Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ethics Predetermined Overhead Rate and Capacity Pat Miranda

Caricato da

Margaret CabreraDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ethics Predetermined Overhead Rate and Capacity Pat Miranda

Caricato da

Margaret CabreraCopyright:

Formati disponibili

Ethics; Predetermined Overhead Rate and Capacity Pat Miranda, the new controller of Vault Hard Drives, Inc.

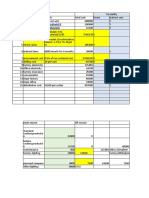

, has just returned from a seminar on the choice of the activity level in the predetermined overhead rate. Even though the subject did not sound exciting at first, she found that there were some important ideas presented that should get a hearing at her company. After returning from the seminar, she arranged a meeting with the production manager, J. Stevens, and the assistant production manager, Marvin Washington. Pat: I ran across an idea that I wanted to check out with both of you. Its about the way we compute predetermined overhead rates. J.: Were all ears. Pat: We compute the predetermined overhead rate by dividing the estimated total factory overhead for the coming year by the estimated total units produced for the coming year. Marvin: Weve been doing that as long as Ive been with the company. J.: And it has been done that way at every other company Ive worked at, except at most places they divide by direct labor-hours. Pat: We use units because it is simpler and we basically make one product with minor variations. But, theres another way to do it. Instead of basing the overhead rate on the estimated total units produced for the coming year, we could base it on the total units produced at capacity. Marvin: Oh, the Marketing Department will love that. It will drop the costs on all of our products. Theyll go wild over there cutting prices. Pat: That is a worry, but I wanted to talk to both of you first before going over to Marketing. J.: Arent you always going to have a lot of underapplied overhead? Pat: Thats correct, but let me show you how we would handle it. Heres an example based on our budget for next year. Traditional Approach to Computation Predetermined Overhead Rate of the

J.: Whoa!! I dont think I like the looks of that Cost of unused capacity: If that thing shows up on the income statement, someone from headquarters is likely to come down here looking for some people to lay off. Marvin: Im worried about something else too. What happens when sales are not up to expectations? Can we pull the hat trick? Pat: Im sorry, I dont understand. J.: Marvins talking about something that happens fairly regularly. When sales are down and profits look like they are going to be lower than the president told the owners they were going to be, the president comes down here and asks us to deliver some more profits. Marvin: And we pull them out of our hat. j.: Yeah, we just increase production until we get the profits we want. Pat: I still dont understand. You mean you increase sales? J.: Nope, we increase production. Were the production managers, not the sales managers. Pat: I get it. Since you have produced more, the sales force has more units it can sell. J.: Nope, the marketing people dont do a thing. We just build inventories and that does the trick. Required: In all of the questions below, assume that the predetermined overhead rate under the traditional method is $25 per unit, and under the new method it is $20 per unit. Also assume that under the traditional method any underapplied or overapplied overhead is taken directly to the income statement as an adjustment to Cost of Goods Sold. 1. Suppose actual production is 160,000 units. Compute the net operating incomes that would be realized under the traditional and new methods if actual sales are 150,000 units and everything else turns out as expected.

New Approach to Computation of the Predetermined Overhead Rate Using Capacity in the Denominator

2. How many units would have to be produce under each of the methods in order to realize the budgeted net operating income of $500,000 if actual sales are 150,000 units and everything else turns out as expected?

3. What effect does the new method based on capacity have on the volatility of net operating income? 4. Will the hat trick be easier or harder to perform if the new method based on capacity is used? 5. Do you think the hat trick is ethical?

