Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accounting Standards in India

Caricato da

deeptihimcsDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Accounting Standards in India

Caricato da

deeptihimcsCopyright:

Formati disponibili

Accounting Standards are used as one of the main compulsory regulatory mechanisms for preparation of general-purpose financial reports

and subsequent audit of the same, in almost all countries of the world. Accounting standards are concerned with the system of measurement and disclosure rules for preparation and presentation of financials statements. Accounting Standards are the policy documents (authoritative statements of best accounting practice) issued by recognized expert accountancy bodies relating to various aspects of measurement, treatment and disclosure of accounting transactions and events! Sub Section (3A) to section 211 of Companies Act, 1956 requires that every Profit/Loss Account and Balance Sheet shall comply with the Accounting Standards. The standard of accounting recommended by the ICAI and prescribed by the Central Government in consultation with the National Advisory Committee on Accounting Standards constituted under section 210(1) of companies Act, 1956. According to Government of India, there are 31 accounting standards, but 32 are also included in 31st accounting standard (Financial Instrument: Presentation). So we can say that there are 32 accounting standards. Accounting Standard 1 Disclosure of Accounting Policies Accounting Standard 2 Valuation of Inventories Accounting Standard 3 Cash Flow Statements Accounting Standard 4 Contingencies and Events Occurring after the Balance Sheet Date Accounting Standard 5 Net Profit or Loss for the Period, Prior Period Items and Changes in AS Accounting Standard 6 Depreciation Accounting Accounting Standard 7 Construction Contracts Accounting Standard 8 Accounting for Research and Development Accounting Standard 9 Revenue Recognition Accounting Standard 10 Accounting for Fixed Assets Accounting Standard 11 the Effects of Changes in Foreign Exchange Rates Accounting Standard 12 Accounting for Government Grants Accounting Standard 13 Accounting for Investments

Accounting Standard 14 Accounting for Amalgamations Accounting Standard 15 Employee Benefits Accounting Standard 16 Borrowing Costs Accounting Standard 17 Segment Reporting Accounting Standard 18 Related Party Disclosures Accounting Standard 19 Leases Accounting Standard 20 Earnings per Share 4 Accounting Standard 21 Consolidated Financial Statements Accounting Standard 22 Accounting for Taxes on Income Accounting Standard 23 Accounting for Investments in Associates in Consolidated Financial Statements Accounting Standard 24 Discontinuing Operations Accounting Standard 25 Interim Financial Reporting Accounting Standard 26 Intangible Assets Accounting Standard 27 Financial Reporting of Interests in Joint Ventures Accounting Standard 28 Impairment of Assets Accounting Standard 29 Provisions, Contingent Liabilities and Contingent Assets Accounting Standard 30 Financial Instruments: Recognition and Measurement Accounting Standard 31 Financial Instruments: Presentation Accounting Standard 32 Financial Instruments: Disclosures and limited revision to AS 19

Introduction Financial statements are prepared to summarize the end-result of all the business activities by an enterprise during an accounting period in monetary terms. These business activities vary from one enterprise to other. To compare the financial statements of various reporting enterprises poses some difficulties because of the divergence in the methods and principles adopted by these enterprises in preparing their financial statements. In order to make these methods and principles uniform and comparable to the extent possible standards are evolved. What are Accounting Standards? Accounting Standards are the statements of code of practice of the regulatory accounting bodies that are to be observed in the preparation and presentation of financial statements. In layman terms, accounting standards are the written documents issued by the expert institutes or other regulatory bodies covering various aspects of measurement, treatment, presentation and disclosure of accounting transactions.

What are the objectives of Accounting Standards? The basic objective of Accounting Standards is to remove variations in the treatment of several accounting aspects and to bring about standardization in presentation. They intent to harmonize the diverse accounting policies followed in the preparation and presentation of financial statements by different reporting enterprises so as to facilitate intra-firm and inter-firm comparison. Who issues Accounting Standards in India? The Institute of Chartered Accountants of India (ICAI) recognizing the need to harmonize the diverse accounting policies and practices at present in use in India constituted Accounting Standards Board (ASB) on April 21, 1977. The main role of ASB is to formulate Accounting Standards from time to time. What is the duty of Statutory Auditor for Compliance with Accounting Standards? Section 211(3A) of Companies Act, 1956 provides that every profit and loss account and balance sheet of the company shall comply with the accounting standards. The statutory auditors are required to make qualification in their report in case any item is treated differently from the prescribed Accounting Standard. However, while qualifying, they should consider the materiality of the relevant item. In addition to this Section 227(3)(d) of Companies Act, 1956 requires an auditor to report whether, in his opinion, the profit and loss account and balance sheet are complied with the accounting standards referred to in Section 211(3C) of Companies Act, 1956.

