Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

10 Articles

Caricato da

Swati Ankit JainDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

10 Articles

Caricato da

Swati Ankit JainCopyright:

Formati disponibili

ARTICLE 1 Urban and Youth Buyers Help Organised Sector to Grow With youth populations increasingly becoming economically

empowered, 2008 witnessed that trends and demand for housewares and home furnishings were increasingly being driven by youths residing in urban India. Most young buyers were first time home owners that frequented the newly developed organised retailing chains and chose the housewares and home furnishings most suited to their lifestyle. There was a trend witnessed wherein young buyers demanded branded housewares and home furnishings as they were better informed about brands and companies operating in this market. Private Labels Continue to Dominate In the review period, the market for housewares and home furnishings continued to be dominated by private labels. Private labels were dominant as they were easily available and perceived to be cheaper than organised brands. Also for the fact that many big retailers launched their in-house labels this helped private labels to grow. Recessionary environments at the end of the year made people look for value for money and private labels seemed to fulfil this need. Expected Economic Growth and Middle Class Prosperity to Help Market Growth After a brief slump in 2009, Indian housewares and furnishings market is expected to recover in the forecast period and grow in high double digits. Forecast growth is expected to be helped by increased per capita income of Indian middle class populations and also due to increased number of home specific organised retailing chains. The market for housewares and furnishings are expected to open up in smaller cities. There is likely to be increased numbers of brands, increased choice and increased demand for house wares and furnishings segment. ARTICLE 2 Tulips Ambbience to increase retail footprint City based Tulips Ambbience Private Limited, a soft furnishings projects company has now forayed into retail by setting up its first exclusive store in Pune. With the first Tulips store in place now the company is planning to open up at Bangalore and Hyderabad in the year 2012 followed by Mumbai and Ahmedabad.The company would be investing around Rs 35 Cr for this expansion drive and its stores in Mumbai, Bangalore, Hyderabad will be opened by the end of 2012 and rest will be by end of2013. Commenting on this, Sidarrth Mutha, director, Tulips Ambbience Private Limited, "After having ourselves established as countrys premier brand for turnkey soft furnishing solutions we are very happy to enter retail business with a plan to establish a chain of company owned and managed stand alone stores. The furnishing and home dcor industry in India is unorganised and the organised sector mostly caters to the mass market, with Tulips Store we are trying to fill this gap that exists for a premium chain of home furnishing stores", he added.

The Tulips store would house drapery as well as upholstery fabrics sourced from India, Europe, USA and Singapore along with the wide range of couture beddings for day and night use, sourced from Turkey, India as well as produced in-house. A wide range or rugs and carpets would also be available at Tulips Store with a variety of Cashmere and Mohair from South Africa and Scotland. Utility items like bed, bath and table would also be offered to customers at the store. Tulips has entered into a tie-up with a renowned Italian Designer Gabriella B, who is know for her work in ceramics home dcor and each store would have a dedicated section to display her creations in ceramics including pottery and lights. Sandeep Verghese, Director, Tulips said that apart from the most exclusive and premium products in soft furnishings, all the Tulips Stores shall offer a specialized Tulips Design Service, which includes the end to end service right from site surveys to designing and from manufacturing to installations. ARTICLE 3 Home furnishings India: Brands excite the market As the unorganized home furnishings sector generates the heat in the markets, the organized sector, which includes giants like Bombay Dyeing, Welspun, Portico and Kurlon among others, have made significant innovations and forays the segment. Brand leader Bombay Dyeing has already stepped up its efforts to retain leadership and market share. Vertically integrated Welspun dominates the towels markets while Spaces, a new home textile brand has been tapping the not-so-crowded home furnishing segment. Spaces is expected to offer a range of bed, bath, and kitchen and table linen, all specifically for the Indian market. The company exports its products across 32 countries. Welspun plans to expand its capacities locally, while also eyeing acquisitions and seeks to replicate its success in the export market by bringing in a new India specific brand. Ambitious plans are drawn to capture at least a 30 per cent share in the home segment and in the process Welspun has availed the services of Ambience Publicis to develop its brand, with a seed investment of Rs 50 crore. Another Mumbai-based apparel and home furnishing export company, Creative Mobus Fabrics Pvt Ltd, has also focussed its attention on the fast growing domestic market. After capturing international market, the company, whose strengths are in sourcing, designing and manufacturing, has now brought in a home furnishings brand from New York, called Portico, through a licensing arrangement. To build the Portico brand, the company has appointed Contract Advertising. With an ad budget of Rs 3 crore, Portico will carry the baseline, `There is no place like Home.' Besides, the Bangalore-based Kurlon Ltd., a pioneer and leader in branded mattress, has now decided to go beyond mattresses and is even contemplating getting into retailing in

