Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CO204 Security Analysis Portfolio Management

Caricato da

Neelam PandeyDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CO204 Security Analysis Portfolio Management

Caricato da

Neelam PandeyCopyright:

Formati disponibili

CO204 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT (4 Credits) Objective: This course aims at providing the students a comprehensive

introduction to the areas of security analysis and portfolio management and equipping them with advanced tools and techniques for making profitable investment decisions. MODULE I: INTRODUCTION TO INVESTMENT AND SECURITY ANALYSIS (10) Unit 1: Meaning of investment speculation and Gambling Investment avenues Types of investors Investment objectives The investment process Security Analysis Meaning of security Types of securities Meaning of security analysis Unit 2: Risk and Return Computation of return Meaning and definition of risk Types: (Systematic risk- Market risk, Purchasing power risk, Interest rate risk, Unsystematic risk- Business risk (Internal, External), Financial risk) Minimising risk exposure Unit 3: Risk measurement - Standard deviation Meaning of Beta Computation and interpretation Use of beta in estimating returns. (Including simple problems) MODULE II: FUNDAMENTAL ANALYSIS & TECHNICAL ANALYSIS (20) Unit 1: Economic analysis: Factors in Domestic and International economy Economic forecasting and stock-investment decisions Types of economic forecasts Forecasting techniques Anticipatory surveys Barometric or Indicator approach (Delhi School of Economics- ECRI methodology) Money supply approach Econometric model building Opportunistic model building. Unit 2: Industry analysis: Industry classification schemes Classification by product and according to business cycle Key characteristics in industry analysis Industry life cycle Sources of information for industry analysis. Unit 3: Company analysis: Sources of information for company analysis (Internal, External) Factors in company analysis Operating analysis Management analysis Financial analysis Earnings quality. Unit 4 : Technical Analysis - Meaning and Assumptions of technical analysis Trend lines and their significance Market indicators The Dow theory Market indices Mutual fund activity Confidence level Price indicators Support and Resistance levels Gap analysis - New high-low The most active list Moving averages of stock prices Volume indicators- Price-volume relationship Short selling Breadth of market (Advance/Decline) Odd lot trading Oscillators Relative Strength Index (RSI) Rate of Change (ROC) Charting Types of price charts Price patterns.

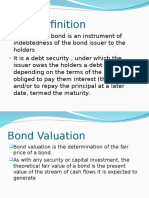

MODULE III: SECURITIES RETURN AND VALUATION ANALYSIS (10) Unit 1: Fixed-Income Securities Overview of fixed-income securities Risk factors in fixed-income securities (Systematic and unsystematic) Bond analysis Types of bonds Major factors in bond rating process Bond returns Holding period return - Concept of yield Current yield Yield-to-Maturity Price-yield relationship Convexity Term structure of interest rates and yield curve Duration - Valuation of preference shares. Unit 2: Stock Return and Valuation Anticipated returns, Present value of returns, Constant Growth model, Two-Stage Growth model, The Three-Phase Model, Valuation through P/E ratio.

MODULE IV: PORTFOLIO MANAGEMENT, CAPITAL MARKET THEORY, AND DERIVATIVES MARKET (20) Unit 1: Efficient Market Hypothesis (EMH) Random Walk theory Forms of EMH EMH and empirical findings Implication of EMH on fundamental and technical analysis Market inefficiencies. Unit 2: Portfolio Analysis Selection and Evaluation Meaning of portfolio Reasons to hold portfolio Diversification analysis Markowitzs Model Assumptions Specific model Risk and return optimization Efficient frontier Efficient portfolios Leveraged portfolios Corner portfolios Sharpes Single Index model Portfolio evaluation measures Sharpes Performance Index Treynors Performance Index Jensens Performance Index. Unit 3: Capital Market Theory CAPM theory: Assumptions CAPM Model Capital Market Line (CML) Security Market Line (SML) Evaluation of securities Present validity of CAPM Arbitrage Pricing Theory (APT) Assumptions APT model AP equation Factors affecting return APT and CAPM. Unit 4: Derivatives: Financial Derivatives Meaning Definition Futures and Options Pay-off in future and options Stock and Index futures and options Trading strategies Commodity Derivatives Structure of commodity exchanges Commodity futures and options Hedging using commodity futures. Suggested readings: 1. Fischer & Jordan, Security Analysis and Portfolio Management, Prentice Hall India. 2. Punithavathy Pandian, Security Analysis and Portfolio Management, Vikas Publishing House Pvt. Ltd.

