Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Asia - Weekly Debt Highlights

Caricato da

rryan123123Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Asia - Weekly Debt Highlights

Caricato da

rryan123123Copyright:

Formati disponibili

5 December 2011

Key Developments in Asian Local Currency Markets

asianbondsonline.adb.org

onsumer price inflation in Indonesia eased for a third consecutive month in November to 4.15% year-on-year (y-oy) compared with 4.42% in October. In the Republic of Korea consumer price inflation accelerated to 4.2% y-o-y in November from 3.6% in October on the back of price hikes in food, transportation, and utilities. In Thailand consumer price inflation stood at 4.19% y-o-y in November, the same rate as in October.

The People's Bank of China announced last week that it will reduce the reserve requirement ratio of banks by 50 basis points (bps) effective 5 December. The Philippines held steady its policy rates last week, while the Bank of Thailand decided to lower its policy interest rate by 25 bps to 3.25%. Philippine real GDP growth eased to 3.2% y-o-y in 3Q11 from 3.4% in the previous quarter. The purchasing managers' index (PMI) for the People's Republic of China's (PRC) manufacturing sector fell to 49.0 in November from 50.4 in October. Industrial production in the Republic of Korea grew 6.2% y-o-y in October, while contracting 35.8% y-o-y in Thailand. Japan's industrial production rose 2.4% month-on-month (m-o-m) in October. The Republic of Korea's current account surplus widened to US$4.2 billion in October, the largest surplus position since November 2010. In contrast, Thailand's current account surplus shrank to US$39 million in October. Indonesia's export growth stood at 16.7% yo-y in October, compared with 44.0% annual growth in September. The Republic of Korea's annual export growth accelerated to 13.8% in November from 8.0% in October.

Asia Bond Monitor November 2011

10-Year Selected LCY Government Security Yields

Markets

Close of 2 December 2011

basis point change from Latest Closing Previous Day* Previous Week* 1-Jan-11*

2.03 2.14 1.04 3.49 1.35 8.67 6.23 3.72 3.79 5.59 1.73 3.29 12.88 -5.42 -4.30 -2.10 -8.00 -0.70 -3.00 -14.40 0.00 -1.00 0.53 4.00 -5.00 26.20

-12.80

US EU Japan PR C H ong Kong, C hina In dia Indones ia Malays ia Korea, R ep. of Philippines Singapore Thailand Viet N am

-14.00

-15.10 -66.50 -2.40 -1.00 -9.40

-12.90

6.96 6.96 -12.80 1.60 1.60 -14.00 8.30 8.30 -15.10 -66.50 -2.40 -1.00 -9.40 6.00 6.00 -12.90 19.2019.20

-126.04 -82.80 -8.40 -42.00 -150.50 75.30 -137.60 -31.60 -73.00 -29.57 -98.00 -43.40 112.50

Selected Government Security Yields Benchmark Yield Curves - Local Currency Government Bonds 2-versus-10 Yield Spread Chart Policy Rate versus Inflation Rate Charts Credit Default Swap Spreads & Exchange Rate Indexes Selected Debt Security Issuances Selected Asia Data Releases

Last week, Shenzhen raised CNY2.2 billion from a dual-tranche local government bond sale; ICBC issued US$750 million worth of 10year bonds; Hyundai Motors priced US$500 million worth of 5.5-year bonds; BMW Australia sold CNH400 million of 1-year bonds in Hong Kong, China; Anih Berhad-a Malaysian toll road operator-raised MYR2.5 billion from a multitranche Islamic medium-term note sale; and Malaysian holding company DRB-HICOM raised MYR500 million from a dual-tranche sukuk (Islamic bonds) sale. LCY corporate bond issuance in the Republic of Korea surged 20.3% m-o-m in October. Last week, Pefindoan Indonesian rating agencyannounced plans of the local governments of Jakarta and Makassar to issue

municipal bonds. Separately, the Indonesian government plans to offer retail sukuk by March 2012. In the Philippines, Security Bank plans to issue up to PHP5 billion of long-term negotiable certificates of time deposit. Bank Negara Malaysia and the Monetary Authority of Singapore signed a Memorandum of Understanding last week to enhance the liquidity of financial institutions in both countries and strengthen cooperation in carrying out domestic liquidity management. Government bond yields fell last week for all tenors in Indonesia and Thailand, and for most tenors in the PRC, Republic of Korea, Malaysia, and the Philippines. Yields rose for most tenors in Hong Kong, China; Singapore; and Viet Nam. Yield spreads between 2- and 10-year tenors widened in the PRC; Hong Kong, China; Republic of Korea; Singapore; Thailand; and Viet Nam, while spreads narrowed in Indonesia, Malaysia, and the Philippines. What's New: Last week the results of our 2011 Asia Bond Market Survey were attached to our quarterly Asia Bond Monitor. This week we are sending out the survey to our AsianBondsOnline distribution list as a separate document. 1

....

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.........

Summary Text of News Articles Consumer Price Inflation Eases in Indonesia, Accelerates in Republic of Korea, Remains Steady in Thailand in November

.......................................................................................................................

Consumer price inflation in Indonesia eased for a third straight month in November to 4.15% year-on-year (y-o-y), compared with 4.42% in October, amid lower food price inflation. The November inflation figure was a 19-month low and provides room for the central bank to keep its benchmark interest rate at low levels to ensure economic growth. Bank Indonesia's Board of Governors is scheduled to meet on 8 December. Consumer price inflation for January to November was 3.2%, well below the 5.65% target set by the government and the 4.0%-6.0% target of Bank Indonesia. In the Republic of Korea consumer price inflation-based on the revised consumer price index (CPI) using 2010 as the base year-accelerated to 4.2% y-o-y in November from 3.6% in October. The increase was accentuated by a 6.0% y-oy hike in prices for food and non-alcoholic beverages. Transport costs also rose for the month, by 8.2% y-o-y, and the price indices for clothing and footwear and housing and utilities increased 6.0% and 6.3% y-o-y, respectively. On a month-on-month (m-o-m) basis, the CPI rose marginally by 0.1% in November. Meanwhile, the government of the Republic of Korea launched a new CPI with 2010 as the base year in order to better capture the impact of recent economic and social changes in the country on price fluctuations. In Thailand consumer price inflation stood at 4.19% y-o-y in November, the same rate as in October. Food prices continued their steady climb, rising 10.2% y-o-y for the month following a 9.9% increase in the previous month. This was the eighth consecutive month for consumer price inflation to have exceeded 4.0% on a y-o-y basis. Consumer prices climbed 0.2% m-o-m in November. For historical trends on inflation in Indonesia, refer to this link: http://asianbondsonline.adb.org/indonesia/data/marketwatch.php?code=policy_rate_and_inflation_trends For inflation rate statistics in the Republic of Korea, refer to this link: http://asianbondsonline.adb.org/korea/data/macroeconomic_credit.php For inflation rate statistics in Thailand, refer to this link: http://asianbondsonline.adb.org/thailand/data/macroeconomic_credit.php

.......................................................................................................................

