Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

RH 5 Year Assumptions-October 2011

Caricato da

The News-HeraldTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

RH 5 Year Assumptions-October 2011

Caricato da

The News-HeraldCopyright:

Formati disponibili

1 October 27, 2011

Richmond Heights Local School District Cuyahoga County Assumptions for the Five-Year Forecast Fiscal Years Ending June 30, 2012 through 2016

The assumptions given for the Five Year Forecast for fiscal years 2012 through 2016 are conservative estimations of revenues and expenditures, as they affect the financial concerns of the Richmond Heights Local School District, Cuyahoga County. They serve as an indication of district finances and the opportunity of the Governing Board to address needs to meet financial responsibility.

REVENUE ASSUMPTIONS: Line 1.010, 1.020, 1.050 Taxes and State Reimbursements Current year 2012 Real estate taxes, personal property taxes and the property tax allocation (state rollbacks of 10%, and homestead exemption of 2.5%) are being projected based on the current Schedule A as follows: Per the Schedule A: Residential/Agricultural Commercial/Other Public Utility Tangible General Personal Total Valuation $181,742.850 62,921,480 2,230,650 00,000 $ 246,984,980

A new certification from the Ohio Department of Taxation is anticipated on or about December 15, 2011. No additional reductions in taxable values are anticipated with the new certification. The district did receive an increase in valuation of .157% or $390,230 due to growth in Residential/Agricultural properties. Real Estate revenues are assumed at $8,527,957 for fiscal year 2012. Current certification from the Cuyahoga County Auditor is reflective of this assumption, and is based at 89.5% of collection. The district currently has a large number of foreclosures and tax delinquencies in the Richmond Heights School District. As of June 30, 2011, the district had $3,480,364.70 accumulated delinquencies to the General Fund and $37,476.87 accumulated delinquencies to the Permanent Improvement Fund.

The Richmond Heights Board of Education currently has forty-three residential and two commercial tax complaints pending with the Cuyahoga County Board of Revisions. The district also has four commercial property tax complaints, for prior periods, in various stages of appeal. No assumed revenues are projected on the delinquent taxes of record. If the district is fortunate to receive delinquent tax revenues, it will be used to support the bottom line. Other tax revenues are projected based on assessed values and effective rates of taxation. The Tangible Personal Property Tax revenue is being phased out in the State of Ohio. It is anticipated that $14,500 will be received in fiscal year 2012. Future Years A 1% trend increase is estimated for real estate taxes for 2013 through 2016. The additional 1% growth is anticipated for new construction and inside millage in the Richmond Heights area. The district does have a number of buildable sites available for new construction; however, with the stale economy for housing, historical trends are being projected with this submission, and no new construction parcels anticipated. Tangible Personal Property Taxes will be in the last year of collection in 2013. It is anticipated that $5,000 will be received during that fiscal period. The State of Ohio will distribute hold harmless funds in reimbursement to the district, for the loss of this revenue as a local tax source. (See line 1.04). Line 1.035, 1.040 State Funding (Restricted and Unrestricted Grants) Current Year 2012 State Foundation income is the most volatile area of this forecast. Annual district funding is dependent on many variables. These variables include: Biennial state funding legislation, student enrollment and attendance as measured during one full week in October, special education status of students, transportation and student full-time equivalency with other state and charter schools. Basic State Foundation is stated at $969,029. Basic State Foundation is supported in the State of Ohio biennium budget (HB153). The guarantee program that the district had operated under since November 2008 will no longer support the district. The effect on the Richmond Heights Board of Education will be a loss of $260,260 in fiscal year 2012, and an increase in Basic State Aide funding of $71,007 in fiscal year 2013.