3. I. M. Pandey, Financial Management, Vikas Publishing House Pvt. Ltd. 4. Martin Pring, Technical Analysis Explained, McGraw Hill. 5. V. A. Avadhani, Investment and Securities Market in India, Himalaya Publishing House. 6. D. C. Patwari, Options and Futures: Indian Perspective, Jaico Publishing House. 7. Hull, Introduction to Futures and Options, Prentice Hall. 8. Richard Waldron, An Introduction to Commodity Trading, Quantum Publishing. 9. Nick Battley, Introduction to Commodity Futures and Options, Irwin 10. French, Don, Security and Portfolio Analysis, Merril Publishing Co. 11. Preeti Singh, Investment Management, Himalaya Publishing. 12. Devin S., Portfolio Management, Prentice Hall. 13. Cheney, Muses, Fundamentals of Investments 14. V. K. Bhalla, Portfolio Analysis and Management, Sultan Chand & Sons 15. Agarwal, A Guide to Indian Capital Markets, New Delhi. 16. Jack Clark Francis and Richard W. Taylor, Investment, Schaums outline series, Tata McGraw Hill.

Potrebbero piacerti anche

- Security Analysis and Portfolio Management Blown Up SyllabusDocumento5 pagineSecurity Analysis and Portfolio Management Blown Up SyllabusRupa H GowdaNessuna valutazione finora

- Sapm Punithavathy Pandian PDFDocumento27 pagineSapm Punithavathy Pandian PDFGitanshuNessuna valutazione finora

- Sapm 2 Total 90 PagesDocumento91 pagineSapm 2 Total 90 PagesPochender VajrojNessuna valutazione finora

- Ch-09 Findings, Suggestions & Conclusion GayathriDocumento4 pagineCh-09 Findings, Suggestions & Conclusion Gayathrirgkusumba0% (1)

- Investment Process and CharacteristicsDocumento305 pagineInvestment Process and Characteristicsrajvinder deolNessuna valutazione finora

- 3rd Sem MBA - International FinanceDocumento1 pagina3rd Sem MBA - International FinanceSrestha ChatterjeeNessuna valutazione finora

- Common Stock Types of A Common Stock: Q1. Define EIC Analysis. Discuss The Various Components of EIC FrameworkDocumento2 pagineCommon Stock Types of A Common Stock: Q1. Define EIC Analysis. Discuss The Various Components of EIC FrameworkAshutosh MohantyNessuna valutazione finora

- Portfolio MGMT SynopsisDocumento3 paginePortfolio MGMT Synopsiskhushbookhetan0% (1)

- Asg 1 Role of Finance ManagerDocumento2 pagineAsg 1 Role of Finance ManagerRokov N ZhasaNessuna valutazione finora

- Future TerminologyDocumento9 pagineFuture TerminologyavinishNessuna valutazione finora

- Investment Analysis and Portfolio Management (Mba 3RD Sem)Documento30 pagineInvestment Analysis and Portfolio Management (Mba 3RD Sem)priyank chourasiyaNessuna valutazione finora

- Security Analysis & Portfolio Management Syllabus MBA III SemDocumento1 paginaSecurity Analysis & Portfolio Management Syllabus MBA III SemViraja GuruNessuna valutazione finora

- Portfolio Management Banking SectorDocumento133 paginePortfolio Management Banking SectorNitinAgnihotri100% (1)

- Mba III Investment Management (14mbafm303) SolutionDocumento55 pagineMba III Investment Management (14mbafm303) Solutionjanardhanvn83% (6)

- INDIAN FINANCIAL SYSTEMDocumento36 pagineINDIAN FINANCIAL SYSTEMMony RrrNessuna valutazione finora

- Merchant Banking SyllabusDocumento4 pagineMerchant Banking SyllabusjeganrajrajNessuna valutazione finora

- Impact of Macroeconomic Factors On Indian Stock MarketDocumento16 pagineImpact of Macroeconomic Factors On Indian Stock MarketMohammad AmmarNessuna valutazione finora

- Portfolio Management AbstractDocumento1 paginaPortfolio Management AbstractAnnapurna Vinjamuri0% (1)

- Investment Management Unit 1Documento12 pagineInvestment Management Unit 1Fahadhtm MoosanNessuna valutazione finora

- Topics On FinanceDocumento3 pagineTopics On FinancePintoo Kumar GuptaNessuna valutazione finora

