Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Eurozone Crisis

Caricato da

rashvishDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Eurozone Crisis

Caricato da

rashvishCopyright:

Formati disponibili

From late 2009, Iears oI a sovereign debt crisis developed among investors concerning some

European states, intensiIying in early 2010. This included eurozone members Greece, Ireland,

Italy, Spain and Portugal, and also some non-eurozone European Union (EU) countries.

Iceland, the country which experienced the largest Iinancial crisis in 2008 when its entire

international banking system collapsed, has emerged less aIIected by the sovereign debt

crisis. In the EU, especially in countries where sovereign debts have increased sharply owing

to bank bailouts, a crisis oI conIidence has emerged with the widening oI bond yield spreads

and risk insurance on credit deIault swaps between these countries and other EU members,

most importantly Germany.

While the sovereign debt increases have been most pronounced in only a Iew eurozone

countries, they have become a perceived problem Ior the area as a whole.

Concern about rising government debt levels across the globe together with a wave oI

downgrading oI European government debt created alarm in Iinancial markets. On 9 May

2010, Europe's Finance Ministers approved a rescue package worth t750 billion aimed at

ensuring Iinancial stability across Europe by creating the European Financial Stability

Facility (EFSF).

In October 2011, eurozone leaders meeting in Brussels agreed on a package oI measures

designed to prevent the collapse oI member economies due to their spiralling debt. This

included a proposal to write oII 50 oI Greek debt owed to private creditors, increasing the

EFSF to about t1 trillion and requiring European banks to achieve 9 capitalisation. As oI

November 2011, the same eurozone leaders that extended the package to save the eurozone

have extended an ultimatum toward Greece. Both President Nicolas Sarkozy oI France and

Prime Minister Angela Merkel oI Germany have made it public that both oI their

governments have reached the end oI their patience with the beleaguered Greek economy.

Eurozone sovereign debt concerns

Members oI the European Union signed the Maastricht Treaty, under which they pledged to

limit their deIicit spending and debt levels. However, a number oI European Union member

states, including Greece and Italy, were able to circumvent these rules and mask their deIicit

and debt levels through the use oI complex currency and credit derivatives structures. The

structures were designed by prominent U.S. investment banks, who received substantial Iees

in return Ior their services and who took on little credit risk themselves thanks to special legal

protections Ior derivatives counterparties. Financial reIorms within the U.S. since the

Iinancial crisis have only served to reinIorce special protections Ior derivativesincluding

greater access to government guaranteeswhile minimizing disclosure to broader Iinancial

markets.

In the Iirst weeks oI 2010, there was renewed anxiety about excessive national debt. Some

politicians, notably Angela Merkel, have sought to attribute some oI the blame Ior the crisis

to hedge Iunds and other speculators stating that "institutions bailed out with public Iunds are

exploiting the budget crisis in Greece and elsewhere"

Although some Iinancial institutions clearly proIited Irom the growing Greek government

debt in the short run, there was a long lead up to the crisis. EU politicians in Brussels turned a

blind eye and gave Greece a Iairly clean bill oI health, even as the reality oI economics

suggested the Euro was in danger. Investors assumed they were implicitly lending to a strong

Berlin when they bought eurobonds Irom weaker Athens. Historic enmity to Turkey led to

high deIense spending, and Iuelled public deIicits Iinanced primarily by German and

French banks.

ond market

Prior to development oI the crisis it was assumed by both regulators and banks that sovereign

debt Irom the Euro zone was saIe. Banks had substantial holdings oI bonds Irom weaker

economies such as Greece which oIIered a small premium and seemingly were equally

sound. As the crisis developed it became obvious that Greek, and possibly other country's,

bonds oIIered substantially more risk. Contributing to lack oI inIormation about the risk oI

European sovereign debt was conIlict oI interest by banks that were earning substantial sums

underwriting the bonds.

Greece

In the early-mid 2000s, Greece's economy was strong and the government took advantage by

running a large deIicit. As the world economy cooled in the late 2000s, Greece was hit

especially hard because its main industriesshipping and tourismwere especially sensitive

to changes in the business cycle. As a result, the country's debt began to pile up rapidly. In

early 2010, as concerns about Greece's national debt grew, policy makers suggested that

emergency bailouts might be necessary.

On 23 April 2010, the Greek government requested that the EU/IMF bailout package (made

oI relatively high-interest loans) be activated. The IMF had said it was "prepared to move

expeditiously on this request". The initial size oI the loan package was t45 billion ($61

billion) and its Iirst installment covered t8.5 billion oI Greek bonds that became due Ior

repayment.

On 27 April 2010, Standard & Poor's slashed Greece's sovereign debt rating to BB or "junk"

status amid Iears oI deIault. The yield oI the Greek two-year bond reached 15.3 in the

secondary market. Standard & Poor's estimates that, in the event oI deIault, investors would

lose 3050 oI their money. Stock markets worldwide and the Euro currency declined in

response to this announcement.

Prime Minister George Papandreou and European Commission President Jose Manuel

Barroso aIter their meeting in Brussels on 20 June 2011.

On 1 May 2010, a series oI austerity measures was proposed. The proposal helped persuade

Germany, the last remaining holdout, to sign on to a larger, 110 billion euro EU/IMF loan

package over three years Ior Greece (retaining a relatively high interest oI 5 Ior the main

part oI the loans, provided by the EU). On 5 May, a national strike was held in opposition to

the planned spending cuts and tax increases. Protest on that date was widespread and turned

violent in Athens, killing three people.

On 2 May 2010, the Eurozone countries and the International Monetary Fund agreed to a

t110 billion loan Ior Greece, conditional on the implementation oI harsh austerity measures.

The Greek bail-out was Iollowed by a t85 billion rescue package Ior Ireland in November, a

t78 billion bail-out Ior Portugal in May 2011, then continuing eIIorts to meet the continuing

crisis in Greece and other countries.

The November 2010 revisions oI 2009 deIicit and debt levels made accomplishment oI the

2010 targets even harder, and indications signal a recession harsher than originally Ieared.

Japan, Italy and Belgium's creditors are mainly domestic institutions, but Greece and Portugal

have a higher percent oI their debt in the hands oI Ioreign creditors, which is seen by certain

analysts as more diIIicult to sustain. Greece, Portugal, and Spain have a 'credibility problem',

because they lack the ability to repay adequately due to their low growth rate, high deIicit,

less FDI, etc.

In May 2011, Greek public debt gained prominence as a matter oI concern. The Greek people

generally reject the austerity measures, and have expressed their dissatisIaction through angry

street protests. In late June 2011, Greece's government proposed additional spending cuts

worth 28bn euros (25bn) over Iive years. The next 12 billion euros Irom the Eurozone bail-

out package will be released when the proposal is passed, without which Greece would have

had to deIault on loan repayments due in mid-July.

