Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CAPM Model Explained - Relationship of Risk & Return

Caricato da

Gautam ReddyDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CAPM Model Explained - Relationship of Risk & Return

Caricato da

Gautam ReddyCopyright:

Formati disponibili

Capital Asset Pricing Model - CAPM

A model that describes the relationship between risk and expected return and that is used in the pricing of risky securities.

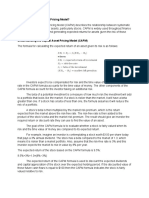

The general idea behind CAPM is that investors need to be compensated in two ways: time value of money and risk. The time value of money is represented by the risk-free (rf) rate in the formula and compensates the investors for placing money in any investment over a period of time. The other half of the formula represents risk and calculates the amount of compensation the investor needs for taking on additional risk. This is calculated by taking a risk measure (beta) that compares the returns of the asset to the market over a period of time and to the market premium (Rm-rf). The CAPM says that the expected return of a security or a portfolio equals the rate on a risk-free security plus a risk premium. If this expected return does not meet or beat the required return, then the investment should not be undertaken. The security market line plots the results of the CAPM for all different risks (betas). In finance, the capital asset pricing model (CAPM) is used to determine a theoretically appropriate required rate of return of an asset, if that asset is to be added to an already well-diversified portfolio, given that asset's non-diversifiable risk. The model takes into account the asset's sensitivity to nondiversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta () in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset. The model was introduced by Jack Treynor (1961, 1962), William Sharpe (1964), John Lintner(1965) and Jan Mossin (1966) independently, building on the earlier work of Harry Markowitz on diversification and modern portfolio theory. Sharpe, Markowitz and Merton Miller jointly received the Nobel Memorial Prize in Economics for this contribution to the field of financial economics. The CAPM is a model for pricing an individual security or a portfolio. For individual securities, we make use of the security market line (SML) and its relation to expected return and systematic risk (beta) to show how the market must price individual securities in relation to their security risk class. The SML enables us to calculate the reward-to-risk ratio for any security in relation to that of the overall market. Therefore, when the expected rate of return for any security is deflated by its beta coefficient, the rewardto-risk ratio for any individual security in the market is equal to the market reward-to-risk ratio, thus:

The market reward-to-risk ratio is effectively the market risk premium and by rearranging the above equation and solving for E(Ri), we obtain the Capital Asset Pricing Model (CAPM).

where:

is the expected return on the capital asset is the risk-free rate of interest such as interest arising from government bonds (the beta) is the sensitivity of the expected excess asset returns to the expected excess

market returns, or also

is the expected return of the market is sometimes known as the market premium (the difference between the expected market rate of return and the risk-free rate of return). is also known as the risk premium

Restated, in terms of risk premium, we find that:

which states that the individual risk premium equals the market premium times .

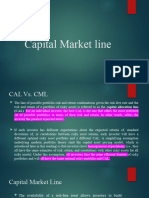

Security market line The SML essentially graphs the results from the capital asset pricing model (CAPM) formula. The x-axis represents the risk (beta), and the y-axis represents the expected return. The market risk premium is determined from the slope of the SML. The relationship between and required return is plotted on the securities market line (SML) which shows expected return as a function of . The intercept is the nominal risk-free rate available for the market, while the slope is the market premium, E(Rm) Rf. The securities market line can be regarded as representing a single-factor model of the asset price, where Beta is exposure to changes in value of the Market. The equation of the SML is thus:

It is a useful tool in determining if an asset being considered for a portfolio offers a reasonable expected return for risk. Individual securities are plotted on the SML graph. If the security's expected return versus risk is plotted above the SML, it is undervalued since the investor can expect a greater return for the inherent risk. And a security plotted below the SML is overvalued since the investor would be accepting less return for the amount of risk assumed.

Asset pricing Once the expected/required rate of return, E(Ri), is calculated using CAPM, we can compare this required rate of return to the asset's estimated rate of return over a specific investment horizon to determine whether it would be an appropriate investment. To make this comparison, you need an independent estimate of the return outlook for the security based on either fundamental or technical analysis techniques, including P/E, etc. Assuming that the CAPM is correct, an asset is correctly priced when its estimated price is the same as the present value of future cash flows of the asset, discounted at the rate suggested by CAPM. If the observed price is higher than the CAPM valuation, then the asset is undervalued (and overvalued when the estimated price is below the CAPM valuation).[2] When the asset does not lie on the SML, this could also suggest mis-pricing. Since the expected return of the asset at time t is , a higher expected return than what CAPM suggests indicates that Pt is too low (the asset is currently undervalued), assuming that at time t + 1 the asset returns to the CAPM suggested price.[3] The asset price P0 using CAPM, sometimes called the certainty equivalent pricing formula, is a linear relationship given by

where PT is the payoff of the asset or portfolio.

