Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hedge Funds and Financial Stability

Caricato da

Ashish Live To WinDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Hedge Funds and Financial Stability

Caricato da

Ashish Live To WinCopyright:

Formati disponibili

Speeches Hedge funds and financial stability

447

Hedge funds and financial stability

In this speech,(1) Sir John Gieve, Deputy Governor responsible for financial stability, discusses how the rapid growth of hedge funds forms part of a wider transformation in financial markets. He notes that in the long run this should help widen the range of options for investors and promote stability, although in the short run there are risks while the funds, other market participants and the authorities gain experience of new products and markets. He concludes that the FSA and other authorities, including the Bank, are alive to the dangers and are doing what they can to assess and mitigate the risks. Introduction

Hedge funds get a bad press. They often appear as the latest in a long line of financial demons from the gnomes of Zurich whom Harold Wilson blamed for the pressure on the pound in the 1960s, the asset strippers and property tycoons of the 1970s, Gordon Gekko and the liars poker players of the trading floors of the late 1980s, and Harry Enfields loadsamoney lads of the 1990s. The phrase hedge fund can conjure up an image of secrecy, million dollar bonuses, and the mysterious world of mathematical models and offshore havens. On top of that they are often presented as a threat to financial stability and thus to the savings and prospects of real workers. But despite, or possibly with the help of, this commentary, assets managed by hedge funds have continued to grow strongly. They have moved on from being the province of rich professional investors to collecting an increasing share of institutional funding. They may still have only a small proportion of total assets under management but they are growing fast and their leverage and active trading strategies make them very influential in many markets traditionally in equities, but more recently in new structured credit markets. And of course, while they may be worried by the growth of hedge funds and modern financial markets, most other cities and countries are deeply envious of Londons place as the location of choice of such a high proportion of hedge fund managers. So Im pleased to have the opportunity today to set out our assessment of how the growth of hedge funds is affecting the financial system and risks to financial stability.

Hedge fund industry

But Id like to start with the question why why have hedge funds grown so rapidly in the past few years? After all they have been around since Alfred Winslow Jones set up the first long short equities fund in 1949 and there has been a steady development of the sector over the intervening decades with a growing variety of styles, strategies, sizes and status; hedge funds are like a family you can see the resemblance without finding a single common feature. But the recent growth of the hedge fund sector has been explosive (Chart 1) with assets growing from around $200 billion in 1998 to about $11/4 trillion today.(2)

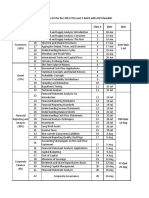

Chart 1 Size of the hedge fund industry(a)

Total assets under management (left-hand scale) Quarterly ows (right-hand scale) US$ billions 1,000 US$ billions 50

40 750 30

500

20

10 250

+

0

0 1994 95 96 97 98 99 2000 01 02 03 04 05 06 10

Source: Tremont Capital Management, Inc. (a) Sample does not cover the entire industry.

(1) Given at the HEDGE 2006 Conference on 17 October 2006. This speech can be found on the Banks website at www.bankofengland.co.uk/publications/speeches/2006/speech285.pdf. (2) Note that Chart 1 does not cover the entire hedge fund industry.

448

Quarterly Bulletin 2006 Q4

Part of the answer is the growing power of technology and financial theory to unpack traditional investment products, like equities and bonds, into their component parts and then sell them separately or in new bundles which may appeal to particular groups of investors. This has increased the opportunities for specialisation. So the growth of hedge funds is one aspect of the technological revolution which is also transforming the structure of other industries from manufacturing to entertainment. The technology has allowed a ferment of financial innovation and put a huge value on the relatively few people who can understand and handle the growing complexity of markets. It is no surprise therefore that some of those people have seized the opportunity to take the rewards of ownership by setting up on their own. This was perhaps encouraged in the early days by the fact that the expertise lay mainly on the trading sides of the banks on the other side of the Chinese walls from the investment managers. The hedge funds are something of an investment bank diaspora. Of course the banks are responding to the loss of key staff and expertise by establishing their own internal hedge funds or adding hedge funds to the range of investments offered by their asset management activities. They have the resources and breadth and depth of market penetration to be formidable competitors to the independent funds as asset managers. On the other side of course, in their role as prime brokers, the investment banks have benefited hugely in terms of fees, interest and the trading income generated by the active management of hedge fund portfolios. It will be interesting to see how the balance shifts in the coming years. I would be surprised not to see a rationalisation into a smaller number of large, independent funds with a shift of business back into the big institutions as the new markets and products become more familiar. This is what we have seen elsewhere in the financial sector and in other industries.