On 13 June 2011, Standard and Poor's downgraded Greece's sovereign debt rating to CCC,

the lowest in the world, Iollowing the Iindings oI a bilateral EU-IMF audit which called Ior

Iurther austerity measures. AIter the major political parties Iailed to reach consensus on the

necessary measures to qualiIy Ior a Iurther bailout package, and amidst riots and a general

strike, Prime Minister George Papandreou proposed a re-shuIIled cabinet, and asked Ior a

vote oI conIidence in the parliament. The crisis sent ripples around the world, with major

stock exchanges exhibiting losses.

Some experts argue the best option Ior Greece and the rest oI the EU should be to engineer an

'orderly deIault on Greece`s public debt which would allow Athens to withdraw

simultaneously Irom the eurozone and reintroduce its national currency the drachma at a

debased rate. Economists who Iavor this approach to solve the Greek debt crisis typically

argue that a delay in organising an orderly deIault would wind up hurting EU lenders and

neighboring European countries even more.

In the early hours oI 27 October 2011, Eurozone leaders and the IMF came to an agreement

with banks to accept a 50 write-oII oI (some part oI) Greek debt,

the equivalent oI t100

billion. The aim oI the haircut is to reduce Greece's debt to 120 oI GDP by 2020.

$5read beyond Greece

Long-term interest rates oI selected European countries (secondary market yields oI

government bonds with maturities oI close to ten years). Note that weak non-eurozone

countries (Hungary, Romania) lack the sharp rise in interest rates characteristic oI weak

eurozone countries. A yield oI 6 or more indicates that Iinancial markets have serious

doubts about credit-worthiness.

A wave oI selling swept across global markets Tuesday, a day aIter Greece's prime minister

said he would call a national vote on an unpopular European plan that would result in painIul

tax increases and drastic welIare cuts to rescue that nation's economy.

II the European rescue plan Ialls through and Greece deIaults on its debt, the ripple eIIect

would be global. Europe could Iall into recession, hurting a major market Ior American

exports, and banks could severely restrict lending.

The Dow Iell 2.5 percent to close at 11,657.96 on Tuesday. It was the biggest drop since

Sept. 22, 2011. The S&P 500 lost 2.8 percent to 1,218.28. The Nasdaq composite dropped 2.9

percent to 2,606.96. One oI the central concerns prior to the bailout was that the crisis could

spread beyond Greece. The crisis has reduced conIidence in other European economies.

Ireland, with a government deIicit in 2010 oI 32.4 oI GDP, Spain with 9.2, and Portugal

at 9.1 are most at risk. According to the UK Financial Policy Committee "Market concerns

remain over Iiscal positions in a number oI euro area countries and the potential Ior contagion

to banking systems."

Financing needs Ior the eurozone in 2010 come to a total oI t1.6 trillion, while the US is

expected to issue US$1.7 trillion more Treasury securities in this period, and Japan has 213

trillion oI government bonds to roll over. According to Ferguson similarities between the

U.S. and Greece should not be dismissed.

For 2010, the OECD Iorecasts $16,000bn will be raised in government bonds among its 30

member countries. Greece has been the notable example oI an industrialised country that has

Iaced diIIiculties in the markets because oI rising debt levels. Even countries such as the US,

Germany and the UK, have had Iraught moments as investors shunned bond auctions due to

concerns about public Iinances and the economy.

reland

The Irish sovereign debt crisis was not based on government over-spending, but Irom the

state guaranteeing the six main Irish-based banks who had Iinanced a property bubble. On 29

September 2008 the Finance Minister Brian Lenihan, Jnr issued a one-year guarantee to the

banks' depositors and bond-holders. He renewed it Ior another year in September 2009 soon

aIter the launch oI the National Asset Management Agency, a body designed to remove bad

loans Irom the six banks.

The December 2009 hidden loans controversy within Anglo Irish Bank had led to the

resignations oI three executives, including chieI executive Sean FitzPatrick. A mysterious

"Golden Circle" oI ten businessmen are being investigated over shares they purchased in

Anglo Irish Bank, using loans Irom the bank, in 2008. The Anglo Irish Bank Corporation Act

2009 was passed to nationalise Anglo Irish Bank was voted through Dail Eireann and passed

through Seanad Eireann without a vote on 20 January 2009. President Mary McAleese then

signed the bill at Aras an Uachtarain the Iollowing day, conIirming the bank's nationalisation.

In April 2010, Iollowing a marked increase in Irish 2-year bond yields, Ireland's NTMA state

debt agency said that it had "no major reIinancing obligations" in 2010. Its requirement Ior

t20 billion in 2010 was matched by a t23 billion cash balance, and it remarked: "We're very

comIortably circumstanced". On 18 May the NTMA tested the market and sold a t1.5 billion

issue that was three times oversubscribed.

By September 2010 the banks could not raise Iinance and the bank guarantee was renewed

Ior a third year. This had a negative impact on Irish government bonds, government help Ior

the banks rose to 32 oI GDP, and so the government started negotiations with the ECB and

the IMF, resulting in the t85 billion "bailout" agreement oI 29 November 2010. In February

the government lost the ensuing Irish general election, 2011. In April 2011, despite all the

measures taken, Moody's downgraded the banks' debt to junk status. Debate continues on

whether Ireland will need a "second bailout".

!ortugal

A report published in January 2011 by the Diario de Noticias

demonstrated that in the period

between the Carnation Revolution in 1974 and 2010, the democratic Portuguese Republic

governments have encouraged over-expenditure and investment bubbles through unclear

public-private partnerships and Iunding oI numerous ineIIective and unnecessary external

consultancy and advisory oI committees and Iirms. This allowed considerable slippage in

state-managed public works and inIlated top management and head oIIicer bonuses and

wages. Persistent and lasting recruitment policies boosted the number oI redundant public

servants. Risky credit, public debt creation, and European structural and cohesion Iunds were

mismanaged across almost Iour decades. The Prime Minister Socrates's cabinet was not able

to Iorecast or prevent this in 2005, and later it was incapable oI doing anything to improve the

situation when the country was on the verge oI bankruptcy by 2011.

Robert Fishman, in the New York Times article "Portugal's Unnecessary Bailout", points out

that Portugal Iell victim to successive waves oI speculation by pressure Irom bond traders,

rating agencies and speculators. In the Iirst quarter oI 2010, beIore markets pressure, Portugal

had one oI the best rates oI economic recovery in the EU. Industrial orders, exports,

entrepreneurial innovation and high-school achievement the country matched or even

surpassed its neighbors in Western Europe.

On 16 May 2011 the Eurozone leaders oIIicially approved a t78 billion bailout package Ior

Portugal. The bailout loan will be equally split between the European Financial Stabilisation

Mechanism, the European Financial Stability Facility, and the International Monetary

Fund.

|61|

According to the Portuguese Iinance minister, the average interest rate on the bailout

loan is expected to be 5.1 As part oI the bailout, Portugal agreed to eliminate its golden

share in Portugal Telecom to pave the way Ior privatization. Portugal became the third

Eurozone country, aIter Ireland and Greece, to receive a bailout package.

