Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

3561 - Exercise On Cash Flows

Caricato da

Tanu SharmaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

3561 - Exercise On Cash Flows

Caricato da

Tanu SharmaCopyright:

Formati disponibili

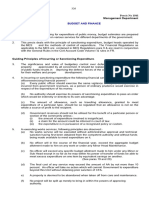

Balance Sheet Current Yr. Previous Yr.

Sources of funds Paid up share capital 400 300 General reserve 800 650 Securities premium 700 600 Profit and Loss account 45 340 Long-term loans 1250 1450 Short-term loans 650 400 TOTA SOURCES 3845 3740 Application of funds Fixed assets: Gross block 4500 4050 Less: Accumulated depreciation 2250 1850 Net Block 2250 2200 Investments: Long-term 840 1050 Short-term (less than 3 months) 330 75 Current Assets, Loans and Advances Inventories 370 175 Debtors 320 255 Cash and bank balances 55 90 Prepaid expenses 25 50 Advance tax 555 370 Other loans and advances 325 350 Total current assets, loans and advances 1650 1290 Less: Current Liabilities & provisions: Sundry creditors 350 225 Provision for tax 525 350 Proposed dividend 350 300 Total current liabilities & provisions 1225 875 Net current assets 425 415 TOTAL APPLICATIONS 3845 3740 Prepare cash flow statement for the current year.

Profit & Loss Account INCOME Sales Interest income Dividend income Stock adjustment TOTAL EXPENDITURE Raw materials consumed Manufactring costs Depreciation Other operating costs Interest expenses TOTAL PBT Provision for tax PAT Balance b/f from last year Profit available for appropriation Transfer to reserve Proposed dividend(incl. tax) Balance carried to Balance Sheet

Current Yr. Previous Yr. 4250 75 65 25 4415 2050 850 400 550 185 4035 380 175 205 340 545 150 350 45 3320 85 90 -30 3465 1250 550 350 500 200 2850 615 225 390 350 740 100 300 340

Cash flow from Operating Activities: PBT Add: Interest expenses Depreciation Less: Interest income Dividend income Cash flow before wc adjustment and tax Working capital adjustments: Inventories Debtors Prepaid expenses Sundry Creditors Net WC adjustments Operating cash flows before tax Tax paid Cash flows from operating activities after tax Cash flows from Investing Activities Purchase of fixed assets Sale of long-term investments Realisation of loans and advances Interest received Dividend received Net cash used in investing activities Cash flows from Financing Activities Proceeds of issue of shares Repayment of long-term borrowing (net) Raising of short-term borrowing (net) Interest paid Dividend paid Net cash used in financing activities Net increase in cash and cash equivalents Opening balance of cash and cash equivalents Closing balance of cash and cash equivalents CHECK

380 185 400 75 65

585

-140 825

-195 -65 25 125 -110 715 -185 530 -450 210 25 75 65 -75 200 -200 250 -185 -300 -235 220 165 385 385

Consider the Balance Sheet of XYZ Ltd. as on 31 December, 2000 (figs in Rs. lacs) 31.12.200031.12.1999 Sources of Fund Shareholders funds Share Capital( equity shares of Rs.10 each) 2500 2000 Reserves and Surplus: General Reserve 650 500 Share Premium 900 400 Profit & Loss Balance 420 250 Loan Funds 14% Secured Debentures 100 200 Long-term Borrowings from Banks 650 300 Cash Credit 280 200 Total Sources 5500 3850 Application of Funds Fixed Assets: Gross Block 4300 2650 Less: Accumulated Depreciation 1775 1250 Net Block 2525 1400 Capital-work-in-progress 775 450 Investments: Long-term 625 455 Short-term (less than three months) 245 225 Current Assets, Loans and Advances: Inventories: Raw materials 415 550 Semi-finished goods 225 195 Finished goods 180 225 Sundry Debtors 645 465 Cash and Bank balances 145 156 Advance Tax 365 225 Other Loans and Advances 485 259 Less: Current Liabilities and Provisions: Sundry Creditors 350 225 Provision for tax 340 200 Proposed Dividend 400 300 Tax on dividend 40 30 Net Current Assets 1330 1320 Total Applications 5500 3850 Other Information: (a) During the year XYZ Ltd. acquired Zed Ltd. for a consideration of Rs.1000 Lacs. The following assets and liabilities of the transferor company are incorporated in the Balance Sheet of XYZ Ltd. : Rs. Lacs Fixed Assets 1025 Finished goods inventory 50 Sundry Debtors 150 Sundry Creditors 75 Long-tem Bank Loan 150 Net assets taken over 1000 (b) The purchase consideration is discharged as below: Equity shares of Rs. 10 each at a premium of Rs.10 500

