Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Indiandairyindustr1 100502012652 Phpapp01

Caricato da

Bikram Walia0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

19 visualizzazioni16 pagineThe Indian dairy industry is rapidly growing, trying to keep pace with the galloping progress around the world. India's dairy sector is expected to triple its production in the next 10 years in view of expanding potential for export to Europe and the West. The urban market for milk products is expected to grow at an accelerated pace of around 33% per annum to around Rs.43,500 crores by year 2005.

Descrizione originale:

Titolo originale

indiandairyindustr1-100502012652-phpapp01

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe Indian dairy industry is rapidly growing, trying to keep pace with the galloping progress around the world. India's dairy sector is expected to triple its production in the next 10 years in view of expanding potential for export to Europe and the West. The urban market for milk products is expected to grow at an accelerated pace of around 33% per annum to around Rs.43,500 crores by year 2005.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

19 visualizzazioni16 pagineIndiandairyindustr1 100502012652 Phpapp01

Caricato da

Bikram WaliaThe Indian dairy industry is rapidly growing, trying to keep pace with the galloping progress around the world. India's dairy sector is expected to triple its production in the next 10 years in view of expanding potential for export to Europe and the West. The urban market for milk products is expected to grow at an accelerated pace of around 33% per annum to around Rs.43,500 crores by year 2005.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 16

1

Indian dairy Industry - a profiIe

Today, ndia is 'The Oyster' of the global dairy industry. t offers opportunities galore to entrepreneurs

worldwide, who wish to capitalize on one of the world's largest and fastest growing markets for milk and

milk products. A bagful of 'pearls' awaits the international dairy processor in ndia. The ndian dairy

industry is rapidly growing, trying to keep pace with the galloping progress around the world. As he

expands his overseas operations to ndia many profitable options await him. He may transfer technology,

sign joint ventures or use ndia as a sourcing center for regional exports. The liberalization of the ndian

economy beckons to MNC's and foreign investors alike.

ndia's dairy sector is expected to triple its production in the next 10 years in view of expanding potential

for export to Europe and the West. Moreover with WTO regulations expected to come into force in

coming years all the developed countries which are among big exporters today would have to withdraw

the support and subsidy to their domestic milk products sector. Also ndia today is the lowest cost

producer of per litre of milk in the world, at 27 cents, compared with the U.S' 63 cents, and Japan's $2.8

dollars. Also to take advantage of this lowest cost of milk production and increasing production in the

country multinational companies are planning to expand their activities here. Some of these milk

producers have already obtained quality standard certificates from the authorities. This will help them in

marketing their products in foreign countries in processed form.

The urban market for milk products is expected to grow at an accelerated pace of around 33% per

annum to around Rs.43,500 crores by year 2005. This growth is going to come from the greater

emphasis on the processed foods sector and also by increase in the conversion of milk into milk

products. By 2005, the value of ndian dairy produce is expected to be Rs 10,00,000 million. Presently

the market is valued at around Rs7,00,000mn

ackground

ndia with 134mn cows and 125mn buffaloes, has the largest population of cattle in the world. Total cattle

population in the country as on October'00 stood at 313mn. More than fifty percent of the buffaloes and

twenty percent of the cattle in the world are found in ndia and most of these are milch cows and milch

buffaloes.

ndian dairy sector contributes the large share in agricultural gross domestic products. Presently there are

around 70,000 village dairy cooperatives across the country. The co-operative societies are federated

into 170 district milk producers unions, which is turn has 22-state cooperative dairy federation. Milk

production gives employment to more than 72mn dairy farmers. n terms of total production, ndia is the

leading producer of milk in the world followed by USA. The milk production in 1999-00 is estimated at

78mn MT as compared to 74.5mn MT in the previous year. This production is expected to increase to

81mn MT by 2000-01. Of this total produce of 78mn cows' milk constitute 36mn MT while rest is from

other cattle.

While world milk production declined by 2 per cent in the last three years, according to FAO estimates,

ndian production has increased by 4 per cent. The milk production in ndia accounts for more than 13%

of the total world output and 57% of total Asia's production. The top five milk producing nations in the

world are ndia ,USA, Russia, Germany and France.

Although milk production has grown at a fast pace during the last three decades (courtesy: Operation

Flood), milk yield per animal is very low. The main reasons for the low yield are

O Lack of use of scientific practices in milching.

O nadequate availability of fodder in all seasons.

O Unavailability of veterinary health services.

2

iIk YieId comparison:

Country iIk YieId

(Kgs per

year)

USA 7002

UK 5417

Canada 5348

New Zealand 2976

Pakistan 1052

ndia 795

World (Average) 2021

Source: Export prospects for agro-based industries, World Trade Centre, Mumbai.

!roduction of miIk in India

Year !roduction in miIIion %

1988-89 48.4

1989-90 51.4

1990-91 53.7

1991-92 56.3

1992-93 58.6

1993-94 61.2

1994-95 63.5

1995-96 65

1996-97 68.5

1997-98 70.8

1998-99 74.7

1999-00(E) 78.1

2000-01(T) 81.0

Source: DFPI, Annual Report-1999-2000

orId's major miIk producers

3

(Million MTs)

Country 1997-98

1998-99 (

Approx.)

ndia 71 74.5

USA 71 71

Russia 34 33

Germany 27 27

France 24 24

Pakistan 21 22

Brazil 21 27

UK 14 14

Ukraine 15 14

Poland 12 12

New

Zealand

11 12

Netherlands 11 11

taly 10 10

Australia 9 10

peration FIood

The transition of the ndian milk industry from a situation of net import to that of surplus has been led by

the efforts of National Dairy Development Board's Operation Flood. programme under the aegis of the

former Chairman of the board Dr. Kurien.

