Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

John M Case Exhibits

Caricato da

Michael ConnorsCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

John M Case Exhibits

Caricato da

Michael ConnorsCopyright:

Formati disponibili

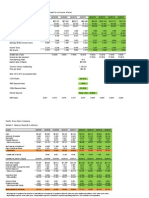

Exhibit 1 Consolidated Income Statements, 1980 - 1984 ($ 000s)

Exhibit 1

Consolidated Income Statements, 1980 - 1984 ($ 000s)

1980

1981

1982

1983

1984

Net sales

9,740

10,044

11,948

13,970

15,260

Cost of sales

5,836

5,648

6,994

8,304

9,298

Gross profit on sales

3,904

4,396

4,954

5,666

5,962

Selling and admin. expenses

2,216

2,072

2,470

3,022

3,274

40

108

70

128

120

1,728

2,432

2,554

2,772

2,808

Federal income taxes

816

972

920

942

842

Net profit

912

1,460

1,634

1,830

1,966

Other income and (expense), net

Profit before income taxes

Exhibit 2

Consolidated Balance Sheet as of December 31, 1984

ASSETS

LIABILITIES & SHAREHOLDERS EQUITY

Current assets:

Current liabilities

Cash and marketable securities

5,762

Accounts payable

654

Accounts receivable

2,540

Accrued expenses

366

Accrued income taxes

246

Inventories at lower cost or market

588

Prepaid expenses

108

Total current assets

Property,plant, & equipment, net

Miscellaneous assets

Total current liabilities

1,266

8,998

Common stock ($1.00 par value)

2,110

Retained profits

9,716

Shareholders' equity

9,916

74

200

Total liability and

Total assets:

11,182

shareholders' equity

11,182

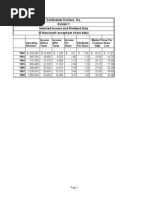

Exhibit 3 Ten-Year Summary of Operations, 1975 - 1984 ($ 000, except per share data)

1975

1976

1977

1978

1979

1980

1981

1982

1983

Net sales

7,688

8,356

8,526

8,790

9,350

9,740 10,044

11,948

13,970

Net profit

638

668

742

748

758

912

1,460

1,634

1,966

Dividends

600

200

280

280

440

440

480

1,220

1,480

3.19

3.34

3.71

3.74

3.79

4.56

7.3

8.17

9.83

Earnings per share ($)

Net profit margin

Exhibit 4

8.30% 8.00% 8.70% 8.50% 8.10% 9.40% 14.50% 13.70% 12.90%

Monthly Working Capital Balances, 1984 ($ 000s)

Jan.

Feb.

Mar.

Apr.

May

Jun.

Jul.

Cash

5,536

5,714

5,396

4,784

4,328

4,098

2,354

Accounts Receivable

1,480

760

734

804

718

604

Inventories

1,124

1,666

2,210

2,752

3,294

Current Liabilities

1,186

1,220

1,242

1,146

Net Working Capital

6,954

6,920

7,098

7,194

Aug.

Sep.

Oct.

Nov.

Dec.

766

2,050

3,830

5,734

5,762

3,432

6,104

6,164

4,322

2,398

2,540

3,838

2,754

1,670

526

588

608

588

1,422

1,344

1,072

1,216

1,174

1,384

1,340

1,266

6,918

7,196

7,468

7,324

7,566

7,356

7,400

7,624

Exhibit 5

Comparative Data on Selected Companies in Related Lines of Business

Standard &

Poor's 425

Industrial Stocks

Standard & Poor's

Publishing

Averages

DeLuther, Inc.*

Trading market

Wakefield Co.**

OTC

Current market price

OTC

$22.25

Indicated dividend yield

John M. Case

Company

Officomp, Inc.***

OTC

$14.75

---

$29.25

---

5.50%

8.70%

3.70%

---

Price-earning ratio

1984

9.9

14.6

8.7

7.2

10.5

---

1983

11.8

19.6

6.4

10.2

---

1982

10.4

14.4

10.8

11.9

13.8

---

1984

$24.625-16.25

$14.125-8.125

$33.125-26.5

1983

$18.5-12.125

$11.5-5.125

$19.75-12.875

Price range

Earnings per share (E)($) and Index(I)

(E)

(I)

(E)

(I)

(E)

(I)

(E)

(I)

1984

$2.48

110

$1.62

82

$2.98

177

$9.83

216

1980

$2.26

100

$1.97

100

$1.68

100

$4.56

100

Sales (S)($000s) and Index (I)

(S)

(I)

(S)

(I)

(S)

(I)

(S)

(I)

1984

$16,427

142

$12,223

108

$18,608

160

$15,260

157

1980

$11,568

100

$11,317

100

$11,630

100

$9,740

100

Net earnings (N)($000s) and Index (I)

(N)

