Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BBA342 HWA 2 - 3 Post BBA Career Proposal Mock File

Caricato da

Musa Kazim QizalbashDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

BBA342 HWA 2 - 3 Post BBA Career Proposal Mock File

Caricato da

Musa Kazim QizalbashCopyright:

Formati disponibili

Internet Specialist

Internet Specialist for the Banking Industry

by Chris S. Volk

A research project proposal submitted to the faculty of Mount Vernon Nazarene University in partial fulfillment of the requirements for the degree of Bachelor of Business Administration January, 2000

Internet Specialist

Executive Summary The purpose of this study is to develop a set of Individual Learning Outcomes related to the post Bachelor of Business Administration(BBA) career goal, Internet specialist for the banking industry. Achieving the Individual Learning Outcomes in the BBA program is the plan for preparing the investigator for the post BBA career goal. The research question for this study is: What competencies, abilities, and skills should an Internet specialist for the banking industry possess? A Plan to Achieve Individual Learning Outcomes is the expected result of a literature review and interviews with three experts in banking on the Internet. A properly developed plan will help achieve the post BBA career goal within the BBA program.

Internet Specialist

Post Bachelor of Business Administration Degree Career Goal: Internet Specialist for the Banking Industry Problem Statement and Purpose The Bachelor of Business Administration (BBA) program at Mount Vernon Nazarene University (MVNU) accommodates adult learners working in various careers. All adult learners enroll in the same package of standard courses for a BBA degree. The problem is that adult learners post BBA career goals range from improving abilities for a current position to developing competencies for a new career at a new organization. The variety of post BBA career goals require that the individual learning needs be fulfilled within the standard curriculum. The purpose of this study is to develop a set of Individual Learning Outcomes related to the post BBA career goal, Internet specialist for the banking industry. Achieving the Individual Learning Outcomes in the BBA program is the plan for preparing the investigator for the post BBA career goal. Current Career The investigator is a loan officer for the Park National Bank located in Hebron, Ohio. This is the highest position available with an associate college degree. Current Skills and Abilities Current skills and abilities include the following areas: (a) using a personal computer, (b) loan analysis, and (c) conflict resolution. The personal computer skills include using various Microsoft software packages (Word, PowerPoint, and Excel) and a loan processing program. Analyzing business plans and personal financial statements to determine loan ratios is a result of being a loan officer for seven years. A loan officer attempts to resolve conflicts related to slow payment or default on a loan agreement. It is in the banks interest to achieve a resolution that allows some form of cash flow to continue. Post BBA Career Goal

Internet Specialist

The post BBA career goal is to become an Internet specialist for the banking industry. The Internet will change the future of the banking industry. Ignoring the Internet will allow outside competitors to draw profitable consumer services away from the banking industry. Internet specialists in the banking industry will be in great demand for the next several years. Problem Background and Literature Review An Internet specialist for the banking industry will be at the heart of the next banking revolution. If the banking industry is to survive, it will need specialists to coordinate the variety of software, security, marketing, and service issues related to placing banking on the Internet. Over the past 10 years, the telephone has been transforming the retail-banking industry. It currently accounts for 25% of all personal banking transactions. The Internet is now another way to reach retail-banking customers. Since 1989, the number of financial-services groups on the Internet has gone from zero to over 500 (Surfs Up for New-Wave Bankers, 1995). Wells Fargo and Bank of America are exploring how to use the Internet for retail-banking. Both institutions are designing security mechanisms to allow financial transactions via the Internet. Wells Fargo will probably be the first to allow transactions. Bank of America is working with Meca Software to implement a read-only access via the Internet. Both institutions are expecting to solve security problems that are barriers to using the Internet (Nash & Hoffman, 1995). One primary motivation for the banking industry to quickly move to the Internet is credit-card transactions. This is a substantially profitable area for most banks. The Internet will provide at least 10 billion dollars worth of transactions by the year 2000. Merchants will expect prompt processing of those transactions. If banks are not setup to deal with merchants on the Internet, some other non-banking company will process those credit-card transactions

