Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Kalimantan Coal Railway Project

Caricato da

mimandapiconeDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Kalimantan Coal Railway Project

Caricato da

mimandapiconeCopyright:

Formati disponibili

CONTENTS

List of Contents

1 Introduction ......................................................................................................................... 1 1.1 Background ............................................................................................................ 1 1.2 Transportation Constraints .................................................................................... 1 1.3 Long Term Plan ...................................................................................................... 1 1.4 Central Kalimantan Overview ................................................................................ 2 2 Demand for Coal and Likely Supply from the Project Area .................................................. 4 2.1 Global Demand for Coal......................................................................................... 4 2.2 Domestic Coal Consumption and Supply ............................................................... 5 2.3 Coal Resources, Reserves and Production in Central Kalimantan.......................... 6 3 The Project ......................................................................................................................... 11 3.1 Project Scope ....................................................................................................... 11 3.2 Project Cost Estimate........................................................................................... 11 3.3 Implementation Schedule.................................................................................... 11 4 Economic and Financial Evaluations................................................................................... 12 4.1 Economic Evaluation............................................................................................ 12 4.2 Financial Evaluation ............................................................................................. 12 5 Railway Alignment and Train Operations ........................................................................... 13 5.1 Selection of Location for Coal Loading or Unloading ........................................... 13 5.2 Provisional Train Operations Plan ........................................................................ 14 6 Outline of Key Laws and Regulations Applicable to the Project ......................................... 15 6.1 Railway Sector Law .............................................................................................. 15 6.2 PPP Cross Sector Regulatory Framework............................................................. 15 6.3 Relevant Ministerial Regulations ......................................................................... 15 6.4 Environmental and Social Resettlement Laws and Regulations .......................... 15 6.5 Other Laws ........................................................................................................... 15 7 Environmental and Land .................................................................................................... 16 7.1 Environmental and Social Characteristic of the Area........................................... 16 7.2 Land Acquisition and Resettlement Characteristics of the Area.......................... 16 7.3 Outline of Environmental and Land Issues Connected with the Coal Rail Project 16 7.4 Environmental Requirements .............................................................................. 17 7.5 Land Acquisition-Resettlement Requirements .................................................... 17

Tables

Table 1.1: Condition of Main Rivers in Central Kalimantan ....................................................... 2 Table 2.1: Current Coal Demand by Industries in Indonesia ..................................................... 5 Table 2.2: Indonesian Coal Resources/Reserves ....................................................................... 6 Table 2.3: Coal Resources in Central Kalimantan Province ....................................................... 6 Table 2.4: Coal Reserves by Mining Concessionaires (PKP2B)................................................... 7 Table 2.5: List of Mining Companies and Plans for Coal Production ......................................... 9 Table 3.1: Project Cost for Puruk Cahu Bangkuang Coal Railway (Financial)........................ 11 Table 4.1: Base Case: Results of Economic Analysis ................................................................ 12 Table 5.1: Estimated Numbers of Trains per Day .................................................................... 14 Table 5.2: Train Formation and Rolling Stock .......................................................................... 14

Figures

Figure 1.1: Phased Railway Development Program in Central Kalimantan ............................... 2 Figure 2.1: World Coal Consumption by Country Grouping, 1980-2030 ................................... 4 Figure 2.2: Non-OECD Coal Consumption by Region, 1980, 2006, 2015 and 2030 ................... 4 Figure 2.3: Estimation of Production, Export and Domestic Demand of Coal in Indonesia ...... 5 Figure 2.4: Coal Concessions and Resources in Central Kalimantan ......................................... 8 Figure 2.5: Coal Mining Concessions and Proposed Railway in Central Kalimantan ............... 10 Figure 5.1: Rail Alignment ....................................................................................................... 13

Appendices

Appendix 1: Risk Allocation ........................................................................................................ i Appendix 2: Implementation Schedule ..................................................................................... ii

Executive Summary: Central Kalimantan Coal Railway Puruk Cahu - Bangkuang

Central Kalimantan is a major source of high grade coal that is in demand nationally and internationally. The Government has already issued permits for the extraction of coal in large areas of the Barito River valley and actual extraction is now starting. However, there are significant constraints to the transportation of coal to the seaports on the Kalimantan coast caused by distance, remoteness of the area, and the lack of reliable transportation. Transportation by road is only feasible for comparatively short distances, and the Barito River suffers from seasonal variations which make transportation during the dry season unreliable except in the lower reaches of the river. The construction of a coal railway will ensure a cost effective, reliable, and all season transportation of coal in this region. The construction of the railway is an integral part of the Central Kalimantan Province railway development program. The proposed project has already received the approval of the Provincial assembly. A Public Consultation meeting for this project was conducted on 23rd May 2009 and there was general support for the Project. The Provincial Government will be responsible for land acquisition and cost. The railway line is 185 km long and will include the provision of land, railway infrastructure, signalling, telecommunications and electricity system, rolling stock, stations, depot, workshops, loading on/off track facilities, stock piles, and an O&M system. The project is prima facie technically, economically and financially feasible. The project cost estimate is about US$ 1.5 billion. The forecast project ROE is 13.8%. The route passes through commercial forests which are now being exploited. The project is likely to have impacts on the remaining adjacent forests, particularly during the construction phase. Most of the land is stateowned (Ministry of Forestry). The Central Kalimantan Provincial Government now has responsibility for management of the land. There is unlikely to be much acquisition of buildings or resettlement. The project will require an AMDAL (Environmental Impact Assessment) which will be prepared by the project concessionaire. This Information Memorandum presents the currently available information to potential investors. A proposed project implementation schedule indicates a timeline for implementation.

Deleted: This Information Memorandum is on the proposed coal railway between Puruk Cahu - Bangkuang in the Barito river valley in Central Kalimantan. Deleted: developer. Most of the land is stateowned (Ministry of Forestry). The Central Kalimantan Provincial Government now has responsibility for management of the land. Deleted: A Public Consultation meeting for this project was conducted on 23rd May 2009 and there was general support for the Project. Deleted: , in Appendix 2,

Deleted: Deleted: e

1. Introduction

Introduct ion

1.1

Background

The areas to be mined are mainly in the upper and northern parts of the Barito river valley where barging is even more difficult.

Coal has always played an important role in the development of the overall economy in Indonesia. The Country has extensive deposits, possibly sufficient for more than 150 years based on recent calculations. Coal is seen as an alternative to the dwindling domestic oil resources. Indonesia increased coal production in the early 1990s and now has the seventh largest annual coal production world-wide (approx wide (approximately 200 million tons per year). Indonesia is now also the second largest coal exporting country (150 million tons per year) after Australia. About 70% of Indonesian coal is bout exported to Asian countries, of which Japan is the largest importer (approximately 30 million tons). Kalimantan has some of the most extensive coal resources and the coal extracted is known for its high calorific, low ash and low sulphur content. c, Coal resources in the Central Kalimantan are currently estimated to be about oal 4.8 billion tons.

