Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

First Home Buyers Return As Lenders Compete On Rates: National

Caricato da

economicdelusionDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

First Home Buyers Return As Lenders Compete On Rates: National

Caricato da

economicdelusionCopyright:

Formati disponibili

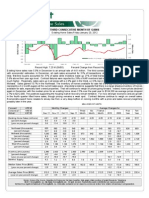

NATIONAL

FIRST HOME BUYERS RETURN AS LENDERS COMPETE ON

RATES

2 November 2011

First Home Buyers are returning to the market in greater numbers than at any time since September

2009, according to AFG, Australias largest mortgage broker. The AFG Mortgage Index shows that

First Home Buyers comprised 16.4% of all loans processed a 40% increase for this buyer category

compared to October 2010 when they comprised 11.8% of the mortgage market.

First Home Buyers were particularly active in NSW, where 21.1% of home loans were arranged for

them in October, as well as QLD (17.9%) and WA (17.3%).

More mortgage buyers opted for fixed rate loans in October than in any month since March 2008.

Fixed rate loans comprised 20.4% of all home loans processed in October dramatic growth

considering they comprised only 7.9% of home loans as recently as July 2011.

Mark Hewitt, General Manager of Sales and Operations at AFG says: Buyers are reaping the benefits

of one of the most competitive mortgage markets weve seen in years. Discounted fixed rate loans

appealed to all buyer types, but especially first home buyers and those looking to refinance. We have

been slightly surprised with the popularity of fixed rates given it has been generally predicted variable

rates would decrease and we would now expect the proportion of fixed rate loans to fall, following

the cut in variable rates announced yesterday. Non major lenders are doing increasingly well in this

environment and hopefully yesterdays news will further support a market recovery which is still in its

very early stages.

Non majors have seized more market share than at any time over the past twelve months now

comprising 21.1% of all home loans. Their products are of particular appeal to first home buyers,

where almost 30% of the market is held by non majors, as well as buyers looking to refinance, where

non majors account for a 21.2% market share.

Investment accounted for 35.6% of all new mortgages, with investors especially active in NSW

(39.2%) and Vic (38.9%) with lower levels of activity in QLD (32.9%) WA (32.2%) and SA (29.8%).

AFG has 10% of the national mortgage market (Source: ABS data and AFG figures). The companys

data is usually indicative of the data published by the ABS six weeks later. Figures for each state are

available at: www.afgonline.com.au: Corporate - News.

