Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Analysis Packaging in Thailand

Caricato da

Vijitpong SayanhavadhanaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Analysis Packaging in Thailand

Caricato da

Vijitpong SayanhavadhanaCopyright:

Formati disponibili

Packaging - Thailand

Euromonitor International : Industry Overview April 2011

Packaging

Thailand

List of Contents and Tables

Executive Summary ................................................................................................................................................ 1 Global Economic Crisis and Thai Political Instability Slows Down Packaging Growth .......................................... 1 Packaging for Single-serve Product Sizes Increases ................................................................................................ 1 New Types of Packaging Amidst Growing Trend for Health Wellness Products ...................................................... 1 Flexible Packaging Continues To Be A Very Important Packaging Type ................................................................. 1 Bio-plastic Brings Innovation To Both Mass Market and Niche Products................................................................ 1 Key Trends and Developments .............................................................................................................................. 2 Increasing Demand for Eco-friendly Packaging ....................................................................................................... 2 Increasing On-the-go Lifestyles Drive Portable Packaging...................................................................................... 3 Packaging Innovation Focuses More on Bio-plastic Packaging Materials .............................................................. 5 Refill Packs See Growth Due To Increasing Price-sensitive Consumers .................................................................. 6 Growing Trend for Health and Wellness Products Increases Demand for Packaging ............................................. 7 Market Background ................................................................................................................................................ 9 Packaging Legislation............................................................................................................................................... 9 Draft of Act on Economic Tools for Environment Tax Management ........................................................................ 9 Recycling and the Environment ...............................................................................................................................10 Table 1 Overview of Packaging Recycling and Recovery in the Thailand 2008/2009 and Targets for 2010 .........................................................................................................10 Category Data ........................................................................................................................................................10 Table 2 FMCG Packaging by Pack Type: Retail Unit Volume 2004-2009 ...................................10 Table 3 FMCG Packaging by Pack Type: % Retail Unit Volume Growth 2004-2009 ..................11 Table 4 Total Packaging by Industry: Retail Unit Volume 2004-2009..........................................11 Table 5 Total Packaging by Industry: % Retail Unit Volume Growth 2004-2009 ........................11 Table 6 FMCG Closures by Type: Retail Unit Volume 2005-2009 ..............................................12 Table 7 FMCG Closures by Type: % Retail Unit Volume Growth 2005-2009 .............................12 Table 8 Total Closures by Industry: Retail Unit Volume 2005-2009 ............................................13 Table 9 Total Closures by Industry: % Retail Unit Volume Growth 2005-2009 ...........................13 Table 10 Forecast FMCG Packaging by Pack Type: Retail Unit Volume 2009-2014 .....................13 Table 11 Forecast FMCG Packaging by Pack Type: % Retail Unit Volume Growth 2009-2014.........................................................................................................................13 Table 12 Forecast Total Packaging by Industry: Retail Unit Volume 2009-2014 ...........................14 Table 13 Forecast Total Packaging by Industry: % Retail Unit Volume Growth 20042009 ..................................................................................................................................14 Table 14 Forecast FMCG Closures by Type: Retail Unit Volume 2009-2014 ................................14 Table 15 Forecast FMCG Closures by Type: % Retail Unit Volume Growth 20092014 ..................................................................................................................................15 Table 16 Forecast Total Closures by Industry: Retail Unit Volume 2009-2014 ..............................15 Table 17 Forecast Total Closures by Industry: % Retail Unit Volume Growth 20042009 ..................................................................................................................................16

Euromonitor International

Page

Packaging

Thailand

PACKAGING INDUSTRY IN THAILAND

EXECUTIVE SUMMARY

Global Economic Crisis and Thai Political Instability Slows Down Packaging Growth

Packaging in Thailand registered moderate growth in 2009/2010. This was due to several negative factors such as uncertainty over the pace of the ongoing economic recovery coupled with political instability in Thailand. Thai consumers spent cautiously and this negatively affected consumer goods consumption. Consequently, packaging demand was also compromised. Another negative factor in 2008 was the melamine contamination scandal and the consumer fear of consuming melamine contaminated milk, dairy products and confectionery. This risk continued to cause a high degree of concern among Thai consumers and led to somewhat slower consumption and consequently lower demand for packaging.

Packaging for Single-serve Product Sizes Increases

Due to the higher prevalence of busier urban lifestyles and eating and drinking on-the-go, more single-serve packs were launched in Thailand during 2010 and packaging producers continued to adapt to this changing demand. Lighter, smaller sized packs and improved closures were some of the areas in which packaging development was seen in response to this evolving consumer trend. Another trend which led to rises in singleserve packs was the trend towards eating healthy and fresh food in single-serve packs which do not need to be resealed and kept for future consumption. This trend was not restricted to human food, extending also to pet food as the use of single-serve packaging increased in wet dog and cat food. Another factor was the lower retail price of single-serve packs, which helped sustained demand during 2010. Small packs carry a lower retail price and are therefore more affordable. For example, single-use sachets remained popular in shampoos and conditioners.

New Types of Packaging Amidst Growing Trend for Health Wellness Products

Rising incomes and increased education and awareness is leading to a growing trend for the consumption of health wellness products in categories such as food, beverages and beauty and personal care products. In light of this, special packaging types for such products are also emerging, including the high quality plastic bottles and jars used for premium health and wellness oriented food. Furthermore, many premium beverages, especially juice drinks, are being packaged in glass due to its superior chemical compatibility with the product. The increasing consumption of yoghurt, which is considered to be very healthy, has positively impacted demand for thin wall plastic containers in spoonable yoghurt and rigid plastic, mainly HPDE bottles, in drinking yoghurt. Many such premium healthy products require packaging with high quality graphics, designs and labelling. Often, healthy eating entails the consumption of smaller portions, particularly in indulgence categories such as confectionery and sweet and savoury snacks, and this trend is also helping drive demand for smaller packaging sizes.

Flexible Packaging Continues To Be A Very Important Packaging Type

Many Thai brand owners continued to select flexible packaging as their main type of packaging for both food and non-food products during 2010. This is due to its lighter weight and inherent economic benefits over other packaging types. Flexible packaging can be used for many applications including flexible plastic and stand-up pouches. Furthermore, new areas of innovation in flexible plastic such as microwaveable packaging, boil-in-bag and push-through blister packs are all helping many manufacturers to bring innovation to their products.

Bio-plastic Brings Innovation To Both Mass Market and Niche Products

Due to the rising concern for the use of eco friendly packaging, bio-plastic is currently being evaluated in Thailand as a viable alternative to more conventional plastic as well as other packaging types. The interest in bio-plastic stems from its inherent advantages. For example, it is derived from renewable natural resources and is therefore less harmful in terms of its environmental emissions upon biodegrading. However, the use of bio-

Euromonitor International

Page

Packaging

Thailand

plastic packaging is still at an early stage in Thailand. There are many agricultural products which can be used as the raw materials for bio-plastic production. However, as the cost of its production is still several times higher than for conventional packaging and there are fewer packaging manufacturers currently interested in offering their products with bio-plastic packaging, bio-plastic may take some time to take off fully in Thailand.