1.3

Long Term Plan

As a result of the present transportation constraints t Central Kalimantan the Provincial Government is considering the development of a railway network; To secure a reliable all season mode of transport for the exploitation of various resources such as coal, plantations and forests, to overcome the very limited capacity of the road network and constraints in river transport; To provide a high volume, more reliable and safer mode of transport. It is also environmentally less damaging compared to other transport modes; To ensure a more cost effective transportation system. o The development of a railway network for Central Kalimantan consists of the following phases: (See Figures 1.1) Phase 1A Phase 1B Phase 2 Phase 3 Phase 4A Phase 4B : Puruk Cahu-Bangkuang (185km) Bangkuang : Bangkuang- Lupak Dalam (175km) : Kudangan-Kumai (195km) Kumai : Puruk Cahu-Kuala Kurun Kuala Kurun-Kuala Pembuang (466km) : Tumbang Samba-Nanga Nangabulik (418km) : Kuala Kurun-Lupak Dalam (390km) Lupak

1.2

Transportation Constraints

At present most of the coal mined in Central Kalimantan is transported by ost private roads to the Barito River and then barged to intermediate and final stockpiles downstream on the same river. Below Bangkuang the river . Bangkuang, remains navigable by large barges throughout the year that transport coal to the port of Lupak Dalam in the Java Sea. There are significant problems associated with transporting coal on the Barito River due to the low water levels during the dry season, making the river impassable even for smaller barges. The problems are obviously more acute in the upper reaches of the river and during longer dry seasons. The river constraints have the effect of limiting present coal production in Central Kalimantan to about 1.5 million tons per year. Other factors are the unreliability of road transport and higher costs. Without these constraints the coal production could increase in the project area to 20 million tons per year.

Phase 1, which is the subject of this Information Memorandum will be a , Memorandum, railway from Puruk Cahu to Bangkuang on the Barito River. At that point, river transport will be utilized from Bangkuang to Lupak Dalam offshore terminal. The proposed project is in the Regional Medium Term Development Plan (RPJMD) 2006-2010 and Spatial Plans (RTRW) Central Kalimantan 2010 Province 2007. In addition, the project has been approved by the regional rovince parliament (DPRD) (letter No. 162/1866/DPRD/2008).

1. Introduction

Figure 1.1: Phased Railway Development Program in Central : Kalimantan

The province has many rivers flowing through the area. From the northern area there are with 11 major rivers and over 30 small rivers flowing to the Java Sea. Table 1.1 below shows the condition of the 11 wide rivers. The widest rivers in Central Kalimantan function as important transport links to connect regencies, districts and villages, and also the northern part and southern parts of Kalimantan. The Barito is clearly the most significant of these rivers. Table 1.1: Condition of Main Rivers in Central Kalimantan :

No. 1. 2. Name of River Length of River (km) Potential Navigable Navigable Length (km) Length (km) 200 150 250 190 250 100 300 270 520 150 500 420 700 Width (m) 150 100 150 250 250 350 250 100 450 450 500 Depth (m) 8 4 6 6 5 6 6 5 7 6 8

Sungai Jelai Sungai Arut Sungai 3. 300 Lamandau 4. Sungai Kumai 175 5. Sungai Seruyan 350 6. Sungai Mentaya 400 7. Sungai Katingan 650 Sungai 8. 200 Sebangau 9. Sungai Kahayan 600 10. Sungai Kapuas 600 11. Sungai Barito 900 Source: Central Kalimantan Provincial Government Source: Central Kalimantan Provincial Government

1.4

Central Kalimantan Overview

The southern part of Central Kalimantan comprises coastal and swamp areas with an altitude of 0-50 m above sea level, the middle part comprises 50 flat land and plateau with an altitude of 50-150 m above sea level, and the 150 northern part is hilly and mountainous, with an altitude of more than 150 m above sea level. There are no volcanic mountains.

The Gross Regional Domestic Product (GRDP) of Central Kalimantan was Rp. 32.35 trillion in 2008 at current market price. This is the lowest in the whole of Kalimantan and is only 13% of the GRDP of Eastern Kalimantan. % The Central Kalimantans economic growth rate was 6.2% in 2008 at constant 2000 prices, which is higher than the growth rate for the whole of Indonesia. The agriculture sector accounts for 30.4% of total GRDP in 2008, followed by the trade, hotel and restaurant sector (1 (19.7%) and the services sector (12.4%). The total length of public roads in Central Kalimantan was 12,134 km in ds 2007, consisting of 1,715 km of national roads, 1,708 km of provincial roads

1. Introduction

and 8,711 km of Regency/City roads. Although the road length in Central Kalimantan is the second longest in Kalimantan, the road network density econd (roads per 1,000 km2 area) is only 79 km, which is very low compared to y 200 km, the average for the whole of Indonesia. It is estimated that about 56% of the total road length in Central Kalimantan is unsurfaced, and about 40% of the road length is in poor condition. Even on national roads, the average width is only 4.5 m and the maximum load capacity is limited to 8 tons. Central Kalimantan has 10 seaports consisting of 6 national ports and 4 regional ports. In addition, there are also two special quays for loading CPO (Crude Palm Oil) and two special ports for coal transportation. The 2007 population of Central Kalimantan is 2,048,000, and this is forecast to increase by about 60% to 3,414,000 by 2025. The province shows the 5. highest population growth of the four provinces within Kalimantan. Such a high growth of future population is an important factor for developing regional economic activities. Central Kalimantan is now seeking to attract investment not only from foreign but also local investors in such sectors as forestry, food crops, estate crops, livestock, fishery, mining, trade, industry, tourism, etc. In order to support such investment opportunities, the development of infrastructure is indispensable, with the transportation sector is given the highest priority.

2. Demand for Coal and likely Supply from the Project Area upply

Demand for Coal and Likely Supply from the Project Area

2.1 2.1.1

Global Demand for Coal World Coal Consumption

Figure 2.2: Non-OECD Coal Consumption by Region, 1980, 2006 2015 OECD 2006, and 2030

According to the International Energy Outlook 2009, world coal consumption is expected to increase by 49% from 2006 to 2030, and coals share of world energy consumption will increase from 27% in 2006 to 28% in 2030. The 28 world coal consumption will increase by 49%, from 127.5 quadrillion Btu in , 2006 to 190.2 quadrillion Btu in 2030 (Figure 2.1). ). The growth rate for coal consumption is fairly even over the period, averaging 1.9% per year from 2006 to 2015 and 1.6% per year from 2015 to d 1.6 2030generally reflecting the growth trends for both world GDP and world generally primary energy consumption. Regionally, increased use of coal in nonnon OECD countries accounts for 94% of the total growth in world coal consumption over the entire period. Figure 2.1: World Coal Consumption by Country Grouping, 1980-2030 : 1980

2.1.2

Non-OECD Countries

Led by strong economic growth and rising energy demand in non non-OECD Asia, total coal consumption in the non non-OECD countries is projected to increase to 139.6 quadrillion Btu in 2030, an increase of 73 percent over the 2006 total (Figure 2.2). The increase of 59.0 quadrillion Btu, which ). represents 94 percent of the projected increase in total world coal consumption, underscores the continuing importance of coal in meeting overall energy demand in the non-OECD nations. Over the entire reference OECD refer case horizon, coal accounts for about one one-third of total non-OECD energy consumption.

2.1.3

Non-OECD Asia

Deleted: Growth in Dema Demand for Coal

The countries of non-OECD Asia account for 90 of the projected increase OECD 90% in world coal consumption from 2006 to 2030. Strong economic growth is expected for non-OECD Asia, averaging 5.7 pa from 2006 to 2030, with OECD 5.7%

2. Demand for Coal and likely Supply from the Project Area upply

Million Tons

Chinas economy averaging 6.4% per year and Indias by 5.6% per year. 5.6 Much of the increase in demand for energy in non non-OECD Asia, particularly in the electric power and industrial sectors, is expected to be met by coal. d Because China has limited reserves of oil and natural gas, coal remains the leading source of energy in its industrial sector. In India, more than 71 of 71% the growth in coal consumption is expected to be in the electric power sector and most of the remainder in the industrial sector. Coal use for electricity generation in India is projected to grow by 1.9% per year, to 9.3 quadrillion Btu in 2030, as an additional 65 gigawatts of coal-fired capacity (net of coal retirements) is brought on line. OECD In the other nations of non-OECD Asia, coal consumption is expected to grow by an average of 3.0% per year, from 5.1 quadrillion Btu in 2006 to 10.4 quadrillion Btu in 2030, with increases in both the electric power and industrial sectors. In the electric power sector, significant growth in coal consumption is expected in Indonesia and Vietnam, where considerable amounts of new coal-fired generating capacity are expected to come on line fired before 2030.