On 6 July 2011 it was conIirmed that the ratings agency Moody's had cut Portugal's credit

rating to junk status, Moody's also launched speculation that Portugal may Iollow Greece in

requesting a second bailout.

taly

Italy's deIicit oI 4.6 percent oI GDP in 2010 was similar to Germany`s at 4.3 percent and less

than that oI the U.K. and France. Italy even has a surplus in its primary budget, which

excludes debt interest payments. However, over the years it has piled up debt at almost 120

percent oI GDP and economic growth was lower than the EU average Ior over a decade. This

has led investors to view Italian bonds more and more as a risky asset.

On 15 July and 14 September Italy's government passed austerity measures meant to save

124 billion euro. Nonetheless, by 8 November 2011 the Italian bond yield was 6.74 percent

Ior 10-year bonds, climbing above the 7 percent level where the country is thought to lose

access to Iinancial markets. On 11 November 2011, Italian 10-year borrowing costs Iell

sharply Irom 7.5 to 6.7 percent aIter Italian legislature approved Iurther austerity measures

and the Iormation oI an emergency government to replace that oI Prime Minister Silvio

Berlusconi. The measures include a pledge to raise 15 billion euros Irom real-estate sales

over the next three years, a two-year increase in the retirement age to 67 by 2026, opening up

closed proIessions within 12 months and a gradual reduction in government ownership oI

local services. The interim government, which is expected to put the laws into practice will

be led by Iormer European Union Competition Commissioner Mario Monti.

$5ain

Shortly aIter the announcement oI the EU's new "emergency Iund" Ior eurozone countries in

early May 2010, Spain's government announced new austerity measures designed to Iurther

reduce the country's budget deIicit. The socialist government had hoped to avoid such deep

cuts, but weak economic growth as well as domestic and international pressure Iorced the

government to expand on cuts already announced in January. As one oI the largest eurozone

economies the condition oI Spain's economy is oI particular concern to international

observers, and Iaced pressure Irom the United States, the IMF, other European countries and

the European Commission to cut its deIicit more aggressively.

According to the Financial Times, Spain succeeded in trimming its deIicit Irom 11.2 oI

GDP in 2009 to 9.2 in 2010. It should be noted that Spain's public debt (60.1 oI GDP in

2010) is signiIicantly lower than that oI Greece (142.8), Italy (119), Portugal (93),

Ireland (96.2), and Germany (83.2), France (81.7) and the United Kingdom (80.0)

elgium

In 2010, Belgium's public debt was 100 oI its GDP the third highest in the eurozone aIter

Greece and Italy and there were doubts about the Iinancial stability oI the banks. AIter

inconclusive elections in June 2010, by July 2011 the country still had only a caretaker

government as parties Irom the two main language groups in the country (Flemish and

Walloon) were unable to reach agreement on how to Iorm a majority government. Financial

analysts Iorecast that Belgium would be the next country to be hit by the Iinancial crisis as

Belgium's borrowing costs rose.

However the government deIicit oI 5 was relatively modest and Belgian government 10-

year bond yields in November 2010 oI 3.7 were still below those oI Ireland (9.2),

Portugal (7) and Spain (5.2). Furthermore, thanks to Belgium's high personal savings

rate, the Belgian Government Iinanced the deIicit Irom mainly domestic savings, making it

less prone to Iluctuations oI international credit markets.

ther Euro5ean countries

United Kingdom

According to the Financial Policy Committee "Any associated disruption to bank Iunding

markets could spill over to UK banks." Bank oI England governor Mervyn King declared that

the UK is very much at risk Irom a domino-Iall oI deIaults and called on banks to build up

more capital when Iinancial conditions allowed. The incoming coalition government declared

its austerity measures to be essential lest the markets lose conIidence in the UK too.

celand

Iceland suIIered the Iailure oI its banking system and a subsequent economic crisis. AIter a

sharp increase in public debts due to the banking Iailures, the government has been able to

reduce the size oI deIicits each year. The eIIort has been made more diIIicult by a more

sluggish recovery than earlier expected. BeIore the crash oI the three largest commercial

banks in Iceland, Glitnir, Landsbanki and Kaupthing, they jointly owed over 10 times

Iceland's GDP. In October 2008, the Icelandic parliament passed emergency legislation to

minimise the impact oI the Iinancial crisis. The Financial Supervisory Authority oI Iceland

used permission granted by the emergency legislation to take over the domestic operations oI

the three largest banks.

The Ioreign operations oI the banks, however, went into receivership. As a result, the country

has not been seriously aIIected by the European sovereign debt crisis Irom 2010. In large part

this is due to the success oI an IMF Stand-By Arrangement in the country since November

2008. The government has enacted a program oI medium term Iiscal consolidation, based on

expenditure cuts and broad based and signiIicant tax hikes. As a result, central government

debts have been stabilised at around 8090 percent oI GDP. Capital controls were also

enacted and the work began to resurrect a sharply downsized domestic banking system on the

ruins oI its gargantuan international banking system, which the government was unable to

bail out.

Despite a contentious debate with Britain and the Netherlands over the question oI a state

guarantee on the Icesave deposits oI Landsbanki in these countries, credit deIault swaps on

Icelandic sovereign debt have steadily declined Irom over 1000 points prior to the crash in

2008 to around 200 points in June 2011. Further, on 9 June 2011, the Icelandic government

successIully raised 1$ billion with a bond issue indicating that international investors are

viewing positively the eIIorts oI the government to consolidate the public Iinances and

restructure the banking system, with two oI the three biggest banks now in Ioreign hands.

$itzerland

In September 2011, the Swiss National Bank weakened the Swiss Iranc to a Iloor oI 1.20

Irancs per euro. The Iranc has been appreciating against the euro during to the crisis, harming

Swiss exporters. The SNB surprised currency traders by pledging that "it will no longer

tolerate a euro-Iranc exchange rate below the minimum rate oI 1.20 Irancs." This is the

biggest Swiss intervention since 1978.

$olution

EU emergency measures

Euro5ean Financial $tability Facility (EF$F)

On 9 May 2010, the 27 member states oI the European Union agreed to create the European

Financial Stability Facility, a legal instrument aiming at preserving Iinancial stability in

Europe by providing Iinancial assistance to eurozone states in diIIiculty. The Iacility is jointly

and severally guaranteed by the Eurozone countries' governments, the EU and the IMF. The

European Parliament, the European Council, and especially the European Commission, can

all provide some support Ior the treasury while it is still being built.