Arbitrage pricing theory

In finance, arbitrage pricing theory (APT) is a general theory of asset pricing that holds that the expected return of a financial asset can be modeled as a linear function of various macro-economic factors or theoretical market indices, where sensitivity to changes in each factor is represented by a factorspecific beta coefficient. The model-derived rate of return will then be used to price the asset correctly the asset price should equal the expected end of period price discounted at the rate implied by the model. If the price diverges, arbitrage should bring it back into line. The theory was proposed by the economist Stephen Ross in 1976. The APT model Risky asset returns are said to follow a factor structure if they can be expressed as:

where

aj is a constant for asset j Fk is a systematic factor bjk is the sensitivity of the jth asset to factor k, also called factor loading, and is the risky asset's idiosyncratic random shock with mean zero.

Idiosyncratic shocks are assumed to be uncorrelated across assets and uncorrelated with the factors. The APT states that if asset returns follow a factor structure then the following relation exists between expected returns and the factor sensitivities:

where

RPk is the risk premium of the factor, rf is the risk-free rate, That is, the expected return of an asset j is a linear function of the assets sensitivities to the n factors.

What is hedging? Hedging is the process of managing the risk of price changes in physical material by offsetting that risk in the futures market. Hedging can vary in complexity from a relatively simple activity, through to a highly complex strategies, including the use of options. The ability to hedge means that industry can decide on the amount of risk it is prepared to accept. It may wish to eliminate the risk entirely and can generally do so quickly and easily using the LME. Managing price risk means achieving greater control of either the cost of inputs, or revenues from sales, or both; planning for the future based on assured costs and revenues; and eliminating concerns that a sharply adverse move in the price of material could turn an otherwise flourishing and efficient business into a loss maker. Hedging by trade and industry is the opposite of speculation and is undertaken in order to eliminate an existing physical price risk, by taking a compensating position in the futures market. Speculators come to the futures market with no initial risk. They assume risk by taking futures positions. Hedgers reduce or eliminate the chance of further losses or profits, while the speculators risk losses in order to make profits. Before starting a hedging programme it is essential to assess the risk due to exposure to the price of physical material. Once the hedger has an understanding of the tools available at the LME, it is relatively easy to select the appropriate action to manage this risk. It is important that this action is properly managed at all times and that the appropriate controls and approval procedures are in place. Hedging means reducing or controlling risk. This is done by taking a position in the futures market that is opposite to the one in the physical market with the objective of reducing or limiting risks associated with price changes. Hedging is a two-step process. A gain or loss in the cash position due to changes in price levels will be countered by changes in the value of a futures position. For instance, a wheat farmer can sell wheat futures to protect the value of his crop prior to harvest. If there is a fall in price, the loss in the cash market position will be countered by a gain in futures position. How hedging is done In this type of transaction, the hedger tries to fix the price at a certain level with the objective of ensuring certainty in the cost of production or revenue of sale. The futures market also has substantial participation by speculators who take positions based on the price movement and bet upon it. Also, there are arbitrageurs who use this market to pocket profits whenever there are inefficiencies in the prices. However, they ensure that the prices of spot and futures remain correlated.

Potrebbero piacerti anche

- Capital Asset Pricing Model: Make smart investment decisions to build a strong portfolioDa EverandCapital Asset Pricing Model: Make smart investment decisions to build a strong portfolioValutazione: 4.5 su 5 stelle4.5/5 (3)

- Capital Asset Pricing ModelDocumento8 pagineCapital Asset Pricing ModelJanani RaniNessuna valutazione finora

- Capm 1 PDFDocumento8 pagineCapm 1 PDFAbhishek AroraNessuna valutazione finora

- CMPMDocumento8 pagineCMPMLarry DixonNessuna valutazione finora

- Capital Asset Pricing ModelDocumento8 pagineCapital Asset Pricing ModelashaarumugamNessuna valutazione finora

- Capital Asset Pricing Mode1Documento9 pagineCapital Asset Pricing Mode1Shaloo SidhuNessuna valutazione finora

- SAPMDocumento83 pagineSAPMSuchismitaghoseNessuna valutazione finora

- The Capital Asset Pricing ModelDocumento5 pagineThe Capital Asset Pricing ModelFaisal KhanNessuna valutazione finora