How many Accounting Standards have been prescribed? Are these applicable to all companies irrespective of its size? In all 29 Accounting Standards have been prescribed. However their applicability is dependent on its size Level I / II / III company. The following table lists out the Accounting Standards and its applicability.

Level I Company: Enterprises, which fall in any one or more of the following categories, at any time during the accounting period, are classified as Level I enterprises: i) Enterprises whose equity or debt securities are listed whether in India or outside India. ii) Enterprises, which are in the process of listing their equity or debt securities as evidenced by the board of directors resolution in this regard. iii) Banks including co-operative banks. iv) Financial Institutions v) Enterprises carrying on insurance business. vi) All commercial, industrial and business reporting enterprises, whose turnover for the immediately preceding accounting period on the basis of audited financial statements exceeds Rs. 500 million. Turnover does not include other income. vii) All commercial, industrial and business reporting enterprises having borrowings, including public deposits, in excess of Rs. 100 million at any time during the accounting period. viii) Holding and subsidiary enterprises of any one of the above at any time during the accounting period. Level II Company: Enterprises, which are, not Level I enterprises but fall in any one or more of the following categories are classified as Level II enterprises; i) All commercial, industrial and business reporting enterprises, whose turnover for the immediately preceding accounting period on the basis of audited financial statements exceeds Rs. 4 million, but does not exceed Rs. 500 million. Turnover does not include other income.

ii) All commercial, industrial and business reporting enterprises having borrowing, including public deposits, in excess of Rs. 10 million but not in excess of Rs. 100 million at any time during the accounting period. iii) Holding and subsidiary enterprises of any one of the above at any time during the accounting period. Level III Company: Enterprises, which are not covered under Level I and Level II are considered as Level III enterprises. Applicability Level II and Level III enterprises are considered as SMEs Level I enterprises are required to comply fully with all the accounting standards.

No relaxation is given to Level II and Level III enterprises in respect of recognition and measurement principles. Relaxations are provided with regard to disclosure requirements. Accordingly, Level II and Level III enterprises are fully exempted from certain accounting standards, which mainly lay down disclosure requirements. In respect of certain other accounting standards, which lay down recognition, measurement and disclosure requirements, relaxations from certain disclosure requirements are given.

Sr. No. 1 2 3 Particulars Disclosure of Accounting Policies Valuation of Inventories Cash Flow Statements Contingencies and Events Occurring After the Balance Sheet Date Net Profit or Loss for the period, Prior period Items and Changes in Accounting Policies. Depreciation Accounting Construction Contracts Applicability I, II, III I, II, III I

I, II, III

I, II, III

6 7

I, II, III I, II, III

Accounting for Research and Development (This standard has been withdrawn w.e.f. 01.04.2004 for all levels of enterprises and AS 26 is applicable) Revenue recognition Accounting for Fixed Assets The Effect of Changes in Foreign Exchange Rates Accounting for Government Grants Accounting for Investments Accounting for Amalgamations Accounting for Retirement Benefits in the Financial Statements of Employers Borrowing Costs Segment Reporting

As withdrawn

9 10

I, II, III I, II, III

11

I, II, III

12 13 14

I, II, III I, II, III I, II, III

15

I, II, III

16 17

I, II, III I II-with modification III- with modification I II-with modification III- with modification I II-with modification III- with modification I II-with modification III- with modification I I,II,III

18

Related Party Disclosures

19

Leases

20

Earning Per Share

21 22

Consolidated Financial Statements Accounting for Taxes on Income Accounting for Investments in Associates in Consolidated Financial Statements Discontinuing Operations

23

24

25 26

Interim Financial Reporting Intangible Assets

I I,II,III I-with clarification II-with clarification III-with clarification I II-with modification III-with modification

27

Financial Reporting of Interests in Joint Ventures

28

Impairment of Assets

29

Provisions, Contingent Liabilities and Contingent Asset

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Use The Following Information To Answer The Question(s) BelowDocumento36 pagineUse The Following Information To Answer The Question(s) BelowOla PietruszewskaNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Dutch Lady Milk Industries Berhad-2Documento16 pagineDutch Lady Milk Industries Berhad-2Navinya Gopala Krishnan100% (2)

- Tire City Case SolutionDocumento6 pagineTire City Case SolutionShivam Bhasin60% (10)

- Week 03 - Accounts ReceivablesDocumento4 pagineWeek 03 - Accounts ReceivablesPj ManezNessuna valutazione finora