home furnishings. A string of almost 50 stores under the name of `Kurlon Nests' are to be launched in major cities by the end of 2005. The company is expanding its range and venturing into soft furnishings and launching bed and bath linen, curtains and towels. And when talking locally, why should global pastures be forgotten? There are also plans to make a foray into the global markets, starting with Sri Lanka, Dubai and East Africa. Sri Lanka would be a base for their international operations. Meanwhile, the Rs 1,000-crore Bombay Dyeing is all set to enhance its image in the textile industry by spending lavishly on promoting its baseline `Bring Style Home.' Plans are afoot to project Bombay Dyeing as an aspirational brand and advertising is targeted at building the mother brand of Bombay Dyeing." According to leading consultants KSA Technopack, the bed and bath market is estimated at at Rs 1,800 crore, and is growing at nearly 25 percent per annum. Saloni Nangia, Manager, KSA Technopak says, "Just like apparel and footwear, the home linen market is moving from unbranded to branded. In fact, more international brands are likely to enter this market." ARTICLE 4 International brands enter the Indian market Many international luxury home dcor and furnishing brands, mainly from Europe, are now stepping into the growing Indian market of premium and luxury home dcor. They are tying up with Indian companies, giving the high-end domestic brands a run for their money. This year will see the launch of many home-dcor brands from Italy. Italian furniture brand, Smania, is all set to make its India debut in Mumbai, having tied up Grandeur Interior, an Indian company for home dcor. Also, Visionnaire from Italian brand Ipe Cavalli is to be launched in by International Furniture Brands (IF Brands), a retail chain for luxury home products. The company will also launch Italian brand VG Newtrend, in addition to showcasing the contemporary offering from brands like Christopher Guy and Fendi Casa, at its exclusive store in New Delhi soon. Another Italian furnishing brand Minotti is in talks with IF Brands to enter India. Others such as Versace Home is already selling in India after a tie-up with Blues Clothing Company while others such as Giorgetti S.p.A and Poltrona Frou, another Italian brand have all been launched over the last year or so. According to Samvit Tara, Director, IF Brands, the market for luxury home dcor is Rs 4,000 crores plus and is growing at 20-30 per cent every year. Builders like Unitech, DLF, Orbit, Lodha and Vadia are coming up with high-end high-rises where they are giving choice like that of a Fendi Casa home or a Cavalli home to customers. The IF Brands, represents 30 global designer furniture lines and accessories is looking at a turnover of Rs 70-100 crores with high-profile clients like the Ambanis, Ruias, Munjals and the Nandas of Escorts. Giorgetti on the other hand has been doing business worth Rs

