Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fernandez vs. de La Rosa, February 3, 1903

Caricato da

Monica MejiaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Fernandez vs. de La Rosa, February 3, 1903

Caricato da

Monica MejiaCopyright:

Formati disponibili

Fernandez vs.

De La Rosa, February 3, 1903

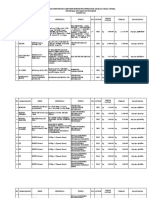

Facts: The Fernandez, the plaintiff, alleged that in January, 1900, he entered into a verbal agreement with De La Rosa, the defendant, to form a partnership for the purchase of cascoes and the carrying on of the business of letting the same for hire in Manila. They also agreed that the profit that will be derived from this partnership will be distributed among them proportionately. The plaintiff furnished the defendant 300 and 825 pesos to purchase a casco designated as No. 1515 and No. 2089 respectively. The defendant did purchase of these two cascoes for 500 and 1000 pesos respectively taking the title of these cascoes in his own name. Marcos Angulo, a partner of the plaintiff in a bakery business, being also a party to the negotiations denied that any agreement was ever consummated. The plaintiff made a demand for an accounting upon him, which the defendant refused to render, denying the existence of the partnership.

Issue/s: Did a partnership exist between the parties? If such partnership existed, was it terminated as a result of the act of the defendant in receiving back the 1,125 pesos?

Decision: This case has been decided on appeal in favor of the plaintiff and the defendant has moved for a rehearing upon the following grounds: o Because that part of the decision which refers to the existence of the partnership which is the object of the complaint is not based upon clear and decisive legal grounds; and o Because, upon the supposition of the existence of the partnership, the decision does not clearly determine whether the juridical relation between the partners suffered any modification in consequence of the withdrawal by the plaintiff of the sum of 1,125 pesos from the funds of the partnership, or if it continued as before, the parties being thereby deprived, he alleges, of one of the principal bases for determining with exactness the amount due to each RTXf.

Duterte vs. Rallos, September 24, 1903

Facts: In a letter made by the defendant, he wrote that he just admitted Rallos into the cockpit partnership to collect what Rallos owe him. It was clearly stated that Duterte was indebted to Rallos for one thousand pesos. The plaintiff rendered services in the management of the cockpit, and that the defendant paid him money on account of the cockpit, is undisputed. The profits were divided. A portion was given to two friends, Seores Duterte and Castro, but not as partners. A portion was given to Seor Duterte solely because he was a friend who aided and encouraged the cockpit. Duterte said that he only paid them for his pleasure, as friends. He also added that he had no legal interest. Castro, the other supposed partner, denied that he was such a partner. He said that Rallos sent him the money because he went to the cockpit to aid the president.

Issue/s: Did a partnership exist between the parties?

Decision: The finding of fact by the court below, that there was no partnership, at least to September 1, 1901, was plainly and manifestly against the evidence, and for that reason a new trial of this case must be had. In this new trial, if the evidence is the same as upon the first trial, the plaintiff will be entitled to an accounting, at least to September 1, 1901, and for such further term as the proof upon the new trial shows, in the opinion of the court below, that the partnership existed; that accounting can be had in this suit and a final judgment rendered for the plaintiff if any balance appears in his favor. No second or other suit will be necessary. The judgment of the court below is reversed and the case remanded for a new trial, with the costs of this instance against the appellee, and after the expiration of twenty days, reckoned from the date of this decision, judgment shall be rendered accordingly, and the case is returned to the court below for compliance therewith.

