Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Customer Value Management

Caricato da

xattitudeDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Customer Value Management

Caricato da

xattitudeCopyright:

Formati disponibili

WHITE PAPER

CUSTOMER VALUE MANAGEMENT: ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Balancing customer and shareholder value

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Table of Contents

Introduction ................................................................................................. 1 Understanding costs, potential customer value and customer needs ..... 2 Evaluating customers by combining nancial value with loyalty ............. 3 The trade-off between customer and shareholder value .......................... 7 Focusing, without obsessing, on the customer ......................................... 9 Methods for measuring existing customer potential ............................... 10 Requirements for a customer-focused strategy ...................................... 11 1. A single view of the customer ........................................................ 11 2. An understanding of customer value and protability drivers ........ 12 3. Meaningful customer segmentation schemes................................. 13 4. Targeted cross-selling, up-selling and retention programs ............ 14 5. Effective marketing delivery systems ............................................. 14 Realigning around customers rather than products ................................ 15 Preparing for the integration of customer analytics ................................ 16 Physics, customer value and shareholder wealth ................................... 17 About SAS .................................................................................................. 19

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

This white paper was written by Gary Cokins, an internationally recognized expert, speaker and author on the subject of advanced cost management and performance management systems. He is a solutions manager with SAS, a leading provider of business intelligence and analytic software headquartered in Cary, NC. Gary received a B.S. in Industrial Engineering/Operations Research from Cornell University and an M.B.A. from Northwestern Universitys Kellogg School of Management. Gary began his career at FMC Corporation and has served as a management consultant with Deloitte, KPMG Peat Marwick and Electronic Data Systems (EDS). His latest book is Performance Management: Finding the Missing Pieces to Close the Intelligence Gap. Gary can be reached at gary.cokins@sas.com.

ii

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Introduction

In 2005, Best Buy stunned the business media by announcing that it was focusing its marketing and sales efforts to attract and grow only those customers most likely to generate prots. This strategy implied that Best Buy would pay little or no attention to certain types of customers, such as infrequent shoppers or customers who only purchase discounted items. Best Buys competitors immediately broadcast to the marketplace that they would cater to all customers equally. Best Buy held their ground and continued to outpace the industry average on prots. In its seemingly cold strategy, Best Buy was pursuing a fact that many organizations have sensed intuitively some customers are more protable than others. Additionally, some customers have more potential to be protable in the future. Business is no longer just about increasing sales. Its about increasing the protability of sales. It is not enough only to measure gross margin protability for sales of products and services. Most products or service lines require fairly standard and predictable work activities that do not vary from month to month and are, therefore, not dependent on customer behavior. Companies must instead start to identify the difference in cost to serve between different types of customers (called the fully loaded costs of serving a customer). This effort will help them get a full picture of where their businesses are making or losing money. Peter Mathias and Noel Capon of Columbia University explain the importance of measuring fully loaded costs: Most sales people manage for short-term revenues (regardless of prots). With an increasingly sophisticated customer base that wants lower prices, greater service and more control, this strategy most often results in declining prot margins and commoditization. Increasingly buying power and market inuence is being concentrated in an ever-smaller number of strategic customers. Hence, going forward, we believe that companies will have to think beyond short-term revenue and protability of today. They will have to take the long view and manage their strategic customer relationships as assets. They will attempt to maximize the net present value (NPV) of future prot streams from these customers, thus shifting to the enhancement of long-term Customer Relationship Capital.1 It is important to understand that customers sometimes become unprotable as a direct result of the way the business operates in its relationship with them. For example, a protable customer may inadvertently be cross-sold a product or service that cannibalizes an existing source of revenue for the business. Similarly, the way the sales process is conducted and remunerated for sales staff may well encourage the acquisition of unprotable customers.

Business is no longer just about increasing sales. Its about increasing the profitability of sales.

1 Mathias, Peter F., and Noel Capon. Managing Strategic Customer Relationships as Assets.

Columbia Business School (2003), p. 2.

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Hence, companies must improve in several areas to develop successful strategies that focus on customer value. Any customer-related initiative or interaction must differentiate customers to give insight into the value-creating potential of those customers. Nevertheless, at the strategy level, many companies remain focused on pushing out products rather than drawing in customers. If a companys strategic focus is to sell as many products as possible, customers will be overwhelmed by irrelevant marketing and sales offers, and their satisfaction will be lowered. It is very difcult to acquire, grow or retain protable customers in that kind of environment. Ultimately, insight into the value created by each customer relationship provides the most useful information for decision makers. Traditional CRM prot measures typically calculate historical revenues and costs and, therefore, do not provide insights to future value creation.

Ultimately, insight into the value

created by each customer relationship provides the most useful information for decision makers.

Understanding costs, potential customer value and customer needs

A customer-oriented strategy for improving shareholder wealth should focus on three factors: costs, potential customer value and customer needs. When companies miss the mark on these three areas, they end up placing customers into the wrong value groups. This error ripples out to enable suboptimal managerial decisions, misallocation of marketing and sales resources, and, ultimately, lower prots, slower growth and lost competitive advantage. Companies need a complete picture of the measurable value of each customer relationship. The only value your company will ever create is the value that comes from customers the ones you have now and the ones you will have in the future, say Peppers and Rogers in their most recent book, Return on Customer. To remain competitive, you must gure out how to keep your customers longer, grow them into bigger customers, make them more protable and serve them more efciently. Over time, enterprise value goes up because a company can maximize its return on customer.2 Lets look more closely at the three important factors for a customeroriented strategy. Costs. Any measure of customer value depends on an accurate view of both revenue and costs. All companies use sales accounting systems to track and assign sources of revenue to individual customers. And there is usually enough transparency between customers and their purchases to come up with a reliable revenue gure for each customer. Unfortunately, the same transparency does not apply to costs, and many companies struggle to get a clear picture of the cost-toserve for different customers.

2 Peppers, Don, and Martha Rogers, Ph.D. Return on Customer: Creating Maximum Value from Your

Scarcest Resource. Currency/DoubleDay (2005). Return on Customers and ROC are registered service marks of Peppers & Rogers Group, a division of Carlson Marketing Group.