Cash 500 Total purchase consideration 1000 (c) Debentures of Rs.100 lacs were converted into equity shares at par. (d) Profit on sale of fixed assets 50 (e) Depreciation charged to Profit and Loss statement for600 year the (f) Interest paid during the year 145 (g) Interest received 65 (h) Dividend received 40 (I) Assessment of tax for the last year is not yet done. (j) Sale proceeds of fixed assets 150 Prepare cash flow statement of XYZ Ltd. for the year 2000.

ing assets and liabilities of

Cash Flow Statement for the year ended 31 December, 2000 (figs in Rs. lacs) Cash Flows from Operating Activities Increase in Profit and Loss balance 170 Increase in General Reserve balance 150 Add: Depreciation 600 Interest paid 145 Provision for taxation 140 Proposed dividend (inclusive of dividend tax) 440 1325 Less: Profit on sale of fixed assets 50 Interest income 65 Dividend income 40 155 Operating profit before working capital changes 1490 Adjustment for working capital changes (Note 1): Decrease in raw materials inventory 135 Increase in semi-finished goods -30 Decrease in finished goods inventory 95 Increase in Sundry Debtors -30 Increase in Sundry Creditors 50 220 Cash generated from operations 1710 Income tax paid 140 Net cash flows from operating activities 1570 Cash Flows from Investing Activities Acquisition of fixed assets(Note 2) -800 Sale proceeds of fixed assets 150 Investment in capital-work-in-progress -325 Long-term investments in shares and securities -170 Interest received 65 Dividend received 40 Loans and advances given to third parties -226 Purchase consideration paid in cash -500 Net cash used in Investing activities -1766 Cash Flows from Financing Activities Proceeds out of fresh issue of shares at premium for cash, including premium (Note 5,6) 400 Raising of long-term bank borrowings (Note 7) 200 Raising of cash credit 80 Interest paid -145 Dividend paid (inclusive of dividend tax) -330 Net cash flows from financing activities 205 Net increase in cash and cash equivalents 9 Cash and cash equivalents at the beginning of the year 381 Cash and cash equivalents at the end of the year 390 Note 1. Working capital changes RM Position as on 31 December, 2000 Less: Taken over from Zed Ltd. on acquisition of the company Less: Position as on 31 December, 1999 Increase/ Decrease(-) in position

WIP 415 550 -135 225 195 30

FG 180 50 225 -95

Debtors 645 150 465 30

2. Acquisition of Fixed Assets Balance as reported in Balance Sheet as on 31 December,1999 2650 Add: Taken over from Zed Ltd. on acquisition of the company 1025

Less: Cost of fixed assets sold (Note 3) 175 Net position 3500 Fresh purchases during the year(balancing figure ) 800 Balance as reported in balance Sheet as on 31 December,2000 4300 3. Cost of Fixed Assets Sold Sale proceeds of fixed assets Less: Profit on sale of fixed assets Written down value of assets sold Add: Accumulated depreciation on assets sold (Note 4) Cost of fixed assets sold

150 50 100 75 175

4. Accumulated Depreciation on Assets Sold Accumulated depreciation balance as on 31 December,1999 1250 Add: Depreciation charged during the year 600 Less: Accumulated depreciation on asset sold( balancing figure) 75 Accumulated depreciation balance as on 31 December,2000 1775 5. Cash Proceeds out of Share Issue Balance of paid up share capital as on 31 December, 1999 2000 Add: Issued to the shareholders of Zed Ltd.as part of purchase consideration 250 Add: Issued to debentureholders on conversion 100 Fresh issue during the year for cash consideration (balancing figure) 150 Balance of paid up share capital as on 31 december, 2000 2500 6. Realisation of Share Premium Balance as on 31 December,1999 Add: Premium on issue of shares to the shareholders of Zed Ltd. Premium on fresh issue of shares for cash (balancing figure) Balance as on 31 December,2000 7. Raising of Long-term Loan Balance as on 31 December, 1999 Add: Acquired from Zed Ltd. Fresh loans raised during the year (balancing figure) Balance as on 31 December,2000