Chart 2 Cumulative returns since 1994

Per cent 300 CSFB/Tremont hedge fund index 250 200 150 100 50 FTSE All-World

S&P 500

+

0

50 1994 95 96 97 98 99 2000 01 02 03 04 05 06

Sources: CSFB/Tremont, Datastream and Bank calculations.

Chart 2 seems to provide some support for this. It shows if you had placed money with a representative group of hedge funds in 1994, regularly switching your allocation across different hedge funds exactly to follow that of the sectoral composition, you would have matched the cumulative appreciation of the world equity index but in a way that largely avoided the collapse in equity prices in 200002. So the risk-adjusted rate of return, even net of the fees, may have been higher. I should caution that this analysis ignores the survivorship and other biases associated with the construction of hedge fund indices so getting this ideal result would have been much harder than it looks. More recently the emphasis has been on the ability of hedge funds to achieve alpha.(1) This is a braver claim and the record is less clear. The position of hedge funds may have been aided by the restrictions on the types of product that can be marketed to retail investors. In that sense, while the derivative markets are highly competitive they have not been completely free and there may have been a premium for hedge funds and their professional investors. But for the longer term, I must admit I am a sceptic. While a few investors or funds can consistently beat the markets, there seem reasons to doubt whether the whole sector can deliver superior risk-adjusted returns, especially as the rest of the market catches up with the financial innovations they have led and as they grow to become much more than marginal players. Indeed, this search for investors Holy Grail may go some way to account for the surge in births and closures among hedge funds with, according to Hedge Fund Research, over 2,600 new starts since the beginning of 2005 but with nearly 1,100 closures, double the rate of 2004.

(1) The abnormal rate of return in excess of what would be predicted by an equilibrium model like the Capital Asset Pricing Model.

Hedge fund performance

Finally, of course, hedge funds have been growing because they have offered attractive returns at a time when there has been a search for yield across the major markets and when, partly as a result of the greater sophistication of capital markets, long yields in particular have been low worldwide. At risk of some caricature, it seems to me that the sector has been using two rather different sales pitches. One is the offer which matches the name: the claim that funds can provide average returns comparable with those of an index but without the indexs volatility.

Speeches Hedge funds and financial stability

449

The impact of hedge funds on the financial system

What does the growth of the hedge fund sector mean for the stability of the financial system? In the Banks previous Financial Stability Report (FSR) in July we identified six main sources of vulnerability in the financial system and the growth of hedge funds was not one of them nor, I believe, would it have been in the next six. That doesnt mean they are not important. They are mentioned 40 times in the Report. And our market intelligence function has developed regular and frequent contacts with several of the large funds and many of the prime brokers in London, the United States and Asia and we are very grateful for the time they give us. From a systemic point of view what matters is the wider change hedge funds are part of and the different incentives and behaviour to which that gives rise. In many ways the growth of hedge funds and the derivative markets they feed off is part of a shift from bilateral negotiated banking finance to arms-length finance through asset markets. In the long term, that shift should be good for stability. What has traditionally worried central banks and regulators most is the risk that the key intermediaries at the centre of the financial system especially the big banks may fail in a way that sends shock waves throughout the system and damages the wider economy. The development of more sophisticated markets which allow these key players to transfer some of the risk that they have traditionally held on their own balance sheets is positive for the system as a whole. And what better place to put it than in a large number of independent funds financed by very rich individuals and professional investors, whose losses are of interest only to themselves, and in long-term investment institutions with highly diversified portfolios? It is important always when assessing risks from a change in financial markets to remember the risks in the status quo. And the traditional world of vanilla products and national markets was not a haven of stability. In the early 1970s, for example, a surge of highly leveraged property investment was channelled through the United Kingdoms fringe banking sector. When their over-leveraged bets on real estate came to grief because of unexpected increases in interest rates, the large UK clearers had to step in through a Bank of England organised lifeboat which amounted at its peak to about 40% of the large UK clearing banks capital. The active trading of hedge funds makes markets more liquid and facilitates genuine hedging activity by others including systemically important banks. Increasingly, hedge funds led