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Without an accurate view of customer-related costs, companies end up with a distorted understanding of customer value. Customers thought to be high-value, for instance, may actually be much less valuable if their cost-to-serve far exceeds the average. Activity-based costing can be used to resolve this measurement problem. Potential customer value. Potential customer value tells you which customers bring the highest value today, which will offer the highest value tomorrow and which core attributes you should look for in prospects. This measurement requires an extension of retrospective cost accounting to include prospective value-based accounting. People are creatures of habit, so historical behavior patterns for individual customers can be used to extrapolate projections into the future. This knowledge directly helps your efforts to retain, grow and acquire the right customers. You can learn about customers capacity to deliver future prot, as well as where to focus your resources (e.g., employees and marketing spend) to avoid wasting precious time and money with the wrong types of customers. Customer needs. If value tells you where to focus, an understanding of customer needs tells you how to win. Customer needs analysis helps you tackle the question: What will motivate customers to strengthen their relationships with my company? The answer may be to scale back cross-sell offers to specic types of customers or to communicate with high-value customers only through their preferred channels. This type of analysis leads to more intelligent, differentiated service levels and offers to the right type of customer. Understanding needs means uncovering customers preferences (e.g., Please send me new offers only via e-mail.), goals and desires. These clues point to factors that motivate customers to buy at different points in their life cycles. This information also helps sales and marketing teams make the right offers to the right customers at the right time and across the right channels. Though these measures are essential, a complete customer analysis should address why a customer would be of value. The why is important to help analysts predict the above values and extrapolate them across the customer base. The end result of this is to enable the organization to develop marketing and sales strategies to proactively manage customer value upwards.

The activity-based costing

methodology and its supporting software technologies have provided the ability to trace the unique costs of customers, channels, services and products.

Evaluating customers by combining nancial value with loyalty

More advanced analytic organizations have become competent in measuring customer protability. The activity-based costing methodology and its supporting software technologies have provided the ability to trace the unique costs of customers, channels, services and products including salaries, supplies, etc. The vertical axis of Figure 1 shows the protability of customers (or customer segments) generated during a past time period.

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Figure 1: Combining current prot and long-term potential value.

In practice, the ranking of customers by their prot contribution during some past period is a continuously changing list, due to the timing and mix of customer purchases. Past-period prot measures are useful as a proxy for ranking the prot generation of customers, but the true insights that determine the level of differentiated service to various types of customers must be derived by understanding the future nancial rankings of the customer base. In many industries, particularly the service sector, a sizable portion of revenues and costs are incurred after the initial sale of a product or service line. Post-sales activities occur in future periods, not past ones. This suggests the need to estimate the short-term future prot impact of past sales and show them on the horizontal axis of Figure 1. An even more challenging task is to locate customers along the horizontal axis in Figure 1 by determining their long-term potential value. Understanding long-term potential value requires viewing customers as investments. Much like equity stocks in an investment portfolio, some customers may be big winners while others disappoint. Evaluating investments in accounting and nance involves calculating future streams of revenue and their associated costs. In contrast to calculating the prot from a past time period, calculations of projected nancial returns use discounted cash ow (DCF), time-value-of-money principles and math that considers the timing of future cash inows and outows, as well as the cost of capital. Most protability measures are historical and do not consider products and customers prospective prot contribution. The DCF of a customers future purchases minus the cost-to-serve the customer is called customer lifetime value (CLV). Calculating the DCF of a customer is not as complicated as it initially appears. Figure 2 shows a DCF equation for measuring future customer value. While it may seem intimidating, Figure 3 recasts key elements of the equation into a spreadsheet view that most of us are more comfortable with. The equations quantify the price less cost for the expected purchased volume of each product or standard service-line, less the cost to serve (including the cost to maintain). These costs are calculated for each customer (or each customer segment) and then factored for probabilities. The horsepower of todays software makes these calculations feasible.

In contrast to calculating the profit

from a past time period, calculations of projected financial returns use discounted cash flow (DCF) timevalue-of-money principles and math that considers the timing of future cash inflows and outflows, as well as the cost of capital.

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Since a DCF amount is more heavily

Figure 2: Example of a companys customer lifetime value formula.

influenced by the first few years of cash flow, there is less impact to the DCF amount beyond five years.

Figure 3: A spreadsheet-based view of CLV calculations.

The challenging tasks in this DCF calculation are: 1. Estimating current and future purchase level probabilities for individual customers. 2. Predicting the likelihood that certain customers may defect to competitors (or stop purchasing from you). There is typically no contractual termination date with customer relationships, and attrition must be considered. More traditional calculations of costs and cost-to-serve are much simpler than the two calculations above presuming that sufcient historical unit cost rates exist, and that sales and marketing program plans are available for each customer segment. Activity-based costing systems provide such unit cost data. Traditional DCF calculations are typically point solutions and disregard the complexities of probabilistic scenarios. Regardless of the level of sophistication in the math, the key for accuracy and reliability is in the assumptions and the ability to estimate projections. There is some debate about the number of years that should be included in the planning horizon for DCF calculations. Some organizations only project out ve years to coincide with their corporate strategic plans. In addition, since a DCF amount is more heavily inuenced by the rst few years of cash ow, there is less impact to the DCF amount beyond ve years. A ve year horizon DCF can be referred to as customer long-term value rather than customer lifetime value. If the business is nancial services, such as insurance, mortgages or long-term annuities, it may be important to include data well beyond ve years. In short, the appropriate number of future periods and the level of detail should depend on the accuracy required for DCF-based decisions to be made with the DCF information.

5

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

The nal element of the DCF equation, the discount rate, also causes debate. Rather than agonizing about the risk-based cost of capital assumptions, some organizations use the same rate for each customer. With this approach, only the customers unique actions will impact his ultimate economic value scores. An exception might be in the nancial services industry, where a customers credit standing and risk could support matching higher-quality customers with lower discount rates. But lets suppose for now that a DCF-based CLV amount can be calculated with reasonable discount rate assumptions and minimal administrative effort via automation (several companies today are successfully calculating CLV, so evidence exists that it can be done). Whats the next step? How would you use customer value scores? One obvious option would be to identify, prioritize and target prospective customers who are similar to your most valuable existing customers. Another option would be to migrate existing customers to higher CLV levels using crafted interactions with them. Ultimately, these possibilities are about getting a higher yield from your marketing and sales budget. A less obvious but possibly more important choice would be to use CLV calculations to determine the optimal level of spending for marketing and sales. Figure 4 illustrates how the customer data points in Figure 1 could be assigned a single customer nancial value score using each customers distance from the upperright corner (where the best customers are located).

A companys ability to satisfy its

customers and retain their loyalty provides a sustainable competitive edge that allows higher average prices relative to competitors and results in higher sales growth and financial return on assets.

Figure 4: Ranking customer value scores.