ENDS

CONTACT DETAILS

Mark Hewitt, AFG General Manager Sales & Operations

Mob 0414 801 251 | Tel (08) 9420 7888

David Michie, Mosaic Reputation Management

Tel

(08) 9381 4494 | Mob 0411 453 404

www.afgonline.com.au

AFG MORTGAGES SOLD

TABLE 1: ALL AUSTRALIA

MONTH

TOTAL

NUMBER

TOTAL

AMOUNT

AVERAGE SIZE

PROPERTY

INVESTORS

FIRST TIME

BUYERS

%

REFINANCE

Aug 10

Sep 10

Oct 10

Nov 10

Dec 10

Jan 11

Feb 11

Mar 11

Apr 11

May 11

June 11

July 11

Aug 11

Sep 11

Oct 11

6,269

6,157

5,891

6,619

5,472

3,583

5,365

6,436

5,489

6,483

6,205

5,937

7,198

6,687

6,349

$2,343 m

$2,335 m

$2,234 m

$2,511 m

$2,076 m

$1,310 m

$2,053 m

$2,513 m

$2,119 m

$2,517 m

$2,382 m

$2,293 m

$2,764 m

$2,633 m

$2,509 m

$373k

$379k

$380k

$379k

$379k

$365k

$382k

$390k

$386k

$388k

$384k

$386k

$384k

$393k

$395k

34.3%

34.5%

35.4%

35.1%

35.5%

34.7%

33.9%

34.7%

34.9%

36.5%

36.2%

35.6%

36.5%

37.7%

35.6%

11.7%

12.6%

11.8%

12.2%

11.4%

14.1%

14.6%

13.9%

13.9%

13.2%

12.9%

13.6%

13.8%

15.7%

16.4%

38.3%

36.8%

37.8%

38.5%

41.5%

36.1%

37.0%

36.9%

36.7%

36.8%

39.2%

39.1%

38.2%

37.9%

37.9%

MAJOR VS NON MAJOR LENDER MARKET SHARE

TABLE 2: BY BUYER T YPE

TOTAL MORTGAGES

REFINANCE

FIRST HOME BUYERS

INVESTORS

MONTH

MAJOR

NONMAJOR

MAJOR

NONMAJOR

MAJOR

NONMAJOR

MAJOR

NONMAJOR

2010 10

2010 11

2010 12

2011 01

2011 02

2011 03

2011 04

2011 05

2011 06

2011 07

2011 08

2011 09

2011 10

80.6%

80.6%

81.1%

80.7%

79.4%

81.7%

82.4%

80.4%

82.1%

81.7%

82.0%

80.1%

78.9%

19.4%

19.4%

18.9%

19.3%

20.6%

18.3%

17.6%

19.6%

17.9%

18.3%

18.0%

19.9%

21.1%

77.1%

77.3%

78.7%

77.5%

74.5%

79.0%

80.5%

78.7%

78.7%

79.8%

80.3%

78.6%

78.8%

22.9%

22.7%

21.3%

22.5%

25.6%

20.9%

19.5%

21.3%

21.3%

20.2%

19.7%

21.4%

21.2%

74.6%

77.6%

79.0%

77.1%

75.0%

79.7%

77.3%

77.1%

76.2%

77.6%

77.8%

70.7%

70.8%

25.4%

22.5%

20.9%

22.9%

24.9%

20.3%

22.8%

22.9%

23.8%

22.5%

22.2%

29.3%

29.2%

83.7%

82.9%

82.4%

82.2%

81.6%

82.2%

83.3%

83.0%

82.9%

83.0%

83.4%

82.8%

82.7%

16.3%

17.1%

17.6%

17.8%

18.4%

17.8%

16.7%

17.0%

17.0%

17.0%

16.6%

17.2%

17.3%

Majors

= Four major banks including the brands they own

Non-Majors = All other lenders

www.afgonline.com.au

AVERAGE MORTGAGE SIZE IN DOLL ARS

TABLE 3: STATE BY STATE

MONTH

2010 07

2010 08

2010 09

2010 10

2010 11

2010 12

2011 01

2011 02

2011 03

2011 04

2011 05

2011 06

2011 07

2011 08

2011 09

2011 10

AUSTRALIA

370,505

373,750

379,374

380,027

379,385

379,444

365,799

382,725

390,479

386,218

388,384

384,042

386,382

384,124

393,822

395,226

NSW

428,943

433,378

454,325

442,743

434,898

432,540

416,527

451,630

467,034

453,492

453,286

455,559

456,388

452,230

461,132

447,144

QLD

335,850

341,353

318,556

354,651

354,220

344,485

319,554

354,012

357,177

357,453

354,886

347,506

360,034

348,880

358,846

358,142

SA

288,165

305,536

300,754

315,306

305,978

324,070

301,933

321,672

309,931

315,692

302,057

294,092

318,695

323,487

325,771

329,566

VIC

356,642

360,431

354,673

359,271

359,343

370,978

349,155

346,465

360,051

363,724

379,993

362,063

388,360

382,884

383,114

396,238

WA

393,134

391,397

398,064

393,479

395,325

396,047

397,102

394,922

396,572

404,714

399,372

412,557

371,500

382,598

397,917

406,019

NT

358,630

332,643

318,556

307,661

338,145

339,641

329,902

360,971

376,348

326,205

383,786

347,725

355,855

321,164

338,159

369,765

WA

61.4%

61.6%

63.7%

64.1%

63.6%

66.8%

65.9%

65.0%

65.1%

63.8%

65.2%

66.5%

65.0%

66.4%

67.8%

NT

60.6%

59.7%

59.0%

64.2%

68.7%

66.2%

78.2%

63.1%

56.8%

66.1%

61.0%

66.0%

67.1%

62.3%

60.5%

LOAN VALUE RATIOS (loan stated as % of property value)

