Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Results Sep 2011

Caricato da

Shankar GargDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Results Sep 2011

Caricato da

Shankar GargCopyright:

Formati disponibili

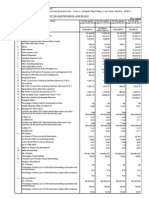

PUNJAB NATIONAL BANK

REVIEWED FINANCIAL RESULTS

FOR THE QUARTER/HALF-YEAR ENDED 30th SEPTEMBER, 2011

Particulars

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

Interest Earned ( a+b+c+d )

a) Interest/discount on advances/bills

b) Income on Investments

c) Interest on Balances with RBI & other

Inter Bank Funds

d) Others

Other Income

TOTAL INCOME (1+2)

Interest Expended

Operating Expenses (i+ii)

(i) Employees' Cost

(ii) Other operating expenses

TOTAL EXPENSES (4+5)

(excluding provisions & contingencies)

Operating Profit (3-6)

(Profit before Provisions & Contingencies)

Provisions (other than tax) and contingencies

Exceptional items

Profit (+)/Loss (-) from ordinary activities

before tax (7-8-9)

Tax Expense

Net Profit (+)/Loss(-) from ordinary

activities after tax (10-11)

Extraordinary items (net of tax expense)

Net Profit (+)/Loss(-) for the period (12-13)

Paid up equity Share Capital (Face value Rs.10/-)

Reserves excluding revaluation reserves (As per Balance Sheet of previous year)

Quarter Ended

30.09.2011

30.09.2010

REVIEWED REVIEWED

Half-Year Ended

30.09.2011

30.09.2010

REVIEWED

REVIEWED

Rs. In lacs

Year Ended

31.03.2011

AUDITED

895201

704475

185238

4835

645544

503520

139718

2045

1726725

1362060

353819

8203

1242707

971108

267252

3645

2698648

2110455

563755

8420

653

88886

984087

549944

181366

124042

57324

731310

261

71824

717368

347874

159485

111309

48176

507359

2643

197253

1923978

1069940

353868

245306

108562

1423808

702

160999

1403706

685203

298677

210831

87846

983880

16018

361258

3059906

1517914

636422

446110

190312

2154336

252777

210009

500170

419826

905570

71032

0

181745

51603

0

158406

160384

0

339786

105016

0

314810

249198

0

656372

61242

120503

50952

107454

108776

231010

100527

214283

213022

443350

0

120503

31681

1972099

0

107454

31530

1591562

0

231010

31681

1972099

0

214283

31530

1591562

0

443350

31681

1972099

58.00

11.07

12.23

57.80

11.65

12.60

58.00

11.07

12.23

57.80

11.65

12.60

58.00

11.76

12.42

38.04

38.04

34.08

34.08

72.92

72.92

67.96

67.96

140.60

140.60

515011

208851

2.05

0.84

1.21

402482

142550

1.91

0.69

1.36

515011

208851

2.05

0.84

1.18

402482

142550

1.91

0.69

1.37

437939

203863

1.79

0.85

1.34

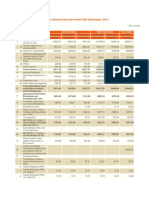

Analytical Ratios

(i) Share holding of Govt. of India (%)

(iia) Capital Adequacy Ratio (%) as per Basel-I

(iib) Capital Adequacy Ratio (%) as per Basel-II

(iii) Earnings per Share (EPS) not annualized in Rs.

(a) Basic & diluted EPS before extraordinary items

(b) Basic & diluted EPS after extraordinary items

(iv) NPA Ratios:

(a) Amount of gross non-performing assets

(b) Amount of net non-performing assets

(c) % of gross NPAs

(d) % of net NPAs

(v) Return on Assets ( Annualised) %

18.

19.

a)

b)

Public Shareholding

(i) No. of Shares

(ii) Percentage of Share holding

133061200

133061200

133061200

133061200

133061200

42.00

42.20

42.00

42.20

42.00

Promoters and Promoter Group Share Holding

Pledged/Encumbered

--Number of shares

--Percentage of shares(as % of the total

shareholding of promoter & promoter group)

--Percentage of shares(as % of the total

share capital of the bank)

Non-Encumbered

--Number of shares

--Percentage of shares(as % of the total

shareholding of promoter & promoter group)

--Percentage of shares(as % of the total

share capital of the bank)

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

183750957

182241300

183750957

100%

182241300

100%

183750957

100%

100%

100%

58.00%

57.80%

58.00%

57.80%

58.00%

As On 30.09.11

UNAUDITED

As On 30.09.010

UNAUDITED

Rs. In lacs

Foot Note To The Financial Results

CAPITAL & LIABILITIES

Capital

Reserves & surplus

Deposits

Borrowings

Other Liabilities and Provisions

TOTAL

ASSETS

Cash & Balances with Reserve Bank of India

Balances with Banks & Money at Call & Short Notice

Investments

Advances

Fixed Assets

Other Assets

TOTAL

31681

2349122

34178318

2473127

1263005

40295253

31530

1953927

27339445

2492347

1003525

32820774

2297191

578803

11054248

24901956

314690

1148365

40295253

1878310

412749

8627379

20876435

255218

770683

32820774

Potrebbero piacerti anche

- Audited Financial 2011Documento1 paginaAudited Financial 2011gayatri9324814475Nessuna valutazione finora