- Capital Asset Pricing ModelDocumento10 pagineCapital Asset Pricing Modeljackie555Nessuna valutazione finora

- CAPM Model ExplainedDocumento8 pagineCAPM Model ExplainedAshu158Nessuna valutazione finora

- On Capital Asset Pricing Model: Submitted byDocumento14 pagineOn Capital Asset Pricing Model: Submitted bybansiiboyNessuna valutazione finora

- What Does Modern Portfolio TheoryDocumento5 pagineWhat Does Modern Portfolio TheoryIlangeeranNessuna valutazione finora

- The Formula: Security Market Line Systematic RiskDocumento7 pagineThe Formula: Security Market Line Systematic RiskPrem Chand BhashkarNessuna valutazione finora

- Assignment#04Documento10 pagineAssignment#04irfanhaidersewagNessuna valutazione finora

- Capm-Apt Notes 2021Documento4 pagineCapm-Apt Notes 2021hardik jainNessuna valutazione finora

- Capital Asset Pricing Model IIIDocumento8 pagineCapital Asset Pricing Model III27usmanNessuna valutazione finora

- Pim Mod-VDocumento27 paginePim Mod-VAkhand RanaNessuna valutazione finora

- An Analysis of CAPMDocumento5 pagineAn Analysis of CAPMJenipher Carlos HosannaNessuna valutazione finora

- CAPM: A Theory of Risk and ReturnDocumento16 pagineCAPM: A Theory of Risk and ReturnAmandeep sainiNessuna valutazione finora

- Solution Manual For Capital Markets Institutions and Instruments 4th Edition Frank J Fabozzi Franco ModiglianiDocumento10 pagineSolution Manual For Capital Markets Institutions and Instruments 4th Edition Frank J Fabozzi Franco ModiglianiJonathanBradshawsmkc100% (42)

- Portfolio Long Ans QuestionDocumento5 paginePortfolio Long Ans QuestionAurora AcharyaNessuna valutazione finora

- Key TakeawaysDocumento19 pagineKey TakeawaysSamuel DebebeNessuna valutazione finora

- Investments Chapter 7Documento7 pagineInvestments Chapter 7b00812473Nessuna valutazione finora

- What Is The Capital Asset Pricing Model?Documento4 pagineWhat Is The Capital Asset Pricing Model?Klester Kim Sauro ZitaNessuna valutazione finora

- Equity Research & Stock Trading: (Professional Certificate Level - II - FIN)Documento10 pagineEquity Research & Stock Trading: (Professional Certificate Level - II - FIN)Switi AgrawalNessuna valutazione finora

- SHARPE SINGLE INDEX MODEL - HarryDocumento12 pagineSHARPE SINGLE INDEX MODEL - HarryEguanuku Harry EfeNessuna valutazione finora

- Portfolio Theories1Documento17 paginePortfolio Theories1ayazNessuna valutazione finora

- Analyzing the Capital Asset Pricing Model (CAPMDocumento12 pagineAnalyzing the Capital Asset Pricing Model (CAPMSimu MatharuNessuna valutazione finora

- Resume CH 7 - 0098 - 0326Documento5 pagineResume CH 7 - 0098 - 0326nur eka ayu danaNessuna valutazione finora

- CAPM Represented in The SMLDocumento3 pagineCAPM Represented in The SMLKarthik KNessuna valutazione finora

- Rangkuman Bab 9 Asset Pricing PrinciplesDocumento4 pagineRangkuman Bab 9 Asset Pricing Principlesindah oliviaNessuna valutazione finora

- Capital Asset Pricing Model and Modern Portfolio TheoryDocumento16 pagineCapital Asset Pricing Model and Modern Portfolio TheoryJemarie Mañgune SalacNessuna valutazione finora

- Sapm Unit 3Documento13 pagineSapm Unit 3pm2640047Nessuna valutazione finora

- Notes For The Review of The Capital Asset Pricing ModelDocumento8 pagineNotes For The Review of The Capital Asset Pricing ModelJeremiah KhongNessuna valutazione finora

- What Does Capital Asset Pricing Model - CAPM Mean?Documento6 pagineWhat Does Capital Asset Pricing Model - CAPM Mean?nagendraMBANessuna valutazione finora

- Capital Asset Pricing ModelDocumento24 pagineCapital Asset Pricing ModelBrij MohanNessuna valutazione finora

- Capital Market TheoryDocumento25 pagineCapital Market Theoryiqra sarfarazNessuna valutazione finora

- Module 2 CAPMDocumento11 pagineModule 2 CAPMTanvi DevadigaNessuna valutazione finora