10 crores, on an average, for the last three years through agents, without having a proper store. They target customers with incomes above Rs 50 lakh per annum. On an average, the price of articles starts from Rs 50,000 and goes up to a few crores. Buyers are mostly celebrities, industrialists, embassy personnel and the homebound NRIs. Besides Mumbai and Delhi, a lot of demand is coming from Tamil Nadu, Hyderabad, Bangalore, Kolkata, and Surat among other cities. ARTICLE 5 ENTRY OF INTERNATIONAL BRANDS IN INDIAN MARKET India's burgeoning middle class is proving an enticing target for European retailers. Britains Marks & Spencer is reportedly looking for joint venture partners in India, according to a news report, and French furniture maker Gautier and retail giantCarrefour detailed plans Monday to set up operations on the subcontinent as well. Three or four companies are keen on partnering with Marks & Spencer (otherotc: MAKSY - news - people ), which will own 51% of the venture, the Economic Times reported Monday, citing an anonymous source. The company already has around 20 stores in Indian cities, operated by the Planet Retail brand. Earlier this month, Marks & Spencer Chief Executive Stuart Rose said the company was looking to expand into the Indian market, with a focus on cities like New Delhi, Mumbai and Bangalore. He also announced plans to enter China on a wholly owned rather than a franchise basis. (See: M&S Looks To China For Growth) The companys first store in Shanghai will open next year. Britains largest clothing retailer reported a 40% rise in net profits for the six months to Sept. 29. In India, where single-brand retailers can own up to 51% in joint ventures, the company is reportedly planning to make a foray into food and home furnishings under its new format. French furniture maker Gautier said Monday it will enter the Indian retail market by yearend, with a range of furniture for children and infants. It is looking to open outlets ranging from 20,000 to 40,000 square feet, and is scouting around for a local partner for a joint venture. The escalating lifestyle aspirations of the new-age Indian consumers along with the retail industry boom sweeping through the country has prompted our company to seriously look at establishing its presence in the Indian market, Gautier Chairman M. Dominique Soulard said in a statement. Also Monday, the head of Carrefour was quoted as saying it would choose an Indian supermarket partner early next year and plans to launch a cash and carry venture under its own brand in 2009. Carrefour has identified two or three potential partners and plans to make a final decision in the first quarter of 2008, Chief Executive Jose Louis Duran told La Tribune newspaper. Indias $350 billion retail industry--dominated by mom-and pop stores--is expected to double by 2015. The government does not allow foreign retailers selling multiple brands to set up shop in the country, but Wal-Mart (nyse: WMT - news - people ) recently

entered the market in a cash-and-carry venture with Bharti Enterprises. Plenty of protests greeted the U.S. retailing giant over its entry, with small-scale retailers saying millions would lose their livelihoods if both foreign and domestic firms brought radical change to the retail market. With Indias economy expanding at around 9% every year, the ranks of the rich are steadily rising. Retail consultancy Technopak Advisors estimates there are now 1.8 million households earning $100,000 or more per year and spending about $9,000 annually on luxury goods and services. That number is growing by 14% annually and represents a market potential of about $18 billion. But there still arent many customers for brands like Cartier, Gucci(other-otc: GUCG news - people ) and Chanel, the firm says, mainly because Indias rich have different priorities, like housing, education, automobiles and consumer electronics. And the main craze in India is for jewelry, accounting for 27% of the luxury market pie. ARTICLE 6 International products are bringing excitement to the soft furnishings, bed and bath retail space in India. Rahul Basu takes a look at a top player, Portico, in this segment Portico New York, a part of the textile and apparel manufacturing and exporting Creative Group, is a premium home textile brand targeted at middle- and high-end customers. It offers a range of products for complete home dcor needs. Through its aesthetic and understated contemporary designs, Portico has come a long way in capturing the imagination of its Indian customers.

As a niche player, it offers a wide range of bed and bath merchandise along with accessories often purchased for the purpose of gifting. The Portico range comprises bed sheets, duvet covers, towels, towels gift sets, shower curtains, soya bean quilts, anti-mite and anti-bacterial pillows, eco-pillows, micro-bead pillows, bath mats, bath room sets, blankets and more. Portico is primarily known for fashion and design and is a category leader in the branded bed and bath segment at most outlets where it is present. It primarily targets women in the age group of 25-35 yrs. Apart from these, Portico has also tied up with leading toymakers and kids entertainment channels like Mattel, Disney, Marvel, Cartoon Network and Nick to sell licensed soft furnishing products for kids. Creative Portico markets the following brands in India: Portico Tommy Hilfiger Home Soft furnishing products for kids and teens