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento2 pagineFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results For Sept 30, 2015 (Standalone) (Result)Documento2 pagineFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- India BullsDocumento2 pagineIndia Bullsrajesh_d84Nessuna valutazione finora

- Cement2001 2006Documento1 paginaCement2001 2006Mahnoor KhanNessuna valutazione finora

- Financial Results For The Quarter Ended 30 June 2012Documento2 pagineFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNessuna valutazione finora

- Financial Results For Sept 30, 2015 (Standalone) (Result)Documento2 pagineFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For December 31, 2015 (Result)Documento2 pagineFinancial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Accounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Documento1 paginaAccounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Jatin GuptaNessuna valutazione finora

- Financial Results & Limited Review For June 30, 2015 (Company Update)Documento7 pagineFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNessuna valutazione finora

- Ref: Code No. 530427: Encl: As AboveDocumento3 pagineRef: Code No. 530427: Encl: As AboveShyam SunderNessuna valutazione finora

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento2 pagineFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- MSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012Documento4 pagineMSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012kpatil.kp3750Nessuna valutazione finora

- Particulars: Form II Operating StatementDocumento26 pagineParticulars: Form II Operating StatementvineshjainNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Format of The Revised Schedule VIDocumento2 pagineFormat of The Revised Schedule VIJoydip DasNessuna valutazione finora

- Noida Toll Bridge Company Limited: Expenditure CycleDocumento38 pagineNoida Toll Bridge Company Limited: Expenditure CycleArpit ManglaNessuna valutazione finora

- Last Years Actuals As Per The Audited Accounts Current Years Estimates Following Years ProjectionsDocumento22 pagineLast Years Actuals As Per The Audited Accounts Current Years Estimates Following Years ProjectionsAnupam BaliNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- The Red Marks Contain Instructions. To View The Tips, Place Cursor in That CellDocumento15 pagineThe Red Marks Contain Instructions. To View The Tips, Place Cursor in That Cellsiddharthzala0% (1)

- Audited Result 2010 11Documento2 pagineAudited Result 2010 11Priya SharmaNessuna valutazione finora

- Financial Results For Sept 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- HDFC BankDocumento11 pagineHDFC BankPrasad KhandekarNessuna valutazione finora

- Financial Results For March 31, 2013 (Result)Documento3 pagineFinancial Results For March 31, 2013 (Result)Shyam SunderNessuna valutazione finora

- Userfiles Financial 6fDocumento2 pagineUserfiles Financial 6fTejaswini SkumarNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Bil Quarter 2 ResultsDocumento2 pagineBil Quarter 2 Resultspvenkatesh19779434Nessuna valutazione finora

- Financial Results MARCH2011Documento4 pagineFinancial Results MARCH2011Rajat KukretiNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- SEBI Apr 25 2011Documento2 pagineSEBI Apr 25 2011reachsubbusNessuna valutazione finora

- Pakistan Petroleum Overall: A.Non-Current Assets (A1+A3+A5+A6+A7)Documento16 paginePakistan Petroleum Overall: A.Non-Current Assets (A1+A3+A5+A6+A7)0300MalikamirNessuna valutazione finora

- Barwa Real Estate Balance Sheet Particulars Note NoDocumento28 pagineBarwa Real Estate Balance Sheet Particulars Note NoMuhammad Irfan ZafarNessuna valutazione finora

- CMA FinalDocumento62 pagineCMA FinalKartik DoshiNessuna valutazione finora

- Cma DataDocumento13 pagineCma DataJoseph LunaNessuna valutazione finora

- BsheetDocumento4 pagineBsheetDeepak KumarNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- CMA Data in ExcelDocumento7 pagineCMA Data in ExcelVaishali MkNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Bank of India Fund BasedDocumento33 pagineBank of India Fund BasedVandana ChoudharyNessuna valutazione finora

- Corporate Centre, Mumbai - 400 021: State Bank of IndiaDocumento1 paginaCorporate Centre, Mumbai - 400 021: State Bank of IndiajoshijaysoftNessuna valutazione finora

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Documento1 paginaAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNessuna valutazione finora

- Unaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Documento4 pagineUnaudited Financial Results For The Quarter/Half Year Ended 30th September, 2014Dhruba DebnathNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento1 paginaStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Documento1 paginaIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNessuna valutazione finora

- Results Q1FY11 12Documento1 paginaResults Q1FY11 12rao_gsv7598Nessuna valutazione finora

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Documento4 pagineAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Documento2 pagineFinancial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Review Report 311210Documento1 paginaReview Report 311210Hriday PandeyNessuna valutazione finora

