Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Letter of Credit

Caricato da

skpnextDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Letter of Credit

Caricato da

skpnextCopyright:

Formati disponibili

Letter of credit Letter of credit is a document issued by a bank that guarantees the payment of a customer's draft.

A letter of credit is issued by a bank in the importers country, at the request of the importer, in favour of the exporter, informing him that the issuing bank undertakes to accept the bills of exchange drawn by the exporter up to a specified amount in respect of the goods exported by him to the importer specified therein. Benefits of bankers letter of credit Benefits for Exporter 1. Letter of credit guaranteed payment upon presentation of the documents specified in the terms of the letter of credit. 2. Reducing the production risk for the situations when the buyer cancels or changes his order. 3. The ability to structure the delivery schedule according to the exporter's interests. 4. The chance to obtain financing for production or purchase of goods (preexport finance). 5. The chance to get financing in the period between the shipment of the goods and receipt of payment. 6. The buyer cannot refuse to pay due to a complaint about the goods. Benefits for Importers 1. The possibility to structure the payment plan in the contract according to the importer's interests. 2. Certainty that the payment will be made only upon presentation of the documents confirming shipment of the goods. 3. The use of a letter of credit allows the importer to avoid or reduce prepayment. 4. The seller must fulfill all terms of the contract, as indicated in the letter of credit (shipment of the goods, meeting delivery terms on stock, amount, and deadlines) in order to receive the payment. 5. Having opened a letter of credit, the importer proves his ability to pay and can count on more favourable payment terms in the future. 6. Documentary letters of credit help the importer significantly reduce the risk connected with the seller not meeting its delivery obligations.

The different types of letter of credits are as follows: 1. Documentary letter of credit :The letter of credit issued by the issuing banker on the condition that bill drawn under the letter of credit must be accompanied by the relevant shipping documents such as marine insurance, policy, invoice etc., is called as documentary letter of credit. It safeguards the interest of the issuing banker. 2. Clean letter of credit: The letter of credit which is issued by the issuing banker without insisting that the bill drawn under the letter of credit should be accompanied by the relevant shipping documents is called as clean letter of credit. 3) Revocable letter of credit : A letter of credit which can be revoked (i.e.. cancelled) by the issuing banker at any time he likes without the consent of all the parties concerned is called a revocable letter of credit. 4) Irrevocable letter of credit: A letter of credit which cannot be revoked or cancelled by the issuing banker without the consent of all the parties concerned is called an irrevocable bill of credit. 5) Confirmed letter of credit: If a letter of credit contain in addition to the undertaking of the issuing banker, an undertaking of the negotiating bank in the beneficiarys (i.e. exporters) country to honour the bill drawn by the exporter, it is called a confirmed letter of credit. 6) Unconfirmed letter of credit: If a letter of credit does not contain the undertaking of the negotiating bank in the exporters country to honour the bill, it is called an unconfirmed letter of credit. It is not very safe to the exporter. 7) Fixed Letter of credit: If a letter of credit is issued for a fixed amount and for a fixed period, it is called a fixed letter of credit. 8) Revolving letter of credit: If the amount allowed under a letter of credit is automatically renewed, after the bills negotiated under it are duly honoured, it is called a revolving letter of credit. 9) With alternative letter of credit: If the drawee bank can have alternative i.e. turn back to the drawer of the bill, i.e. the exporter, for payment in the event of default on the part of the importer to honour the bill, it is called a with alternative letter of credit. 10) Without alternative letter of credit: If the drawee bank cannot have alternative to the drawer of the bill, i.e. the exporter for payment in the event of dishonour of the bill by the importer, it is called as without recourse letter of credit. 11) Transferable letter of credit: If the beneficiary of a letter of credit can transfer his benefit, i.e. the right to draw bill to another person is called a transferable letter of credit. 12) Non-transferable letter of credit: If the beneficiary of a letter of credit cannot transfer his benefit i.e. the right to draw a bill, to another person, it is called a non-transferable letter of credit.

Classification of securities The different kinds of securities for advances are as follows: 1. Stock Exchange securities: Stock exchange securities are those which are regularly dealt with (i.e. buying and selling) in recognized stock exchanges. They include Central and State govt. securities, securities of semi govt. bodies, corporate securities i.e. shares, debentures of joint stock companies. 2. Government securities: Government securities include the securities issued by Central and State Governments. They include bearer bonds, inscribed stocks, Government promissory notes, savings deposit certificates etc. 3. Shares of public companies: Shares of public companies means shares of joint, stock companies which involve public. These shares are easily transferable. 4. Shares of private companies: Privately owned and managed companys shares are also one form of securities used for advances. 5. Debentures of joint stock companies: Debentures are better than shares as securities for bank advances. Joint stock companys debentures involve less risk. 6. Goods: There are advances against agricultural and industrial/commodities such as rice, wheat, jaggery, sugar, oils, cotton, cotton textiles products, paper, iron and steel goods etc., The advances constitute more than 60% of the total secured advances of banks. 7. Documents of title of goods: A document of title to goods is a document which is used in the ordinary course of business as a proof of the possession or control of goods. There are also used as securities for advances. These documents include bill of lading, dock warrants, warehouse keepers certificates or receipts, whar fingers certificate or receipts, delivery orders and railway receipts etc. 8. Plant and Machinery: Plant and machinery also act as securities if advances are given to manufacturers of machinery, importers and dealers in machinery and industries which use machinery. 9. Real estate, immovable properties or land and buildings: 10. Gold bullion: Gold bullion is an instrument which has universal marketability and has a general steady price. It can be used as a security for advance. 11. Gold Ornaments: Gold ornaments also sometimes can be taken up as security against advances by banks.

