Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

SR Mortgage Underwriter or Quality Control Underwriter or Fraud

Caricato da

api-121321627Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

SR Mortgage Underwriter or Quality Control Underwriter or Fraud

Caricato da

api-121321627Copyright:

Formati disponibili

Aquila Mends-Cole am1188298@westpost.

net OBJECTIVE: To secure a position that will best utilize my experience and skills within the mortgage financing industry. QUALIFICATIONS I have a comprehensive knowledge of the mortgage financing industry, retail and wholesale for over 9 years. Familiar with high-pressure work environments that require structure and time constraints, my strengths include but are not limited to the following: leadership, problem solving, project development, and person nel training. A self-starter, I have consistently met and exceeded deadlines an d quotas set forth for me. I have the ability to master new software and materi als efficiently. A goal oriented individual, I am comfortable working independe ntly or as part of a team. Software/Skill Summary Report Preparation Problem Solving Written Correspondence Team Building General Office Skills Office Operations Microsoft Office Suite Lotus Notes PROFESSIONAL EXPERIENCE Delegated Underwriter (Most Recent Assignment - - 04/2010 - 12/2010) *On-site contract Sr. Quality Control Underwriter for Freddie Mac with Contract Exception (CE) Authority with $1M signing authority, 1-4 unit properties *Underwriting loans in compliance with Master Policies and all applicable endors ements, agreements, and guidelines that are set forth by Freddie Mac regarding t heir Affiliates *Full credit and property manual underwrite following Freddie Mac / Fannie Mae / Affiliates Guidelines *Continuous knowledge of the most current Freddie Mac / Fannie Mae manuals and l ender updates; including, requirements of private investors correspondent manual s furnished by Freddie Mac Affiliates *Making decisions on a highly secure network platform and working with highly co nfidential documents using a dual monitor system *Independently approving and determining loans that are eligible for purchase an d comply with all requirements by Freddie Mac and/or their Affiliates *Used an automated scoring system and traditional underwriting to determine acce ptability of moderate requests. *Review credit, credit bureau information, collateral valuation, tax returns, co mplex financial statements, and or other supporting documentation to recommend/a pprove requests within decision authority level *Follow-up with external vendors to ensure prompt turnaround time of request doc umentation (income & asset re-verified docs, private investigators, BPO, review appraisals) required to complete loan review *Maintain detail notes of the including vendor re-verifications, red flags and i nternal correspondence *Identify loan components that indicate a potential for fraud and/or misrepresen tation and determine if an independent private investigator is required *Re-verify original loan documentation with external vendors to confirm accuracy DU & LP CLOUT / CLUES QUANTUM LEPURRD AUS Systems ACCURINT AUTOTRAC Lexis Nexis DIGITAL RISK BLITZDOCS STRAT Q MOAI, E-MITS FRAUD GUARD ADFITECH True Logic All REGS