- Management AccountingDocumento12 pagineManagement AccountingS BNessuna valutazione finora

- Institute of Administration & Commerce (Zimbabwe) : Financial Accounting 2 Syllabus (W.E.F May 2009)Documento4 pagineInstitute of Administration & Commerce (Zimbabwe) : Financial Accounting 2 Syllabus (W.E.F May 2009)Ronnie Vond McRyttsson MudyiwaNessuna valutazione finora

- 16 April 16 Internal Financial Control Reporting - Practical Approach CA Murtuza KanchwalaDocumento100 pagine16 April 16 Internal Financial Control Reporting - Practical Approach CA Murtuza Kanchwalapreeti singhNessuna valutazione finora

- Mutual Fund Industry Decade of Growth 2010 2020 ReportDocumento36 pagineMutual Fund Industry Decade of Growth 2010 2020 ReportHarshit SinghNessuna valutazione finora

- What Is Clause 49Documento3 pagineWhat Is Clause 49Kaushik ShahNessuna valutazione finora

- Accounting For Government and Non-Profit OrganizationsDocumento13 pagineAccounting For Government and Non-Profit OrganizationsPatricia ReyesNessuna valutazione finora

- Chapter 3. The Accounting EquationDocumento2 pagineChapter 3. The Accounting EquationKarysse Arielle Noel JalaoNessuna valutazione finora

- Far660 - Dec 2019 QuestionDocumento5 pagineFar660 - Dec 2019 QuestionHanis ZahiraNessuna valutazione finora

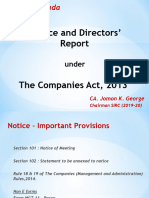

- Notice & DRDocumento25 pagineNotice & DRvermasanjay69Nessuna valutazione finora

- Financial+Statements Ceres+Gardening+CompanyDocumento7 pagineFinancial+Statements Ceres+Gardening+CompanyBudhaditya basuNessuna valutazione finora

- IAS Plus: IFRS 8 Operating SegmentsDocumento4 pagineIAS Plus: IFRS 8 Operating SegmentsScarlet FoxNessuna valutazione finora

- SIRC Official Directory 2019 20Documento224 pagineSIRC Official Directory 2019 20CIVILNessuna valutazione finora

- Bus 5111 Discussion Assignment Unit 7 5Documento6 pagineBus 5111 Discussion Assignment Unit 7 5ifeanyi ukachukwuNessuna valutazione finora

- Errors and Corrections ProblemsDocumento13 pagineErrors and Corrections ProblemsJoyluxxiNessuna valutazione finora

- Note That The TaxpayerDocumento2 pagineNote That The Taxpayerleshz zynNessuna valutazione finora

- Balance Sheet-Part1-Classification of AssetsDocumento40 pagineBalance Sheet-Part1-Classification of AssetsAnonymous 9NspcEaNessuna valutazione finora

- Hyundai Motor Company 1q 2022 Consolidated FinalDocumento61 pagineHyundai Motor Company 1q 2022 Consolidated FinalNitesh SinghNessuna valutazione finora

- Bobs - Baubles ProblemDocumento1 paginaBobs - Baubles Problemlisa lheneNessuna valutazione finora

- Functions OF DepositoryDocumento32 pagineFunctions OF DepositoryShakti ShivanandNessuna valutazione finora

- Financial Reporting ICAI Study MaterialDocumento1.821 pagineFinancial Reporting ICAI Study MaterialKrishna Kowshik100% (1)

- Module 11. A. Financial Planning and StrategiesDocumento10 pagineModule 11. A. Financial Planning and StrategiesNorfaidah IbrahimNessuna valutazione finora

- 240 001 075 01 Ca Od/fac Non Profit Residen 311,609.82 6008990190 600899 240 001 075 02 Ca Od/fac Non Profit Residen 90.00-6008990290Documento57 pagine240 001 075 01 Ca Od/fac Non Profit Residen 311,609.82 6008990190 600899 240 001 075 02 Ca Od/fac Non Profit Residen 90.00-6008990290Natasha RoosNessuna valutazione finora

- Utopia Corporation Law Reviewer 2008Documento171 pagineUtopia Corporation Law Reviewer 2008Tristan Lindsey Kaamiño AresNessuna valutazione finora

- Annual: Service With PassionDocumento289 pagineAnnual: Service With Passioni-ka-hayashiNessuna valutazione finora

- Garlington Technologies IncDocumento2 pagineGarlington Technologies IncRamarayo MotorNessuna valutazione finora

- PFRS 9 - Financial InstrumentDocumento3 paginePFRS 9 - Financial InstrumentErika Panit ReyesNessuna valutazione finora