PRC Cuts Reserve Requirement Ratio of Banks; Policy Rates Kept Unchanged in the Philippines, Lowered in Thailand

The People's Bank of China (PBOC) announced last week that it will reduce the reserve requirement ratio of banks by 50 basis points (bps) effective 5 December. For large commercial banks the new reserve requirement ratio is 21%. This is the first time in 3 years that the PBOC has lowered the reserve requirement ratio. In the Philippines the Monetary Board of Bangko Sentral ng Pilipinas (BSP) decided to leave its policy rates unchanged last week. The interest rates on term reverse repurchases, repurchases, and special deposit accounts were also maintained. The reserve requirement ratios remained unchanged as well. While subdued economic growth was taken into account, BSP also took note of the upside risks to prices. BSP raised its average inflation forecast for the years 2011, 2012, and 2013 from 4.46%, 3.05%, and 3.02%, respectively, to 4.52%, 3.51%, and 3.12%. The Bank of Thailand's Monetary Policy Committee decided on 30 November to cut the policy interest rate-the 1-day repurchase rate-by 25 bps to 3.25%. The Committee noted the increased risk of a global economic slowdown amid the eurozone's sovereign debt crisis and the United States' (US) fragile economic recovery. It took into account the adverse impact of flooding on the domestic economy, with an expectation of slower economic growth for the fourth quarter and the full year. Against this backdrop the accommodative monetary policy stance of the central bank will help support economic restoration and reconstruction efforts, as well as support investment activity. For policy rate trends in the Philippines, refer to this link: http://asianbondsonline.adb.org/philippines/data/marketwatch.php?code=policy_rate_and_inflation_trends For policy rate trends in Thailand, refer to this link: http://asianbondsonline.adb.org/thailand/data/marketwatch.php?code=policy_rate_and_inflation_trends

.......

2

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.........

Summary Text of News Articles Philippine Real GDP Growth Eases to 3.2% y-o-y in 3Q11; Manufacturing Activity Contracts in the PRC in November; Industrial Output Grows in Japan and Republic of Korea, Contracts in Thailand in October

.......................................................................................................................

Real gross domestic product (GDP) growth in the Philippines eased to 3.2% y-o-y in 3Q11 from a revised 3.4% in 2Q11. The slowdown in growth was attributed to the eurozone's debt crisis, still limited government spending, the impact of tropical storms on the agricultural sector, and high oil prices. Growth for the quarter was buoyed primarily by the services sector, which expanded 5.3% y-o-y, while agriculture, hunting, forestry, and fisheries grew 1.8% y-o-y. Cumulative GDP for the first 9 months of 2011 stood at 3.6% y-o-y, lower than the government's full-year target of 4.5%. The People's Republic of China's (PRC) manufacturing activity dropped in November as indicated by a fall in the manufacturing purchasing managers' index (PMI). The PRC's manufacturing PMI fell to 49.0 from 50.4 in October. A PMI reading below 50 indicates a contraction in manufacturing activity. In Japan industrial production accelerated 2.4% m-o-m in October, reversing a drop of 3.3% m-o-m in September. Actual factory output beat expectations of a 1.2% m-o-m increase, supported by demand for automobiles. The transport, general machinery, and chemical (excluding drugs) sectors led gainers. In terms of commodities, large and small passenger cars and drive, transmission, and control parts posted the largest increases. The outlook for industrial production, however, is bleak as overseas demand is expected to slow. Industrial output in the Republic of Korea grew 6.2% y-o-y in October, but was down 0.7% from the previous month. Manufacturing production growth slowed to 6.3% y-o-y in October from 7.1% in September largely due to weaker growth in vehicle production. Thailand's manufacturing production index plunged 35.8% y-o-y in October amid supply disruptions caused by the flooding. Among the sectors adversely affected by the flooding were the automobile, electrical appliance, and hard disk drive and integrated circuits and parts industries. For manufacturing production statistics in Thailand, refer to this link: http://asianbondsonline.adb.org/thailand/data/macroeconomic_credit.php

.......................................................................................................................

Current Account Surplus Widens in Republic of Korea, Narrows in Thailand in October

The Republic of Korea's current account surplus in October widened to US$4.2 billion, the largest surplus since November 2010. The increase was on the back of the goods account surplus rising to US$3.7 billion as the monthly decline in merchandise imports outpaced that of merchandise exports. The primary income surplus also increased to US$640 million in October from US$540 million in the previous month. Thailand's current account surplus shrank to US$39 million in October from US$404 million in September. The decline in the country's surplus position was largely due to a marginal decline in export growth of 0.1% y-o-y coupled with 20.6% y-o-y import growth. For current account statistics in the Republic of Korea, refer to this link: http://asianbondsonline.adb.org/korea/data/macroeconomic_credit.php For export growth and current account statistics in Thailand, refer to this link: http://asianbondsonline.adb.org/thailand/data/macroeconomic_credit.php

.......................................................................................................................

Export Growth Slows in Indonesia in October, Accelerates in Republic of Korea in November

In Indonesia export growth stood at 16.7% y-o-y in October-with exports valued at US$16.8 billion-following revised 44.0% annual growth in September. Non-oil and gas exports climbed 20.3% y-o-y while oil and gas exports grew at a much slower pace of 1.9%. Import growth eased to 29.1% y-o-y in October after revised 57.1% growth a month earlier. A trade surplus of US$1.2 billion was recorded in October.

...

3

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.........

Summary Text of News Articles

.......................................................................................................................

Export Growth Slows in Indonesia in October, Accelerates in Republic of Korea in November (cont)

The Republic of Korea's export growth rate for the month of November stood at 13.8% y-o-y, higher than October's growth of 8.0%. Import growth weakened to 11.3% y-o-y for the month from 15.6% in the previous month. This led the country's trade surplus to narrow to US$3.9 billion in November from US$4.1 billion in the previous month. For export and import statistics in the Republic of Korea, refer to this link: http://asianbondsonline.adb.org/korea/data/macroeconomic_credit.php

.......................................................................................................................