2.2.2

Future Domestic Coal demand

Figure 2.3: Estimation of Production, Export and Domestic Demand of : Coal in Indonesia

450 400 350 300 250 200 150 100 50 0 2004 2005 2006 2007 2008 2009 Year 2010 2015 2020 2025 131 95 36 154 113 41 193 145 48 217 163 229 160 69 230 184 250 186 84 201 120 54 66 191 170 220 185 321

Domestic Export Production

405 361

Source: Ministry of Energy and Mineral Resources

2.2 2.2.1

Domestic Coal Consumption and Supply Estimate of Coal Production in Indonesia Indonesi

As the demand for coal has steadily increased in the industries shown in Figure 2.3, it is expected that the demand keeps increasing in each industry , in Indonesia. The domestic demand for coal has steadily increased in the industries as shown in Table 2.1 Table 2.1: Current Coal Demand by Industries in Indonesia :

(Units: Million Tons) Coal CV>5100 Kcal/kg Year Electricity 2006 2007 2008 2009 2010 2011 2012 2013 2014 27.1 28.9 30.0 32.0 32.0 30.0 28.0 28.0 28.0 Cement 5.3 6.5 6.8 8.1 9.0 9.9 10.4 10.9 11.5 Metalurgy, Textile, Pulp 1.9 7.2 9.4 10.9 11.1 27.0 28.4 29.2 31.4 Others 13.0 7.5 16.5 6.6 6.6 Sub Total 47.3 50.1 62.7 57.6 58.7 66.9 66.8 68.2 70.9 Electricity 0.7 3.5 5.5 9.6 15.2 21.0 21.0 21.0 30.0 Coal CV<5100 Kcal/kg UBC 0.0 0.4 0.4 0.4 1.0 1.2 1.3 1.4 1.8 Briquite, Fertilizer, BCL, Licol 0.0 0.1 0.1 0.1 0.1 4.1 5.8 5.9 7.3 Sub Total 0.7 3.9 5.9 10.0 16.3 26.2 28.1 28.2 39.1 Total

Coal production in Indonesia reached 212.5 million tons (MT) in 2007, up oal 8.4% from 2005. The major part of this coal output was produced by 29 companies which are PKP2B (mainly owned by Foreign Private Companies) Foreig contractors while PT. Bukit Asam (PT. BA) (State Owned Enterprises) produced about 9.3 MT and companies with mining rights produced around 0.22 MT. So far, all the coal produced by PT. B Bukit Asam has been sold within Indonesia as the fuel for the Suryalaya Thermal Power Plant. Plant

48.0 54.0 68.6 67.6 75.0 93.1 94.9 96.4 110.0

Source: Ministry of Energy and Mineral Resources

2. Demand for Coal and likely Supply from the Project Area upply

As seen in Table 2.1, the demand in the electricity industry is expected to double in 2010 - 2014 compared with the demand in 200 It is urgent to 2007. improve production capacity at coal mining sites and also to improve the supply and transportation of coal to domestic coal users. Between 2015 and 2020, it expected that the quantity of coal exported , abroad and domestic demand in Indonesia will be balanced After 2020 it is balanced. expected that the growth in domestic consumption will be larger than that of coal exports. Furthermore, the demand for electric electricity, which consumes 80% of domestic coal output is growing at a high rate. It is expected therefore that . there will be no lack of demand for the coal to be mined in the north-eastern parts of Central Kalimantan province.

Indicated: Coal for which estimates of the rank, quality, and quantity has been computed partly : from sample analyses and measurements and partly from reasonable geologic projections. Measured: Coal for which estimates of the rank, quality, and quantity has been computed, within a margin of error of less than 20 percent, from sample analyses and measurements from closely spaced and geologically well-known sample sites. known Resources: Concentrations of coal in such forms that economic extraction is currently or may become feasible. Reserves comprise the sum of Indicated and Measured Resources

Formatted: Font: 8 pt, (Asian) Japanese, (Other) English (U.S.) Formatted: Font: 8 pt Formatted: Font: 8 pt, (Asian) Japanese, (Other) English (U.S.) Formatted: Font: 8 pt Formatted: Font: 8 pt, (Asian) Japanese, (Other) English (U.S.) Formatted: Font: 8 pt Formatted: Font: 8 pt, (Asian) Japanese, (Other) English (U.S.) Formatted: Font: 8 pt

2.3

Coal Resources, Reserves and Production in Central Kalimantan

2.2.3

Supply of Coal in Indonesia

The coal resources and reserves in Indonesia (in 2007) are indicated in Table 2.2. Table 2.2: Indonesian Coal Resources/Reserves : Resources

Quality Low Medium High Very High kcal/kg Hypothetical <5100 5100-6100 6100-7100 >7100 Total

Source: Indonesia Coal Brief 2007

The coal resources and reserves in Central Kalimantan were announced by the Provincial Office of Mining and Energy of Central Kalimantan in June 2008, as indicated in Table 2.3. Table 2.3: Coal Resources in Ce : Central Kalimantan Province

(Unit: Million Tons) T Measured 1,178 1,178 Indicated 1,344 1,344 Inferred 2,293 Total 4,815 2,512

Resources (million tonnes) Inferred 8,711 19,653 4,998 464 33,826 Indicated 2,382 9,176 670 11 12,239 Measured 2,317 4,939 3,326 187 10,769 Total 15,094 35,692 9,066 662 60,514 1,685 1,924 71 0 3,680

% 25 59 15 1 100

Formatted Table Deleted: (Resources) Deleted: 2,512 Formatted: Centered, Space After: 0 pt, Tab stops: 3", Centered + 6", Right Deleted: (Reserves) Formatted: Normal, Tab stops: 3", Centered + 6", Right

Resources Reserves

Source Provincial Office of Mining and Energy in Central Kalimantan excluding hypothetical resources

Total measured and indicated resources (reserves) in Central Kalimantan ndicated Province amount to some 2,500 MT of coal.

2.3.1

Indonesia is one of the big coal exporters (with Australia and Colombia). Total measured reserves are more than 10,000 MT of coal, of which more than 80% is of medium to high calorific value.

Notes on Classification System:

Hypothetical: Undiscovered Coal Resources in beds that may reasonably be expected to exist in known mining districts under known geologic conditions. In general, Hypothetical Resources are in broad areas of coal fields where points of observation are absent and evidence is from evidenc distant outcrops, drill holes, or wells. Exploration that confirms their existence and reveals quantity and quality will permit their reclassification as a Reserve or Identified Sub-economic Sub Resource. Inferred: Coal in unexplored extensions of Demonstrated Resources for which estimates of the monstrated quality and size are based on geologic evidence and projection.

Coal Reserves by Mining Concessionaires (PKP2B)

The Indonesian coal industry consists of four types of producer, namely: State Owned Mining Company (PT Bukit Asam /PTBA), Mining Contractors (PKP2B). Mining Authorization Holder (KP holder), and Cooperative Units Holders (KUD). However in Central Kalimantan most coal development and production is confined to the Mining Conc Concessionaire (PKP2B) group. In Central Kalimantan at present the KP holders are inactive but they may become important suppliers of coal, because of their large concessions. Fifteen Mining Concessionaires are active (see Table 2.4) Coal resources are extensive and of high calorific value. Coal reserves total

Formatted: Font: 8 pt Formatted: Font: 8 pt, (Asian) Japanese, (Other) English (U.S.) Formatted: Font: 8 pt Formatted: Font: 8 pt, (Asian) Japanese, (Other) English (U.S.) Formatted: Font: 8 pt

2. Demand for Coal and likely Supply from the Project Area upply

some 1.42 BT. Many PKP2B mines have calorific values of over 7,000 ADB. T. For example, during the period 2004-2008 PT Marunda Graha Mineral 2008 [MGM] mined about 5 MT of coal. In 2008 they mined 1.5 MT o coal and all of production was exported.