ARRA subsidy is no longer a revenue source for the 2012-2016 fiscal years. The district realized a net loss of $103,163 from the 2011 to the 2012 fiscal periods. HB153 also addressed the receipt of Tangible Personal Property and Utility Reimbursements received through the State of Ohio. Richmond Heights School loss is capped at 20% of its Tangible Personal Property Replacement fund, or a loss of $222,398.40 in fiscal year 2012. The district files and receives state reimbursement for catastrophic aide reimbursement on behalf of special education expenses over the state threshold. This reimbursement is based on the actual special education expenditures of fiscal year 2011, it is anticipated that $73,000 in revenue will be realized in the second state settlement of May of 2012. Future Years The district anticipates an additional $71,007 state funding for fiscal year 2013. Basic State Aide will be $1,040,036. This will be the final year of the biennium period. The State of Ohio is researching a new funding formula for basic state aide to schools. It is not known at this date, what that formula will look like and if the effects will be positive or negative to the Richmond Heights School District. The assumption of no change in basic state aide is assumed for fiscal years 2014 through 2016. State Foundation revenues for fiscal years 2013 to 2016 are presented at $1,040,036. A decrease in State funding equal to one percent of the School Districts foundation revenue would decrease Unrestricted State Grants-inAid by $10,400.36 for fiscal year 2013 and each year thereafter. In accordance to HB153, the phase out of Tangible Personal Property Replacement funds will be an additional 2% per year phase out until final phase out. A 2% loss is assumed for fiscal year 2013 and forward. Catastrophic aide reimbursement is considered at $70,000 for fiscal year 2013. There is no assumption for continued catastrophic aide reimbursement after fiscal year 2013. No Federal support through ARRA Stimulus funds. No funding through the Education Jobs Fund. Line 1.060 Other Revenue Current Year 2012

All other revenue sources are estimated by the Treasurer based upon historical and current trend data. These items include class fees, tuition income, refunds and interest income. Student fee collections are being addressed early in the school year in order to deter delinquencies and uncollected fees. The poverty index in Richmond Heights Schools is 58%. HB1 grants a fee waiver to those students in the poverty index and receiving free lunch. Interest rates are down with the state of the economy and minimal cash flow available for termed investments. The amount of $240,000 is anticipated in fiscal year 2012. This amount includes $26,000 in anticipated revenues for the pay-toparticipate program initiated in fiscal 2010. Students participating in programs are required to pay $100 per student per activity. Maximum per family is $1,000 for the school year. Future Years Restoring local revenues to previous levels for fiscal years 2013, 2014, 2015 and 2016 are projected. It is recommended that the Board address increases to tuition cost, classroom fees, and student activity participation fees to offset projected deficits. Line 2.04 Operating Transfers in Current Year 2012 None are planned. Future Years None are planned. Line 2.05 Advances - In Current Year 2012 The district anticipates the return of $56,194 to the general fund in fiscal year 2012, as repayment from other funds that were advanced in previous fiscal years. Future Years The district anticipates the return of $45,000 will be received to the General Fund in fiscal year 2013, 2014, 2015 and 2016. This number is an estimate only, and is subject to change based on activities within the district for each school year.

Federal Support Current Year 2012 The district will receive no Federal Support to operations in fiscal year 2012. Future Years The district will receive no Federal Support to operations in fiscal year 2013 2016. EXPENDITURE ASSUMPTIONS Line 3.010 - Salaries Current Year 2012 Salaries are based on current year contracts of district staff. This includes administrative, certificated, classified, substitute and supplemental salaries. The district did reduce two teaching staff members for fiscal 2012. One staff member is paid by a grant fund that does not affect the forecast. One staff member is General Fund, resulting in a $76,716. In total the district anticipates a savings of $169,325.64 due to staffing changes and administration shifts in 2012. Salaries are $5,333,550 and are based on a 0.00% increase in wages. Incremental changes are included in the projection. The Richmond Heights Education Association, representing certificated and classified employees, is currently operating under a one year contract, expiring August 2012. The last salary increase given to staff was a 2.00% in May 2011, retroactive to the beginning of the 2010-2011 school year. Future Years No additional staffing is included in this projection. Salary increases for 2013, 2014, 2015 and 2016 are reflected as 0.00% increase to the base. A 2.00% increase has been assumed for step increments only. The November 8, 2011 election will address Senate Bill 5 on a statewide level. Voters will be asked to approve or deny a state-wide change to educator contracts, which will have a dramatic effect on how all school districts do business in future years. SB5 is not assumed or considered in this projection. Following that election, the forecast is subject to revision for fiscal year 2013 and forward, as future years could be addressed in revised salary schedules and employee benefits.