In order to reach these goals the Facility is devised in the Iorm oI a special purpose vehicle

(SPV) that will sell bonds and use the money it raises to make loans up to a maximum oI t

440 billion to eurozone nations in need. The new entity will sell debt only aIter an aid request

is made by a country. The EFSF loans would complement loans backed by the lender oI last

resort International Monetary Fund, and in selected cases loans by the EFSF. The total saIety

net available would be thereIore t750 billion, consisting oI up to t 440 billion Irom EFSF, up

to t 60 billion loan Irom the European Financial Stabilisation Mechanism (reliant on

guarantees given by the European Commission using the EU budget as collateral) and t

250 billion loan backed by the IMF. The agreement is interpreted to allow the ECB to start

buying government debt Irom the secondary market which is expected to reduce bond yields.

(Greek bond yields Iell Irom over 10 to just over 5; Asian bonds yields also Iell with the

EU bailout.

The German Bundestag voted 523 to 85 to approve the increase in the EFSF's available Iunds

to t440bn (Germany's share t211bn), a victory Ior Merkel, though other possible ways to

expand the EFSF and EMU powers were not addressed in the legislation. WolIgang

Schuble, the German Iinance minister, and Philipp Rsler, the economics minister, were

concurrently on record against leveraging the EFSF. In early October, Slovakia remained

uncertain as to the approval, with "political turmoil in Bratislava, the nation`s capital,

exposing strains within the Iour-party ruling coalition". Mid-October Slovakia became the

last country to give approval, though not beIore parliament speaker Richard Sulik registered

strong questions as to how "a poor but rule-abiding euro-zone state must bail out a serial

violator with twice the per capita income, and triple the level oI the pensions a country

which is in any case irretrievably bankrupt? How can it be that the no-bail clause oI the

Lisbon treaty has been ripped up?"

In July 2011, it was agreed during the EU summit that the EFSF will be given more powers

to intervene in the secondary markets, thus dramatically socializing risk in the eurozone,

which ends the crisis. Furthermore the EU agreed that Greece should receive EU loans at

lower interest rates oI 3.5.

In Mid 2013 the EFSF will be replace by a permanent rescue Iunding program called

European Stability Mechanism (ESM). It will be established once the ratiIication process oI

its treaty is completed.

EIIects oI EU emergency measures

AIter the EU announced to create the EFSF on 9 May 2010 stocks worldwide surged as Iears

that the Greek debt crisis would spread subsided, some rose the most in a year or more. The

Euro made its biggest gain in 18 months, beIore Ialling to a new Iour-year low a week

later.

|102|

Shortly aIter the euro rose again as hedge Iunds and other short-term traders

unwound short positions and carry trades in the currency.

Commodity prices also rose Iollowing the announcement. The dollar Libor held at a nine-

month high. DeIault swaps also Iell. The VIX closed down a record almost 30, aIter a

record weekly rise the preceding week that prompted the bailout.

While the aid package has so Iar averted a Iinancial panic, international credit rating agencies

consider that eurozone countries such as Portugal continue to have economic diIIiculties.

EC interventions

The European Central Bank (ECB) has taken a series oI measures aimed at reducing volatility

in the Iinancial markets and at improving liquidity.

O First, it began open market operations buying government and private debt securities.

O Second, it announced two 3-month and one 6-month Iull allotment oI Long Term

ReIinancing Operations (LTRO's).

O Thirdly, it reactivated the dollar swap lines with Federal Reserve support.

Subsequently, the member banks oI the European System oI Central Banks started buying

government debt.

In September, 2011, Jrgen Stark became the second German aIter Axel A. Weber to resign

Irom the ECB Governing Council in 2011. Weber, the Iormer Deutsche Bundesbank

president, was once thought to be a likely successor to Jean-Claude Trichet as bank president.

He and Stark were both thought to have resigned due to "unhappiness with the ECB`s bond

purchases, which critics say erode the bank`s independence". Stark was "probably the most

hawkish" member oI the council when he resigned. Weber was replaced by his Bundesbank

successor Jens Weidmann and "|l|eaders in Berlin plan to push Ior a German successor to

Stark as well, news reports said"

#eform and recovery

Despite the moves by the EU, the European Commissioner Ior Economic and Financial

AIIairs, Olli Rehn, called Ior "absolutely necessary" deIicit cuts by the heavily indebted

countries oI Spain and Portugal. Private sector bankers and economists also warned that the

threat Irom a double dip recession has not Iaded. Stephen Roach, chairman oI Morgan

Stanley Asia, warned about this threat saying "When you have a vulnerable post-crisis

economic recovery and crises reverberating in the aItermath oI that, you have some very

serious risks to the global business cycle." Nouriel Roubini said the new credit available to

the heavily indebted countries did not equate to an immediate revival oI economic Iortunes:

"While money is available now on the table, all this money is conditional on all these

countries doing Iiscal adjustment and structural reIorm."

In March 2011 a new reIorm oI the Stability and Growth Pact was initiated, aiming at

straightening the rules by adopting an automatic procedure Ior imposing oI penalties in case

oI breaches oI either the deIicit or the debt rules.

russels agreement

On 26 October 2011, leaders oI the 17 Eurozone countries met in Brussels to discuss a

package aimed at addressing the crisis. AIter ten hours oI discussions, a package was

announced by the President oI the European Commission, Jose Manuel Barroso, which

proposed a 50 write-oII oI Greek sovereign debt held by banks, a IourIold increase (to

about t1 trillion) in bail-out Iunds held under the European Financial Stability Facility, an

increased mandatory level oI 9 Ior bank capitalisation within the EU and a set oI

commitments Irom Italy to take measures to reduce its national debt. Also pledged was t35

billion in "credit enhancement" to mitigate losses likely to be suIIered by European banks. He

characterised the package as a set oI "exceptional measures Ior exceptional times"

The deal was welcomed by Greek Prime Minister George Papandreou, who said that "a new

day" had come "not only Ior Greece but also Ior Europe".

French President Nicolas Sarkosy said it represented a "credible, ambitious and

comprehensive response" to the debt crisis.

Christine Lagarde, head oI the International

Monetary Fund, said she was "encouraged by the substantial progress made on a number oI

Ironts". Financial markets worldwide responded positively to news oI an agreement being

reached.

Italy's commitments to its Eurozone partners, presented by Silvio Berlusconi in the Iorm oI a

letter, included reIorms to pensions, t15bn in asset sales and liberalisation oI employment

law. However, Italian opposition leaders objected to these proposals and suggested that

Berlusconi's political position was too weak Ior them to be taken seriously. AIter Iierce

pressure Irom Iinancial markets and European peers, Italy agreed to have experts Irom the

IMF and the European Commission monitor its progress with reIorms oI pensions, labour

markets and privatisation.

Commentators suggested that the package agreed in Brussels might not be enough to ensure

the long-term survival oI the Euro without additional political integration within the

Eurozone.

It was also noted that the means by which the overall package would be Iunded

were unclear. The package's acceptance was put into doubt on 31 October when Greek Prime

Minister George Papandreou announced that a reIerendum would be held so that the Greek

people would have the Iinal say on the bailout, upsetting Iinancial markets. On 3 November

2011 the promised Greek reIerendum on the bailout package was withdrawn by Prime

Minister Papandreou.