of documentation. *Review current and delinquent loans for quality assurance, fraud, misrepresenta tion & risk analysis *Confirm fraud and misrepresentation with third party documentation, prepare det ailed report with evidence of fraud and/or misrepresentation and submit package to management for review *The authority to issue repurchase for any breach of any representation or warra nty contained in the Addendum and/or Agreement of the Master Policies of Freddie Mac and their Affili ates Sr. Contract Underwriter (02/05 - Present) *Reverse Mortgage Underwriter, ensuring each loan met FHA/Investor required comp liance, quality control and Lender guidelines *Fraud/Forensic Underwriter, Sr. Risk Analyst performing comprehensive analysis of investor findings and internal audit reports *Underwrite all loans that need traditional underwriting (due to not meeting aut omated standards) *Decision secondary market underwriting regarding Alt-A, Jumbo, and Non-Conformi ng loan products *Perform comprehensive analysis of Title Commitment including knowledge of Trust s, POA, and Guarantees *Perform comprehensive collateral analysis with knowledge of valuation methods: calculating Net, Line item and Gross comparable adjustments, Hazard Insurance an Title Policy coverage, and evaluate comparables and property variables *Stay inform of regulatory and legislative developments related to federal guide lines, FMNA/FLMAC *Analyze investor findings and internal audit reports with requests for repurcha sing loans from various investors, and provide alternatives to make loans saleab le (assess risk versus missing/inaccurate documentation). *Audit client contract and staff underwritersa loans to ensure files comply with investor guidelines *Meet established turn-around times for reviewing loan files *Meet production and quality requirements on a consistent basis Compliance and Due Diligence Contract Underwriter (02/05 a" 06/07) *Analyze loan file to determine credit grade and program preference *Verify required credit documentation is present in loan file and complies to th e loan program *Approve or decline loan package based on clientas and secondary investors under writing guidelines *Grade various loan pools base on secondary investor guidelines and document acc urate S & P codes *Verify all required legal documentation and signatures are endorsed correctly *Complete compliance review analysis for high cost, APR, Reg. Z & State Predato ry lending *Perform HMDA review and securitization analysis of clients portfolio Underwriter (05/02 - 01/05) *Underwrite for several wholesale, retail, conforming & non-conforming lenders *Provide guidance and instructions to associate underwriters when necessary *Calculate and analyze pay stubs, W-2as, bank statements, and personal and busin ess tax returns to properly determine income and liquid assets used to qualify t he borrowers *Apply compensating factors to approve loans with challenging credit scores *Review appraisals on condos/ co-ops, mixed use, single and multifamily homes *Interact with client's underwriting staff to provide alternative approval optio

ns *Met and cleared all underwriting and closing conditions prior to funding loans *Approve, decline, or counter offers loan submissions based on clientas underwri ting guideline Jr. Underwriter (03/01 a" 05/02) *Verified all documents (VOE, VOM, VOD) *Processed loans using D.U., L.P. and Calyx Points software *Processed full doc, stated programs for purchase and refinance loans *Ordered termite letter, flood certification, property title, and hazard insuran ce *Submitted completed loan packages to the underwriting department *Audited files and managed pipelines for 10 representatives EMPLOYMENT HISTORY The Clayton Group a" Sr. Contract Underwriter (05/09 a" Present) R.R. Donnelley (Office Tiger) - Sr. Contract Underwriter (05/07 a" 04/09) Mortgage Data Management Corp. a" Compliance and Due Diligence Underwriter (07/0 5 a" 05/07) Price Waterhouse Cooper/ Waterson Prime a" Compliance and Due Diligence Underwri ter (2/05 a" 05/06) INTEGRUS Mortgage (ZNET Financial) a" Underwriter (05/02 a" 01/05) Option One / Bank of America a" Jr. Underwriter (03/01 a" 05/02) EDUCATION Freddie Mac Atlanta, Georgia Delegated Mortgage Underwriter Certification Capstone Mortgage Institute, Atlanta, Georgia, Certified Mortgage Loan Underwrit er University of Kansas, Lawrence, Kansas, Studied Liberal Arts & Science References - Excellent personal and professional references available upon reque st

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Loans How ToDocumento515 pagineLoans How ToRaj RicardoNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Investment Banking - Lecture-1 (08 09 2014)Documento26 pagineInvestment Banking - Lecture-1 (08 09 2014)alibettaniNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Financial Accountinng 3Documento10 pagineFinancial Accountinng 3Nami2mititNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Supreme Court: Roman J. Lacson For Appellant. Ross and Lawrence For AppelleeDocumento40 pagineSupreme Court: Roman J. Lacson For Appellant. Ross and Lawrence For AppelleeColeen Navarro-RasmussenNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- BCG Space Tow SCPMDocumento5 pagineBCG Space Tow SCPMDanica Rizzie TolentinoNessuna valutazione finora

- Rehabilitation Plan - Steel Corporation of The Philippines V Mapfre InsuranceDocumento2 pagineRehabilitation Plan - Steel Corporation of The Philippines V Mapfre InsuranceKatch Roraldo100% (1)