y y y

Marketing marvel Following its entry into the bed and bath soft furnishing business in April 2004, Portico

has made extensive use of the print medium across 18 Indian cities, advertising in newspapers like the Times of India, Bombay Times and magazines like Femina and Filmfare. Portico has made unprecedented use of the shop-inshop format and has outlets in some of the biggest retail chains, where it has observed maximum footfalls. With a retail network consisting of 150 shop-in-shops, Portico outlets can be found today in leading departmental store chains like Shoppers Stop, Lifestyle, Piramyd, Ebony, Central and Pantaloons and also at home dcor and furnishing stores like Home Stop, Home Center, @home, Home Town, Evok, the Home Store, House Full, Godrej Lifespace, Reliance Retails specialty soft furnishing stores, and others. Some bookstores and children's stores also display Portico products Landmark, Odyssey and other multi-brand apparel stores. Apart from this, Portico also caters to leading hotels and pharmaceutical companies, which obtain its products for gifting purposes. Shop-in-shops has truly been a major factor in Porticos success in the premium home furnishings market in India. This has given Portico a very distinct identity, differentiating it from its competitors, and also acts as a very good brand touch-point. With the adoption of the shop-in-shop format, Portico has managed to reach out to its customers without having to spend heavily on advertisements. It has helped Portico to make its distinct identity and a known name to its customers. We have successfully used the shop-in-shop format to carry out visual merchandising of our products, says Mr Chandan, Brand and Marketing Manager, Creative Portico India Pvt Ltd.

Customers call

Customers today are routinely exposed to world-class products manufactured under international standards. They are not willing to pay for imported goods that are exorbitantly priced in the Indian market. Hence, Portico tries to offer such products at Indian prices. Its bold colours and designs and experimentation with different products has assisted in its overall success in India. Portico attributes a great part of its success to its promoters, salespersons and the back-end team who have shown patience and offered their assistance to customers at every step of the way. They have played a big part in the overall success of the brand. The home furnishing brand has received numerous awards in various categories right from the Award for Brand Excellence at Indira Marketing Awards in February 2006 to the Award for the Best Home-Ware Brand 2006-07 by Shoppers Stop and the Award for the Best Licensee 2007 by Mattel Ltd.

Dcor

At a Portico store, customers can find two or three beds covered with bed sheets, quilts and surrounded by other Portico merchandise, to help customers to visualise the products in their bedrooms at home. The store lighting, the appearance of the store, the dcor and display of products gives visual appeal to its products and helps customers to make the right choice.

Future

At present, Portico has only one franchisee outlet, but the premium retail brand wishes to

follow the franchisee route for its future endeavours. Talking about Portico's expansion plans, Mr Chandan said, The last few years have not been too good for the retail market, and we were waiting for things to improve with regard to the realty prices. We are looking at setting up another 10 stores in about a year's time. We want to hold on to our position in the market and consolidate our distribution network in the coming years. Portico also has plans to add readymade curtains to its product portfolio. Even though many of Porticos fine products are not manufactured in India, of late, most of its products have been coming in from India itself. At present, there are a number of retailers who are selling similar products in the market, but Portico is doing well on its own and has enjoyed good response and demand for its products. ARTICLE 7 International furniture Brands coming to Indian market. Going by the various industry reports the Indian furniture and related market is witnessing a very healthy growth rate due the boom in the Indian economy and the corresponding increase in the spending power of the population Said Mr. Liyakat Ali Khan, President, Universal Expositions Group. According to Mr. Khan, the market for imported furniture too has shown a tremendous growth in the recent times. The size of imported furniture market in India was USD 152.43 Million in the year 20052006 and USD 53.82 Million for 2006-2007 April-July quarter. . The main source of these imports are China, Malaysia, Italy, Germany and Singapore. While China and Malaysia cater predominantly to the middle class, Italy and Germany account for upper end furniture for home, office and commercial spaces, added Mr. Khan. The Index International Furniture Fair 2007 to be held at Mumbai has over 200 exhibitors (70 international names). The fair will be spread over an area of 40,000 square meters, while the fair in New Delhi with well over 100 exhibitors (30 international brands and counting) will be spread over an area of approx 15000 to 20,000 m2 The Indian Construction industry, ranked 12th in the world, is experiencing maximum growth and in turn, has created an explosive demand for furniture & allied products. The size of the Indian furniture industry is estimated to be approximately Rs. 8 billion and is growing at over 20 % per annum. Needless to say that the industry is poised to expand to meet the surge in demand. Almost every international furniture manufacturing country is looking to enter this vibrant market. While the furniture & allied product imports have touched an all time high,it will be the local players who will play an important role in the growth story of this sector. According