Line 3.020 - Benefits Current Year 2012 The current years appropriations reflect current health insurance rates, STRS, SERS, Medicare, Workers Compensation and unemployment. Employee benefits are projected at $2,009,016. The projection includes 16.76% of projected salaries for retirement, Medicare Tax and Workers Compensation. Health care costs are based on current premium for medical, dental, vision, prescription drugs and life insurance as members of the Lake County Healthcare Consortium. The total anticipated cost of health and life insurances is $1,115,113.58 for fiscal 2012. The district received a 12.52% renewal increase in health care rates for the 2012 fiscal year. Life insurance premium rates are based on $50,000 term and accidental death and dismemberment coverage on all non-administrative staff at the cost of $72 per year per staff member. Life insurance premium rates of based on $200,000 term and accidental death and dismemberment coverage is provided for all administrative staff at the cost of $288 per year per administrative staff member.

Future Years Benefits are calculated based upon the respective percentages for STRS, SERS, Medicare and Workers Compensation. Medical, dental, vision and prescription drug insurance is projected with a trend of 10% premium increase to current year rates. Life insurance rates are fixed for three years based on the most recent contract with the Lake County Healthcare Consortium. Line 3.030 Purchased Services Current Year 2012 The current years appropriation reflects costs for purchased services at $4,216,961. There are no federal funds anticipated to help offset these costs in fiscal year 2012. Purchased service costs are made up of a variety of subcategories which include utilities, insurances, legal fees, Educational Service Center contracts, special education services, special education placements, and out of district tuition. The district contracts with the Educational Service Center of Cuyahoga County for all its special education administration, special education

instruction and for its security services. The district contract with the ESC is currently anticipated to run $78,431.85 over budget for fiscal year 2012. The district enrollment declined by 69 students in grades K-12 from the same period in 2011. The district has a number of students who choose open enrollment options in other school districts in the area. Richmond Heights Schools will be expending an additional $161,700 to support tuition deductions for open enrollment students in fiscal 2012. Special Education costs continue to increase in the district as new special needs students are enrolled.

Future Years Purchased Services are projected at $4,215,000 for fiscal 2013 through 2016. It is the assumption that the district will continue to operate in the same fashion through future years. No reductions to purchased services are anticipated at this time. It is probable that costs would actually exceed what is being anticipated as of this date. Line 3.040 - Materials and Supplies Current Year 2012 Materials and Supplies represent 3.03% of the total operating appropriations and spending plan. The amount of $378,000 is anticipated for supplies and textbooks. The Board of Education adopted and approved the purchase of new textbooks for the Elementary School in May 2011. The new textbook adoption for math and reading at the elementary level K-5 is The Houghton Mifflin Harcourt Go Math 2012 and the Houghton Mifflin Harcourt Journeys/Medallions/Portals 2010-12. The cost of the adoption was $125,000 included in the fiscal year 2012 fiscal year. Future Years Supplies and materials are anticipated to remain fixed at $293,000 for 2013, 2014, 2015 and 2016 fiscal years. No new textbook adoptions have been assumed for fiscal years 2013 through 2016.

Line 3.050 Capital Outlay Current Year 2012 Equipment purchases are anticipated at $149,954 for fiscal year 2012. This includes one replacement bus being purchased in 2012 at the bid cost of $80,046. Other equipment purchases are assumed for computer and technology replacement and upgrades. Future Years Equipment purchases are anticipated at $230,000 per year for the 2013, 2014, 2015 and 2016 fiscal years. The same assumptions for computer and technology equipment have been carried forward. Two replacement buses per year are also included at $170,000 for both buses.