Ina of t q st ll he ue ions be , a low ssum t tt pre t rm dove a ra eu rt t dit l m t e ha he de e ine rhe d t nde he ra iona e hodis $ 5pe un , a dun t n wm t 2 r it n der he e e hoditis $ 0pe unit Also a 2 r . ssum e t tund rt et dit a m t ha e h ra ion l e hoda y un ra n de pplie orove pp dove e dis t ke dire ly t t incom st t m nta a a just e t Costof G d ra lie rh a a n ct o he e a e e s n d m nt o oods Sold. p e 1 Supposeactual productionis 160,000units.Com utethenetoperatingincom s ) t tw ldbere lize und rt et d ion l a n wm t ha ou a d e h ra it a nd e e hods ifa ua sa s a 1 0 0 ct l le re 5 ,0 0 unit a e ryt inge t s nd ve h lse urns outa e ct d. s xpe e Sa s le Costof G s S ood old Manuf uringCost Variable act Tot Produced al Manuf uringCost Variable act (D eductInv ory Ending) ent , Manuf uringCost Fixed Ov act erhead Tot Produced al Manuf uringCost Fixed Ov act erhead (D eductInv ory Ending) ent , 9,000,000 a ould e 2 Howm nyunits w haveto beproduceundereachofthem thods inorderto ) re lizet ebu t dn tope t in a h dgee e ra ing com of$ 0 ,0 0if a ua sa s a 1 0 0 unit e 50 0 ct l le re 5 ,0 0 s a e ryt nd ve hinge t rns outa e ct d? lse u s xpe e Sa s le Costof G s S ood old Manuf uring Cost Variable act Tot Produced al Manuf uring Cost Variable act (D eductInv ory Ending) ent , Manuf uring Cost Fixed Ov act erhead Tot Produced al Manuf uring Cost Fixed Ov act erhead (D eductInv ory Ending) ent , Add(D educt Underapplied (Ov ): erapplied) Gross M rgin a Se llinga dA in n dm N tope t incom e ra ing e 9,000,000

TR D N A ITIO AL

160,000 (10,000) 160,000 (10,000)

15 15 25 25

2,400,000 (150,000) 4,000,000 (250,000) 6,000,000

168,000 (18,000) 168,000 (18,000)

15 15 25 25

2,520,000 (270,000) 4,200,000 (450,000) (200,000) 5,800,000 3,200,000 2,700,000 500,000

Gross M rgin a Se llinga A in nd dm N tope t incom e ra ing e

3,000,000 2,700,000 300,000

Under t t ional approach, t report netoperat incom can be increasedby he radit he ed ing e increasingt product lev w t result in ov he ion el hich hen s erappliedov erheadw is deduct f hich ed rom CostofGoods Sold. 4,000,00 $200,000 Addit ional netoperat incom requiredt ing e o this only is how m we uch atain t t argetnetoperat incom ($500,000 ing e allocated $300,000) (a) $25per unit Ov erhead applied per unitofout (b) put but we overproduced and 8,000unit s Addit ional out required t atain t put o t argetnet applied the same POR bringingour overhead cost operat incom (a) (b) ing e $4 ,000,000 applied to Act t al m act ual ot anuf uring ov erhead cost 4,200,000 incurred Manuf uring ov act erhead applied thuswe overapplied 4 ,200,000 [(160,000 unit +8,000 unit $25 per unit s s) ] Ov erhead ov erapplied N A PR ACH EW P O Sa s le Costof G s S ood old Manuf uringCost Variable act Tot Produced al Manuf uringCost Variable act (D eductInv ory Ending) ent , Manuf uringCost Fixed Ov act erhead Tot Produced al Manuf uringCost Fixed Ov act erhead (D eductInv ory Ending) ent , Gross M rgin a Costof u nuse ca cit d pa y Se llinga A in nd dm N tope t incom e ra ing e 9,000,000 Sa s le Costof G s S ood old Manuf uring Cost Variable act Tot Produced al Manuf uring Cost Variable act (D eductInv ory Ending) ent , Manuf uring Cost Fixed Ov act erhead Tot Produced al Manuf uring Cost Fixed Ov act erhead (D eductInv ory Ending) ent , Gross M rgin a Costof u nuse ca cit d pa y Add( e D duct: U ra ) nde pplie (O ra plie ) d ve p d Se llinga dA in n dm N tope t incom e ra ing e 9,000,000

$200,000

160,000 (10,000) 160,000 (10,000) 40,000

15 15 20 20 20

2,400,000 (150,000) 3,200,000 (200,000) 5,250,000 3,750,000 800,000 2,700,000 250,000

172,500 (22,500) 172,500 (22,500) 40,000 (12,500)

15 15 20 20 20 20

2,587,500 (337,500) 3,450,000 (450,000) 800,000 (250,000) 5,250,000 3,750,000 550,000 2,700,000 500,000

Newapproach: Under t newapproach, t report netoperat incom canbe increased byincreasing t he he ed ing e he product lev This result in less ofa deduct on t incom st em f t CostofUnused ion el. s ion he e at ent or he Capacit . y 4,000,000 $250,000 Addit ional netoperat incom requiredt ing e o this only is how m we uch atain t t argetnetoperat incom ($500,000 ing e allocated $250,000) (a) $20per unit Ov erhead applied per unitofout (b) put but we overproduced and 12,500un s it Addit ional out required t atain t put o t argetnet applied the sam POR e operat incom (a) (b) ing e bringingour overhead cost 160,000 unit s Est at num ofunit produced im ed ber s applied to 172,500 unit s Act num ofunit t be produced ual ber so 4,250,000 thuswe overapplied