Research has validated an intuitive hypothesis that customer loyalty directly inuences a companys sales and prot growth.3 This research demonstrates that a companys ability to satisfy its customers and retain their loyalty provides a sustainable competitive edge that allows higher average prices relative to competitors and results in higher sales growth and nancial return on assets. In this same research, however, it is pointed out that managerial accounting systems do not measure what drives customer value from the companys perspective. To combine nancial customer value information with non-nancial information about degrees of customer loyalty, it is necessary to equate the two-axis data points in Figure 4 with a single customer nancial value score. A customers degree of loyalty directly inuences the amount of spending that may be required to retain that customer. Some advanced companies use business intelligence software to understand psycho-demographic characteristics of customers and predict their future behavior.

3 Smith, Rodney E. and Wright, William F.; Determinants of Customer Loyalty and Financial Perfor-

mance; Journal of Management Accounting Research; Volume 16; 2004; p. 203.

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

It is not unusual for the customer analytics departments in such companies to claim that their customer survival (i.e., retention) projections are reliably accurate. They can almost predict by name which customers are likely to defect. Still, the question remains whether it is worth the extra cost to retain them. Figure 5 places the ranked customer nancial value score from Figure 4 on the vertical axis and combines it with a customer loyalty score on the horizontal axis. With both pieces of information, that customers location in Figure 5 implies the level (and associated cost) of differentiated incentives, deals, discounts and the like that will be required to retain the customers revenue stream. Less loyal customers will require more retention spending.

Figure 5: Value score vs. loyalty.

How does the integration of customer value and customer loyalty translate into business decisions? The spending budget for sales and marketing is critical, but those funds must be treated as a preciously scarce resource if they are to generate the highest long-term prots. Accomplishing this goal means answering questions like: Which types of customers are attractive to acquire, retain, grow or win back? How much should we spend attracting, retaining, growing or recovering those customers? (Both spending too much on loyal customers and spending too little on less loyal customers can adversely impact future prots.) Ultimately, cost accounting measures, which are typically product-based and retrospective, must extend to become forward-looking, value-based measures. Evaluating customers requires calculating prospective metrics that, when acted upon intelligently, truly convert to bottom-line earnings and shareholder wealth.

Evaluating customers requires

calculating prospective metrics that, when acted upon intelligently, truly convert to bottom-line earnings and shareholder wealth.

The trade-off between customer and shareholder value

The second question above is about determining how much to spend on valuable customers. This type of analysis is often called sensitivity analysis. In essence, sensitivity analysis helps you determine what impact you will get by spending an extra dollar (or euro) on each customer.

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

In some cases, excess spending can lead to the destruction of shareholder wealth. With unbridled spending, you can bribe customers in order to retain their loyalty, but they might also become less valuable even to the point of being unprotable if you spend too much on differentiated services or deals with them. In contrast, insufcient spending on a customer can also harm shareholder wealth. By neglecting customers, particularly marginally loyal ones, you risk losing them to a competitor or affecting how often they spend. Both results reduce the lifetime value for that customer. A company affects customer loyalty constantly, through every interaction. Interactions can include actively pursuing customers with new offers or passively assigning them to segments that receive a set of dormant offers. Figure 6 displays these trade-offs in terms of an optimization problem intended to maximize shareholder wealth. Combining customer nancial value scores with loyalty measures will help determine the optimal level of marketing and sales spending for each customer cluster.

A company affects customer loyalty

constantly, through every interaction.

Figure 6: Trade-off analysis of differentiated spending.

Many skeptics still believe this type of DCF calculation of customers is unrealistic. Even the academic world has yet to explore these interdependent relationships fully: Customer value management can be regarded as the key driver of Shareholder Value (but) surprisingly, although being of obvious importance, literature taking a more comprehensive view of customer valuation has only recently been appearing. A composite picture of customers and investors is hardly found in business references.4 Nevertheless, the concept of integrating customer value and shareholder value is being addressed by the leading authorities in the eld of CRM, Peppers and Rogers: A higher promotion budget might improve customer acquisition. But each new acquisition will be more expensive. Its possible to wind up spending more than a new incrementally lower prot customer will ever be worth . Creating value from customers is an optimization problem. Often, however, the trade-offs occur in terms of generating increased future cash ows with adverse results of reduced current cash ows, or vice-versa . If CLV doesnt improve enough to offset increased costs, then value will be destroyed, even as loyalty improves.5

4 Bayon, Gutsche and Bauer. Customer Equity Marketing. European Management Journal, June 2002. 5 Peppers, Don, and Martha Rogers. Return on Customer, pp. 12-13.

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Focusing, without obsessing, on the customer

Ultimately, our discussion is about managing a companys customer portfolio to reward shareholders. Theres a difference between customer-obsessed and customerfocused. Customer obsession can result in sales at any cost and unnecessary services for some customer types. Such practices work to destroy shareholder wealth. Instead, a company must continuously analyze its customer portfolio in innovative ways to discover new protable revenue growth opportunities. A business strategy designed to accomplish this goal must facilitate revenue growth and will generally pursue the following objectives: Identify, understand and address your best (and worst) customers. Target and sell existing products and services to existing customers. Target prospective customers that are similar to your most valuable existing customers. Develop compelling new product and service offerings, price schemes and marketing programs for the entire customer portfolio. But focus rst on high-value customers. Retain the most valuable customers. Increase wallet share for customers with high potential CLV but currently low protability. Develop organizational brand and image aimed at attracting high-value customers. There are, of course, other questions that must be resolved if a customer-focused business strategy is going to provide the most benet. Should sunk costs (i.e., money already spent on acquiring customers) be included in decisions about customer value? The prevailing thinking on this is to ignore sunk costs for existing customers, since acquisition has already occurred. Ongoing traceable spending on existing customers should be evaluated based on the incremental revenues it will produce. In contrast, for potential customers, acquisition expense should be included, since it affects capital budgeting. Do relative or absolute measures matter more for decision making? The two options in this scenario are to calculate actual currency amounts for CLV and to use CLV calculations as comparative values. Generally relative measures will sufce as long as CLV is calculated consistently for each customer. The focus should be on how each next spent dollar or euro can trigger a future prot-producing income. Should customer value calculations be used to justify additional budget allocations for customer acquisition and retention? While it may be theoretically possible for marketing to use these analytics to build a case for additional funding, the politics in most companies make this situation unlikely in the foreseeable future. Instead, its best to focus insights from customer value calculations toward the best allocation of existing funds and not to negotiate for higher budgets (but that day will come).

A company must continuously

analyze its customer portfolio in innovative ways to discover new profitable revenue growth opportunities.

