Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Joining The Euro

Caricato da

bebi00Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Joining The Euro

Caricato da

bebi00Copyright:

Formati disponibili

Joining the Euro convergence criteria Countries wishing to join the single currency must meet four convergence

e criteria.

1. Stable prices: Inflation must not be more than 1.5 percentage points higher than the

average in the three member countries with best price stability, i.e. lowest inflation.

2. Stable exchange rate: The national currency must have been stable relative to other 3.

EU currencies for a period of two years prior to entry into the monetary union (ERMII entry). Sound government finances: a. Gross government debt must not exceed 60 per cent of GDP. b. The annual government budget deficit must not be greater than 3 per cent of GDP.

1. Low interest rates: The 5-year government bond rate must not be more than 2

percentage points higher than in the three member countries where inflation is lowest. The Case for UK Membership of the Euro Trade, investment and productivity: The Treasurys official assessment of its five economic tests published in June 2003 acknowledged that EMU membership for the UK could enhance productivity by increasing trade flows between the UK and other EU nations; boost investment and stimulate competition in product markets. It could also help to promote supply-side reforms in the EU and encourage specialization and further exploitation of the UKs comparative advantage in several sectors of the economy in the longer term. Increased price transparency: Membership of the Euro should in practice make it easier for consumers and businesses to compare relative prices levels across member nations. This will encourage cross-border trade and increase the competitive pressures across many different markets. There are potential gains in consumer welfare if price transparency leads to improvements in allocative efficiency. Business uncertainty and transactions costs: Joining the Euro would reduce exchange rate uncertainty for British businesses and lower transactions costs for companies and tourists. Nearly 60% of our trade in goods and services is conducted with other members of the European Union a figure that will grow in future years The Euro as a complement to the working of the Single Market: The Euro is vital as a complement to the success of the Single European Market. This should lead to an increase in intra-European trade flows and higher inward investment within the EU region. Britains flexible labour market would enhance our performance within the Euro Zone: Britain's flexible labour market would be highly effective inside a single currency area and would help to attract even more inward investment from outside the EU. Foreign investment flows and the development of UK multinational enterprises: Britain has been a major recipient of foreign direct investment in recent years. Some commentators believe this would be threatened if the UK remains outside the system in the long run. By removing a currency barrier to trade and potentially improving access to funding, EMU could also facilitate the development of UK-owned multinational enterprises. Higher wages and employment for UK workers: EMU could have long-term benefits for households, including potentially lower prices and higher wages although the potential benefits here do depend greatly on the degree of sustainable convergence between the UK and other Euro Zone countries Political and economic influence: Britain stands to lose political and economic influence in shaping future economic integration if it remains outside the monetary system.

Transactions costs and price transparency explained Transactions Costs When each country has its own currency, transactions between two countries will incur currency conversion costs. A round trip of 40,000 Belgian Francs, through 10 European countries finished as 21,300 Belgian Francs: 47% of the funds were lost through currency conversion costs. By forming a common currency area the transactions and reporting costs are eliminated. Price Transparency The price of the same good can differ between countries, shielded by the price of the good being given in different currencies. While must of the price difference is due to differences in VAT, some is due to the use of difference currencies. Such price differences can be eliminated by forming a common currency area, which increases price transparency. Firms that charge a higher price due to inefficient production methods may lose business by the price transparency and resulting increase in competition. Source: Richard Ashlin, LSE The Case against UK Participation Critics of the Euro argue that the new currency does not meet the requirements of an optimal currency area and that structural differences between member nations threaten to undermine the success of the project. Other economists believe that the UK can continue to enjoy a sustained period of macroeconomic prosperity outside the Euro Zone whilst still deriving some of the benefits from participation in the single European market.

1. Past history and deflationary bias: Currency unions have collapsed in the past. There

is no guarantee that EMU will be a success. It may indeed prove to be a recipe for economic stagnation including slower growth and high unemployment if the ECB pursues a deflationary monetary policy to keep inflation within the 2% limit. Many economists have been critical of the reluctance of the ECB to cut interest rates in a more aggressive manner during its first six and a half years in operation. The Euro is not an optimal currency area: The Euro Zone does not meet the conditions required for an optimal currency area (OCA). By this we mean that within the Euro Zone countries there is immobility of labour and there is insufficient wage flexibility inside European labour markets to cope with the inevitable external economic shocks. A lack of real economic convergence: Member economies have not converged fully in a real or structural sense. And, at some stage, there is a risk that excessively high interest rates will be set across the Euro Area because of an inflationary fear in one part of the zone that is unsuited to another area. This is the essence of the argument that in a currency union comprising many countries, it is virtually impossible for the official short-term interest rates to be at a level than is optimum for any one country. Loss of domestic monetary policy freedom: Joining a single currency reduces Britains monetary policy autonomy. Britain might wish to retain the flexibility to set short term interest rates to meet her own internal macroeconomic objectives. Entry to the Euro Zone means a permanent transfer of domestic monetary sovereignty to the ECB. Constraints of the fiscal stability pact: Countries joining the Euro signed up initially to the fiscal stability pact which limited the scale of government borrowing to 3% of national income. Several nations have already broken the conditions of the pact and it has now effectively been abandoned. But remaining outside the Euro Zone gives the UK a degree of fiscal policy freedom not available to member states. Monetary policy asymmetry between the UK and the Euro Zone: There is plenty of evidence that the British economy is more sensitive to the effects of interest rate