KEY TRENDS AND DEVELOPMENTS

Increasing Demand for Eco-friendly Packaging

Thai consumers are becoming increasingly conscious about global warming and the effect that waste has on the environment. Concerns are growing about the environment impacts of packaging. Thai consumers are ever more alert to what they see as unnecessary waste. Currently, the Thai government and private companies are making greater efforts to promote the recycling of packaging materials while consumers are more aware about the three Rs: recycle, reuse and reduce. Thus, packaging types which can be recycled such as glass, liquid cartons and paper-based containers tended to receive a much warmer welcome from consumers throughout 2010. In addition, manufacturers are attempting to reduce the amount of packaging used for the products they sell as well as packaging materials used for storage and transportation. Significantly, consumers are also beginning to choose brands with less packaging. Current Impact The Thailand Institute for Packaging Management for Sustainable Environment (TIPMSE) promotes postconsumer waste collection, recycling and integrated waste management and has established as its goal a 12% reduction in packaging waste in Thailand by the end of 2010 Procter & Gamble and Unilever and packaging giant SIG are all collaborating with TIPMSE. During the review period, Unilevers Sunsilk shampoo brand launched its Hair for Hope campaign. Consumers who collect three used Sunsilk shampoo bottles are eligible for one free Sunsilk shampoo. This campaign collects used Sunsilk shampoo bottles from consumers with the aim of recycling the bottles. The proceeds from the sale of the bottles are donated to the Association for the Promotion of the Status of Women. In addition, Unilever has reduced the amount of packaging used for its products through the application of design technology. The new bottle for the Dove brand has been designed to fit into the hand and uses less plastic than previous designs. The Coca-Cola Company introduced its Ultra Glass contour bottle to improve impact resistance and reduce weight and hence transport costs. Crown Holdings Inc is committed to achieving continuous improvements in product design and manufacturing practices in order to provide the best outcomes for the natural environment both now and into the future. SIG Combiblocs liquid cartons consist mainly of fibre pulp obtained from renewable wood resources and represent the efficient use of resources across the packagings entire lifecycle. Liquid cartons are exceptionally light, can be transported and stored in a space-saving way and are fully recyclable. Olays top-selling line of anti-aging moisturisers, Total Effects, is introducing an improved pump closure design which is expected to save around 362,900 kg of plastic per year. Leading beverage producers such as Coca-Cola, Nestl, Singha, Thai Bev, Pepsi, Osotspa, Greensport, Tipco and TAPB and leading packaging manufacturers such as Tetra Pak, Bangkok Can Manufacturing, Crown, TBC and Bangkok Glass Industry are all working in collaboration with TIPMSE. During the review period, Tetra Pak co-sponsored a nationwide liquid cartons collection and recycling campaign through a popular television programme. Over 21 million cartons were recycled, being used in the production of notebooks which were then donated to schools, along with supporting educational material relating to recycling. Bangkok Can Manufacturing is collaborating with the Prostheses Foundation and Pollution Control Department in the Royal Patronage for Prostheses Project. The project features a campaign encouraging the public to donate aluminium beverage cans to the Foundation. Aside from informing the public about recycling, this project has also created public awareness of the process of sorting waste materials. Bangkok Glass Co Ltd continues to invest heavily in promoting recycling campaigns. The company set up its Glass Bottle Bank to buy back glass packaging from consumers and promotes its activities heavily via television advertising and other mass media campaigns, promoting the idea that glass packaging can be sold back to the

Euromonitor International

Page

Packaging

Thailand

packager. Glass packaging, unlike other packaging types, can be completely recycled. These campaigns have attracted the attention of consumers to the companys recycling activities. The recycling concept is moving away from basic levels such as the three Rs towards more complex ideas of sustainable packaging across the entire life cycle of the packaging. Furthermore, in many earlier cases, the trend towards reducing packaging material was driven by the need to cut packaging costs, but is now moving away from mere cost control towards a focus on green consumption. Outlook As a greater global awareness falls on environmental issues and the ongoing increase in waste, the three Rs concept is being heavily promoted across Asia, and is well underway in Thailand. As consumers become more concerned about the environment, product manufacturers and brand owners will need to take more responsibility for collecting and recycling their products and packaging. Therefore, the recycling trend is expected to be sustained over the forecast period. In addition, eco-friendly packaging design will be an important area which will see further developments. Reductions in weight and size and the use of less composite materials are focus areas which will receive greater attention from the leading companies. Procter & Gamble aims to continue to attract the positive attention of consumers with meaningful sustainable innovations which reduce the environment impact of its products across the full product lifecycle. In addition, many companies will try harder to eliminate all remaining uses of PVC in consumer goods packaging during the forecast period. Future Impact There are also rising concerns about global warming in Thailand. Consumers, product manufacturers and packagers continue taking on more responsibility in order to minimise the impact of global warming. Other social efforts and government initiatives to support sustainable packaging will increase. For example, schools are already teaching children to recycle from a very young age. Many manufacturers continue to invest in recycling campaigns as part of their corporate social responsibility programmes as large manufacturers are perceived as sources of huge waste and pollution in society. The investment of packagers in new eco-friendly technology to allow the maximum recycling of packaging will increase during the forecast period. This trend will continue to benefit packaging that can be easily recycled such as glass, liquid cartons and paper-based containers. Newer approaches including reductions in unnecessary secondary packaging and the use of by thinner paper will also gain further ground over the forecast period. The focus on carbon footprints and the introduction of sustainable packaging across the packaging lifecycle will be more widely accepted in Thailand during the forecast period and this will raise awareness of the concept of eco-friendly packaging up from the base level of the three Rs.

Increasing On-the-go Lifestyles Drive Portable Packaging

Growing urbanisation means that Thai consumers are leading increasingly hectic lifestyles, which involve more activities being undertaken away from the home. This has resulted in time becoming precious as consumers are required to perform multiple tasks at the same time. Thus, Thai consumers are now looking for more portable packaging. The concept of portable packaging is comprised of a product which is convenient to use and has an easy opening closure. More often than not, these products come in single-serve sizes, are lightweight and generally small. Packaging and closures have had to respond to this demand by developing products which are user friendly. Current Impact During the review period, an increasing number of on-the-go products maintained strong growth. Thai consumers seem to be more than willing to pay for convenience, and this includes on-the-go convenience. The higher cost-per-serving of on-the-go packaged products does not seem to have inhibited sales growth, provided that the product and packaging meet genuine consumer needs. Consumers tend to make use of on-the-go products outside of the home. Convenient packaging therefore represents a cost saving as well as a time saving. Similarly, in the case that on-the-go products are purchased with the express intention of consumption at home, consumers are able to justify the added expense because of the reduced preparation and cleanup time of products with convenient packaging and the elimination of leftovers. Currently, packaged food manufacturers are using

Euromonitor International

Page

Packaging

Thailand

packaging to stimulate on-the-go consumption. This trend is most visible in confectionery, sweet and savoury snacks and dried processed food. During 2010, Sino-Pacific Trading (Thailand) Ltd introduced Ice Breakers in a flat round-shaped other rigid plastic container with dispensing closures on two sides. One side opens around half of the package and it carries a to share label, while the other side opens slightly and carries a not to share label, for eating alone. Pepsi-Cola (Thai) Trading Co Ltd launched Lays Stax in composite containers with a plastic tray inside. This packaging allows easy handling without dirtying the consumers hands. The product is suitable for consumption at parties and functions away from the home. There are also an increasing number of cups/bowl noodle and congee products in thin wall plastic continuers with peel-off paper closures, which are convenient for on-the-go consumption. In coffee, Moccona offers on-the-go products through outlets of 7eleven, which allow the consumer to put hot water in the cup and drink anywhere outside home. Over the review period, an increasing number of new product innovations featuring convenient closures which are suitable for on-the-go usage emerged, particularly in packaged food. The development of easy-open can ends in canned/preserved food, particularly canned/preserved fruit, has reduced the need for a can opener while still protecting the food product from spoilage. Furthermore, in beverages, the development of easy-open closures which allow consumers to open the packaging and enjoy the product anywhere and anytime such as peel-off foil and liquid carton closures is becoming more important. It is mainly producers of drinking milk and fruit/vegetable juice which use liquid carton closures for their products. In addition, fruit juice brands such as Malee, Unif and Tipco use plastic screw closures or flip-top closures on their brick liquid cartons. Vitamilk also launched a bottle which consumers can take away and drink anywhere outside the home. Jele recently launched it Jele Beautie Light and Jele Beautie in packaging which features an innovative design which makes the product convenient to drink. Jele Beautie comes in flexible plastic package with plastic screw closures and Jele Beautie Light comes in a plastic cup. PiPo Jelly was also launched in new packaging featuring a plastic cup, which is specifically intended to capture the attention of younger consumers. Flavoured milk drinks are becoming increasingly popular in Thailand due to their health appeal. Many more onthe-go packs were launched in flavoured milk drinks during the review period, which benefited metal beverage cans and liquid cartons. Cups/bowl instant noodles, ready meals in ready meal trays, and sliced cakes are other categories benefiting from the move towards convenient packaging for on-the-go consumption. Glass has suffered from the rise of the on-the-go trend due to its heavier weight and fragility. Rigid plastic, mainly PET bottles, and flexible plastic gained packaging volume share at the expense of glass due to the increased popularity of on-the-go consumption in 2010. It is not only food and beverages which are seeing the effects of on-the-go packaging, but also categories such as beauty and personal care. Many items in this category are being used outside the home by consumers in gyms and health clubs and at offices and other workplaces. Examples of beauty and personal care products which are currently popular for use on-the-go include hand sanitizers, face wash, moisturisers, hair gel, sun protection, colour cosmetics and fragrances. This has opened up higher demand for beauty and personal care packaged in PET and HDPE bottles and jars, squeezable plastic tubes and metal aerosol cans in a wider range of sizes. Outlook The demand for on-the-go products is likely to increase in Thailand over the forecast period. Thai consumers are becoming more sophisticated as they gain more exposure to products through foreign travel, television, magazines, and internet. This is stimulating demand for products which best meet consumer needs at specific times and on particular occasions. Therefore, consumers demand convenience in terms of products which are quick and easy to use. As demand for convenience products is expected to remain strong over the forecast period, this will encourage packaged food manufacturers to identify how the needs of their target consumers are changing and what additional benefits beyond on-the-go convenience are set to become requirements as a condition of purchase. Future Impact On-the-go, occasion-based consumption trends are likely to affect several categories in packaged food, including confectionery, sweet and savoury snacks, biscuits, packaged/industrial cakes and dried processed food as well as all beverages categories, predominantly soft drinks. In addition, Thailand has now reached a new demographic turning point as the ageing society becomes a key issue in society. The nature of convenience will change in the consumers mind. Quick and easy is no longer

