Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Indian Income Tax Deductions

Caricato da

Preetesh AnandDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Indian Income Tax Deductions

Caricato da

Preetesh AnandCopyright:

Formati disponibili

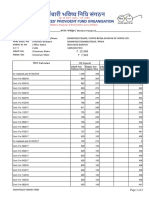

Indian Income Tax deductions, Tax exemption limits Financial year 2008/2009 (will be updated later for 2009/2010)

Income Tax Deductions Explaination Income Tax deduction - Section 80C Provident Funds, Life Insurance premia, ELSS, Bank deposits (>5 yr.), tution fees, principal part of EMI on housing loan, etc. Maximum deduction allowed Remarks

Maximum tax deduction or tax exemption limit:

Rs. 1,00,000

Income Tax deduction - Section 80D Premium in health insurance of you, your spouse, children or dependent parents

Maximum tax deduction or tax exemption limit:

Rs. 15000 (tax exemption limit

for senior citizen is

Rs. 20000) Income Tax deduction - Section 80DD Medical treatment (including insurance) of disabled dependent Income Tax deduction - Section 80E Interest paid on educational loan taken for higher education of you, your spouse or children.

Maximum tax deduction or tax exemption limit:

Rs. 50000. (Rs. 75000 if disability is severe, e.g. >80%)

Maximum tax deduction or tax exemption limit:

no limit !

Income Tax deduction - Section 80GG or tax exemption limit: House rent in excess of 10% of income, if no Rs. 2000 per month or 25% of your gross HRA is received. salary, whichever less.

Maximum tax deduction or tax exemption limit:

Maximum tax deduction

Income Tax deduction - Section 24 Interest paid on housing loan.

Rs. 1,50,000

Maximum tax deduction or tax exemption limit:

Income Tax deduction - Section 80G Donations

100% of donation amount for special funds(see below), 50% of donation amount for all other donations.

Section 10(1) 10(2) 10(2A) 10(3) 10(10D) 10(16) 10(17)

Nature of Income Agricultural income Share from income of HUF Share of profit from firm Casual and non-recurring receipts Receipts from life Insurance Policy Scholarships to meet cost of education Allowances of MP and MLA.

Exemption limit, if any

Winnings from races Rs.2500/- other receipts Rs.5000/For MLA not exceeding Rs. 600/per month

10(17A) Awards and rewards (i) from awards by Central/State Government (ii) from approved awards by others (iii) Approved rewards from Central & State Governments 10(26) Only on income Income of Members of scheduled tribes arising in those areas residing in certain areas in North or interest on Eastern States or in the Ladakh region. securities or dividends On income arising in Income of resident of Ladakh Ladakh or outside India (i) Subsidy from Tea Board under approved scheme of replantation (ii) Subsidy from concerned Board under approved Scheme of replantation Minors income clubbed with Upto Rs. 1,500/individual Dividend from Indian Companies, Income from units of Unit Trust of India and Mutual Funds, and income from Venture Capital Company/fund. Profit of newly established undertaking in free trade zones electronic hardware technology park on software technology park for 10 years (net beyond 10 year from 2000-01) Profit of 100% export oriented undertakings manufacturing articles or

10(26A) 10(30) 10(31) 10(32) 10(33)

10(A) 10(B)

Section

Nature of Income things or computer software for 10 years (not beyond 10 years from 200001) Profit of newly established undertaking in I.I.D.C or I.G.C. in North-Eastern Region for 10 years

Exemption limit, if any

10(C) Income From Interest 10(15)(i)(iib)(iic)

10(15)(iv)(h) 10(15)(iv)(i)

10(15)(vi) 10(15)(vii) Income from Salary 10(5)

Interest, premium on redemption or To the extent other payments from notified mentioned in securities, bonds, Capital investment notification bonds, Relief bonds etc. Income from interest payable by a Public Sector Company on notified bonds or debentures Interest payable by Government on deposits made by employees of Central or State Government or Public Sector Company of money due on retirement under a notified scheme Interest on notified Gold Deposit bonds Interest on notified bonds of local authorities Not to exceed the amount payable by Central Government to its employees

Leave Travel assistance/ concession

10(5B)

10(7) 10(8)

Remuneration of technicians having specialised knowledge and experience Exemption in respect in specified fields (not resident in any of income in the from of the four preceding financial years) of tax paid by whose services commence after 31.3.93employer for a period and tax on whose remuneration is paid upto 48 months by the employer Allowances and perquisites by the government to citizens of India for services abroad Remuneration from foreign governments for duties in India under Cooperative technical assistance programmes. Exemption is provided also in respect of any other income arising outside India provided tax on such income is payable to that

Section 10(10) (i) from Government (ii) Under payment of Gratuity Act 1972 (iii) Any other 10(10A) (i) from government, statutory Corporation etc. (ii) from other employers (iii) from fund set up by LIC u/s 10(23AAB) 10(10AA) (i) from Central or State government (ii) from other employers

Nature of Income Government. Death-cum-retirement GratuityAmount as per Sub-sections (2), (3) and (4) of the Act. Upto one-half months salary for each year of completed service. Commutation of PensionWhere gratuity is payable value of 1/3 pension. Where gratuity is not payable value of 1/2 pension Encashment of unutilised earned leave Upto an amount equal to 10 months salary or Rs. 1,35,360/- which ever is less

Exemption limit, if any

10(10B)

Retrenchment compensation

Amount u/s. 25F(b) of Industrial Dispute Act 1947 or the amount notified by the government, whichever is less.

