Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Succesion and Prescription

Caricato da

Lea AyuyaoDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Succesion and Prescription

Caricato da

Lea AyuyaoCopyright:

Formati disponibili

SUCCESSION CASES

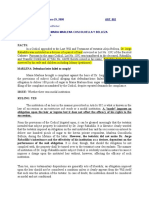

Succession Case#1 Coronel v. CA (Martinez, Joseph Eufemio)

Facts: On 19 January 1985, Romulo Coronel, et al. executed a document entitled Receipt of Down Payment in favor of Ramona Patricia Alcaraz for P50,000 downpayment of the total amount of P1.24M as purchase price for an inherited house and lot (TCT 119627, Registry of Deeds of Quezon City), promising to execute a deed of absolute sale of said property as soon as such has been transferred in their name. The balance of P1.19M is due upon the execution of said deed. On the same date, Concepcion D. Alcaraz, mother of Ramona, paid the down payment of P50,000.00. On 6 February 1985, the property originally registered in the name of the Coronels father was transferred in their names (TCT 327043). However, on 18 February 1985, the Coronels sold the property to Catalina B. Mabanag for P1,580,000.00 after the latter has paid P300,000.00. For this reason, Coronels canceled and rescinded the contract with Alcaraz by depositing the down payment in the bank in trust for Alcaraz. On 22 February 1985, Alcaraz filed a complaint for specific performance against the Coronels and caused the annotation of a notice of lis pendens at the back of TCT 327403. On 2 April 1985, Mabanag caused the annotation of a notice of adverse claim covering the same property with the Registry of Deeds of Quezon City. On 25 April 1985, the Coronels executed a Deed of Absolute Sale over the subject property in favor of Mabanag. On 5 June 1985, a new title over the subject property was issued in the name of Mabanag under TCT 351582. In the course of the proceedings, the parties agreed to submit the case for decision solely on the basis of documentary exhibits. Upon submission of their respective memoranda and the corresponding comment or reply thereto, and on 1 March 1989, judgment was handed down in favor of the plaintiffs, ordering the defendant to execute a deed of absolute sale of the land covered by TCT 327403 and canceling TCT 331582 and declaring the latter without force and effect. Claims for damages by plaintiffs and counterclaims by the defendants and intervenors were dismissed. A motion for reconsideration was thereafter filed, which was denied. Petitioners interposed an appeal, but on 16 December 1991, the CA rendered its decision fully agreeing with the trial court. Hence, the instant petition. The Supreme Court dismissed the petition and affirmed the appealed judgment. Issue: Whether or not the petitioner-sellers could validly sell their shares? Held: Yes. Article 774 of the Civil Code defines Succession as a mode of transferring ownership, providing succession is a mode of acquisition by virtue of which the property, rights and obligations to the extent and value of the inheritance of a person are transmitted through his death to another or others by his will or by operation of law. In the present case, petitioners-sellers being the sons and daughters of the decedent Constancio P. Coronel are compulsory heirs who were called to succession by operation of law. Thus, at the instance of their fathers death, petitioners stepped into his shoes insofar as the subject property is concerned, such that any rights or obligations pertaining thereto became binding and enforceable upon them. It is expressly provided that rights to the succession are transmitted from the moment of death of the decedent. Succession Case#2 Litonjua v. Montilla (Morales, Raymond Noel) Litonjua vs. Montilla Facts: Litonjua obtained a judgment against Claudio Montilla for a sum of money. In the meantime, Agustin Montilla died. During the proceedings for the settlement of the deceaseds estate, Litonjua filed a motion praying for the satisfaction of Claudio Montillas judgment debt from his share in his Agustins estate. Issue: Can Montilla can collect the amount of Claudios judgment debt from Agustins estate pending settlement proceedings?

Held: No. Collection is premature because the debts of the estate have not yet been paid and Claudios inheritance has not yet been ascertained. Moreover, intervention was improper because Montilla is not a creditor nor an heir of Agustin. The creditor of the heirs of a deceased person is entitled to collect his claim out of the property which pertains by inheritance to said heirs, only after the debts of the testate or intestate succession have been paid and when the net assets that are divisible among the heirs are known, because the debts of the deceased must first be paid before his heirs can inherit. Moreover, a person who is not a creditor of a deceased, testate or intestate, has no right to intervene either in the proceedings brought in connection with the estate or in the settlement of the succession. Succession Case#3 Ledesma v. McLachlin (Osdon, Charity Anne) FACTS Socorro Ledesma cohabited with Lorenzo Quitco. She bore him a daughter who is the other plaintiff Ana Quitco Ledesma. When their relationship ended Lorenzo executed a deed acknowledging Ana Quitco Ledesma as his natural daughter and on January 21, 1922, he issued in favor of the plaintiff Socorro Ledesma a promissory note for P2,000 of which P1,500 was to be paid two years from the date of the execution of the note. Subsequently, Lorenzo married Conchita McLachlin, with whom he had four children, who are the other defendants. Lorenzo died without leaving any property and then thereafter his father Eusebio Quitco also died, the latter having left real and personal properties upon his death. Socorro Ledesma filed before the committee on claims the promissory note for payment which was denied. An order of declaration of heirs in the intestate of the deceased Eusebio Quitco was issued by the court and as Ana Quitco Ledesma was not included among the declared heir. Socorro Ledesma, as mother of Ana Quitco Ledesma, asked for the reconsideration but was denied. ISSUE: WON Socorro can claim the P1,500 against the estate of Lorenzo's father for the payment of the promissory note HELD: NO. While it is true that under the provisions of articles 924 to 927 of the Civil Code, a children presents his father or mother who died before him in the properties of his grandfather or grandmother, this right of representation does not make the said child answerable for the obligations contracted by his deceased father or mother, because, as may be seen from the provisions of the Code of Civil Procedure referring to partition of inheritances, the inheritance is received with the benefit of inventory, that is to say, the heirs only answer with the properties received from their predecessor. The herein defendants, as heirs of Eusebio Quitco, in representation of their father Lorenzo M. Quitco, are not bound to pay the indebtedness of their said father from whom they did not inherit anything. Succession Case#4 Rabadilla v. CA (Palafox, Vincent Patrick) FACTS In a Codicil appended to the Last Will and Testament of testatrix Aleja Belleza, Dr. Jorge Rabadilla, predecessor-ininterest of the herein petitioner, Johnny S. Rabadilla, was instituted as a devisee of 511, 855 square meters of that parcel of land surveyed as Lot No. 1392 of the Bacolod Cadastre. It provided inter alia, that: 1) the Bacolod Cadastre be given Dr. Jorge Rabadilla or his children and spouse should he die before testator; 2) should Jorge Rabadilla or his heirs receive ownership of the Bacolod Cadastre, and also at the time that the lease of Balbinito G. Guanzon of the said lot shall expire, Jorge Rabadilla shall have the obligation until he dies, every year to give to Maria Marlina Coscolluela y Belleza, 75 piculs of Export sugar and 25 piculs of Domestic sugar, until the said Maria Marlina Coscolluela y Belleza dies; 3) In the event that Dr. Rabadilla shall later sell, lease, mortgage this said Lot, the buyer, lessee, mortgagee, shall have also the same obligation to Maria Marlina until she shall die; 4) Should the buyer, lessee or the mortgagee of this lot, not have respected the Codicil, Maria Marlina Coscolluela y Belleza, shall immediately seize the land and turn it over to testators near descendants and the latter shall then have the same obligation to Maria Marlina until she shall die; and 5) Should Dr. Rabadilla or his heirs decide to sell, lease, mortgage, they cannot negotiate with others than the near descendants and sister of the testator.

