Bremen v. Zapata Off-Shore Co. (1972) Supreme Court upheld choice of law clause specifying UK law, even though American company would probably be hurt by it, because of the need to facilitate transnational commerce forum selection clauses are prima facie valid and should be enforced unless enforcement is shown by the resisting party to be unreasonable under the circumstances o Scherk v. Alberto-Culver Co. (1974) Supreme Court ordered arbitration of a claim arising under Securities Exchange Act in the foreign forum that arbitration clause specified, even though outcome might be negative for American party o Exceptions: Enforcement would result in substantial inconvenience or denial of remedy Fraud or unconscionable conduct in the contract Enforcement would result in violation of public policy or cause manifest unfairness In Latin America, courts competence is considered a matter of public policy, and choice of forum or law doesnt necessarily remove that competency o Inter-American Convention on International Commercial Arbitration came into force in 1990 for US US isnt party to any convention on enforcement of foreign judgments

Mitsubishi Motors Corp. v. Soler Chrysler-Plymouth (US 1985)

18

IBT Fall 2006 Professor Brand

Claim under Sherman Anti-Trust Act can be settled by arbitration in Japan if parties chose that: By agreeing to arbitrate a statutory claim, a party does not forgo the substantive rights afforded by the statute; it only submits to their resolution in an arbitral, rather than a judicial, forum. o Whats most important is that litigant can pursue statutory cause of act o No reason to assume that arbitration wont provide an effective remedy US court can later refuse to enforce damages if judgment is improper o If Congress expresses intent that a certain statute not be subject to arbitration, it shouldnt be arbitrated but thats not the case here When asked to compel arbitration, courts must ask o Did parties agree to arbitrate this dispute? o Do legal constraints outside of contract foreclose arbitration of these claims? Arbitration clause read: any and all disputes arising out of or related to this K will be arbitrated in Japan thats different from any claim of breach of K After Mitsubishi, it seems like if theres a valid arbitration clause, arbitration will be compelled unless its very narrowly drafted

Other Choice of Forum cases Shearson/American Express v. McMahon (US 1987) Securities Exchange Act and RICO claims can be arbitrated if theres a valid agreement, even if appears in a form brokerage contract that isnt subject to negotiation Allied Signal v. B.F. Goodrich (7th Cir 1999) arbitration clause did not require antitrust claims to be arbitrated o not all parties to suit had signed on the clause and parties could fully comply with other aspects of the agreement and still cause antitrust injury to P Carnival Cruise Lines v. Shute (US 1991) relying on Bremen, Sup Ct upheld choice of forum clause on ticket even though P didnt receive ticket until after paying P took advantage of lower prices made possible by such a practice Hill v. Gateway (7th Cir 1997) court upheld clause inside computer box requiring claims to be arbitrated by ICC and for P to pay $2k Advantages to Arbitration

Parties can select procedural and substantive law applicable to dispute Less complicated; fewer rules of procedure Neutral location Can take place without disrupting contract performance NY Convention means awards are more likely to be enforceable in foreign courts Finality usually not subject to appeal

Disadvantages to Arbitration

Lack of court record makes it less predictable Other party may agree to litigation in your home court Preliminary relief usually not available Appeal from litigation can be favorable

Arbitration clause should be clear about: 1. Institution whose rules and assistance will govern (Intl Chamber of Commerce, American Arb Assoc., other), or ad hoc arbitration 2. Rules to be applied