to Mr. Khan, an increase demand for furniture will logically mean growth in the manufacturer base. The fair is expected to assess the scope and trends of thisexpanding sector. International brands such as Arredo Classic, Art Design Group, B.T.C. International, Bastex, Bizzarri, Cantori, Desire, Effebiquattro, Elledue Arredamenti, Flou, Friulintagli Industries, Gardesa, Girasole, Gold Line, Gori Cucine, Laboratorio del Marmo, Lumina, Matteograssi, Mepsystem, Mida, Mobilificio Tre Ci, Nord Light, Paola Lenti, Pordenone Export, Presotto, Reflex, Riva Mobili d'Arte, Scavolini, Segis, Sicis, Stellare Mobili 2, Stival, Tonin Casa , Tonon & C., Uffix, Vitemper are looking to enter the Indian market and all these international brands are participating in the Index International Fair, at Mumbai and New Delhi said Mr. Khan. Apart from the tradefair, held concurrently will be prestigious Mostra Design Exhibit organised by the Italian Government.Many of the top minds of the industry will be participating at twoSeminars, also held concurrently. One being the Seminar organised by the Italian Furniture Association that includes B2B meetings and the other being a forumon Retail Spaces with the top expertson the subjectorganised by the IndexFurniture Journal (ifj ), the premiertradepublication for the industry. ARTICLE 8 Key Players in Home furnishing sector The players in the field who offer a variety of home furnishings products include Home Store, Home Saaz, @Home , Hanung Toys and Textiles, Big Bazaar, Vishal Mart, Jagdish Store, Seasons, Harrisons, Green Ply and Vistar. While players like Mothers' Interiors, Mac and Vista are specialists in curtain rods, chick blinds and awnings. The home furnishings industry is not only catering to the real estate/housing sector but also to the hospitality and healthcare industry through its hospitals, clinics and research institutes. This happens in the domestic market as well in the international market. The only problem it faces in India is that it is still part of the unorganized sector. According to Manoj Choudhary, director, Mothers Interiors, furnishings industry in India will take another five-six years to become an organised sector. Hospitality industry will help push forward the furnishing industry with 20-25 per cent in the coming years." The home furnishings market is on the recovery stage; it has almost said good bye to the economic slump. "The rise in middle-class incomes, especially after the sixth pay commission and an increase in the number of home furnishings retail chains, particularly