Launched in 1970, Operation Flood has led to the modernization of ndia's dairy sector and created a

strong network for procurement processing and distribution of milk by the co-operative sector. Per capita

availability of milk has increased from 132 gm per day in 1950 to over 220 gm per day in 1998. The main

thrust of Operation Flood was to organize dairy cooperatives in the milkshed areas of the village, and to

link them to the four Metro cities, which are the main markets for milk. The efforts undertaken by NDDB

have not only led to enhanced production, improvement in methods of processing and development of a

strong marketing network, but have also led to the emergence of dairying as an important source of

employment and income generation in the rural areas. t has also led to an improvement in yields, longer

lactation periods, shorter calving intervals, etc through the use of modern breeding techniques.

Establishment of milk collection centers, and chilling centers has enhanced life of raw milk and enabled

minimization of wastage due to spoilage of milk. Operation Flood has been one of the world's largest

4

dairy development programme and looking at the success achieved in ndia by adopting the co-operative

route, a few other countries have also replicated the model of ndia's White Revolution.

!er Capita avaiIabiIity of miIk

Year gm/day

1950 132

1960 127

1968 113

1973 111

1980* 128

1990 178

1992 192

1996 198

1997 200

1998 202

1999 203

2000 212

2001E 225

2002P 250

Fresh iIk

Over 50% of the milk produced in ndia is buffalo milk, and 45% is cow milk. The buffalo milk contribution

to total milk produce is expected to be 54% in 2000. Buffalo milk has 3.6% protein, 7.4% fat, 5.5% milk

sugar, 0.8% ash and 82.7% water whereas cow milk has 3.5% protein, 3.7% fat, 4.9% milk sugar, 0.7%

ash and 87% water. While presently (for the year 2000) the price of Buffalo milk is ruling at $261-313 per

MT that of cow is ruling at $170-267 per MT. Fresh pasteurized milk is available in packaged form.

However, a large part of milk consumed in ndia is not pasteurized, and is sold in loose form by vendors.

Sterilized milk is scarcely available in ndia.

Packaged milk can be divided according to fat content as follows,

Whole (full cream) milk - 6% fat tandardized (toned) milk - 4.5% fat Doubled toned (low fat) milk - 3% fat

Another category of milk, which has a small market is flavoured milk.

The Indian Market - A Pyramid

Consumer Habits And !ractices

Milk has been an integral part of ndian food for centuries. The per capita availability of milk in ndia has

grown from 172 gm per person per day in 1972 to 182gm in 1992 and 203 gm in 1998-99.This is

5

expected to increase to 212gms for 1999-00. However a large part of the population cannot afford milk.

At this per capita consumption it is below the world average of 285 gm and even less than 220 gm

recommended by the Nutritional Advisory Committee of the ndian Council of Medical Research.

There are regional disparities in production and consumption also. The per capita availability in the north

is 278 gm, west 174 gm, south 148 gm and in the east only 93 gm per person per day. This disparity is

due to concentration of milk production in some pockets and high cost of transportation. Also the output

of milk in cereal growing areas is much higher than elsewhere which can be attributed to abundant

availability of fodder, crop residues, etc which have a high food value for milch animals.

n ndia about 46 per cent of the total milk produced is consumed in liquid form and 47 per cent is

converted into traditional products like cottage butter, ghee, paneer, khoya, curd, malai, etc. Only 7 per

cent of the milk goes into the production of western products like milk powders, processed butter and

processed cheese. The remaining 54% is utilized for conversion to milk products. Among the milk

products manufactured by the organized sector some of the prominent ones are ghee, butter, cheese, ice

creams, milk powders, malted milk food, condensed milk infants foods etc. Of these ghee alone accounts

for 85%.

t is estimated that around 20% of the total milk produced in the country is consumed at producer-

household level and remaining is marketed through various cooperatives, private dairies and vendors.

Also of the total produce more than 50% is procured by cooperatives and other private dairies.

While for cooperatives of the total milk procured 60% is consumed in fluid form and rest is used for

manufacturing processed value added dairy products; for private dairies only 45% is marketed in fluid

form and rest is processed into value added dairy products like ghee, makhan etc.

Still, several consumers in urban areas prefer to buy loose milk from vendors due to the strong

perception that loose milk is fresh. Also, the current level of processing and packaging capacity limits the

availability of packaged milk.

The preferred dairy animal in ndia is buffalo unlike the majority of the world market, which is dominated

by cow milk. As high as 98% of milk is produced in rural ndia, which caters to 72% of the total

population, whereas the urban sector with 28% population consumes 56% of total milk produced. Even in

urban ndia, as high as 83% of the consumed milk comes from the unorganized traditional sector.

Presently only 12% of the milk market is represented by packaged and branded pasteurized milk, valued

at about Rs. 8,000 crores. Quality of milk sold by unorganized sector however is inconsistent and so is

the price across the season in local areas. Also these vendors add water and caustic soda, which makes

the milk unhygienic.

ndia's dairy market is multi-layered. t's shaped like a pyramid with the base made up of a vast market for

low-cost milk. The bulk of the demand for milk is among the poor in urban areas whose individual

requirement is small, maybe a glassful for use as whitener for their tea and coffee. Nevertheless, it adds

up to a sizable volume - millions of litres per day. n the major cities lies an immense growth potential for

the modern sector. Presently, barely 778 out of 3,700 cities and towns are served by its milk distribution

network, dispensing hygienically packed wholesome, quality pasteurized milk. According to one estimate,

the packed milk segment would double in the next five years, giving both strength and volume to the

modern sector. The narrow tip at the top is a small but affluent market for western type milk products.

rowing Volumes

The effective milk market is largely confined to urban areas, inhabited by over 25 per cent of the country's

population. An estimated 50 per cent of the total milk produced is consumed here. By the end of the

twentieth century, the urban population is expected to increase by more than 100 million to touch

364 million in 2000 a growth of about 40 per cent. The expected rise in urban population

would be a boon to ndian dairying. Presently, the organized sector both cooperative and private and

the traditional sector cater to this market.