Evangelista vs. the Collector of Internal Revenue, October 15, 1957

Facts: That the petitioners borrowed from their father the sum of P59,1400.00 which amount together with their personal monies was used by them for the purpose of buying real properties. That in a document dated August 16, 1945, they appointed their brother Simeon Evangelista to 'manage their properties with full power to lease; to collect and receive rents; to issue receipts therefor; in default of such payment, to bring suits against the defaulting tenants; to sign all letters, contracts, etc., for and in their behalf, and to endorse and deposit all notes and checks for them; That after having bought the above-mentioned real properties the petitioners had the same rented or leases to various tenants; The records show that petitioners have habitually engaged in leasing the properties above mentioned for a period of over twelve years, and that the yearly gross rentals of said properties from June 1945 to 1948 ranged from P9,599 to P17,453. Thus, they are subject to the tax provided in section 193 (q) of our National Internal Revenue Code, for "real estate dealers,".

Issue/s: The issue in this case whether petitioners are subject to the tax on corporations provided for in section 24 of Commonwealth Act. No. 466, otherwise known as the National Internal Revenue Code, as well as to the residence tax for corporations and the real estate dealers fixed tax. With respect to the tax on corporations, the issue hinges on the meaning of the terms "corporation" and "partnership,". Decision: For purposes of the tax on corporations, our National Internal Revenue Code includes these partnerships with the exception only of duly registered general co-partnerships within the purview of the term "corporation." It is, therefore, clear to our mind that petitioners herein constitute a partnership, insofar as said Code is concerned and are subject to the income tax for corporations. Wherefore, the appealed decision of the Court of Tax appeals is hereby affirmed with costs against the petitioners herein. It is so ordered.

Rojas vs. Maglana, December 10, 1990

Facts: There was a partnership at the very beginning called Eastcoast Development Enterprises (EDE), being Maglana as the managing partner and Rojas as the logging superintendent. There was no operation of the partnership during the period from January 14, 1955 to April 30, 1956. Because of the difficulties encountered, the partners decided to avail of the services of Pahamotang as industrial partner and new partnership was created. The partners executed a document entitled Conditional Sale of Interest in the Partnership, Eastcoast Development Enterprise, agreeing among themselves that Maglana and Rojas shall purchase the interest, share and participation in the Partnership of Pahamotang assessed in the amount of P31,501.12. Rojas entered into a management contract with amother logging enterprise, the CMS Estate, Inc. He left and abandoned the partnership. Maglana wrote Rojas reminding the latter of his obligation to contribute, either in cash or in equipment, to the capital investments of the partnership as well as his obligation to perform his duties as logging superintendent but Rojas told him that he will not be able to comply with his obligations. Rojas took funds from the partnership more than his contribution. Thus, in a letter dated February 21, 1961, Maglana notified Rojas that he dissolved the partnership.

Issue/s: The nature of partnership and the legal relations of Maglana and Rojas after the dissolution of the second partnership; Their sharing basis: whether in proportion to their contribution or share and share alike; The ownership of properties bought by Maglana in his wife's name; The damages suffered and who should be liable for them; and The legal effect of the letter dated February 23, 1961 of Maglana dissolving the partnership. Decision: the partnership of the defendant and the plaintiff is one of a de facto and at will;

the sharing of profits and losses is on the basis of actual contributions the plaintiff's share will be on the basis of his actual contribution and, considering his indebtedness to the partnership, the plaintiff is not entitled to any share in the profits of the said partnership;

the Court declares that there is no evidence that these properties were acquired by the partnership funds, and therefore the same should not belong to the partnership; the Court declares that neither parties is entitled to damages, for as already stated above it is not a wise policy to place a price on the right of a person to litigate and/or to come to Court for the assertion of the rights they believe they are entitled to;

the Court declares that the letter of the defendant to the plaintiff dated February 23, 1961, in effect dissolved the partnership;

The assailed decision of the Court of First Instance of Davao, Branch III, is hereby modified in the sense that the duly registered partnership of Eastcoast Development Enterprises continued to exist until liquidated and that the sharing basis of the partners should be on share and share alike as provided for in its Articles of Partnership, in accordance with the computation of the commissioners. The court also hereby affirms the decision of the trial court in all other respects.