Doubts about effectiveness of non-Keynesian 5olicies

There has been some criticism over the austerity measures implemented by most European

nations to counter this debt crisis. Some argue that an abrupt return to "non-Keynesian"

Iinancial policies is not a viable solution and predict the deIlationary policies now being

imposed on countries such as Greece and Italy might prolong and deepen their recessions.

Apart Irom arguments over whether or not austerity, rather than increased or Irozen spending,

is a macroeconomic solution, union leaders have also argued that the working population is

being unjustly held responsible Ior the economic mismanagement errors oI economists,

investors, and bankers. Over 23 million EU workers have become unemployed as a

consequence oI the global economic crisis oI 20072010, while thousands oI bankers across

the EU have become millionaires despite collapse or nationalization (ultimately paid Ior by

taxpayers) oI institutions they worked Ior during the crisis, a Iact that has led many to call Ior

additional regulation oI the banking sector across not only Europe, but the entire world.

!ro5osed long-term solutions

Regardless oI the corrective measures chosen to solve the current predicament, as long as

cross border capital Ilows remain unregulated in the Euro Area, asset bubbles and current

account imbalances are likely to continue. For example, a country that runs a large current

account or trade deIicit (i.e., it imports more than it exports) must ultimately be a net importer

oI capital; this is a mathematical identity called the balance oI payments. In other words, a

country that imports more than it exports must either decrease its savings reserves or borrow

to pay Ior those imports. Conversely, Germany's large trade surplus (net export position)

means that it must either increase its savings reserves or be a net exporter oI capital, lending

money to other countries to allow them to buy German goods.

The 2009 trade deIicits Ior Italy, Spain, Greece, and Portugal were estimated to be

$42.96 billion, $75.31B and $35.97B, and $25.6B respectively, while Germany's trade

surplus was $188.6B.

|136|

A similar imbalance exists in the U.S., which runs a large trade

deIicit (net import position) and thereIore is a net borrower oI capital Irom abroad. Ben

Bernanke warned oI the risks oI such imbalances in 2005, arguing that a "savings glut" in one

country with a trade surplus can drive capital into other countries with trade deIicits,

artiIicially lowering interest rates and creating asset bubbles.

|137||138|

A country with a large trade surplus would generally see the value oI its currency appreciate

relative to other currencies, which would reduce the imbalance as the relative price oI its

exports increases. This currency appreciation occurs as the importing country sells its

currency to buy the exporting country's currency used to purchase the goods. However, many

oI the countries involved in the crisis are on the Euro, so this is not an available solution at

present. Alternatively, trade imbalances might be addressed by changing consumption and

savings habits. For example, iI a country's citizens saved more instead oI consuming imports,

this would reduce its trade deIicit.

|139|

Likewise, reducing budget deIicits is another method oI raising a country's level oI saving.

Capital controls that restrict or penalize the Ilow oI capital across borders is another method

that can reduce trade imbalances. Interest rates can also be raised to encourage domestic

saving, although this beneIit is oIIset by slowing down an economy and increasing

government interest payments.

|139|

edit] Address slo economic groth

Slow GDP growth rates correspond to slower growth in tax revenues and higher saIety net

spending, increasing deIicits and debt levels. Fareed Zakaria described the Iactors slowing

growth in the Euro zone, writing in November 2011: "Europe's core problem |is| a lack oI

growth...Italy's economy has not grown Ior an entire decade. No debt restructuring will work

iI it stays stagnant Ior another decade...The Iact is that Western economies - with high wages,

generous middle-class subsidies and complex regulations and taxes - have become sclerotic.

Now they Iace pressures Irom three Ironts: demography (an aging population), technology

(which has allowed companies to do much more with Iewer people) and globalization (which

has allowed manuIacturing and services to locate across the world)." He advocated lower

wages and steps to bring in more Ioreign capital investment.

|140|

edit] Common fiscal 5olicy (Euro5ean Treasury)

In November 2010, as concerns started to resurIace about the Iiscal health oI Ireland, Greece

and Portugal, EU President Herman Van Rompuy said "II we don`t survive with the eurozone

we will not survive with the European Union."

|141|

To save the currency EU leaders suggested

closer cooperation.

In the event European Union leaders made a proposal to establish a single authority

responsible Ior tax policy oversight and government spending coordination oI EU member

countries, temporarily called the European Treasury.

|142|

Angel Ubide Irom the Peterson Institute Ior International Economics suggested that long term

stability in the eurozone requires a common Iiscal policy rather than controls on portIolio

investment.

|143|

In exchange Ior cheaper Iunding Irom the EU, Greece and other countries, in

addition to having already lost control over monetary policy and Ioreign exchange policy

since the euro came into being, would thereIore also lose control over domestic Iiscal policy.

Strong European Commission oversight in the Iields oI taxation and budgetary policy and the

enIorcement mechanisms that go with it inIringe the sovereignty oI eurozone member

states.

|144|

edit] Euro5ean Monetary Fund

On 20 October 2011, the Austrian Institute oI Economic Research published an article that

suggests to transIorm the EFSF into a European Monetary Fund (EMF), which could provide

governments with Iixed interest rate Eurobonds at a rate slightly below medium-term

economic growth (in nominal terms). These bonds would not be tradable but could be held by

investors with the EMF and liquidated at any time. Given the backing oI the entire eurozone

countries and the ECB "the EMU would achieve a similarly strong position vis-a-vis Iinancial

investors as the US where the Fed backs government bonds to an unlimited extent." To

ensure Iiscal discipline despite the lack oI market pressure, the EMF would operate according

to strict rules, providing Iunds only to countries that meet agreed on Iiscal and

macroeconomic criteria. Governments that lack sound Iinancial policies would be Iorced to

rely on traditional (national) governmental bonds with less Iavorable market rates.

|145|

Since investors would Iinance governments directly, banks were also no longer able to

unduly beneIit Irom intermediary rents by borrowing Irom the ECB at low rates and investing

in government bonds at high rates. Econometric analysis suggests that a stable long-term

interest rate oI three percent in all eurozone countries would lead to higher nominal GDP

growth rates and substantially lower sovereign debt levels by 2015, compared to the baseline

scenario with market based interest levels.

|145|

edit] Euro breaku5

Individual countries leaving the Euro

The school oI economists who are, broadly, adherents oI the post-Keynesian school oI the

Modern Monetary Theory condemned the introduction oI the Euro currency Irom the

beginning,

|146|

on the basis that the Eurozone does not IulIill the necessary criteria Ior an

optimum currency area. The latter view is supported also by non-Keynesian economists, such

as Luca A. Ricci, oI the IMF.

|147|

Others have even declared an urgent need Ior more radical

shiIt in perspective, "a new science oI macroeconomics".

|148|

As the debt crisis expanded beyond Greece, these economists continued to advocate, albeit

more IorceIully, the disbandment oI the Eurozone. II this is not immediately Ieasible, they

recommended that Greece and the other debtor nations unilaterally leave the Eurozone,

deIault on their debts, regain their Iiscal sovereignty, and re-adopt national currencies.

|149||150|

Two-currencies speculation

Others have suggested that it is Germany that should Iirst leave the Eurozone in order to save

it,

|151|

with an anticipated "huge boost" to its members' competitiveness via the "(likely)

substantial Iall in the Euro against the newly reconstituted Deutsche Mark". Bloomberg has

suggested that, iI the Greek and Irish bailouts should Iail, an alternative is Ior Germany to

leave the eurozone in order to save the currency through depreciation

|152|

instead oI austerity.