2.

3.

4.

5.

6.

7. 8.

9.

changes than other EU countries. In part this is because of the high scale of owneroccupation in the housing market on variable-rate mortgages. Joining a currency union with little monetary flexibility requires the UK to have more flexibility in labour markets, product markets and in the housing market. But the British rented housing sector is too small to be a good substitute for owner-occupation and major change will have to be made to the structure of housing finance. Another factor behind monetary policy asymmetry is that British companies rely more heavily on debt finance to pay for their investment projects rather than the issuing of new equity (shares) through the capital markets. They are more exposed to changes in interest rates than businesses in other EU countries. Adjustment costs: The change over process to the introduction of the Euro will involve substantial menu costs for businesses and banks. These menu costs will bear heavily on small-medium sized enterprises. Foreign investment issue: Opponents of Euro membership argue that Britain can continue to attract capital inflows outside of the Euro Zone. Favourable supply-side factors in both product and labour markets make the UK attractive for foreign investment. The performance of the Bank of England since 1997: The Bank of Englands success in keeping inflation within target and at the same time changing interest rates to keep the economy on track for sustained growth, may have undermined the case for UK entry into the Euro Zone for the UK. Would macroeconomic performance using the Euro be noticeably better

The 5 Economic Tests The Labour Government's decision on EMU membership reflects what it believes is best for the long-term economic interests of the British people and the performance of the UK economy. (Statement of Policy on the 5 Economic Tests, June 2003) The Labour government is committed to holding a binding referendum on the issue of the single currency before making a decision on entry. Gordon Brown has outlined five economic tests to be met before he will recommend membership of the single currency.

1. Economic Convergence: This test revolves around the following question. Are UK and 2.

Euro Zone business cycles and economic structures compatible so that we and others could live comfortably with euro interest rates on a permanent basis? Economic Flexibility: This test considers whether there is sufficient flexibility in the system to cope with economic shocks. Brown wants there to be more flexibility in the European labour market and increased competitive pressures in markets for goods and services. Some of this may happen naturally (driven for example by the impact of the Internet) but the European labour markets may require root and branch reforms. The British government is certainly pushing strongly for wider economic reforms in Europe before it will countenance membership of the single currency Investment: This test focuses on whether membership of the single currency has a beneficial effect on the level of capital investment across many sectors of the economy. This includes the potential impact of foreign direct investment from within and outside of the Euro Zone. Would joining EMU create better conditions for overseas firms making long-term decisions to invest in Britain? The Financial Services Industry: This test is not the most important one. It considers the likely impact of Euro participation on the health of the UK's financial services industry Employment: Whether the Euro is good in the long term for raising employment and reducing unemployment according to the Treasury, this test can be summed up as

3.

4. 5.

follows: Will joining EMU promote higher growth, stability and a lasting increase in jobs?

Benefits of the EURO

1. Transaction Costs: There will be no longer a cost involved in changing currencies; this will benefit tourists and firms who trade within the EURO area. It has been estimated that this benefit will be equal to 1% of GDP so will be quite significant. (this is sometimes known as frictional costs) 2. Price Transparency: With a common currency it will be easier to compare prices in different European countries because they would all be in Euros. This enables firms to source cheaper raw material and consumers to but cheaper goods For example, new car prices are much higher in the UK than elsewhere, a single currency could help reduce these price differentials. 3. Eliminating Exchange Rate uncertainty. Volatile swings in the exchange rate can destroy the profitability of exports. This undermines business confidence in investing. Therefore with a single currency business confidence should improve leading to greater trade and economic growth. 4. Improvement in Inflation Performance. The ECB which sets interest rates for the whole Eurozone area will be committed to keeping inflation low; countries with traditionally high inflation will benefit from this. However this point is debatable as countries outside the Euro have maintained low inflation. 5. Euro could emerge as a global trading currency 6. Inward investment Inward investment may increase from outside the EU as firms take advantage of lower transaction costs within the EU area. Recently the Chairman of Nissan said the UK would lose inward investment if it stayed out of the Euro 7. Economizing on foreign currency reserves 8. The financial sector could benefit. It would be easier to conduct banking and insurance with a single currency. It would be easier to trade German shares on the London stock market