Ejercito vs. M.R. Vargas Construction, April 10, 2008

Facts: The City Government of Quezon City, represented by Mayor Feliciano Belmonte, Jr., entered into a construction contract[4] with M.R. Vargas Construction, represented by Marcial Vargas in his capacity as general manager of the said business enterprise, for the improvement and concreting of Panay Avenue. Claiming that the clearing operations lacked the necessary permit and prior consultation, petitioners Bienvenido Ejercito and Jose Martinez, as well as a certain Oscar Baria, brought the matter to the attention of the barangay authorities, Mayor Belmonte, Senator Ma. Ana Consuelo A.S. Madrigal, the Department of Environment and Natural Resources and the Philippine Coconut Authority The efforts of petitioners proved unsuccessful. Hence, on 10 September 2004, they filed a petition for injunction before the Quezon City RTC. The petition named "M.R. Vargas Construction Co., represented by herein Marcial R. Vargas and Renato Agarao," as respondent The petition was accompanied with an application for a temporary restraining order (TRO) and a writ of preliminary injunction.[11] Thus, the Office of the Clerk of Court forthwith issued summons and notice of raffle on 10 September 2004.[12] Upon service of the processes on the aforementioned address, they were returned unserved on the ground that respondent enterprise was unknown thereat. Issue/s: Whether the trial court acquired jurisdiction over respondent enterprise. Whether the defense of lack of jurisdiction had been waived.

Decisions: Wherefore, the instant petition for certiorari is denied. The Decision and Resolution of the Court of Appeals in CA-G.R. SP No. 89001 are affirmed in toto. Costs against petitioners. The temporary restraining order issued in this case is dissolved.

Obillos vs. Commissioner of Internal Revenue, October 29, 1985

Facts: Jose Obillos,Sr. transferred his rights to his four children, the petitioners, to enable them to build their residences. The company sold the two lots to petitioners for P178,708.12 on March 13. Presumably, the Torrens titles issued to them would show that they were co-owners of the two lots. After having held the two lots for more than a year, the petitioners resold them to the Walled City Securities Corporation and Olga Cruz Canda for the total sum of P313,050 and divide it among themselves. They treated the profit as a capital gain and paid an income tax on one-half thereof. The Commissioner of Internal Revenue required the four petitioners to pay corporate income tax on the total profit of P134, 336 in addition to individual income tax on their shares thereof. CIR considered the share of the profits of each petitioner in the sum of P33,584 as a "taxable in full and required them to pay deficiency income taxes aggregating P56,707.20 including the 50% fraud surcharge and the accumulated interest. Petitioners original purpose was to divide the lots for residential purposes. If later on they found it not feasible to build their residences on the lots because of the high cost of construction, then they had no choice but to resell the same to dissolve the coownership. The division of the profit was merely incidental to the dissolution of the coownership which was in the nature of things a temporary state. It had to be terminated sooner or later.

Issue/s: The Commissioner alleged that the four petitioners had formed an unregistered partnership or joint venture so they are entitled to pay additional taxes.

Decision: The judgment of the Tax Court is reversed and set aside. The assessments are cancelled. No costs.

Potrebbero piacerti anche

- Anthony Robbins - Time of Your Life - Summary CardsDocumento23 pagineAnthony Robbins - Time of Your Life - Summary CardsWineZen97% (58)

- Compiled Digests in ObliConDocumento127 pagineCompiled Digests in ObliConRichard100% (4)

- Parker HPD Product Bulletin (HY28-2673-01)Documento162 pagineParker HPD Product Bulletin (HY28-2673-01)helden50229881Nessuna valutazione finora

- Simple Guide for Drafting of Civil Suits in IndiaDa EverandSimple Guide for Drafting of Civil Suits in IndiaValutazione: 4.5 su 5 stelle4.5/5 (4)

- Digest For Fernandez Vs Dela RosaDocumento2 pagineDigest For Fernandez Vs Dela RosaJenifer PaglinawanNessuna valutazione finora

- Case Digest PartnershipDocumento12 pagineCase Digest Partnershipkingofhearts006Nessuna valutazione finora