Shenzhen Issues CNY2.2 Billion of Local Government Bonds; ICBC Issues US$750 Million 10-Year Bond; Hyundai Motors Prices US$500 Million 5.5-Year Bond; BMW Australia Sells CNH400 Million 1-Year Bond; Anih Raises MYR2.5 Billion from Multi-Tranche Islamic MTN; DRB-HICOM Raises MYR500 Million from Dual-Tranche Sukuk; LCY Corporate Bond Issuance in Republic of Korea Rises in October

Last week the local government of Shenzhen issued CNY1.1 billion worth of 3-year bonds at a coupon rate of 3.03% and another CNY1.1 billion worth of 5-year bonds at a coupon of 3.25%. Meanwhile, Industrial and Commercial Bank of China (ICBC) issued US$750 million worth of 10-year bonds at a coupon of 4.875%. The deal was subscribed by mostly Asian investors who purchased 95% of the issue size. In Hong Kong, China, BMW Australia issued CNH400 million worth of 1-year bonds at a coupon of 2.0%. Hyundai Motors-through its issuing entity Hyundai Capital America-priced a 5.5-year US$500 million bond at a coupon rate of 4.0% last week. In Malaysia toll road operator Anih Berhad issued MYR2.5 billion worth of multi-tranche Islamic medium-term notes last week. The notes, rated AAIS by Malaysian Rating Corporation (MARC), were issued in tenors of 3 years-18 years and carried coupons from 4.40% to 6.15% per annum. Anih also issued 19- and 20-year junior bonds worth MYR350 million and MYR270 million, respectively, both carrying a 7.00% coupon per year. Malaysian holding company DRB-HICOM Berhad issued MYR500 million worth of dual-tranche sukuk (Islamic bonds) last week. The sukuk, rated AAIS with stable outlook by MARC. The 5-year sukuk worth MYR250 million pays 4.5% profit per year while the 7-year sukuk worth MYR250 million carries 4.75% per year profit rate. The Financial Supervisory Service (FSS) in the Republic of Korea reported that local currency (LCY) corporate bond issuance rose 20.3% m-o-m to KRW12.4 trillion in October. This was led by a 51.3% m-o-m hike in non-financial corporate bond issuance, which reached KRW6.4 trillion for the month, as non-financial companies raised funds in preparation for refinancing a large amount of bonds maturing in 1H12. Issuance of bank debentures also climbed 17.4% m-o-m to KRW2.6 trillion in October, while asset-backed securities issuance surged 175.2% m-o-m to KRW1.6 trillion. In contrast, financial companies' bond issuance dropped 44.2% m-o-m to KRW1.8 trillion for the month.

.......................................................................................................................

Municipal Bond and Retail Sukuk Issuances Planned in Indonesia; Security Bank Plans to Issue PHP5 Billion of Long-Term Negotiable Certificates of Time Deposit

According to Pemeringkat Efek Indonesia (Pefindo), two local governments, Jakarta and Makassar, are planning to issue municipal bonds. They have informally expressed interest to Pefindo on the process of issuing bonds. The local government of Jakarta may issue about IDR1.7 trillion worth of bonds while the government of Makassar may issue less than IDR1.0 trillion. Meanwhile, the Indonesian government plans to offer retail sukuk in March next year. According to news reports, the finance ministry's Debt Management Office began accepting applications last week from banks and brokerages to act as the sales agent for the retail sukuk issue. The government will appoint the sales agent on 4 January 2012.

...

4

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.........

Summary Text of News Articles Municipal Bond and Retail Sukuk Issuances Planned in Indonesia; Security Bank Plans to Issue PHP5 Billion of Long-Term Negotiable Certificates of Time Deposit (cont)

.......................................................................................................................

In the Philippines, Security Bank plans to issue up to PHP5 billion of Long-Term Negotiable Certificates of Time Deposit (LTNCD) after securing approval from the Bangko Sentral ng Pilipinas on 17 November. Minimum deposits for the LTNCDs will be PHP50,000 in increments of PHP1,000. The bank is looking at issuing bonds with minimum maturity of 5.25 years up to a maximum of 7 years. The timing for the issue is still to be finalized. LTNCDs are similar to time deposits that carry higher interest rates due to their long-term nature and tax-exempt features, and they cannot be preterminated. However, these instruments can be traded in the secondary market. The bank named Deutsche Bank AG (Manila) and Standard Chartered Bank as joint lead underwriters for the issue.

.......................................................................................................................

BNM and MAS Sign MOU to Enhance Domestic Liquidity

Bank Negara Malaysia (BNM) and the Monetary Authority of Singapore (MAS) signed a Memorandum of Understanding last week to enhance the liquidity of financial institutions in both countries and strengthen cooperation in carrying out domestic liquidity management. The cross-border collateral agreement allows eligible financial institutions in Singapore to pledge ringgit or MYR-denominated government and central bank securities to obtain Singapore dollar liquidity from the MAS. Likewise, eligible financial institutions in Malaysia may pledge Singapore dollars or SGD-denominated government securities to obtain ringgit liquidity from BNM.

...

5

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

Selected Government Security Yields

Tip: Zoom-in on the table using the Acrobat zoom tool

3-Month Selected LCY Government Security Yields

Latest Closing -0.01 0.23 0.10 2.54 0.17 8.78 2.99 3.32 2.10 0.32 3.25 basis point change from Previous Previous 1-Jan-11* Day* Week* -2.04 0.00 -2.04 -12.48 -8.70 1.80 -8.70 -16.80 0.00 0.00 0.00 -2.40 -5.00 -12.00 -12.00 -64.00 3.00 0.00 3.00 -11.00 -6.00 4.00 -6.00 168.00 0.00 0.00 0.00 21.30 0.00 0.00 0.00 81.00 2.50 22.92 22.92 90.50 1.00 0.00 1.00 -7.00 -4.33 2.17 -4.33 127.99

Markets US EU Japan PRC Hong Kong, China India Malaysia Korea, Rep. of Philippines Singapore Thailand

Close of 2 December 2011

10-Year Selected LCY Government Bond Yields

Latest Closing 2.03 2.14 1.04 3.49 1.35 8.67 6.23 3.72 3.79 5.59 1.73 3.29 12.88 basis point change from Previous Previous 1-Jan-11* Day* Week* -5.42 6.96 6.96 -126.04 -12.80 -4.30 -12.80 -82.80 -2.10 1.60 1.60 -8.40 -14.00 -8.00 -14.00 -42.00 -0.70 8.30 8.30 -150.50 -15.10 -3.00 -15.10 75.30 -14.40 -66.50 -66.50 -137.60 -2.40 0.00 -2.40 -31.60 -1.00 -1.00 -1.00 -73.00 -9.40 0.53 -9.40 -29.57 4.00 6.00 6.00 -98.00 -12.90 -5.00 -12.90 -43.40 26.20 19.20 19.20 112.50

Markets US EU Japan PRC Hong Kong, China India Indones ia Malays ia Korea, Rep. of Philippines Singapore Thailand Viet Nam

Close of 2 December 2011

Source: Based on data from Bloomberg, LP.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

Indonesia

.......