Euromonitor International

Page

Packaging

Thailand

enough, and the challenges that this will bring for convenience products will also have ramifications for packaging manufacturers. Increasing developments are expected in terms of microwaveable packaging design for on-the-go ready meals. Lightweight, easy-grip packs and convenient closures are expected to set the agenda during the forecast period. Since lightweight packaging is appealing for on-the-go consumers, increasing usage of thin wall plastic , which is currently limited, is likely in beverages categories such bottled water, juices and RTD drinks. Since the smaller sizes of these products may lead to increases in the number of packs and perhaps even greater consumption and disposal of packaging materials, it may increase the negative impact of packaging on environment. As such, improved disposal and collection systems are likely, as is the use of more eco friendly packaging materials.

Packaging Innovation Focuses More on Bio-plastic Packaging Materials

Plastic packaging has been identified as a cause of global warming. A lot of energy is used in the production of and waste disposal processes for such materials. Petroleum-based plastic is commonly used in the production of plastic packaging and this is difficult to recycle. Bio-plastic is therefore a good solution for global warming and waste disposal problems at present and as such is becoming increasingly popular. Bio-plastic is derived from renewable biomass sources such as vegetable oil, corn starch, and pea starch as opposed to traditional plastic, which is made from petroleum by-products. Bio-plastic is used either as a direct replacement for, or blended with, traditional plastic. The focus on bio-plastic production represents a new trend in many countries, especially in countries where environmental issues constitute a key social concern. Current Impact In Thailand, the production of bio-plastic packaging is still in its early stages. Only a few packagers have tapped into the production of bio-plastic packaging. This mainly because it is priced up to twice as high as conventional packaging. Moreover, the government still does not offer any incentives for manufacturers to produce green and environmentally friendly packaging. However, leading packagers and retailers are starting to pay more attention to bio-plastic in response to eco-friendly consumer trends. As such, bio-plastic is becoming a packaging material with the potential to have an effect on certain pack types, and which food companies are starting to consider. CP Packaging Industry Co Ltd, the leading food packager in Thailand, has introduced the innovation of compostable and biodegradable plastic packaging in Thailand. The company offers bio-plastic packaging options for several of its packaging products such as cold plastic cups, plastic bags, cosmetic containers and vacuum plastic film. Most of the companys production focus for its bio-plastic packaging products is on exports to clients in the US and Japan as domestic demand for bio-plastic remains low. Leading retailers such as Central Food Retail Co Ltd also used bio-degradable plastic in all branches of its retail brands Central Food Hall, Tops Market, Tops Super and Tops Daily across the country. This is part of its Go Green marketing strategy, which was launched in 2008. The company has communicated that its plastic bags are made from environmental friendly materials and become fully decompose after disposal. According to industry estimates, approximately 98% of bio-plastic packaging in Thailand is for direct export rather than domestic usage. This mainly due to its high production cost. Until recently, domestic manufacturers of packaged food had not adopted bio-plastics. Only manufacturers of high value luxury items such as mobile telephones, hi-fi equipment and cars can absorb the higher cost of using bio-plastics. Outlook Over the forecast period, the Thai bio-plastics industry will continue to benefit from growing government support. The cabinet recently approved the governments Road Map for the Development of the Bio-plastics Industry in 2008, providing a budget of Bt1.8 billion for the implementation of the scheme. The National Innovation Agency, under the Ministry of Science and Technology, was assigned by the National Economic and Social Development Board to oversee the scheme. The National Innovation Agency will supervise the scheme, which will be carried out between 2008 and 2012. It is expected that this initiative will help to develop Thailand into the regional leader in the production of bio-plastic.

Euromonitor International

Page

Packaging

Thailand

The National Innovation Agency aims to promote the use of all available natural resources such as cassava and sugar cane in the production of bio-plastics. Future Impact Increasing concerns about environmental preservation will continue to drive growth in the use of bio-plastic over the forecast period, ensuring that it becomes an increasingly important packaging material across key packaging types including food packaging. Thai consumers will become more aware about global warming and public and private organisations will continue to advertise and educate consumers to reduce, reuse and recycle packaging waste. Packagers, manufacturers and retailers will continue to invest in campaigns highlighting ecological concerns and large-scale food manufacturers and packagers will be increasingly perceived as the creators of pollution and excessive waste. To improve their image, packaging players will increasingly use eco-friendly packaging as part of corporate social responsibility campaigns. Thailand produces huge amounts of agricultural products such as sugar cane, tapioca, and cassava which can be used as raw materials for bio-plastic and strong support from the government will help to promote the bioplastics industry. The National Innovation Agency also plans to seek cooperation from other countries such as the US, Japan, China, and Brazil for the development of the bio-plastics industry. In addition, Thailand is one of the key Asian countries in the promotion of the three Rs campaign. This will help other member countries such as Japan to support Thailand in terms of providing the technology necessary for the efficient development of bio-plastics. The production volume of bio-plastics in Thailand is predicted to account for about 5% of total plastic production over the forecast period. However, bio-plastic packaging will remain a niche category as the cost of bio-plastic packaging will remain quite high, although it will command higher volume share and may become a key packaging material in the longer term, especially if costs decrease.

Refill Packs See Growth Due To Increasing Price-sensitive Consumers

Due to the economic downturn Thai consumers have been tightening their belts, particularly with regard to products used on a daily basis such as home care and beauty and personal care. Consumers have sought various ways to reduce their monthly expenditure. Thai consumers have sought out more economical products, although some have chosen to remain loyal to certain brands. Manufacturers have thus sought to reduce packaging costs, among other initiatives, and this has led to the increasing use of flexible plastic refill packs which are replacing more expensive packaging materials such as rigid plastic, metal and glass. Demand for stand-up refill pouches was one of the more obvious trends in consumer products during the second half of the review period. Stand-up pouches is gaining significant ground in home and personal care products. Current Impact Currently, refillable packaging provides consumers with an opportunity for cost savings as stand-up pouches for refills retail at significantly lower prices than standard HDPE bottles. The strong penetration of stand-up pouch refill packs has been observed in liquid fabric softeners, shower gel, liquid dishwashing, detergents and floor cleaning liquids. The leading brands using stand-up pouches as refill packs are Essence in laundry detergent, Johnsons in body wash, Sunlight in dishwashing liquid and Oriental Princess in hair care. These refill packs are popular with consumers in different income groups as they are cheaper as well as more environmentally friendly compared to HDPE bottles. Refills, which are often intended to refill starter bottles in rigid plastic, are also used in categories such as shampoo and conditioners as well as packaged food categories such as tea, coffee, other hot drinks and sauces, dressings and condiments. Not only are these refill packs being used by small and mid-level brands and private label in a bid to reduce packaging costs, but they are also popular with larger multinational brands. The use of refills packs no longer denotes a cheap product or economy brand. In fact, due to the environmental benefits offered by refill packs,