- Big Bang Theory EpisodesDocumento24 pagineBig Bang Theory EpisodesBroly dbzNessuna valutazione finora

- Drafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsDa EverandDrafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsValutazione: 1 su 5 stelle1/5 (2)

- Digest 1Documento47 pagineDigest 1Yuri AnnNessuna valutazione finora

- Partnership Case DigestsDocumento15 paginePartnership Case DigestsButch MaatNessuna valutazione finora

- Case DigestDocumento43 pagineCase DigestJames Jake ParkerNessuna valutazione finora

- Pascual vs. Cir (Art. 1769)Documento2 paginePascual vs. Cir (Art. 1769)Czara DyNessuna valutazione finora

- 01 - ACCLAW Case DigestDocumento45 pagine01 - ACCLAW Case DigestNatalie SerranoNessuna valutazione finora

- GSIS 170 Scra 533Documento6 pagineGSIS 170 Scra 533Mp CasNessuna valutazione finora

- Atty. Delson PATCaseDigest1-10Documento17 pagineAtty. Delson PATCaseDigest1-10ZariCharisamorV.ZapatosNessuna valutazione finora

- Torres V CADocumento6 pagineTorres V CAHudson CeeNessuna valutazione finora

- Agency and Partnership Digests #5Documento9 pagineAgency and Partnership Digests #5Janz Serrano100% (2)

- Digest Partnership CaseDocumento12 pagineDigest Partnership Casejaynard9150% (2)

- Agency CasesDocumento25 pagineAgency CasesJan Aldrin AfosNessuna valutazione finora

- Evangelista v. CIRDocumento7 pagineEvangelista v. CIRHudson CeeNessuna valutazione finora

- Partnersip Case DigestsDocumento29 paginePartnersip Case DigestsAMBNessuna valutazione finora

- Case Digest 2Documento38 pagineCase Digest 2Clarise Satentes Aquino100% (1)

- People's Industrial Com. Corp Vs CADocumento2 paginePeople's Industrial Com. Corp Vs CAFai MeileNessuna valutazione finora

- 2Documento74 pagine2JbMeraNessuna valutazione finora

- Oblicon Digests 2 (New Edit)Documento44 pagineOblicon Digests 2 (New Edit)DanielleNessuna valutazione finora

- Statco - Finals AssignmentDocumento22 pagineStatco - Finals AssignmentDanielle Nicole ValerosNessuna valutazione finora

- PAT Cases - Sept 12, 2020Documento35 paginePAT Cases - Sept 12, 2020Sarah Zabala-AtienzaNessuna valutazione finora

- Partnership CasesDocumento4 paginePartnership CasesshutauwuNessuna valutazione finora

- Partnership DigestDocumento31 paginePartnership DigestFG FGNessuna valutazione finora

- LAGARE Case DigestDocumento37 pagineLAGARE Case DigestJulie Mae LagareNessuna valutazione finora

- Lim Tong Lim V. Philippine Fishing Gear IndustriesDocumento7 pagineLim Tong Lim V. Philippine Fishing Gear IndustriesPeanutButter 'n JellyNessuna valutazione finora

- Pascual Vs CirDocumento6 paginePascual Vs CirReth GuevarraNessuna valutazione finora

- Bus Org Cases 3 5 6 13Documento5 pagineBus Org Cases 3 5 6 13Ana AdolfoNessuna valutazione finora

- Torres vs. CADocumento9 pagineTorres vs. CACharles BusilNessuna valutazione finora

- Pascual v. CIRDocumento8 paginePascual v. CIRAngela AngelesNessuna valutazione finora

- Pascual V CIRDocumento8 paginePascual V CIRLorjyll Shyne Luberanes TomarongNessuna valutazione finora

- Partnership Case DigestDocumento6 paginePartnership Case DigestTea AnnNessuna valutazione finora