Benchmark Yield Curves Local Currency Government Bonds

Tip: Zoom-in on the table using the Acrobat zoom tool

China, Peoples Rep. of

3.90 3.65 1.5

Yield (%)

Hong Kong, China

2.0 8.3 7.5

Yield (%)

Yield (%)

3.40 3.15 2.90 2.65 2.40 0 1 2 3 4 5 6 7 8 9 10 11

6.8 6.0 5.3

1.0

0.5

0.0 0 2 4 6 8 10 12 14 16

4.5 0 3 6 9 12 15 18 21 24 27 30 33

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Korea, Republic of

4.25 4.00 3.75 3.50 3.25 3.00 0 2 4 6 8 10 12 14 16 18 20 22 4.2 4.0 3.8

Yield (%)

Yield (%)

Malaysia

8.0 7.0 6.0

Yield (%)

Philippines

3.6 3.4 3.2 3.0 2.8 0 2 4 6 8 10 12 14 16 18 20 22

5.0 4.0 3.0 2.0 1.0 0.0 0 3 6 9 12 15 18 21 24 27

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Singapore

2.5

3.8

Thailand

13.0

Viet Nam

2.0 1.5 1.0 0.5 0.0 0 3 6 9 12 15 18 21

3.0 0 2 4 6 8 10 12 14 16 3.5

Yield (%) Yield (%)

12.8

Yield (%)

12.5

3.3 12.3

12.0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

US

3.5 3.0 2.5

Yield (%)

3.5 3.0 2.5

EU

2.5 2.3 2.0 1.8

Yield (%)

Japan

Yield (%)

2.0 1.5 1.0 0.5 0.0 0 4 8 12 16 20 24 28 32

2.0 1.5 1.0 0.5 0.0 0 5 10 15 20 25 30

1.5 1.3 1.0 0.8 0.5 0.3 0.0 0 4 8 12 16 20 24 28 32 36 40

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Time to maturity (years)

02-Dec-11 25-Nov-11 18-Nov-11

Source: Based on data from Bloomberg.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

2-versus-10 Yield Spread Chart

Tip: Zoom-in on the table using the Acrobat zoom tool

Yield Spread between the Two- and Ten-Year Government Bonds

China, People's Rep. of

2-Dec-11

Hong Kong, China Indonesia Korea, Rep. of Malaysia Philippines Singapore Thailand Viet Nam U.S. E.U. Japan 0 50 100 150 200 basis points 250

25-Nov-11 18-Nov-11

300

350

Source: Based on data from Bloomberg LP.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

India

.......

Policy Rate versus Inflation Rate Charts

Tip: Zoom-in on the table using the Acrobat zoom tool

China, Peoples Rep. of

10 8 6 4 2 2 0 0 Inflation Rate -2 -4 Jan-06 -2 -4 Jan-06 1-year Lending Rate 6 6.56 5.50 4 HKMA Base Rate 8

Hong Kong, China

12 10 8 6 4 0.50 2 0 -2 Jan-06 Inflation Rate Repurchase Cut-off Yield

5.80 Inflation Rate

9.73 8.50

Dec-06

Dec-07

Dec-08

Nov-09

Nov-10

Nov-11

Dec-06

Dec-07

Dec-08

Nov-09

Nov-10

Nov-11

Dec-06

Dec-07

Dec-08

Nov-09

Nov-10

Nov-11

PRC uses 1-year lending rate as one of its policy rates. Source: Bloomberg LP.

The Hong Kong Monetary Authority maintains a Discount Window Base Rate. Source: Bloomberg LP.

The Reserve Bank of India uses the repurchase (repo) cutoff yield as its policy rate. Source: Bloomberg LP.

Indonesia

20 18 16 14 12 10 8 6 4 2 0 Jan-06 Dec-06 Dec-07 Dec-08 Nov-09 Nov-10 Nov-11 0 Jan-06 Dec-06 Inflation Rate 6.00 4.15 2 4 BI Rate 6 7-Day Repo Rate 8

Korea, Republic of

10

c

Malaysia

8 6 4.20 4 2 0

Overnight Policy Rate

3.40 3.00

3.25

Inflation Rate

-2 -4 Jan-06

Inflation Rate

Dec-07

Dec-08

Nov-09

Nov-10

Nov-11

Dec-06

Dec-07

Dec-08

Nov-09

Nov-10

Nov-11

Bank Indonesia uses its reference interest rate (BI rate) as its policy rate. Source: Bloomberg LP.

The Bank of Korea shifted its policy rate from the overnight repurchase (repo) rate to the 7-day repo rate in March 2008. Source: Bloomberg LP.

Bank Negara Malaysia uses the overnight policy rate (OPR) as its policy rate. Source: Bloomberg LP.

Philippines

12 10 8 6 5.2 4 2 0 Jan-06 4.50 0 -2 Overnight Reverse Repo Rate 10 8 Inflation Rate 6 4 2 1-Day Repo Rate

Thailand

30 Inflation Rate 27 24 4.19 3.25 21 18 15 12 9 6 -4 -6 Jan-06 3 Dec-06 Dec-07 Dec-08 Nov-09 Nov-10 Nov-11 0 Jan-06 Dec-06 Dec-07 Prime Lending Rate

Viet Nam

Inflation Rate

19.83

9.00

Dec-06

Dec-07

Dec-08

Nov-09

Nov-10

Nov-11

Dec-08

Nov-09

Nov-10

Nov-11

Bangko Sentral uses the Philippine overnight reverse repurchase agreement rate as one of its policy instruments. Source: Bloomberg LP.

The Bank of Thailand replaced the 14-day repurchase rate with the 1-day repurchase rate in January 2007 as its policy rate. Source: Bloomberg LP.