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryDa EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryDa EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Mutual Funds The Future of Investment in Pakistan?: Sponsored By: Al Meezan Investment Management LTDDocumento26 pagineMutual Funds The Future of Investment in Pakistan?: Sponsored By: Al Meezan Investment Management LTDsirfanalizaidiNessuna valutazione finora

- Jaypee Business School: Comparative Analysis of Sharekhan Ltd. With Other Stock Broking HousesDocumento72 pagineJaypee Business School: Comparative Analysis of Sharekhan Ltd. With Other Stock Broking HousesLOKESH CHAUDHARYNessuna valutazione finora

- Credit Rating Report of JP MorganDocumento6 pagineCredit Rating Report of JP MorganPOOONIASAUMYANessuna valutazione finora

- The Indian Startup ScenarioDocumento80 pagineThe Indian Startup ScenarioAashish SonaraNessuna valutazione finora

- Quick Stock AnalysisDocumento7 pagineQuick Stock AnalysisKaustubh Keskar100% (1)

- Mkibn20080331 0016eDocumento20 pagineMkibn20080331 0016eberznikNessuna valutazione finora

- FM 301 ... Chp. 4Documento8 pagineFM 301 ... Chp. 4Navinesh NandNessuna valutazione finora

- BKM Chapter 7Documento43 pagineBKM Chapter 7Isha0% (1)

- Ansuman Saha Research Scholar, ICFAI University JharkhandDocumento36 pagineAnsuman Saha Research Scholar, ICFAI University JharkhandAnshuman ShahNessuna valutazione finora

- Aboitiz Power CorporationDocumento10 pagineAboitiz Power CorporationrobertNessuna valutazione finora

- Jawaban Tugas Bab 3 Dan 4Documento4 pagineJawaban Tugas Bab 3 Dan 4Made Ari HandayaniNessuna valutazione finora

- Central Proteina Prima TBKDocumento3 pagineCentral Proteina Prima TBKDenny SiswajaNessuna valutazione finora

- BCG Consolidation Remakes Chemicals - 0818Documento7 pagineBCG Consolidation Remakes Chemicals - 0818Carol ChanNessuna valutazione finora

- Current Scenario of Financial ServicesDocumento8 pagineCurrent Scenario of Financial Servicessureshsen80% (5)

- ComprehensiveDocumento9 pagineComprehensiveChristopher RogersNessuna valutazione finora

- FM14e - PPT - Ch03 - Ratio - Analysis - PPTX Filename - UTF-8''FM14e - PPT - Ch03 Ratio AnalysisDocumento56 pagineFM14e - PPT - Ch03 - Ratio - Analysis - PPTX Filename - UTF-8''FM14e - PPT - Ch03 Ratio AnalysisInciaNessuna valutazione finora

- Comparative Financial Analysis of Construction Companies in IndiaDocumento4 pagineComparative Financial Analysis of Construction Companies in IndiaEditor IJRITCC0% (1)

- Beat The Market With Momentum InvestingDocumento1 paginaBeat The Market With Momentum InvestingHerbert LianNessuna valutazione finora

- Fundamentals of Corporate Finance, 2nd Edition, Selt Test Ch01Documento6 pagineFundamentals of Corporate Finance, 2nd Edition, Selt Test Ch01macseuNessuna valutazione finora

- Overview of Indian Financial MARKETSDocumento46 pagineOverview of Indian Financial MARKETSGaurav Rathaur100% (2)

- Intraday Trading Tips and Tricks - Part 1Documento5 pagineIntraday Trading Tips and Tricks - Part 1Chandramouli KonduruNessuna valutazione finora

- The Stock Market For DummiesDocumento2 pagineThe Stock Market For DummiesjikolpNessuna valutazione finora

- Central Banking and Financial RegulationsDocumento9 pagineCentral Banking and Financial RegulationsHasibul IslamNessuna valutazione finora

- HedgeWeekly2018 No22.GBMDocumento62 pagineHedgeWeekly2018 No22.GBMLondonAltsNessuna valutazione finora

- 19 - 22187 - Pritchard RD (1969)Documento36 pagine19 - 22187 - Pritchard RD (1969)Isaias MoralesNessuna valutazione finora

- BlackstoneJTH Credit Suisse Presentation Final WEB PDFDocumento31 pagineBlackstoneJTH Credit Suisse Presentation Final WEB PDFMikeNessuna valutazione finora

- f2 InvestorsDocumento27 paginef2 InvestorsCommunity Institute of Management StudiesNessuna valutazione finora

- Brookfield 2015 Investor DayDocumento122 pagineBrookfield 2015 Investor DayRocco HuangNessuna valutazione finora

- Bootstrapping The Libor CurveDocumento3 pagineBootstrapping The Libor Curveto_vin100% (1)

- AnchoringDocumento10 pagineAnchoringWaseem AbbasiNessuna valutazione finora