Table 2.4: Coal Reserves by Mining Concessionaires (PKP2B)

(Unit: Billion Tons t: Tons)

Quality No. Company PT Marunda Graha Mineral PT Asmin Bara Bronang PT Asmin Bara Jaan 4 PT. Asmin Koalindo Tuhup PT Batubara Duaribu Abadi PT Bharinto Ekatama 7 PT Juloi Coal 8 PT Kalteng Coal 9 PT Lahai Coal 10 PT Maruwai Coal 11 PT Multi Tambangjaya Utama 12 13 14 PT Pari Coal PT Ratah Coal PT Sumber Barito Coal PT Suprabari Mapanindo Mineral Total Coal Reserves/ Measured/ Indicated 0.12 0.10 0.01 0.02 0.01 0.02 0.06 0.03 0.22 0.17 0.08 0.10 na 0.00 na 0.00 0.01 0.00 0.00 0.13 0.07 0.02 na na na 0.00 0.03 0.23 1.42 Construction Production Exploration Exploration Ts : 0,88 % ; Cal : 5.853 8.157 adb; Ts : 0.93 % Feasibility Study Exploration-Construction Exploration Construction Feasibility Study + Construction Construction Construction Construction Production Activity Condition Cal : 7.239 7.627 adb Ts : 0,45 1,05 %: CSN : 3 5,5 Ca,l: 5.015 7.614 adb. Ts : 0,22 3,43 Cal : 6.038 adb; Ts : 0,63 % Cal : 6.114 8.556 adb; Ts : 0,79 % ; CSN : 0,5 9,0 Cal : 5.104 6.466 adb; Ts : 0,19 2,74 % Cal : 6.788 7.855 adb; Ts : 0,3 2 % Cal : 7.515 8.239 adb ; Exploration Ts : 0,63 % ; Cal : 7.736 8.507 adb, Ts :0,62, Cal : 7.223 7.731 adb Ts : 1,24 % Cal : 8.000 adb, Ts : 0,52 % Cal : 6.507 8.422 adb Ts : 0,4 2,4 % na na Cal : 8.350 8.383 adb ; Exploration

2.3.2

Location of Resources and Concessions PKP2B

of the Mining

The location of the resources and concessions Concessionaires (PKP2B) are shown in Figure 2.4 4.

2 3

At present the 15 coal mining companies listed in Table 2.4 have 527,444 ha 2. of Concessions.

5 6

15

Notes: [Coal Reserves): upper box provides Indicated key Reserves, lower box indicates Measured Reserves Notes: Cal: Calorific Value, Ts: Total Sulfur, CSN: Crushable Swelling No. Source: Central Kalimantan Provincial Government

2. Demand for Coal and likely Supply from the Project Area upply

Figure 2.4: Coal Concessions and Resources in Central Kalimantan

Coal Mining Company (PKP2B) PT Marunda Graha Mineral PT Asmin Bara Bronang PT Asmin Bara Jaan PT Asmin Koalindo Tuhup PT Batubara Duaribu Abadi PT Bharinto Ekatama PT Juloi Coal PT Kalteng Coal PT Lahai Coal PT Maruwai Coal PT Multi Tambang Jaya Utama PT Pari Coal PT Ratah Coal PT Sumber Barito Coal PT Suprabari Mapanindo Mineral

Legend

Deleted: <sp><sp>

Coal Concession Road

Source: Provincial Office of Mining and Energy Bureau in Central Kalimantan

Scheduled Route of Railway Scheduled Stockpile

Deleted: <sp><sp><sp> <sp> Formatted: Font: (Default) Arial, 11 pt

River

2. Demand for Coal and likely Supply from the Project Area upply

2.3.3

Coal Production by Mining Authorization Holders (KP Holders) and PKP2B

The list of mining companies of all types which have c coal resources and reserves in Central Kalimantan located in the eastern area near the River Barito are indicated in Table 2.5. Table 2.5: List of Mining Companies and Plans for Coal Production Plan

No. Name of Company Type of Average Target Concession Production Contract [ton / year] KP KP KP PKP2B PKP2B PKP2B PKP2B KP KP KP KP KP KP PKP2B KP PKP2B PKP2B KP KP KP KP KP KP KP 600,000 850,000 850,000 2,000,000 5,000,000 600,000 3,000,000 600,000 600,000 600,000 600,000 600,000 600,000 5,000,000 600,000 5,000,000 2,000,000 600,000 600,000 600,000 1,500,000 500,000 600,000 300,000 33,800,000 Port Plan / Location District

Although the target production is high, actual implementation will depend upon a) the mining contractors capabilities (at present the existing coal production is only some 1.5 MT p.a.) and b) the areas of utilization which p.a. would need approvals from the Ministry of Forestry. The latest coal mining concessions (under the production and construction stages) as well as the railway alignment plan is shown in Figure 2.5.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

PT Borneo Prima PT Bara International PT Daya Bumindo PT Marunda Graha Mineral PT Asmin Koalindo Tuhup PT Lahai Coal PT Maruwai Coal PT Victor Dua Tiga Mega PT Duta Nurcahya PT Trisula Kencana Sakti PT Padang Anugrah PT Batara Perkasa PT Rizki Baratama Mandiri PT Bharinto Ekatama PT Bara Prima Mandiri PT Batubara Duaribu Abadi PT Multi Tambang Jaya Utama PT Batubara Duaribu Lestari PT Bara Prima Mandiri PT Batubara Bandung Pratama PT Bangun Nusantara Jaya Makmur PT Bara Meratus PT Kike PT Karya Gemilang Limpah Rejeki Total

Laung Tuhup Sub-District Laung Tuhup Sub-District Laung Tuhup Sub-District Laung Tuhup Sub-District Laung Tuhup Sub-District Laung Tuhup Sub-District Laung Tuhup Sub-District Lahai Sub-District Lahai Sub-District Teweh Tengah Sub-District Teweh Tengah Sub-District Teweh Tengah Sub-District Teweh Tengah Sub-District Teweh Tengah Sub-District Dusun Utara Sub-District Karau Kuala Sub-District Karau Kuala Sub-District Karau Kuala Sub-District Dusun Utara Sub-District Telang Baru Telang Baru Telang Baru Telang Baru Telang Baru

Murung Raya Murung Raya Murung Raya Murung Raya Murung Raya Murung Raya Murung Raya Barito Utara Barito Utara Barito Utara Barito Utara Barito Utara Barito Utara Barito Utara Barito Selatan Barito Selatan Barito Selatan Barito Selatan Barito Selatan Barito Timur Barito Timur Barito Timur Barito Timur Barito Timur

Source: Provincial Office of Mining and Energy in Central Kalimantan, June 2009.

There are some 24 companies, of KP and PKP2B classification, with plans for coal production in the influence area of the railway. ailway. The total production plans illustrate a potential transport requirement (by railway and/or barge) of some 34 MT p.a. however not all of these plans are likely to be realized.