The State Bank of Viet Nam uses a benchmark prime lending rate as its policy rate. Source: Bloomberg LP.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

Credit Default Swap Spreads & Exchange Rate Indexes

Tip: Zoom-in on the table using the Acrobat zoom tool

Credit Default Swap Spreads - Senior 5-year*

1,400

C hina , P e ople 's R e p. of

H ong K ong, C hina

1,200

Indone s ia

K ore a , R e p. of

1,000

Mid spread in basis points

J a pa n

M a la ys ia

800

P hilippine s

600

Tha ila nd

400

200

* In USD currency and based on sovereign bonds Source: Thomson Reuters

0 Dec-07

Dec-08

Dec-09

No v-10

No v-11

Exchange Rate Indexes (vis--vis US$, 2 January 2007=100)

130 130

China , P e ople 's R e p. of

Indone s ia

120

120

Ma la ys ia

P hilippine s

110

110

Tha ila nd

100

100

S inga pore

Kore a , Re p. of

90

90

V ie t N a m

80

80

70

70

60

60

Source: ADB-OREI staff calculations based on Bloomberg data.

50 Jan - 07

50 A u g -07 M ar-08 O ct- 08 Ju n -09 Jan -10 A u g -10 M ar- 11 N o v-11

10

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

Selected Debt Security Issuances (28 November - 2 December 2011)

Tip: Zoom-in on the table using the Acrobat zoom tool

Mark ets

PRC HK JP KR

A u c tio n D ate

29-Nov 29-Nov 29-Nov 30-Nov 28-Nov

T y p e o f S ec u rity

1-year PBOC Notes 91-day Exchange Fund Bills 182-day Exchange Fund Bills 2-year Japan Government Bonds 3-month Treasury Discount Bills 91-day Monetary Stabilization Bonds 1-year Monetary Stabilization Bonds 20-year Treasury Bonds

A v erag e C o u p o n A m o u n t O ffered A m o u n t Is s u ed (in % ) Y ield (% ) L C Y B illio n s L C Y B illio n s

3.49 0.17 0.17 0.15 0.10 3.49 3.50 4.01 3.30 0.27 3.21 3.18 3.18 4.75 0.20 15.00 26.05 9.00 2,700.00 5,700.00 1,200.00 800.00 1,000.00 3.00 4.00 15.00 17.00 18.00 15.00 26.05 9.00 2,705.46 5,739.83 1,010.00 840.00 1,000.00 3.00 4.00 15.00 17.00 18.00

MY SG TH

29-Nov 28-Nov 29-Nov

5-year Malaysian Govermnet Securities 91-day Treasury Bills 28-day BOT Bills 91-day BOT Bills 182-day BOT Bills

Sources: Local market sources and Bloomberg, LP.

11

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

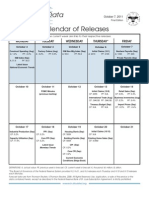

Selected Asia Data Releases (6 - 12 December 2011)

Tip: Zoom-in on the table using the Acrobat zoom tool

C o u n tr y / a r ia b le V

Re public of Kor e a Re al GDP (Final) y-o-y, % 3Q11 Philippine s Cons um e r Pr ice Inde x y-o-y, % NOV Indone s ia BI Re fe r e nce Rate % 8 DEC Re public of Kor e a 7-Day Re pur chas e Rate % 8 DEC Japan Tr ade Balance JPY billion OCT Japan M achine Or de r s y-o-y,% OCT M alays ia Indus tr ial Pr oduction y-o-y, % OCT Pe ople s Re public of China Cons um e r Pr ice Inde x y-o-y, % NOV Pe ople s Re public of China Indus tr ial Pr oduction y-o-y, % NOV Re public of Kor e a Pr oduce r Pr ice Inde x y-o-y, % NOV M alays ia Expor ts y-o-y, % OCT Pe ople s Re public of China Expor ts y-o-y, % NOV

R e le a s e D a te

12/06

H is to r ic a l D a ta

3Q10: 4.4% 4Q10: 4.7% 2Q11: 3.4% 3Q11: 3.4% 10/10: 3.3% 11/10: 3.7% 09/11: 4.8% 10/11: 5.2% 11/10: 6.50% 12/10: 6.50% 10/11: 6.50% 11/11: 6.00% 11/10: 2.50% 12/10: 2.50% 10/11: 3.25% 11/11: 3.25% 09/10: 911 10/10: 903.6 08/11: -694.7 09/11: 373.2 09/10: 4.1% 10/10: 6.9% 08/11: 2.1% 09/11: 9.8% 09/10: 5.8% 10/10: 2.6% 08/11: 3.7% 09/11: 2.5% 10/10: 4.4% 11/10: 5.1% 09/11: 6.1% 10/11: 5.5% 10/10: 13.1% 11/10: 13.3% 09/11: 13.8% 10/11: 13.2% 10/10: 5.0% 11/10: 4.9% 09/11: 5.7% 10/11: 5.6% 09/10: 5.3% 10/10: 0.4% 08/11: 10.9% 09/11: 16.6% 10/10: 22.9% 11/10: 34.9% 09/11: 17.1% 10/11: 15.9%

R ec en t T ren d s

A dvance estimates f or the Republic of Koreas gross domestic product (GDP) show ed grow th of 3.4% year-on-year (y-o-y) in 3Q11, the same as in the previous quarter. The Philippines consumer price inf lation quickened to 5.2% y-o-y in October f rom 4.8% in September based on the new series using 2006 as the base year.

12/06

12/08

Bank Indonesia (BI) low ered its benchmark interest rate by 50 basis points (bps) to 6.00% in its meeting on 10 November.

12/08

The 7-day repurchase rate in the Republic of Korea has remained steady at 3.25% since June.

12/08

Japans trade balance recovered to a surplus of JPY 373.2 billion in September f rom a def icit of JPY 694.7 billion in A ugust.

12/08

Grow th in machine orders in Japan surged to 9.8% y-o-y in October f rom 2.1% in A ugust.

12/08

Industrial production grow th in Malaysia eased to 2.5% y-o-y in September f rom 3.7% in the previous month.

12/09

Consumer price inf lation in the Peoples Republic of China (PRC) eased to 5.5% y-oy in October f rom 6.1% in September.

12/09

Industrial production in the PRC expanded 13.2% y-o-y in October f ollow ing 13.8% grow th in the previous month.