by those managed from London have become an important part of the risk transfer process, providing liquidity to evolving structured derivative markets. So hedge funds have been positive for market efficiency. And in recent episodes of market stress the autumn of 2003 and the spring of last year some have helped provide liquidity to markets, enabling large banks and other investors to adjust their positions. Of course at times of turbulence we have seen some hedge funds taking losses and facing liquidity difficulties, but we have also seen other funds stepping in to pick up the assets as prices fall and thus to provide liquidity to the market. If we face a financial crisis in the next few years we are almost bound to find some hedge funds at or near the centre of it; equally we should expect hedge funds to play a part in providing the solution. To complete the upside story, funds have not just been a source of financial innovation but some have been pioneers in risk management and have helped make the industry more resilient for example through participation in the Corrigan Group.

Challenges to systemic stability

But if the growth of hedge funds is part of a helpful structural shift in the long term, any major change brings transitional risks and problems. Periods of rapid growth and innovation in financial markets have often led to difficulties and overshooting and we should not assume that this one will be different. The LTCM episode of course demonstrated the risks. The problems in a large and exceptionally highly leveraged hedge fund threatened widespread market dislocation and large losses for other institutions. The fund flipped from being a liquidity provider to a liquidity demander. A great deal has changed since then of course. The sophistication of the risk controls in prime brokers and in many hedge funds has been hugely improved, and 1998 and the collapse of the high-tech stock prices in 2000 form part of regular stress tests throughout the financial sector. Recent events suggest that the financial system may genuinely have become more resilient. It would be difficult to speak about hedge funds at the moment without referring to Amaranth. What should we make of the fact that this fund incurred enormous losses and yet left markets largely unmoved? Can we put the apparently limited collateral damage down to much improved counterparty risk management since 1998? Or were we just lucky?

450

Quarterly Bulletin 2006 Q4

I suspect the answer is a bit of both. I dont have full details of what went wrong or how much the funds several prime brokers knew about the funds overall exposure and leverage. But while Amaranth had leveraged up, it had not done so or been allowed to do so on the scale seen at LTCM and that lower leverage has been seen across the market (Chart 3). The fund was able to meet its margin obligations without dislocating markets and other players were willing to step in and liquidate its positions albeit on terms which shocked the Amaranth management.

times. The resilience of the valuations, the diversification of portfolios, the depth of liquidity, and firms risk management has not been tested by a severe shock. Our FSR identified the risk that the business pressure to maintain or establish market share in rapidly expanding markets might drive companies to take on more risk than they should. There is no reason to change that assessment now. Indeed, after a short pause in May and June, we have seen the return of aggressive risk-taking in many financial markets this autumn. There must be a danger that the search for yield is driving many investors into similar trades (or trades which would become closely correlated in a crisis) and that risk models are giving too much weight to the low volatility of recent times. For example, it is possible that positions are being built up, or only partially hedged, on the assumption that currently compressed corporate credit spreads will adjust moderately or smoothly. Chart 4 shows that corporate high-yield markets have not behaved in this benign way in the past.

Chart 4 Yield differentials with ten-year US Treasury bond

Emerging markets sovereign and corporate index(a) US high-yield bond index(b) US Corporate Baa US Corporate Aaa

Chart 3 BIS indicators of hedge fund leverage

Level 5.0 4.5 4.0 Equity funds 3.5 3.0 Weighted average(a) 2.5 2.0 1.5 1.0 Fixed-income funds 1998 99 2000 01 02 03 04 05 06 0.5 0.0

Source: Bank for International Settlements.

Basis points

1,400 1,200

(a) Includes equity funds, market neutral funds, directional funds, fixed-income funds, and fund of funds.