(I)

(N)

(I)

(N)

(I)

(N)

(I)

1984

$1,051

117

$501

84

$1,656

178

$1,966

216

1980

$902

100

$600

100

$930

100

$912

100

1984

6.40%

4.10%

8.90%

12.90%

1980

7.80%

5.30%

8.00%

9.40%

1984

16.60%

6.00%

16.90%

19.80%

1983

14.20%

5.70%

15.00%

19.00%

1982

15.40%

8.80%

14.70%

19.20%

Net profit margins

Profit/Net worth

Book capitalization ($000s)****

Long-term debt

$3,995 ######

$1,882

18%

$4,173

29.90%

Common stock and surplus

$6,318 ######

$8,298

82%

$9,783

70.10%

$9,916

100%

$10,313 ######

$10,180

100%

$13,956

100.00%

$9,916

100%

Total

Total market value

$9,456

Shares outstanding

* Producer of desk-top accessories, advertising specialty calendars, office stationery.

** Producer of advertising specialty calendars

*** Producer of broad line of office paper products and desk accessories

**** All companies, December 31, 1984

425

$4,573

310

$16,234

555

---

--200

---

exhibit 7

Exhibit 7 Cash Flow Forecasts 1985-1990 ($000s)

Net sales

Earnings before interest and taxes*

Interest expense**

Profit before tax

Taxes

Profit after tax

Add back: noncash charges

Cash flow from operations

Less: increase in working capital

Less: capital expenditures

Available for debt retirement

1985

1986

1987

1988

1989

1990

16,024

3,433

1,675

1,758

274

1,484

240

1,724

156

120

1,448

$16,844

3,640

1,538

2,102

364

1,738

260

1,998

162

134

1,702

$17,686

3,757

1,369

2,388

440

1,948

284

2,232

170

142

1,920

$18,570

3,608

908

2,700

556

2,144

300

2,444

180

150

2,114

$19,498

3,788

800

2,988

660

2,328

310

2,638

190

466

1,982

$20,472

3,976

800

3,176

714

2,462

340

2,802

200

600

2,002

1,448

0

0

89%

1,702

0

0

80%

1,920

0

0

70%

930

1,184

0

58%

0

4766***

0

47%

2,002

0

0

35%

Planned debt retirement:

Bank loan

Mr. Case's loan

Subordinated loan

Debt as % of total capital

* Reflects elimination of Mr. Case's salary.

** 9% coupon on subordinated loan of $6 million; 4% coupon on sellers note of $6 million; 12%

rate on bank term loan; 10% rate on seasonal loan.

*** Mr. Case's note is retired from cash flow and a $2.8 million new bank term loan in 1989.

Page 5

Potrebbero piacerti anche

- Hope Foundation ConstitutionDocumento10 pagineHope Foundation Constitutionapi-29487204050% (2)

- Financial Analysis of Bata BangladeshDocumento20 pagineFinancial Analysis of Bata BangladeshSajeed Mahmud MaheeNessuna valutazione finora

- Sam Seiden CBOT KeepItSimpleDocumento3 pagineSam Seiden CBOT KeepItSimpleferritape100% (2)

- Hansson Private Label: Operating ResultsDocumento28 pagineHansson Private Label: Operating ResultsShubham SharmaNessuna valutazione finora

- Flash - Memory - Inc From Website 0515Documento8 pagineFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- ButlerLumberCompany Final ExcelDocumento17 pagineButlerLumberCompany Final Excelkaran_w3Nessuna valutazione finora

- Tire City AssignmentDocumento6 pagineTire City AssignmentderronsNessuna valutazione finora

- Flash Memory AnalysisDocumento25 pagineFlash Memory AnalysisTheicon420Nessuna valutazione finora

- Business ValuationDocumento431 pagineBusiness ValuationAnonymous 7zUBWZZfy50% (2)

- Mercury Athletic Footwear Case (Work Sheet)Documento16 pagineMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNessuna valutazione finora

- Case - Polar SportsDocumento12 pagineCase - Polar SportsSagar SrivastavaNessuna valutazione finora

- Tire City Spreadsheet SolutionDocumento7 pagineTire City Spreadsheet SolutionSyed Ali MurtuzaNessuna valutazione finora

- Flash Memory IncDocumento7 pagineFlash Memory IncAbhinandan SinghNessuna valutazione finora

- Parent, Inc Actual Financial Statements For 2012 and OlsenDocumento23 pagineParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNessuna valutazione finora

- Sampa Video Case ExhibitsDocumento1 paginaSampa Video Case ExhibitsOnal RautNessuna valutazione finora

- Polar SportDocumento4 paginePolar SportKinnary Kinnu0% (2)

- Mercury - Case SOLUTIONDocumento36 pagineMercury - Case SOLUTIONSwaraj DharNessuna valutazione finora