12/09

Producer prices in the Republic of Korea climbed 5.6% y-o-y in October f ollow ing a 5.7% hike in September.

12/09

Malaysias export grow th rate increased to 16.6% y-o-y in September f rom 10.9% in A ugust.

12/10

The PRCs export grow th rate decreased to 15.9% y-o-y in October f rom 17.1% in the previous month.

Source: AsianBondsOnline, Bloomberg LP, and Reuters.

12

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

News Articles: Sources for Further Reading

Tip: Click on link to open a new browser (Acrobat Reader 8); for lower versions right-click to open a new browser) Consumer Price Inflation Eases in Indonesia, Accelerates in Republic of Korea, Remains Steady in Thailand in November Indonesian Inflation Hits 19-Month Low Jakarta Globe (01 December 2011) Consumer Price Index in November 2011 Statistics Korea (01 December 2011) Revision of the Consumer Price Index based on 2010 Statistics Korea (29 November 2011) Prices up 4.19% on year in November The Nation (01 December 2011) Export Growth Slows in Indonesia in October, Accelerates in Republic of Korea in November RIs Exports in October Fell Slightly Antara News (01 December 2011) South Koreas Trade Surplus to US$3.9 Bln in Nov. YONHAP News (01 December 2011)

PRC Cuts Reserve Requirement Ratio of Banks; Policy Rates Kept Unchanged in the Philippines, Lowered in Thailand China to Lower RRR For First Time in Three Years Xinhua (30 November 2011) Monetary Board Keeps Policy Settings Steady Bangko Sentral ng Pilipinas (01 December 2011) Monetary Policy Committees Decision on 30 November 2011 Bank of Thailand (30 November 2011)

Shenzhen Issues CNY2.2 Billion of Local Government Bonds; ICBC Issues US$750 Million 10-Year Bond; Hyundai Motors Prices US$500 Million 5.5-Year Bond; BMW Australia Sells CNH400 Million 1-Year Bond; Anih Raises MYR2.5 Billion from Multi-Tranche Islamic MTN; DRB-HICOM Raises MYR500 Million from DualTranche Sukuk; LCY Corporate Bond Issuance in Republic of Korea Rises in October ICBC Sells $750 Million Bond through Hong Kong Branch Finance Asia (01 December 2011) BONDS: BMW Australia Raises Rmb400m via1-yr Dim Sum Debut IFR Asia (28 November 2011) BOND: Hyundai Motor US$500m to Price Today IFRAsia (01 December 2011) Anih Tolls for Sukuk IFR Asia (26 November 2011) DRB-Hicom Issues RM500m Debt Notes for Working Capital, Projects The Edge Malaysia (01 December 2011) Analysis of Direct Corporate Financing for October 2011Capital, Projects Financial Supervisory Service (29 November 2011)

Philippine Real GDP Growth Eases to 3.2% y-o-y in 3Q11; Manufacturing Activity Contracts in the PRC in November; Industrial Output Grows in Japan and Republic of Korea, Contracts in Thailand in October Philippine Economy Grows by 3.2 Percent in Q3 2011 National Statistical Coordination Board (28 November 2011) China's Nov. PMI Falls to 49 Pct, Indicating Contraction Xinhua (01 December 2011) The Industrial Activities in October 2011 Statistics Korea (30 November 2011) Press Release on Economic and Monetary Conditions for October 2011 Bank of Thailand (30 November 2011)

Municipal Bond and Retail Sukuk Issuances Planned in Indonesia; Security Bank Plans to Issue PHP5 Billion of Long-Term Negotiable Certificates of Time Deposit Two Local Governments Review Bond Issuance Bisnis Indonesia (01 December 2011) Govt to Offer Sukuk Retail Bonds in March The Jakarta Post (30 November 2011) Security Bank Gets Approval for LTNCDs Philippine Star (29 November 2011)

Current Account Surplus Widens in Republic of Korea, Narrows in Thailand in October Balance of Payments during October 2011 The Bank of Korea (29 November 2011) Press Release on Economic and Monetary Conditions for October 2011 Bank of Thailand (30 November 2011)

BNM and MAS Sign MOU to Enhance Domestic Liquidity Memorandum of Understanding between Bank Negara Malaysia and the Monetary Authority of Singapore Bank Negara Malaysia (28 November 2011)

13

Disclaimer: AsianBondsOnline Newsletter is available to users free of charge. The ADB provides no warranty or undertaking of any kind in respect to the information and materials found on, or linked to, AsianBondsOnline Newsletter. The ADB accepts no responsibility for the accuracy of the material posted or linked to the publication, or the information contained therein, or for any consequences arising from its use and does not invite or accept reliance being placed on any materials or information so provided. Views expressed in articles marked with AsianBondsOnline are those of the authors, and not ADB. This disclaimer does not derogate from, and is in addition to, the general terms and conditions regarding the use of the AsianBondsOnline Web Site, which also apply.

Potrebbero piacerti anche

- Asia Bonds - Debt Highlights - August 08, 2011Documento12 pagineAsia Bonds - Debt Highlights - August 08, 2011rryan123123Nessuna valutazione finora

- Asian Bonds - Weekly Debt HighlightsDocumento12 pagineAsian Bonds - Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- Asian Development Bank - Weekly HighlightsDocumento13 pagineAsian Development Bank - Weekly Highlightsrryan123123Nessuna valutazione finora

- Key Developments in Asian Local Currency Markets: Asia Bond Monitor March 2011 Read MoreDocumento12 pagineKey Developments in Asian Local Currency Markets: Asia Bond Monitor March 2011 Read Morerryan123123Nessuna valutazione finora

- Asian Weekly Debt HighlightsDocumento12 pagineAsian Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- Asian Weekly Debt Highlights - September 05, 2011Documento12 pagineAsian Weekly Debt Highlights - September 05, 2011rryan123123Nessuna valutazione finora

- Asia Bonds Weekly Highlights - August 15, 2011Documento12 pagineAsia Bonds Weekly Highlights - August 15, 2011rryan123123Nessuna valutazione finora

- Asian Development Bank - Weekly Debt HighlightsDocumento13 pagineAsian Development Bank - Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- Study of Macroeconomic Policies and Their Impact On Major Macro-Indicators of ChinaDocumento10 pagineStudy of Macroeconomic Policies and Their Impact On Major Macro-Indicators of ChinaRatnesh MishraNessuna valutazione finora

