Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Alt Inc Fund Nov 2011

Caricato da

Bill HallmanDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Alt Inc Fund Nov 2011

Caricato da

Bill HallmanCopyright:

Formati disponibili

G.I.

Alternative Income Strategy November 2011

GI Capital

G.I. Alternative Income Strategy

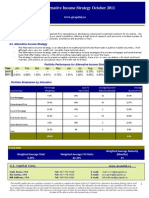

The Alternative Income Strategy is an alternative to traditional bond funds, which although carry very low credit risk, currently have minimal return; and to equity funds that exhibit high volatility. The Alternative Income Strategy seeks to invest in alternative income strategies like private mortgages and asset backed loans that offer higher returns, while still providing reasonable security to cover the loans. The strategys objectives are to preserve capital, minimize volatility, have a low or zero correlation with stock and bond markets, and achieve an annualized return of 8-10% net of all fees.

Portfolio Performance for Alternative Income Strategy

Year 2010 2011 Jan -0.63% Feb -0.68% Mar -1.33% Apr -0.91% May -0.72% Jun -1.91% Jul 0.84% 1.26% Aug 0.78% 0.93% Sep 0.87% 0.90% Oct 0.80% 1.11% Nov 0.83% 0.83% Dec 0.54% YTD 4.75% 11.79%

Property by Classification 5% 19% 26% 40% 10%

Residential Hospitality Retail Mixed Use Self Storage

*Note: The property classifications only apply to real estate holdings.

Portfolio Breakdown by Allocation

Loan To Value Ratio 66% 65% 72% n.a. 50% 0% 0% 65.57% Average Expected Maturity (Months) 31 30 21 41 1 11 0 25.36 Average

Expected

Security Type First Mortgage Subordinated First Second Mortgage Real Estate Equity Asset Backed Loans

Percentage Weighting 4% 44% 18% 16% 7% 8% 3% 100.0%

Yield 14% 12% 10% 10% 12% 15% 0% 10.8%

Property by Location 10% 30% 40% 9% 10%

Distressed Debt Cash Total/Weighted AVG

AB BC ON QC USA

FEATURE INVESTMENT

Subordinated First Mortgage, Condos, Montreal:

This is an inventory loan on a condo project in downtown Montreal. The total loan is $10.7 million and our piece of the first mortgage sits between 37% and 46% on a loan to value ratio. However, the developer has pre-sales on 56% of the condo units for $10.6 million, of which $7.4 million is expected to close within 4 months of advancing the mortgage. Once these units close, the funds will be used to pay down the priority piece of the first mortgage, which will bring the loan to value ratio on our subordinated piece down to 21%. There is also 21,000 square feet of commercial space attached to the project that is under contract for sale. The proceeds of this will also go to reduce the priority piece of the loan bringing the leverage and the LTV down even further, or pay it off completely. The loan is for 12 months and the interest rate is 13.5%. The developer is very experienced with over 20 years of real estate development experience, and has given a personal guarantee on the loan.

*Note: The property locations only apply to real estate holdings.

Service Providers

Custodian (for Fund) Administrator Legal Auditor Custodian (for Managed Accounts) TD Waterhouse

G.I. Capital Corp.

3625 Dufferin St. Suite 340 Toronto, Ontario M3K 1Z2

Mark Irwin, CFA 647-776-4028 mark.irwin@gicapital.ca

Jim Goren, CFA 647-776-4029 jim.goren@gicapital.ca

Bill Hallman, CFA 905-510-0963 bill.hallman@gicapital.ca

G.I. Capital Corp. (GI) is a wealth management firm specializing in developing customized investment solutions for its clients. We are a boutique firm focused on managing our clients portfolios, offering a high level of research and service to a limited number of clients. Our client base consists of professionals, executives and business owners. Visit us at www.gicapital.ca

This monthly update does not constitute or purport to constitute a complete description of the G.I. Capital Corp. Alternative Investment Strategy and is in all respects subject to the more detailed provisions found in the fund's declaration of trust. The Alternative Income Strategy is only available to GI clients who have engaged GI to manage their account under the alternative income mandate as outlined in their investment policy statement. The returns above are net of all fees, other than management fees. The references to the target rates of return are provided for illustrative purposes only and there can be no assurance that the fund will be able to achieve the targeted rates of return.