1,000 800 600 400 200

Incidentally that shock at the way markets moved so aggressively against their positions was a common feature of LTCM and Amaranths experience and it is an example of a trend which is not peculiar to the financial sector. In the past a failing firm could hope to get its bankers into a room and persuade them to put in more money or allow time for recovery (as the saying went, if I lose thousands of pounds its a problem for me, if I lose billions of pounds its a problem for you). I suspect those times are going: firms often dont know now who holds their shares and debt and many investors are looking to take the hit and get out as quickly as possible. This is a more brutal world to fail in. But another key difference from LTCM was that the market event that appears to have undone Amaranth a fall in natural gas futures prices could otherwise be considered a benign one for growth and inflation. In that respect it was very different from 1998 when Russias default sent a shock through a wide range of markets. So while we can take some comfort from the fact that losses from Amaranth were limited by improvements in counterparty risk management, we should not conclude that it will be as smooth and easy next time and of course there will be a next time. The fact is the fantastic growth of derivative markets and hedge funds of the past few years has taken place in benign

+

0

1978 80 82 84 86 88 90 92 94 96 98 2000 02 04 06

Sources: Bloomberg, Merrill Lynch and Bank calculations. (a) Yield to maturity. (b) Monthly data until 1990, daily data thereafter. High-yield index shows the yield to maturity rather than the effective yield.

200

But I should not end on a gloomy note. Working closely together, the authorities which in the United Kingdom means the Financial Services Authority (FSA), Bank of England and HM Treasury are aware of these risks, as are the industry. And measures to address them are being taken. The second report of the Corrigan Group, unlike its predecessor, has been published to forestall, rather than as a reaction to, a crisis. The rating agencies are beginning to publish operational risk ratings for hedge funds and managers. Complementing these industry initiatives, the FSA has been developing its approach to the regulation of hedge fund managers. It has set up a special unit to supervise hedge fund managers and ensure they are subject to the same standards

Speeches Hedge funds and financial stability

451

of market conduct, systems and controls as other asset managers and that potential conflicts of interest are addressed (for example in the area of asset valuations). It is encouraging further improvements in counterparty risk management practices by prime brokers. It has worked with the Fed in New York and the industry to significantly reduce backlogs in derivative confirmations and assignments. Its surveys of prime brokers exposures to hedge funds provide an important guide to any developing concentrations or an excessive build-up of leverage. And today Andrew Shrimpton of the FSA is also here leading a business showcase session on material side letters. In these ways the FSA is seeking to ensure that proportionate regulation complements the disciplines provided by Londons large and sophisticated market.

To sum up, the rapid growth of hedge funds is one aspect of a wider transformation in financial markets. In the long term there are good reasons to see this as welcome not just in widening the range of options for investors but in promoting the stability of the financial system. In the shorter term, there are bound to be risks while the funds, other market participants and the authorities gain experience of how the new products and markets behave in a full range of trading conditions. The FSA and other authorities, including the Bank, are alive to the dangers and are doing what they can to assess and mitigate those risks.

Potrebbero piacerti anche

- Life Settlements and Longevity Structures: Pricing and Risk ManagementDa EverandLife Settlements and Longevity Structures: Pricing and Risk ManagementNessuna valutazione finora

- Strategic and Tactical Asset Allocation: An Integrated ApproachDa EverandStrategic and Tactical Asset Allocation: An Integrated ApproachNessuna valutazione finora

- Diebold 2Documento30 pagineDiebold 2fedegrassoNessuna valutazione finora

- Forecasting The Term Structure of Government Bond Yields: Article in PressDocumento28 pagineForecasting The Term Structure of Government Bond Yields: Article in Pressstan32lem32Nessuna valutazione finora

- CBOT-Understanding BasisDocumento26 pagineCBOT-Understanding BasisIshan SaneNessuna valutazione finora

- Global Macro BarcapDocumento16 pagineGlobal Macro BarcapvishwachandraNessuna valutazione finora

- Currency OverlayDocumento6 pagineCurrency OverlayprankyaquariusNessuna valutazione finora

- Hans Buehler DissDocumento164 pagineHans Buehler DissAgatha MurgociNessuna valutazione finora