Pursuant to the same Codicil, Lot No. 1392 was transferred to Dr. Jorge Rabadilla, and Transfer Certificate of Title No. 44498 thereto issued in his name. Dr. Jorge Rabadilla died in 1983 and was survived by his wife Rufina and children Johnny (petitioner), Aurora, Ofelia and Zenaida, all surnamed Rabadilla. On 21 August 1989, Maria Marlena Coscolluela y Belleza Villacarlos brought a complaint, against the abovementioned heirs of Dr. Jorge Rabadilla, to enforce the provisions of subject Codicil for alleged violations of the conditions of the Codicil: 1) Mortgage to the Philippine National Bank and the Republic Planters Bank in disregard of the testatrix's specific instruction to sell, lease, or mortgage only to the near descendants and sister of the testatrix. 2) Defendant-heirs failure to comply with their obligation to deliver one hundred (100) piculs of sugar, despite repeated demands for compliance. 3) The banks failed likewise to deliver 100 piculs of sugar per crop year to herein private respondent. The plaintiff then prayed that judgment be rendered ordering defendant-heirs to reconvey/return Lot No. 1392 to the surviving heirs of the late Aleja Belleza, the cancellation of TCT No. 44498 in the name of the deceased, Dr. Jorge Rabadilla, and the issuance of a new certificate of title in the names of the surviving heirs of the late Aleja Belleza. On the basis of a MOA between petitioner and private respondent, that the obligation be paid by partial delivery of sugar and partly its cash equivalent in instalments, from 1988- 1992, the trial court dismissed the action for being premature. However, there was no compliance with the aforesaid Memorandum of Agreement except for a partial delivery of 50.80 piculs of sugar corresponding to sugar crop year 1988-1989. On appeal by plaintiff, the First Division of the Court of Appeals reversed the decision of the trial court. The CA held that the evidence on record established plaintiff-appellant's right to receive 100 piculs of sugar annually out of the produce of Lot No. 1392; defendants-appellee's obligation under Aleja Belleza's codicil, as heirs of the modal heir, Jorge Rabadilla, to deliver such amount of sugar to plaintiff-appellant; defendants-appellee's admitted noncompliance with said obligation since 1985; and, the punitive consequences enjoined by both the codicil and the Civil Code, of seizure of Lot No. 1392 and its reversion to the estate of Aleja Belleza in case of such noncompliance, this Court deems it proper to order the reconveyance of title over Lot No. 1392 from the estates of Jorge Rabadilla to the estate of Aleja Belleza. However, plaintiff-appellant must institute separate proceedings to re-open Aleja Belleza's estate, secure the appointment of an administrator, and distribute Lot No. 1392 to Aleja Belleza's legal heirs in order to enforce her right, reserved to her by the codicil, to receive her legacy of 100 piculs of sugar per year out of the produce of Lot No. 1392 until she dies. Dissatisfied with the aforesaid disposition by the Court of Appeals, petitioner appealed to Supreme Court via the present petition, contending that the Court of Appeals erred in ordering the reversion. ISSUE WON CA erred in ordering the reversion of Lot 1392 to the estate of the testatrix Aleja Belleza on the basis of the Codicil, and in ruling that the testamentary institution of Dr. Jorge Rabadilla is a modal institution within the purview of Article 882 of the New Civil Code. HELD NO to both. Petition dismissed. The Court of Appeals found that the private respondent had a cause of action against the petitioner. The disquisition made on modal institution was, precisely, to stress that the private respondent had a legally demandable right against the petitioner pursuant to subject Codicil; on which issue the Court of Appeals ruled in accordance with law. Under Article 776 of the New Civil Code, inheritance includes all the property, rights and obligations of a person, not extinguished by his death. Conformably, whatever rights Dr. Jorge Rabadilla had by virtue of subject Codicil were transmitted to his forced heirs, at the time of his death. And since obligations not extinguished by death also form part of the estate of the decedent; corollarily, the obligations imposed by the Codicil on the deceased Dr. Jorge Rabadilla, were likewise transmitted to his compulsory heirs upon his death. Such obligation of the instituted heir reciprocally corresponds to the right of private respondent over the usufruct, the fulfillment or performance of which is now being demanded by the latter through the institution of the case at bar. Therefore, private respondent has a cause of action against petitioner and the trial court erred in dismissing the complaint below.

This is not a substitution as theorized by the petitioner since substitution is the designation by the testator of a person or persons to take the place of the heir or heirs first instituted. It is not a simple substitution because the provisions of subject Codicil do not provide that should Dr. Jorge Rabadilla default due to predecease, incapacity or renunciation, the testatrix's near descendants would substitute him. What the Codicil provides is that, should Dr. Jorge Rabadilla or his heirs not fulfill the conditions imposed in the Codicil, the property referred to shall be seized and turned over to the testatrix's near descendants. Neither is there a fideicommissary substitution since the instituted heir is in fact allowed under the Codicil to alienate the property provided the negotiation is with the near descendants or the sister of the testatrix. Thus, a very important element of a fideicommissary substitution is lacking; the obligation clearly imposing upon the first heir the preservation of the property and its transmission to the second heir. Also, the near descendants' right to inherit from the testatrix is not definite. The property will only pass to them should Dr. Jorge Rabadilla or his heirs not fulfill the obligation to deliver part of the usufruct to private respondent. Another important element of a fideicommissary substitution is also missing here. Under Article 863, the second heir or the fideicommissary to whom the property is transmitted must not be beyond one degree from the first heir or the fiduciary. A fideicommissary substitution is therefore, void if the first heir is not related by first degree to the second heir. In the case under scrutiny, the near descendants are not at all related to the instituted heir, Dr. Jorge Rabadilla. The Court of Appeals did not err in ruling that the institution of Dr. Jorge Rabadilla under subject Codicil is in the nature of a modal institution and therefore, Article 882 of the New Civil Code is the provision of law in point. The institution of an heir in the manner prescribed in Article 882 is what is known in the law of succession as an institucion sub modo or a modal institution. In a modal institution, the testator states (1) the object of the institution, (2) the purpose or application of the property left by the testator, or (3) the charge imposed, by the testator upon the heir. A "mode" imposes an obligation upon the heir or legatee but it does not affect the efficacy of his rights to the succession. It is clear from the Codicil that should the obligation be not complied with, the property shall be turned over to the testatrix's near descendants. The manner of institution of Dr. Jorge Rabadilla under subject Codicil is evidently modal in nature because it imposes a charge upon the instituted heir without, however, affecting the efficacy of such institution. Then too, since testamentary dispositions are generally acts of liberality, an obligation imposed upon the heir should not be considered a condition unless it clearly appears from the Will itself that such was the intention of the testator. In case of doubt, the institution should be considered as modal and not conditional.

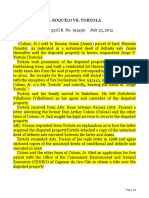

Succession Case#5 Suarez v. CA (Palattao, Rodolfo John Robert) Facts: Petitioners are siblings. Their father died but his estate consisting of several parcels of land has not been liquidated. Then the mother petitioners lost in the consolidated cases for rescission of contract and damages. The judgment having become final and executory, five parcels of land were levied to satisfy the judgment. Private respondents were the highest bidder and was issued a certificate of sale then registered. Before the expiration of the redemption period, petitioners filed a reinvindicatory to recover ownership of the said properties. They allege that being strangers to the case, their properties cannot be levied nor sold. The court then issued an order directing them to vacate the premises of the said lands and to give the duplicate titles to private respondents. Petitioners filed for a motion for reconsideration an the order to vacate was lifted. The respondents then appealed to the CA which annulled the orders of the RTC. Issue: Whether or not private respondents can validly acquire all the five parcels of land co-owned by petitioners and registered in the name of petitioners deceased father whose estate has not been liquidated, after the said properties were levied and publicly sold to private respondents to satisfy the personal debt of the surviving spouse and mother of herein petitioners? Ruling: Only of the 5 parcels of land should have been the subject of the auction sale. The law in point is Article 777 of the Civil Code, the law applicable at the time of the institution of the case: The rights to the succession are transmitted from the moment of the death of the decedent.