10(10C)

10(11)

10(12) 10(13)

Amount received on voluntary retirement or termination of service or voluntary separation under the schemes Amount as per the prepared as per Rule 2BA from public Scheme subject to sector companies, statutory authorities, maximum of Rs. 5 local authorities, Indian Institute of lakh Technology, specified institutes of management or under any scheme of a company or Co-operative Society Payment under Provident Fund Act 1925 or other notified funds of Central Government To the extent Payment under recognised provident provided in rule 8 of funds Part A of Fourth Schedule Payment from approved

Section

Nature of Income Superannuation Fund House rent allowance

Exemption limit, if any

10(13A) least of(i) actual allowance (ii) actual rent in excess of 10% of salary (iii) 50% of salary in Mumbai, Chennai, Delhi and Calcutta and 40% in other places 10(14) Prescribed [See Rule 2BB (1)] special allowances or benefits specifically To the extent such granted to meet expenses wholly expenses are actually necessarily and exclusively incurred in incurred. the performance of duties Pension including family pension of 10(18) recipients of notified gallantry awards Exemptions to Non-citizens only (i) passage money from employer for 10(6)(i)(a) and (b) the employee and his family for home leave outside India (ii) Passage money for the employee and his family to Home country after retirement/termination of service in India. Remuneration of members of diplomatic missions in India and their staff, provided the members of staff are 10(6)(ii) not engaged in any business or profession or another employment in India. Remuneration of employee of foreign enterprise for services rendered during his stay in India in specified 10(6)(vi) circumstances provided the stay does not exceed 90 days in that previous year. Remuneration of foreign Government 10(6)(xi) employee on training in certain establishments in India. Exemptions to Non-resident Indians (NRIs) only 11.2 The units purchased by them are out of

Section

Nature of Income the amount remitted from abroad or from their Non-resident (External) Account

Exemption limit, if any

Exemptions to funds, institutions, etc. Section Nature of Income Public Financial Institution from exchange risk premium received from person borrowing in foreign currency if the amount of such premium is credited to a fund specified in section 10(23E) Central Bank of Ceylon from interest on securities Securities held by Welfare Commissioners Bhopal Gas Victims, Bhopal from Interest on securities held in Reserve Banks SGL Account No. SL/DH-048 (a) Business income derived from Supply of water or electricity any where. Supply of other commodities or service within its own jurisdictional area. Exemption limit, if any

10(14A)

10(15)(iii)

10(15)(v)

10(20)

any local Authority

(b) Income from house property, other sources and capital gains. 10(20A) 10(21) 10(23) Housing or other Development authorities Approved Scientific Research Association Notified Sports Association/ Institution for control of cricket, hockey, football, tennis or other notified games. Notified professional All income except association/institution from house property, interest or dividends on investments and rendering of any specific services

10(23A)

Section 10(23AA) 10(23AAA) 10(23AAB) 10(23B) 10(23BB) 10(23BBA)

Nature of Income Regimental fund or Non-public fund Fund for welfare of employees or their dependents. Fund set up by LIC of India under a pension scheme Public charitable trusts or registered societies approved by Khadi or Village Industries commission Any authority for development of khadi or village industries Societies for administration of public, religious or charitable trusts or endowments or of registered religious or charitable Societies. European Economic Community from Income from interest, dividend or capital gains SAARC Fund Certain funds for relief, charitable and promotional purposes, certain educational or medical institutions Notified Mutual Funds Notified Exchange Risk Administration Funds Notified Investors Protection Funds set up by recognised Stock Exchanges

Exemption limit, if any

10(23BBB) 10(23BBC) 10(23C) 10(23D) 10(23E) 10(23EA) 10(23FB)

10(23G)

10(24) 10(25)(i)

Income from Venture capital Fund/ company set up investment in to raise funds for investment in venture capital venture Capital undertaking undertaking Income from dividend, interest and long term capital Infrastructure capital fund, or gains from infrastructure capital company investment in approved infrastructure enterprise Income from house Registered Trade Unions property and other sources Provident Funds Interest on securities and capital gains from transfer of such

Section 10(25)(ii) 10(25)(iii) 10(25)(iv) 10(25)(v) 10(25A) 10(26B)(26BB) and (27)