6

The consumer access has become easier with the information revolution. The number of households with

TV has increased from 23 million in 1989 to 45 million in 1995. About 34 per cent of these households in

urban ndia have access to satellite television channel.

Potential for further growth

Of the three A's of marketing - avaiIabiIity, acceptabiIity and affordabiIity, ndian dairying is already

endowed with the first two. People in ndia Iove to drink miIk. Hence no efforts are needed to make it

acceptable. ts availability is not a limitation either, because of the ample scope for increasing milk

production, given the prevailing low yields from dairy cattle. t leaves the third vital marketing factor

affordability. How to make milk affordable for the large majority with limited purchasing power? That is

essence of the challenge. One practical way is to pack milk in small quantities of 250 ml or less in

polythene sachets. Already, the glass bottle for retailing milk has given way to single-use sachets which

are more economical. Another viable alternative is to sell small quantities of milk powder in mini-sachets,

adequate for two cups of tea or coffee.

Marketing Strategy for 2000 AD

Two key elements of marketing strategy for 2000 AD are: Focus on strong brands and, product mix

expansion to include UHT milk, cheese, ice creams and spreads. The changing marketing trends will

see the shift from generic products to the packaged quasi, regular and premium brands. The national

brands will gradually edge out the regional brands or reduce their presence. The brand image can do

wonders to a product's marketing as is evident from the words of Perfume Princess Coco Channel: n the

factory, we pack perfume; in the market, we sell hope!

merging Dairy Markets

O Food service institutionaI market: t is growing at double the rate of consumer market

O efense market: An important growing market for quality products at reasonable prices

O Ingredients market: A boom is forecast in the market of dairy products used as raw material in

pharmaceutical and allied industries

O !arIour market: The increasing away-from-home consumption trend opens new vistas for ready-to-

serve dairy products which would ride piggyback on the fast food revolution sweeping the urban ndia

ndia, with her sizable dairy industry growing rapidly and on the path of modernization, would have a

place in the sun of prosperity for many decades to come. The one index to the statement is the fact that

the projected total milk output over the next 15 years (1995-2010) would exceed 1457.6 million tonnes

which is twice the total production of the past 15 years!

!enetration of miIk products

Western table spreads such as butter, margarine and jams are not very popular in ndia. All ndia

penetration of butter/ margarine is only 4%. This is also largely represented by urban areas, where

penetration is higher at 9%. n rural areas, butter/ margarine have penetrated in 2.1% of households only.

The use of these products in the large metros is higher, with penetration at 15%.

Penetration of cheese is almost nil in rural areas and negligible in the urban areas. Per capita

consumption even among the cheese-consuming households is a poor 2.4kg pa as compared to over

20kg in USA. The lower penetration is due to peculiar food habits, relatively expensive products and also

non-availability in many parts of the country. Butter, margarine and cheese products are mainly

manufactured by organized sector.

Similarly, penetration of ghee is highest in medium sized towns at 37.2% compared to 31.7% in all urban

areas and 21.3% in all rural areas. The all ndia penetration of ghee is 24.1%. n relative terms,

penetration of ghee is significantly higher in North and West, which are milk surplus regions. North

7

accounts for 57% of ghee consumption and West for 23%, South & East together account for the balance

20%. A large part of ghee is made at home and by small/ cottage industry from milk. The relative share of

branded products in this category is very low at around 1-2%.

Milk powder and condensed milk have not been able to garner any significant consumer acceptance in

ndia as indicated by a very low 4.7% penetration. The penetration is higher at 8.1% in urban areas and

lower at 3.5% in rural areas. Within urban areas, it is relatively higher in medium sized towns at 8.5%

compared to 7.7% in a large metros.

arket Size And Growth

Market size for milk (sold in loose/ packaged form) is estimated to be 36mn MT valued at Rs470bn. The

market is currently growing at round 4% pa in volume terms. The milk surplus states in ndia are Uttar

Pradesh, Punjab, Haryana, Rajasthan, Gujarat, Maharashtra, Andhra Pradesh, Karnataka and Tamil

Nadu. The manufacturing of milk products is concentrated in these milk surplus States. The top 6 states

viz. Uttar Pradesh, Punjab, Madhya Pradesh, Rajasthan, Tamil Nadu and Gujarat together account for

58% of national production.

Milk production grew by a mere 1% pa between 1947 and 1970. Since the early 70's, under Operation

Flood, production growth increased significantly averaging over 5% pa.

About 75% of milk is consumed at the household level which is not a part of commercial dairy industry.

Loose milk has a larger market in ndia as it is perceived to be fresh by most consumers. n reality

however, it poses a higher risk of adulteration and contamination.

The production of milk products, i.e. milk products including infant milk food, malted food, condensed milk

& cheese stood at 3.07 lakh MT in 1999. Production of milk powder including infant milk-food has risen to

2.25 lakh MT in 1999, whereas that of malted food is at 65000 MT. Cheese and condensed milk

production stands at 5000 and 11000 MT respectively in the same year.

Source: Annual Report 1999-2000, DFPI)

ajor !Iayers

The packaged milk segment is dominated by the dairy cooperatives. Gujarat Co-operative Milk Marketing

Federation (GCMMF) is the largest player. All other local dairy cooperatives have their local brands (For

e.g. Gokul, Warana in Maharashtra, Saras in Rajasthan, Verka in Punjab, Vijaya in Andhra Pradesh,

Aavin in Tamil Nadu, etc). Other private players include J K Dairy, Heritage Foods, ndiana Dairy, Dairy

Specialties, etc. Amrut ndustries, once a leading player in the sector has turned bankrupt and is facing

liquidation.