19

IBT Fall 2006 Professor Brand

3. Neutral place in which to hold hearings (country whose law favors arb and who is a party to NY Convention) 4. Language to be used 5. whether contract performance can continue pending award 6. number, qualification and manner of selecting arbitrators Preliminary injunctions 4 Circuit courts held a court can grant a preliminary injunction in an arbitrable dispute if necessary to preserve the status quo New York Convention - 1958 UN Convention on the Recognition & Enforcement of Foreign Arbitral Awards entered into force in US in 1970 (100+ parties) Article II recognizes agreements to arbitrate Article III calls for recognition and enforcement of arbitral awards Article V contains exceptions if party proves: o Incapacity of parties or invalidity of agreement to arbitrate o Lack of proper notice in arbitration proceedings o Decisions on matters beyond scope of arbitration agreement o Arbitral panel violates agreement or law o Award isnt yet binding or has been suspended in country whose laws govern o Policy reasons: Subject matter cant be settled by arbitration in country where recognition is sought Recognition/enforcement would be contrary to public policy of country where recognition is sought Article VII says Convention shall not . . . deprive any interested party of any right he may have to avail himself of an arbitral award in the manner and to the extent allowed by the law or treaties of the country where such award is sought to be relied upon o Chromalloy Aeroservices v. Egypt (DDC 1996) Article V exceptions are permissive, while Article VII language is mandatory; therefore, even though Egypt nullified an arbitral award, it could still be enforced by US o Some courts say if the law of that state governs arbitration and its court sets it aside, it may be null D. Recognition of Foreign Judgments in US Common law is the basis, supplemented by UFMJRA Problems with US approach: o Law is fractured because of Erie 7 states have a reciprocity requirement, only 31 states have signed the Act o This means that if an American wants a judgment enforced abroad, he must prove to foreign court that a similar judgment would be enforced in US Still, US is one of most liberal places for enforcement of foreign judgments 2 most common bases for non-recognition of foreign judgments are: o Lack of jurisdiction (rules of forum court apply, so in US, its due process) o Public policy (German court decision)

20

IBT Fall 2006 Professor Brand

Hilton v. Guyot (US 1895) last US case on recognition of foreign judgments o If there is reciprocity in recognizing foreign judgments, comity of nations says they should be given effect if 1) full and fair trial, 2) rendered by a court having jurisdiction, 3) proper notice given and procedural rules followed, 4) impartial system of justice, 4) no fraud Judgments in rem are valid everywhere Differing procedural rules differ is no problem main criteria is fairness Comity is the recognition which one nation allows within its territory to the legislative, executive or judicial acts of another nation which is neither an absolute obligation nor merely courtesy and good will o In this case, no reciprocity in France, so no recognition of judgment (this was general rule in England and rule predominates in Europe and Latin America today) Supreme Court applies federal common law (pre-Erie), found in US and UK commentary and jurisprudence, practice of countries o international law . . . is part of our law, and must be ascertained and administered by the courts of justice as often as such questions are presented in litigation o Would the result have been different if parties had been different? (see p. 595) the extraterritorial effect of judgments in personam, at law, or in equity may differ, according to the parties to the cause. Court indicates that a US citizen sued in France by a French P warrants greater examination o dicta in this case has survived, rather than the holding the comity analysis, looking to general practices of states Somportex v. Philadelphia Chewing Gum (3rd Cir 1971) default judgment against D in UK courts after he was given extra time to contest jurisdiction and took no action was proper o Court applies PA common law as parties are diverse, according to Erie PA law says judgments of foreign courts are subject to comity Comity should be withheld only when acceptance would be contrary or prejudicial to interest of nation Most important questions are whether reasonable notification was used and reasonable opportunity was had to be heard No violation of US due process occurred o award of lawyers fees and loss of good will enforced b/c it doesnt defy public policy o Somportex engaged in forum shopping, bringing case in UK to get more money o Court says no one follows reciprocity in Hilton v. Guyot Restatement of Foreign Relations Law 481 says final judgment in a foreign court is entitled to recognition in US court unless exception under 482 is met o State courts havent generally followed Hilton principle its unfair to punish P for his states failure to recognize US judgments other judgments can be enforced in US, too family status, succession to property, etc. Decisions by foreign administrative agencies have been enforced if fair