- CS - GMN - 22 - Collateral Supply and Overnight RatesDocumento49 pagineCS - GMN - 22 - Collateral Supply and Overnight Rateswmthomson50% (2)

- Artemis Capital Q12012 Volatility at Worlds End1Documento18 pagineArtemis Capital Q12012 Volatility at Worlds End1Sean GreelyNessuna valutazione finora

- DynamicVIXFuturesVersion2Rev1 PDFDocumento19 pagineDynamicVIXFuturesVersion2Rev1 PDFsamuelcwlsonNessuna valutazione finora

- FX and Interest Rates - 1996Documento2 pagineFX and Interest Rates - 1996itreasurerNessuna valutazione finora

- TradeDocumento6 pagineTradekyleleefakeNessuna valutazione finora

- Dispersion Trading: An Empirical Analysis On The S&P 100 OptionsDocumento12 pagineDispersion Trading: An Empirical Analysis On The S&P 100 OptionsTataNessuna valutazione finora

- 807512Documento24 pagine807512Shweta SrivastavaNessuna valutazione finora

- VelocityShares Etn Final Pricing Supplement VixlongDocumento196 pagineVelocityShares Etn Final Pricing Supplement VixlongtgokoneNessuna valutazione finora

- Money and Inflation: MacroeconomicsDocumento71 pagineMoney and Inflation: MacroeconomicsDilla Andyana SariNessuna valutazione finora

- Swap Chapter 1Documento18 pagineSwap Chapter 1sudhakarhereNessuna valutazione finora

- Portfolio ConstructionDocumento15 paginePortfolio ConstructionParul GuptaNessuna valutazione finora

- FX 102 - FX Rates and ArbitrageDocumento32 pagineFX 102 - FX Rates and Arbitragetesting1997Nessuna valutazione finora

- Use Duration and Convexity To Measure RiskDocumento4 pagineUse Duration and Convexity To Measure RiskSreenesh PaiNessuna valutazione finora

- Mele Obayashi 2012 - An Interest Rate Swap Volatility Index and Contract PDFDocumento61 pagineMele Obayashi 2012 - An Interest Rate Swap Volatility Index and Contract PDFm325075Nessuna valutazione finora

- Option Trading: Pricing and Volatility Strategies and TechniquesDocumento5 pagineOption Trading: Pricing and Volatility Strategies and TechniquesrockochenNessuna valutazione finora

- The IBS Effect Mean Reversion in Equity ETFsDocumento31 pagineThe IBS Effect Mean Reversion in Equity ETFstylerduNessuna valutazione finora

- The Dynamics of Leveraged and Inverse Exchange-Traded FundsDocumento24 pagineThe Dynamics of Leveraged and Inverse Exchange-Traded FundsshorttermblogNessuna valutazione finora

- Portfolio ConstructionDocumento21 paginePortfolio ConstructionRobin SahaNessuna valutazione finora

- Leh QCRDocumento68 pagineLeh QCRzaphbebroxNessuna valutazione finora

- Day1 Session3 ColeDocumento36 pagineDay1 Session3 ColeLameuneNessuna valutazione finora

- FX Deal ContingentDocumento23 pagineFX Deal ContingentJustinNessuna valutazione finora

- Introducing Base CorrelationsDocumento4 pagineIntroducing Base CorrelationsLatoya AndersonNessuna valutazione finora

- Graham CapitalDocumento49 pagineGraham CapitalDave JohnsonNessuna valutazione finora

- A Step-By-Step Guide To The Black-Litterman Model Incorporating User-Specified Confidence LevelsDocumento34 pagineA Step-By-Step Guide To The Black-Litterman Model Incorporating User-Specified Confidence LevelsMang AwanNessuna valutazione finora

- DRKW Rate StructuringDocumento20 pagineDRKW Rate StructuringLisa SmithNessuna valutazione finora

- JPM Flows Liquidity 2016-10-07 2145906Documento18 pagineJPM Flows Liquidity 2016-10-07 2145906chaotic_pandemoniumNessuna valutazione finora