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Methods for measuring existing customer potential

There are no standardized methods for customer analytics groups to apply the customer value scoring information. For existing customers, generally their objective is to generate the highest prot payback by targeting the correct customers with the correct product and service offerings and the most effective stimulating message, offer or deal. Short-term vs. perhaps an even more lucrative long-term payback will always be controversial, but that is typically governed by the short-term impatience of the nancial capital markets. Two analytic methods appear to be emerging: Total Market Share and Incremental. What they both have in common is that they focus more on growing sales than on sustaining customers identied for retention. These two methods do not result in spending the relatively highest amount of the marketing budget on the most valuable customers. Instead, they focus on selling more protable products or services to the highest potential customers. That is, it is obviously important to retain an existing valuable customer who is already steadily purchasing high-margin products and services (ideally with low cost-to-serve); but a higher payback for shareholders may be to induce any existing customer with the potential to purchase more products and services, particularly the high-prot-margin ones. Total Market Share This method applies to companies whose customers likely purchase some products or services from competitors. For example, a television cable company may have customers that purchase telephone services and highspeed Internet services from two other vendors. This method starts with the existing customers revenue and prot stream as a base, and then it intelligently adds estimates through deductive reasoning for what other products and services and their associated amounts each customer is likely purchasing from competitors. Good modeling techniques of household spending behavior can provide this total market picture reliably. The purpose of this method is to measure the share of wallet or purse for each household that remains to be won, and to target the highest prot potential from it relative to the cost of the marketing effort, offer, discount or deal required to secure it. Incremental This method focuses on determining the best combination of a low incremental marketing cost and a high incremental increase in product or service offering prot. Similar to the Total Market Share method, this method begins with developing a baseline from which to evaluate changes. But this method seeks a long-term planning horizon that includes product and customer life-cycle changes. It begins with all customers ongoing purchases as forever repeating. It then adjusts those nancial revenue and prot streams based on the introduction of new product features (e.g., video streaming into cellular phones). Approaches can vary, but one approach is to determine the similar proles of what customers have purchased in the past and apply those effort-free purchases to existing customers and to do so with zero marketing spend.

10

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Next, a future desired spending level of product mix and volume is projected. The gap between those two scenarios is measured for each customer. With knowledge of which deals (e.g., discounts, free minutes in cellular phones, etc.) successfully create which purchase responses from customers, a tapered list can indicate the highest revenue stream net of the products cost and marketing investment to evoke the purchase. Spending is prioritized beginning at the highest potential on the tapered list. These are not the only methods, but they provide insights to the levels of sophistication that companies CRM departments can employ to maximize the yield from their marketing budgets to retain and grow sales.

Requirements for a customer-focused strategy

To accomplish the objectives and address the issues above, a company must possess ve core capabilities (see Figure 7).

Figure 7: A foundation for customer portfolio management.

Becoming customer-centric requires

a 360-degree view of data.

1. A single view of the customer

Companies often have difculty accessing, consolidating and analyzing the customer data that exists across their various business systems. This issue is exacerbated over time as the number of discrete customer databases expands. Becoming customer-centric requires a 360-degree view of data. A bank, for example, should ideally consolidate its information into a single database rather than keep its credit card data in one place, its bank account data in another and its mortgage data in yet another.

11

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

2. An understanding of customer value and protability drivers

Meaningful transactional customer data and the right analytic processes and software can give you insight into which customers are most valuable. Activity-based costing methods help dene value and protability segments, along with factors that drive protability. They also provide clues on how to improve cost-to-serve (and protability) in the future. Furthermore, it is crucial to expand your cost accounting approach beyond simply assigning product, standard service-line and distribution costs to customers. Your system should also trace and causally assign (not allocate) all other costs and capital. This expanded approach identies less protable (or unprotable) customers and provides alternative strategies for unlocking hidden value. As described in Figures 2 and 3, once an understanding of cost and value drivers are assessed, arriving at a DCF-based CLV requires estimating how long these cost and revenue streams will continue. This means understanding how long customers will hold their current products and how likely they are to purchase new products and services from you. Predictive analytics and forecasting methods provide this understanding.

3. Meaningful customer segmentation schemes A deficient segmentation scheme

A customer-centric approach segments the customer base in multiple ways. For example, it isnt enough for a bank to say, Well market IRAs to people over 40, or to calculate a customers total assets per account. Customer segmentation should be much more granular and strategic. Customer segments are groupings of customers with similar attributes that are identiable, measurable and can be monitored over time. In general, the more sophisticated these attributes are, the more powerful the segmentation schemes. Organizations that measure some form of customer value or protability often consider this nancial basis to be their primary segmentation scheme, and they organize their business decisions around it. The customer value pyramid in Figure 8 typies many organizations approach to move customers up the pyramid from low to high value. This method is ne to the extent that it creates divisions of the business focused on customers with high net worth. But for many line-of-business managers, this nancial segmentation scheme may be relatively meaningless as a means of dening marketing and sales strategies. For example, an internationally traveling business man and a teenage girl may both be valuable customers for their mobile phone providers, but they will have very different wants and needs. Many organizations go a step further and segment their customers using metrics important to their industries. For example, retailers often use recency, frequency and monetary spend (RFM) metrics, as well as demographics and purchase data. The additional insight gained from these methods considerably improve decision making. These segmentation schemes should be an overlay to the customer value scheme.

might hurt customer loyalty and increase costs by mismatching product and pricing offers with customer segments.

12

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

In more sophisticated organizations, these segmentation approaches have been further extended by methods that consider customer attitudes and their likely future needs and behaviors. It is only when segmentation analysis combines all of these customer elements (i.e., attitudes, soft behaviors, transactional behaviors, geodemographics and long-term customer nancial value) that the true picture emerges. With this knowledge, you can have a fuller understanding of how to build and maintain your relationships with customers to maximize shareholder benet. Without such predictive insights, improving customer protability longer term will be difcult. A decient segmentation scheme might also hurt customer loyalty and increase costs by mismatching product and pricing offers with customer segments.

Figure 8: The customer value pyramid.

Figure 9 illustrates how a range of segmentation matrices can be built and managed to relate the CLV generated by customers to their attitudes, behaviors and geodemographic attributes. This analysis lets an organization understand which cells of the matrix generate more value, both per customer and in total, as an aggregate of all the customers in that segment. The proactive management of customers from low- to high-value segments then becomes the focus for the organization. More sophisticated schemes for segmenting customers by meaningful dimensions including sales transaction and mix volumes, demographic, geographic, attitude, behavior and protability will yield distinct, manageable groups for targeted activities and differentiated services. Programs tailored for specic groups will have much higher success rates over time due to their greater relevance for customers.