12. Life Insurance policies: The life insurance policy is a document which contains the terms and conditions of the contract between the insurer and the insured. This can be used as a security for advances. 13. Book debts: The book debts of customers for goods supplied or services rendered constitutes an actionable claim, are sometimes accepted by the banker as security for bank advances. 14. Fixed Deposit Receipts: Fixed deposit receipts issued by banks can also be used as a security and these are very safe, as the borrowers money is in custody of the lending banker himself. 15. Supply bills: A supply bill is a bill for the goods supplied by him to the government or semi government department after inspection and other formalities. These can also be used as security.

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Monetary Economic 1Documento8 pagineMonetary Economic 1skpnextNessuna valutazione finora

- Managerial Economics - SyllabusDocumento2 pagineManagerial Economics - SyllabusskpnextNessuna valutazione finora

- Unit 20 Dealing With Unions and Associations: ObjectivesDocumento28 pagineUnit 20 Dealing With Unions and Associations: ObjectivesSatyam mishraNessuna valutazione finora

- 11 Business Ethics SyllabusDocumento2 pagine11 Business Ethics SyllabusskpnextNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Tugas 1 Bahasa Inggris NiagaDocumento2 pagineTugas 1 Bahasa Inggris NiagaWilliamson Uda80% (5)

- 9 Rules of Trading DivergenceDocumento10 pagine9 Rules of Trading DivergenceAdam MohdNessuna valutazione finora

- Applied Economics Final ExamDocumento3 pagineApplied Economics Final ExamDaisy Orbon67% (3)

- Idea Submission TemplateDocumento9 pagineIdea Submission TemplateDarkartsNessuna valutazione finora

- Chapter 4: The Theory of Individual Behavior Answers To Questions and ProblemsDocumento11 pagineChapter 4: The Theory of Individual Behavior Answers To Questions and ProblemsAmal IriansahNessuna valutazione finora

- Top Seven HR Challenges.Documento20 pagineTop Seven HR Challenges.myasirnsNessuna valutazione finora

- 7 Rejection Price PatternDocumento7 pagine7 Rejection Price PatternMuhammad Irwan Chong100% (1)

- What Are Corporate Bonds?: Investor BulletinDocumento6 pagineWhat Are Corporate Bonds?: Investor BulletinSangeetha ChandramohanNessuna valutazione finora

- Compunding Machine PortfolioDocumento1 paginaCompunding Machine PortfolioManmohan ToshniwalNessuna valutazione finora

- Xerox Equipment HandbookDocumento586 pagineXerox Equipment HandbookdarwinabadNessuna valutazione finora

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocumento1 paginaAlphaex Capital Candlestick Pattern Cheat Sheet InfographEchaNessuna valutazione finora

- Sales Plan TemplateDocumento17 pagineSales Plan TemplaterameshNessuna valutazione finora

- Commercial Paper in IndiaDocumento8 pagineCommercial Paper in IndiaMalyala JagadeeshNessuna valutazione finora

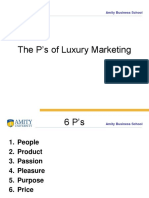

- LUXURY Retail - 6 P's of Luxury MarketingDocumento8 pagineLUXURY Retail - 6 P's of Luxury MarketingRahulRahejaNessuna valutazione finora

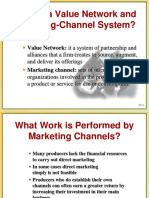

- What Is A Value Network and Marketing-Channel System?Documento8 pagineWhat Is A Value Network and Marketing-Channel System?Sønder SøulNessuna valutazione finora

- GCWORLD PRELIMshgghDocumento2 pagineGCWORLD PRELIMshgghAndrei Dela CruzNessuna valutazione finora

- Lays B PDFDocumento12 pagineLays B PDFprabhu g sNessuna valutazione finora

- Marketing Mix:: ProductDocumento2 pagineMarketing Mix:: Productbilal asifNessuna valutazione finora

- Great Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByDocumento6 pagineGreat Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByAbhishek ChaurasiaNessuna valutazione finora

- 5.1 Cash DiscountsDocumento15 pagine5.1 Cash DiscountsPearl DavidNessuna valutazione finora

- Walmart Swaps Case Study Interest Rate SwapsDocumento12 pagineWalmart Swaps Case Study Interest Rate SwapsSimonaltkorn0% (2)

- Facility LocationDocumento30 pagineFacility Locationtush_chiefNessuna valutazione finora

- Other Comprehensive IncomeDocumento5 pagineOther Comprehensive Incometikki0219Nessuna valutazione finora

- IBM SummaryDocumento9 pagineIBM SummaryEliana SolangeNessuna valutazione finora

- ACC 401 Week 7 QuizDocumento8 pagineACC 401 Week 7 QuizEMLNessuna valutazione finora

- By Emran Mohammad (Emd) MKT 337 (Sections 3)Documento16 pagineBy Emran Mohammad (Emd) MKT 337 (Sections 3)Asif RafiNessuna valutazione finora

- SWOT AnalysisDocumento7 pagineSWOT Analysissahil kumarNessuna valutazione finora

- Fundamentals of Corporate Finance 8th Edition by Brealey Myers Marcus ISBN Solution ManualDocumento6 pagineFundamentals of Corporate Finance 8th Edition by Brealey Myers Marcus ISBN Solution Manualmary100% (24)

- NBP Nafa Funds PDFDocumento23 pagineNBP Nafa Funds PDFHamid AliNessuna valutazione finora

- Marketing Performance Management Benchmark ReportDocumento130 pagineMarketing Performance Management Benchmark ReportDemand MetricNessuna valutazione finora