- CDS AswDocumento28 pagineCDS AswEmiliano CarchenNessuna valutazione finora

- EDHEC-Risk Publication Dynamic Risk Control ETFsDocumento44 pagineEDHEC-Risk Publication Dynamic Risk Control ETFsAnindya Chakrabarty100% (1)

- Survey of Microstructure of Fixed Income Market PDFDocumento46 pagineSurvey of Microstructure of Fixed Income Market PDF11: 11100% (1)

- Cambria Tactical Asset AllocationDocumento48 pagineCambria Tactical Asset Allocationemirav2Nessuna valutazione finora

- Lecture2 PDFDocumento16 pagineLecture2 PDFjeanturqNessuna valutazione finora

- IIF Capital Flows Report 10 15Documento38 pagineIIF Capital Flows Report 10 15ed_nycNessuna valutazione finora

- Riding The Yield Curve 1663880194Documento81 pagineRiding The Yield Curve 1663880194Daniel PeñaNessuna valutazione finora

- Ambrus Capital - Volatility and The Changing Market Structure Driving U.S. EquitiesDocumento18 pagineAmbrus Capital - Volatility and The Changing Market Structure Driving U.S. EquitiespiwipebaNessuna valutazione finora

- JPM Global Fixed Income 2012-03-17 810381Documento72 pagineJPM Global Fixed Income 2012-03-17 810381deepdish7Nessuna valutazione finora

- Easy Volatility Investing AbstractDocumento33 pagineEasy Volatility Investing AbstractcttfsdaveNessuna valutazione finora

- Convertible WarrantDocumento3 pagineConvertible WarrantrameshkumartNessuna valutazione finora

- Two Stage Fama MacbethDocumento5 pagineTwo Stage Fama Macbethkty21joy100% (1)

- Barclays US Futures H3-M3 Treasury Futures Roll Outlook PDFDocumento9 pagineBarclays US Futures H3-M3 Treasury Futures Roll Outlook PDFLorenzo RossiNessuna valutazione finora

- Demystifying Managed FuturesDocumento29 pagineDemystifying Managed Futuresjchode69Nessuna valutazione finora

- Hull White Prepay OASDocumento24 pagineHull White Prepay OASwoodstick98Nessuna valutazione finora

- Asset Allocation and Tactical Asset AllocationDocumento16 pagineAsset Allocation and Tactical Asset AllocationGabriel ManjonjoNessuna valutazione finora

- Cappuccino Notes: An Investment Offering A Enhanced Exposure To A Portfolio of Underlying AssetsDocumento3 pagineCappuccino Notes: An Investment Offering A Enhanced Exposure To A Portfolio of Underlying AssetsLameuneNessuna valutazione finora

- The Exponencial Yield Curve ModelDocumento6 pagineThe Exponencial Yield Curve Modelleao414Nessuna valutazione finora

- Fabozzi Gupta MarDocumento16 pagineFabozzi Gupta MarFernanda RodriguesNessuna valutazione finora

- Inflation Linked Bonds - 9-15 PDFDocumento27 pagineInflation Linked Bonds - 9-15 PDFClutch Derivative100% (1)

- Asia Risk QIS Special Report 2019 PDFDocumento16 pagineAsia Risk QIS Special Report 2019 PDFStephane MysonaNessuna valutazione finora

- European Fixed Income Markets: Money, Bond, and Interest Rate DerivativesDa EverandEuropean Fixed Income Markets: Money, Bond, and Interest Rate DerivativesJonathan A. BattenNessuna valutazione finora

- Sectors and Styles: A New Approach to Outperforming the MarketDa EverandSectors and Styles: A New Approach to Outperforming the MarketValutazione: 1 su 5 stelle1/5 (1)

- Exchange Rate Determination Puzzle: Long Run Behavior and Short Run DynamicsDa EverandExchange Rate Determination Puzzle: Long Run Behavior and Short Run DynamicsNessuna valutazione finora

- Answer Key of Rectification of Errors 2Documento3 pagineAnswer Key of Rectification of Errors 2menekyakiaNessuna valutazione finora

- Introduction To Accounting EXE 1Documento6 pagineIntroduction To Accounting EXE 1ntxthuy04Nessuna valutazione finora