!ackaging %echnoIogy

Milk was initially sold door-to-door by the local milkman. When the dairy co-operatives initially started

marketing branded milk, it was sold in glass bottles sealed with foil. Over the years, several

developments in packaging media have taken place. n the early 80's, plastic pouches replaced the

bottles. Plastic pouches made transportation and storage very convenient, besides reducing costs. Milk

packed in plastic pouches/bottles have a shelf life of just 1-2 days , that too only if refrigerated. n 1996,

Tetra Packs were introduced in ndia. Tetra Packs are aseptic laminate packs made of aluminum, paper,

board and plastic. Milk stored in tetra packs and treated under Ultra High Temperature (UHT) technique

can be stored for four months without refrigeration. Most of the dairy co-operatives in Andhra Pradesh,

Tamil Nadu, Punjab and Rajasthan sell milk in tetra packs. However tetra packed milk is costlier by Rs5-7

compared to plastic pouches. n 1999-00 Nestle launched its UHT milk. Amul too re-launched its Amul

Taaza brand of UHT milk. The UHT milk market is expected to grow at a rate of more than 10-12% in

coming years.

xport !otentiaI

ndia has the potential to become one of the leading players in milk and milk product exports. Locational

advantage : ndia is located amidst major milk deficit countries in Asia and Africa. Major importers of milk

8

and milk products are Bangladesh, China, Hong Kong, Singapore, Thailand, Malaysia, Philippines,

Japan, UAE, Oman and other gulf countries, all located close to ndia.

ow Cost f !roduction : Milk production is scale insensitive and labour intensive. Due to low labour

cost, cost of production of milk is significantly lower in ndia.

Concerns in export competitiveness are

"uaIity : Significant investment has to be made in milk procurement, equipments, chilling and

refrigeration facilities. Also, training has to be imparted to improve the quality to bring it up to international

standards.

!roductivity : To have an exportable surplus in the long-term and also to maintain cost competitiveness,

it is imperative to improve productivity of ndian cattle.

There is a vast market for the export of traditional milk products such as ghee, paneer, shrikhand,

rasgolas and other ethnic sweets to the large number of ndians scattered all over the world

India's exports of miIk products

escription

("uantity, %.:

VaIue, Rs.

miIIion)

1995-96 1996-97 1997-98

"uantity VaIue "uantity VaIue "uantity VaIue

Skimmed milk

powder

4,638.62 3,35.32 282.70 19.64 5.00 0.375

Milk and Milk Food

for babies

8.27 2.019 111.37 4.27 11.00 2.02

Milk cream 332.23 28.04 1.00 0.084 - -

Sweetened

condensed milk

41.73 2.84 9.22 0.97 60.39 7.22

Whey 78.46 3.75 11.50 1.01 6.00 0.342

Ghee/Butter/Butter

oil

7,895.08 431.1 299.97 19.2 4,352.08 2,38.95

Cheese

(a) Fresh 0.10 0.013 - - - -

(b) Processed 5.67 1.20 2.1 0.375 22.10 2.19

(c) Other 66.64 8.35 36.78 0.69 24.84 4.55

TOTAL - 8,72.7 - 52.4 - 2,55.6

hat does the Indian Dairy Industry has to Offer to Foreign

Investors?

ndia is a land of opportunity for investors looking for new and expanding markets. Dairy food processing

holds immense potential for high returns. Growth prospects in the dairy food sector are termed healthy,

according to various studies on the subject.

9

The basic infrastructural elements for a successful enterprise are in place.

O Key elements of free market system

O raw material (milk) availability

O an established infrastructure of technology

O supporting manpower

An entrepreneur's participation is likely to provide attractive returns on the investment in a fast growing

market such as ndia, along with an export potential in the Middle East, Singapore, Malaysia, ndonesia,

Korea, Thailand, Hong Kong and other countries in the region.

Among several areas of potential participation by NRs and foreign investors, the following list outlines a

few promising opportunities:

iotechnoIogy:

O Dairy cattle breeding of the finest buffaloes and hybrid cows

O Milk yield increase with recombinant somatotropin

O Recombinant chymosin, acceptable to vegetarian consumers

O Dairy cultures, probiotics, dairy biologics, enzymes and coloring materials for food processing

O Fermentation derived foods and industrial products alcohol, citric acid, lysine, flavor preparations, etc.

O Biopreservative ingredients based on dairy fermentation, viz., Nisin, pediococcin, acidophilin,

bulgarican contained in dairy powders.

airy/food processing equipment:

Potential exists for manufacturing and marketing of cost competitive food processing machinery of world-

class quality.

Food packaging equipment:

Opportunities lie in the manufacturing of both machinery and packaging materials that help develop

brand loyalty and a clear edge in the marketing of dairy foods.

istribution channeIs:

For refrigerated and frozen food distribution, a world class cold chain would help in providing quality

assurance to the consumers around the region.

RetaiIing:

There is scope for standardizing and upgrading food retailing in major metropolitan cities to meet the

shopping needs of a vast middle class. This area includes grocery stores of European and North

American quality, warehousing and distribution.

!roduct deveIopment:

O Dairy foods can be manufactured and packaged for export to countries where ndian food enjoys

basic acceptance. The manufacturing may be carried out in contract plants in ndia. An option to market

the products in collaboration with local establishments or entrepreneurs can also be explored. Products

exhibiting potential include typical indigenous dairy foods either not available in foreign countries or

products whose authenticity may be questionable. Gulabjamuns, Burfi, Peda, Rasagollas, and a host of

other ndian sweets have good business prospects.