- Lady M CaseDocumento8 pagineLady M CaseEvelyn MonzonNessuna valutazione finora

- John M CaseDocumento6 pagineJohn M CaseSwapnil JainNessuna valutazione finora

- New Heritage DoolDocumento9 pagineNew Heritage DoolVidya Sagar KonaNessuna valutazione finora

- Flash Memory CaseDocumento6 pagineFlash Memory Casechitu199233% (3)

- LBC-STRATEGIC-PAPER - Rev.1 22021Documento42 pagineLBC-STRATEGIC-PAPER - Rev.1 22021Dennis Alea100% (5)

- Panera BreadDocumento23 paginePanera BreadtomNessuna valutazione finora

- Tire City AnalysisDocumento3 pagineTire City AnalysisKailash HegdeNessuna valutazione finora

- Mercury QuestionsDocumento6 pagineMercury Questionsapi-239586293Nessuna valutazione finora

- John M CaseDocumento10 pagineJohn M Caseadrian_simm100% (1)

- TAX01 Midterm Exam AY 2022 2023Documento7 pagineTAX01 Midterm Exam AY 2022 2023robNessuna valutazione finora

- New Heritage Doll Company Student SpreadsheetDocumento4 pagineNew Heritage Doll Company Student SpreadsheetGourav Agarwal73% (11)

- Mercuryathleticfootwera Case AnalysisDocumento8 pagineMercuryathleticfootwera Case AnalysisNATOEENessuna valutazione finora

- Online AnswerDocumento4 pagineOnline AnswerYiru Pan100% (2)

- 0405 MAS Preweek QuizzerDocumento22 pagine0405 MAS Preweek QuizzerSol Guimary60% (10)

- 4214-XLS-ENG New Herritage Doll Case SpreadsheetDocumento4 pagine4214-XLS-ENG New Herritage Doll Case SpreadsheetAlex HuesingNessuna valutazione finora

- Glaxo ItaliaDocumento11 pagineGlaxo ItaliaLizeth RamirezNessuna valutazione finora

- G3 Assignment John - M - Case - Co - Valuation 0700 141216Documento26 pagineG3 Assignment John - M - Case - Co - Valuation 0700 141216viperovNessuna valutazione finora

- NHDC Solution EditedDocumento5 pagineNHDC Solution EditedShreesh ChandraNessuna valutazione finora

- Table A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)Documento30 pagineTable A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)rooptejaNessuna valutazione finora

- Case - John Case CompanybDocumento6 pagineCase - John Case Companybryancoburn100% (2)

- A1.2 Roic TreeDocumento9 pagineA1.2 Roic TreemonemNessuna valutazione finora

- Pacific Grove Spice Company SpreadsheetDocumento7 paginePacific Grove Spice Company SpreadsheetAnonymous 8ooQmMoNs10% (1)

- HBS Mercury CaseDocumento4 pagineHBS Mercury CaseDavid Petru100% (1)

- Solucion Caso Lady MDocumento13 pagineSolucion Caso Lady Mjohana irma ore pizarroNessuna valutazione finora

- Chevron Philippines, Inc. vs. Bases Conversion Development Authority and Clark Development Corporation, G.R. No. 173863, September 15, 2010Documento1 paginaChevron Philippines, Inc. vs. Bases Conversion Development Authority and Clark Development Corporation, G.R. No. 173863, September 15, 2010Jeselle Ann VegaNessuna valutazione finora

- Mercury AthleticDocumento13 pagineMercury Athleticarnabpramanik100% (1)

- PM Kraft ExhibitSheetDocumento19 paginePM Kraft ExhibitSheetkarthik_srinivasa_14Nessuna valutazione finora

- John M. Case Co Case QuestionsDocumento1 paginaJohn M. Case Co Case QuestionsRazi Ullah0% (3)

- Heritage CaseDocumento3 pagineHeritage CaseGregory ChengNessuna valutazione finora

- PGP Heritage Doll ExcelDocumento5 paginePGP Heritage Doll ExcelPGP37 392 Abhishek SinghNessuna valutazione finora

- ButlerDocumento1 paginaButlerarnab.for.ever9439100% (1)

- Pacific Grove Spice Company Case CalculationsDocumento11 paginePacific Grove Spice Company Case CalculationsMinh Hà33% (3)

- John Case WorksheetDocumento10 pagineJohn Case Worksheetzeeshan33% (3)

- Tire City AssignmentDocumento6 pagineTire City AssignmentXRiloXNessuna valutazione finora

- Johncaselbo2Documento6 pagineJohncaselbo2yupper12100% (1)

- Peter Swan Economics of Standardization UpdateDocumento83 paginePeter Swan Economics of Standardization UpdateAlexander MartinezNessuna valutazione finora