- Investors' Perceptions Towards Mutual FundsDocumento3 pagineInvestors' Perceptions Towards Mutual Fundssaurabh dixitNessuna valutazione finora

- RNSTE Management NotesDocumento71 pagineRNSTE Management Notesantoshdyade100% (1)

- Project Dissertation on Portfolio ManagementDocumento50 pagineProject Dissertation on Portfolio ManagementAshish BaniwalNessuna valutazione finora

- Banking & Insurance ManagementDocumento2 pagineBanking & Insurance ManagementVishal Mandowara100% (1)

- Understanding Investors and Equity MarketsDocumento81 pagineUnderstanding Investors and Equity Marketschaluvadiin100% (2)

- 20773d1259766411 Financial Services M y Khan Ppts CH 1 NBFC M.y.khanDocumento54 pagine20773d1259766411 Financial Services M y Khan Ppts CH 1 NBFC M.y.khanPriyanka VashistNessuna valutazione finora

- A Study On Mergers and Acquisitions of Indian Banking SectorDocumento9 pagineA Study On Mergers and Acquisitions of Indian Banking SectorEditor IJTSRDNessuna valutazione finora

- Central Bank InterventionDocumento31 pagineCentral Bank InterventionmilktraderNessuna valutazione finora

- A Comparision Between Bse and Nasdaq (Kshitij Thakur)Documento35 pagineA Comparision Between Bse and Nasdaq (Kshitij Thakur)Kshitij Thakur0% (1)

- Financial DerivativesDocumento15 pagineFinancial DerivativesSai Ragini RamachandranNessuna valutazione finora

- Finance Function in Global Business ScenarioDocumento3 pagineFinance Function in Global Business Scenarioarjunga50% (2)

- Investment Banking & Financial Services IDocumento407 pagineInvestment Banking & Financial Services Iapi-371582583% (18)

- Structure of Indian Financial SystemDocumento14 pagineStructure of Indian Financial SystemAnamik vermaNessuna valutazione finora

- National Stock Exchange: Presented by Benson Berlin Jinshy Pranav PunyaDocumento14 pagineNational Stock Exchange: Presented by Benson Berlin Jinshy Pranav Punyapranav sharmaNessuna valutazione finora

- Mutual Fund Question BankDocumento3 pagineMutual Fund Question BankarunvklplmNessuna valutazione finora

- A Study of Investment Preferences of InvestorsDocumento8 pagineA Study of Investment Preferences of InvestorsHarshNessuna valutazione finora

- 5011 Merchant Banking and Financial Services: Iii Semester/Ii Year BaDocumento18 pagine5011 Merchant Banking and Financial Services: Iii Semester/Ii Year Bas.muthuNessuna valutazione finora

- Portfolio Construction Models Risk ReturnDocumento40 paginePortfolio Construction Models Risk ReturnjitendraNessuna valutazione finora

- SAPM Full NotesDocumento305 pagineSAPM Full NotesDeeKsha BishnoiNessuna valutazione finora

- Equity Research Fundamental and Technical Analysis and Its Impact On Stock Prices With Reliance MoneyDocumento81 pagineEquity Research Fundamental and Technical Analysis and Its Impact On Stock Prices With Reliance MoneyRs rs100% (2)

- Module 3 - Management of Financial Services Housing Finance: GenesisDocumento12 pagineModule 3 - Management of Financial Services Housing Finance: GenesisSiji SundaranNessuna valutazione finora

- Fundamental Analysis AssignmentDocumento2 pagineFundamental Analysis Assignmentayushmanepal100% (1)

- Introduction To Risk and ReturnDocumento59 pagineIntroduction To Risk and ReturnGaurav AgarwalNessuna valutazione finora

- Uti Mutual Fund Project 2022Documento45 pagineUti Mutual Fund Project 2022Anuja DekateNessuna valutazione finora

- Bond Valuation NTHMCDocumento24 pagineBond Valuation NTHMCAryal LaxmanNessuna valutazione finora

- Chapter 1 Part 1 Investment Speculation GamblingDocumento29 pagineChapter 1 Part 1 Investment Speculation GamblingNAVEEN GARG100% (1)

- Upon Completion of This Course, The Student Should Be Able ToDocumento3 pagineUpon Completion of This Course, The Student Should Be Able ToShivam GuptaNessuna valutazione finora

- Security Analysis SyllabusDocumento2 pagineSecurity Analysis SyllabusTaksh DhamiNessuna valutazione finora