Line 4.30 Other Objects For the most part, dues and fees are amounts paid to the State and County for fiscal services (Auditor and Treasurer Fees, election expenses and delinquent tax advertising). A small portion pays for items such as district memberships dues, fees and bonds (position bonds). The district anticipates expenditures of $385,000 in fiscal 2012. Cuyahoga County has established a Land Bank Assessment fee to the distribution of Real Estate Tax in support of the Board of Revisions department. This assessment fee is only on Cuyahoga County government entities, and is the only such assessment in the State of Ohio. This additional collection assessment is anticipated at $33,000 for fiscal 2012. The district received in excess of $500,000 in Federal Funds through grants, flowthrough grants and Federal free and reduced lunch subsidies in 2011. The district is required to amend its audit schedule to an annual audit. The district will incurred an audit cost of $24,800 from the independent audit firm of James G. Zupka, CPA, Inc., and review fees of approximately $4,200 from the Auditor of State Office. It is anticipated that the district will continue on annual audits from this point forward. Future Years Fiscal years 2013, 2014, 2015 and 2016 are anticipated at $385,000. The County Land Bank Assessment discussed in current year, is assumed to continue through future years.

Line 5.010 Transfers Out Current Year 2012 The district underwent a HB 264 Energy Conservation Project during the summer of 2008. The project total of $1,051,507 is under financing with Capital One. The cost savings realized to the general fund is used to make the semiannual payments of principal and interest. Funds are transferred from the General Fund (001) to the Bond Retirement Fund (002) to facilitate the payments. The payments of the project are due September 2011 and March 2012 for a total $104,430. Future Years The HB 264 Energy Conservation Project is under a fifteen (15) year repayment schedule. Payments are made semiannually. The sum of $104,430 per year has been set aside for these payments through the balance of the forecast.

OTHER LINE ITEMS Line 9.030 - Budget Reserve None. Line 9.070 Bus Purchase None. The bus purchases are addressed in line 3.050 - Capital Outlay. Line 10.010 Fund Balance June 30 Cash balances are shown in each fiscal year as gross cash. The district is operating in a cash deficit position for fiscal year 2012 through 2016. Year end encumbrances will affect the deficit cash position in a larger negative balance. At this time the Richmond Heights Board of Education has made no plans for budgetary reductions to offset the deficit. Line 13.010 and 13.020 Revenue from New Levies

No new operating funds from the passage of future levies have been assumed with this forecast.

Revision Prepared by Brenda Brcak Treasurer October 27, 2011

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- SBI Corporate Card ApplicationDocumento9 pagineSBI Corporate Card ApplicationArvindNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- PDF DocumentDocumento10 paginePDF DocumentNIKHIL DASARINessuna valutazione finora

- Business Proposal Online GroceryDocumento21 pagineBusiness Proposal Online GroceryRubyrose TagumNessuna valutazione finora

- Wireless Statement: Bill-At-A-GlanceDocumento44 pagineWireless Statement: Bill-At-A-GlanceВасилий ГорохNessuna valutazione finora

- Citibank Credit CardDocumento6 pagineCitibank Credit CardgjvoraNessuna valutazione finora

- Find Vehicle Parts EasilyDocumento44 pagineFind Vehicle Parts EasilyMohanavel KathirvelNessuna valutazione finora

- OneHub eGoberno Enrollment FormDocumento3 pagineOneHub eGoberno Enrollment FormElya Abillon100% (1)

- Rent vehicles online with an automated car rental systemDocumento4 pagineRent vehicles online with an automated car rental systemShrijan BudhathokiNessuna valutazione finora

- Available Ad SizesDocumento2 pagineAvailable Ad SizesThe Morning Journal0% (1)

- News-Herald Print Specs Ad SizesDocumento2 pagineNews-Herald Print Specs Ad SizesThe News-Herald0% (3)

- ASHLAWN - Complaint Against City of Painesville (FILED)Documento28 pagineASHLAWN - Complaint Against City of Painesville (FILED)The News-HeraldNessuna valutazione finora

- Damus Habeas Corpus PetitionDocumento21 pagineDamus Habeas Corpus PetitionThe News-HeraldNessuna valutazione finora

