Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hjalmar Lindholm - Investment Banking, An Overview

Caricato da

SimoeLoganCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Hjalmar Lindholm - Investment Banking, An Overview

Caricato da

SimoeLoganCopyright:

Formati disponibili

Investment banking is somewhat of a generic term that equates to niche finance activities, complicated financial instruments and high

risk and reward outcomes. Newspaper articles abound with articles of excess during the successful times, together with reports of staggering losses in a leaner era. Behind the headlines, it may be useful to gain a basic understanding of how investment banks are constructed, so that we can obtain a better insight into their activities and how these are controlled and managed. The standard investment bank divides its functions into three overall sections: front, middle and back office. The front office is the client-facing component and undertakes the transactions. The middle office oversees the front office and manages risk and compliance, with the responsibility for ensuring adherence to internal controls and regulatory requirements. Finally, the back office undertakes support roles, such as IT and operations, ensuring transactional information is correct. Clearly, this is a very broad overview of the distinction between the three sections. We can this down further, by briefly describing the activities within the three offices. The front office comprises corporate finance, which advises companies on making decision that will augment their corporate value, such as managing investments, raising finance and dealing with mergers and acquisitions. The front office also includes the sales staff, who act as the relationship managers for clients, suggesting sales and purchases of shares, funds, derivatives, securities and so on and the traders who perform the transactions. In theory, there is a Chinese wall between the advisory function of corporate finance and the markets division of sales and traders. In addition, there are researchers who analyse market information and make suggestions to the sales and trading staff and finally, a structures team, which develops financial instruments and packages them for the banks clients. The middle office can be viewed as the policing function of an investment bank, and consists of risk management and compliance. The risk management team seeks to limit the banks exposure to overly adverse trading positions and can restrict exposure by placing caps on trades. Compliance officials are tasked with ensuring the bank adheres to regulatory requirements and controls. Lastly, the back office contains the operations team, which checks the data of the trading desks transactions and ensures these have been performed as per instructions. It is also where IT sits, which is responsible for ensuring trading platforms are running correctly and that the banks IT systems are properly maintained and secure.

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

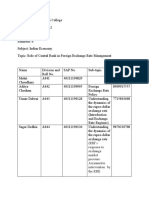

- Tybcom - A - Group No. - 5Documento10 pagineTybcom - A - Group No. - 5Mnimi SalesNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- 47 Electricity Accounting Theory ProblemsDocumento5 pagine47 Electricity Accounting Theory Problemsbala_ae100% (1)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- SM-Investment-Corporation-Financial-Ratios Tramps SM InvestmentsDocumento14 pagineSM-Investment-Corporation-Financial-Ratios Tramps SM InvestmentsKathnie911100% (1)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- HCGCCGFC SawaalDocumento6 pagineHCGCCGFC SawaalBhanu SharmaNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grp02 S07 - Toyota in France Qn01Documento1 paginaGrp02 S07 - Toyota in France Qn01api-3695734Nessuna valutazione finora

- 12th SP Paper Time Management March 2022Documento17 pagine12th SP Paper Time Management March 2022Sharvari PatilNessuna valutazione finora

- Agm ChecklistDocumento3 pagineAgm ChecklistMohd MohdNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Solución de Problemas Planteados PresupuestosDocumento13 pagineSolución de Problemas Planteados PresupuestosAndre AliagaNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- IFT Assignment 1 (Akhilesh Jajee)Documento3 pagineIFT Assignment 1 (Akhilesh Jajee)anushaNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Dell Working CapitalDocumento6 pagineDell Working CapitalNavi Spl50% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Sample Engagement LetterDocumento4 pagineSample Engagement LetterAnurag Gupta50% (2)

- Naspers Investments and Divestment ActivitiesDocumento11 pagineNaspers Investments and Divestment ActivitiesManideep NuluNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Flat Cargo Case SummaryDocumento7 pagineFlat Cargo Case Summaryamir5035Nessuna valutazione finora

- Indonesian Railways Law and StudyDocumento108 pagineIndonesian Railways Law and StudyGonald PerezNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- What Is Return On Equity - ROE?Documento12 pagineWhat Is Return On Equity - ROE?Christine DavidNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Slide Tax Incentives For Green Technology Industry 27 Feb 2018Documento30 pagineSlide Tax Incentives For Green Technology Industry 27 Feb 2018rexNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- TCWDocumento2 pagineTCWPanget PenguinNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Title First Name Last Name Designation CompanyDocumento18 pagineTitle First Name Last Name Designation CompanyPriti ThakurNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Formation of A Company Act 1956Documento56 pagineFormation of A Company Act 1956Dhaval ThakorNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDocumento19 pagineCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- 2nd Online Week5-6Documento34 pagine2nd Online Week5-6Jennifer De LeonNessuna valutazione finora

- JLL Asia Pacific Property Digest 4q 2015Documento76 pagineJLL Asia Pacific Property Digest 4q 2015limpuppyNessuna valutazione finora

- Corporate Strategy A Lecture 1Documento64 pagineCorporate Strategy A Lecture 1Falak ShaikhaniNessuna valutazione finora

- Your Palletizing SolutionDocumento8 pagineYour Palletizing SolutionKien Nguyen TrungNessuna valutazione finora

- NPC vs. QuezonDocumento11 pagineNPC vs. QuezonSjaneyNessuna valutazione finora

- Viral Patel Trupal Vagadiya Jugen Shah Pradeep Tiwari Ravi Thakarar Hardik ThakerDocumento24 pagineViral Patel Trupal Vagadiya Jugen Shah Pradeep Tiwari Ravi Thakarar Hardik ThakerHardik ThakerNessuna valutazione finora

- Arcadia Share and Stock Broker PVT LTDDocumento20 pagineArcadia Share and Stock Broker PVT LTDdivya priyaNessuna valutazione finora

- NPV Irr Payback & Pi As Well From The Very BasicsDocumento37 pagineNPV Irr Payback & Pi As Well From The Very BasicsZab JaanNessuna valutazione finora

- Business Analysis and Valuation 3 4Documento23 pagineBusiness Analysis and Valuation 3 4Budi Yuda PrawiraNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Project Report On Mutual Funds in IndiaDocumento43 pagineProject Report On Mutual Funds in Indiapednekar_madhuraNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)