Internet Specialist

(McWilliams, 1995). Many non-banking companies will provide retail-banking services in the future (Pierce, 1991). Banks that learn to use the Internet to reach and serve customers will be ready for the next century. Those that do not, will see an erosion of customers within the next few years. Internet raises the customers expectation level for speed and access to information. Waiting till the next day for a response to information will not be acceptable (Cronin, 1994). Customers will demand easy access and prompt processing in future financial transactions. It will be up to the banking industry to decide if it wants to meet these expectations or wither. Proposed Expert Interviews See Appendix A for names, addresses, and telephone numbers of the three banking industry experts to be interviewed for this study. All have expertise in banking and Internet applications. The literature review yielded information used for selecting the experts. Research Question The development of a set of Individual Learning Outcomes related to the post BBA career goal is the problem presented in this study. The research question to solve that problem is: What competencies, abilities, and skills should an Internet specialist for the banking industry possess? Method The development methodology is the design chosen to form the Individual Learning Outcomes related to the post BBA career goal. This method allows for the development of Individual Learning Outcomes as a solution for achieving the post BBA career goal within the standard BBA curriculum. Often the purpose of a development study is to find a solution to a specific problem through the development of a product. The product can be in any of the following forms: (a) plan, (b) program, (c) process, or (d) model. For this study the product will be in the form of a plan. Procedure As a rule, procedures do not begin until after the

Internet Specialist

approval of the research proposal. The literature review and the selection of the experts are the exceptions for this study. The first step was to conduct a literature review related to the research question. Periodicals and books were primary sources. By using banking as a key word, NIFTY identified relevant books in the library. The expression banking and Internet allowed INFOTRAC to identify periodical sources. The literature review yielded information used for selecting three banking and Internet experts (see Appendix A). Each expert will give an opinion of the future impact of Internet on retail-banking. They also will state the ideal set of competencies, skills, and abilities that an Internet specialist for the banking industry should possess. The development of the initial set of Individual Learning Outcomes will be the result of the literature review and expert interviews. The formative committee (consisting of fellow students) will evaluate the Individual Learning Outcomes during the third class session for BBA342 Business Research Project I. Committee members will give suggestions for improvements. During the class session, the formative committees suggestions will result in a revised set of Individual Learning Outcomes. The summative committee (consisting of fellow students not in the formative committee) will evaluate the revised Individual Learning Outcomes during the last portion of the third class session. Committee members will give suggestions for improvements. The summative committees suggestions will produce a final Plan to Achieve Individual Learning Outcomes. This developed plan will be ready for implementation within the BBA program. Possible Findings The Plan to Achieve Individual Learning Outcomes will answer the research question: What competencies, abilities, and skills should an Internet specialist for the banking industry possess? The plan will identify five Individual

Internet Specialist

Learning Outcomes achievable within the BBA program.

Internet Specialist

References Cronin, M J. (1994). Doing business on the Internet: How the electronic highway is transforming American companies. New York: Van Nostrand Reinhold. McWilliams, B. (1995, June 26). Financial insecurity. Computerworld, 29, 79-84. Nash, K. S., & Hoffman, T. (1995, August 21). Banks hit info highway at different speeds. Computerworld, 29, 52. Pierce, J. L. (1991). The future of banking. New Haven, CT: The Twentieth Century Fund, Inc. Surfs up for new-wave bankers. (1995, October 7). The Economist, 337, 77-78.

Internet Specialist

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Print to PDF without novaPDF messageDocumento46 paginePrint to PDF without novaPDF messageCj Santiago100% (2)

- Ecommerce WebsiteDocumento49 pagineEcommerce WebsiteMonsta X100% (1)

- Application Structure and Files-R14Documento23 pagineApplication Structure and Files-R14Developer T24Nessuna valutazione finora

- Bano S.A Ye Abid Ko Batla Rahi HaiDocumento2 pagineBano S.A Ye Abid Ko Batla Rahi HaiMusa Kazim QizalbashNessuna valutazione finora

- Global Marketing Channels and Physical DistributionDocumento24 pagineGlobal Marketing Channels and Physical DistributionMusa Kazim QizalbashNessuna valutazione finora

- Ghar WapisDocumento2 pagineGhar WapisMusa Kazim QizalbashNessuna valutazione finora

- Asad Amanat Ali Khan song about longing for returnDocumento4 pagineAsad Amanat Ali Khan song about longing for returnMusa Kazim QizalbashNessuna valutazione finora

- FIVE - 5566-Accounting and FinanceDocumento9 pagineFIVE - 5566-Accounting and FinancebeelahmedNessuna valutazione finora

- StatisticsDocumento19 pagineStatisticsMusa Kazim QizalbashNessuna valutazione finora

- StatisticsDocumento19 pagineStatisticsMusa Kazim QizalbashNessuna valutazione finora