Potrebbero piacerti anche

- CHAPTER 5 - Assignment SolutionDocumento16 pagineCHAPTER 5 - Assignment SolutionCoci KhouryNessuna valutazione finora

- Value Chain Management Capability A Complete Guide - 2020 EditionDa EverandValue Chain Management Capability A Complete Guide - 2020 EditionNessuna valutazione finora

- Corporate Financial Analysis with Microsoft ExcelDa EverandCorporate Financial Analysis with Microsoft ExcelValutazione: 5 su 5 stelle5/5 (1)

- Tutorial Questions Week 6Documento7 pagineTutorial Questions Week 6julia chengNessuna valutazione finora

- Profitability of Products and Relative ProfitabilityDocumento5 pagineProfitability of Products and Relative Profitabilityshaun3187Nessuna valutazione finora

- BMGT 321 Chapter 13 HomeworkDocumento11 pagineBMGT 321 Chapter 13 Homeworkarnitaetsitty100% (1)

- Instant download Test bank for Managerial Accounting Decision Making and Motivating Performance 1st Edition Datar and RajanDocumento9 pagineInstant download Test bank for Managerial Accounting Decision Making and Motivating Performance 1st Edition Datar and RajanAlly CapacioNessuna valutazione finora

- MCS MatH QSTN NewDocumento7 pagineMCS MatH QSTN NewSrijita SahaNessuna valutazione finora

- Module 1 PDFDocumento13 pagineModule 1 PDFWaridi GroupNessuna valutazione finora

- Relevant Costs 4Documento6 pagineRelevant Costs 4Franklin Evan PerezNessuna valutazione finora

- Https Doc 0k 0s Apps Viewer - GoogleusercontentDocumento4 pagineHttps Doc 0k 0s Apps Viewer - GoogleusercontentAnuranjan Tirkey0% (1)

- Audit Report AnalysisDocumento9 pagineAudit Report AnalysisRey Aurel TayagNessuna valutazione finora

- It’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersDa EverandIt’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersNessuna valutazione finora

- Flexible Budgets and Overhead Analysis: True/FalseDocumento69 pagineFlexible Budgets and Overhead Analysis: True/FalseRv CabarleNessuna valutazione finora

- Solutions Chapter 7Documento39 pagineSolutions Chapter 7Brenda Wijaya100% (2)

- ESS and Hotel IndustryDocumento20 pagineESS and Hotel Industryparul198731100% (1)

- Question Bank - Practical QuestionsDocumento10 pagineQuestion Bank - Practical QuestionsNeel KapoorNessuna valutazione finora

- Bab Vii BalandcorcardDocumento17 pagineBab Vii BalandcorcardCela Lutfiana100% (1)

- The Correct Answer For Each Question Is Indicated by ADocumento19 pagineThe Correct Answer For Each Question Is Indicated by Aakash deepNessuna valutazione finora

- 2009-02-05 171631 Lynn 1Documento13 pagine2009-02-05 171631 Lynn 1Ashish BhallaNessuna valutazione finora

- Programmazione e Controllo Esercizi Capitolo 9Documento32 pagineProgrammazione e Controllo Esercizi Capitolo 9Azhar SeptariNessuna valutazione finora

- ACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDDocumento17 pagineACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDEjaz KhanNessuna valutazione finora

- Soal P 7.2, 7.3, 7.5Documento3 pagineSoal P 7.2, 7.3, 7.5boba milkNessuna valutazione finora

- CH 4Documento6 pagineCH 4Jean ValderramaNessuna valutazione finora

- يوــــيــــــلعلا Note 1 Acc451 Accounting Information Systems AIS: An OverviewDocumento8 pagineيوــــيــــــلعلا Note 1 Acc451 Accounting Information Systems AIS: An OverviewsararabeeaNessuna valutazione finora

- Ppsas 27 in Comparison With Ias 41Documento2 paginePpsas 27 in Comparison With Ias 41Lia SyNessuna valutazione finora

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyDocumento33 pagineChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- Activity-Based Costing, Customer Profitability, and Activity-Based ManagementDocumento26 pagineActivity-Based Costing, Customer Profitability, and Activity-Based ManagementJoeNessuna valutazione finora