21

IBT Fall 2006 Professor Brand

o 482 lists basically same exceptions fraud, lack of jurisdiction originally, etc. o 483 says US courts dont have to recognize judgments for collection of taxes, fines or penalties rendered by foreign courts Uniform Foreign Money Judgments Recognition Act (31 states, 7 require reciprocity) o 2: Act applies if judgment is 1) final and conclusive, and 2) enforceable where rendered o 3 says its enforceable in same manner as judgment from a sister state provided it doesnt fall under any of 4 exceptions o 4 mandatory grounds for non-recognition: 1) Tribunal was not impartial or no due process; 2) Foreign court lacked PJ over D, 3) Foreign court lacked SMJ o 4 discretionary grounds for non-recognition: Improper notice to D, Fraud, Contrary to public policy, Judgment conflicts with another judgment, Proceeding violated agreement to arbitrate or something else, PJ was based on service and forum was inconvenient o 5 personal jurisdiction established by: tag jurisdiction, consent, agreement, domicile, place of business, operating motor vehicle Once theres recognition, ask if theres enforcement Uniform Enforcement of Foreign Judgments Act (incorporated under 3) o UFMJRA is similar to Restatement, except that: Lack of subject matter jurisdiction is a mandatory ground for non-recognition under Act (discretionary under Restatement) Act allows discretionary non-recognition if US court is a seriously inconvenient forum when PJ is based on personal service o Forum-shopping: foreign party looking to enforce a judgment in the US may forum shop depending on a states acceptance of the UFMJRA they could get recognition of the judgment in State A (which has signed it), then take judgment to State B (which hasnt) to enforce it under full faith & credit b/c state common law is fairly uniform, doesnt matter much if a state has signed becomes important enforcing US judgments abroad you must prove that courts judgment would be enforced here Conventions being considered: Hague Convention providing recognition for foreign judgments in civil and commercial matters has been drafted but not widely agreed upon o What type of convention will it be? Single convention enforcing court indirectly considers jurisdiction of original court (approach of Restatement and Recognition Act) Double convention provides direct jurisdiction rules applicable in original court, so theres no need for indirect consideration of original courts jurisdiction (Brussels Regulation) Mixed convention lists of required and prohibited bases of jurisdiction; former would require enforcement of original courts judgment UFCMJRA being considered by ALI o 2 issues are federalism and reciprocity Currently, state common law governs should it be federal? 22

IBT Fall 2006 Professor Brand

Some states have a reciprocity requirement, others dont

Decision of German Fed. Ct of Justice (BGH) 1992 German court enforced CA judgment against a German-American sex offender for (past and future) compensatory and punitive damages o Court first ensures that theres reciprocity with CA o Polices & procedures may be different, but decisive factor is whether application of foreign law is manifestly incompatible with the essential principles of German law Refuses to enforce punitive damages, b/c they conflict with public policy o German court applies rules similar to Hilton and Somportex courts & seems to be as liberal as US in enforcing foreign judgments

G. Foreign Currency Judgments Traditional rule Foreign currency paid in US $$ paid abroad Restatement rule Foreign currency appreciates Foreign currency depreciates

Breach date determines rate of conversion Judgment date Judgment date Breach date

UFMCA rule exchange rate determined on payment date (day you receive the money) Ways to protect client: o Buy currency insurance o Write into K that in case of breach, rate of conversion will be the same as it was when K was signed Origins of traditional rule: o Currency Act of 1792 20 originally said the money account of the United States shall be expressed in dollars and all accounts in the public offices and all proceedings in the courts shall be kept and had in conformity with this regulation o Two Justice Chase decisions in 1869; two Justice Holmes decisions Neither of these considered the question of whether judgment could be made in foreign currency They emphasize giving full effect to the intention of the parties o In federal diversity cases, Erie means state law is applied Some states follow NY strict breach date rule Teca-Print v. Amacoil Machinery (NY 1988) court awarded dollar equivalent of Swiss francs at judgment date, holding equitable result was more important than strictly following breach-date rule Swiss P had contract with NY D in Swiss francs o 11/30/83 breach date rate was $0.45 per franc 23