Potrebbero piacerti anche

- Real Estate Community Digital Guide Book 3RD EditionDa EverandReal Estate Community Digital Guide Book 3RD EditionNessuna valutazione finora

- Alt Inc Fund Jan 2012Documento1 paginaAlt Inc Fund Jan 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund Feb 2012Documento1 paginaAlt Inc Fund Feb 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund June 2012Documento1 paginaAlt Inc Fund June 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund May 2012Documento1 paginaAlt Inc Fund May 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund Mar 2012Documento1 paginaAlt Inc Fund Mar 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund Sept 2012Documento1 paginaAlt Inc Fund Sept 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund Nov 2012Documento1 paginaAlt Inc Fund Nov 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund Apr 2012Documento1 paginaAlt Inc Fund Apr 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund Feb 2013 - FinalDocumento1 paginaAlt Inc Fund Feb 2013 - FinalBill HallmanNessuna valutazione finora

- Alt Inc Fund July 2012Documento1 paginaAlt Inc Fund July 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund May 2013Documento1 paginaAlt Inc Fund May 2013Bill HallmanNessuna valutazione finora

- Alt Inc Fund Sep 2011Documento1 paginaAlt Inc Fund Sep 2011Bill HallmanNessuna valutazione finora

- Alt Inc Fund Aug 2011Documento1 paginaAlt Inc Fund Aug 2011Bill HallmanNessuna valutazione finora

- Alt Inc Fund June 2011Documento1 paginaAlt Inc Fund June 2011Bill HallmanNessuna valutazione finora

- Alt Inc Fund Oct 2011Documento1 paginaAlt Inc Fund Oct 2011Bill HallmanNessuna valutazione finora

- Alt Inc Fund July 2011Documento1 paginaAlt Inc Fund July 2011Bill HallmanNessuna valutazione finora

- Alt Hedge Strategies May 2013Documento1 paginaAlt Hedge Strategies May 2013Bill HallmanNessuna valutazione finora

- Citigroup Inc: Stock Report - May 7, 2016 - NYS Symbol: C - C Is in The S&P 500Documento11 pagineCitigroup Inc: Stock Report - May 7, 2016 - NYS Symbol: C - C Is in The S&P 500Luis Fernando EscobarNessuna valutazione finora

- Zillow Group Q3'21 Shareholder LetterDocumento20 pagineZillow Group Q3'21 Shareholder LetterGeekWireNessuna valutazione finora

- Financial Metrics: Whether Your Product Solves A Key Customer NeedDocumento4 pagineFinancial Metrics: Whether Your Product Solves A Key Customer NeedS RNessuna valutazione finora

- JPMorgan Global Investment Banks 2010-09-08Documento176 pagineJPMorgan Global Investment Banks 2010-09-08francoib991905Nessuna valutazione finora

- 2012 11 13 Cyn Bofa-Ml Slides FinalDocumento37 pagine2012 11 13 Cyn Bofa-Ml Slides FinalrgosaliaNessuna valutazione finora

- 2011 Annual ReportDocumento162 pagine2011 Annual ReportNooreza PeerooNessuna valutazione finora

- Bac Zack HoldDocumento9 pagineBac Zack HoldsinnlosNessuna valutazione finora

- ProjDocumento46 pagineProjRafi KhanNessuna valutazione finora

- Home Capital Group Initiating Coverage (HCG-T)Documento68 pagineHome Capital Group Initiating Coverage (HCG-T)Zee MaqsoodNessuna valutazione finora

- Business PlanDocumento21 pagineBusiness Plankrunal joshiNessuna valutazione finora