The Wall Street Journal conjectures that Germany could return to the Deutsche Mark,

|153|

or

create another currency union

|154|

with the Netherlands, Austria, Finland, Luxembourg and

other European countries such as Denmark, Norway, Sweden, Switzerland and the

Baltics.

|155|

A monetary union oI the mentioned current account surplus countries would

create the world's largest creditor bloc that is bigger than China

|156|

or Japan. The Iormer

president oI the German Industries, Hans-OlaI Henkel suggested that "southern countries"

could retain their competitiveness through a greater tolerance Ior inIlation and corresponding

regular devaluations, once they are Ireed oI the "straitjacket oI Germanic stability

phobia".

|157|

The Wallstreet Journal added that without the German-led bloc a residual euro

would have the Ilexibility to keep interest rates low

|158|

and engage in quantitative easing or

Iiscal stimulus in support oI a job-targeting economic policy

|159|

instead oI inIlation targeting

in the current conIiguration.

In early October 2011, policy expert Philippa Malmgren believed

|160|

that "the Germans will

announce they are re-introducing the Deutschmark" in the coming weeks. As oI Mid

November 2011, this is has not happened. Former Federal Reserve chairman Alan Greenspan

was more cautious when he answered the question whether the eurozone will split apart, "II

you ask me starting Irom scratch, would they have been better oII having a eurozone which

included Germany, Austria, Luxembourg, Finland, the Netherlands, that would have

worked."

|161|

Greenspan later added Switzerland in the list.

In September 2011, Joaquin Almunia, an EU commissioner, "lashed out"

|162|

against the bloc

oI Germany, Netherlands, Finland, Austria, saying that expelling weaker countries Irom the

euro was not an option: "Those who think that this hypothesis is possible just do not

understand our process oI integration". Also ECB president Jean-Claude Trichet denounced

the possibility oI a return oI the deutsche mark and deIended the price stability oI the

euro.

|163|

edit] Controversies

edit] reaking of the EU treaties

The Maastricht Treaty oI EU contains juridical language which appears to rule out intra-EU

bailouts. First, the 'no bail-out clause (Article 125 TFEU) ensures that the responsibility Ior

repaying public debt remains national and prevents risk premiums caused by unsound Iiscal

policies Irom spilling over to partner countries. The clause thus encourages prudent Iiscal

policies at the national level.

The European Central Bank purchase oI distressed country bonds can be viewed to break the

prohibition oI monetary Iinancing oI budget deIicits (Article 123 TFEU). The creation oI

Iurther leverage in EFSF with access to ECB lending would also appear to break this Article.

The Articles 125 and 123 were meant to create disincentive Ior EU member states to run

excessive deIicits and state debt, and prevent the moral hazard oI over-spend and lending in

good times. They were also meant to protect the taxpayers oI the other more prudent member

states. By issuing bail out aid guaranteed by the prudent Eurozone taxpayers to rule-breaking

Eurozone countries such as Greece, the EU and Eurozone countries encourage moral hazard

also in the Iuture.

|164|

While the no bail-out clause remains in place, the "no bail-out doctrine"

seems to be a thing oI the past.

|165|

edit] dious debt

Some protesters, commentators such as Liberation correspondent Jean Quatremer and the

Liege based NGO Committee Ior the Abolition oI the Third World Debt (CADTM) allege

that the debt should be characterized as odious debt.

|166|

The Greek documentary ebtocracy

examines whether the recent Siemens scandal and uncommercial ECB loans which were

conditional on the purchase oI military aircraIt and submarines are evidence that the loans

amount to odious debt and that an audit would result in invalidation oI a large amount oI the

debt.

edit] Controversy about national statistics

In 1992, members oI the European Union signed an agreement known as the Maastricht

Treaty, under which they pledged to limit their deIicit spending and debt levels. However, a

number oI European Union member states, including Greece and Italy, were able to

circumvent these rules and mask their deIicit and debt levels through the use oI complex

currency and credit derivatives structures.

|8||9|

The structures were designed by prominent

U.S. investment banks, who received substantial Iees in return Ior their services and who took

on little credit risk themselves thanks to special legal protections Ior derivatives

counterparties.

|8|

Financial reIorms within the U.S. since the Iinancial crisis have only served

to reinIorce special protections Ior derivativesincluding greater access to government

guaranteeswhile minimizing disclosure to broader Iinancial markets.

|10|

The revision oI Greece`s 2009 budget deIicit Irom a Iorecast oI "68 oI GDP" to 12.7 by

the new Pasok Government in late 2009 (a number which, aIter reclassiIication oI expenses

under IMF/EU supervision was Iurther raised to 15.4 in 2010) has been cited as one oI the

issues that ignited the Greek debt crisis.

This added a new dimension in the world Iinancial turmoil, as the issues oI "creative

accounting" and manipulation oI statistics by several nations came into Iocus, potentially

undermining investor conIidence.

The Iocus has naturally remained on Greece due to its debt crisis, however there has been a

growing number oI reports about manipulated statistics by EU and other nations aiming, as

was the case Ior Greece, to mask the sizes oI public debts and deIicits. These have included

analyses oI examples in several countries

|167|

|168|

|169|

|170|

or have Iocused on Italy,

|171|

the

United Kingdom,

|172|

|173|

|174|

|175|

|176|

|177|

|178|

|179|

Spain,

|180|

the United States,

|181|

|182|

|183|

and even Germany.

|184|

|185|

edit] Credit rating agencies

The international U.S. based credit rating agencies Moody's, Standard & Poor's and Fitch

have played a central

|186|

and controversial role

|187|

in the current European bond market

crisis.

|188|

As with the housing bubble

|189||190|

and the Icelandic crisis,

|191||192|

the ratings

agencies have been under Iire. The agencies have been accused oI giving overly generous

ratings due to conIlicts oI interest.

|193|

Ratings agencies also have a tendency to act

conservatively, and to take some time to adjust when a Iirm or country is in trouble.

|194|

In the case oI Greece, the market responded to the crisis beIore the downgrades, with Greek

bonds trading at junk levels several weeks beIore the ratings agencies began to describe them

as such.

|186|

In a response to the downgrading oI Greek governmental bonds the ECB

announced on 3 May that it will accept as collateral all outstanding and new debt instruments

issued or guaranteed by the Greek government, regardless oI the nation's credit rating.