Article 888 further provides: The legitime of legitimate children and descendants consists of one-half of the hereditary estate of the father and of the mother. The latter may freely dispose of the remaining half, subject to the rights of illegitimate children and of the surviving spouse as hereinafter provided. Article 892 par. 2 provides: If there are two or more legitimate children or descendants, the surviving spouse shall be entitled to a portion equal to the legitime of each of the legitimate children or descendants. The propriety interest of petitioners is different and adverse to that of their mother. Petitioners became co-owners of the property not because of their mother but through their own right, therefore they are not barred in any way from annulling the auction sale. Succession Case#6 Opulencia v. CA (Palis, Lynn Margarita) FACTS: Private respondents Aladin Simundac and Miguel Oliven alleged that petitioner Natalia Opulencia executed a Contract to Sell over a piece of land and that they paid the petitioner the downpayment but the latter refused to comply with her obligations. Petitioner admitted to executing the contract but asserts that she cannot comply because the probate court did not allow the contract; its approval was necessary since the property belong to the estate of her deceased father. She also claims that the contract was subject to a suspensive condition (approval of the probate court) which the petitioners knew. Likewise, she avers that she wanted to give back the downpayment but the petitioners refused her. RTC dismissed the complaint on the ground that the probate court did not allow the contract to sell. CA reversed the RTC and claimed that the contract did not need the approval of the probate court since the contract was made by the petitioner in her capacity as an heir of a property that was devised to her under the will sought to be probated. ISSUE: W/N the contract to sell without the requisite approval of the probate court is valid HELD: Contract is valid. As correctly ruled by the Court of Appeals, Section 7 of Rule 89 of the Rules of Court is not applicable, because petitioner entered into the Contract to Sell in her capacity as an heiress, not as an executrix or administratrix of the estate. In the contract, she represented herself as the "lawful owner" and seller of the subject parcel of land. 12 She also explained the reason for the sale to be "difficulties in her living" conditions and consequent "need of cash." 13 These representations clearly evince that she was not acting on behalf of the estate under probate when she entered into the Contract to Sell. Accordingly, the jurisprudence cited by petitioners has no application to the instant case. We emphasize that hereditary rights are vested in the heir or heirs from the moment of the decedent's death. Petitioner, therefore, became the owner of her hereditary share the moment her father died. Thus, the lack of judicial approval does not invalidate the Contract to Sell, because the petitioner has the substantive right to sell the whole or a part of her share in the estate of her late father. The Contract to Sell stipulates that petitioner's offer to sell is contingent on the "complete clearance of the court on the Last Will Testament of her father." Consequently, although the Contract to Sell was perfected between the petitioner and private respondents during the pendency of the probate proceedings, the consummation of the sale or the transfer of ownership over the parcel of land to the private respondents is subject to the full payment of the purchase price and to the termination and outcome of the testate proceedings. Therefore, there is no basis for petitioner's apprehension that the Contract to Sell may result in a premature partition and distribution of the properties of the estate. Indeed, it is settled that "the sale made by an heir of his share in an inheritance, subject to the pending administration, in no wise stands in the way of such administration." Finally, petitioner is estopped from backing out of her representations in her valid Contract to Sell with private respondents, from whom she had already received P300,000 as initial payment of the purchase price. Petitioner may not renege on her own acts and representations, to the prejudice of the private respondents who have relied on them. Succession Case#7 Ferrer v. Sps. Diaz (Quinsay, Stacy) FACTS: Ferrers Version: Atty. Ferrer claimed in his original Complaint that the Diazes, as represented by their daughter Comandante, through a Special Power of Attorney (SPA), obtained from him a loan of P1,118,228.00. The loan was secured by a Real Estate Mortgage Contract. Prior to this, Comandante, for a valuable consideration of P600,000.00,

executed in his favor a Waiver of Hereditary Rights and Interests Over a Real Property (Still Undivided). On the basis of said waiver, Ferrer executed an Affidavit of Adverse Claim which he caused to be annotated at the back of TCT. The Diazes, however, reneged on their obligation so he filed a Complaint for Collection of Sum of Money Secured by Real Estate Mortgage Contract. Diazes Version: Comandante alleged she sought financial accommodations from Ferrer couple which totaled P500,000.00. These loans were secured by chattel mortgages over her taxi units in addition to several postdated checks. As she could not practically comply with her obligation, Ferrer spouses presented to Comandante a Waiver of Hereditary Rights and Interests Over a Real Property (Still Undivided) to secure Comandantes loan with the couple which at that time had already ballooned to P600,000.00 due to interests. Comandante likewise alleged that she later executed an Affidavit of Repudiation/Revocation of Waiver of Hereditary Rights and Interests Over A (Still Undivided) Real Property, which she caused to be annotated on the title of the subject property. Apart from executing the affidavit of repudiation, Comandante also filed a Petition for Cancellation of Adverse Claim. ISSUE: Is a waiver of hereditary rights in favor of another executed by a future heir while the parents are still living valid? Is an adverse claim annotated on the title of a property on the basis of such waiver likewise valid and effective as to bind the subsequent owners and hold them liable to the claimant? RULING: All the respondents contend that the Waiver of Hereditary Rights and Interest Over a Real Property (Still Undivided) executed by Comandante is null and void for being violative of Article 1347 of the Civil Code, hence, petitioners adverse claim which was based upon such waiver is likewise void and cannot confer upon the latter any right or interest over the property. We agree with the respondents. Pursuant to the second paragraph of Article 1347 of the Civil Code, no contract may be entered into upon a future inheritance except in cases expressly authorized by law. For the inheritance to be considered "future", the succession must not have been opened at the time of the contract. A contract may be classified as a contract upon future inheritance, prohibited under the second paragraph of Article 1347, where the following requisites concur: (1) That the succession has not yet been opened. (2) That the object of the contract forms part of the inheritance; and, (3) That the promissor has, with respect to the object, an expectancy of a right which is purely hereditary in nature.38 In this case, there is no question that at the time of execution of Comandantes Waiver of Hereditary Rights and Interest Over a Real Property (Still Undivided), succession to either of her parents properties has not yet been opened since both of them are still living. With respect to the other two requisites, both are likewise present considering that the property subject matter of Comandantes waiver concededly forms part of the properties that she expect to inherit from her parents upon their death and, such expectancy of a right, as shown by the facts, is undoubtedly purely hereditary in nature. From the foregoing, it is clear that Comandante and petitioner entered into a contract involving the formers future inheritance as embodied in the Waiver of Hereditary Rights and Interest Over a Real Property (Still Undivided) executed by her in petitioners favor. Waiver of Hereditary Rights and Interest Over a Real Property (Still Undivided) executed by Comandante in favor of petitioner as not valid and that same cannot be the source of any right or create any obligation between them for being violative of the second paragraph of Article 1347 of the Civil Code. Anent the validity and effectivity of petitioners adverse claim, it is provided in Section 70 of PD 1529, that it is necessary that the claimant has a right or interest in the registered land adverse to the registered owner and that it must arise subsequent to registration. Here, as no right or interest on the subject property flows from Comandantes invalid waiver of hereditary rights upon petitioner, the latter is thus not entitled to the registration of his adverse claim. Therefore, petitioners adverse claim is without any basis and must consequently be adjudged invalid and ineffective and perforce be cancelled. Succession Case#8 Reyes v. CA (Realo, Glenn) REYES, et. al. V. CA, GR 124099, October 30, 1997 FACTS: Torcuato J. Reyes executed his last will and testament wherein he bequeathed to his wife Asuncion Oning Reyes all his shares in their personal properties, as well as of all the real estates that he co-owns with his brother. (par. II (a) and (b)). His will consisted of 2 pages. Upon his death, a petition for the probate of his will was filed before the RTC. This was opposed by the recognized natural children of Torcuato Reyes with Estebana Galolo. According to them, Reyes was never married and could never marry Asucnion Reyes, the woman he claimed to be his wife in the will, because the latter was already