IBT Fall 2006 Professor Brand

o 12/2/86 judgment date rate was $0.61 per franc Problems: o Interest was awarded based on NY rates from date of breach Economists say b/c weaker currency has higher interest rate and stronger currency has lower, P may have gotten a double recovery o Court issued decision on appropriate rate of exchange 14 months after judgment Milangos v. George Frank (UK House of Lords 1976) broke with traditional rule, saying English court could give judgment in foreign currency if 1) that currency was specified in contract, and 2) foreign law governed contract o Subsequent cases dropped these requirements Home currency judgment rule no longer served its original purpose; justice demands that the creditor should not suffer from fluctuations in the value of sterling

Restatement (3rd) of Foreign Relations Law 823 1) US Courts ordinarily give judgments from foreign states in US dollars, but they are not precluded from giving judgment in the currency in which the obligation is denominated or the loss was incurred. 2) If the court gives judgment in dollars, rate of conversion should make the creditor whole and avoid rewarding a debtor who has delayed in carrying out the obligation. Comments: judgment should only be in a foreign currency 1) when requested by judgment creditor, and 2) when it would best accomplish objectives in subsection (2) When judgment is in $$, breach date determines conversion if foreign currency has depreciated since breach; judgment date determines if foreign currency has appreciated since breach o Court can depart from this if justice requires Uniform Foreign-Money Claims Act (20 states, DC and Virgin Islands) 3-4: party autonomy respected parties can decide which currency to use 5: if payment is to be made in a different money, exchange rate is determined on conversion date day before it will be paid to a claimant o 5c: If rate of exchange causes inequitable result, court shall amend the judgment or award accordingly o NEW proposed 9 says consequential damages can be awarded 6: person can assert a claim in a specified foreign money o If parties disagree, money of claim is a matter of law 7: judgment given in money of the claim, which is currency on which parties have agreed o 7b: can be paid in the amount of US dollars which will purchase that foreign money on the conversion date at a bank-offered spot rate o 7c: assessed costs entered in US dollars 10: If action is brought to enforce a judgment expressed in foreign money and its enforceable, the enforcing judgment must be entered as provided in Section 7, whether or not [it] confers an option to pay in an equivalent amount of United States dollars. Whats the best rule? 24

IBT Fall 2006 Professor Brand

o Breach date seems best for American seller o Conditions can make any rule inequitable for this reason, Restatement rule is flexible o Consequential damage awards for fluctuations increase probability that judgment will be equitable

VII. DEALS AND DISPUTES INVOLVING FOREIGN STATES

2 major defenses available to foreign sovereigns in judicial actions are: o sovereign immunity o Act of State Doctrine

A. Sovereign Immunity a substantive right that is often used as a jurisdictional defense Absolute theory sovereign cant be subject to jurisdiction without his consent; political and diplomatic means are most appropriate to solve these problems o The Schooner Exchange v. McFaddon (US 1812) immunity for French warship docked in US waters, as it was public property under the direct command of a foreign sovereign employed for national objects o Berizzi Bros. v. The Pesaro (US 1926) a merchant ship owned and operated by a foreign government has the same immunity that a warship has, b/c its an instrument of the foreign sovereign Republic of Mexico v. Hoffman (US 1945) courts have traditionally deferred to the Executive branch in determining whether they should exercise jurisdiction courts should not so act as to embarrass the executive arm in its conduct of foreign affairs Restrictive theory o Tate Letter of 1952 US executive is adopting this theory, granting immunity with regard to a states public acts but not its private acts o Cites Brussels Convention of 1926 immunity for government-owned merchant vessels waived Foreign Sovereign Immunities Act of 1976 Congress tells courts what international law is, and at the same time, makes it domestic law by adopting it 1330 (a) District courts have original jurisdiction in any nonjury civil action against a foreign state if its not entitled to immunity under 1605 1330(b) If theres subject matter jurisdiction and service of process, theres personal jurisdiction 1605(a)(2) No immunity for a foreign state when action is based on: A commercial activity carried on in US by foreign state o NOTE: commercial activity alone isnt enough it must affect US An act performed in US in connection with a commercial activity of foreign state elsewhere An act outside the US in connection with a commercial activity of the foreign state elsewhere that causes a direct effect in US 1603(d) Commercial character determined by analyzing nature and course of conduct, particular transaction or act, rather than its purpose 1610(d) Property of a foreign state used for a commercial activity in the US shall not be 25