400 250 250 900

300 150 200 650

Creditors 350 75 225 50

3. Consider the following Balance Sheet of ABC Ltd (all figures in Rs. Million)

Balance Sheet as on 31 March, 2004 31 March, 2003

Sources of Funds Shareholders Funds: Paid-up Share Capital (Equity shares of Rs. 10 each) 500 500 Reserves and Surplus 1350 1100 Loan Funds: Secured Loan 1550 1250 Unsecured Loan 635 720 TOTAL 4035 3570 Applications of Funds Fixed Assets: Gross Block 3275 2580 Less: Accumulated Depreciation 1675 1325 Net Block 1600 1255 Capital work-in-progress 745 540 Investment 975 1250 Current Assets: Inventories 445 350 Sundry Debtors 350 185 Prepaid expenses 55 85 Cash and Bank Balances 125 210 Total Current Assets 975 830 Current Liabilities & Provisions: Sundry Creditors 150 165 Payables 85 105 Provision for tax 25 35 Total Current Liabilities & Provisions 260 305 Net Current Assets 715 525 TOTAL 4035 3570 Other information: (a) An equipment (original cost Rs.100 million) with a book value of Rs.45 million was sold for Rs.60 million. The profit on sale was credited to capital reserve. (b) Investment includes short-term investment (less-than three months duration) of Rs.115 million (previous year Rs.85 million) (c) Provision for tax is net of advance tax of Rs.145 million (previous year Rs.140 million) (d) Excerpts from Profit & Loss Account for the year 2003-2004 2002-2003 Profit before depreciation, interest and taxes (PBDIT) 1145 1025 Depreciation 415 285 Interest 165 175 Profit before tax 565 565 Provision for tax 170 175 (e) PBDIT includes interest and dividend income of Rs. 105 million (previous year Rs. 135 million) (f) During the year 2003-2004, assessment of income tax for the previous year was completed. Final gross tax liability for the year 2002-2003 was assessed at Rs.185 million. The balance of tax was paid in the current year. and included in advance tax. (g) Interest paid during the year Rs.160 million. Prepare cash flow statement of ABC Ltd. for the year 2003-2004.

4. Consider the following financial statements of XYZ Ltd (all figures in Rs. Million)

Balance Sheet as on

31 March, 2004 31 March, 2003 Sources of Funds Shareholders Funds: Paid-up Share Capital (Equity shares of Rs. 10 each) 525 350 Reserves and Surplus 455 525 Loan Funds: Secured Loan 1245 765 Unsecured Loan 445 790 TOTAL 2670 2430 Applications of Funds Fixed Assets: Gross Block 2550 2245 Less: Accumulated Depreciation 885 715 Net Block 1665 1530 Capital work-in-progress 420 410 Investment 255 165 Current Assets: Inventories 175 245 Sundry Debtors 195 245 Advance tax 115 145 Cash and Bank Balances 125 45 Total Current Assets 610 680 Current Liabilities & Provisions: Sundry Creditors 110 145 Interest accrued but not due 45 55 Provision for tax 125 155 Total Current Liabilities & Provisions 280 355 Net Current Assets 330 325 TOTAL 2670 2430 Profit and Loss Account for the year ended 31 March, 2004 31 March, 2003 Sales 1875 1555 Other income 35 18 Operating expenses 1220 1090 Depreciation 170 125 Interest 155 140 Profit before tax 365 218 Provision for tax 110 70 Profit after tax 255 148 Other information: (a) During the year XYZ Ltd. issued bonus shares @1:2 by capitalizing general reserves (b) Assessment of income tax not done for the past two years. (c) Investments of Rs. 45 million was sold during the year for Rs.60 million. The profit on sale was included in other income. (d) All investments are long-term in nature. (e)Dividend/interest income received during the year was Rs.20 million. Prepare cash flow statement for the year 2003-2004.

n (previous year Rs.85 million)

x was paid in the current year.