Figure 9: A segmentation matrix.

13

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

4. Targeted cross-selling, up-selling and retention programs

Undisciplined mass marketing can sometimes result in a negative ROI for that spending. Such campaigns can be a turnoff to customers whose mailboxes are bursting with offers. Microsegmenting is now taking hold, with the smallest microsegment being an individual or a household. With the foundation of a single customer view, an understanding of customer value and protability drivers, and a rened customer segmentation scheme, a company can use sophisticated analytic software to predict what next? for individual customers. Analytic software allows you to build predictive models based on customer characteristics and outcomes (i.e., demonstrated behaviors), and then apply those smart models to other customers to determine which ones are good candidates for similar cross-selling and up-selling offers. Market-basket analysis lets you predict likely candidates for cross-sell opportunities, given historical data on products and service lines previously purchased, as well as customer demographics, purchase patterns and other variables. Continuing with a bank example, you can identify customers purchase paths, starting from simple checking and savings accounts to more protable automobile loans and home mortgages. Equipped with data like this, those customers (and others likely to follow the same path) can be scored and then marked to receive marketing campaigns and other differentiated offers. Retaining protable and potentially protable customers should be a top priority. Analytics like those described above can also be used to identify which customers are likely to leave and why information that can be used to target retention programs and ensure that the best customers stay. The ability to predict which customers are likely to defect can be a critical competitive differentiator.

With the foundation of a single

customer view, an understanding of customer value and profitability drivers, and a refined customer segmentation scheme, a company can use sophisticated analytic software to predict what next? for individual customers.

5. Effective marketing delivery systems

Finally, a company will need to apply an array of marketing mechanisms to deliver the right offers to the right customers at the right time as cost-efciently as possible. There are software solutions available to accomplish these objectives. Marketing automation software helps companies plan, automate, execute and measure marketing campaigns. Advanced analytic capabilities included in some offerings integrate with the single view customer database, as well as the processes used to assess customer value and protability. Together, these capabilities help companies develop target audiences and appropriate cross-sell, up-sell and retention programs.

The best software offerings integrate

with marketing automation software to ensure a closed-loop marketing delivery system.

14

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Interaction management software enables marketers to respond immediately to changes in individual customer behavior. Sophisticated algorithms can track and recognize changes in behavior and create real-time triggers and alerts that enable businesses to execute cross-sell, up-sell and retention strategies. For example, when a customer contacts a call center, the customer service representative can follow rule-based instructions to offer deals designed to entice the customer to purchase additional items. Marketing optimization software helps companies model and assess the cost/benet trade-offs of increasingly sophisticated and frequent customer communications. It can provide insight on how marketing constraints affect protability and can recommend the best assignment of offers to customers based on company objectives (such as maximizing protability) and given constraints. Channel analytics give organizations a way to understand and predict customer behavior through certain channels, such as the company Web site. Analyzing this type of behavior can help you decide which offers to make to certain customers, or how to format the information you present to them. Though many of these software offerings are fairly new, the best ones integrate with marketing automation software to ensure a closed-loop marketing delivery system. The use of real-time customer behavior to improve customer retention and increase cross-sell and up-sell revenue gives companies an opportunity to take a major step toward one-to-one customer communications.

Realigning around customers rather than products

The process of realignment around

Even when armed with fresh customer insight, companies will fall short of expectations if this knowledge does not become central to their everyday activities. A bank, for example, must deliver a positive and consistent experience to high-value and high-growth customers. Doing this requires alignment between every part of the organization, from relationship managers and call center representatives to segment managers and ATMs. But the majority of companies continue to organize around product groups or lines of business rather than customer groups. Such misalignments create poor customer experiences with real nancial impacts. Realignment around customer value cannot happen without technology. Fortunately, technology has matured to the point where it can collect and distribute the information needed to keep employees focused on building customer value. When a breakdown does occur, it is because technology is not tied to a focused strategy of acquiring, retaining and growing the right customers.

customers involves balancing a product-driven environment with manageable steps to make better use of customer insight.

15

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

Technology cannot do its job if lines of business work independently with their own solutions and business rules. In this new organizational view, technologys role is to integrate data, processes and people to create a single customer view. The best approach is to deploy a suite of solutions that deliver analytics based on rigorous data management. A single technology platform is the organizational backbone for capitalizing on such solutions. Technology can enforce customer treatment rules. Offers, levels of care, price discounts, etc. can be communicated to the customer representative through technology in a way that ensures that they do the right thing for the customer and the organization. Ownership, accountability and performance measures are also important. Customer value management must happen at the management level and in customer-facing parts of the company. Strategy maps and balanced scorecards both topics worth investigating are useful here. Once you have established accurate customer value scores and tracking mechanisms, you can execute strategies, processes and policies to increase customer value and manage the customer experience. It is then up to customer-facing teams to implement strategic directives. With these measures in place, companies can assess and reward employees based on changes in customer value rather than traditional sales volume-based benchmarks. The process of realignment around customers involves balancing a product-driven environment with manageable steps to make better use of customer insight. By mapping the experiences of customers across channels and at each stage of the customer life cycle, a company gets a clearer picture of the gaps in execution. It can then identify which organizational capabilities must improve to close the gaps, whether those capabilities involve people, processes, infrastructure or culture. The nal step is to prioritize the needed capabilities and create action plans for achieving results in a manageable time frame.

Preparing for the integration of customer analytics

An executive must evaluate his or her companys ability to manage its customer portfolio proactively. Each executive should ask some of the following questions: Can we build a single customer view using all available data sources? How quickly can we merge an acquired rms data into ours? With what level of data integrity? Do we understand the protability (and protability drivers) of our existing customers? Are we more product-centric than customer-centric in our understanding of protability? How do we develop our brand, channel strategies and product portfolio to attract and retain customers from whom we can generate the most value?

16

Measuring and acting on customer

value is proven to deliver higher profitability, organic growth and competitive advantage..