- Gad Partner 1Q-2012Documento8 pagineGad Partner 1Q-2012Sww WisdomNessuna valutazione finora

- Equity Pag LNDocumento4 pagineEquity Pag LNFabrizio De NotarisNessuna valutazione finora

- Sample Investment ReportDocumento27 pagineSample Investment ReportMs.WhatnotNessuna valutazione finora

- Top 10 Tips Web ReadyDocumento29 pagineTop 10 Tips Web ReadyAnonymous 0B3LJYoTNessuna valutazione finora

- Study of ICICI Home LoansDocumento107 pagineStudy of ICICI Home LoansMukesh AwasthiNessuna valutazione finora

- Think FundsIndia August 2014Documento8 pagineThink FundsIndia August 2014marketingNessuna valutazione finora

- Donnan-Exh 6, Exh 7, Exh 8, Exh 9, Exh 10Documento21 pagineDonnan-Exh 6, Exh 7, Exh 8, Exh 9, Exh 10Southern Free PressNessuna valutazione finora

- Trestle Creek Cabinets ProposalDocumento3 pagineTrestle Creek Cabinets ProposalGirum Abebe0% (1)

- RE 01 09 Hotel Acquisition Renovation SolutionsDocumento7 pagineRE 01 09 Hotel Acquisition Renovation SolutionsAnonymous bf1cFDuepPNessuna valutazione finora

- Marketing and Design PortfolioDocumento33 pagineMarketing and Design PortfolioMelissa YorkNessuna valutazione finora

- Investors' Behaviour in Real Estate: Realized by Jad EL BOUSTANI (B00153448)Documento7 pagineInvestors' Behaviour in Real Estate: Realized by Jad EL BOUSTANI (B00153448)Jad G. BoustaniNessuna valutazione finora

- Ubben ValueInvestingCongress 100212Documento27 pagineUbben ValueInvestingCongress 100212VALUEWALK LLC100% (1)

- For Business OwnersDocumento24 pagineFor Business Ownerskeithn3514Nessuna valutazione finora

- Finamn 1Documento11 pagineFinamn 1michean mabaoNessuna valutazione finora

- Singapore Property Weekly Issue 284Documento11 pagineSingapore Property Weekly Issue 284Propwise.sgNessuna valutazione finora

- Citi Third Quarter 2013 Earnings Review: October 15, 2013Documento26 pagineCiti Third Quarter 2013 Earnings Review: October 15, 2013Mark ReinhardtNessuna valutazione finora

- The Vilas Fund LP - Quarterly Letter Q4 2017 v1Documento6 pagineThe Vilas Fund LP - Quarterly Letter Q4 2017 v1Michael BenzingerNessuna valutazione finora

- UPD Bond BrochureDocumento24 pagineUPD Bond BrochureRobert PiechotaNessuna valutazione finora

- Midyear Outlook: Five Distinct Macro Disconnects: InsightsDocumento28 pagineMidyear Outlook: Five Distinct Macro Disconnects: Insightsastefan1Nessuna valutazione finora

- Corn Private Wealth Program1Documento11 pagineCorn Private Wealth Program1Jeff CrawfordNessuna valutazione finora

- 5.1 Receivable ManagementDocumento18 pagine5.1 Receivable ManagementJoshua Cabinas100% (1)

- Ar14c enDocumento327 pagineAr14c enPinaki MishraNessuna valutazione finora

- Bam q2 2015 LTR To ShareholdersDocumento6 pagineBam q2 2015 LTR To ShareholdersDan-S. ErmicioiNessuna valutazione finora

- Embargo - Exhibit 99.3 FinalDocumento20 pagineEmbargo - Exhibit 99.3 FinalABC Action NewsNessuna valutazione finora

- Carlyle Model Interview Test - InstructionsDocumento2 pagineCarlyle Model Interview Test - Instructionsjorgeetcheverria100% (1)

- Citi Fourth Quarter 2013 Earnings Review: January 16, 2014Documento30 pagineCiti Fourth Quarter 2013 Earnings Review: January 16, 2014Mark ReinhardtNessuna valutazione finora