married Lupo Ebarle, who was still then alive and their marriage was never annulled. Thus, Asuncion cannot be a compulsory heir for her open cohabitation with Reyes was violative of public morals. RTC: Allowed the probate of the will except for par. II (a) and (b) of the will which was declared null and void for being contrary to law and morals. It ruled that Asuncion Reyes was never marred to the deceased Reyes and, therefore, their relationship was an adulterous one. CA: Affirmed but with the modification that par. II including subpars. (a) and (b) were declared valid because the oppositors never showed any competent, documentary or otherwise during the trial to show that Asuncion Oning Reyes marriage to the testator was inexistent or void, either because of a re-existing marriage or adulterous relationship. ISSUE: W/N it was correct for the RTC to have passed upon the intrinsic validity of the will of Torcuato. HELD: HELL NO! CA was damn right! CA affirmed. As a general rule, courts in probate proceedings are limited to pass only upon the extrinsic validity of the will sought to be probated. Thus the court merely inquires on its due execution, whether or not it complies with the formalities prescribed by law, and the testamentary capacity of the testator. It does not determine nor even by implication prejudge the validity or efficacy of the wills provisions. The intrinsic validity is not considered since the consideration thereof usually comes only after the will has been proved and allowed. There are, however, notable circumstances wherein the intrinsic validity was first determined as when the defect of the will is apparent on its face and the probate of the will may become a useless ceremony if it is intrinsically invalid. The intrinsic validity of a will may be passed upon because practical considerations demanded it as when there is preterition of heirs or the testamentary provisions are of doubtful legality. Where the parties agree that the intrinsic validity be first determined, the probate court may also do so. Parenthetically, the rule on probate is not inflexible and absolute. Under exceptional circumstances, the probate court is not powerless to do what the situation constrains it to do and pass upon certain provisions of the will. The case at bar arose from the institution of the petition for the probate of the will of the late Torcuato Reyes. Perforce, the only issues to be settled in the said proceeding were: (1) W/N the testator had animus testandi; (2) W/N vices of consent attended the execution of the will; and (3) W/N the formalities of the will had been complied with. Thus, the lower court was not asked to rule upon the intrinsic validity or efficacy of the provisions of the will. As a result, the declaration of the testator that Asuncion Oning Reyes was his wife did not have to be scrutinized during the probate proceedings. The propriety of the institution of Oning Reyes as one of the devisees/legatees already involved inquiry on the wills intrinsic validity and which need not be inquired upon by the probate court. We agree with the CA that the RTC relied upon uncorroborated testimonial evidence that Asuncion Reyes was still married to another during the time she cohabited with the testator. The testimonies of the witnesses were merely hearsay and even uncertain as to the whereabouts or existence of Lupo Ebarle, the supposed husband of Oning. Succession Case#9 Nepomuceno v. CA (Rilloraza, Cynthia) NEPOMUCENO vs CA (Topic: Wills in General) Facts: Martin Jugo died on July 16, 1974 in Malabon, Rizal. He left a last Will and Testament duly signed by him at the end of the Will on page three and on the left margin of pages 1, 2 and 4 thereof in the presence of Celestina Alejandro, Myrna C. Cortez, and Leandro Leano, who in turn, affixed their signatures below the attestation clause and on the left margin of pages 1, 2 and 4 of the Will in the presence of the testator and of each other and the Notary Public. The Will was acknowledged before the Notary Public Romeo Escareal by the testator and his three attesting witnesses. In the said Will, the testator named and appointed herein petitioner Sofia J. Nepomuceno as his sole and only executor of his estate. It is clearly stated in the Will that the testator was legally married to a certain Rufina Gomez by whom he had two legitimate children, Oscar and Carmelita, but since 1952, he had been estranged from his lawfully wedded wife and had been living with petitioner as husband and wife. In fact, on December 5, 1952, the testator Martin Jugo and the petitioner herein, Sofia J. Nepomuceno were married in Victoria, Tarlac before the Justice of the Peace. The testator devised to his forced heirs, namely, his legal wife Rufina Gomez and his children Oscar and Carmelita his entire estate and the free portion thereof to herein petitioner. The Will reads in part: Art. III. That I have the following legal heirs, namely: my aforementioned legal wife, Rufina Gomez, and our son, Oscar, and daughter Carmelita, both surnamed Jugo, whom I declare and admit to be legally and properly entitled to inherit from me; that while I have been estranged from my above-named wife for so many years, I cannot deny that I

was legally married to her or that we have been separated up to the present for reasons and justifications known fully well by them: Art. IV. That since 1952, 1 have been living, as man and wife with one Sofia J. Nepomuceno, whom I declare and avow to be entitled to my love and affection, for all the things which she has done for me, now and in the past; that while Sofia J. Nepomuceno has with my full knowledge and consent, did comport and represent myself as her own husband, in truth and in fact, as well as in the eyes of the law, I could not bind her to me in the holy bonds of matrimony because of my aforementioned previous marriage; On August 21, 1974, the petitioner filed a petition for the probate of the last Will and Testament of the deceased Martin Jugo in the Court of First Instance of Rizal, Branch XXXIV, Caloocan City and asked for the issuance to her of letters testamentary. On May 13, 1975, the legal wife of the testator, Rufina Gomez and her children filed an opposition alleging inter alia that the execution of the Will was procured by undue and improper influence on the part of the petitioner; that at the time of the execution of the Will, the testator was already very sick and that petitioner having admitted her living in concubinage with the testator, she is wanting in integrity and thus, letters testamentary should not be issued to her. On January 6, 1976, the lower court denied the probate of the Will on the ground that as the testator admitted in his Will to cohabiting with the petitioner from December 1952 until his death on July 16, 1974, the Will's admission to probate will be an Idle exercise because on the face of the Will, the invalidity of its intrinsic provisions is evident. The petitioner appealed to the respondent-appellate court. On June 2, 1982, the respondent court set aside the decision of the Court of First Instance of Rizal denying the probate of the will. The respondent court declared the Will to be valid except that the devise in favor of the petitioner is null and void pursuant to Article 739 in relation with Article 1028 of the Civil Code of the Philippines. On June 15, 1982, oppositors Rufina Gomez and her children filed a "Motion for Correction of Clerical Error" praying that the word "appellant" in the last sentence of the dispositive portion of the decision be changed to "appellees" so as to read: "The properties so devised are instead passed on intestacy to the appellees in equal shares, without pronouncement as to costs." The motion was granted by the respondent court. The petitioner filed a motion for reconsideration. This was denied by the respondent court. Issue: Whether or not the respondent court acted in excess of its jurisdiction when after declaring the last Will and Testament of the deceased Martin Jugo validly drawn, it went on to pass upon the intrinsic validity of the testamentary provision in favor of herein petitioner. Ruling: The respondent court acted within its jurisdiction when after declaring the Will to be validly drawn, it went on to pass upon the intrinsic validity of the Will and declared the devise in favor of the petitioner null and void. The general rule is that in probate proceedings, the court's area of inquiry is limited to an examination and resolution of the extrinsic validity of the Will. The rule is expressed thus: xxx xxx xxx ... It is elementary that a probate decree finally and definitively settles all questions concerning capacity of the testator and the proper execution and witnessing of his last Will and testament, irrespective of whether its provisions are valid and enforceable or otherwise. (Fernandez v. Dimagiba, 21 SCRA 428) The petition below being for the probate of a Will, the court's area of inquiry is limited to the extrinsic validity thereof. The testators testamentary capacity and the compliance with the formal requisites or solemnities prescribed by law are the only questions presented for the resolution of the court. Any inquiry into the intrinsic validity or efficacy of the provisions of the will or the legality of any devise or legacy is premature. xxx xxx xxx True or not, the alleged sale is no ground for the dismissal of the petition for probate. Probate is one thing; the validity of the testamentary provisions is another. The first decides the execution of the document and the testamentary capacity of the testator; the second relates to descent and distribution (Sumilang v. Ramagosa, 21 SCRA 1369) xxx xxx xxx To establish conclusively as against everyone, and once for all, the facts that a will was executed with the formalities required by law and that the testator was in a condition to make a will, is the only purpose of the proceedings under the new code for the probate of a will. (Sec. 625). The judgment in such proceedings determines and can determine nothing more. In them the court has no power to pass upon the validity of any provisions made in the will. It can not decide, for example, that a certain legacy is void and another one valid. ... (Castaneda v. Alemany, 3 Phil. 426) The rule, however, is not inflexible and absolute. Given exceptional circumstances, the probate court is not powerless to do what the situation constrains it to do and pass upon certain provisions of the Will.