O Products typically foreign to ndia but indigenous to other countries could also be developed for

export. Such products can be manufactured in retail package sizes and could be produced from milk of

10

sheep, goats and camel. Certain products are characteristically produced from milk of a particular

species. For example, Feta cheese is used in significant tonnage, in ran. Sheep milk is traditionally used

for authentic Feta cheese. Accordingly, ndia's goat and sheep herds can be utilized for the manufacture

of such authentic products.

Ingredient manufacture:

Export markets for commodities like dry milk, condensed milk, ghee and certain cheese varieties are well

established. These items are utilized as ingredients in foreign countries. These markets can be expanded

to include value-added ingredients like aseptically packaged cheese sauce and dehydrated cheese

powders.

O Cheese sauce: Canned cheese sauce is made from real cheese to which milk, whey, modified food

starch, vegetable oil, colorings and spices may be added. Cheese sauce is useful in kitchens for the

preparation of omelet, sandwiches, entrees, and soups. n addition, cheese sauce is used as a topping

on potatoes and vegetables and may be incorporated in pasta dishes.

O Cheese powders: Cheese powders are formulated for dusting or smearing of popular snacks like

potato chips, crackers, etc. They impart flavor and may be blended with spices.

With the globalization of food items, an opportunity should open up for food service and institutional

markets.

%echnoIogy-driven manufacturing units:

These plants would fulfil an essential need by providing a centralized and specialized facility for hire by

the units which cannot justify capital investment but do need such services. Potential areas for state-of-

the-art contract-pack units may conceivably specialize in cheese slicing, or dicing line, cheese packaging,

butter printing, and aseptic packaged fluid products.

%raining centers for continuing education:

NRs could set up technology transfer and updating centers for conducting seminars and workshops -

catering to the needs of workers at all levels of the dairy industry. Here technical, marketing and

management topics can be offered to ensure that the manpower continues to acquire the latest know-

how of their respective fields.

The entrepreneurs need powerful tools to implement their plans. Appropriate investment and involvement

by NRs can serve as a catalyst for ndia's dairy food industry leading to exploration of business potential

in domestic and export trade. Risk factors must be identified and managed by in-depth study of chosen

areas so that chances of rewards are maximized under the current liberalization climate.

Indian (traditionaI) iIk !roducts

There are a large variety of traditional ndian milk products such as

Makkhan - unsalted butter.Ghee - butter oil prepared by heat clarification, for longer shelf life.

Kheer - a sweet mix of boiled milk, sugar and rice. Basundi - milk and sugar boiled down till it thickens.

Rabri - sweetened cream. Dahi - a type of curd. Lassi - curd mixed with water and sugar/ salt.

Channa/Paneer - milk mixed with lactic acid to coagulate. Khoa - evaporated milk, used as a base to

produce sweet meats.

The market for indigenous based milk food products is difficult to estimate as most of these products are

manufactured at home or in small cottage industries catering to local areas.

Consumers while purchasing dairy products look for freshness, quality, taste and texture, variety and

convenience. Products like Dahi and sweets like Kheer, Basundi, Rabri are perishable products with a

shelf life of less than a day. These products are therefore manufactured and sold by local milk and sweet

shops. There are several such small shops within the vicinity of residential areas. Consumer loyalty is

11

built by consistent quality, taste and freshness. There are several sweetmeat shops, which have built a

strong brand franchise, and have several branches located in various parts of a city.

randing f %raditionaI iIk !roducts

Among the traditional milk products, ghee is the only product, which is currently marketed, in branded

form. main ghee brands are Sagar, MilkMan (Britannia), Amul (GCMMF), Aarey (Mafco Ltd), Vijaya (AP

Dairy Development Cooperative Federation), Verka ( Punjab Dairy Cooperative), Everyday (Nestle) and

Farm Fresh (Wockhardt).

With increasing urbanization and changing consumer preferences, there is possibility of large scale

manufacture of indigenous milk products also. The equipments in milk manufacturing have versatility and

can be adapted for several products. For instance, equipments used to manufacture yogurt also can be

adapted for large scale production of ndian curd products (dahi and lassi). Significant research work has

been done on dairy equipments under the aegis of NDDB.

Mafco Limited sells Lassi under the Aarey brand and flavoured milk under the Energee franchise (in the

Western region, mainly in Mumbai). Britannia has launched flavored milk in various flavors in tetra packs.

GCMMF has also made a beginning in branding of other traditional milk products with the launch of

packaged Paneer under the Amul brand. t has also created a new umbrella brand "Amul Mithaee", for a

range of ethnic ndian sweets that are proposed to be launched The first new product Amul Mithaee

Gulabjamun has already been launched in major ndian markets.

estern iIk !roducts

Western milk products such as butter, cheese, yogurt have gained popularity in the ndian market only

during the last few years. However consumption has been expanding with increasing urbanization.

utter

Most ndians prefer to use home made white butter (makkhan) for reasons of taste and affordability. Most

of the branded butter is sold in the towns and cities. The major brands are Amul, Vijaya, Sagar, Nandini

and Aarey. Amul is the leading national brand while the other players have greater shares in their local

markets. The latest entrant in the butter market has been Britannia. Britannia has the advantages of a

wide distribution reach and a strong brand recall. Priced at par with the Amul brand, it is expected to give

stiff competition to the existing players. n 1999-00 the butter production is estimated at 4 lakh MT of this

only 45K MT is in the white form used for table purposes rest all is in the yellow form.