Euromonitor International

Page

Packaging

Thailand

they are sometimes intentionally chosen by companies in order to give their brand a superior image as being an environmentally friendly brand. Outlook While refills are often marketed as being environmentally friendly, it is for the cost savings that consumers are turning to refills. For this reason economy brands have been among the first to offer refills in a significant manner. As cost saving is a significant driver for the uptake of refills, brand owners should ensure that the price difference between standard packs and refills is well communicated. The demand of refillable package will be increased and the products will be more offered in refillable packs. From laundry care, where this option has been present for a few years, refill packs are now appearing in categories such as cleaning products, home and personal products. Over the forecast period, most liquid format consumer products are expected to be offered in flexible stand-up pouches for refill purposes. Apart from the economic sense of using stand-up pouch packaging, this format will also catch the attention of environmentally friendly consumers. Stand-up pouch packaging will ultimately be a good choice for green consumers who cannot afford to pay a premium for green products as these both help the environment and are available at an affordable retail price. Future Impact While the main driver for consumer demand for refill packaging over the forecast period will remain cost savings, increasing environmental legislation and higher expectations are driving brand owners to introduce lightweight and recyclable refill packaging. While products within home care lend themselves well to refill pouches, refill packaging will increasingly expand into categories such as skin care and hair care. The share of rigid containers will gradually be squeezed by flexible packaging during the forecast period as the purchase of rigid plastic containers will increasingly be restricted to first-time purchasers who will thereafter opt for refills. In particular, demand for home care products in flexible packaging will rise as the range of products available in refill pouches increases. While these refill pouches are often tear open, as the trend towards refill pouches continues, the use of resealable spouts on refill pouches will become more common. Pouches may then replace bottles as the standard packaging format for liquid products in home care, particularly for the cheaper economy brands. Increasing the usage of flexible packaging will also support environmental consumer trends as this type of packaging creates less waste than rigid plastic packaging such as HDPE bottles.

Growing Trend for Health and Wellness Products Increases Demand for Packaging

There is an increasing trend towards the consumption of health and wellness products such as food, beverages and beauty and personal care. Thailand has now reached a new demographic turning point with the advent of the ageing society. The increasing share of older consumers among the Thai population is due to the fact that the growth rate of the elderly population exceeds that of the overall population. Furthermore, not only is the overall share of the ageing population increasing, but also the older population itself is ageing as evidenced by an increase in the proportion of elderly people who are aged over 80 years. This is driving increasing consumption of health and wellness products in food, beverages and home care. In addition, the number of women in employment in Thailand continues to grow. The growing number of elderly people and career women is resulting in higher demand for health and wellness related products. As a result of the higher number of women in the workforce, the standard of living is rising in Thailand and the purchasing power of women continues to rise, evidence of which can be seen in the higher demand for health and beauty products. In addition, a survey carried out by leading manufacturers in personal care has found that working female consumers have become the main growth driver in health and beauty products. Current Impact

Euromonitor International

Page

Packaging

Thailand

Health and beauty products are no longer considered luxury items in Thailand and consumers no longer exclude them from their shopping baskets during times of economic hardship. Buying and spending patterns over the review period revealed that these commodities have become an essential part of the daily lives of a vast number of Thai women. Regardless of the economic situation, this group of female consumers continues to invest in vitamins and supplements, facial care and body care as Thai women are generally known for placing a high degree of importance in their personal appearance. Due to the increasing demand for health and wellness products in food and beverages, home care and beauty and personal care products, demand for packaging in these categories also increased during the review period. Much of Thailands premium health and wellness food comes packaged in high quality plastic bottles/jars and many premium beverages, particularly juices, use glass packaging for its superior chemical compatibility as well as because glass is associated with premium, high quality products. The increasing consumption of yoghurt, which is considered to be very healthy, has positively impacted demand for thin wall plastic containers in spoonable yoghurt and rigid plastic, usually HPDE, in drinking yoghurt. Premium health and wellness oriented beauty and personal care products in categories and such as bath and shower not only use high-grade rigid or flexible plastic and high grade glass but also have packaging which is adorned with high-quality graphics, designs and labelling. Often these health and wellness products are comparatively expensive. As such, smaller sized packs have been employed in order to make them attractively priced. Furthermore, the shift towards healthy eating has meant consumption of smaller portions in impulse and indulgence food categories such as confectionery and sweet and savoury snacks and this trend has also helped drive demand for smaller packaging sizes. Outlook The consumption of health and wellness products is likely to increase in Thailand as consumers become more health conscious and also as incomes rise, meaning that more Thais will be able to afford these products. Manufacturers will stimulate sales of health and beauty products through continuous product innovation in terms of improved formulations. Manufacturers will seek to better determine consumer needs and develop products to match these more specifically. Packaging in Thailand will continue to benefit from growth of these products. The complementary role of packaging in lending a premium image to these products will increase as current developments in packaging design and graphics become more widespread over the forecast period. Future Impact The strong sales performance of health and beauty products is expected to continue over the forecast period. The development of health and beauty products will not only focus on women but also extend to men, children and even pets. Mens grooming products is expected to expand in Thailand over the forecast period as there will be a significant increase in the number of Thai men who are concerned about their health and personal appearance. Currently, single-serve portion packaged food products are preferred by Thai consumers for their own consumption as well as for their pets and this trend will only grow stronger over the forecast period, leading to the increasing use of smaller sizes such as single-serve aluminium trays in wet dog and cat food, smaller sized ready meal trays in ready meals and slimmer metal cans for energy-rich beverages such as carbonates, some juice drinks and certain drinking milk products. The increasing consumption of salads and healthy ready meals in Thailands cities and urban areas will likely open up further demand for thin wall plastic trays and containers during the forecast period. Prepared baby food in single-serve packs is likely to become more popular as Thai mothers become more educated and disposable incomes rise. Smaller sized baby food packaging will be preferred as this is ideal for maintaining freshness as the food is used in one go, negating the need to tore food for later.

Euromonitor International

Page

Packaging

Thailand

Glass, high quality plastic, aluminium /plastic pouches and liquid cartons are some key packaging types which might benefit from the further development of single-serve packaging over the forecast period. Packaging types such as liquid cartons which use technology that requires fewer preservatives to be used, thus rendering products healthier, will also see further development over the forecast period.

MARKET BACKGROUND

Packaging Legislation

FDA laws and regulations on food packaging and labels Food packaging and labelling in Thailand is regulated by the Thai Food and Drug Administration. According to the Food Act of B.E.2522 (1979), the Minister of Public Health is empowered to designate food according to labelling categories and determine the categorisation of the kinds of food produced for distribution or import for sale. Food packaging regulations encompass labels, the content of labels, conditions and criteria of labelling as well as principles and methods of advertising on labels. Mislabelling on the packaging of food products may deceive and even endanger consumers. Food which is labelled with an intention to deceive or an attempt to deceive buyers as to quality quantity benefit or other special descriptions is designated as adulterated food. The principles of food labelling in terms of packaging control aim to ensure that the content listed on the label is correct and concise, causes no consumer confusion and does not mislead consumers. In addition, food products are required to bear labels containing information in Thai language. This information includes the name of the product, the main ingredients and the name and address of the manufacturer or repackagers of the food which is produced within the country as well as any other particulars relating to the food such as the names and addresses of importers and the products country of origin. These rules are enforced by the Notification of the Ministry of Public Health No.194 (B.E.2544) on Labelling. Nutrition labelling According to the Notification of the Ministry of Public Health (No. 182) B.E. 2541 (1998) on Nutrition Labelling, nutrition labelling with the aim of providing information and useful nutritional facts should be clearly laid out to consumers. The Food and Drug Administration control which categories of food are required to have nutrition labelling. In general, nutritional information printed on food packaging should relate to the type or quantity of nutrients. These nutrients can be assessed by comparative claims or the function of the nutrients can be stated on the labelling. Food which defines specific consumer groups in sale promotions must strictly follow the particular guidelines issued by the Ministry of Public Health. Nutrition labelling must be expressed in Thai language, although foreign languages may also be added. Nutritional content should be measured in quantity per one serving unit as well as quantity per consumption unit per container. Moreover, these amounts must be referenced to the recommended daily intakes for consumers aged of 6 years and over.