In Nuguid v. Nuguid (17 SCRA 449) cited by the trial court, the testator instituted the petitioner as universal heir and completely preterited her surviving forced heirs. A will of this nature, no matter how valid it may appear extrinsically, would be null and void. Separate or latter proceedings to determine the intrinsic validity of the testamentary provisions would be superfluous. Even before establishing the formal validity of the will, the Court in Balanay .Jr. v. Martinez (64 SCRA 452) passed upon the validity of its intrinsic provisions. Invoking "practical considerations", we stated: The basic issue is whether the probate court erred in passing upon the intrinsic validity of the will, before ruling on its allowance or formal validity, and in declaring it void. We are of the opinion that in view of certain unusual provisions of the will, which are of dubious legality, and because of the motion to withdraw the petition for probate (which the lower court assumed to have been filed with the petitioner's authorization) the trial court acted correctly in passing upon the will's intrinsic validity even before its formal validity had been established. The probate of a will might become an Idle ceremony if on its face it appears to be intrinsically void. Where practical considerations demand that the intrinsic validity of the will be passed upon, even before it is probated, the court should meet the issue (Nuguid v. Nuguid, 64 O.G. 1527, 17 SCRA 449. Compare with Sumilang vs. Ramagosa L-23135, December 26, 1967, 21 SCRA 1369; Cacho v. Udan L-19996, April 30, 1965, 13 SCRA 693). There appears to be no more dispute at this time over the extrinsic validity of the Will. Both parties are agreed that the Will of Martin Jugo was executed with all the formalities required by law and that the testator had the mental capacity to execute his Will. The petitioner states that she completely agrees with the respondent court when in resolving the question of whether or not the probate court correctly denied the probate of Martin Jugo's last Will and Testament, it ruled: This being so, the will is declared validly drawn. (Page 4, Decision, Annex A of .) On the other hand the respondents pray for the affirmance of the Court of Appeals' decision in toto. The only issue, therefore, is the jurisdiction of the respondent court to declare the testamentary provision in favor of the petitioner as null and void. We sustain the respondent court's jurisdiction. As stated in Nuguid v. Nuguid, (supra): We pause to reflect. If the case were to be remanded for probate of the will, nothing will be gained. On the contrary, this litigation will be protracted. And for aught that appears in the record, in the record, in the event of probate or if the court rejects the will, probability exists that the case will come up once again before us on the same issue of the intrinsic validity or nullity of the will. Result, waste of time, effort, expense, plus added anxiety. These are the practical considerations that induce us to a belief that we might as well meet head-on the issue of the validity of the provisions of the will in question. (Section 2, Rule 1, Rules of Court. Case, et al. v. Jugo, et al., 77 Phil. 517, 522). After all, there exists a justiciable controversy crying for solution. We see no useful purpose that would be served if we remand the nullified provision to the proper court in a separate action for that purpose simply because, in the probate of a will, the court does not ordinarily look into the intrinsic validity of its provisions. Article 739 of the Civil Code provides: The following donations shall be void: (1) Those made between persons who were guilty of adultery or concubinage at the time of the donation; (2) Those made between persons found guilty of the same criminal offense, in consideration thereof; (3) Those made to a public officer or his wife, descendants and ascendants, by reason of his office. In the case referred to in No. 1, the action for declaration of nullity may be brought by the spouse of the donor or donee; and the guilt of the donor and donee may be proved by preponderance of evidence in the same action. Article 1028 of the Civil Code provides: The prohibitions mentioned in Article 739, concerning donations inter vivos shall apply to testamentary provisions. Moreover, the prohibition in Article 739 of the Civil Code is against the making of a donation between persons who are living in adultery or concubinage. It is the donation which becomes void. The giver cannot give even assuming that the recipient may receive. The very wordings of the Will invalidate the legacy because the testator admitted he was disposing the properties to a person with whom he had been living in concubinage. WHEREFORE, the petition is DISMISSED for lack of merit. The decision of the Court of Appeals, now Intermediate Appellate Court, is AFFIRMED. No costs. Succession Case#10 Castaneda v. Alemany (Robles, Jo) Facts

The will of Dona Juana Moreno was typewritten in the office of her lawyer. After being typed, it was presented to the testatrix and to the three witnesses who signed it as witnesses in the presence of the testatrix and each other. Appellants are now contending that the will should not be allowed probate because it was not written by the testatrix herself nor was it done by someone else in her presence and under her direction Issue : W/N the will should be allowed probate? Held: Yes. There is nothing in the language of section 618 of the Code of Civil Procedure which supports the claim of the appellants that the will must be written by the testator himself or by someone else in his presence and under his express direction. That section requires (1) that the will be in writing and (2) either that the testator sign it himself or, if he does sign it, that it be signed by some one in his presence and by his express direction. Who does the mechanical work of writing the will is a matter of indifference. The fact, therefore, that in this case the will was typewritten in the office of the lawyer for the testratrix is of no consequence. What is the purpose of the probate of a will? To establish conclusively as against everyone, and once for all, the facts that a will was executed with the formalities required by law and that the testator was in a condition to make a will, is the only purpose of the proceedings under the new code for the probate of a will. (Sec. 625.) The judgment in such proceedings determines and can determine nothing more. In them the court has no power to pass upon the validity of any provisions made in the will All such questions must be decided in some other proceeding. The grounds on which a will may be disallowed are stated the section 634. Unless one of those grounds appears the will must be allowed. They all have to do with the personal condition of the testator at the time of its execution and the formalities connected therewith. It follows that neither this court nor the court below has any jurisdiction in this proceedings to pass upon the questions raised by the appellants by the assignment of error relating to the appointment of a guardian for the children of the deceased Succession Case#11 In Re Will of Riosa v. Riosa (Saunar, Kris Norwin) In Re Will of Riosa GR L-14074 November 7, 1918 Facts: Jose Riosa died on April 17, 1917. He left a will made in the month of January, 1908 The will was duly executed in accordance with the law then in force, namely, section 618 of the Code of Civil Procedure. However, the will was not executed in accordance with a subsequent law that was enacted, Act No. 2645 which prescribes certain additional formalities for the signing and attestation of the wills, in force on and after July 1, 1916. The will was in writing, signed by the testator, and attested and subscribed by three credible witnesses in the presence of the testator and of each other; but was not signed by the testator and the witnesses on the left margin of each and every page, nor did the attestation state these facts. The new law, therefore, went into effect after the making of the will and before the death of the testator, without the testator having left a will that conforms to the new requirements.