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

How do we create and target customer segments? Is each dened segment distinct and manageable? If we acquired a company today, could we quickly determine which customers might be interested in a unique product offering from the acquired company? How long would it take to tailor a pitch to new customers about products we currently offer? How would we identify desirable customers who are at greatest risk of leaving? Can we create high-volume, opt-in e-mail campaigns that provide a highly personalized communication with compelling response rates? Can our managers and customer service reps access customer proles on their desktops to plan smarter customer interactions? Can the technology at our disposal actively guide our service representatives into the offers and prices that they should surface to the customer to increase CLV? Having positive answers for these questions can mean the difference between meeting and falling short of shareholder expectations. Measuring and acting on customer value is proven to deliver higher protability, organic growth and competitive advantage. But the why behind customer value has never been the problem. It is the how that most companies nd elusive. By refocusing customer strategy, retooling measurements and taking steps to realign the organization around customers, companies will unlock the vast prot potential of their investment in customers. They will retain and grow existing customers and acquire new, high-potential customers that will drive the greatest amount of prot. Lasting competitive advantage is not far behind.

Physics, customer value and shareholder wealth

In 1905 Albert Einstein, then a 26-year-old patent clerk in Austria, published four research papers that fundamentally changed the study of physics. He received the Nobel Prize for one and published his famous E=mc2 in another. In these papers, Einstein rened Newtonian principles of physics by theorizing that space, time and mass are interrelated his theory of relativity. His work dealt with the large-scale behavior of the universe. Meanwhile, other physicists like Neils Bohr and Edward Schrodinger were researching the physical universe at the scale of subatomic particles. At this micro level, physicists examining quantum mechanics theorized mind-boggling phenomena in our physical world, including that matter could be simultaneously both a particle and a wave. The problem is that physicists have yet to reconcile the equations of quantum mechanics at the micro level with Einsteins macro-level equations. Nevertheless, both theories must operate within one seamless, physical universe.

17

In business, organizations are still

working to reconcile the seemingly contradictory forces of customer value and shareholder wealth.

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

In business, organizations are still working to reconcile the seemingly contradictory forces of customer value and shareholder wealth. Hypothetically, companies can increase customer satisfaction (value perceived by the customer) by providing additional product features and service offerings. But if they do not raise prices, increase market share or grow the market, they may have increased customer satisfaction at the expense of shareholder wealth. So whose value is the enterprise supposed to be looking out for, and how is that value measured? Value according to nance: The capital markets evaluate the future value of an enterprise using decomposition tree modeling of revenue and expense streams. Corporate nancial analysts learn complex equations that divide projected net operating prot after tax (NOPAT) by risk-adjusted, weighted average cost of capital from equity and loan nancing. Ultimately, though, nance is still seeking a single economic equation to determine the return on any investment. Value according to sales, marketing and customer service: Meanwhile, analysts in sales, marketing and customer service who examine customer relationships are testing the previously described equation for customer lifetime value. In other words, they measure value today, tomorrow or 10 years from now to develop the appropriate customer strategy for differentiated service levels and interactions. Though Einstein did not live to witness the completion of a grand unied theory of physics a theory that ties together his theory of relativity with the principles of quantum mechanics physicists are focusing on this challenge and expect to resolve it. Similarly, with issues of trade-offs between customers and shareholders, we should expect the mathematical reconciliation of customer value and shareholder value to be realized soon. The data and math already exist. The business intelligence tools, computing power and analytic expertise can also be found in companies today to exploit the data. All that is left is to create the modeling algorithms and establish more collaboration between nance and customer-centric lines of business. To maximize shareholder wealth, you have to dig much deeper than predicting income statements and balance sheets to compute free cash ow, as the nancial community does today. You have to look at customer lifetime value and return on customer as the core drivers of shareholder wealth. Customer value management is a bottom-up calculation. It presumes that the number of differentiated services aimed at customer microsegments are the independent variable and that shareholder wealth creation is the dependent variable. Successful organizations will implement analytic tools for tasks such as customer segmentation, loyalty analysis, forecasting and activity-based costing; and they will use these tools to calculate customer value, reduce internal debates and make more condent decisions. It is inevitable that, with such tools, a companys executive team will be better-equipped to create shareholder wealth and make decisions based on facts, not hunches and intuition.

Successful organizations will

implement analytic tools for tasks such as customer segmentation, loyalty analysis, forecasting and activity-based costing; and they will use these tools to calculate customer value, reduce internal debates and make more confident decisions.

18

ARE YOU CUSTOMER-FOCUSED OR CUSTOMER-OBSESSED?

About SAS

SAS is the leader in business intelligence software and services. Customers at 40,000 sites use SAS software to improve performance through insight into vast amounts of data, resulting in faster, more accurate business decisions; more protable relationships with customers and suppliers; compliance with governmental regulations; research breakthroughs; and better products. Only SAS offers leading data integration, intelligence storage, advanced analytics and business intelligence applications within a comprehensive enterprise intelligence platform. Since 1976, SAS has been giving customers around the world The Power to Know.

19

SAS INSTITUTE INC. WORLD HEADQUARTERS 919 677 8000 U.S. & CANADA SALES 800 727 0025 SAS INTERNATIONAL +49 6221 416-0

WWW.SAS.COM

SAS and all other SAS Institute Inc. product or service names are registered trademarks or trademarks of SAS Institute Inc. in the USA and other countries. indicates USA registration. Other brand and product names are trademarks of their respective companies. Copyright 2006, SAS Institute Inc. All rights reserved. 102449_ 411553.0906

Potrebbero piacerti anche

- Guide To Managerial AccountingDocumento23 pagineGuide To Managerial AccountingTai LeNessuna valutazione finora

- How To Retain Existing CustomersDocumento15 pagineHow To Retain Existing CustomersPioneer MarketersNessuna valutazione finora

- Test Bank - Chapter17 Cash FlowsDocumento51 pagineTest Bank - Chapter17 Cash FlowsAiko E. Lara100% (4)

- Do Customer Loyalty Programs Really WorkDocumento17 pagineDo Customer Loyalty Programs Really WorkUtkrisht Kumar ShandilyaNessuna valutazione finora

- How To Create A Customer-Centric Strategy For Your BusinessDocumento10 pagineHow To Create A Customer-Centric Strategy For Your BusinessdhanNessuna valutazione finora

- HBR's 10 Must Reads on Strategic Marketing (with featured article "Marketing Myopia," by Theodore Levitt)Da EverandHBR's 10 Must Reads on Strategic Marketing (with featured article "Marketing Myopia," by Theodore Levitt)Valutazione: 3.5 su 5 stelle3.5/5 (10)

- Nirc (Codal)Documento247 pagineNirc (Codal)Jierah Manahan0% (1)

- Marketing and The 7psDocumento10 pagineMarketing and The 7pskartuteNessuna valutazione finora