- PSPDocumento2 paginePSPtejjaNessuna valutazione finora

- Switch Enterasys Cli - GuideDocumento720 pagineSwitch Enterasys Cli - GuideRaul Iglesias Gomez100% (2)

- Wooldridge 2002 Rudiments of StataDocumento11 pagineWooldridge 2002 Rudiments of StataDineshNessuna valutazione finora

- BSBRSK501 Manage RiskDocumento105 pagineBSBRSK501 Manage RiskStavros NathanailNessuna valutazione finora

- Estimation of Timber Volume in A Coniferous Plantation Forest Using Landsat TMDocumento5 pagineEstimation of Timber Volume in A Coniferous Plantation Forest Using Landsat TMMagno JuniorNessuna valutazione finora

- Visual C++ NET TutorialsDocumento39 pagineVisual C++ NET Tutorialspgoyal10Nessuna valutazione finora

- Tcs Assurance ServicesDocumento4 pagineTcs Assurance ServicesA.R.Sathish kumarNessuna valutazione finora

- Domination in Graphs PDFDocumento56 pagineDomination in Graphs PDFuebecsNessuna valutazione finora

- Temperature Transmitter RadixDocumento4 pagineTemperature Transmitter RadixRohit MoreNessuna valutazione finora

- Digital Banking UpdatesDocumento46 pagineDigital Banking Updatesvivek_anandNessuna valutazione finora

- 10ME64 FEM Lesson Plan (Student)Documento9 pagine10ME64 FEM Lesson Plan (Student)PavanKumarNNessuna valutazione finora

- Task Checklist Exhibition Re 2019Documento4 pagineTask Checklist Exhibition Re 2019zikrillah1Nessuna valutazione finora

- Install Ansible On Mac OSXDocumento5 pagineInstall Ansible On Mac OSXNagendraNessuna valutazione finora

- Tia Eia 637 ADocumento110 pagineTia Eia 637 ApzernikNessuna valutazione finora

- Telit GL865-DUAL-QUAD Hardware User Guide r7Documento76 pagineTelit GL865-DUAL-QUAD Hardware User Guide r7salasugo5751Nessuna valutazione finora

- BSNL 4G Plus Work ProcessDocumento23 pagineBSNL 4G Plus Work ProcessDipankar MandalNessuna valutazione finora

- Choosing the Right Commerce PlatformDocumento5 pagineChoosing the Right Commerce PlatformShafeer VpNessuna valutazione finora

- BIOS Configuration Utility User GuideDocumento19 pagineBIOS Configuration Utility User GuidecornolioNessuna valutazione finora

- OX8XXBDocumento4 pagineOX8XXBEngr Irfan AkhtarNessuna valutazione finora

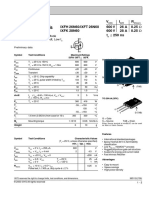

- Hiperfet Power Mosfets: V I R Ixfh 26N60/Ixft 26N60 600 V 26 A 0.25 Ixfk 28N60 600 V 28 A 0.25 T 250 NsDocumento2 pagineHiperfet Power Mosfets: V I R Ixfh 26N60/Ixft 26N60 600 V 26 A 0.25 Ixfk 28N60 600 V 28 A 0.25 T 250 NsAmirNessuna valutazione finora

- U.S. Pat. 6,114,618, Plek Guitar System, 2000.Documento9 pagineU.S. Pat. 6,114,618, Plek Guitar System, 2000.Duane BlakeNessuna valutazione finora

- Sandra Coates Skating Club: Creating Tables, Queries, Forms, and Reports in A DatabaseDocumento9 pagineSandra Coates Skating Club: Creating Tables, Queries, Forms, and Reports in A DatabaseKalama KitsaoNessuna valutazione finora

- CodetantraDocumento51 pagineCodetantrapratik ghoshNessuna valutazione finora

- The Air Land Sea Bulletin: Tactical Convoy OperationsDocumento24 pagineThe Air Land Sea Bulletin: Tactical Convoy OperationsMarko Hadzi-RisticNessuna valutazione finora

- Lesson 6.1 - Managing ICT Content Using Online PlatformsDocumento9 pagineLesson 6.1 - Managing ICT Content Using Online PlatformsMATTHEW LOUIZ DAIRONessuna valutazione finora

- How to Register for Smart Prepaid Innovation Generation FAQsDocumento12 pagineHow to Register for Smart Prepaid Innovation Generation FAQsKELLY CAMILLE GALIT ALAIRNessuna valutazione finora

- PrefaceDocumento2 paginePrefaceAKSNessuna valutazione finora