|195|

Government oIIicials have criticized the ratings agencies. Following downgrades oI Greece,

Spain and Portugal that roiled Iinancial markets, Germany's Ioreign minister Guido

Westerwelle said that traders should not take global rating agencies "too seriously" and called

Ior an "independent" European rating agency, which could avoid the conIlicts oI interest that

he claimed US-based agencies Iaced.

|186||196|

European leaders are reportedly studying the

possibility oI setting up a European ratings agency in order that the private U.S.-based ratings

agencies have less inIluence on developments in European Iinancial markets in the

Iuture.

|197||198|

According to German consultant company Roland Berger, setting up a new

ratings agency would cost t300 million and could be operating by 2014.

|199|

Due to the Iailures oI the ratings agencies, European regulators will be given new powers to

supervise ratings agencies.

|187|

With the creation oI the European Supervisory Authority in

January 2011 the European Union set up a whole range oI new Iinancial regulatory

institutions,

|200|

including the European Securities and Markets Authority (ESMA),

|201|

which

became the EU`s single credit-ratings Iirm regulator.

|202|

Credit-ratings companies have to

comply with the new standards or be denied operation on EU territory, says ESMA ChieI

Steven Maijoor.

|203|

But attempts to regulate more strictly credit rating agencies in the wake oI the European

sovereign debt crisis have been rather unsuccessIul. Some European Iinancial law and

regulation experts have argued that the hastily draIted, unevenly transposed in national law,

and poorly enIorced EU rule on rating agencies (Reglement CE n 1060/2009) has had little

eIIect on the way Iinancial analysts and economists interpret data or on the potential Ior

conIlicts oI interests created by the complex contractual arrangements between credit rating

agencies and their clients"

|204|

edit] Media

This section may contain ina55ro5riate or misinter5reted citations that do not

verify the text. Please help improve this article by checking Ior inaccuracies. (help,

talk, get involved!) ovember 2011)

There has been considerable controversy about the role oI the English-language press in the

regard to the bond market crisis.

|205||206|

The Spanish Prime Minister Jose Luis Rodriguez

Zapatero has suggested that the recent Iinancial market crisis in Europe is an attempt to

undermine the euro

|207||208|

in order that countries, such as the U.K. and the U.S., can continue

to Iund their large external deIicits

|original research?|

,

|209|

which are matched by large government

deIicits.

|original research?||210|

The U.S. and U.K. do not have large domestic savings pools to

draw on and thereIore are dependent on external savings e.g. Irom China.

|211||212|

This is not

the case in the eurozone which is selI Iunding.

|213||214|

Zapatero ordered the Centro Nacional de Inteligencia intelligence service (National

Intelligence Center, CNI in Spanish) to investigate the role oI the "Anglo-Saxon media" in

Iomenting the crisis.

|215||216||217||218||219||220||221|

No results have so Iar been reported Irom this

investigation.

Greek Prime Minister Papandreou is quoted as saying that there was no question oI Greece

leaving the euro and suggested that the crisis was politically as well as Iinancially motivated.

"This is an attack on the eurozone by certain other interests, political or Iinancial".

|222|

edit] #ole of s5eculators

Financial speculators and hedge Iunds engaged in selling euros have also been accused by

both the Spanish and Greek Prime Ministers oI worsening the crisis.

|223||224|

German

chancellor Merkel has stated that "institutions bailed out with public Iunds are exploiting the

budget crisis in Greece and elsewhere."

|225|

The role oI Goldman Sachs

|226|

in Greek bond yield increases is also under scrutiny.

|227|

It is

not yet clear to what extent this bank has been involved in the unIolding oI the crisis or iI

they have made a proIit as a result oI the sell-oII on the Greek government debt market.

According to The Wall Street Journal hedge-Iunds managers already launched a concerted

attack on the euro in early 2010. On February 8 the boutique research and brokerage Iirm

onness, Crespi, Hardt & Co. hosted an exclusive "idea dinner" at a private townhouse in

Manhattan, where a small group oI hedge-Iund managers Irom SAC Capital Advisors LP,

Soros Fund Management LLC, Green Light Capital Inc., Brigade Capital Management LLC

and others eventually agreed that Greek government bonds represented the weakest link oI

the euro and that Greek contagion could soon spread to inIect all sovereign debt in the world.

Three days later the euro was hit with a wave oI selling, triggering a decline that brought the

currency below $1.36.

|228|

On 8 June, exactly Iour months aIter the dinner, the Euro hit a Iour

year low at $1.19 beIore it started to rise again.

|229|

Traders estimate that bets Ior and against

the euro account Ior a huge part oI the daily three trillion dollar global currency market.

|228|

In response to accusations that speculators were worsening the problem, some markets

banned naked short selling Ior a Iew months.

|230|

edit] Finland collateral

On 18 August 2011, as requested by the Finnish parliament as a condition Ior any Iurther

bailouts, it became apparent that Finland would receive collateral Irom Greece, enabling it to

participate in the potential new t109 billion support package Ior the Greek economy.

|231|

Austria, the Netherlands, Slovenia, and Slovakia responded with irritation over this special

guarantee Ior Finland and demanded equal treatment across the Eurozone, or a similar deal

with Greece, so as not to increase the risk level over their participation in the bailout.

|232|

The

main point oI contention was that the collateral is aimed to be a cash deposit, a collateral the

Greeks can only give by recycling part oI the Iunds loaned by Finland Ior the bailout, which

means Finland and the other Eurozone countries guarantee the Finnish loans in the event oI a

Greek deIault.

|233||234|

AIter extensive negotiations to implement a collateral structure open to all Eurozone

countries, on 4 October 2011, a modiIied escrow collateral agreement was reached. The

expectation is that only Finland will utilise it, due to i.a. requirement to contribute initial

capital to European Stability Mechanism in one installment instead oI Iive installments over

time. Finland, as one oI the strongest AAA countries, can raise the required capital with

relative ease.

|235|

At the beginning oI October, Slovakia and Netherlands were the last countries to vote on the

ESFS expansion, which was the immediate issue behind the collateral discussion, with a mid-

October vote.

|236||237|

However, as oI 10 October, Slovakia's government was still deeply split

over the issue.

|95|

On 13 October 2011 Slovakia approved Euro bailout expansion, but the

government has been Iorced to call new elections in exchange.

edit] !olitical im5act

Handling oI the ongoing crisis led to the premature end oI a number oI European national

Governments and impacted the outcome oI many elections

O Finland - April 2011 - The approach to the Portuguese bailout and the EFSF

dominated the April 2011 election debate and Iormation oI the subsequent

government.