Draft of Act on Economic Tools for Environment Tax Management

In 2010, the Fiscal Policy Office of the Ministry of Finance was engaged with a group of experts working on the draft of the Act on Economic Tools for Environment Tax Management. This act contains some 90 sections. The legislation is intended to be used as a basic law or a parent law for issuing a series of royal decrees for the purpose of levying taxes related to the environment. One section contains provisions for a royal decree on a putative packaging tax. A royal decree on packaging tax has been proposed with the focus on the most suitable way of achieving effective management of packaging waste in a developing country such as Thailand.

Euromonitor International

Page

Packaging

Thailand

Packaging companies and consumer product manufacturers are expected to follow the launch of the act closely as well as the enforcement of the royal decree on packaging tax. One likely result of this Act is higher costs of packaging production, the burden of which will fall on producers, distributors and end consumers.

Recycling and the Environment

Thailand Institute of Packaging and Recycling Management for Sustainable Environment In 2005, the Thailand Institute of Packaging and Recycling Management for Sustainable Environment (TIMPSE) was first established under the cooperation of the Plastic Industry Club, the Pulp and Paper Industry Club and the Glass Industry Club to facilitate the management of used packaging between relevant government agencies, the Thai Metal Packaging Association and other consumer product manufacturers in private sectors. TIPMSE actively takes part in the management of used packaging by segregating it and adding value to it together with achieving environmental conservation aims such as the preservation of natural resources and reductions in global warming. TIMPSE aims to reduce packaging waste with a safe and sustainable methodology through educating individuals and communities, systematically promoting selective waste collection, setting up integrated systems of collecting already sorted packaging waste, promoting the establishment of packaging waste collecting and sorting centres and providing support to the recycling industry. Some of the recycling projects launched by TIPMSE include: its Project for Community recycling banks; its project for the promotion of segregation of recyclables by municipal authorities; its project for recyclable management at universities and on housing estates; its project for establishing recycling centres for packaging waste collectors; and its project for cooperation in the establishment of recyclable waste drop-off points in supermarkets/hypermarkets and convenience stores for charitable purposes. Tetra Pak (Thailand) and SIG Combibloc join members of Thai Beverage Carton Group Beverage Carton Group is established under the collaboration of the leading beverage carton manufacturers such as Tetra Pak (Thai) Ltd and SIG Combibloc Ltd; to support and encourage consumers to collect used liquid cartons and transport them to recycling centres. The collection points for beverage cartons are widely located at various shopping malls, hypermarkets/supermarkets, community areas, office buildings and educational centres. Liquid cartons waste is then sent for recycling and turned into recycled materials for the production of environmentally friendly cardboard.

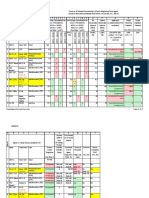

Table 1 Overview of Packaging Recycling and Recovery in the Thailand 2008/2009 and Targets for 2010

Recycling by material (in kg) 2008 Glass Plastic Metal Paper

Source:

2009 992,227.2 413,848.3 300,191.6 835,177.8

2010 target 1,111,294.4 496,618.0 345,220.4 1,002,213.3

862,806.2 359,868.1 261,036.2 726,241.6

Thailand Institute of Packaging and Recycling Management for Sustainable Environment

CATEGORY DATA

Table 2 Million units 2004 Metal Rigid plastic Glass Liquid cartons 3,165.0 3,819.6 6,410.8 2,240.1 2005 3,251.2 4,146.8 6,605.4 2,266.5 2006 3,520.2 4,489.3 6,970.3 2,421.1 2007 3,733.2 4,871.2 7,234.9 2,569.3 2008 3,622.0 5,201.4 7,102.9 2,686.1 2009 3,567.5 5,597.3 7,118.1 2,804.7 FMCG Packaging by Pack Type: Retail Unit Volume 2004-2009

Euromonitor International

Page

10

Packaging

Thailand

Paper-based containers Flexible packaging

Source: Note:

1,195.0 12,865.8

1,248.8 13,449.8

1,313.9 13,608.6

1,393.9 14,248.0

1,456.6 14,573.3

1,526.0 14,963.6

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates FMCG includes packaged food, alcoholic drinks, soft drinks, hot drinks, beauty and personal care, home care, dog and cat food, tobacco, tissue and hygiene

Table 3

FMCG Packaging by Pack Type: % Retail Unit Volume Growth 2004-2009

% Total Unit Volume Growth 2008/09 Metal Rigid plastic Glass Liquid cartons Paper-based containers Flexible packaging

Source: Note:

2004-09 CAGR 2.4 7.9 2.1 4.6 5.0 3.1

2004-09 TOTAL 402.5 1,777.7 707.3 564.6 331.0 2,097.8

-1.5 7.6 0.2 4.4 4.8 2.7

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates FMCG includes packaged food, alcoholic drinks, soft drinks, hot drinks, beauty and personal care, home care, dog and cat food, tobacco, tissue and hygiene

Table 4 Million units

Total Packaging by Industry: Retail Unit Volume 2004-2009

2004 Beauty and personal care packaging Alcoholic drinks packaging Hot drinks packaging Soft drinks packaging Dog and cat food packaging Food packaging Home care packaging Tissue and hygiene packaging Tobacco packaging

Source:

2005 1,206.2 3,638.7 536.1 6,230.8 80.3 12,238.1 600.5 347.9 6,438.1

2006 1,286.5 3,973.6 625.4 6,566.9 93.2 13,005.3 668.8 367.3 6,104.0

2007 1,359.5 4,192.9 727.4 6,894.1 106.3 13,774.9 720.4 385.4 6,275.2

2008 1,441.6 3,887.7 821.5 7,006.2 114.2 14,301.3 812.3 405.8 6,257.7

2009 1,530.5 3,732.1 924.2 7,237.4 123.8 14,896.6 851.0 428.9 6,282.9

1,163.0 3,698.5 466.6 5,868.0 72.1 11,480.3 531.1 328.7 6,417.0

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 5

Total Packaging by Industry: % Retail Unit Volume Growth 2004-2009

% Total Unit Volume Growth 2008/09 Beauty and personal care packaging Alcoholic drinks packaging Hot drinks packaging Soft drinks packaging Dog and cat food packaging Food packaging Home care packaging Tissue and hygiene packaging Tobacco packaging

Source:

2004-09 CAGR 5.6 0.2 14.6 4.3 11.4 5.3 9.9 5.5 -0.4

2004-09 TOTAL 367.5 33.6 457.6 1,369.4 51.7 3,416.3 319.9 100.2 -134.1

6.2 -4.0 12.5 3.3 8.4 4.2 4.8 5.7 0.4

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Euromonitor International

Page

11

Packaging

Thailand

Table 6 Million units

FMCG Closures by Type: Retail Unit Volume 2005-2009

2005 Corks Easy-open can ends Glass stoppers Liquid carton closures Metal crowns Metal lug closures Metal screw closures Peel-off foil Peel-off paper Peel-off plastic Plastic dispensing closures Plastic overcaps Plastic screw closures Pumps Sports caps Sprays Standard can ends Trigger closures Other plastic closures Other closures

Source: Note:

2006 7.3 308.8 0.3 751.2 2,755.9 62.5 2,876.2 1,138.3 65.0 157.6 1,438.1 162.5 2,494.3 21.6 30.8 72.7 416.1 12.7 234.9 222.5

2007 7.7 325.6 0.4 834.6 2,970.9 68.5 2,886.5 1,213.2 67.4 175.2 1,518.7 173.0 2,696.8 25.0 35.5 76.6 433.9 13.9 254.5 228.1

2008 8.0 334.7 0.4 899.9 2,802.2 72.3 2,929.8 1,259.2 69.4 189.8 1,585.0 182.3 2,881.3 34.9 39.4 80.7 442.3 15.2 271.2 225.3

2009 7.7 347.5 0.4 947.1 2,684.1 75.4 3,032.4 1,340.8 74.2 212.3 1,657.4 198.7 3,094.9 41.8 44.3 85.0 448.3 16.6 288.8 225.8

7.0 287.0 0.3 673.6 2,463.7 57.7 2,817.7 1,081.7 59.7 138.1 1,350.7 149.7 2,343.9 17.9 26.9 68.2 402.1 11.3 216.5 215.5

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates FMCG includes packaged food, alcoholic drinks, soft drinks, hot drinks, beauty and personal care, home care, dog and cat food, tobacco, tissue and hygiene