- Lecture 28 PDFDocumento13 pagineLecture 28 PDFAlson BenhuraNessuna valutazione finora

- CAPM & APT Theory Guide to Capital Asset Pricing & Arbitrage ModelsDocumento23 pagineCAPM & APT Theory Guide to Capital Asset Pricing & Arbitrage ModelsBhakti Bhushan MishraNessuna valutazione finora

- Capital Asset Pricing Model: Watan YarDocumento17 pagineCapital Asset Pricing Model: Watan YarAmeer B. BalochNessuna valutazione finora

- PM Model Explains Security Pricing Using SML & CAPMDocumento2 paginePM Model Explains Security Pricing Using SML & CAPMGajanan JagtapNessuna valutazione finora

- Arbitrage Pricing TheoryDocumento4 pagineArbitrage Pricing TheoryShabbir NadafNessuna valutazione finora

- Capital Asset Pricing Model (CAPM)Documento25 pagineCapital Asset Pricing Model (CAPM)ktkalai selviNessuna valutazione finora

- How CAPM Helps Calculate Investment Risk and Expected ReturnsDocumento7 pagineHow CAPM Helps Calculate Investment Risk and Expected ReturnsVaishali ShuklaNessuna valutazione finora

- 4 Equilbrium in Capital MarketsDocumento18 pagine4 Equilbrium in Capital MarketsESTHERNessuna valutazione finora

- Arbitrage Pricing Theory, CAPMDocumento11 pagineArbitrage Pricing Theory, CAPMMazhar HossainNessuna valutazione finora

- Security Market LineDocumento5 pagineSecurity Market LineHAFIAZ MUHAMMAD IMTIAZ100% (1)

- 3.2 Capital Asset Pricing Model (CAPM)Documento10 pagine3.2 Capital Asset Pricing Model (CAPM)Rajarshi DaharwalNessuna valutazione finora

- Sapm Work NotesDocumento138 pagineSapm Work NotesShaliniNessuna valutazione finora

- Malinab Aira Bsba FM 2-2 Activity 3 Finman 1Documento4 pagineMalinab Aira Bsba FM 2-2 Activity 3 Finman 1Aira MalinabNessuna valutazione finora

- 2lecture-6 CML.Documento32 pagine2lecture-6 CML.Habiba BiboNessuna valutazione finora

- Perf Assignment 1Documento7 paginePerf Assignment 1Blessed NyamaNessuna valutazione finora

- Saim Unit 3 & Unit 4 NotesDocumento9 pagineSaim Unit 3 & Unit 4 NotesSantosh MaheshwariNessuna valutazione finora

- E (R) Is Expected Return On Capital Asset R: Security Market LineDocumento3 pagineE (R) Is Expected Return On Capital Asset R: Security Market LineAvinash AstyaNessuna valutazione finora

- Corporate Finance A Focused Approach 6th Edition Ehrhardt Solutions Manual 1Documento32 pagineCorporate Finance A Focused Approach 6th Edition Ehrhardt Solutions Manual 1phyllis100% (31)

- Capital Asset Pricing Model (CAPM) : by Himani GrewalDocumento48 pagineCapital Asset Pricing Model (CAPM) : by Himani Grewalshekhar_anand1235807Nessuna valutazione finora

- Critically evaluate the assumptions of CAPM modelDocumento4 pagineCritically evaluate the assumptions of CAPM modelRAVI RAUSHAN JHANessuna valutazione finora

- C A P M: Apital Sset Ricing OdelDocumento14 pagineC A P M: Apital Sset Ricing OdelInvisible CionNessuna valutazione finora

- Financial Management Theory and Practice 15Th Edition Brigham Solutions Manual Full Chapter PDFDocumento36 pagineFinancial Management Theory and Practice 15Th Edition Brigham Solutions Manual Full Chapter PDFchristopher.ridgeway589100% (10)

- IFRS Vs US GAAPDocumento5 pagineIFRS Vs US GAAPtibebu5420Nessuna valutazione finora

- 500 Practice Questions For BRBL PaperDocumento89 pagine500 Practice Questions For BRBL PaperJyoti LahaneNessuna valutazione finora

- True or False Conceptual Framework Set 2Documento2 pagineTrue or False Conceptual Framework Set 2Demi Pardillo100% (1)

- Reviewer For AccountingDocumento8 pagineReviewer For AccountingAnnie RapanutNessuna valutazione finora