- G.R. No. 128759 - Jaromay Laurente Pamaos Law OfficesDocumento8 pagineG.R. No. 128759 - Jaromay Laurente Pamaos Law OfficeswencyNessuna valutazione finora

- Right To Transfer of ShareholdingsDocumento4 pagineRight To Transfer of ShareholdingscjadapNessuna valutazione finora

- Atp CasesDocumento14 pagineAtp CasesRonald Z. RayaNessuna valutazione finora

- Evangelista, Et Al. v. CIR, GR No. L-9996, October 15, 1957Documento5 pagineEvangelista, Et Al. v. CIR, GR No. L-9996, October 15, 1957mimisabaytonNessuna valutazione finora

- Tax Page8Documento25 pagineTax Page8Cyrus Santos MendozaNessuna valutazione finora

- Dira v. TañegaDocumento6 pagineDira v. TañegaClement del RosarioNessuna valutazione finora

- Case #12 Luzon Surety v. de Garcia, G.R. No. L-25659Documento4 pagineCase #12 Luzon Surety v. de Garcia, G.R. No. L-25659castorestelita63Nessuna valutazione finora

- Pascual Vs CirDocumento5 paginePascual Vs CirGlo Allen CruzNessuna valutazione finora

- Digests On PartnershipDocumento4 pagineDigests On PartnershipNeapolle FleurNessuna valutazione finora

- Partneship Cases 2Documento55 paginePartneship Cases 2Maria Yolly RiveraNessuna valutazione finora

- Antonia Torres DigestedDocumento3 pagineAntonia Torres DigestedAtty. R. PerezNessuna valutazione finora

- Partnershjip Digested CasesDocumento4 paginePartnershjip Digested CasesNurz A Tantong100% (1)

- Pascual vs. Cir 166 Scra 560Documento5 paginePascual vs. Cir 166 Scra 560FranzMordenoNessuna valutazione finora

- Pat DigestsDocumento10 paginePat DigestsAnonymous Exek9bNessuna valutazione finora

- Petitioner Vs Vs Respondents People's Law Office Ilaya Law OfficeDocumento9 paginePetitioner Vs Vs Respondents People's Law Office Ilaya Law OfficeJade ClementeNessuna valutazione finora

- 87 Saludo Vs PNBDocumento6 pagine87 Saludo Vs PNBlouryNessuna valutazione finora

- Katipunan vs. Katipunan, Jr. G.R. No. 132415, January 30, 2002Documento9 pagineKatipunan vs. Katipunan, Jr. G.R. No. 132415, January 30, 2002Hannah BarrantesNessuna valutazione finora

- Partnership W2 Cases 1 4Documento8 paginePartnership W2 Cases 1 4Luke LunaNessuna valutazione finora

- PAT DigestDocumento7 paginePAT Digestjames oliverNessuna valutazione finora

- Credit Transaction CasesDocumento24 pagineCredit Transaction CasesJanice M. PolinarNessuna valutazione finora

- Supreme Court: de La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsDocumento5 pagineSupreme Court: de La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsCeleste CamelloNessuna valutazione finora

- Partnership Case Digests FinalDocumento15 paginePartnership Case Digests FinalDrew DalapuNessuna valutazione finora

- Evidence Digests Vi and ViiDocumento20 pagineEvidence Digests Vi and ViiJesús LapuzNessuna valutazione finora

- Pascual vs. Commissioner of Internal Revenue 166 SCRA 560 GR No. L 78133 October 18 1988Documento7 paginePascual vs. Commissioner of Internal Revenue 166 SCRA 560 GR No. L 78133 October 18 1988Roland ApareceNessuna valutazione finora

- De La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsDocumento36 pagineDe La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsIrene Cristina GonoNessuna valutazione finora

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemDa EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNessuna valutazione finora

- Inspection Report For Apartment Building at 1080 93rd St. in Bay Harbor IslandsDocumento13 pagineInspection Report For Apartment Building at 1080 93rd St. in Bay Harbor IslandsAmanda RojasNessuna valutazione finora