Table 7

FMCG Closures by Type: % Retail Unit Volume Growth 2005-2009

% Total Unit Volume Growth 2008/09 Corks Easy-open can ends Glass stoppers Liquid carton closures Metal crowns Metal lug closures Metal screw closures Peel-off foil Peel-off paper Peel-off plastic Plastic dispensing closures Plastic overcaps Plastic screw closures Pumps Sports caps Sprays Standard can ends Trigger closures Other plastic closures Other closures

Source: Note:

2005-09 CAGR 2.4 4.9 7.5 8.9 2.2 6.9 1.9 5.5 5.6 11.3 5.2 7.3 7.2 23.6 13.3 5.7 2.8 10.1 7.5 1.2

2005-09 TOTAL 0.7 60.5 0.1 273.5 220.4 17.7 214.7 259.1 14.5 74.2 306.7 49.0 751.0 23.9 17.4 16.8 46.2 5.3 72.3 10.3

-3.8 3.8 0.0 5.2 -4.2 4.3 3.5 6.5 6.9 11.9 4.6 9.0 7.4 19.8 12.4 5.3 1.4 9.2 6.5 0.2

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates FMCG includes packaged food, alcoholic drinks, soft drinks, hot drinks, beauty and personal care, home care, dog and cat food, tobacco, tissue and hygiene

Euromonitor International

Page

12

Packaging

Thailand

Table 8 Million units

Total Closures by Industry: Retail Unit Volume 2005-2009

2005 Beauty and personal care packaging Alcoholic drinks packaging Hot drinks packaging Soft drinks packaging Dog and cat food packaging Food packaging Home care packaging Tissue and hygiene packaging Tobacco packaging

Source:

2006 647.6 2,704.5 107.9 4,970.5 53.8 4,474.0 268.8 0.0 1.9

2007 686.1 2,805.9 123.6 5,252.6 58.7 4,784.0 293.1 0.0 2.0

2008 731.6 2,631.3 142.7 5,397.8 59.8 5,001.2 356.7 0.1 2.1

2009 783.0 2,553.0 164.1 5,630.2 64.2 5,252.3 374.6 0.1 2.1

604.1 2,531.7 90.0 4,681.1 44.6 4,192.6 243.0 0.0 1.9

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 9

Total Closures by Industry: % Retail Unit Volume Growth 2005-2009

% Total Unit Volume Growth 2008/09 Beauty and personal care packaging Alcoholic drinks packaging Hot drinks packaging Soft drinks packaging Dog and cat food packaging Food packaging Home care packaging Tissue and hygiene packaging Tobacco packaging

Source:

2005-09 CAGR 6.7 0.2 16.2 4.7 9.5 5.8 11.4 2.5

2005-09 TOTAL 178.9 21.3 74.1 949.1 19.6 1,059.7 131.6 0.1 0.2

7.0 -3.0 15.0 4.3 7.4 5.0 5.0 0.0 0.0

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 10 Million units

Forecast FMCG Packaging by Pack Type: Retail Unit Volume 2009-2014

2009 Metal Rigid plastic Glass Liquid cartons Paper-based containers Flexible packaging

Source: Note:

2010 3,497.1 6,059.7 7,250.2 2,915.6 1,597.4 15,327.6

2011 3,544.0 6,464.9 7,366.9 3,033.0 1,662.3 15,705.5

2012 3,589.4 6,884.5 7,499.5 3,147.1 1,725.1 16,089.3

2013 3,648.6 7,301.0 7,640.4 3,264.0 1,786.6 16,478.9

2014 3,716.7 7,737.9 7,783.5 3,377.8 1,846.7 16,865.6

3,567.5 5,597.3 7,118.1 2,804.7 1,526.0 14,963.6

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates FMCG includes packaged food, alcoholic drinks, soft drinks, hot drinks, beauty and personal care, home care, dog and cat food, tobacco, tissue and hygiene

Table 11

Forecast FMCG Packaging by Pack Type: % Retail Unit Volume Growth 2009-2014

% Total Unit Volume Growth 2013/14 Metal 1.9 2009-14 CAGR 0.8 2009-14 TOTAL 149.2

Euromonitor International

Page

13

Packaging

Thailand

Rigid plastic Glass Liquid cartons Paper-based containers Flexible packaging

Source: Note:

6.0 1.9 3.5 3.4 2.3

6.7 1.8 3.8 3.9 2.4

2,140.6 665.4 573.1 320.7 1,902.0

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates FMCG includes packaged food, alcoholic drinks, soft drinks, hot drinks, beauty and personal care, home care, dog and cat food, tobacco, tissue and hygiene

Table 12 Million units

Forecast Total Packaging by Industry: Retail Unit Volume 2009-2014

2009 Beauty and personal care packaging Alcoholic drinks packaging Hot drinks packaging Soft drinks packaging Dog and cat food packaging Food packaging Home care packaging Tissue and hygiene packaging Tobacco packaging

Source:

2010 1,613.9 3,720.3 1,031.5 7,495.5 132.6 15,507.1 889.5 452.2 6,260.0

2011 1,693.4 3,720.8 1,143.3 7,800.3 141.5 16,098.3 927.7 476.1 6,255.4

2012 1,772.5 3,720.9 1,247.3 8,131.2 150.5 16,687.6 968.0 500.3 6,262.1

2013 1,845.7 3,725.4 1,342.0 8,495.0 158.8 17,277.1 1,003.7 524.9 6,277.7

2014 1,914.2 3,733.2 1,431.1 8,890.3 167.0 17,861.8 1,038.4 549.8 6,299.4

1,530.5 3,732.1 924.2 7,237.4 123.8 14,896.6 851.0 428.9 6,282.9

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 13

Forecast Total Packaging by Industry: % Retail Unit Volume Growth 2004-2009

% Total Unit Volume Growth 2013/14 Beauty and personal care packaging Alcoholic drinks packaging Hot drinks packaging Soft drinks packaging Dog and cat food packaging Food packaging Home care packaging Tissue and hygiene packaging Tobacco packaging

Source:

2009-14 CAGR 4.6 0.0 9.1 4.2 6.2 3.7 4.1 5.1 0.1

2009-14 TOTAL 383.7 1.1 506.9 1,652.9 43.2 2,965.2 187.4 120.9 16.5

3.7 0.2 6.6 4.7 5.2 3.4 3.5 4.7 0.3

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 14 Million units

Forecast FMCG Closures by Type: Retail Unit Volume 2009-2014

2009 Corks Easy-open can ends Glass stoppers Liquid carton closures Metal crowns Metal lug closures Metal screw closures Peel-off foil 7.7 347.5 0.4 947.1 2,684.1 75.4 3,032.4 1,340.8

2010 7.9 365.0 0.5 1,001.2 2,693.6 81.6 3,120.6 1,423.2

2011 8.1 377.4 0.5 1,052.8 2,719.6 85.6 3,200.4 1,503.9

2012 8.4 389.7 0.5 1,105.9 2,747.6 89.3 3,275.0 1,590.5

2013 8.7 401.8 0.5 1,161.7 2,782.4 94.4 3,352.2 1,674.5

2014 9.0 413.6 0.5 1,217.6 2,821.6 99.9 3,427.7 1,759.4

Euromonitor International

Page

14

Packaging

Thailand

Peel-off paper Peel-off plastic Plastic dispensing closures Plastic overcaps Plastic screw closures Pumps Sports caps Sprays Standard can ends Trigger closures Other plastic closures Other closures

Source: Note:

74.2 212.3 1,657.4 198.7 3,094.9 41.8 44.3 85.0 448.3 16.6 288.8 225.8

83.2 233.0 1,735.8 197.5 3,372.9 48.0 49.5 76.6 458.8 22.0 308.3 222.6

89.9 256.6 1,796.3 209.5 3,612.7 53.8 56.0 79.7 472.2 23.8 326.4 194.9

96.5 280.8 1,856.3 220.9 3,860.2 60.6 62.7 82.6 487.1 25.6 343.9 187.0

104.0 307.0 1,910.7 232.8 4,107.8 66.2 70.7 85.3 501.5 27.4 361.2 179.8

112.8 333.0 1,961.3 245.5 4,379.1 71.5 79.4 87.8 518.2 29.2 378.1 172.3

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates FMCG includes packaged food, alcoholic drinks, soft drinks, hot drinks, beauty and personal care, home care, dog and cat food, tobacco, tissue and hygiene