- Customer Relationship Management SDocumento88 pagineCustomer Relationship Management SMuraliKarthik M LeeNessuna valutazione finora

- Customer Equity Is The Total Combined Customer Lifetime Values of All of A CompanyDocumento10 pagineCustomer Equity Is The Total Combined Customer Lifetime Values of All of A CompanySniper ShaikhNessuna valutazione finora

- 20 Secrets To Designing The Best Pricing Strategy-1Documento24 pagine20 Secrets To Designing The Best Pricing Strategy-1Vinay VashisthNessuna valutazione finora

- An Introduction To Customer Segmentation EbookDocumento21 pagineAn Introduction To Customer Segmentation EbookdneptuneNessuna valutazione finora

- ProfitabilityDocumento28 pagineProfitabilityint3nsoNessuna valutazione finora

- CRMDocumento50 pagineCRMAshley_RulzzzzzzzNessuna valutazione finora

- Business Focus PearsonDocumento340 pagineBusiness Focus PearsonNate100% (2)

- How To Become A Customer Centric GrocerDocumento4 pagineHow To Become A Customer Centric Grocersatishjb29Nessuna valutazione finora

- Competitors Moving Ever Faster, The Race Will Go To Those Who Listen and Respond More Intently". - Tom Peters, Thriving On ChaosDocumento80 pagineCompetitors Moving Ever Faster, The Race Will Go To Those Who Listen and Respond More Intently". - Tom Peters, Thriving On ChaosMithun NambiarNessuna valutazione finora

- Exercise No.4 Bus. Co.Documento56 pagineExercise No.4 Bus. Co.Jeane Mae BooNessuna valutazione finora

- Customer Relationship ManagementDocumento56 pagineCustomer Relationship Managementsnehachandan91Nessuna valutazione finora

- SEE Diversey ProFormaDocumento34 pagineSEE Diversey ProFormaJose Luis Becerril BurgosNessuna valutazione finora

- Essay On Customer RetentionDocumento30 pagineEssay On Customer RetentionChefJumboTheSoundchef0% (1)

- Sri Lanka Real Estate Market Brief Jan 2012 (Softcopy)Documento10 pagineSri Lanka Real Estate Market Brief Jan 2012 (Softcopy)nerox87Nessuna valutazione finora

- Return on Customer (Review and Analysis of Peppers and Rogers' Book)Da EverandReturn on Customer (Review and Analysis of Peppers and Rogers' Book)Nessuna valutazione finora

- Fdi in Indian Defence SectorDocumento18 pagineFdi in Indian Defence SectorAnonymous Y0M10GZVNessuna valutazione finora

- Assistant Accountant CV TemplateDocumento3 pagineAssistant Accountant CV TemplateAhmed TallanNessuna valutazione finora

- Chapter 3 - CRM and It'S EconomicsDocumento7 pagineChapter 3 - CRM and It'S EconomicsYogesh GomsaleNessuna valutazione finora

- Customer Value: Presented By: Aastha - Abhinav - AkshatDocumento35 pagineCustomer Value: Presented By: Aastha - Abhinav - Akshatmokshgoyal2597Nessuna valutazione finora

- CLV Reading1Documento28 pagineCLV Reading1aditi13goyalNessuna valutazione finora

- Chapter 1: Conceptual Framework For CRM: What Is Customer Relationship Management?Documento68 pagineChapter 1: Conceptual Framework For CRM: What Is Customer Relationship Management?Santosh VishwakarmaNessuna valutazione finora

- Customer Driven StrategyDocumento15 pagineCustomer Driven StrategySonam ChawlaNessuna valutazione finora

- End TermDocumento2 pagineEnd Termarpitasahumbaba2022Nessuna valutazione finora

- Assessing Customer Profitability: OPEN Roadmap: Practical Insights For Business GrowthDocumento8 pagineAssessing Customer Profitability: OPEN Roadmap: Practical Insights For Business GrowthNguyen Hoang YenNessuna valutazione finora

- Customer Equity Is The: Net Present Value LoyaltyDocumento2 pagineCustomer Equity Is The: Net Present Value Loyaltyanon-882411Nessuna valutazione finora

- CRM Value Chain ButtleDocumento7 pagineCRM Value Chain ButtleHuong PhamNessuna valutazione finora

- Rosell Cortez-ReportingDocumento17 pagineRosell Cortez-ReportingAyegNessuna valutazione finora

- How Do Our Service Offerings Differ From Competitor's?: AnswerDocumento6 pagineHow Do Our Service Offerings Differ From Competitor's?: AnswerYandex PrithuNessuna valutazione finora

- Connecting With Customer - 0Documento40 pagineConnecting With Customer - 0eurainnepacleb710Nessuna valutazione finora

- CRMDocumento70 pagineCRMsandeepsinha151283Nessuna valutazione finora

- Customer Retention Management in The Information Era: Devashish Das Gupta Snehashish MukherjeeDocumento13 pagineCustomer Retention Management in The Information Era: Devashish Das Gupta Snehashish MukherjeeShiva ReddyNessuna valutazione finora

- Customer Retention StrategiesDocumento10 pagineCustomer Retention StrategiesShivali Chatterjee0% (1)

- Marketing When Customer Equity MattersDocumento2 pagineMarketing When Customer Equity MattersDevante DixonNessuna valutazione finora

- Turning Into The Voice of Your CustomerDocumento1 paginaTurning Into The Voice of Your CustomerSaurabh MahajanNessuna valutazione finora

- Assignment #2Documento4 pagineAssignment #2Hmh LodgesNessuna valutazione finora

- Cost Accounting - Customer Profitability AnalysisDocumento18 pagineCost Accounting - Customer Profitability AnalysisNayeem AhmedNessuna valutazione finora

- Customer willingness to pay: How to use pricing to boost your salesDa EverandCustomer willingness to pay: How to use pricing to boost your salesNessuna valutazione finora

- Key Account ManagementDocumento3 pagineKey Account ManagementjksmecNessuna valutazione finora

- Mcdonald Grant Value Propositions White Paper January 2016Documento16 pagineMcdonald Grant Value Propositions White Paper January 2016goutham sivasailamNessuna valutazione finora

- 01-Intro To MarketingDocumento42 pagine01-Intro To MarketingAnurag RakshitNessuna valutazione finora

- Principles of Marketing 1Documento10 paginePrinciples of Marketing 1Youmna007Nessuna valutazione finora

- PCX - Report April ShanDocumento10 paginePCX - Report April Shanpoe layNessuna valutazione finora