- Module 2Documento7 pagineModule 2karthik karti100% (1)

- Mahatma Gandhi University: Priyadarshini Hills, Kottayam-686560Documento136 pagineMahatma Gandhi University: Priyadarshini Hills, Kottayam-686560Rashmee DwivediNessuna valutazione finora

- Roland Fantom s88Documento51 pagineRoland Fantom s88harryoliff2672100% (1)

- Biscotti: Notes: The Sugar I Use in France, Is CalledDocumento2 pagineBiscotti: Notes: The Sugar I Use in France, Is CalledMonica CreangaNessuna valutazione finora

- ASHRAE Elearning Course List - Order FormDocumento4 pagineASHRAE Elearning Course List - Order Formsaquib715Nessuna valutazione finora

- Model Answer Winter 2015Documento38 pagineModel Answer Winter 2015Vivek MalwadeNessuna valutazione finora

- AAR Shell ProgrammingDocumento13 pagineAAR Shell ProgrammingMarimuthu MuthaiyanNessuna valutazione finora

- Attachment 1 Fiber Data SheetDocumento2 pagineAttachment 1 Fiber Data SheetflavioovNessuna valutazione finora

- Comparitive Study of Fifty Cases of Open Pyelolithotomy and Ureterolithotomy With or Without Double J Stent InsertionDocumento4 pagineComparitive Study of Fifty Cases of Open Pyelolithotomy and Ureterolithotomy With or Without Double J Stent InsertionSuril VithalaniNessuna valutazione finora

- Key Performance Indicators - KPIsDocumento6 pagineKey Performance Indicators - KPIsRamesh Kumar ManickamNessuna valutazione finora

- Effect of Plant Growth RegulatorsDocumento17 pagineEffect of Plant Growth RegulatorsSharmilla AshokhanNessuna valutazione finora

- Contemp Person Act.1Documento1 paginaContemp Person Act.1Luisa Jane De LunaNessuna valutazione finora

- IbmautomtiveDocumento38 pagineIbmautomtiveMeltz NjorogeNessuna valutazione finora

- What Are Some of The Best Books On Computer ScienceDocumento9 pagineWhat Are Some of The Best Books On Computer ScienceSarthak ShahNessuna valutazione finora

- Ethiopian Airlines-ResultsDocumento1 paginaEthiopian Airlines-Resultsabdirahmanguray46Nessuna valutazione finora

- Simon Fraser University: Consent and Release FormDocumento1 paginaSimon Fraser University: Consent and Release FormpublicsqNessuna valutazione finora

- Rab Sikda Optima 2016Documento20 pagineRab Sikda Optima 2016Julius Chatry UniwalyNessuna valutazione finora

- MN Rules Chapter 5208 DLIDocumento24 pagineMN Rules Chapter 5208 DLIMichael DoyleNessuna valutazione finora

- Garments Costing Sheet of LADIES Skinny DenimsDocumento1 paginaGarments Costing Sheet of LADIES Skinny DenimsDebopriya SahaNessuna valutazione finora

- Donnan Membrane EquilibriaDocumento37 pagineDonnan Membrane EquilibriamukeshNessuna valutazione finora

- Remedy MidTier Guide 7-5Documento170 pagineRemedy MidTier Guide 7-5martin_wiedmeyerNessuna valutazione finora

- MSC ACFN2 RD4 ClassDocumento25 pagineMSC ACFN2 RD4 Classmengistu jiloNessuna valutazione finora

- ProspDocumento146 pagineProspRajdeep BharatiNessuna valutazione finora

- Zambia National FormularlyDocumento188 pagineZambia National FormularlyAngetile Kasanga100% (1)

- Rocker ScientificDocumento10 pagineRocker ScientificRody JHNessuna valutazione finora

- Profibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/SpDocumento3 pagineProfibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/Spmelad yousefNessuna valutazione finora