- Assignment On Merchandising Business Answer Only. TH 12:00-3:00 Due Sunday 10/2 6:00 PMDocumento5 pagineAssignment On Merchandising Business Answer Only. TH 12:00-3:00 Due Sunday 10/2 6:00 PMMarinella LosaNessuna valutazione finora

- Chapter 11 Cash Flow Estimation and Risk Analysis PDFDocumento80 pagineChapter 11 Cash Flow Estimation and Risk Analysis PDFGelyn Cruz100% (1)

- PresentationDocumento7 paginePresentationStefan ApostolNessuna valutazione finora

- Mergers and AcquisitionDocumento93 pagineMergers and Acquisitionapi-3712392100% (7)

- Literature Review SalmanDocumento3 pagineLiterature Review SalmanvdocxNessuna valutazione finora

- EDP)Documento2 pagineEDP)02 - CM Ankita AdamNessuna valutazione finora

- Nerolac - On Ratio - SolvedDocumento6 pagineNerolac - On Ratio - Solvedricha krishnaNessuna valutazione finora

- F2 một số dạng BTDocumento15 pagineF2 một số dạng BTdohanh0512Nessuna valutazione finora

- Role of Capital Market in Developing EconomyDocumento9 pagineRole of Capital Market in Developing Economysakshi tomarNessuna valutazione finora

- Mcom Ind As 33 Theory.Documento11 pagineMcom Ind As 33 Theory.Umang PatelNessuna valutazione finora

- Dec 2017 CFA Level 1 ScheduleDocumento2 pagineDec 2017 CFA Level 1 ScheduleSyed AhmadNessuna valutazione finora

- Pair Nifty Bank NiftyDocumento3 paginePair Nifty Bank NiftyRavi KiranNessuna valutazione finora

- Chapter 3 Lesson 1: Analyzing Changes in Financial PositionDocumento22 pagineChapter 3 Lesson 1: Analyzing Changes in Financial PositionSneha DasNessuna valutazione finora

- Assignment: Financial Management: Dividend - MeaningDocumento4 pagineAssignment: Financial Management: Dividend - MeaningSiddhant gudwaniNessuna valutazione finora

- First Metro Save and Learn Fixed Income FundDocumento1 paginaFirst Metro Save and Learn Fixed Income FundkimencinaNessuna valutazione finora

- Preserbasyon Kulturang Tradisyon at WikaDocumento9 paginePreserbasyon Kulturang Tradisyon at Wikamarianne capina de jesus100% (1)

- Exam 2022 AccountingDocumento2 pagineExam 2022 AccountingEditz meniaNessuna valutazione finora

- Guide To Managerial AccountingDocumento23 pagineGuide To Managerial AccountingTai LeNessuna valutazione finora

- Module B Dec 2017questionDocumento8 pagineModule B Dec 2017questionConnieChoiNessuna valutazione finora

- Macro-Economic and Industry AnalysisDocumento33 pagineMacro-Economic and Industry AnalysisPraveen Kumar SinhaNessuna valutazione finora

- 202E14Documento22 pagine202E14dubbs210% (1)

- Revision II (Ratio Analysis)Documento6 pagineRevision II (Ratio Analysis)Allwin GanaduraiNessuna valutazione finora

- 1.6.2015 January PresentationDocumento29 pagine1.6.2015 January Presentationjack luNessuna valutazione finora

- The Yield CurveDocumento14 pagineThe Yield CurveAmirNessuna valutazione finora

- AppendicesDocumento7 pagineAppendicesKrishna ShresthaNessuna valutazione finora

- An Analysis of Capital Structure For Hindustan Unilever Limited, Vadamangalam PuducherryDocumento65 pagineAn Analysis of Capital Structure For Hindustan Unilever Limited, Vadamangalam PuducherryRaja SekarNessuna valutazione finora

- HW#3Documento9 pagineHW#3digital1dwNessuna valutazione finora

- AUDITING PROBLEM - From Audit of InvestmentDocumento60 pagineAUDITING PROBLEM - From Audit of InvestmentMa. Hazel Donita Diaz100% (1)