- QuestionsDocumento30 pagineQuestionsArra VillanuevaNessuna valutazione finora

- Ar07c enDocumento8 pagineAr07c enMark ReinhardtNessuna valutazione finora

- Bond Investment Project Fixed Income Investment Analysis Fin 123 (Y) Submitted To: Roger Sy Siong Kiao, Phd. February 27, 2015Documento15 pagineBond Investment Project Fixed Income Investment Analysis Fin 123 (Y) Submitted To: Roger Sy Siong Kiao, Phd. February 27, 2015Nicole PTNessuna valutazione finora

- Annual Report BlueNile 2007Documento72 pagineAnnual Report BlueNile 2007Simon-Peter NötzelNessuna valutazione finora

- DreamerTopia Investments LPDocumento21 pagineDreamerTopia Investments LPDonald Alan Kernan Jr.Nessuna valutazione finora

- Citi Second Quarter 2014 Earnings Review: July 14, 2014Documento28 pagineCiti Second Quarter 2014 Earnings Review: July 14, 2014Mark ReinhardtNessuna valutazione finora

- Alt Inc Fund Feb 2013 - FinalDocumento1 paginaAlt Inc Fund Feb 2013 - FinalBill HallmanNessuna valutazione finora

- Alt Inc Fund Sept 2012Documento1 paginaAlt Inc Fund Sept 2012Bill HallmanNessuna valutazione finora

- Alt Hedge Strategies May 2013Documento1 paginaAlt Hedge Strategies May 2013Bill HallmanNessuna valutazione finora

- Alt Inc Fund May 2013Documento1 paginaAlt Inc Fund May 2013Bill HallmanNessuna valutazione finora

- Alt Inc Fund Nov 2012Documento1 paginaAlt Inc Fund Nov 2012Bill HallmanNessuna valutazione finora

- Alt Hedge Strategies August 2012Documento1 paginaAlt Hedge Strategies August 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund July 2012Documento1 paginaAlt Inc Fund July 2012Bill HallmanNessuna valutazione finora

- GI Report May 2012Documento3 pagineGI Report May 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund Oct 2011Documento1 paginaAlt Inc Fund Oct 2011Bill HallmanNessuna valutazione finora

- Alt Inc Fund Apr 2012Documento1 paginaAlt Inc Fund Apr 2012Bill HallmanNessuna valutazione finora

- GI Report January 2012Documento3 pagineGI Report January 2012Bill HallmanNessuna valutazione finora

- GI Report February 2012Documento3 pagineGI Report February 2012Bill HallmanNessuna valutazione finora

- Alt Inc Fund Aug 2011Documento1 paginaAlt Inc Fund Aug 2011Bill HallmanNessuna valutazione finora

- Alt Inc Fund Sep 2011Documento1 paginaAlt Inc Fund Sep 2011Bill HallmanNessuna valutazione finora

- Alt Inc Fund June 2011Documento1 paginaAlt Inc Fund June 2011Bill HallmanNessuna valutazione finora

- Alt Inc Fund July 2011Documento1 paginaAlt Inc Fund July 2011Bill HallmanNessuna valutazione finora

- Intercompany TransactionsDocumento5 pagineIntercompany TransactionsJessica IslaNessuna valutazione finora

- Effect of Micro-Finance On PovertyDocumento18 pagineEffect of Micro-Finance On PovertyKarim KhaledNessuna valutazione finora

- Gold Quarterly ReportDocumento43 pagineGold Quarterly ReportLavanya SubramaniamNessuna valutazione finora

- 911 BIZ201 Assessment 3 Student WorkbookDocumento7 pagine911 BIZ201 Assessment 3 Student WorkbookAkshita ChordiaNessuna valutazione finora

- Acc 702 Assignment 2Documento10 pagineAcc 702 Assignment 2laukkeasNessuna valutazione finora