in smaller cities, will help propel the growth of the industry by many folds" , said Choudhary. "While doing a survey of the market trends, Mothers interiors marketing professionals noticed changing trends in smaller cities. Apart from metro cities, the emerging markets for home dcor business are Assam, Patna and Jharkhand," said Choudhary. New cities that have started appearing on India's map are contributing to the home furnishings market. Previously, in a city such as Kolkata, the market was limited to standard curtains and rickety straight backed chairs. Now, the same people and their progeny would like to furnish their smaller apartments with more classy sofas and window bric-abrac . The items that are sold in this industry are so light to handle and also demand a lot of artistic work that a lot of people who are one off individual companies thrive easily in a few years and build up both quite a reputation and also good turnover. Another time when home furnishings had taken off as an industry was when Captain Gopinath's Deccan Airways had been successful in giving poor women in small towns and villages to sell their produce in far off cities by traveling in aircraft. This kick started a huge industry and women could sell items such as handmade wicker baskets and hand woven curtains to housewives in cities by traveling in one of the Deccan Airways flights. This was stopped abruptly when Deccan went belly up and sold off to Kingfisher Airlines. However, the same suppliers began to sell to accumulators and distributors and thence began a saga of home furnishings which refused to die down. The same trend is continuing today but the slump with the real estate industry caused a yearlong set back to the whole process. ARTICLE 9 LATEST TRENDS IN HOME INDUSTRY SECTOR Designers and design professionals pride themselves in causing confusion every year. They promptly junk whatever you bought last year and pronounce something totally different to become mandatory purchases all over the house and in the office. If you have a business with an in-house design consultant or an employee, then you have had the worst of both worlds, as far as expenditure goes. Right now, the latest trends refer to soft pastel shades in fabrics; matted finish furniture; contemporary look curtains and curtain rods; bright as well as pastel shades in wall colours, and half regular and half modular kitchen settings. This looks good if you try them in a house which is the right size. Kindly do not superimpose the design suitable for a large sized villa, on a two bedroom apartment on the fifth floor. Design also has everything to do with colour. The same design that can look playful and joyful in an area which is in a rainy tropical region such as Guwahati and Kolkata will look garish in a desert city such as Delhi or Jodhpur.

Design is now available in every street corner with an expert wearing the right clothes and making the right noises in every home furnishings shop. However, you may not want to get taken in with the sweet talk. Home dcor is your problem and your own solution will work best for you. If you make a mistake you will know how to appropriately rectify it and get the best out of your own home. According to Alex Joseph, vice president, marketing and communications, Greenply Industries, "The latest trend in home furnishings is experimenting with your dcor. Today we have plethora of choices available to decorate our homes like from choosing the right colors with the right designs and matching it with the surroundings in the room such as curtains, chicks etc. Bright colored and abstract walls are very much in vogue. With the advent of monsoon/autumn, warm and earthy colors will rule the palettes. Our very recent range under Greenlam Laminates offers new textures, abstract designs and wood patterns which set the trend in the market. The look has to be minimalist and not overcluttered. If your walls are dramatic, try keep everything else very neutral and viceversa." Greenply's flagship brand Greenlam laminates focuses on bringing in the latest designs for the affluent class of customers who are conscious about their lifestyle and follow the latest trends. Whereas the Vaastu inspired range of New Mika is for people who believe in evergreen designs and enjoy the classiscs. "Our USP would be diversity and innovation in design and materials. Our laminates and sheets can be teamed up with furniture, floors, walls and everything imaginable under the sun. The variety in texture, colors gives the consumer a lot to choose from", said Joseph. ARTICLE 10 MARKET GROWTH IN HOME HOME FURNISHING SECTOR The home furnishing market in India is driven by growth in the real estate and hospitality sector. Rise in disposable income and willingness to spend on contemporary design and high quality furnishings have increased overall demand for home furnishing products. The home furnishing market is poised to grow gradually. The report begins with an overview of the textile industry in India including market size and growth. This is followed by an overview of the home furnishing market in India, its size and growth. The major products have been highlighted and are followed by the key manufacturing centers in India. The value chain is also provided which is followed by a section on import and export for the home furnishing products. An analysis of the drivers explains the factors for growth of the market including growth in real estate sector, growth in hospitality sector, growth in organized retail and growth in disposable income. The key challenges of the market include raw material unavailability and cost, active unorganized market and market potential being restricted to cities. Government regulations are provided followed by a section on the latest trends that govern the market.

The competition section provides a summary of the nature of businesses of the major players. This is followed by brief profiles of these players including their corporate information and business highlights.