2. Demand for Coal and likely Supply from the Project Area upply

Figure 2.5: Coal Mining Concessions and Proposed Railway in Central Kalimantan

2.3.4

Estimate of Coal to be Hauled on the Coal Freight Railway

Based on the above preliminary demand exercises, demand projections of a fixed 10 million ton/year for the first 10 years and 20 million ton/year from the tenth year onward have been assumed These projections depend also on assumed. the effective restriction of the construction of new private coal roads to the Barito River and its tributaries and the use of the Barito River beyond Bangkuang for transportation of coal. The construction of new roads between mines and the proposed railway will of course be allowed. Over a 30 year concession period, it is therefore expected that a minimum of 500 MT of coal would be mined in the nort northern area and transported on the railway. If exploration confirms larger deposits of coal then annual coal transport of 20 MT could commence earlier than 2022. The Project, based on somewhat conservative estimates of coal transport demand, and the known problems with river transport on the Barito River, results in rail transport becoming the most reliable mode of transport to move coals speedily from the mines to river ports to the south having all year round barge access.

Source: Provincial Office of Mining and Energy in Central Kalimantan, June 200 2009

10

3. The Project

The Project

3.1

Project Scope

a) Land acquisition b) Construction of single track between Puruk Cahu Bangkuang (185km) including civil, bridge, signaling & facilities works; c) Others station, workshop and depot, coal loading/unloading facilities; d) Procurement and maintenance of rolling stock; e) Consultant service; and f) Operation & management.

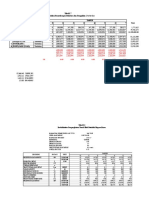

Table 3.1: Project Cost for Puruk Cahu Bangkuang Coal Railway (Financial)

No Cost Item 1 USD = Rp 10,000 1 2 3 4 5 6 7 8 7 Civil Works Bridge Works Railway Track Preparing Works Station Workshop and Depot Signal & Telecom Loading/Unloading Facility Maintenance Equipment Sub-Total 1 8 9 10 11 12 Consultant Fee VAT Project Management Fee Land Cost Contingency Sub-Total 2 Railway Infrastructure (excl. Rolling Stock) 13 14 15 Main Locomotive Shunting Locomotive Coal Wagon Sub-Total 3 Rolling Stock Railway Infrastructure (incl. Rolling Stock)

Source: TAS-IRSDP/JTC Study 2009

Deleted:

The Project Scope is as follows:

Total Cost USD 1,000

3.2

Project Cost Estimate

The financial cost estimate in Table 3.1 is derived from engineering cost estimates. Hence, in the absence of a basic engineering design, it is c somewhat difficult to validate some figures, but they have been r ut refined based on field visit and on-site inspection. Capital cost ( tal (capex) is about US$ 1.5 billion.

637,448 5,742 102,856 115,000 875 33,300 10,100 90,000 1,000 996,321 49,766 104,609 99,532 10,606 13,226 277,739 1,274,060 78,000 6,000 144,900 228,900 228,900 1,502,960

Deleted: erify Deleted: the estimated Deleted: . Some (downward) adjustments to ome some of the cost elements have been made based upon information received during the Consultant Deleted: s Deleted: to Central Kalimantan Formatted: Heading 2, Left Formatted: Font: (Default) Arial, 10 pt

3.3

Implementation Schedule

A proposed implementation schedule is shown in Appendix 2.

Grand Total A

Grand Total B Grand Total C

11

4.4.0 Economic and Financial 4.

4 Econ o mic and Financial Evaluat ions

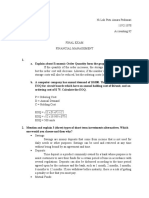

4.2.2 4.1 Economic Evaluation

The most important benefits from the transport improvement could include any or all of the following: Reduced operating expenses, Stimulation of economic development; Savings in time for freight shipments; and Fewer accidents and reduced property damage.

Financial Results

Return on Equity (IRR on Eq Equity) = 13.8%, nearly 6 percentage points above the cost of capital at 8%. Financial Net Present Value = US$ 125 million cial Debt Service Coverage Ratio as shown in Table 4.2 th Project Cost recovery is estimated to occur in 2028 (19 year of ecovery concession period)

Table 4.2: Debt Service Coverage Ratio (tariff of $22 per ton) : s In the calculation of EIRR, only direct benefits were considered excluding indirect and intangible benefits, the results are shown in (Table 4.1). Benefits gible and costs were calculated based on constant 2008 price prices. Table 4.1: Base Case: Results of Economic Analysis :

EIRR NPV (million US$ )

Source: TAS IRSDP

Year DSCR

2013 1.17

2014 1.16

2015 1.15

2016 1.14

2017 1.13

2018 1.11

2019 1.10

2020 1.09

2021 1.07

2022 1.05

2023 1.98

2024 1.96

Source: TAS IRSDP

27.9% 2,909

4.2.3

Risk Allocation

Formatted: Heading 3, Left, Space Before: 0 pt, After: 0 pt Formatted: Left, Space Before: 0 pt, After: 10 pt Formatted: Font: Not Italic

An assessment of project risks is shown in Appendix 1.

The sensitivity analysis confirmed that the project is economically via viable. The EIRR is well above a cut-off rate of 10%, and NPV is still substantial. %,

4.2 4.2.1

Financial Evaluation Assumptions

The investment cost is projected to be about US $1.5 billion. Financial modeling is in US$ terms US$ denominated debt is charged at 8% interest rate with a 12-year 12 loan repayment assumed. Minimum target Return on Equity is assumed at 12% quity Tariff is assumed US$ 22 per ton of coal transported.

12

Railway Alignment and Train Operations

Rai lway Al ign m ent and Trai n Operat ions

5.1

Selection of Location for Coal Loading or Unloading U

Figure 5.1: Rail Alignment :

Considering several requirements for the location of coal loading or unloading, such as the required space for on and off loading, access from mines or to the existing barge ports, consistency with the railway ge development program for Central Kalimantan Province, and to construct a special place for unloading from where it would be possible to carry out the stable transport of coal throughout the year to large ships offshore, a location near Puruk Cahu was selected as a loading terminal and Bangkuang was selected as an unloading terminal. The rail alignment connecting these two locations is shown in the figure 5.1 has been selected as the most suitable route, however this is only for reference purposes.

Source: JTC Study

13

Railway Alignment and Train Operations

5.2

Provisional Train Operations Plan

Table 5.2: Train Formation and Rolling Stock :

Case A (1) Transport volume (ton/day) (2) No. of train to be operated per day (3) Headway (min.) (4) Operating time without 1.Condition stopping (min.) (5) Dwelling time (min.) (6) Total stopping time at intermediate station (7) One cycle operation time (min.) (1) No. of train formation for operation 2.Train (2) No. of reserved train Formation formation (3) Total of required train formation (1) Required number for operation 3.Locomotive (2) Reserved one for for Hauling maintenance (15%) (3) Total number of required locomotive (1) Required number for operation (2) Reserved one for 4. Wagon maintenance (3) Total number of required wagon (1) Required for shunting 5.Locomotive (2) Reserved for maintenance for Shunting (3) Total number of required shunting locomotive Source : JTC Study 33,300 5 288 290 288 (Max) 10 588 4 (588 x 2/288) 2 6 12 (6x2) 2 14 600 90 690 2 1 3 Case B 66,600 10 144 290 144 (Max) 10 444 6 (444 x 2/144) 2 8 16(8x2) 3 19 800 120 920 2 1 3

Deleted: Deleted: According to this train diagram, i Deleted: with three stations in Case A, and with five stations in Case B (e.g. the addition of two intermediate stations to Case A).

The required numbers of trains per day, the train formation, the rolling stock, etc. to transport the programmed coal volume (10 million ton/year in Case A and 20 million ton/year in Case B) have been estimated, as shown in the table below, based upon various conditions Table 5.1: Estimated Numbers of Trains per Day

Case A 1. Transport Volume (Ton/Year) 2. Transport Volume (Ton/Day) 3. Required No. of Wagon 4. Required No. of Train per Day 5. Headway (min.) Source : JTC Study a b = a/300 c = b/70 d = c/100 e = 1440/d 10,000,000 33,300 476 5 288 B 20,000,000 66,600 952 10 144

The crude train diagram has been arranged, based upon the travel time between stations with 300 min. (5 hours) for both cases, whereby the average operating speed is 37.2 km/h. It is necessary to allocate t intermediate stations for train passing.