IBT Fall 2006 Professor Brand

immune from attachment prior to judgment in US court if: Foreign state has explicitly waived immunity from pre-judgment attachment, AND Purpose of attachment isnt to get jurisdiction, but to satisfy a judgment

Texas Trading v. Nigeria (2nd Cir 1981) no sovereign immunity for Nigeria, as claim based on commercial activity and has direct effects within the US In analyzing a 1605 case under FSIA, ask: 1. Does the conduct in question qualify as a commercial activity under 1603 (d)? a. If govt enters contract to buy goods and services, its commercial activity b. If a private person could perform this activity, its commercial and no immunity 2. Is that activity sufficiently related to the US under 1605 (a)(2) to warrant exercise of subject matter jurisdiction under 1330 (a)? a. When P is a corporation, direct financial loss satisfies effects test b. When evaluating whether its felt in the US, ask whether Congress would have intended to provide access to US courts in this type of case 3. Is exercise of subject matter jurisdiction within the limits of US Const. Article III? a. Is it between a US citizen and a foreign state? No suits by aliens against foreign states 4. Do SMJ under 1330 (a) and service of process under 1608 exist, making PJ proper? 5. Does exercise of PJ comply with due process? at this point, there can be little doubt that international law follows the restrictive theory of sovereign immunity. Nigeria opened confirmed, irrevocable letters of credit on behalf of US cement sellers (which turned out not to be confirmed) and then revoked them, canceling contracts o b/c LOC wasnt confirmed, Ps had to sue Nigeria & Central Bank instead of Morgan 4 waivers that every contract should include: o 1605(a)(1) explicit waiver of foreign sovereign immunity 1605(a)(6) agreement to arbitrate disputes in US waives immunity, too o Waivers of immunity from attachment of property: 1610(a)(1) in aid of execution of a judgment 1610(d) pre-judgment attachment 1611(b)(1) of a bank or money authority Simple waivers arent good enough you can even reference the section in the waiver First step in any international lawsuit is to attach the assets up front (or advise D to get rid of assets) Libra Bank v. Banco Nacional de Costa Rica (2nd Cir 1982) Costa Rican bank held to have explicitly waived immunity from pre-judgment attachment of assets under 1610(d) by a contract clause: o The Borrower hereby irrevocably and unconditionally waives any right or immunity from legal proceedings including suit judgment and execution on grounds of sovereignty which it or its property may now or hereafter enjoy. Court looked to wording of agreement, wording of 1610(d) and intent of parties