Cheese

The present market for cheese in ndia is estimated at about 9,000 tonnes and is growing at the rate of

about 15% per annum. Cheese is mainly consumed in the urban areas. The four metro cities alone

account for more than 50% of consumption . Mumbai is the largest market (accounting for 30% of cheese

sold in the country), followed by Delhi (20%). Calcutta (7%) and Chennai (6%). Mumbai has a larger

number of domestic consumers, compared to Delhi where the bulk institutional segment (mainly hotels) is

larger.

emand for various types of cheese in the Indian market

%ype of cheese % of totaI consumption

Processed 50

Cheese spread 30

Mozzarella 10

12

Flavoured/Spiced 5

Others 5

The major players are Amul, Britannia, and Dabon nternational dominating the market. Other major

brands were Vijaya, Verka and Nandini (all brands of various regional dairy cooperatives) and Vadilal.

The heavy advertising and promotions being undertaken by these new entrants is expected to lead to

strong 20% growth in the segment. Amul has also become more aggressive with launch of new variants

such as Mozzarella cheese (used in Pizza), cheese powder, etc.

The entry of new players and increased marketing activity is expected to expand the market. All the major

players are expanding their capacities

Capacity expansion in Cheese

Company rands State Capacity

Dynamix Group Manufactures for Britannia Maharashtra 35 tons per

day

GCMMF Amul Gujarat 20 tons per

day

APDDCF Vijaya Andhra Pradesh 10 tons per

day

iIk !owder

Milk powder are mainly of 2 types

O Whole milk powder

O Skimmed milk powder

Whole milk powder contains fat, as distinguished from skimmed milk powder, which is produced by

removing fat from milk solids. Skimmed milk powder is preferred by diet conscious consumers. Dairy

whiteners contain more fat than skimmed milk powder but less compared to whole milk powder. Dairy

whiteners are popular milk substitute for making tea, coffee etc. The penetration of these products in milk

abundant regions is driven by convenience and non perishable nature (longer shelf life) of the product.

Dairy sector of advanced nations export milk products with a subsidy of $ 1000 per tonne with a level of

subsidy more than 60 % of the price of milk powder produced in ndia, this has led to large scale imports

of milk powder both in whole and skimmed form. To protect the domestic sector from these subsidized

imports the central government has recently increased the basic import duty on all imports of milk powder

more than 10000 MT to 60% from 15%. For imports less than 10000 MT the basic customs duty has

been left unchanged at 15%.

n 1999-00 ndia is estimated to have imported about 18,000 tonnes of milk powder against a total

estimated production of 2.40 Lakh MTs. n 2000-01 ndia is expected to export 10000 MT of skimmed

milk powder due to rise in international prices to $2300 per MT from last year's levels of $1400 per MT.

These expectations are based on the strong demand from Russia, East Asia and Latin America, and also

on tightening of supply in EU, which accounts for 75% of the annual global Skimmed Milk Powder

exports.

13

ajor !Iayers

Milk Powder/Dairy Whiteners : Major skimmed milk brands are Sagar (GCMMF) and Nandini (Karnataka

Milk Federation), Amul Full Cream milk powder is a whole milk powder brand.

Leading brands in the dairy whitener segment are Nestle's Everyday, GCMMF's Amulya, Dalmia

ndustry's Sapan, Kwality Dairy ndia's KreamKountry, Wockhardt's Farm Fresh and Britannia's MilkMan

Dairy Whitener.

Condensed iIk

The condensed milk market has grown from 9000 MT in 1998 to 11000 MT in 1999. Condensed milk is a

popular ingredient used in home-made sweets and cakes. Nestle's Milkmaid is the leading brand with

more than 55% market share. The only other competitor is GCMMF's Amul.

VaIue addition in miIk powder - Infant Foods

Nestle is the market leader in the segment. This is a category where brand loyalties are very strong as

mothers want the best for their babies. Heinz is the only other significant competitor to Nestle in this

segment. Nestle's Cerelac and Nestum together have around 80% market share and Heinz's Farex has

close to 18% share. Wockhardt is a relatively new entrant with its First Food brand. Wockhardt also

proposes to launch a new baby food Easum containing moong (moong is one of the easily digestible

pulses). The Easum brand will directly compete with Nestle's Nestum (made from rice).

n infant formula also Nestle's Lactogen formula and Lactogen standard formula are the leading brands

with around 75% market share. Other brands are Heinz's Lactodex Farex, Wockhardt's Raptakos, and

Amul's Amulspray

ReguIatory Framework

The dairy industry was de-licensed in 1991 with a view to encourage private investment and flow of

capital and new technology in the segment. Although de-licensing attracted a large number of players,

concerns on issues like excess capacity, sale of contaminated/ substandard quality of milk etc induced

the Government to promulgate the MMPO (Milk and Milk Products Order) in 1992. Milk and Milk Products

Order (MMPO) regulates milk and milk products production in the country. The order requires no

permission for units handling less than 10,000 litres of liquid milk per day or milk solids up to 500 tpa.

MMPO prescribes State registration to plants producing between 10,000 to 75,000 litres of milk per day

or manufacturing milk products containing between 500 to 3,750 tonnes of milk solids per year. Plants

producing over 75,000 litres per day or more than 3,750 tonnes per year of milk solids have to be

registered with the Central Government. The stringent regulations, government controls and licensing

requirements for new capacities have restricted large ndian and MNC players from making significant

investments in this product category. Most of the private sector players have restricted themselves to

manufacture of value added milk products like baby food, dairy whiteners, condensed milk etc.

All the milk products except malted foods are covered in the category of industries for which foreign

equity participation up to 51% is automatically allowed. ce cream, which was earlier reserved for

manufacturing in the small-scale sector, has now been de-reserved. As such, no license is required for

setting up of large-scale production facilities for manufacture of ice cream.

Subsequent to de-canalization, exports of some milk based products are freely allowed provided these

units comply with the compulsory inspection requirements of concerned agencies like: National Dairy

Development Board, Export nspection Council etc. Bureau of ndian standards has prescribed the

necessary standards for almost all milk-based products, which are to be adhered to by the industry.