Issue: W/N Act No 2645 prescribing additional requirements in the execution of a will should be applied in Jose Riosas will? Held: No. there should be no retroactive effect. There are three views to consider. 1) The rule laid down by the courts in many jurisdictions is that the statutes in force at the testator's death are controlling, and that a will not executed in conformity with such statutes is invalid, although its execution was sufficient at the time it was made. 2) The rule prevailing in many other jurisdictions is that the validity of the execution of a will must be tested by the statutes in force at the time of its execution and that statutes subsequently enacted have no retrospective effect. 3) Retrospective laws generally if not universally work injustice, and ought to be so construed only when the mandate of the legislature is imperative. When a testator makes a will, formally executed according

to the requirements of the law existing at the time of its execution, it would unjustly disappoint his lawful right of disposition to apply to it a rule subsequently enacted, though before his death. This court is given the opportunity to choose between the three rules above described. Our selection, under such circumstances, should naturally depend more on reason than on technicality. Above all, we cannot lose sight of the fact that the testator has provided in detail for the disposition of his property and that his desires should be respected by the courts. Justice is a powerful pleader for the second and third rules on the subject. The plausible reasoning of the authorities which back the first proposition is, we think, fallacious. The act of bequeathing or devising is something more than inchoate or ambulatory. In reality, it becomes a completed act when the will is executed and attested according to the law, although it does not take effect on the property until a future time Nevertheless, it is proper to observe that the general principle in the law of wills inserts itself even within the provisions of said section 634. Our statute announces a positive rule for the transference of property which must be complied with as completed act at the time of the execution, so far as the act of the testator is concerned, as to all testaments made subsequent to the enactment of Act No. 2645, but is not effective as to testaments made antecedent to that date. To answer the question with which we began this decision, we adopt as our own the second rule, particularly as established by the Supreme Court of Pennsylvania. The will of Jose Riosa is valid. The order of the Court of First Instance for the Province of Albay of December 29, 1917, disallowing the will of Jose Riosa, is reversed, and the record shall be returned to the lower court with direction to admit the said will to probate Succession Case#12 Enriquez v. Abadia (Trinidad, Jay-Ryan)

In re: Will and Testament of the deceased REVEREND SANCHO ABADIA. SEVERINA A. VDA. DE ENRIQUEZ vs EL ABADIA, ET AL. August 9, 1954 DOCTRINE: THE VALIDITY OF THE WILL AS TO FORM IS TO BE JUDGED NOT BY THE LAW IN FORECE AT THE TIME OF THE TESTATORS DEATH OR AT THE TIME THE SUPPOSED WILL IS PRESENTED IN COURT FOR PROBATE OR WHEN THE PETITION IS DECIDED BY THE COURT BUT AT THE TIME THE INSTRUMENT WAS EXECUTED. FACTS: Father Sancho Abadia, parish priest of Talisay, Cebu. In 1923, he executed a document purporting to be his Last Will and Testament. He died on January 14, 1943. He left properties estimated at P8,000 in value. Andres Enriquez, one of the legatees, filed a petition for its probate in the CFI of Cebu. Some cousins and nephews who would inherit the estate of the deceased if he left no will, filed opposition. During the hearing one of the attesting witnesses, the other two being dead, testified without contradiction that in his presence and in the presence of his co-witnesses, Father Sancho wrote out in longhand;

TRIAL COURT: ADMITTED TO PROBATE THE HOLOGRAPHIC WILL. Reasoning of the TC: It found and declared that the will to be a holographic will; and that it was in the handwriting of the testator and that ALTHOUGH at the time it was executed and at the time of the testator's death, holographic wills were not permitted by law still, But because at the time of the hearing and when the case was to be decided

the new Civil Code was already in force, which Code permitted the execution of holographic wills, said trial court admitted to probate. LEGAL ISSUE: What is the law to apply to the probate of the holographic will? SUPREME COURT: It is a fact, that at the time that the will was executed in 1923 and at the time that Father Abadia died in 1943, holographic wills were not permitted. What is the law to apply to the probate of the will? May we apply the provisions of the new Civil Code which not allows holographic wills? But article 795 of this same new Civil Code expressly provides: "The validity of a will as to its form depends upon the observance of the law in force at the time it is made." The above provision is but an expression or statement of the weight of authority to the affect that the validity of a will is to be judged not by the law enforce at the time of the testator's death or at the time the supposed will is presented in court for probate or when the petition is decided by the court but at the time the instrument was executed. One reason in support of the rule is that although the will operates upon and after the death of the testator, the wishes of the testator about the disposition of his estate among his heirs and among the legatees is given solemn expression at the time the will is executed, and in reality, the legacy or bequest then becomes a completed act. In view of the foregoing, the holographic will is denied probate.

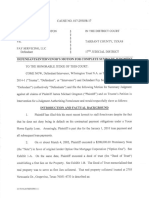

Succession Case#13 Bellis v. Bellis (Balauag, Ed Warren) Bellis vs. Bellis 20 SCRA 358 June 6, 1967 Facts: Amos G. Bellis, born in Texas, was "a citizen of the State of Texas and of the United States." By his first wife, Mary E. Mallen, whom he divorced, he had five legitimate children: Edward A. Bellis, George Bellis (who pre-deceased him in infancy), Henry A. Bellis, Alexander Bellis and Anna Bellis Allsman; by his second wife, Violet Kennedy, who survived him, he had three legitimate children: Edwin G. Bellis, Walter S. Bellis and Dorothy Bellis; and finally, he had three illegitimate children: Amos Bellis, Jr., Maria Cristina Bellis and Miriam Palma Bellis. Amos G. Bellis executed a will in the Philippines, in which he directed that after all taxes, obligations, and expenses of administration are paid for, his distributable estate should be divided, in trust, in the following order and manner: (a) $240,000.00 to his first wife, Mary E. Mallen; (b) P120,000.00 to his three illegitimate children, Amos Bellis, Jr., Maria Cristina Bellis, Miriam Palma Bellis, or P40,000.00 each and (c) after the foregoing two items have been satisfied, the remainder shall go to his seven surviving children by his first and second wives, namely: Edward A. Bellis, Henry A. Bellis, Alexander Bellis and Anna Bellis Allsman, Edwin G. Bellis, Walter S. Bellis, and Dorothy E. Bellis, in equal shares. Amos G. Bellis died a resident of San Antonio, Texas, U.S.A. His will was admitted to probate in the Court of First Instance of Manila. The People's Bank and Trust Company, as executor of the will, paid all the bequests therein. In the project of partition, the executor pursuant to the "Twelfth" clause of the testator's Last Will and Testament divided the residuary estate into seven equal portions for the benefit of the testator's seven legitimate children by his first and second marriages. Maria Cristina Bellis and Miriam Palma Bellis filed their respective oppositions to the project of partition on the ground that they were deprived of their legitimes as illegitimate children and, therefore, compulsory heirs of the deceased. The lower court issued an order overruling the oppositions and approving the executor's final account, report and administration and project of partition. Relying upon Art. 16 of the Civil Code, it applied the national law of the decedent, which in this case is Texas law, which did not provide for legitimes.

Issue: Whether or not the national law of the decedent applies to succession and capacity to succeed? YES. Whether or not the renvoi doctrine is applicable? NO. Held: The decedents national law governs the order of succession, the amount of successional rights, the intrinsic validity of the provisions of the will and capacity to succeed. A provision in a foreigner's will to the effect that his properties shall be distributed in accordance with Philippine law and not with his national law, is illegal and void, for his national law cannot be ignored in regard to those matters that Article 16 of the Civil Code states said national law should govern. The parties admit that the decedent, Amos G. Bellis, was a citizen of the State of Texas, U.S.A., and that under the laws of Texas, there are no forced heirs or legitimes. Accordingly, since the intrinsic validity of the provision of the will and the amount of successional rights are to be determined under Texas law, the Philippine law on legitimes cannot be applied to the testacy of Amos G. Bellis. The Renvoi doctrine is usually pertinent where the decedent is a national of one country, and a domicile of another. It does not apply to a case where the decedent was a citizen of Texas and was domiciled therein at the time of his death. In the present case, it is not disputed that the decedent was both a national of Texas and a domicile thereof at the time of his death. Succession Case#14 Aznar v. Garcia (Baybay, Benedict Dominic) Edward S. Christensen, though born in New York, migrated to California where he resided and consequently was considered a California Citizen for a period of nine years to 1913. He came to the Philippines where he became a domiciliary until the time of his death. However, during the entire period of his residence in this country, he had always considered himself as a citizen of California. In his will, executed on March 5,1951, he instituted an acknowledged natural daughter, Maria Lucy Christensen as his only heir but left a legacy of some money in favor of Helen Christensen Garcia who, in a decision rendered by the Supreme Court had been declared as an acknowledged natural daughter of his. Counsel of Helen claims that under Art. 16 (2) of the civil code, California law should be applied, the matter is returned back to the law of domicile, that Philippine law is ultimately applicable, that the share of Helen must be increased in view of successional rights of illegitimate children under Philippine laws. On the other hand, counsel for daughter Maria , in as much that it is clear under Art, 16 (2) of the New Civil Code, the national of the deceased must apply, our courts must apply internal law of California on the matter. Under California law, there are no compulsory heirs and consequently a testator should dispose any property possessed by him in absolute dominion. Issue: Whether Philippine Law or California Law should apply. Held: The Supreme Court deciding to grant more successional rights to Helen Christensen Garcia said in effect that there be two rules in California on the matter. 1. The conflict rule which should apply to Californians outside of California, and; 2. The internal Law which should apply to California domiciles in California. The California conflict rule, found on Art. 946 of the California Civil code States that if there is no law to the contrary in the place where personal property is situated, it is deemed to follow the decree of its owner and is governed by the law of the domicile. Christensen being domiciled outside California, the law of his domicile, the Philippines is ought to be followed. Wherefore, the decision appealed is reversed and case is remanded to the lower court with instructions that partition be made as that of the Philippine law provides. Succession Case#15 Miciano v. Brimo (Black, Dominique)