Table 15

Forecast FMCG Closures by Type: % Retail Unit Volume Growth 2009-2014

% Total Unit Volume Growth 2013/14 Corks Easy-open can ends Glass stoppers Liquid carton closures Metal crowns Metal lug closures Metal screw closures Peel-off foil Peel-off paper Peel-off plastic Plastic dispensing closures Plastic overcaps Plastic screw closures Pumps Sports caps Sprays Standard can ends Trigger closures Other plastic closures Other closures

Source: Note:

2009-14 CAGR 3.2 3.5 4.6 5.2 1.0 5.8 2.5 5.6 8.7 9.4 3.4 4.3 7.2 11.3 12.4 0.7 2.9 12.0 5.5 -5.3

2009-14 TOTAL 1.3 66.1 0.1 270.5 137.5 24.5 395.3 418.6 38.6 120.7 303.9 46.8 1,284.2 29.7 35.1 2.8 69.9 12.6 89.3 -53.5

3.4 2.9 0.0 4.8 1.4 5.8 2.3 5.1 8.5 8.5 2.6 5.5 6.6 8.0 12.3 2.9 3.3 6.6 4.7 -4.2

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates FMCG includes packaged food, alcoholic drinks, soft drinks, hot drinks, beauty and personal care, home care, dog and cat food, tobacco, tissue and hygiene

Table 16 Million units

Forecast Total Closures by Industry: Retail Unit Volume 2009-2014

2009 Beauty and personal care packaging Alcoholic drinks packaging Hot drinks packaging Soft drinks packaging Dog and cat food packaging Food packaging Home care packaging 783.0 2,553.0 164.1 5,630.2 64.2 5,252.3 374.6

2010 831.3 2,561.1 187.8 5,955.4 68.3 5,514.6 380.9

2011 877.1 2,573.5 212.3 6,220.9 72.4 5,763.8 397.8

2012 922.5 2,582.0 236.5 6,516.2 76.6 6,017.7 417.3

2013 964.0 2,591.4 258.7 6,835.0 80.3 6,264.8 434.0

2014 1,002.5 2,600.7 280.8 7,181.1 83.8 6,516.2 450.0

Euromonitor International

Page

15

Packaging

Thailand

Tissue and hygiene packaging Tobacco packaging

Source:

0.1 2.1

0.1 2.2

0.1 2.2

0.1 2.3

0.1 2.3

0.1 2.3

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Table 17

Forecast Total Closures by Industry: % Retail Unit Volume Growth 2004-2009

% Total Unit Volume Growth 2013/14 Beauty and personal care packaging Alcoholic drinks packaging Hot drinks packaging Soft drinks packaging Dog and cat food packaging Food packaging Home care packaging Tissue and hygiene packaging Tobacco packaging

Source:

2009-14 CAGR 5.1 0.4 11.3 5.0 5.5 4.4 3.7 0.0 1.8

2009-14 TOTAL 219.5 47.7 116.7 1,550.9 19.6 1,263.9 75.4 0.0 0.2

4.0 0.4 8.5 5.1 4.4 4.0 3.7 0.0 0.0

Official statistics, trade associations, trade press, company research, trade interviews, Euromonitor International estimates

Euromonitor International

Page

16

Potrebbero piacerti anche

- Chapter-1: About Packaging IndustryDocumento96 pagineChapter-1: About Packaging IndustryDheeraj SharmaNessuna valutazione finora

- Packaging Unwrapped 2011Documento48 paginePackaging Unwrapped 2011Guillaume DryNessuna valutazione finora

- Organisational Study On Aglass Manufacturing FirmDocumento61 pagineOrganisational Study On Aglass Manufacturing Firmthis_is_noorNessuna valutazione finora

- Euromonitor - Packaging Industry in IndonesiaDocumento9 pagineEuromonitor - Packaging Industry in IndonesiaKristhoperNessuna valutazione finora

- Report On Packaging Industry in IndiaDocumento8 pagineReport On Packaging Industry in IndiaAjey BhangaleNessuna valutazione finora

- Ajanta Packaging - Himanshu P16002 & Saumya P16046Documento8 pagineAjanta Packaging - Himanshu P16002 & Saumya P16046Himanshu AgrawalNessuna valutazione finora

- India's Packaging Sector Growth and TrendsDocumento40 pagineIndia's Packaging Sector Growth and TrendsLamdNessuna valutazione finora

- Baked Goods in The Philippines PDFDocumento11 pagineBaked Goods in The Philippines PDFAngelo FerrerNessuna valutazione finora

- Packaging Industry ReportDocumento44 paginePackaging Industry ReportKunalNessuna valutazione finora

- Ob Group 26 - 06Documento35 pagineOb Group 26 - 06Nam NguyễnNessuna valutazione finora

- Dog and Cat Food Packaging in ColombiaDocumento4 pagineDog and Cat Food Packaging in ColombiaCamilo CahuanaNessuna valutazione finora

- My Porrfolio: Coverp AgeDocumento13 pagineMy Porrfolio: Coverp AgeАлексей МорозовNessuna valutazione finora

- Social perceptions of single-use plastic consumption in BaliDocumento53 pagineSocial perceptions of single-use plastic consumption in BaliMustafa Khuzema GangerdiwalaNessuna valutazione finora

- Business Plan On Manufacturing Knitted and Woven BagsDocumento40 pagineBusiness Plan On Manufacturing Knitted and Woven BagsBijoy Salahuddin82% (17)

- Packaging Industry FinalDocumento30 paginePackaging Industry FinalUtkarsh Tyagi100% (1)

- Baked Goods in The PhilippinesDocumento11 pagineBaked Goods in The Philippinesrosettejoy278100% (2)

- Food Drop: Fundamentals of Innovation and Entrepreneurship - 02E Course Code - 033200Documento17 pagineFood Drop: Fundamentals of Innovation and Entrepreneurship - 02E Course Code - 033200Waad MajidNessuna valutazione finora

- Report-Entrepreneurship RanaDocumento17 pagineReport-Entrepreneurship RanaRameesha IshtiaqNessuna valutazione finora

- HARSHDRUVDocumento11 pagineHARSHDRUVrameshsyNessuna valutazione finora

- The Role of Food Packaging: February 2019Documento11 pagineThe Role of Food Packaging: February 2019Agrian HuntsmanNessuna valutazione finora

- Literature Review: Chocolate & Confectionery PackagingDocumento10 pagineLiterature Review: Chocolate & Confectionery PackagingAhmed KabirNessuna valutazione finora

- Increase Use of Biodegradable Plastics by 10Documento18 pagineIncrease Use of Biodegradable Plastics by 10Anustha ChoudharyNessuna valutazione finora

- OatDocumento18 pagineOatPrachi SharmaNessuna valutazione finora

- Ajanta PackagingDocumento2 pagineAjanta PackagingRajatNessuna valutazione finora

- Home Care - Vietnam: Euromonitor International: Country Market InsightDocumento15 pagineHome Care - Vietnam: Euromonitor International: Country Market InsightNguyen Ngoc Tuong VINessuna valutazione finora

- Food & Beverage IndustryDocumento5 pagineFood & Beverage Industryobiero peterNessuna valutazione finora

- Packaged Food in MexicoDocumento37 paginePackaged Food in MexicoMarina VargasNessuna valutazione finora

- Packaging-Trends eBook-En V3.3Documento66 paginePackaging-Trends eBook-En V3.3zus2012Nessuna valutazione finora

- Questionnaire On Packaging of FMCG ProductsDocumento15 pagineQuestionnaire On Packaging of FMCG ProductsSreyas ChackoNessuna valutazione finora

- Breakfast Cereals in The PhilippinesDocumento9 pagineBreakfast Cereals in The PhilippinesCristal Jane Esguerra50% (2)

- Arpit 166024 Section A WAC I.1Documento6 pagineArpit 166024 Section A WAC I.1Arpit JaiswalNessuna valutazione finora

- Rana PackagingDocumento26 pagineRana PackagingVignesh DurairajNessuna valutazione finora

- Food Packaging DissertationDocumento5 pagineFood Packaging DissertationHelpMeWithMyPaperAnchorage100% (1)

- Individual OMDocumento17 pagineIndividual OMNam NguyễnNessuna valutazione finora