- Comprehensive Plan For Lake CountyDocumento3 pagineComprehensive Plan For Lake CountyThe News-HeraldNessuna valutazione finora

- Harbor Crest Childcare Academy Pao 7084Documento6 pagineHarbor Crest Childcare Academy Pao 7084The News-HeraldNessuna valutazione finora

- 1740 N. Ridge Rd. Painesville Township Lease BrochureDocumento4 pagine1740 N. Ridge Rd. Painesville Township Lease BrochureThe News-HeraldNessuna valutazione finora

- Better Flip Request For Interested BiddersDocumento1 paginaBetter Flip Request For Interested BiddersThe News-HeraldNessuna valutazione finora

- Wright v. City of EuclidDocumento18 pagineWright v. City of EuclidsandydocsNessuna valutazione finora

- Lake County Opioid Caseload 2013-PresentDocumento2 pagineLake County Opioid Caseload 2013-PresentThe News-HeraldNessuna valutazione finora

- Port Authority Letters of Interest To Replace McMahonDocumento14 paginePort Authority Letters of Interest To Replace McMahonThe News-HeraldNessuna valutazione finora

- Quilts 2018 WinnersDocumento3 pagineQuilts 2018 WinnersThe News-HeraldNessuna valutazione finora

- Willoughby Hills Ordinance 2009-10Documento2 pagineWilloughby Hills Ordinance 2009-10The News-HeraldNessuna valutazione finora

- Lake County 2018 BudgetDocumento74 pagineLake County 2018 BudgetThe News-HeraldNessuna valutazione finora

- Willoughby Hills Ordinance 2018-11Documento2 pagineWilloughby Hills Ordinance 2018-11The News-HeraldNessuna valutazione finora

- 2016 Lake County Accidental Overdose Death ReportDocumento4 pagine2016 Lake County Accidental Overdose Death ReportThe News-HeraldNessuna valutazione finora

- First Energy Resolution 2.7.18Documento2 pagineFirst Energy Resolution 2.7.18The News-HeraldNessuna valutazione finora

- Willoughby Hills Ordinance No. 2017-75Documento3 pagineWilloughby Hills Ordinance No. 2017-75The News-HeraldNessuna valutazione finora

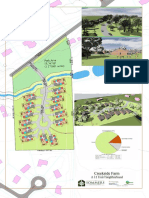

- Creekside Farm SubdivisionDocumento1 paginaCreekside Farm SubdivisionThe News-HeraldNessuna valutazione finora

- Yolimar Tirado Motion To DismissDocumento8 pagineYolimar Tirado Motion To DismissThe News-HeraldNessuna valutazione finora

- Richard Hubbard III Motion To DismissDocumento7 pagineRichard Hubbard III Motion To DismissThe News-HeraldNessuna valutazione finora

- NH Anniversary Form PDFDocumento1 paginaNH Anniversary Form PDFThe News-HeraldNessuna valutazione finora

- Jack Thompson TestimonyDocumento3 pagineJack Thompson TestimonyThe News-HeraldNessuna valutazione finora

- Amiott Disciplinary Charges Finding 8-18-17Documento5 pagineAmiott Disciplinary Charges Finding 8-18-17The News-HeraldNessuna valutazione finora

- Feral Cat Ordinance 2017 (v3)Documento5 pagineFeral Cat Ordinance 2017 (v3)Anonymous h4rj255ANessuna valutazione finora

- Lake County CCW Stats Since Law StartedDocumento14 pagineLake County CCW Stats Since Law StartedThe News-HeraldNessuna valutazione finora

- Willoughby Officer-Involved Shooting BCI Investigative SynopsisDocumento36 pagineWilloughby Officer-Involved Shooting BCI Investigative SynopsisThe News-HeraldNessuna valutazione finora

- NH Wedding Form PDFDocumento1 paginaNH Wedding Form PDFThe News-HeraldNessuna valutazione finora