- Syllabus 4th SemDocumento23 pagineSyllabus 4th Semsagar09100% (1)

- Security Analysis and Portfolio ManagementDocumento1 paginaSecurity Analysis and Portfolio ManagementFranky CnuNessuna valutazione finora

- Mcom Semester IIIDocumento11 pagineMcom Semester IIIuma deviNessuna valutazione finora

- The Objective of This Course Is To Impart The Knowledge On Basic Aspects of Security Analysis and Portfolio ManagementDocumento3 pagineThe Objective of This Course Is To Impart The Knowledge On Basic Aspects of Security Analysis and Portfolio ManagementvijayageetaNessuna valutazione finora

- Investment ManagementDocumento28 pagineInvestment ManagementseemaagiwalNessuna valutazione finora

- 4ca62security Analysis & PortfolioDocumento1 pagina4ca62security Analysis & PortfolioAkhil VijayNessuna valutazione finora

- Investment ManagementDocumento3 pagineInvestment Management29_ramesh170Nessuna valutazione finora

- Moam - Info Financial Management 10dba341 Financial Derivative 5a30a3e61723ddd5c9583218Documento13 pagineMoam - Info Financial Management 10dba341 Financial Derivative 5a30a3e61723ddd5c9583218Manish MakwanaNessuna valutazione finora

- PG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDocumento166 paginePG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDeeNessuna valutazione finora

- Analyze investments and build optimal portfoliosDocumento3 pagineAnalyze investments and build optimal portfoliosramakrishnanNessuna valutazione finora

- Security Analysis Syllabus IBSDocumento2 pagineSecurity Analysis Syllabus IBSnitin2khNessuna valutazione finora

- Mba - FT & PTDocumento7 pagineMba - FT & PTNawin KumarNessuna valutazione finora

- Joseph Anbarasu, ASUDocumento19 pagineJoseph Anbarasu, ASUNeelam PandeyNessuna valutazione finora

- Exim Policy-2009-2014Documento16 pagineExim Policy-2009-2014Viral ShahNessuna valutazione finora

- The Role of A CAMEL Downgrade Model in Bank Surveillance: Working Paper SeriesDocumento34 pagineThe Role of A CAMEL Downgrade Model in Bank Surveillance: Working Paper SeriesRohit JaiswalNessuna valutazione finora

- Foreign Trade Policy 2009-2014Documento112 pagineForeign Trade Policy 2009-2014shruti_siNessuna valutazione finora

- Clearance Procedures for ImportsDocumento36 pagineClearance Procedures for ImportsNina Bianca Espino100% (1)

- About Ushar & Zakat 000000000000034 PDFDocumento3 pagineAbout Ushar & Zakat 000000000000034 PDFsyed Muhammad farrukh bukhariNessuna valutazione finora

- The Little Black Book of Copywriting SecretsDocumento30 pagineThe Little Black Book of Copywriting SecretsJeeva2612100% (27)

- Exercises (Time Value of Money) : TH TH THDocumento2 pagineExercises (Time Value of Money) : TH TH THbdiitNessuna valutazione finora

- Time Value - Future ValueDocumento4 pagineTime Value - Future ValueSCRBDusernmNessuna valutazione finora

- Exam 3 Practice Exam, Econ 204, Fall 2019Documento10 pagineExam 3 Practice Exam, Econ 204, Fall 2019abdulelahaljaafariNessuna valutazione finora

- Cash Flow Final PrintDocumento61 pagineCash Flow Final PrintGeddada DineshNessuna valutazione finora

- Topic No 2Documento2 pagineTopic No 2javeria nazNessuna valutazione finora

- Co Operative BankingDocumento11 pagineCo Operative BankingMahesh VermaNessuna valutazione finora

- Tgs Kelompok Ganda Kasus 3Documento18 pagineTgs Kelompok Ganda Kasus 3GARTMiawNessuna valutazione finora

- What is a continuing guaranteeDocumento9 pagineWhat is a continuing guaranteeSuchitra SureshNessuna valutazione finora

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocumento3 pagineINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoice2018hw70285Nessuna valutazione finora

- 1 William Henry Scott - Prehispanic Filipino Concepts of Land Rights PDFDocumento10 pagine1 William Henry Scott - Prehispanic Filipino Concepts of Land Rights PDFRamon Guillermo100% (1)

- Cortazar Schwartz Naranjo 2007Documento17 pagineCortazar Schwartz Naranjo 2007carreragerardoNessuna valutazione finora