14

6. Outline of Key Laws and Regulations Applicable to the Project

Outl ine of Key Laws and Regulati ons Applicable t o the Project

6.1

Railway Sector Law

Railway Law No.23/2007 promotes private provision of infrastructure and related services in the railway sector. On the basis of the Law, the MOT permits a local government to act as a contracting authority for PSP. The Law superseded the previous law, which stipulated that PSP could only be undertaken under a joint venture agreement with a state entity. The movement away from a joint venture modality is consistent with Presidential Regulation No.67/2005, as the latter stresses the principle of transparency. e The separation of the contracting, regulatory and operating roles would he minimize conflict of interest.

As the proposed coal railway is essentially a private railway and is deemed financially viable, the demand risk will not be covered by any government support.

6.4

Environmental and Social Resettlement Laws and Regulations

Deleted: Regulations on environmental impacts assessment (EIA), to include land ssessment (EIA) acquisition and resettlement, have recently been revised, and, Deleted: a Deleted: P Deleted: that are described under the decrees of the Central Kalimantan Provincial Government. Deleted: Deleted: counsel

As the project alignment is more than twenty roject twenty-five (25) kilometres, the Project must comply with the EIA requirements (Regulation of Ministry of Environment No.11/2006) and an AMDAL must be prepared. .11/2006)

6.5

Other Laws

6.2

PPP Cross Sector Regulatory Framework

Presidential Regulation (Perpres) No.67/2005 provides the cross sector 2005 regulatory framework for Private Sector Participation (PSP) in infrastructure and related facilities. Perpres No.67/2005 stipulates that the private sector concessionaire must be selected through competitive and transparent bidding and that tariffs have to be set for full cost recovery. Perpres recovery No.67/2005 further states the principle that risks should be allocated to the 67/2005 party that is best able to manage and control them. The Regulation describes in detail the rules and procedures for the bidding process.

Law No. 17/2008 on Shipping, Law No. 25 25/2007 on Investment, and Law No. 41/1999 on Forestry may also be relevant to the Project, and a local 1999 lawyer should be consulted.

6.3

Relevant Ministerial Regulations

To ensure that risks of individual PPP projects are appropriately allocated re between the public and private sectors, and that the Governments overall exposure is well managed, the Minister of Finance issued Regulation No.38/2006. The dual objective of the new risk mitigation and management k policy is to support infrastructure development while maintaining fiscal sustainability of the Government budget. Regulation No.38/2006 describes the types of risks the Government may consider sharing (those related to political events, project performance and demand). nce

15

7. Environmental and Land

Environ ment al and Land

7.1

Environmental and Social Characteristic of the Area

The area through which the proposed rail alignment passes is suffering from environmental pressures and the southern and central areas are already degraded through the activities of commercial forest opencast mining and forestry, mining transportation routes. In the northern part of the alignment much of the forest remains untouched. The remaining areas of forest have extensive flora and fauna resources. No information is available at present as to the st status of any endangered species. However the development of forestry and coal mining in the southern and central areas has significantly impacted the local forest biodiversity. The main areas of human settlement lie adjacent to the river Barito. There are a number of sizeable settlements in this area, the largest being Buntok Bu with a population of approximately 20,000. Other urban settlements include inclu Muara Teweh and Puruk Cahu which are ports on the Barito River. Other h permanent urban settlement is very small and there are reported to be no l settlements along the rail alignment. Traditional activities by local communities in the forest areas (collection of fruits and nuts, hunting, fishing, slash and burn agriculture etc) may have already been abandoned in many areas.

activities but this can only be confirmed later in the pl planning and design process. Central Kalimantan Provincial Government has stated that they will be responsible for all land and building acquisition activities and all costs associated with acquisition and resettlement.

Deleted: e

7.3

Outline of Environmental and Land Issues Connected with the Coal Rail Project

Throughout this part of Central Kalimantan there are very significant environmental issues connected with coal mining and commercial forestry. Of particular concern is the extensive use made of purpose built coal roads from the coal mining areas to the Barito River. Public roads are not used for the transportation of coal within the project area. The coal roads cause significant environmental problems. The road corridors are wide and the construction and operation of these roads have caused: loss of forest cover for long distances, significant dust creation particularly during the construction phase, blocking of local drainage channels and only limited replacement of cross and parallel drainage. The operation of th road also the causes considerable noise disturbance to the area. The most significant environmental impacts will be related to the direct loss he of some forest and disturbance to adjacent forest areas. This disturbance will be particularly acute during the construction phase when noise, vibration and dust will occur. There will also be disturbance to any remaining traditional forest communities. Although the rail construction and operation will cause environmental uction impacts it is likely that these impacts will be less than impacts caused by the continued construction of coal roads. In addition the environmental benefits of rail for the transportation of coal will be greater if the construction of new coal roads is restricted for all new coal mines. Coal roads will still be necessary from the mine to the rail head, but coal roads to the Barito River will not be necessary. Restricting the development of coal roads to the river will have significant environmental benefits and can be achieved through nt

Deleted: No detailed information is available on any Indigenous or traditional communities living within the forests. Deleted: Based on a recent review by the Technical Advisory Services (TAS) Deleted: t

7.2

Land Acquisition and Resettlement Characteristics of the Area

It is reported by the Provincial Forestry agency that only production forests for are affected by the alignment. The Central Kalimantan Provincial Government now has responsibility for management of the land The land. Governor has also requested all Kabupaten along the alignment not to issue any new development and transaction permits for land along the alignment. Land acquisition has not yet been examined in detail but it has been estimated that about 70% of the land is stated-owned (Ministry of Forestry). owned Resettlement of permanent housing is not likely to be significant. It is estimated that 16 million m (1,600ha) of land is required for all of the rail

Deleted: in Government ownership Deleted: but there is no information on the t ownership characteristics of the other 30%

16

7. Environmental and Land

controls and agreements with the Province and/or Kabupaten: the exact means of doing this is still to be determined.

7.4

Environmental Requirements

In accordance with the regulation of the Ministry of Environment No. 11 year En 2006 for all railway developments of over 25 km an AMDAL (Environmental Impact Assessment) is required and should be prepared by consseionaire. Certain preliminary activities are however required to be undertaken prior to selection of the concessionaire in order to assist in defining the main impacts and their characteristics. These preliminary activities include preparation of an initial environmental examination (IEE) and preparation of Draft Scoping and Draft Terms of Reference (TOR) for the AMDAL.

Deleted: This will not be a formal Kerangka Acuan (KA ANDAL) which will be prepared later by the concessionaire.

7.5

Land Acquisition-Resettlement Requirements Resettlement

To ensure a transparent and equitable process a Resettlement Plan should be prepared. The Resettlement Plan should include details of the area of land required, estimate of the number of owners, estimate of the number of houses and buildings required, compensation and resettlement policies, pensation estimate of total compensation costs, and any resettlement requirements. Full community consultation will also be necessary. The Resettlement Plan can only be completed later in the planning and design process when more mo detailed information is available on the alignment.

Deleted: As stated above all land acquisition costs and activities will be the responsibility of Central Kalimantan Province.

17

Appendix 1: Risk Allocation

Appendix 1: Risk Allocation

Risk

Item Description / Comments

Risk Allocation

Shared Govern ment Private

Land acquisition

Risk of delay and cost. Central Kalimantan LG will acquire and pay for the land Risk is that ground conditions are unsuitable. Risk is that there are major adverse environmental impacts requiring major mitigation cost. Risk is that there will be delays and cost over-run. isk

a a a a a

Landsite unsuitability Environmental

Construction & completion Operational performance (including maintenance) Inflation Foreign exchange Interest Rate Demand

The risk is that the railway is not fully functioning.

a

Risk related to foreign exchange fluctuations Risk is that debt service cost will be higher because of interest rate rise. Risk that demand is insufficient

a a a a

Political/Regulatory Risk

Risk that certain terms and conditions in the PPP agreement are not fulfilled.