26

IBT Fall 2006 Professor Brand

B. Act of State doctrine Should a court with proper jurisdiction rule on the validity of a sovereigns acts w/in its own territory? substantive defense which goes to the merits, based on federal common law o available in suits of private parties, but state action outside US must be at root of claim o called a conflict of laws doctrine and an abstention doctrine In a controversy between citizens of states A and B, do courts apply state As law, state Bs law or international law? In Oetjen case, Mexican govt takes Ps property, P sues in US and US invokes Act of State doctrine, presuming validity of Mexican govts actions o allows US courts to abstain from hearing merits of a case when subject matter is more executive, per separation of powers Underhill v. Hernandez (US 1897) the courts of one country will not sit in judgment on the acts of the government of another, done within its own territory, and grievances should be redressed by diplomatic relations between sovereigns o When US citizen sued Venezuelan official in US courts for forcing him to operate city waterworks after revolution in Venezuela, court invoked doctrine and dismissed b/c Hernandez caused injuries while acting in official capacity as head of de facto government, it wasnt appropriate for courts to judge validity of those acts First Hickenlooper amendment to the Foreign Assistance Act of 1962 president will suspend aid to any country that expropriates assets of US citizens without taking appropriate steps . . . to discharge its obligations under international law Banco Nacional de Cuba v. Sabbatino (US 1964) Supreme Court refused to examine validity of Cuban governments seizure of US ship carrying sugar to NY buyer in retaliation for US reduction of sugar quotas o the Judicial Branch will not examine the validity of a taking of property within its own territory by a foreign sovereign government, extant and recognized by this country at the time of suit, in the absence of a treaty of other unambiguous agreement regarding controlling legal principles, even if the complaint alleges that the taking violates customary international law o Conflict of laws element Banco Nacional took over assets of US-owned company and demanded payment for sugar, but US-appointed caretaker of assets also demanded payment which law to apply? Cuban, NY, international? Although Erie applies to this diversity case, Sup Ct applies federal common law so that rules of international law should not be left to divergent and perhaps parochial state interpretations o Ruling could cause conflict between Judiciary and Executive and the very expression of judicial uncertainty might prove embarrassing to the Executive Branch o constitutional underpinnings for Act of state doctrine due to separation of powers not compelled by international law Second Hickenlooper Amendment US courts must hear cases about confiscation occurring after 1/1/59 that violate international law; they cant invoke Act of State

27

IBT Fall 2006 Professor Brand

o 2 exceptions: 1) where taking doesnt violate international law; 2) where Executive says US foreign policy requires application of Act of State doctrine o First Natl City Bank of NY v. Banco Nacional de Cuba Hickenlooper Amendment only relates to claimants specific property found in US thats directly related to an expropriation Allowed counterclaim for set-off when US bank took over Cuban assets in US as compensation for expropriation of its assets in Cuba Bernstein exception created Dept of State urged adjudication of the matter Later case said property must be in US or have been in US when action was brought Dunhill v. Cuba (US 1976) Act of State doctrine doesnt apply when no sovereign, official act is at stake Dunhill owed $148,600 to Cuban cigar companies, then govt seized companies, their owners fled to America and Cuba appointed interventors to take over the business Dunhill paid interventors mistakenly, then original owners sued him for it b/c Dunhill owed $92,949 on post-intervention sales, court agreed interventors could keep that amount and had to return the difference brief from Dept of State urged court to judge the claim Plurality argues there should be a commercial exception to the act of state doctrine, just as with sovereign immunity Mannington Mills v. Congoleum Corp (3rd Cir 1979) mere issuance of patents by a foreign power isnt an Act of State, but court should decide whether to hear the case on grounds of international comity American company alleged that foreign company obtained foreign patents fraudulently and used them to harm US business interests in violation of Sherman Anti-trust Act Issuing patents is a ministerial, bureaucratic act rather than a discretionary, political act of a sovereign Looking to comity, judges can use balancing tests to decide whether to hear the case Timberlane test, later codified in Restatement Restatement of Foreign Relations Law 402 state has jurisdiction to prescribe law with respect to: Conduct and the status of persons or things in its territory Conduct outside its territory that has or is intended to have substantial effect within it Nationals outside its territory Conduct outside territory directed against state security or limited class of other state interests 403 state cant exercise jurisdiction if its unreasonable, factors including: If activity has a substantial, direct and foreseeable effect on territory Connections between state and person to be regulated Character of activity and desirability of such a regulation Justified expectations that might be hurt or protected by regulation Importance of regulation to political, legal or economic system 28