- Management Accounting Creates Organizational ValueDocumento68 pagineManagement Accounting Creates Organizational ValueinspekturaNessuna valutazione finora

- Costt 12Documento52 pagineCostt 12Niken PurbasariNessuna valutazione finora

- CH 11Documento48 pagineCH 11Pham Khanh Duy (K16HL)Nessuna valutazione finora

- Accounting Chapter 8-Master Budgeting Flashcards - QuizletDocumento7 pagineAccounting Chapter 8-Master Budgeting Flashcards - QuizletBisag AsaNessuna valutazione finora

- Chapter 9 - Budgeting1Documento27 pagineChapter 9 - Budgeting1Martinus WarsitoNessuna valutazione finora

- HICOM Case Analysis: Recommendations to Improve Subsidiary PerformanceDocumento5 pagineHICOM Case Analysis: Recommendations to Improve Subsidiary Performanceezra reyesNessuna valutazione finora

- ACC51112 Transfer PricingDocumento7 pagineACC51112 Transfer PricingjasNessuna valutazione finora

- Cost-Volume-Profit Analysis Techniques for Managerial Decision MakingDocumento3 pagineCost-Volume-Profit Analysis Techniques for Managerial Decision Makingmohammad bilal0% (1)

- Process Costing and Hybrid Product-Costing SystemsDocumento17 pagineProcess Costing and Hybrid Product-Costing SystemsWailNessuna valutazione finora

- David Ruiz Tarea 12-13Documento33 pagineDavid Ruiz Tarea 12-131006110950Nessuna valutazione finora

- ROI measures and profitability ratiosDocumento6 pagineROI measures and profitability ratiosawaischeemaNessuna valutazione finora

- Cost-Volume-Profit AnalysisDocumento50 pagineCost-Volume-Profit AnalysisMarkiesha StuartNessuna valutazione finora

- Estimating service costs in a consulting firmDocumento11 pagineEstimating service costs in a consulting firmPat0% (1)

- Quiz 4 AccountingDocumento2 pagineQuiz 4 AccountingShanthan AkkeraNessuna valutazione finora

- Strategic Planning in RetailDocumento11 pagineStrategic Planning in RetailDILIP JAINNessuna valutazione finora

- ABC Costing Guide for Managerial Accounting ToolsDocumento3 pagineABC Costing Guide for Managerial Accounting Toolssouayeh wejdenNessuna valutazione finora

- Inventory valuation Complete Self-Assessment GuideDa EverandInventory valuation Complete Self-Assessment GuideValutazione: 4 su 5 stelle4/5 (1)

- Variable vs Absorption CostingDocumento3 pagineVariable vs Absorption CostingVadim Pilipenko0% (7)

- 10 Exercises BE Solutions-1Documento40 pagine10 Exercises BE Solutions-1loveliangel0% (2)

- Why Are Ratios UsefulDocumento11 pagineWhy Are Ratios UsefulKriza Sevilla Matro100% (3)

- ADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdDocumento3 pagineADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdSam FishNessuna valutazione finora

- AsDocumento12 pagineAsShubham GautamNessuna valutazione finora

- Partnership Liquidation: Answers To Questions 1Documento28 paginePartnership Liquidation: Answers To Questions 1El Carl Sontellinosa0% (1)

- Harsh ElectricalsDocumento7 pagineHarsh ElectricalsR GNessuna valutazione finora

- Cma IpmiDocumento3 pagineCma IpmiBobby's CastleNessuna valutazione finora

- Auditing AssignmentDocumento17 pagineAuditing Assignmentihsan278Nessuna valutazione finora

- Sales mix variance explainedDocumento6 pagineSales mix variance explained'Qy Qizwa Andini'Nessuna valutazione finora

- Budgeting Profit, Sales, Costs & ExpensesDocumento19 pagineBudgeting Profit, Sales, Costs & ExpensesFarhan Khan MarwatNessuna valutazione finora

- Fma Past Paper 3 (F2)Documento24 pagineFma Past Paper 3 (F2)Shereka EllisNessuna valutazione finora

- Master Budget Assignment CH 9Documento4 pagineMaster Budget Assignment CH 9api-240741436Nessuna valutazione finora

- Conceptual FrameworksDocumento17 pagineConceptual FrameworksShah KamalNessuna valutazione finora