- New Mentor Feral Cat LegislationDocumento7 pagineNew Mentor Feral Cat LegislationThe News-HeraldNessuna valutazione finora

- NH Engagement Form PDFDocumento1 paginaNH Engagement Form PDFThe News-HeraldNessuna valutazione finora

- Chapter-17 Solve ClassDocumento5 pagineChapter-17 Solve ClassRabina Akter JotyNessuna valutazione finora

- SOP AdeelDocumento2 pagineSOP AdeelAdeel SohailNessuna valutazione finora

- 01 Letters To ShareholdersDocumento28 pagine01 Letters To ShareholdersRisdan KristoriNessuna valutazione finora

- Virtual University Prospectus 2016-17Documento107 pagineVirtual University Prospectus 2016-17Fahad KhanNessuna valutazione finora

- Offering Letter Rakernas Federasi Karate Traditional IndonesiaDocumento7 pagineOffering Letter Rakernas Federasi Karate Traditional Indonesiadicky gustiandiNessuna valutazione finora

- Brad Boyd Brags On His Website About Learning Community Organizing and Electoral Campaigns in His Original Home of Chicago. "Documento19 pagineBrad Boyd Brags On His Website About Learning Community Organizing and Electoral Campaigns in His Original Home of Chicago. "HRCCKSNessuna valutazione finora

- Social ScienceDocumento4 pagineSocial Sciencesthandwa98mailNessuna valutazione finora

- Excell CSC Gov PH ELIGSPECIAL Elig BHW HTMLDocumento7 pagineExcell CSC Gov PH ELIGSPECIAL Elig BHW HTMLRoySantosMoralesNessuna valutazione finora

- 22 Beware of Banking Fees (B) - 703063Documento3 pagine22 Beware of Banking Fees (B) - 703063tryguy088Nessuna valutazione finora

- Key Fact Statement and MITCDocumento23 pagineKey Fact Statement and MITCSumeet ShelarNessuna valutazione finora

- Nzse International FormDocumento13 pagineNzse International FormRajvir SinghNessuna valutazione finora

- Advanced Pricing ModifiersDocumento5 pagineAdvanced Pricing Modifiersschak20Nessuna valutazione finora

- 29 - AUYONG HIAN (HONG WHUA HANG) vs. COURT OF TAX APPEALS, Et. Al. G.R. No. L-53401 November 6, 1989Documento3 pagine29 - AUYONG HIAN (HONG WHUA HANG) vs. COURT OF TAX APPEALS, Et. Al. G.R. No. L-53401 November 6, 1989Bae IreneNessuna valutazione finora

- WLSO Jan Expenses AlfonsoMendez JL22-139 USD CombinedDocumento12 pagineWLSO Jan Expenses AlfonsoMendez JL22-139 USD CombinedalfonsoNessuna valutazione finora

- Cebu Pacific - Manage BookingDocumento5 pagineCebu Pacific - Manage BookingWinnie L Lilagan100% (1)

- HandbookAndCalendar 2020 en PDFDocumento576 pagineHandbookAndCalendar 2020 en PDFGisele MallamNessuna valutazione finora

- Chart of AccountDocumento24 pagineChart of AccountHenok Teka DestaNessuna valutazione finora

- Documents Required Education Loan India - IMPDocumento15 pagineDocuments Required Education Loan India - IMPSunil RawatNessuna valutazione finora

- Online Admission System - IBA KarachiDocumento2 pagineOnline Admission System - IBA KarachiMoiz AnwarNessuna valutazione finora

- PI - KOICA-SSU Masters Degree Program in Digital Transformation TechnologyDocumento34 paginePI - KOICA-SSU Masters Degree Program in Digital Transformation TechnologyLuisito. PeNessuna valutazione finora

- Terms Conditions For Prospectus 2022Documento6 pagineTerms Conditions For Prospectus 2022Saumya KhatriNessuna valutazione finora

- Delfin English Schools Enrolment, Payment & Course InformationDocumento3 pagineDelfin English Schools Enrolment, Payment & Course InformationEmanuel WalissonNessuna valutazione finora