!roposaI to Amend the !

A proposal to raise the exemption limit for compulsory registration of dairy plants, from the present

10,000 litres a day to 20,000 litres, is being considered by the Animal Husbandry Department. The

75,000-litre limit is likely to be raised either to 100,000 litres or 125,000 litres in the amended order. The

new order would also do away with the provision for re-registration.

14

AmuI's secret of success

The system succeeded mainly because it provides an assured market at remunerative prices for

producers' milk besides acting as a channel to market the production enhancement package. What's

more, it does not disturb the agro-system of the farmers. t also enables the consumer an access to high

quality milk and milk products. Contrary to the traditional system, when the profit of the business was

cornered by the middlemen, the system ensured that the profit goes to the participants for their socio-

economic upliftment and common good.

Looking back on the path traversed by Amul, the following features make it a pattern and model for

emulation elsewhere. Amul has been able to:

O Produce an appropriate blend of the policy makers farmers board of management and the

professionals: each group appreciating its roles and limitations

O Bring at the command of the rural milk producers the best of the technology and harness its fruit for

betterment

O Provide a support system to the milk producers without disturbing their agro-economic systems

O Plough back the profits, by prudent use of men, material and machines, in the rural sector for the

common good and betterment of the member producers and

O Even though, growing with time and on scale, it has remained with the smallest producer members. n

that sense, Amul is an example par excellence, of an intervention for rural change.

The Union looks after policy formulation, processing and marketing of milk, provision of technical inputs

to enhance milk yield of animals, the artificial insemination service, veterinary care, better feeds and the

like - all through the village societies.

The village society also facilitates the implementation of various production enhancement and member

education programs undertaken by the Union. The staff of the village societies have been trained to

undertake the veterinary first-aid and the artificial insemination activities on their own.

AmuI's success: A modeI for other districts to foIIow.

Amul's success led to the creation of similar structures of milk producers in other districts of Gujarat.

They drew on Amul's experience in project planning and execution. Thus the 'Anand Pattern' was

followed not just in Kaira district but in Mehsana, Sabarkantha, Banaskantha, Baroda and Surat districts

also. Even before the Dairy Board of ndia was born, farmers and their leaders carried out empirical tests

of the hypotheses that explained Amul's success. n these districts, milk producers and their leaders

experienced significant commonalties and found easy and effortless ways to adapt Amul's gameplan to

their respective areas. This led to the Creation of the National Dairy Development Board with the clear

mandate of replicating the 'Anand pattern' in other parts of the country. nitially the pattern was followed

for the dairy sector but at a later stage oilseeds, fruit and vegetables, salt, and tree sectors also benefited

from it's success.

GCF: An verview

Gujarat Cooperative Milk Marketing Federation (GCMMF) is ndia's largest food products marketing

organization. t is a state level apex body of milk cooperatives in Gujarat which aims to provide

remunerative returns to the farmers and also serve the interest of consumers by providing quality

products which are good value for money.

embers: 12 district cooperative milk

producers' Union

15

o. of !roducer embers: 2.12 million

o. of ViIIage Societies: 10,411

%otaI iIk handIing capacity: 6.1 million litres per day

iIk coIIection (%otaI - 1999-00): 1.59 billion litres

iIk coIIection (aiIy Average 1999-

00):

4.47 million litres

iIk rying Capacity: 450 metric Tons per day

CattIe feed manufacturing Capacity: 1450 Mts per day

SaIes %urnover Rs (miIIion) US $ (in miIIion)

1994-95 11140 355

1995-96 13790 400

1996-97 15540 450

1997-98 18840 455

1998-99 22192 493

1999-00 22185 493

ajor dairy products manufacturers

Some of the major dairy products manufacturers in the country:

Company rands ajor !roducts

Nestle ndia

Limited

Milkmaid,Cerelac, Lactogen,

Milo, Everyday

Sweetened condensed milk, malted

foods, milk powder and Dairy whitener

Milkfood

Limited

Milkfood Ghee, ice cream, and other milk products

SmithKline

Beecham

Limited

Horlicks, Maltova, Viva Malted Milkfood, ghee, butter, powdered

milk, milk fluid and other milk based baby

foods.

16

ndodan

ndustries

Limited

ndana Condensed milk, skimmed milk powder,

whole milk powder, dairy milk whitener,

chilled and processed milk

Gujarat Co-

operative milk

Marketing

Federation

Limited

Amul Butter, cheese and other milk products

H.J. Heinz

Limited

Farex, Complan, Glactose,

Bonniemix, Vitamilk

nfant Milkfood, malted Milkfood

Britannia Milkman Flavoured milk, cheese, Milk Powder,

Ghee

Cadbury Bournvita Malted food

Future !rospects

ndia is the world's highest milk producer and all set to become the world's largest food factory. n

celebration, ndian Dairy sector is now ready to invite NRs and Foreign investors to find this country a

place for the mammoth investment projects. Be it investors, researchers, entrepreneurs, or the merely

curious ndian Dairy sector has something for everyone.

Milk production is relatively efficient way of converting vegetable material into animal food. Dairy cows

buffaloes goats and sheep can eat fodder and crop by products which are not eaten by humans. Yet the

loss of nutrients energy and equipment required in milk handling inevitably make milk comparatively

expensive food. Also if dairying is to play its part in rural development policies , the price to milk

producers has to be remunerative. n a situation of increased international prices, low availabilities of

food aid and foreign exchange constraints, large scale subsidization of milk conception will be difficult in

the majority of developing countries.

Hence in the foreseeable future, in most of developing countries milk and milk products will not play the

same roll in nutrition as in the affluent societies of developed countries. Effective demand will come

mainly from middle and high income consumers in urban areas.