- ACC 201 Module Two Short Paper Accounting Cycle StepsDocumento5 pagineACC 201 Module Two Short Paper Accounting Cycle StepsChristian Meese100% (1)

- Merger - Ashish Sharma - 0101151295 PDFDocumento34 pagineMerger - Ashish Sharma - 0101151295 PDFAshish SharmaNessuna valutazione finora

- Audit and Internal ReviewDocumento5 pagineAudit and Internal ReviewkhengmaiNessuna valutazione finora

- Master BudgetDocumento32 pagineMaster BudgetKristelJaneDonaireBihag60% (5)

- Ben & Jerry's Homemade I. Point of View: A.1 Income Statement H-AnalysisDocumento3 pagineBen & Jerry's Homemade I. Point of View: A.1 Income Statement H-AnalysisJeanDianeJovelo100% (1)

- Chapter 4Documento38 pagineChapter 4Haidee Sumampil67% (3)

- Financial Statements, Cash Flow AnalysisDocumento41 pagineFinancial Statements, Cash Flow AnalysisMinhaz Ahmed0% (1)

- Fiscal Policy MeaningDocumento47 pagineFiscal Policy MeaningKapil YadavNessuna valutazione finora

- Raport Bayan Group 2018Documento304 pagineRaport Bayan Group 2018Muhammad Abdul Rochim100% (1)

- STD 12 Accountancy1Documento264 pagineSTD 12 Accountancy1Chetan KhonaNessuna valutazione finora

- Director Finance Controller in Boston MA Resume Gregory MurphyDocumento2 pagineDirector Finance Controller in Boston MA Resume Gregory MurphyGregoryMurphyNessuna valutazione finora

- Chapter 5 PowerpointDocumento37 pagineChapter 5 Powerpointapi-248607804Nessuna valutazione finora

- Income Tax AmendementsDocumento8 pagineIncome Tax AmendementsSassu MaaaNessuna valutazione finora

- Here Is Why He FiledDocumento83 pagineHere Is Why He FileddiannedawnNessuna valutazione finora

- Finolex Industries 2QFY18 Results Show Muted GrowthDocumento10 pagineFinolex Industries 2QFY18 Results Show Muted GrowthAnonymous y3hYf50mTNessuna valutazione finora

- Final Exam Fin 2Documento3 pagineFinal Exam Fin 2ma. veronica guisihanNessuna valutazione finora

- Micro Economics Study GuideDocumento74 pagineMicro Economics Study GuideAdam RNessuna valutazione finora

- US Internal Revenue Service: n746Documento4 pagineUS Internal Revenue Service: n746IRSNessuna valutazione finora

- A Project Report On Direct TaxDocumento52 pagineA Project Report On Direct Taxrani26oct72% (18)

- 3525 25108 Textbooksolution PDFDocumento44 pagine3525 25108 Textbooksolution PDFSatinder SinghNessuna valutazione finora

- WWW Uscis Gov-Sites-Default-Files-Files-Form-I-864Documento9 pagineWWW Uscis Gov-Sites-Default-Files-Files-Form-I-864api-269468511Nessuna valutazione finora

- Life Insurance An Investment AlternativeDocumento63 pagineLife Insurance An Investment Alternativepriya100% (2)

- Presentation On Suc Leveling For Management of ResourcesDocumento12 paginePresentation On Suc Leveling For Management of ResourcesvankenbalNessuna valutazione finora

- CIR V Central LuzonDocumento2 pagineCIR V Central LuzonAgnes FranciscoNessuna valutazione finora

- The Effect of Budgets on Financial Performance of Manufacturing CompaniesDocumento104 pagineThe Effect of Budgets on Financial Performance of Manufacturing CompaniesJulius Ralph PizarroNessuna valutazione finora

- Capital One TaxDocumento2 pagineCapital One Tax16baezmcNessuna valutazione finora

- CFO Guide to Debt Management and Treasury FunctionsDocumento6 pagineCFO Guide to Debt Management and Treasury FunctionsRobinson MojicaNessuna valutazione finora

- 6th Sessiom - Audit of Investment STUDENTDocumento17 pagine6th Sessiom - Audit of Investment STUDENTNIMOTHI LASENessuna valutazione finora

- Balanced Scorecard & Advanced Analysis and Appraisal of Performance, Financial & Related InformationDocumento17 pagineBalanced Scorecard & Advanced Analysis and Appraisal of Performance, Financial & Related InformationSasha 101Nessuna valutazione finora