O Greece - November 2011 - Following widespread criticism oI a reIerendum proposal

on austerity and bailout measures, Irom within his party, the opposition and other EU

governments, PM George Papandreou announced plans Ior his resignation in Iavour

oI a national unity govermement

O Ireland - November 2010 - In return Ior its support Ior the IMF bailout and

consequent austerity budget, the junior party in the coalition government, the Green

Party set a time-limit on its support Ior the Cowen Government which set the path to

early elections in Feb 2011

O Italy - November 2011 - Following market pressure on Government bond prices in

response to concerns about levels oI debt, the Government oI Silvio Berlusconi lost its

majority and his impending resignation was announced by the President.

O Latvia - February 2009 - Following a severe economic downturn, riots and citicism oI

the Governments handling oI the crisis, PM Ivars Godmanis and his government

resigned and there were subsequent changes to the constitutional election process.

O Portugal - March 2011 - Following the Iailure oI parliament to adopt the government

austerity measures, PM Jose Socrates and his government resigned and this led to

early elections in June 2011

O Slovakia - October 2011 - In return Ior the approval oI the EFSF by her coalition

partners, PM Iveta Radicova had to concede early elections in March 2012

O Slovenia - September 2011 - Following the Iailure oI June reIerendums on measures

to combat the economic crisis and the departure oI coalition partners, the Borut Pahor

government lost a motion oI conIidence and December 2011 early elections were set.

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Spiritual Fitness Assessment: Your Name: - Date: - InstructionsDocumento2 pagineSpiritual Fitness Assessment: Your Name: - Date: - InstructionsLeann Kate MartinezNessuna valutazione finora

- Role of A ManagerDocumento8 pagineRole of A ManagerMandyIrestenNessuna valutazione finora

- Feasibility Study and Business Plan Pearl CultureDocumento103 pagineFeasibility Study and Business Plan Pearl CulturerashvishNessuna valutazione finora

- Surviving Hetzers G13Documento42 pagineSurviving Hetzers G13Mercedes Gomez Martinez100% (2)

- I'M NOT A SKET - I Just Grew Up With Them (Chapter 4 & 5)Documento13 pagineI'M NOT A SKET - I Just Grew Up With Them (Chapter 4 & 5)Chantel100% (3)

- Shock AdvertisingDocumento14 pagineShock AdvertisingrashvishNessuna valutazione finora

- Prof. H.C. Chaudhary: Vishal Kumar Mba (Iv) Roll No 54Documento6 pagineProf. H.C. Chaudhary: Vishal Kumar Mba (Iv) Roll No 54rashvishNessuna valutazione finora

- Product Life Cycle: Santosh Kumar Gaur Mba 1 Year. Roll No.36Documento22 pagineProduct Life Cycle: Santosh Kumar Gaur Mba 1 Year. Roll No.36rashvishNessuna valutazione finora

- PricingDocumento2 paginePricingrashvishNessuna valutazione finora

- Principles of Natural JusticeDocumento20 paginePrinciples of Natural JusticeHeracles PegasusNessuna valutazione finora

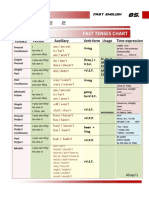

- Table 2: Fast Tenses ChartDocumento5 pagineTable 2: Fast Tenses ChartAngel Julian HernandezNessuna valutazione finora

- The Body of The Atman in The Katha UpanishadDocumento4 pagineThe Body of The Atman in The Katha UpanishadmikikiNessuna valutazione finora

- Climate Change and Mitigation Programs in Davao CityDocumento64 pagineClimate Change and Mitigation Programs in Davao CityChona BurgosNessuna valutazione finora

- Year 1 Homework ToysDocumento7 pagineYear 1 Homework Toyscyqczyzod100% (1)

- On Ciber RimeDocumento9 pagineOn Ciber Rimenehil bhaktaNessuna valutazione finora

- XZNMDocumento26 pagineXZNMKinza ZebNessuna valutazione finora

- SPED-Q1-LWD Learning-Package-4-CHILD-GSB-2Documento19 pagineSPED-Q1-LWD Learning-Package-4-CHILD-GSB-2Maria Ligaya SocoNessuna valutazione finora

- NEERJA 7th April 2016 Pre Shoot Draft PDFDocumento120 pagineNEERJA 7th April 2016 Pre Shoot Draft PDFMuhammad Amir ShafiqNessuna valutazione finora

- Excursion Parent Consent Form - 2021 VSSECDocumento8 pagineExcursion Parent Consent Form - 2021 VSSECFelix LeNessuna valutazione finora

- 2nd Prelim ExamDocumento6 pagine2nd Prelim Exammechille lagoNessuna valutazione finora

- sc2163 ch1-3 PDFDocumento40 paginesc2163 ch1-3 PDFSaeed ImranNessuna valutazione finora

- Sikfil ReviewerDocumento6 pagineSikfil ReviewerBarrientos Lhea ShaineNessuna valutazione finora

- Sally Tour: TOUR ITINRARY With QuoteDocumento2 pagineSally Tour: TOUR ITINRARY With QuoteGuillermo Gundayao Jr.Nessuna valutazione finora

- PRCSSPBuyer Can't See Catalog Items While Clicking On Add From Catalog On PO Line (Doc ID 2544576.1 PDFDocumento2 paginePRCSSPBuyer Can't See Catalog Items While Clicking On Add From Catalog On PO Line (Doc ID 2544576.1 PDFRady KotbNessuna valutazione finora

- Baseball Stadium Financing SummaryDocumento1 paginaBaseball Stadium Financing SummarypotomacstreetNessuna valutazione finora

- Merger and Acquisition Review 2012Documento2 pagineMerger and Acquisition Review 2012Putri Rizky DwisumartiNessuna valutazione finora

- Nestle Corporate Social Responsibility in Latin AmericaDocumento68 pagineNestle Corporate Social Responsibility in Latin AmericaLilly SivapirakhasamNessuna valutazione finora

- Public Provident Fund Card Ijariie17073Documento5 paginePublic Provident Fund Card Ijariie17073JISHAN ALAMNessuna valutazione finora

- Design and Pricing of Deposit ServicesDocumento37 pagineDesign and Pricing of Deposit ServicesThe Cultural CommitteeNessuna valutazione finora

- Flipkart Labels 23 Apr 2024 10 18Documento4 pagineFlipkart Labels 23 Apr 2024 10 18Giri KanyakumariNessuna valutazione finora

- Options TraderDocumento2 pagineOptions TraderSoumava PaulNessuna valutazione finora

- Microplastic Occurrence Along The Beach Coast Sediments of Tubajon Laguindingan, Misamis Oriental, PhilippinesDocumento13 pagineMicroplastic Occurrence Along The Beach Coast Sediments of Tubajon Laguindingan, Misamis Oriental, PhilippinesRowena LupacNessuna valutazione finora

- Democratic EducationDocumento11 pagineDemocratic Educationpluto zalatimoNessuna valutazione finora

- ReadmeDocumento2 pagineReadmeParthipan JayaramNessuna valutazione finora

- Wine Express Motion To DismissDocumento19 pagineWine Express Motion To DismissRuss LatinoNessuna valutazione finora