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- AdRoll The Performance Advertisers Guide To Instagram PDFDocumento10 pagineAdRoll The Performance Advertisers Guide To Instagram PDFMarianoC.ChenaNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Customs DocumentationDocumento2 pagineCustoms DocumentationDHL Express UKNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Marine 2Documento9 pagineMarine 2Neesa AsriNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Marketing Plan ATTDocumento17 pagineMarketing Plan ATTDora Wan100% (1)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Economic Analysis Verka PDFDocumento13 pagineEconomic Analysis Verka PDFPayal MahajanNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- MERCHANDISINGDocumento40 pagineMERCHANDISINGKshipra Gadey100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

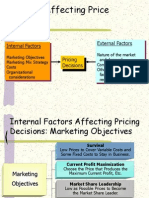

- Internal Factors External Factors Pricing DecisionsDocumento17 pagineInternal Factors External Factors Pricing DecisionssaurabhsaggiNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Aggregate Demand and Aggregate SupplyDocumento38 pagineAggregate Demand and Aggregate SupplyNedaabdiNessuna valutazione finora

- FDL - L1Documento108 pagineFDL - L1Shanice AlexanderNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Review of Literature.Documento13 pagineReview of Literature.Kandlagunta Gayathri Praharshitha100% (2)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Case Study Finals (Coke VS. Pepsi Rivalry)Documento13 pagineCase Study Finals (Coke VS. Pepsi Rivalry)Phao Delos SantosNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Chapter 8 Segmenting and Targeting MarketsDocumento26 pagineChapter 8 Segmenting and Targeting Marketsrizcst9759Nessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Food Tech NotesDocumento2 pagineFood Tech NotesquixoticepiphanyNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Determining The Monetary Amount of Inventory at Any Given Point in TimeDocumento44 pagineDetermining The Monetary Amount of Inventory at Any Given Point in TimeParth R. ShahNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Next Generation Distributed Telephone ExchangeDocumento4 pagineNext Generation Distributed Telephone Exchangebinary11Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Cost Terminology and Cost BehaviorsDocumento8 pagineCost Terminology and Cost BehaviorsHunson Abadeer100% (2)

- Vol CodesDocumento40 pagineVol CodesyennyNessuna valutazione finora

- Boeing 777 FreighterDocumento5 pagineBoeing 777 FreighterIsac Andrei RobertNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Chapter 14 MCQDocumento4 pagineChapter 14 MCQcik sitiNessuna valutazione finora

- Product Marketing Mix PDFDocumento17 pagineProduct Marketing Mix PDFDharani C KNessuna valutazione finora

- End of AdvertisingDocumento253 pagineEnd of AdvertisingMarina BaraNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- This Agreement Is Subject To A 7 Day Cooling Off Period: Important NoticeDocumento58 pagineThis Agreement Is Subject To A 7 Day Cooling Off Period: Important NoticeBlue PrintNessuna valutazione finora

- PEST Analusis and Macro EnvironmentDocumento20 paginePEST Analusis and Macro Environmentrrgsbandara82% (11)

- Loans and AdvancesDocumento64 pagineLoans and AdvancesShams SNessuna valutazione finora

- 520 How Personal Can Ethics GetDocumento6 pagine520 How Personal Can Ethics Getblancher_317924055Nessuna valutazione finora

- Running Head: Tivo: Snapple 2018: Healthy Juice ReimaginedDocumento8 pagineRunning Head: Tivo: Snapple 2018: Healthy Juice ReimaginedAnggun Citra BerlianNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The MRTP ActDocumento4 pagineThe MRTP ActKuber BishtNessuna valutazione finora

- AkzoNobel TAS2009Issue1 Tcm52-30799Documento16 pagineAkzoNobel TAS2009Issue1 Tcm52-30799vblock58Nessuna valutazione finora

- Market Research On Samsung Mobile Phone PDFDocumento103 pagineMarket Research On Samsung Mobile Phone PDFPriyaNessuna valutazione finora

- Retail Cosmetics SephoraDocumento25 pagineRetail Cosmetics Sephoraagga11110% (1)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)