There are ways to mitigate the effects of unequal distribution of incomes. n Cuba where the Government

attaches high priority to milk in its food and nutrition policy, all pre-school children receive a daily ration of

almost a litre of milk fat the reduced price. Cheap milk and milk products are made available to certain

other vulnerable groups, by milk products outside the rationing system are sold price which is well above

the cost level. Until recently, most fresh milk in the big cities of China was a reserved for infants and

hospitals, but with the increase in supply, rationing has been relaxed.

In other countries dairy industries have attempted to reach lower income consumers by variation oI

compositional quality or packaging and distribution methods or blending milk in vegetable ingredients in

Iormula Ioods Ior vulnerable groups For instance, pricing oI products rich in butter Iat or in more luxury

packaging above cost level so as to enable sales oI high protein milk products at a some what a reduced

price has been widely practiced in developing countries This policies need to be brought in Indian Dairy

scenario

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Engro Foods Limited Strategic Marketing Project.Documento52 pagineEngro Foods Limited Strategic Marketing Project.Syed Asim SajjadNessuna valutazione finora

- Project Proposal To Dairy Farm and Milk Processing PlantDocumento50 pagineProject Proposal To Dairy Farm and Milk Processing PlantTesfaye DegefaNessuna valutazione finora

- Lesson 2: Packaging FunctionsDocumento59 pagineLesson 2: Packaging FunctionsUsman WaheedNessuna valutazione finora

- Lesson 31 Sterilization - Definition, Purpose and MethodsDocumento9 pagineLesson 31 Sterilization - Definition, Purpose and MethodsPawandeep SinghNessuna valutazione finora

- Food Technology SummaryDocumento40 pagineFood Technology SummaryAnastasia ElizabethNessuna valutazione finora

- (Doi 10.1016 - B978-0-12-374407-4.00247-8) Haisman, D. - Encyclopedia of Dairy Sciences - IMITATION DAIRY PRODUCTS PDFDocumento4 pagine(Doi 10.1016 - B978-0-12-374407-4.00247-8) Haisman, D. - Encyclopedia of Dairy Sciences - IMITATION DAIRY PRODUCTS PDFThomas Gunardi Santoso100% (1)

- Ministry of Education and Training: Eastern International UniversityDocumento20 pagineMinistry of Education and Training: Eastern International UniversityVi Trần Thị ThúyNessuna valutazione finora

- Import Requirements of Specific Food Products Website ConDocumento15 pagineImport Requirements of Specific Food Products Website ConJagatheesh VelusamyNessuna valutazione finora

- Profesor:: Carlos Alberto Cañizales CabreraDocumento12 pagineProfesor:: Carlos Alberto Cañizales Cabreratalamaska0105Nessuna valutazione finora

- A. China B. France: C. IrelandDocumento12 pagineA. China B. France: C. IrelandK41 DH15TPNessuna valutazione finora

- Strategic Marketing Project Report OnDocumento25 pagineStrategic Marketing Project Report OnMuhammad Kashif GhaffarNessuna valutazione finora

- Skills in Food PreparationDocumento23 pagineSkills in Food Preparationcaryll wacanganNessuna valutazione finora

- ImcDocumento30 pagineImcMuhammad Qasim0% (1)

- MilkDocumento25 pagineMilkJewan Ambadil SampulnaNessuna valutazione finora

- Project KOMULDocumento22 pagineProject KOMULPushpaNessuna valutazione finora

- Engro Foods: Presented by Ziyad Bin BasharatDocumento16 pagineEngro Foods: Presented by Ziyad Bin Basharatshahzaib memon100% (1)

- Milkpack Case StudyDocumento25 pagineMilkpack Case StudyShaique SiddiqueNessuna valutazione finora

- SudhaDocumento45 pagineSudhaAtul Kumar0% (1)

- TH Group SwotDocumento31 pagineTH Group SwotLinh Vo Huynh KhanhNessuna valutazione finora

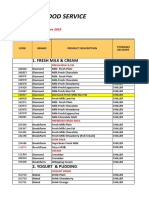

- Price List Food Service by Region APR - JUN 2019 (SUMATERA)Documento24 paginePrice List Food Service by Region APR - JUN 2019 (SUMATERA)Dwi Utari RahayuNessuna valutazione finora

- Detection and Enumeration of Heat-Resistant MoldsDocumento7 pagineDetection and Enumeration of Heat-Resistant MoldsIqlima Sekar MaulaniNessuna valutazione finora

- National Seminar On Value Added Dairy ProductsDocumento214 pagineNational Seminar On Value Added Dairy ProductsMayank Tandon100% (7)

- HalEeb MArKeTiNgDocumento65 pagineHalEeb MArKeTiNglovelove50500% (1)

- Plant-Based Milk Alternatives An Emerging Segment of Functional Beverages: A ReviewDocumento16 paginePlant-Based Milk Alternatives An Emerging Segment of Functional Beverages: A ReviewRafael LuchaNessuna valutazione finora

- I. Brief Introduction About TH True MilkDocumento4 pagineI. Brief Introduction About TH True MilkNgoc AnhNessuna valutazione finora

- SMM Final ProjectDocumento50 pagineSMM Final ProjectSonia SeherNessuna valutazione finora

- Food Processing 2Documento32 pagineFood Processing 2vaniagiraldi50% (2)

- Basic Course Tba PDFDocumento183 pagineBasic Course Tba PDFHoàng Mạnh Linh100% (3)

- Shanghai Jimei Food MachineryDocumento4 pagineShanghai Jimei Food Machinerychirty jimeiNessuna valutazione finora

- PT Cisarua Mountain Dairy TBK: Public ExposeDocumento35 paginePT Cisarua Mountain Dairy TBK: Public ExposeGusti Adi NirwansyahNessuna valutazione finora