IBT Fall 2006 Professor Brand

Consistency of regulation with international system Another states interest in regulating activity Likelihood of conflict with another states regulation Timberlane and Mannington Mills use these factors to deal with judicial subject matter majority of commentators say these should only apply to legislative/prescriptive jurisdiction

W.S. Kirkpatrick & Co. v. Environmental Tectonics Corp. (US 1990) Act of State doctrine didnt apply, b/c allegation that one foreign official took a bribe wasnt sufficient to constitute official action by a foreign sovereign o nothing in the case requires the Court to declare acts of Nigeria invalid Respondent sued Kirkpatrick for obtaining a contract with the Nigerian government through bribes o Dept of State letter said a judicial inquiry into the purpose of a foreign sovereigns act wouldnt produce the embarrassment and problems that result from judging the validity of the act Act of state issues only arise when a court must decide that is, when the outcome of the case turns upon the effect of official action by a foreign sovereign. Exceptions to Act of State Doctrine: 2nd Hickenlooper Amendment no violation of international law Bernstein exception Executive branch supports adjudication No real act of state at issue (Dunhill) o a ministerial, bureaucratic act that doesnt deal w/ sovereigns discretionary functions (Mannington Mills) o bribe by foreign official wasnt official action by a foreign sovereign (Kirkpatrick) Commercial activity exception? (Dunhill plurality) Should there be a commercial activity exception? YES Dunhill plurality

Fear of embarrassing Executive Branch is less likely in commercial sphere exception is consistent with sovereign immunity doctrine consistent with other countries approaches that sovereign loses claims to immunity when acting in a commercial capacity Potential injury to businessmen and trade is great if one party has automatic immunity in carrying on the same activities that private parties do

NO rest of Dunhill

Difference in 2 doctrines means they shouldnt have the same exceptions while FSIA exempts due to status, Act of State is choice of law rule In the absence of unambiguous agreement on intl law, acts of a sovereign committed in its own territory are presumed valid Act of state is a fact-driven inquiry, to be decided case-by-case, just like political question

Example: a state breaches a contract, so FSIA allows adjudication Act of State? o Court must examine if this is truly a public act of state it doesnt seem to be, and in this situation, adjudicating the claim probably wont compromise Executive Act of State is more like political question doctrine than FSIA o Court must decide whether to hear claim based on a variety of factors territoriality, intl comity, separation of powers, embarrassment of Executive Branch

29

IBT Fall 2006 Professor Brand

Commercial nature can be one of the factors to evaluate, but just b/c its present doesnt mean the claim is justiciable per se High court should decide issue apply Act of State Low apply Act of State court should decide issue

When should court decide the issue? Codification of intl law Importance for US foreign relations

Sovereign Immunity vs. Act of State Sovereign immunity procedural status jurisdictional matter source codified in US Code (required by intl law) parties affected states only

Act of State choice of law matter federal common law (not required by intl law, just has const. underpinnings) private parties

Both are gate-keeping doctrines they close the door to the courts in some situations o When considering when to use them, ask if its appropriate to close the courthouse door in this situation If youre entering a contract with a foreign sovereign and worried about sovereign immunity and act of state defenses, how do you deal with it in the contract? o Choose arbitration under FSIA, this constitutes waiver of immunity from jurisdiction to decide case

VIII. PROHIBITIONS ON CORRUPT PRACTICES

Foreign Corrupt Practices Act of 1977 Companies must keep good accounting records of their expenditures (no slush funds) Anti-bribery provisions apply to: o 78dd-1: issuers (companies required to register securities SEC has jurisdiction) o 78dd-2: domestic concerns (US citizens, US businesses & employees/agents) o 78dd-3: persons other than issuers or domestic concerns 78(a)(1)-(2): It shall be unlawful to: 1) make use of interstate commerce 2) corruptly 3) in furtherance of an offer of anything of value 4) to a foreign official or foreign political party 5) for the purpose of influencing any act or decision, inducing an act or omission, or securing any improper advantage 6) in order to obtain or retain business