- Key Developments in Asian Local Currency Markets: Asia Bond Monitor March 2010 Read MoreDocumento12 pagineKey Developments in Asian Local Currency Markets: Asia Bond Monitor March 2010 Read Moreapi-26045138Nessuna valutazione finora

- Third Quarter Review of Monetary Policy 2011-12: Reserve Bank of IndiaDocumento21 pagineThird Quarter Review of Monetary Policy 2011-12: Reserve Bank of Indiaomi_pallaviNessuna valutazione finora

- Analysis About Economic Indicators in IndonesiaDocumento7 pagineAnalysis About Economic Indicators in IndonesiaAndalira Zagita PutriNessuna valutazione finora

- Indo Monetary PolicyDocumento11 pagineIndo Monetary PolicyBoyke P SiraitNessuna valutazione finora

- Conomic: The Impending Signs of Global UncertaintyDocumento16 pagineConomic: The Impending Signs of Global UncertaintyS GNessuna valutazione finora

- ScotiaBank JUL 16 Asia - Oceania Weekly OutlookDocumento3 pagineScotiaBank JUL 16 Asia - Oceania Weekly OutlookMiir ViirNessuna valutazione finora

- The World Economy - 03/03/2010Documento3 pagineThe World Economy - 03/03/2010Rhb InvestNessuna valutazione finora

- Main Indicators: GDP, State Budget, Foreign Trade, Exchange Rate, InflationDocumento5 pagineMain Indicators: GDP, State Budget, Foreign Trade, Exchange Rate, InflationUrtaBaasanjargalNessuna valutazione finora

- Economic Report - 201603Documento4 pagineEconomic Report - 201603bajax_lawut9921Nessuna valutazione finora

- News 11th Jul 2008Documento3 pagineNews 11th Jul 2008DeepakJadhavNessuna valutazione finora

- ECO Scan April'11Documento13 pagineECO Scan April'11itzprasuNessuna valutazione finora

- Asian Bonds - Weekly Debt HightlightsDocumento11 pagineAsian Bonds - Weekly Debt Hightlightsrryan123123Nessuna valutazione finora

- Asia Economic Monitor - December 2003Documento99 pagineAsia Economic Monitor - December 2003Asian Development BankNessuna valutazione finora

- The World Economy ... - 11/03/2010Documento2 pagineThe World Economy ... - 11/03/2010Rhb InvestNessuna valutazione finora

- Pakistan Economic Survey 2011-12 PDFDocumento286 paginePakistan Economic Survey 2011-12 PDFAli RazaNessuna valutazione finora

- Asian Development Outlook 2012 Update: Services and Asia's Future GrowthDa EverandAsian Development Outlook 2012 Update: Services and Asia's Future GrowthNessuna valutazione finora

- The World Economy... - 21/5/2010Documento3 pagineThe World Economy... - 21/5/2010Rhb InvestNessuna valutazione finora

- IR Apirl2011Documento92 pagineIR Apirl2011Nat UdomlertsakulNessuna valutazione finora

- By Dr. D. Subbarao GovernorDocumento31 pagineBy Dr. D. Subbarao GovernoritzindianNessuna valutazione finora

- Monetary Policy of PakistanDocumento8 pagineMonetary Policy of PakistanWajeeha HasnainNessuna valutazione finora

- Credit Policy September 2011Documento6 pagineCredit Policy September 2011Gaurav WamanacharyaNessuna valutazione finora

- Asia Economic Monitor - July 2004Documento27 pagineAsia Economic Monitor - July 2004Asian Development BankNessuna valutazione finora

- Chapter 1Documento5 pagineChapter 1Jakir_bnkNessuna valutazione finora

- 2011-12 Monetary PolicyDocumento21 pagine2011-12 Monetary PolicyNitinAggarwalNessuna valutazione finora

- Add From The First Half of The Print OutsDocumento4 pagineAdd From The First Half of The Print OutsAteev SinghalNessuna valutazione finora

- A Retrospective On Past 30 Years of Development in VietnamDocumento53 pagineA Retrospective On Past 30 Years of Development in VietnamJenny DangNessuna valutazione finora

- Crisil Economic OutlookDocumento36 pagineCrisil Economic OutlookSuresh KumarNessuna valutazione finora

- Anz Research: Asia Pacific EconomicsDocumento5 pagineAnz Research: Asia Pacific EconomicsabbdealsNessuna valutazione finora

- Report On Indonesia: Submitted byDocumento16 pagineReport On Indonesia: Submitted byAsad AttarwalaNessuna valutazione finora

- Monthly Monetary Trends (St. Louis Fed)Documento20 pagineMonthly Monetary Trends (St. Louis Fed)rryan123123Nessuna valutazione finora

- IEA - Monthly Oil Market ReportDocumento67 pagineIEA - Monthly Oil Market Reportrryan123123Nessuna valutazione finora

- IEA - Monthly Oil Market ReportDocumento64 pagineIEA - Monthly Oil Market Reportrryan123123Nessuna valutazione finora

- Gold and The International Monetary SysteDocumento50 pagineGold and The International Monetary SysteGaetano ZappullaNessuna valutazione finora

- OPEC - Monthly Oil Market ReportDocumento75 pagineOPEC - Monthly Oil Market Reportrryan123123Nessuna valutazione finora

- OPEC - Monthly Oil Market ReportDocumento76 pagineOPEC - Monthly Oil Market Reportrryan123123Nessuna valutazione finora

- IEA - Monthly Oil Market Report - November 2011Documento66 pagineIEA - Monthly Oil Market Report - November 2011rryan123123Nessuna valutazione finora

- BP - Annual Energy Outlook To 2030Documento88 pagineBP - Annual Energy Outlook To 2030rryan123123Nessuna valutazione finora

- FullDocumento65 pagineFullAraldqNessuna valutazione finora

- OPEC - Monthly Oil Market Report - January 2012Documento69 pagineOPEC - Monthly Oil Market Report - January 2012rryan123123Nessuna valutazione finora

- World Bank - Global Economic ProspectsDocumento164 pagineWorld Bank - Global Economic Prospectsrryan123123Nessuna valutazione finora

- Asian Bonds - Weekly Debt HighlightsDocumento12 pagineAsian Bonds - Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- Asian Debt Highlights WeeklyDocumento12 pagineAsian Debt Highlights Weeklyrryan123123Nessuna valutazione finora

- R qt1112Documento93 pagineR qt1112Lyubomir SirkovNessuna valutazione finora

- IEA - Monthly Oil Market ReportDocumento70 pagineIEA - Monthly Oil Market Reportrryan123123Nessuna valutazione finora