- Packaging Innovation Effects in Enhance SalesDocumento5 paginePackaging Innovation Effects in Enhance SalesFarhan SuhermanNessuna valutazione finora

- SKSU Regional Communal Food Processing Center Seminar on Product Packaging & LabellingDocumento56 pagineSKSU Regional Communal Food Processing Center Seminar on Product Packaging & LabellingNoel Dela TorreNessuna valutazione finora

- METHOD - SOL 1 and 3Documento4 pagineMETHOD - SOL 1 and 3strifeitdownNessuna valutazione finora

- Trends in Packaging R&D in The USDocumento61 pagineTrends in Packaging R&D in The USSiddu09549Nessuna valutazione finora

- Packaging and Purchase DecisionsDocumento19 paginePackaging and Purchase DecisionsmadalinabalulescuNessuna valutazione finora

- Piyush Sevaldasani C WAC1 1Documento5 paginePiyush Sevaldasani C WAC1 1Piyush SevaldasaniNessuna valutazione finora

- Individual EssayDocumento20 pagineIndividual EssayLewis HaselockNessuna valutazione finora

- The Aranca Report Packaging Industry A ReviewDocumento26 pagineThe Aranca Report Packaging Industry A ReviewdanceNessuna valutazione finora

- Silayoi Speece 2007Documento23 pagineSilayoi Speece 2007flagonsNessuna valutazione finora

- Plastic Packaging Market ReportDocumento21 paginePlastic Packaging Market ReportAdham SalahNessuna valutazione finora

- Top 10 food trends for 2016Documento122 pagineTop 10 food trends for 2016PublicaNessuna valutazione finora

- Food PackagingDocumento8 pagineFood PackagingClara2772Nessuna valutazione finora

- Plastic-Packaging-Report FICCI Jan 2016 PDFDocumento44 paginePlastic-Packaging-Report FICCI Jan 2016 PDFamp0201Nessuna valutazione finora

- Final File Ohoo 2docxDocumento7 pagineFinal File Ohoo 2docxTorrent UploadNessuna valutazione finora

- Packaging and Purchase DecisionsDocumento19 paginePackaging and Purchase Decisionsgirish_gupta509575Nessuna valutazione finora

- Laminated Flexible Packaging Industry OverviewDocumento10 pagineLaminated Flexible Packaging Industry OverviewEstefania ChrillNessuna valutazione finora

- Assignment of Advanced Marketing: Submitted ByDocumento5 pagineAssignment of Advanced Marketing: Submitted ByHarshal VyasNessuna valutazione finora

- The Marketing Plan For A New ProductDocumento19 pagineThe Marketing Plan For A New Productalo alo 1234Nessuna valutazione finora

- Nestle International Business StrategyDocumento16 pagineNestle International Business StrategyagarhemantNessuna valutazione finora

- Nestle International Business StrategyDocumento22 pagineNestle International Business Strategydedon1234100% (1)

- Pricing Strategies for Soft Drinks Amid Rising Homemade Soda TrendDocumento21 paginePricing Strategies for Soft Drinks Amid Rising Homemade Soda TrendJerryTanNessuna valutazione finora

- The New Zealand Land & Food Annual 2017: Volume 2Da EverandThe New Zealand Land & Food Annual 2017: Volume 2Nessuna valutazione finora

- Biopolymers: New Materials for Sustainable Films and CoatingsDa EverandBiopolymers: New Materials for Sustainable Films and CoatingsDavid PlackettNessuna valutazione finora

- Greenwashing in the Fashion Industry - The Flipside of the Sustainability Trend from the Perspective of Generation ZDa EverandGreenwashing in the Fashion Industry - The Flipside of the Sustainability Trend from the Perspective of Generation ZNessuna valutazione finora

- Installation Instruction XALM IndoorDocumento37 pagineInstallation Instruction XALM IndoorVanek505Nessuna valutazione finora

- 'K Is Mentally Ill' The Anatomy of A Factual AccountDocumento32 pagine'K Is Mentally Ill' The Anatomy of A Factual AccountDiego TorresNessuna valutazione finora

- Material Safety Data Sheet Lime Kiln Dust: Rev. Date:5/1/2008Documento6 pagineMaterial Safety Data Sheet Lime Kiln Dust: Rev. Date:5/1/2008suckrindjink100% (1)

- PWC Global Project Management Report SmallDocumento40 paginePWC Global Project Management Report SmallDaniel MoraNessuna valutazione finora

- Individual Assignment ScribdDocumento4 pagineIndividual Assignment ScribdDharna KachrooNessuna valutazione finora

- Board 2Documento1 paginaBoard 2kristine_nilsen_2Nessuna valutazione finora

- PCSE_WorkbookDocumento70 paginePCSE_WorkbookWilliam Ribeiro da SilvaNessuna valutazione finora

- Individual Sports Prelim ExamDocumento13 pagineIndividual Sports Prelim ExamTommy MarcelinoNessuna valutazione finora

- Human Resouse Accounting Nature and Its ApplicationsDocumento12 pagineHuman Resouse Accounting Nature and Its ApplicationsParas JainNessuna valutazione finora

- Driving Continuous Improvement by Developing and Leveraging Lean Key Performance IndicatorsDocumento10 pagineDriving Continuous Improvement by Developing and Leveraging Lean Key Performance IndicatorskellendadNessuna valutazione finora

- Machine Spindle Noses: 6 Bison - Bial S. ADocumento2 pagineMachine Spindle Noses: 6 Bison - Bial S. AshanehatfieldNessuna valutazione finora

- LON-Company-ENG 07 11 16Documento28 pagineLON-Company-ENG 07 11 16Zarko DramicaninNessuna valutazione finora

- Lecture 4Documento25 pagineLecture 4ptnyagortey91Nessuna valutazione finora

- Clean Agent ComparisonDocumento9 pagineClean Agent ComparisonJohn ANessuna valutazione finora

- WhatsoldDocumento141 pagineWhatsoldLuciana KarajalloNessuna valutazione finora

- Radio Theory: Frequency or AmplitudeDocumento11 pagineRadio Theory: Frequency or AmplitudeMoslem GrimaldiNessuna valutazione finora

- Lady Allen On Froebel Training School, Emdrup, CopenhagenDocumento5 pagineLady Allen On Froebel Training School, Emdrup, CopenhagenLifeinthemix_FroebelNessuna valutazione finora

- 00 CCSA TestDocumento276 pagine00 CCSA TestPedro CubillaNessuna valutazione finora

- Environmental Assessment of Sewer ConstructionDocumento32 pagineEnvironmental Assessment of Sewer ConstructionKaleab TadesseNessuna valutazione finora

- PC November 2012Documento50 paginePC November 2012bartekdidNessuna valutazione finora

- Inventarisasi Data Kondisi Jalan Ke Dalam Aplikasi Sistem Informasi Geografis (Sig)Documento10 pagineInventarisasi Data Kondisi Jalan Ke Dalam Aplikasi Sistem Informasi Geografis (Sig)Wiro SablengNessuna valutazione finora

- Obligations and Contracts Bar Questions and Answers PhilippinesDocumento3 pagineObligations and Contracts Bar Questions and Answers PhilippinesPearl Aude33% (3)

- Design and Analysis of Crankshaft ComponentsDocumento21 pagineDesign and Analysis of Crankshaft Componentssushant470% (1)

- Miami Police File The O'Nell Case - Clemen Gina D. BDocumento30 pagineMiami Police File The O'Nell Case - Clemen Gina D. Barda15biceNessuna valutazione finora

- Guidelines Tax Related DeclarationsDocumento16 pagineGuidelines Tax Related DeclarationsRaghul MuthuNessuna valutazione finora

- Identifying The TopicDocumento2 pagineIdentifying The TopicrioNessuna valutazione finora

- PA Inspection Guidelines For Single Site Acceptance: 1 © Nokia Siemens NetworksDocumento18 paginePA Inspection Guidelines For Single Site Acceptance: 1 © Nokia Siemens NetworksDenny WijayaNessuna valutazione finora

- Desert Power India 2050Documento231 pagineDesert Power India 2050suraj jhaNessuna valutazione finora

- What is zone refining processDocumento1 paginaWhat is zone refining processKeshav MadanNessuna valutazione finora

- Practice Like-Love - Hate and PronounsDocumento3 paginePractice Like-Love - Hate and PronounsangelinarojascnNessuna valutazione finora