Topic: Testamentary Succession Wills in General (Article 792) (15) Miciano v. Brimo G.R. No. 22595, November 1, 1924 Facts: Joseph Brimo, a Turkish national, died testate. He placed as a condition in his will that it be disposed of in accordance with the laws in force in the Philippine Islands, it states: it is my wish that the distribution of my property and everything in connection with this, my will, be made and disposed of in accordance with the laws in force in the Philippine islands, requesting all of my relatives to respect this wish, otherwise, I annul and cancel beforehand whatever disposition found in this will favorable to the person or persons who fail to comply with this request. Article 10 of the Civil Code of the Philippines it provides that: o legal and testamentary succession as well as the amount of the successional rights and the intrinsic validity of their provisions, shall be regulated by the national law of the person whose succession is in question, whatever may be the nature of the property or the country in which it may be situated. Partition of the estate left by the deceased Joseph Brimo is in question in this case. The judicial administrator of the estate filed a scheme of partition. Andre Brimo, one of the brothers of the deceased, opposed it. o His opposition was based on the fact that the partition in question puts into effect the provisions of Joseph Brimos will which are not in accordance with the laws of his Turkish nationality, for which reason they are void as being in violation of Article 10 of the Civil Code. Issue: W/N the dispositions in the will remains valid despite the condition in the will which is in violation of Article 10 of the Civil Code. Held: YES! Although the condition is void being contrary to law, according to Article 792 of the Civil Code the said condition will just be considered not imposed and shall not prejudice the heir or legatee in any manner even if the testator otherwise provide. The said condition is contrary to law because it expressly ignores the testators national law when, according to Article 10 of the CC above quoted, such national law of the testator is the one to govern his testamentary dispositions. Said Condition then, in the light of the legal provisions above cited, is considered unwritten and the institution of legatees in said will is unconditional and consequently valid and effective even as to the herein oppositor. All of the remaining clauses of said will with all their dispositions and requests are perfectly valid and effective it not appearing that said clauses are contrary to the testators national laws. Succession Case#16 Llorente v. CA (Bustamante, Cindy) Facts: The deceased Lorenzo N. Llorente was a US Navy serviceman. In 1937, Lorenzo and petitioner Paula Llorente were married in Nabua, Camarines Sur. He departed for the US. 1943, Lorenzo became a US citizen. In 1945, he came home to visit his wife. He discovered that Paula was pregnant and was living in and having an adulterous relationship with his brother, Ceferino Llorente. Paula gave birth to a boy, registered as Crisologo Llorente, with the certificate stating that the child was not legitimate and the line for the fathers name was left blank. Lorenzo refused to forgive Paula and live with her. In 1946, they drew a written agreement to the effect that (1) all the family allowances allotted by the US Navy as part of Lorenzos salary and all other obligations for Paulas daily maintenance and support would be suspended; (2) they would dissolve their marital union in accordance with

judicial proceedings; (3) they would make a separate agreement regarding their conjugal property acquired during their marital life; and (4) Lorenzo would not prosecute Paula for her adulterous act since she voluntarily admitted her fault and agreed to separate from Lorenzo peacefully. It was by both of them and was witnessed by Paulas father and stepmother. The agreement was notarized. Lorenzo returned to the US and filed for divorce. Paula was represented by counsel, John Riley, and actively participated in the proceedings. The divorce decree was issued. Lorenzo returned to the Philippines. In 1958, he married Alicia F. Llorente in Manila. Alicia had no knowledge of the first marriage even if they resided in the same town as Paula, who did not oppose the marriage or cohabitation. From 1958 to 1985, Lorenzo and Alicia lived together as husband and wife.[i]Their 25-year union produced 3 children, Raul, Luz and Beverly, all surnamed Llorente. In 1981, Lorenzo executed a Last Will and Testament. The will was notarized, duly signed by Lorenzo with attesting witnesses Hugo, Neibres and Trajano. He left all his property to Alicia and their three children. In 1983, Lorenzo filed with the RTC a petition for the probate and allowance of his last will and testament wherein Lorenzo moved that Alicia be appointed Special Administratrix of his estate. DENIED since he was still alive. Later, finding that the will was duly executed, the trial court ADMITTED the will to probate. Before it could be terminated, he died. Paula filed with the same court a petition for letters of administration over Lorenzos estate in her favor. Paula contended (1) that she was Lorenzos surviving spouse, (2) that the various property were acquired during their marriage, (3) that Lorenzos will disposed of all his property in favor of Alicia and her children, encroaching on her legitime and 1/2 share in the conjugal property. Alicia filed in the testate proceeding (Sp. Proc. No. IR-755), a petition for the issuance of letters testamentary. TC: Divorce decree granted to Lorenzo is void and inapplicable in the Philippines. Marriage to Alicia is void. Alicias petition is denied. Alicia is not entitled to receive any share from the estate due to his relationship with Lorenzo having gained the status of a paramour. Paula is entitled to 1/3 of the estate and the other 1/3 would go to the 3 illegitimate children. MR Denied. CA affirmed the decision. Issue: Who are entitled to inherit from the late Lorenzo N. Llorente? Ruling: For failing to apply the doctrines in Van Dorn v. Romillo, Quita v. CA, and Pilapil v. Ibay-Somera, the decision of the CA must be reversed. We hold that the divorce obtained by Lorenzo H. Llorente from his first wife Paula was valid and recognized in this jurisdiction as a matter of comity. Now, the effects of this divorce (as to the succession to the estate of the decedent) are matters best left to the determination of the trial court. Validity of the Will The Civil Code provides: Art. 17. The forms and solemnities of contracts, wills, and other public instruments shall be governed by the laws of the country in which they are executed. When the acts referred to are executed before the diplomatic or consular officials of the Republic of the Philippines in a foreign country, the solemnities established by Philippine laws shall be observed in their execution. (underscoring ours) The clear intent of Lorenzo to bequeath his property to his second wife and children by her is glaringly shown in the will he executed. We do not wish to frustrate his wishes, since he was a foreigner, not covered by our laws on family rights and duties, status, condition and legal capacity. Whether the will is intrinsically valid and who shall inherit from Lorenzo are issues best proved by foreign law which must be pleaded and proved. Whether the will was executed in accordance with the formalities required is answered by referring to Philippine law. In fact, the will was duly probated. As a guide however, the trial court should note that whatever public policy or good customs may be involved in our system of legitimes, Congress did not intend to extend the same to the succession of foreign nationals. Congress specifically left the amount of successional rights to the decedent's national law. CA decision is set aside. SC REVERSES the decision of the RTC and RECOGNIZES as VALID the decree of divorce granted in favor of the deceased Lorenzo N. Llorente by the Superior Court of the State of California in and for the County of San Diego, made final on December 4, 1952. SC REMANDS the cases to the court of origin for determination of the intrinsic validity of Lorenzo N. Llorentes will and determination of the parties successional rights allowing proof of foreign law with instructions that the trial court shall proceed with all deliberate dispatch to settle the estate of the deceased within the framework of the Rules of Court.