Nature of Income Recognised Provident Funds Approved Superannuation Funds Approved Gratuity Funds Deposit linked insurance funds Employees State Insurance Fund Corporation or any other body set up or financed by and government for welfare of scheduled caste/ scheduled tribes/backward classes or minorities communities Marketing authorities Certain Boards such as coffee Board and others and specified Authorities

Exemption limit, if any securities

10(29) 10(29A)

Income from letting of godown and warehouses

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Notice of Assessment 2021 04 30 07 31 55 748105Documento4 pagineNotice of Assessment 2021 04 30 07 31 55 748105jack robinsonNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Money Management Cycle: Grade 12Documento9 pagineMoney Management Cycle: Grade 12Leonila Oca100% (2)

- The Greenbury Report (1995)Documento8 pagineThe Greenbury Report (1995)dharmsonu100% (2)

- 2018 Payroll Guide: WWW - Payworks.caDocumento15 pagine2018 Payroll Guide: WWW - Payworks.caPrameela KondaveetiNessuna valutazione finora

- New PF Withdrwal Form 19 & 10c PDFDocumento1 paginaNew PF Withdrwal Form 19 & 10c PDFsrikarbNessuna valutazione finora

- Anna Jong Yu Hiong V Government of SarawakDocumento6 pagineAnna Jong Yu Hiong V Government of SarawakRijah WeiweiNessuna valutazione finora

- Complete Guide To PhilhealthDocumento8 pagineComplete Guide To PhilhealthJoenas TunguiaNessuna valutazione finora

- Financial Aid Application FormDocumento7 pagineFinancial Aid Application FormAqib AnjumNessuna valutazione finora

- Bridgeport City Supervisors Association ContractDocumento50 pagineBridgeport City Supervisors Association ContractBridgeportCTNessuna valutazione finora

- Financial Preparation and Needs of Older PeopleDocumento2 pagineFinancial Preparation and Needs of Older Peoplejasmine alayonNessuna valutazione finora

- Kyc Renewal Form PDFDocumento2 pagineKyc Renewal Form PDFAnonymous nmQBgwNessuna valutazione finora

- Payment of Comp Types of CompensationDocumento6 paginePayment of Comp Types of CompensationJansen GunardiNessuna valutazione finora

- Kisan Samman Nidhi Application FormDocumento1 paginaKisan Samman Nidhi Application Formradhakrishna mamidi100% (2)

- Pay For Performance and Employee BenefitsDocumento23 paginePay For Performance and Employee BenefitsTiya DjNessuna valutazione finora

- PSC Regulations 2020Documento40 paginePSC Regulations 2020Vic Vuhasio KimengineerNessuna valutazione finora

- Financial Life Cycle 1Documento13 pagineFinancial Life Cycle 1api-381832809Nessuna valutazione finora

- HTTPSWWW - Irs.govpubirs Pdff1040es PDFDocumento12 pagineHTTPSWWW - Irs.govpubirs Pdff1040es PDFmark beattyNessuna valutazione finora

- Lec 78 CH 7 S14Documento9 pagineLec 78 CH 7 S14Li YuNessuna valutazione finora

- PF Transfer in Form - Form No. 13 SAMPLEDocumento2 paginePF Transfer in Form - Form No. 13 SAMPLEUdit Satija20% (5)

- Revision of Pensionary BenefitsDocumento3 pagineRevision of Pensionary BenefitsdrtpkNessuna valutazione finora

- PDF&Rendition Converted SignedDocumento71 paginePDF&Rendition Converted Signedmanwanimuki12Nessuna valutazione finora

- DSNHP00237190000175866Documento2 pagineDSNHP00237190000175866Pankaj GuleriaNessuna valutazione finora

- SA106 NotesDocumento20 pagineSA106 Notesjacopo1967Nessuna valutazione finora

- Instructions For All Sample Letters: © Transatlantic Transfers Inc. 2007Documento6 pagineInstructions For All Sample Letters: © Transatlantic Transfers Inc. 2007Naveen MadirajuNessuna valutazione finora

- Vijaya Bank Pension Regulation 1995Documento78 pagineVijaya Bank Pension Regulation 1995Latest Laws Team0% (1)

- State Magazine, April 2005Documento40 pagineState Magazine, April 2005State MagazineNessuna valutazione finora

- A Study On Marine Insurance With Reference To New India Assurance Company LTDDocumento58 pagineA Study On Marine Insurance With Reference To New India Assurance Company LTDnandiniNessuna valutazione finora

- Level 7 UK Taxation For Business and Individuals (v4)Documento55 pagineLevel 7 UK Taxation For Business and Individuals (v4)vedi1969Nessuna valutazione finora

- LIC of India (Employees) Pension Rules, 1995Documento37 pagineLIC of India (Employees) Pension Rules, 1995sheetalNessuna valutazione finora

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Documento6 pagineItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Gajanan DestotNessuna valutazione finora