- 2 Building Customer Satisfaction, Value, and RetentionDocumento9 pagine2 Building Customer Satisfaction, Value, and RetentionAwol TunaNessuna valutazione finora

- Assignment On How CRM Is Prepared in Retailing Submitted To: Prof: PavanDocumento8 pagineAssignment On How CRM Is Prepared in Retailing Submitted To: Prof: PavanMahesh ChowdaryNessuna valutazione finora

- Difference Between Marketing and Sales ManagementDocumento6 pagineDifference Between Marketing and Sales ManagementAdi PatelNessuna valutazione finora

- Managing Customer Profitability 1668900157Documento21 pagineManaging Customer Profitability 1668900157omorquecho.89Nessuna valutazione finora

- Marketing Turistico: Employees Are Well Cared For."Documento16 pagineMarketing Turistico: Employees Are Well Cared For."Luis Edecarlo BarronNessuna valutazione finora

- Customer Value DissertationDocumento8 pagineCustomer Value DissertationCanIPaySomeoneToWriteMyPaperSingapore100% (1)

- Marketers Go To Grow: Always Be ConnectingDocumento17 pagineMarketers Go To Grow: Always Be Connectingshyamgopi06Nessuna valutazione finora

- 7ps Future Trends in MarketingDocumento12 pagine7ps Future Trends in MarketingPeriyasamy PoovendranNessuna valutazione finora

- 7P's of MarketingDocumento12 pagine7P's of MarketingManak SinghNessuna valutazione finora

- The Meaning of SuccessDocumento3 pagineThe Meaning of SuccessRolandas MedžiūnasNessuna valutazione finora

- Imc in Bank SectorDocumento5 pagineImc in Bank SectorNathalie Harris100% (1)

- UdayDocumento50 pagineUdaygopi krishnaNessuna valutazione finora

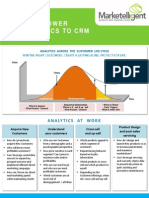

- CRM Analytics - MarketelligentDocumento2 pagineCRM Analytics - MarketelligentMarketelligentNessuna valutazione finora

- Customer Profitability Analysis: Revenues CostsDocumento9 pagineCustomer Profitability Analysis: Revenues CostsRinha MuneerNessuna valutazione finora

- PP P P PPP PPPPPPP PP PPPPPP PPP PPPP P PPPPPPDocumento24 paginePP P P PPP PPPPPPP PP PPPPPP PPP PPPP P PPPPPPRashi Gaurav SambhawaniNessuna valutazione finora

- Comprehensive Report-CRM CLVDocumento33 pagineComprehensive Report-CRM CLVFlorante De LeonNessuna valutazione finora

- CRM Lecture 7Documento61 pagineCRM Lecture 7Myrah LeeNessuna valutazione finora

- Customer CentyricityDocumento6 pagineCustomer Centyricitygregoryho4719Nessuna valutazione finora

- ProQuestDocuments 2023 06 29Documento10 pagineProQuestDocuments 2023 06 29Kenio FilhoNessuna valutazione finora

- Vargas Engineering ManagementDocumento6 pagineVargas Engineering ManagementGillianne Mae VargasNessuna valutazione finora

- Phoenix Light SF Limited Vs Morgan StanleyDocumento311 paginePhoenix Light SF Limited Vs Morgan StanleyRazmik BoghossianNessuna valutazione finora

- CMSL Analysis Sheet Dec 23 (NEW SYLLABUS) - 1Documento10 pagineCMSL Analysis Sheet Dec 23 (NEW SYLLABUS) - 1rashmimandhyan12201Nessuna valutazione finora

- Simar Kaur 0223Documento3 pagineSimar Kaur 0223simar leenNessuna valutazione finora

- BD SM01 Final SN GeDocumento3 pagineBD SM01 Final SN GeSharon Huang ZihangNessuna valutazione finora

- Endemol Interview InformationDocumento6 pagineEndemol Interview InformationShayoke MukherjeeNessuna valutazione finora

- D16Documento12 pagineD16neo14Nessuna valutazione finora

- Stakeholder Relations Guideline 2012 en (FMGT)Documento4 pagineStakeholder Relations Guideline 2012 en (FMGT)SalmaAlnofaliNessuna valutazione finora

- Vizag-Chennai Industrial Corridor - Full ReportDocumento388 pagineVizag-Chennai Industrial Corridor - Full ReportPrasad GogineniNessuna valutazione finora

- Bank (Final)Documento25 pagineBank (Final)MishuNessuna valutazione finora

- PMCourse Fall2022-2023 CH3Documento35 paginePMCourse Fall2022-2023 CH3شاكر احمدNessuna valutazione finora

- $1.2 Billion Invested by The Washington State Investment BoardDocumento2 pagine$1.2 Billion Invested by The Washington State Investment Boardmansudan25Nessuna valutazione finora

- Beta Bloomberg OtomotifDocumento52 pagineBeta Bloomberg OtomotifayuvwxyzNessuna valutazione finora

- Exploring The Viability of Equity Crowdfunding As A Fundraising Instrument 2019Documento9 pagineExploring The Viability of Equity Crowdfunding As A Fundraising Instrument 2019Raphael_BragaNessuna valutazione finora

- Banking and Financial InstitutionsDocumento21 pagineBanking and Financial InstitutionsShriya VermaNessuna valutazione finora

- Comparison and Usage of The Boston Consulting Portfolio and The McKinsey Portfolio Maximilian BäuerleDocumento24 pagineComparison and Usage of The Boston Consulting Portfolio and The McKinsey Portfolio Maximilian BäuerleEd NjorogeNessuna valutazione finora

- Course Outline: Prepared By: MD. EDRICH MOLLA JEWELDocumento2 pagineCourse Outline: Prepared By: MD. EDRICH MOLLA JEWELAlaminTanverNessuna valutazione finora

- LPG IndiaDocumento10 pagineLPG IndiabondwithacapitalbNessuna valutazione finora

- Pure Jump Lévy Processes For Asset Price Modelling: Professor of Finance University Paris IX Dauphine and ESSECDocumento25 paginePure Jump Lévy Processes For Asset Price Modelling: Professor of Finance University Paris IX Dauphine and ESSECBob ReeceNessuna valutazione finora

- Income Tax Procedure PracticeU 12345 RB1Documento20 pagineIncome Tax Procedure PracticeU 12345 RB1Chakram SirishaNessuna valutazione finora

- Camels Rating System in The Context of Islamic BankingDocumento54 pagineCamels Rating System in The Context of Islamic BankingElmelki AnasNessuna valutazione finora