________________________________________ Succession Case#17 Dy Yieng Sangio v. Judge Amor Reyes (Coherco, Calvin Ryan) Facts: On September 21, 1988, private respondents filed a petition for the settlement of the intestate estate of the late Segundo Seangio praying for the appointment of private respondent Elisa D. SeangioSantos as special administrator and guardian ad litem of petitioner Dy Yieng Seangio. Petitioners Dy Yieng opposed the petition. He contended that: 1) He is still very healthy and in full command of her faculties; 2) the deceased Segundo executed a general power of attorney in favor of Virginia giving her the power to manage and exercise control and supervision over his business in the Philippines; 3) Virginia is the most competent and qualified to serve as the administrator of the estate of Segundo because she is a certified public accountant; and, 4) Segundo left a holographic will, dated September 20, 1995, disinheriting one of the private respondents, Alfredo Seangio, for cause. Private respondents moved for the dismissal of the probate proceedings primarily on the ground that the document purporting to be the holographic will of Segundo does not contain any disposition of the estate of the deceased and thus does not meet the definition of a will under Article 783 of the Civil Code. According to private respondents, the will only shows an alleged act of disinheritance by the decedent of his eldest son, Alfredo, and nothing else; that all other compulsory heirs were not named nor instituted as heir, devisee or legatee, hence, there is preterition which would result to intestacy. RTC dismissed the petition for probate proceedings: Issue: Whether the document executed by Segundo can be considered as a holographic will. Held: Segundos document, although it may initially come across as a mere disinheritance instrument, conforms to the formalities of a holographic will prescribed by law. It is written, dated and signed by the hand of Segundo himself. An intent to dispose mortis causa can be clearly deduced from the terms of the instrument, and while it does not make an affirmative disposition of the latters property, the disinheritance of Alfredo, nonetheless, is an act of disposition in itself. In other words, the disinheritance results in the disposition of the property of the testator Segundo in favor of those who would succeed in the absence of Alfredo. Moreover, it is a fundamental principle that the intent or the will of the testator, expressed in the form and within the limits prescribed by law, must be recognized as the supreme law in succession. All rules of construction are designed to ascertain and give effect to that intention. It is only when the intention of the testator is contrary to law, morals, or public policy that it cannot be given effect. Holographic wills, therefore, being usually prepared by one who is not learned in the law, as illustrated in the present case, should be construed more liberally than the ones drawn by an expert, taking into account the circumstances surrounding the execution of the instrument and the intention of the testator. In this regard, the Court is convinced that the document, even if captioned as Kasulatan ng Pag-Aalis ng Mana, was intended by Segundo to be his last testamentary act and was executed by him in accordance with law in the form of a holographic will. Unless the will is probated, the disinheritance cannot be given effect. Issue: Whether or not there was preterition Held: With regard to the issue on preterition, the Court believes that the compulsory heirs in the direct line were not preterited in the will. It was, in the Courts opinion, Segundos last expression to bequeath his estate to all his compulsory heirs, with the sole exception of Alfredo. Also, Segundo did not institute an heir to the exclusion of his other compulsory heirs. The mere mention of the name of one of the petitioners, Virginia, in the document did not operate to institute her as the universal heir. Her name was included plainly as a witness to the altercation between Segundo and his son, Alfredo. Succession Case#18 Bugnao v. Ubag (Concepcion, Giovani) 18 Succession Catalina Bugnao v. Francisco Ubag G.R. No. 4445, September 18, 1909 Facts: Catalina Bugnao asks the Court to admit to probate purporting to be the last will and testament of her deceased husband Domingo Ubag. Under said document Catalina is the sole beneficiary. The probate was contested by Francisco Ubag et al who would be entitled to share in the distribution of his estate, if probate were denied, as it appears that the deceased left no heirs in the direct ascending or descending line.

They contend that the evidence of record is not sufficient to establish the execution of the alleged will in the manner and form prescribed in section 618 of the Code of Civil Procedure; and that at the time when it is alleged that the will was executed, Ubag was not of sound mind and memory, and was physically and mentally incapable of making a will. Allegedly, Catalina argues that said document was executed in accordance with the requirements of the law Two of the subscribing witnesses, Victor J. Bingtoy and Catalino Marino, testified in support of the will, the latter being the justice of the peace of the municipality wherein it was executed; and their testimony was corroborated in all important details by the testimony of the proponent herself, who was present when the will was made. Held: The evidence of record establishes in a strikingly conclusive manner the execution of the instrument propounded as the last will and testament of the deceased While a number of contradictions in the testimony of alleged subscribing witnesses to a will as to the circumstances under which it was executed, or a single contradiction as to a particular incident to which the attention of such witnesses must have been directed, may in certain cases justify the conclusion that the alleged witnesses were not present, together, at the time when the alleged will was executed, a mere lapse of memory on the part of one of these witnesses as to the precise details of an unimportant incident, to which his attention was not directed, does not necessarily put in doubt the truth and veracity of the testimony in support of the execution of the will. Proof of the existence of all the elements in the following definition of testamentary capacity, which has frequently been adopted in the United States, held sufficient to establish the existence of such capacity in the absence of proof of very exceptional circumstance: "Testamentary capacity is the capacity to comprehend the nature of the transaction in which the testator is engaged at the time, to recollect the property to be disposed of and the persons who would naturally be supposed to have claims upon the testator, and to comprehend the manner in which the instrument will distribute his property among the objects of his bounty." Succession Case#19 Bagtas v. Paguio (Dequina, Doanni Lou) o The testator died on the 28th of September, 1909, a year and five months following the date of the execution of the will. o The record shows that the testator, Pioquinto Paguio, for some fourteen of fifteen years prior to the time of his death suffered from a paralysis of the left side of his body; that a few years prior to his death his hearing became impaired and that he lost the power of speech. o Owing to the paralysis of certain muscles his head fell to one side, and saliva ran from his mouth. o He retained the use of his right hand, however, and was able to write fairly well. o Through the medium of signs he was able to indicate his wishes to his wife and to other members of his family. o How was the will executed according to the witnesses? Pioquinto Paguio, the testator, wrote out on pieces of paper notes and items relating to the disposition of his property, and these notes were in turn delivered to Seor Marco, who transcribed them and put them in form. The witnesses testify that the pieces of paper upon which the notes were written are delivered to attorney by the testator; that the attorney read them to the testator asking if they were his testamentary dispositions; that the testator assented each time with an affirmative movement of his head; that after the will as a whole had been thus written by the attorney, it was read in a loud voice in the presence of the testator and the witnesses; that Seor Marco gave the document to the testator; that the latter, after looking over it, signed it in the presence of the four subscribing witnesses; and that they in turn signed it in the presence of the testator and each other. Issue: Whether or not the will was executed in accordance with law, thus valid. Held: Will valid as it was made in accordance with law. One of the attesting witnesses testified that at the time of the execution of the will the testator was in his right mind, and that although he was seriously ill, he indicated by movements of his head what his wishes were. Another of the attesting witnesses stated that he was not able to say whether decedent had the full use of his mental faculties or not, because he had been ill for some years, and that he (the witnesses) was not a physician. The other subscribing witness, Pedro Paguio, testified in the lower court as a witness for the opponents. He was unable to state whether or not the will was the wish of the testator. The only reasons he gave for his statement were the infirmity and advanced age of the testator and the fact that he was unable to speak. The witness stated that the testator signed the will, and he verified his own signature as a subscribing witness.