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Cyber Attacks Implications For UkDocumento79 pagineCyber Attacks Implications For UkAlex Andra MurariuNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- UnemploymentDocumento30 pagineUnemploymentNorman StricksonNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Managerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreDocumento38 pagineManagerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreNishatNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Nguyen Hoang Nam, PHD: Economic GeographyDocumento19 pagineNguyen Hoang Nam, PHD: Economic GeographyTrung NguyenNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Capacity Planning NewDocumento26 pagineCapacity Planning Newvivek3790Nessuna valutazione finora

- Relevance of Keyensian Economics For Developing EconomicsDocumento7 pagineRelevance of Keyensian Economics For Developing EconomicsParas GhaiNessuna valutazione finora

- Journal of Retailing and Consumer Services: Ajay Kumar, Justin Paul, Slađana Star Cevi CDocumento12 pagineJournal of Retailing and Consumer Services: Ajay Kumar, Justin Paul, Slađana Star Cevi CVarinder Pal SinghNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Short Run Costs of Production: An Insight To Economics 1Documento8 pagineShort Run Costs of Production: An Insight To Economics 1rifluNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Personnel Economics LazerDocumento157 paginePersonnel Economics LazerAmit Sharma33% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Wage Determination Under Free Market ForcesDocumento5 pagineWage Determination Under Free Market ForcesKrishna Das ShresthaNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

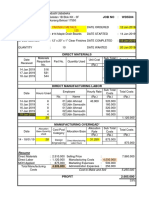

- COST SHEET Atau JOB COSTDocumento1 paginaCOST SHEET Atau JOB COSTWiraswasta MandiriNessuna valutazione finora

- A Crazy Methodology - On The Limits of Macro-Quantitative Social Science ResearchDocumento32 pagineA Crazy Methodology - On The Limits of Macro-Quantitative Social Science ResearchIan RonquilloNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- BCG MatrixDocumento2 pagineBCG Matrixhasan razaNessuna valutazione finora

- Cost Accounting Vs Financial AccountingDocumento2 pagineCost Accounting Vs Financial AccountingSagar NareshNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Economics Notes HindiDocumento77 pagineEconomics Notes HindiYashwant Singh RathoreNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Haas 2010 International Migration ReviewDocumento38 pagineHaas 2010 International Migration ReviewAlexandra NadaneNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Iim Lucknow - Pi KitDocumento176 pagineIim Lucknow - Pi Kitkumbhare100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- 34 48 48 39 66 64 46 24 53 64 54 56 83 31 Total Result 442 268 710 38%Documento89 pagine34 48 48 39 66 64 46 24 53 64 54 56 83 31 Total Result 442 268 710 38%Agus MaulanaNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Macroeconomic Problems of India Economy ProjectDocumento4 pagineMacroeconomic Problems of India Economy ProjectSatyendra Latroski Katrovisch77% (52)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Does Business Ethics Make Economi SencdeDocumento11 pagineDoes Business Ethics Make Economi Sencdemaarghe87Nessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- JLL Asia Pacific Property Digest 2q 2014Documento72 pagineJLL Asia Pacific Property Digest 2q 2014maywayrandomNessuna valutazione finora

- Capacity Planning QuizDocumento3 pagineCapacity Planning QuizLesterAntoniDeGuzman100% (2)

- WP47 Kelton PDFDocumento30 pagineWP47 Kelton PDFEugenio MartinezNessuna valutazione finora

- Forex Journal v1.0Documento13 pagineForex Journal v1.0Hafiz DemonzNessuna valutazione finora

- Case Study Salem TelephoneDocumento3 pagineCase Study Salem TelephoneahbahkNessuna valutazione finora

- PPT04 - Creating Your Business ModelDocumento28 paginePPT04 - Creating Your Business ModelAgus PriyonoNessuna valutazione finora

- MAMCOMDocumento22 pagineMAMCOMRoshniNessuna valutazione finora

- Sassen - The Global City - Introducing A ConceptDocumento18 pagineSassen - The Global City - Introducing A ConceptPedro Felizes100% (1)

- Problem AnalysisDocumento2 pagineProblem AnalysisAriel FernandezNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Brief History of WorkDocumento8 pagineA Brief History of WorkRenan TokkiNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)