- Pacific Grove Spice CompanyDocumento7 paginePacific Grove Spice CompanySajjad Ahmad100% (1)

- Sterling Student ManikDocumento23 pagineSterling Student ManikManik BajajNessuna valutazione finora

- LboDocumento31 pagineLboAitorzinho Pepin100% (2)

- Ib Case MercuryDocumento9 pagineIb Case MercuryGovind Saboo100% (2)

- Strategic ManagementDocumento9 pagineStrategic ManagementdiddiNessuna valutazione finora

- Pacific Grove Spice CompanyDocumento3 paginePacific Grove Spice CompanyLaura JavelaNessuna valutazione finora

- JohnCase PrepDocumento1 paginaJohnCase PrepthaoabbyNessuna valutazione finora

- Polar Sports X Ls StudentDocumento9 paginePolar Sports X Ls StudentBilal Ahmed Shaikh0% (1)

- Nestlé and Alcon-The Value of A ListingDocumento6 pagineNestlé and Alcon-The Value of A ListingRahul KumarNessuna valutazione finora

- Sampa Video Case SolutionDocumento6 pagineSampa Video Case SolutionRahul SinhaNessuna valutazione finora

- Continental CarriersDocumento3 pagineContinental CarriersCharleneNessuna valutazione finora

- Mci 292737Documento11 pagineMci 292737ReikoNessuna valutazione finora

- Uv5354 XLS EngDocumento8 pagineUv5354 XLS EngJohn Andrew MañacopNessuna valutazione finora

- Financial Statement SolutionDocumento21 pagineFinancial Statement SolutionYousaf BhuttaNessuna valutazione finora

- Fin Model Practice 1Documento17 pagineFin Model Practice 1elangelang99Nessuna valutazione finora

- AFSA Assign 1 Enron EditedDocumento7 pagineAFSA Assign 1 Enron EditedVarchas BansalNessuna valutazione finora

- Eic AnalysisDocumento17 pagineEic AnalysisJaydeep Bairagi100% (1)

- HBO IncentivesDocumento25 pagineHBO IncentivesIrish Policarpio BulanadiNessuna valutazione finora

- Chapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Documento32 pagineChapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Judith DelRosario De RoxasNessuna valutazione finora

- Form No. Mgt-9 Extract of Annual Return: Annexure-VIIDocumento10 pagineForm No. Mgt-9 Extract of Annual Return: Annexure-VIIAbhishekNessuna valutazione finora

- Annual Report 2010 BaosteelDocumento160 pagineAnnual Report 2010 Baosteelnalini1501_187919552Nessuna valutazione finora

- ReviewerDocumento15 pagineReviewerALMA MORENANessuna valutazione finora

- Ripken LawsuitDocumento118 pagineRipken LawsuitFOX45Nessuna valutazione finora

- Chapter 9: The Analysis of Competitive MarketsDocumento46 pagineChapter 9: The Analysis of Competitive Marketsmas_999Nessuna valutazione finora

- Economic Growth in Nehru EraDocumento15 pagineEconomic Growth in Nehru Erakoushikonomics4002100% (9)

- TOEFL StructureDocumento7 pagineTOEFL StructureIka Yuliana IkeyNessuna valutazione finora

- Dividend PolicyDocumento9 pagineDividend Policyjimmy rodolfo LazanNessuna valutazione finora

- Chapter1 ExpectedutilityDocumento89 pagineChapter1 ExpectedutilitySijo VMNessuna valutazione finora

- Development Dynamics of Indian Economy Since 1947Documento18 pagineDevelopment Dynamics of Indian Economy Since 1947PLS1991Nessuna valutazione finora

- Quiz - iCPADocumento15 pagineQuiz - iCPAJericho PedragosaNessuna valutazione finora

- UNIT 5.3: Break-Even AnalysisDocumento11 pagineUNIT 5.3: Break-Even AnalysisSachin SahooNessuna valutazione finora

- 1 2 Types of Organisation PDFDocumento3 pagine1 2 Types of Organisation PDFGermanRobertoFongNessuna valutazione finora

- 48 BAEK Bank Ekonomi Raharja TBKDocumento3 pagine48 BAEK Bank Ekonomi Raharja TBKDjohan HarijonoNessuna valutazione finora

- Practical Exercise 1.14: RequiredDocumento3 paginePractical Exercise 1.14: RequiredCherry Mae Delos SantosNessuna valutazione finora

- Ppt6-It Project Cost Management-R0Documento40 paginePpt6-It Project Cost Management-R0Creative PreneurNessuna valutazione finora

- Mckinsey Special 10 Years Corporate Finance PDFDocumento84 pagineMckinsey Special 10 Years Corporate Finance PDFRoi MeiNessuna valutazione finora

- FranchisingDocumento2 pagineFranchisingMangoStarr Aibelle VegasNessuna valutazione finora