30

IBT Fall 2006 Professor Brand

78(a)(3) same thing, but (4) says to any person, while knowing it will be given to foreign official 78(b) Exception: facilitating or expediting payment . . . to expedite or to secure the performance of a routine governmental action 78(c) Affirmative Defenses: 1) Payment was lawful under the written laws of the foreign officials country (this is never likely to happen) 2) Payment was a reasonable, bona fide expenditure, such as travel and lodging expenses, incurred . . . and directly related to promotion, demonstration or explanation of products or services or execution or performance of a contract Definitions: knowing: 78dd-1(f)(2), 78dd-2(h)(3), 78dd-3(f)(3); routine governmental action: 78dd-1(f)(3), 78dd-2(h)(4), 78dd-3(f)(4) Knowledge requirement for vicarious liability Employees can be prosecuted individually even if company isnt o Repeal of Eckhardt scapegoat amendment Penalties: up to $2 million for corporation, $100k for individual plus 5 years in prison o Potential bans on further exports of your product or on contracts with US government No private right of action enforced by SEC and DOJ Bribing private officials is OKAY

What is corruptly? (US v. Liebo) the offer, promise to pay, payment or authorization of the payment must be intended to induce the recipient to misuse his official position or to influence someone else to do so an act is corruptly done if done voluntarily and intentionally, and with a bad purpose of accomplishing either an unlawful end or result, or a lawful end or result by some unlawful method or means International rules OAS Inter-American Convention on Corruption, 1996 Council of Europe Criminal Law Convention on Corruption, 1999 OECD Convention on Combating Bribery of Foreign Public Officials in IBT, 1997 o 33 parties, the source of most of the competition for business in countries where bribes are an issue o Art. 1(1): each party shall make it a crime for any person intentionally to offer, promise, or give any undue pecuniary or other advantage . . . to a foreign public official . . . in order that the official act or refrain from acting in relation to the performance of official duties, in order to obtain or retain business or other improper advantage . . . o Art. 1(2) complicity, conspiracy and attempt should also be criminalized Red Flags which require extra attention: General Red Flags: o Company has received an improper payment audit in the past 5 years

31

IBT Fall 2006 Professor Brand

o Payment in a country with a history of widespread corruption, such as some Middle Eastern and Asian countries, former Soviet Union countries o Widespread news reports of bribes, etc. o Bad industry reputation oil, defense, aircraft, construction Transaction-Specific Red Flags: o Agent refuses to provide confirmation that hell adhere to FCPA o Family or business ties with a govt official o Bad reputation of agent o Agent doesnt want identity to be disclosed o Foreign govt customer recommends the agent (possibly payoff scheme) o Agent lacks facilities and staff to perform the services o Agent is new to the business o Any other odd request by agent (invoices backdated or altered) Payment requests: o Excessive commission o Convoluted payment (through Bahamas, etc) o Over-invoicing (check for more than actual expenses) o Check made out to cash or bearer, cash payments, other anonymous payment o Payment made to third country o Agent requests large credit line o Requests for unusual bonuses o Requests for unorthodox or substantial up-front payment

XI. ALTERNATIVE FORMS OF INVOLVEMENT IN INTL TRADE

A. Forms of increased involvement: 1. Direct Sales from US 2. Orders through employees abroad 3. Contracting through Foreign Agent/Distributor 4. Foreign Branch Sales Operation 5. Foreign Subsidiary 6. Joint Venture 7. Acquisition of Local Entity 8. Direct Investment in Foreign Market Company usually incurs liability through: o Foreign office, foreign agent, sometimes through distributor Usually no liability with: o Foreign subsidiary (unless you can pierce the corporate veil) o Licensing trade info to a third party o Franchise arrangements w/ royalties Key questions: 1. What host country regulations apply? 2. What home country regulations apply? 32

IBT Fall 2006 Professor Brand