- CFP Revenue:: (Amounts in Thousands, Except Per Unit Prices and Monthly Subscription Prices)Documento3 pagineCFP Revenue:: (Amounts in Thousands, Except Per Unit Prices and Monthly Subscription Prices)Shubham SharmaNessuna valutazione finora

- FY20Documento154 pagineFY20city OfficeNessuna valutazione finora

- P7Documento2 pagineP7Andreas Brown0% (1)

- Accounting For Corporations IIDocumento25 pagineAccounting For Corporations IIibrahim mohamedNessuna valutazione finora

- Homework 7Documento3 pagineHomework 7Ei AiNessuna valutazione finora

- R - Monte Carlo - NPV Examples OutlineDocumento13 pagineR - Monte Carlo - NPV Examples OutlineRisk WisdomNessuna valutazione finora

- Mapping Matrik PenelitianDocumento2 pagineMapping Matrik PenelitianKatarina BernardaNessuna valutazione finora

- Nucleon Inc Case Study SolutionDocumento19 pagineNucleon Inc Case Study Solutioncriric.bNessuna valutazione finora

- Executive Summary: Financial AnalysisDocumento67 pagineExecutive Summary: Financial AnalysisSachin JainNessuna valutazione finora

- Emirates Integrated Telecommunications Company PJSC and Its Subsidiaries Consolidated Financial Statements For The Year Ended 31 December 2020Documento70 pagineEmirates Integrated Telecommunications Company PJSC and Its Subsidiaries Consolidated Financial Statements For The Year Ended 31 December 2020Vanshita SharmaNessuna valutazione finora

- Amk 1Documento4 pagineAmk 1rykaNessuna valutazione finora

- Monitoring Yields for Forex SignalsDocumento9 pagineMonitoring Yields for Forex SignalsKasjan MarksNessuna valutazione finora

- Chapter 9Documento39 pagineChapter 9Thảo Thiên ChiNessuna valutazione finora

- FIN 500 Mod6 Assignment6 InstructionDocumento6 pagineFIN 500 Mod6 Assignment6 InstructionalannorainNessuna valutazione finora

- JSW SteelDocumento34 pagineJSW SteelShashank PatelNessuna valutazione finora

- AU-Vanguard Personal Investor Investment MenuDocumento12 pagineAU-Vanguard Personal Investor Investment MenuNick KNessuna valutazione finora

- Stockholder's EquityDocumento8 pagineStockholder's EquityKaila stinerNessuna valutazione finora

- L5-Evaluating A Single Project - FullDocumento59 pagineL5-Evaluating A Single Project - FullHarsh ShahNessuna valutazione finora

- Perception of Investors Towards Indian Commodity Derivative Market With Inferential Analysis in Chennai CityDocumento10 paginePerception of Investors Towards Indian Commodity Derivative Market With Inferential Analysis in Chennai CitySanjay KamathNessuna valutazione finora

- Capital Budgetting Multiple ChoiceDocumento24 pagineCapital Budgetting Multiple ChoiceMaryane Angela67% (3)

- Financial ManagementDocumento31 pagineFinancial ManagementShashikant MishraNessuna valutazione finora

- PAPER F3 Financial StrategyDocumento3 paginePAPER F3 Financial StrategyIzzawah YawNessuna valutazione finora

- Jawaban Contoh Soal PA 2Documento8 pagineJawaban Contoh Soal PA 2Radinne Fakhri Al WafaNessuna valutazione finora

- Temporal Rate Method Balance Sheet AssetsDocumento3 pagineTemporal Rate Method Balance Sheet Assetslinda daibesNessuna valutazione finora

- HHH-111 Risk Assessment 05Documento6 pagineHHH-111 Risk Assessment 05hassanNessuna valutazione finora

- Technical Rooms DetailDocumento24 pagineTechnical Rooms Detailconsultnadeem70Nessuna valutazione finora

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Product-Led Growth: How to Build a Product That Sells ItselfDa EverandProduct-Led Growth: How to Build a Product That Sells ItselfValutazione: 5 su 5 stelle5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsDa EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNessuna valutazione finora

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Da EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Valutazione: 4.5 su 5 stelle4.5/5 (86)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (34)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthDa EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNessuna valutazione finora

- Note Brokering for Profit: Your Complete Work At Home Success ManualDa EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNessuna valutazione finora

- Connected Planning: A Playbook for Agile Decision MakingDa EverandConnected Planning: A Playbook for Agile Decision MakingNessuna valutazione finora

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorDa EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNessuna valutazione finora

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 5 su 5 stelle5/5 (2)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionDa EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionValutazione: 5 su 5 stelle5/5 (1)