Force Majeure

Risk of acts of God and certain man-made events occurring. man

Appendix 2: Proposed Implementation Schedule

Appendix 2: Implementation Schedule

ID Task Name 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 21 22 23 24 25 26 A. Pre-FS Preparation Survey & Analysis Report & Recommendation Corridor/Alignment Approval (from MOT) Completion of the Study (Extended) B. Pre-Market Sounding, Pre-Qualification, and Tender Document Project Assessment Preparation of Public Consultation Document Public Consultation Preparation and Finalization of Info Memo Pre-Market Sounding PQ Documentation Issuance of Request for Expression of Interest (EOI) RFQ Announcement and Distribution of PQ Document Submission of PQ Proposal Evaluation of PQ Proposals Announcement of PQ Result Bid Documentation (incl. Draft Concession Agreement)

2009 2010 Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

Environmental Analysis (IEE, Draft Scoping, Draft TOR Amdal & Draft Resettlement Plan) RFP Issuance Extended Bid Conference Due Diligence and Submission of Bids Evaluation of Bids and Announcement of the Preferred Bidder Announcement of Concessionaire Signing of Concession Agreement

20 C. Bid Process

Contacts: PPP Directorate National Development Planning Agency / Bappenas Jl. Taman Suropati 2 Jakarta 10310 Contact No. +62 21 31934175 Email: pkps@irsdp.org Regional Development Planning Agency / Bappeda Provincial Government of Central Kalimantan Jl. Diponegoro 60 Palangka Raya, Central Kalimantan Contact No. +62 536 3221645 Email: bappeda_kalteng@yahoo.co.id

Potrebbero piacerti anche

- Company Profile PT. Mathesis Global MineralDocumento12 pagineCompany Profile PT. Mathesis Global MineralJeremy lovenNessuna valutazione finora

- Reporting Coal Exploration FriederichMDocumento73 pagineReporting Coal Exploration FriederichMDadan100% (1)

- Banpu - Annual Report - 2011Documento162 pagineBanpu - Annual Report - 2011juli_0942080Nessuna valutazione finora

- Rumus Blending Batubara ADocumento16 pagineRumus Blending Batubara AEka Setia0% (1)

- Coal Sourcing Handling and Transportation Report - Volume - VDocumento497 pagineCoal Sourcing Handling and Transportation Report - Volume - Vদেওয়ানসাহেবNessuna valutazione finora

- JGI EXeSumDocumento2 pagineJGI EXeSumAndi Mursalim100% (1)

- Alur Trading Batubara-Lc Non PB Versi EnglishDocumento3 pagineAlur Trading Batubara-Lc Non PB Versi Englishagus salimNessuna valutazione finora

- PKN Company ProfileDocumento27 paginePKN Company ProfileIntan Dewi Probowati100% (1)

- Sukses Berkarir Di Industri TambangDocumento32 pagineSukses Berkarir Di Industri TambangFaishol UmarNessuna valutazione finora

- Adaro Energy Annual Report 2011 EngDocumento280 pagineAdaro Energy Annual Report 2011 EngAsti MarianaNessuna valutazione finora

- Bayan ReviewDocumento20 pagineBayan Reviewakbar suhadaNessuna valutazione finora

- Muarateweh Field TripDocumento3 pagineMuarateweh Field TripAgus Budiluhur100% (1)

- PT Bhumi Rantau EnergiDocumento2 paginePT Bhumi Rantau EnergihindradiNessuna valutazione finora

- PTISDocumento7 paginePTISAdited MlnNessuna valutazione finora

- Coal Mining ExecutiveDocumento2 pagineCoal Mining ExecutiveBudi Siadjeng100% (2)

- Analisis Kelayakan Ekonomi Pabrik NickelDocumento8 pagineAnalisis Kelayakan Ekonomi Pabrik Nickelفردوس سليمانNessuna valutazione finora

- InPA Coal FormationDocumento1 paginaInPA Coal FormationsantosoNessuna valutazione finora

- CTI PresentationDocumento19 pagineCTI PresentationSantosh BeheraNessuna valutazione finora

- Company Profile 090410r1Documento27 pagineCompany Profile 090410r1Nipindo PrimatamaNessuna valutazione finora

- PT Makmur Perkasa Group Data Summary of Coal Mining ConcessionDocumento3 paginePT Makmur Perkasa Group Data Summary of Coal Mining ConcessionrakhmatdodyNessuna valutazione finora

- Pt. Jayeon SejahteraDocumento52 paginePt. Jayeon SejahteraTrends Property100% (1)

- Kaltim Prima CoalDocumento41 pagineKaltim Prima CoalMeyyer Christopher Lumembang100% (2)

- UntitledadsDocumento20 pagineUntitledadsRAHMAT WIDYANTO100% (1)

- Coal Outlook 2019 - Webinar Alumni Tambang ITB - Sandro H S PDFDocumento32 pagineCoal Outlook 2019 - Webinar Alumni Tambang ITB - Sandro H S PDFhipsterzNessuna valutazione finora

- Independent Coal Mine AssessmentDocumento89 pagineIndependent Coal Mine AssessmentSean Choi100% (1)

- Hasil Bor DasDocumento74 pagineHasil Bor Dasvorda buaymadangNessuna valutazione finora

- EXCUTIVE SUMMARY KP PT. NUSA BARA - (New Updated 2019)Documento1 paginaEXCUTIVE SUMMARY KP PT. NUSA BARA - (New Updated 2019)agus rukmagaNessuna valutazione finora

- Company Profile PT. SJM - ExmDocumento23 pagineCompany Profile PT. SJM - ExmSurya WahyuNessuna valutazione finora

- Corprate Presentation GEO GroupDocumento43 pagineCorprate Presentation GEO GroupFulkan HadiyanNessuna valutazione finora

- Kci Kendilo ProfileDocumento1 paginaKci Kendilo Profileapi-167631790Nessuna valutazione finora

- Summary Sop Sop Pit Control: Production TeamDocumento7 pagineSummary Sop Sop Pit Control: Production TeamRachmat RisejetNessuna valutazione finora

- Proposal Bisnis Coal Mining Jgi Tanung Mangkaliat VilageDocumento13 pagineProposal Bisnis Coal Mining Jgi Tanung Mangkaliat VilageRIDWANNessuna valutazione finora

- GMT Coal Presentation 2010Documento22 pagineGMT Coal Presentation 2010Leris Efronda ManafeNessuna valutazione finora

- SRK Report Central Kalimantan Coal ProjectsDocumento70 pagineSRK Report Central Kalimantan Coal ProjectsREandoNessuna valutazione finora

- APAC ProspectusDocumento84 pagineAPAC Prospectusshare818Nessuna valutazione finora

- Executive-Summary BKPM Japan International CooperationDocumento77 pagineExecutive-Summary BKPM Japan International CooperationoeyianNessuna valutazione finora

- Executive Summary MJUDocumento12 pagineExecutive Summary MJURudianto Sitanggang100% (1)

- Tabel 8.7 Sasaran Produksi Penambangan Batubara Dan Penggalian OverburdenDocumento38 pagineTabel 8.7 Sasaran Produksi Penambangan Batubara Dan Penggalian OverburdenSean ChoiNessuna valutazione finora

- Wa0018Documento25 pagineWa0018mantoNessuna valutazione finora

- Desktop Review Kertawira Sera Lestari, PTDocumento14 pagineDesktop Review Kertawira Sera Lestari, PTis mailNessuna valutazione finora