- European Comission 2011 6 enDocumento248 pagineEuropean Comission 2011 6 enEGUVNessuna valutazione finora

- Monthly Monetary Trends - December 2011Documento20 pagineMonthly Monetary Trends - December 2011rryan123123Nessuna valutazione finora

- Bank of Japan MinutesDocumento22 pagineBank of Japan Minutesrryan123123Nessuna valutazione finora

- EIA - Short Term Energy OutlookDocumento43 pagineEIA - Short Term Energy Outlookrryan123123Nessuna valutazione finora

- OPEC - Monthly Oil Market ReportDocumento78 pagineOPEC - Monthly Oil Market Reportrryan123123Nessuna valutazione finora

- IEA - Key World Energy StatisticsDocumento82 pagineIEA - Key World Energy Statisticsrryan123123Nessuna valutazione finora

- Monetary Trends - NovemberDocumento20 pagineMonetary Trends - NovemberNathan MartinNessuna valutazione finora

- Asian Development Bank - Weekly Debt HighlightsDocumento13 pagineAsian Development Bank - Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- ECB - Monthly Economic BulletinDocumento206 pagineECB - Monthly Economic Bulletinrryan123123Nessuna valutazione finora

- EIA - Short Term Energy OutlookDocumento44 pagineEIA - Short Term Energy Outlookrryan123123Nessuna valutazione finora

- OPEC - Monthly Oil Market ReportDocumento78 pagineOPEC - Monthly Oil Market Reportrryan123123Nessuna valutazione finora

- IMF - Australia Article IV Consultation ReportDocumento59 pagineIMF - Australia Article IV Consultation Reportrryan123123Nessuna valutazione finora

- US Financial Data Weekly - St. Louis FedDocumento24 pagineUS Financial Data Weekly - St. Louis Fedrryan123123Nessuna valutazione finora

- Eng - Record71-Fund CatalogueDocumento26 pagineEng - Record71-Fund CatalogueTing ohnNessuna valutazione finora

- Correct Answers Are Shown in - Attempted Answers, If Wrong, Are inDocumento14 pagineCorrect Answers Are Shown in - Attempted Answers, If Wrong, Are inbharatNessuna valutazione finora

- Stormgain Public Api: Coingecko StandardsDocumento11 pagineStormgain Public Api: Coingecko StandardsCarlos Alejandro PerdomoNessuna valutazione finora

- Checklist PDFDocumento2 pagineChecklist PDFMohammad KamruzzamanNessuna valutazione finora

- Supercharge Your Trading & Inve - Younes, Danny PDFDocumento167 pagineSupercharge Your Trading & Inve - Younes, Danny PDFAvinash Warke100% (1)

- SPDR Periodic Table WebDocumento2 pagineSPDR Periodic Table WebCarla TateNessuna valutazione finora

- MM Unit-3Documento26 pagineMM Unit-3ak980272Nessuna valutazione finora

- Chapter 3 (10th Edition) 2013Documento37 pagineChapter 3 (10th Edition) 2013Nguyen Dac ThichNessuna valutazione finora

- Daniel Ahn Speculation Commodity PricesDocumento29 pagineDaniel Ahn Speculation Commodity PricesDan DickerNessuna valutazione finora

- Bloomberg Aptitude TestDocumento35 pagineBloomberg Aptitude TestShivgan Joshi100% (1)

- Case Study in The Failure of Economic Policy: Zimbabwe: ECO5075: Macroeconomic Policy AnalysisDocumento63 pagineCase Study in The Failure of Economic Policy: Zimbabwe: ECO5075: Macroeconomic Policy AnalysisMark EllyneNessuna valutazione finora

- Multiple Choice Problem (Dayag) Page 76 Items 2-6Documento3 pagineMultiple Choice Problem (Dayag) Page 76 Items 2-6Cookies And CreamNessuna valutazione finora

- VC Fund With An Accelerator - Key TermsDocumento4 pagineVC Fund With An Accelerator - Key TermsAnte MaricNessuna valutazione finora

- Risk and ReturnDocumento31 pagineRisk and ReturnnidamahNessuna valutazione finora

- 10K 123106Documento175 pagine10K 123106anon-764084100% (2)

- Elements 4-3 PPDocumento1 paginaElements 4-3 PPMatika John PierreNessuna valutazione finora

- AFM 132 Unit 8 - Marketing - Tues. Nov. 1 - LEARNDocumento17 pagineAFM 132 Unit 8 - Marketing - Tues. Nov. 1 - LEARNiyengar.amoghNessuna valutazione finora

- Syllabus PDFDocumento3 pagineSyllabus PDFBenjamin ChillamNessuna valutazione finora

- BuyerWinback ChurnDocumento430 pagineBuyerWinback ChurnKazi DarazNessuna valutazione finora

- A Brief History of Money PDFDocumento52 pagineA Brief History of Money PDFCristian CambiazoNessuna valutazione finora

- Capital StructureDocumento41 pagineCapital StructuremobinsaiNessuna valutazione finora

- Chapter19 FXRiskDocumento52 pagineChapter19 FXRiskkishi8mempin100% (1)

- Inv Lectures FinalsDocumento5 pagineInv Lectures FinalsShiela Mae Gabrielle AladoNessuna valutazione finora

- HDFC Mutual FundDocumento93 pagineHDFC Mutual FundKomal MansukhaniNessuna valutazione finora

- Man AHL Analysis CTA Intelligence - On Trend-Following CTAs and Quant Multi-Strategy Funds ENG 20140901Documento1 paginaMan AHL Analysis CTA Intelligence - On Trend-Following CTAs and Quant Multi-Strategy Funds ENG 20140901kevinNessuna valutazione finora

- (Salomon Smith Barney) Exotic Equity Derivatives ManualDocumento92 pagine(Salomon Smith Barney) Exotic Equity Derivatives Manualmarco_aita100% (2)

- Intro To MarketingDocumento70 pagineIntro To MarketingBenjo HilarioNessuna valutazione finora

- Strategic Management An Integrated Approach 10th Edition Hill Solutions Manual 1Documento16 pagineStrategic Management An Integrated Approach 10th Edition Hill Solutions Manual 1michael100% (54)

- Unit 1-2kDocumento49 pagineUnit 1-2kCuti PandaNessuna valutazione finora

- FIN307 Exam1Documento61 pagineFIN307 Exam1mahirahmed51Nessuna valutazione finora