- CGS I PDFDocumento18 pagineCGS I PDFakshayaNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- TX-SML 23 Hour Course Schedule 12 Day Renewal 2015Documento3 pagineTX-SML 23 Hour Course Schedule 12 Day Renewal 2015PraedoInstituteNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Module 016: ANTICHRESIS (Arts. 2132-2139.)Documento6 pagineModule 016: ANTICHRESIS (Arts. 2132-2139.)Krisel JoseNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- 2016 Law On Evidence TSN - Third Exam (No Rules 133 and 134)Documento36 pagine2016 Law On Evidence TSN - Third Exam (No Rules 133 and 134)Ronald ChiuNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Family ProjectDocumento20 pagineFamily ProjectpraharshithaNessuna valutazione finora

- SMMPC (10 04 12)Documento18 pagineSMMPC (10 04 12)tdlfNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Notice of Loss CasesDocumento2 pagineNotice of Loss Caseswesternwound82100% (1)

- 02 Vagilidad Vs VagilidadDocumento13 pagine02 Vagilidad Vs VagilidadXyrus BucaoNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- PS Forclosure ReportDocumento2 paginePS Forclosure ReportJustin HendrixNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Paonessa: The Mechanic's Lien - Are You Protected?Documento30 paginePaonessa: The Mechanic's Lien - Are You Protected?New England Law ReviewNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Indonesia Loans & Secured Financing - Getting The Deal Through - GTDTDocumento12 pagineIndonesia Loans & Secured Financing - Getting The Deal Through - GTDTDewa Gede Praharyan JayadiputraNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Balance Sheet AccountingDocumento7 pagineBalance Sheet AccountingGauravNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- San Beda ReviewerDocumento33 pagineSan Beda Reviewermerren bloomNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

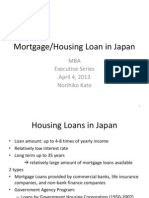

- Mortgage Loans in JapanDocumento16 pagineMortgage Loans in JapanBayarmagnay BaasansurenNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Credit Risk Management in BanksDocumento19 pagineCredit Risk Management in BanksMahmudur RahmanNessuna valutazione finora

- Accounting For Non-Profit OrganizationsDocumento40 pagineAccounting For Non-Profit Organizationsrevel_131100% (7)

- CRE Operating MemorandumDocumento70 pagineCRE Operating MemorandumAndre Hall-RodriguesNessuna valutazione finora

- Art. 2085. The Following Requisites Are Essential To: Chapter 8. Chattel Mortgage A. General ConceptsDocumento5 pagineArt. 2085. The Following Requisites Are Essential To: Chapter 8. Chattel Mortgage A. General ConceptsKenneth Peter MolaveNessuna valutazione finora

- Jayan V Hong Kong and Shanghai Banking Corporation Limited: 2009 Indlaw KER 587Documento2 pagineJayan V Hong Kong and Shanghai Banking Corporation Limited: 2009 Indlaw KER 587Harsha AmmineniNessuna valutazione finora

- Love Leadership: The New Way To Lead in A Fear-Based WorldDocumento6 pagineLove Leadership: The New Way To Lead in A Fear-Based Worldem faNessuna valutazione finora

- VP Commercial Lending Officer in New York City Resume William StephensDocumento2 pagineVP Commercial Lending Officer in New York City Resume William StephensWilliamStephens1Nessuna valutazione finora

- Passion Reborn": Internship Report On Bank of PunjabDocumento99 paginePassion Reborn": Internship Report On Bank of PunjabAleena Shah100% (1)

- Chart of Accounts For Government AccountingDocumento10 pagineChart of Accounts For Government AccountingNeil ArmstrongNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- FIN. 4828 CH. 18: CreateDocumento22 pagineFIN. 4828 CH. 18: CreateSwati VermaNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)