Potrebbero piacerti anche

- Understanding Financial DerivativesDocumento6 pagineUnderstanding Financial Derivativesakhil mehtaNessuna valutazione finora

- Financial Derivatives ExplainedDocumento108 pagineFinancial Derivatives ExplainedSuryanarayanan VenkataramananNessuna valutazione finora

- Understanding Financial DerivativesDocumento6 pagineUnderstanding Financial Derivativesakhil mehtaNessuna valutazione finora

- Foreign Exchange Rat1Documento2 pagineForeign Exchange Rat1Tanu SharmaNessuna valutazione finora

- Human Resource Management 1228111818825613 8Documento44 pagineHuman Resource Management 1228111818825613 8Uday NaiduNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Order ManagementDocumento49 pagineOrder ManagementpvlnraoNessuna valutazione finora

- Vol II (E5)Documento261 pagineVol II (E5)nitinNessuna valutazione finora

- Sas 1-18Documento165 pagineSas 1-18btee2Nessuna valutazione finora

- MA CHAPTER 2 Budgeting Flexible BudgetDocumento29 pagineMA CHAPTER 2 Budgeting Flexible BudgetMohd Zubair KhanNessuna valutazione finora

- Chapter 9Documento27 pagineChapter 9Jayanthi Heeranandani100% (1)

- Acknowledgment Receipt - Loan AgreementDocumento51 pagineAcknowledgment Receipt - Loan AgreementFidelis AijouNessuna valutazione finora

- Project On Pepsico PerformanceDocumento68 pagineProject On Pepsico Performancerahul mehtaNessuna valutazione finora

- Grapevine CommunicationDocumento1 paginaGrapevine CommunicationPavan KoundinyaNessuna valutazione finora

- Retailers Perception Towards Pepsi and Coca-ColaDocumento86 pagineRetailers Perception Towards Pepsi and Coca-ColaAnni Blessy100% (5)

- Nestle SMDocumento44 pagineNestle SMMelissa ArnoldNessuna valutazione finora

- Communication Skills As On 26-10-09Documento29 pagineCommunication Skills As On 26-10-09Thakker NimeshNessuna valutazione finora

- Pragathi Bank customer satisfaction surveyDocumento15 paginePragathi Bank customer satisfaction surveySatveer SinghNessuna valutazione finora

- Topic 4 - Adjusting Accounts and Preparing Financial StatementsDocumento18 pagineTopic 4 - Adjusting Accounts and Preparing Financial Statementsapi-388504348100% (1)

- Harrison - The Peasant Mode of Production in The Work of AV ChayanovDocumento14 pagineHarrison - The Peasant Mode of Production in The Work of AV ChayanovAndrea LeónNessuna valutazione finora

- SaftaDocumento113 pagineSaftabhaskargntNessuna valutazione finora

- Fit Four v. Raww - ComplaintDocumento19 pagineFit Four v. Raww - ComplaintSarah BursteinNessuna valutazione finora

- HDMF Loan Application FormDocumento2 pagineHDMF Loan Application FormAmz Sau Bon100% (1)

- Key Performance Indicators MST NDocumento14 pagineKey Performance Indicators MST NmscarreraNessuna valutazione finora

- Prelim Exam - Attempt Review (Page 2 of 50)Documento1 paginaPrelim Exam - Attempt Review (Page 2 of 50)christoper laurenteNessuna valutazione finora

- Basics of EntrepreneurshipDocumento51 pagineBasics of EntrepreneurshipGanesh Kumar100% (1)

- The Procurement Alignment FrameworkDocumento8 pagineThe Procurement Alignment FrameworkZhe TianNessuna valutazione finora

- General Liability QuestionnaireDocumento2 pagineGeneral Liability QuestionnaireKenny LeBlancNessuna valutazione finora

- NCNDA Contract - OriginalDocumento4 pagineNCNDA Contract - OriginalArun AnandarajNessuna valutazione finora

- Exim PolicyDocumento5 pagineExim PolicyRavi_Kumar_Gup_7391Nessuna valutazione finora

- ISO 9001 For Hammer Strength Fitness ClubDocumento9 pagineISO 9001 For Hammer Strength Fitness Clubsayem.unicertNessuna valutazione finora

- Process Design AssignmentDocumento2 pagineProcess Design Assignmentcarlme012132100% (5)

- Liberty Offshore Investment PlanDocumento8 pagineLiberty Offshore Investment PlanMariusHiggsNessuna valutazione finora

- AMEREX Stainless Steel ShapesDocumento9 pagineAMEREX Stainless Steel ShapesCharlie HNessuna valutazione finora

- Syllabus PGDM PDFDocumento56 pagineSyllabus PGDM PDFKiran SNessuna valutazione finora

- Supreme Court Decision on Certification Election for Bank Employees UnionDocumento19 pagineSupreme Court Decision on Certification Election for Bank Employees UnionFD BalitaNessuna valutazione finora