- 10 Grammar Empower. PassiveDocumento1 pagina10 Grammar Empower. PassiveMariola Buendía VivoNessuna valutazione finora

- NBFC MCQ QuizDocumento2 pagineNBFC MCQ QuizZara KhanNessuna valutazione finora

- Benefits Administration - 1Documento34 pagineBenefits Administration - 1vivek_sharma13Nessuna valutazione finora

- TVM Sums & SolutionsDocumento7 pagineTVM Sums & SolutionsRupasree DeyNessuna valutazione finora

- CEO CFO CertificationDocumento30 pagineCEO CFO CertificationAbhishek GhoshNessuna valutazione finora

- Business Partner Model - UlrichDocumento7 pagineBusiness Partner Model - UlrichDiego Mansilla0% (1)

- 2 Philippine Financial SystemDocumento11 pagine2 Philippine Financial SystemSTELLA MARIE BAUGBOGNessuna valutazione finora

- Lincoln Heights Presentation: 2021-GE AviationDocumento18 pagineLincoln Heights Presentation: 2021-GE AviationWVXU NewsNessuna valutazione finora

- Currency DerivativesDocumento17 pagineCurrency DerivativesRimjhimNessuna valutazione finora

- The California Fire Chronicles First EditionDocumento109 pagineThe California Fire Chronicles First EditioneskawitzNessuna valutazione finora

- Pepsi PaperDocumento6 paginePepsi Paperapi-241248438Nessuna valutazione finora

- Topic 4 AnnuityDocumento22 pagineTopic 4 AnnuityNanteni GanesanNessuna valutazione finora

- 1 Use Worksheet 11 1 To Determine Whether The Woodsons HaveDocumento2 pagine1 Use Worksheet 11 1 To Determine Whether The Woodsons Havetrilocksp SinghNessuna valutazione finora

- Real Estate Finance and TransactionsDocumento60 pagineReal Estate Finance and TransactionsMelanie FernandezNessuna valutazione finora

- Project Management Concepts And ClassificationDocumento29 pagineProject Management Concepts And Classificationankitgupta16Nessuna valutazione finora

- 3-Import ExportDocumento13 pagine3-Import ExportStephiel SumpNessuna valutazione finora

- The Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World IndustryDa EverandThe Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World IndustryValutazione: 4.5 su 5 stelle4.5/5 (40)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Self-Discipline: The Ultimate Guide To Beat Procrastination, Achieve Your Goals, and Get What You Want In Your LifeDa EverandSelf-Discipline: The Ultimate Guide To Beat Procrastination, Achieve Your Goals, and Get What You Want In Your LifeValutazione: 4.5 su 5 stelle4.5/5 (661)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- Leading Product Development: The Senior Manager's Guide to Creating and ShapingDa EverandLeading Product Development: The Senior Manager's Guide to Creating and ShapingValutazione: 5 su 5 stelle5/5 (1)

- The Goal: A Process of Ongoing Improvement - 30th Aniversary EditionDa EverandThe Goal: A Process of Ongoing Improvement - 30th Aniversary EditionValutazione: 4 su 5 stelle4/5 (684)

- Kanban: A Step-by-Step Guide to Agile Project Management with KanbanDa EverandKanban: A Step-by-Step Guide to Agile Project Management with KanbanValutazione: 5 su 5 stelle5/5 (6)

- Process!: How Discipline and Consistency Will Set You and Your Business FreeDa EverandProcess!: How Discipline and Consistency Will Set You and Your Business FreeValutazione: 4.5 su 5 stelle4.5/5 (5)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsDa EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNessuna valutazione finora

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthDa EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNessuna valutazione finora

- Project Planning and SchedulingDa EverandProject Planning and SchedulingValutazione: 5 su 5 stelle5/5 (6)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- Working Backwards: Insights, Stories, and Secrets from Inside AmazonDa EverandWorking Backwards: Insights, Stories, and Secrets from Inside AmazonValutazione: 4.5 su 5 stelle4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- PMP Exam Prep: How to pass the PMP Exam on your First Attempt – Learn Faster, Retain More and Pass the PMP ExamDa EverandPMP Exam Prep: How to pass the PMP Exam on your First Attempt – Learn Faster, Retain More and Pass the PMP ExamValutazione: 4.5 su 5 stelle4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorDa EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNessuna valutazione finora

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Da EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Valutazione: 4.5 su 5 stelle4.5/5 (86)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)