- Consolidated Statement: DepositsDocumento6 pagineConsolidated Statement: DepositsVivekNessuna valutazione finora

- FM TestDocumento5 pagineFM TestSamir JainNessuna valutazione finora

- What Does The Word BIBLE Mean Rev 1Documento1 paginaWhat Does The Word BIBLE Mean Rev 1Kurozato CandyNessuna valutazione finora

- T-Bills: Abhishek Sinha (CSM 1001) Anand Sachdeva (CSM 1002) Pramod Singh (CSM 1013) Saurabh Shukla (CSM 1019)Documento14 pagineT-Bills: Abhishek Sinha (CSM 1001) Anand Sachdeva (CSM 1002) Pramod Singh (CSM 1013) Saurabh Shukla (CSM 1019)anandsachsNessuna valutazione finora

- Customer Perception Towards Mutual FundsDocumento63 pagineCustomer Perception Towards Mutual FundsMT RA100% (1)

- 09 - Chapter 3Documento34 pagine09 - Chapter 3Aakash SonarNessuna valutazione finora

- Seller Finance Real EstateDocumento68 pagineSeller Finance Real EstateChris Goff67% (3)

- NCE - Specimen Audit Report March 2020Documento4 pagineNCE - Specimen Audit Report March 2020damancaNessuna valutazione finora

- CFO1Documento6 pagineCFO1vivekNessuna valutazione finora

- DividendsDocumento28 pagineDividendsSamantha Islam100% (2)

- R. Wadiwala: Morning NotesDocumento7 pagineR. Wadiwala: Morning NotesRWadiwala SecNessuna valutazione finora

- Assurance - Md. Raghib Ahsan FCADocumento94 pagineAssurance - Md. Raghib Ahsan FCAShahid MahmudNessuna valutazione finora

- Trading Chart PatternsDocumento32 pagineTrading Chart Patternsadewaleadeshina8957100% (1)

- Portfolio ConstructionDocumento15 paginePortfolio ConstructionParul GuptaNessuna valutazione finora

- True / False Questions: Accounting in BusinessDocumento101 pagineTrue / False Questions: Accounting in BusinesskiomeNessuna valutazione finora

- Tata Steel Key Financial Ratios, Tata Steel Financial Statement & AccountsDocumento3 pagineTata Steel Key Financial Ratios, Tata Steel Financial Statement & Accountsmohan chouriwarNessuna valutazione finora

- 91 Paculdo Vs RegaladoDocumento2 pagine91 Paculdo Vs RegaladoMichael John Duavit Congress OfficeNessuna valutazione finora

- Diploma in Islamic Banking Examination, October-2021 Part-I 101: Alternative Financial System Time: 3 Hours Full Marks: 100 Pass Marks: 45Documento9 pagineDiploma in Islamic Banking Examination, October-2021 Part-I 101: Alternative Financial System Time: 3 Hours Full Marks: 100 Pass Marks: 45saminNessuna valutazione finora

- Mining Services: An Overview of SRK's Services To The Global Mining IndustryDocumento40 pagineMining Services: An Overview of SRK's Services To The Global Mining IndustryUmesh Shanmugam100% (1)

- Leveraged BuyoutDocumento8 pagineLeveraged Buyoutmanoraman0% (1)

- Audit Testbank PDFDocumento76 pagineAudit Testbank PDFEdison L. ChuNessuna valutazione finora

- MCQ Chap 4Documento6 pagineMCQ Chap 4Diệu QuỳnhNessuna valutazione finora

- Account Statement From 1 Jun 2020 To 10 Jun 2020: TXN Date Value Description Ref No./Cheque Debit Credit Balance Date NoDocumento2 pagineAccount Statement From 1 Jun 2020 To 10 Jun 2020: TXN Date Value Description Ref No./Cheque Debit Credit Balance Date NonKajaNessuna valutazione finora

- Food &beverage Operations Management: AssignmentDocumento33 pagineFood &beverage Operations Management: AssignmentIanc Florin100% (1)