- Summary Pt. Bec1Documento19 pagineSummary Pt. Bec1Energi Alam BorneoNessuna valutazione finora

- Production Plan: Barging Equipment No Min Charge Unit (Hours)Documento14 pagineProduction Plan: Barging Equipment No Min Charge Unit (Hours)Achmad DjunaidiNessuna valutazione finora

- Company Profile Pt. Trimitra Sinergi Sakti, 2021Documento14 pagineCompany Profile Pt. Trimitra Sinergi Sakti, 2021Rizal AlfajarNessuna valutazione finora

- MAS SARI - Legal, Permit, Coal Mine Summary1Documento4 pagineMAS SARI - Legal, Permit, Coal Mine Summary1donwload bunkNessuna valutazione finora

- Summary of Progress Transhipment On Vessel Mv. Manalagi TisyaDocumento1 paginaSummary of Progress Transhipment On Vessel Mv. Manalagi TisyaMuhammad Rabbil AlbadriNessuna valutazione finora

- Draft Ucg ImmDocumento24 pagineDraft Ucg Immzoel tekmiraNessuna valutazione finora

- BBK - MP Survey of Analysis-1Documento4 pagineBBK - MP Survey of Analysis-1A M Joko WinotoNessuna valutazione finora

- KCI Biz Plan 2010Documento23 pagineKCI Biz Plan 2010A M Joko WinotoNessuna valutazione finora

- Company Profile KM EnglishDocumento47 pagineCompany Profile KM EnglishLado Leza100% (2)

- Indonesiacoalconcessionareaa31 140121094533 Phpapp02Documento2 pagineIndonesiacoalconcessionareaa31 140121094533 Phpapp02Sean ChoiNessuna valutazione finora

- Env ScopDocumento48 pagineEnv ScopErnest V SNessuna valutazione finora

- Contract Sales Purchase Agreement - TJU, RRU - ChinaDocumento7 pagineContract Sales Purchase Agreement - TJU, RRU - Chinagarut beraksiNessuna valutazione finora

- Coal Supply in IndonesiaDocumento25 pagineCoal Supply in IndonesiaSunapaNessuna valutazione finora

- Pelabuhan JambiDocumento92 paginePelabuhan JambiLukman Farha NdoleNessuna valutazione finora

- Kalimantan Coal Railway Project PDFDocumento23 pagineKalimantan Coal Railway Project PDFpuput utomoNessuna valutazione finora

- Kipeto Wind Farm and 220kV Line Executive Summary Report FinalDocumento49 pagineKipeto Wind Farm and 220kV Line Executive Summary Report FinalAbderrazzak AbderrazzakNessuna valutazione finora

- Scoping Report-Kilombero BridgeDocumento35 pagineScoping Report-Kilombero BridgeAKONAAY AKO100% (3)

- Final Report Tabeer LNGDocumento27 pagineFinal Report Tabeer LNGzesmemNessuna valutazione finora

- Basalt Agreggate FeasiblityDocumento20 pagineBasalt Agreggate FeasiblityGeta Ejigu100% (1)

- Rap Report TwenteDocumento238 pagineRap Report TwenteNaingLinnSoe JasmineNessuna valutazione finora

- Saint MBA570 Module 2 QuizDocumento2 pagineSaint MBA570 Module 2 Quizteacher.theacestudNessuna valutazione finora

- New 3rd Semester English (MCO-03,07,15, IBO-02) PDFDocumento6 pagineNew 3rd Semester English (MCO-03,07,15, IBO-02) PDFAkash Peter MishraNessuna valutazione finora

- CPM-Module-1 Introduction To Project, Its Stages and Construction Project ManagementDocumento31 pagineCPM-Module-1 Introduction To Project, Its Stages and Construction Project ManagementARTFOLIO .49Nessuna valutazione finora

- Revaluation-Base ThesisDocumento4 pagineRevaluation-Base Thesismuhammad abdullah janNessuna valutazione finora

- Financing Options in The Oil and Gas IndustryDocumento31 pagineFinancing Options in The Oil and Gas IndustrymultieniyanNessuna valutazione finora

- Bba 205Documento458 pagineBba 205divya kalyaniNessuna valutazione finora

- BFS L0 QuesDocumento360 pagineBFS L0 QuesShubhamKaseraNessuna valutazione finora

- Cost Benefit Analysis For PACSDocumento4 pagineCost Benefit Analysis For PACSSue GibbsNessuna valutazione finora

- TB - Chapter21 Mergers and AcquisitionsDocumento12 pagineTB - Chapter21 Mergers and AcquisitionsPrincess EspirituNessuna valutazione finora

- Amara Prabasari 119211078 (Final Exam - Financial Statement)Documento3 pagineAmara Prabasari 119211078 (Final Exam - Financial Statement)Amara PrabasariNessuna valutazione finora

- Corporate Finance MCQDocumento35 pagineCorporate Finance MCQRohan RoyNessuna valutazione finora

- Case Solutions Chapter - 08Documento2 pagineCase Solutions Chapter - 08chadtandon67% (6)

- SRK - Valuation of Mineral AssetsDocumento40 pagineSRK - Valuation of Mineral AssetsBill LiNessuna valutazione finora

- Cs Forex Past Questions - PRNDocumento14 pagineCs Forex Past Questions - PRNSureshArigelaNessuna valutazione finora

- Case Study 4Documento8 pagineCase Study 4Ojas GuptaNessuna valutazione finora

- Basic Long Term Financial ConceptsDocumento8 pagineBasic Long Term Financial ConceptsJohnpaul FloranzaNessuna valutazione finora

- 5.studi Kelayakan Pendirian Pabrik Air Minum Dalam Kemasan PDFDocumento7 pagine5.studi Kelayakan Pendirian Pabrik Air Minum Dalam Kemasan PDFDimas RamadhanNessuna valutazione finora

- Suggested Answers Certificate in Accounting and Finance - Spring 2021Documento7 pagineSuggested Answers Certificate in Accounting and Finance - Spring 2021Maham IlyasNessuna valutazione finora

- A Critical Review of Real Options Thinking For Valuing InvestmentDocumento11 pagineA Critical Review of Real Options Thinking For Valuing InvestmentMaria B.Nessuna valutazione finora

- Chapter 3Documento9 pagineChapter 3Karthik TambralliNessuna valutazione finora

- Practice Manual FTFM Akansha 2015 PDFDocumento375 paginePractice Manual FTFM Akansha 2015 PDFSriraman T100% (1)

- Mini ProjectDocumento49 pagineMini ProjectSyahmiNessuna valutazione finora

- Ubs I Banking GuideDocumento47 pagineUbs I Banking GuideMukund SinghNessuna valutazione finora

- Lecture 1 Manufacturing Project Appraisal, Selection & FeasibilityDocumento41 pagineLecture 1 Manufacturing Project Appraisal, Selection & FeasibilityMuhammadNessuna valutazione finora

- ASA FPC Resource Book PDFDocumento170 pagineASA FPC Resource Book PDFksm256Nessuna valutazione finora

- Capital Investment Appraisal For Long-Term DecisionsDocumento39 pagineCapital Investment Appraisal For Long-Term DecisionsDevon PhamNessuna valutazione finora

- Analisis Kelayakan Finansial Usaha Ternak BabiDocumento8 pagineAnalisis Kelayakan Finansial Usaha Ternak BabiChristuvel ManansangNessuna valutazione finora

- TradeDocumento37 pagineTradeshama100% (4)

- Baking PowderDocumento23 pagineBaking PowderJohn100% (1)

- Quick Die Change in HammersDocumento16 pagineQuick Die Change in HammersBalram JiNessuna valutazione finora