TABLE 4: STATE BY STATE

2010 08

2010 09

2010 10

2010 11

2010 12

2011 01

2011 02

2011 03

2011 04

2011 05

2011 06

2011 07

2011 08

2011 09

2011 10

AUSTRALIA

63.0%

63.0%

64.5%

64.2%

65.9%

65.4%

68.8%

65.8%

63.9%

65.5%

64.2%

66.3%

67.7%

66.0%

66.7%

NSW

67.0%

64.9%

67.5%

65.1%

66.2%

66.5%

69.2%

66.8%

65.4%

66.2%

64.4%

68.7%

70.1%

69.0%

70.0%

QLD

62.4%

63.3%

65.5%

64.2%

65.1%

62.8%

66.5%

65.2%

65.4%

66.0%

66.0%

66.3%

67.1%

68.9%

67.9%

SA

62.3%

63.5%

64.9%

62.1%

65.5%

62.2%

66.5%

67.2%

64.9%

64.8%

63.4%

65.0%

67.8%

64.1%

67.8%

www.afgonline.com.au

VIC

64.1%

64.9%

66.3%

65.5%

66.1%

67.7%

66.5%

67.5%

65.8%

66.0%

65.3%

65.5%

69.9%

65.2%

65.9%

LOAN T YPE

TABLE 5: ALL AUSTRALIA

MONTH

Sep 10

Oct 10

Nov 10

Dec 10

Jan 11

Feb 11

Mar 11

Apr 11

May 11

June 11

July 11

Aug 11

Sep 11

Oct 11

BASIC

16.7%

16.2%

15.0%

13.7%

14.6%

14.2%

11.8%

10.6%

11.7%

10.6%

13.2%

11.7%

9.9%

8.8%

EQUITY

9.0%

10.4%

9.5%

9.0%

7.7%

9.7%

9.3%

9.7%

8.9%

9.3%

8.6%

9.6%

7.7%

8.1%

FIXED

5.4%

6.3%

9.0%

12.6%

9.0%

6.6%

6.6%

6.4%

8.4%

8.2%

7.9%

9.4%

16.6%

20.4%

INTRO

7.5%

6.9%

7.4%

8.9%

11.9%

13.2%

15.6%

14.3%

12.5%

11.5%

8.5%

6.0%

4.7%

3.9%

STANDARD

61.4%

60.0%

59.1%

55.7%

56.7%

56.2%

56.6%

58.9%

58.5%

60.4%

61.8%

63.2%

60.9%

58.6%

DEFINITIONS

1. Standard Variable: includes the full range of features available.

2. Basic Variable: without some features, lower fees and rates.

3. Intro: also known as honeymoon where the borrower is offered a very cheap initial rate (fixed or variable)

before the loan reverts to a Standard Variable.

4. Fixed: interest rate is fixed for a nominated period before it reverts to a Standard Variable.

5. Equity: also known as line of credit allows the borrower to draw out money up to a specified limit. Generally

more expensive than Standard

NOTE TO EDITORS

www.afgonline.com.au

Potrebbero piacerti anche

- Templates For Cost Pricing Labor Burden Overhead CalculationDocumento13 pagineTemplates For Cost Pricing Labor Burden Overhead CalculationameerNessuna valutazione finora

- Blaw Review QuizDocumento34 pagineBlaw Review QuizRichard de Leon100% (1)

- Refinery Operating Cost: Chapter NineteenDocumento10 pagineRefinery Operating Cost: Chapter NineteenJuan Manuel FigueroaNessuna valutazione finora

- Ias 16Documento26 pagineIas 16Niharika MishraNessuna valutazione finora

- Buy and Hold is Still Dead (Again): The Case for Active Portfolio Management in Dangerous MarketsDa EverandBuy and Hold is Still Dead (Again): The Case for Active Portfolio Management in Dangerous MarketsNessuna valutazione finora

- Rich Dad's Guide To Becoming Rich... Without Cutting Up Your Credit CardsDocumento101 pagineRich Dad's Guide To Becoming Rich... Without Cutting Up Your Credit CardsYouert RayutNessuna valutazione finora

- Chapter 6 ACCA F3Documento12 pagineChapter 6 ACCA F3siksha100% (1)

- Problems On Internal ReconstructionDocumento24 pagineProblems On Internal ReconstructionYashodhan Mithare100% (4)

- Hedge Funds-Case StudyDocumento20 pagineHedge Funds-Case StudyRohan BurmanNessuna valutazione finora

- Learnings From DJ SirDocumento94 pagineLearnings From DJ SirHare KrishnaNessuna valutazione finora

- Mortgage Index Jan12 NationalDocumento5 pagineMortgage Index Jan12 NationalChrisBeckerNessuna valutazione finora

- Mortgage Index Dec11 NationalDocumento4 pagineMortgage Index Dec11 NationaleconomicdelusionNessuna valutazione finora

- Mortgageindex December 2012 NationalDocumento4 pagineMortgageindex December 2012 NationalBelinda WinkelmanNessuna valutazione finora

- TRNDGX PressRelease Aug2011Documento2 pagineTRNDGX PressRelease Aug2011deedrileyNessuna valutazione finora

- Mortgageindex January 2013 National PDFDocumento4 pagineMortgageindex January 2013 National PDFftforfree2436Nessuna valutazione finora

- Local Market Trends: The Real Estate ReportDocumento4 pagineLocal Market Trends: The Real Estate ReportSusan StrouseNessuna valutazione finora

- San Mateo County Market Update - November 2011Documento4 pagineSan Mateo County Market Update - November 2011Gwen WangNessuna valutazione finora

- Santa Clara County Market Update - October 2011Documento4 pagineSanta Clara County Market Update - October 2011Gwen WangNessuna valutazione finora

- Local Market Trends: The Real Estate ReportDocumento4 pagineLocal Market Trends: The Real Estate ReportSusan StrouseNessuna valutazione finora

- Local Market Trends: The Real Estate ReportDocumento4 pagineLocal Market Trends: The Real Estate Reportsusan5458Nessuna valutazione finora

- Local Market Reports 2013 q1 NYBuffaloDocumento7 pagineLocal Market Reports 2013 q1 NYBuffaloFevi AbejeNessuna valutazione finora

- Lyon Real Estate Press Release May 2012Documento2 pagineLyon Real Estate Press Release May 2012Lyon Real EstateNessuna valutazione finora

- Freddie Mac August 2012 Economic OutlookDocumento5 pagineFreddie Mac August 2012 Economic OutlookTamara InzunzaNessuna valutazione finora

- San Mateo County Market Update - Septemebr 2011Documento4 pagineSan Mateo County Market Update - Septemebr 2011Gwen WangNessuna valutazione finora

- Local Market Reports 2012 q4 ALMobileDocumento7 pagineLocal Market Reports 2012 q4 ALMobileFevi AbejeNessuna valutazione finora

- Summary of December Finance CommitteeDocumento43 pagineSummary of December Finance CommitteeAthertonPOANessuna valutazione finora

- Weekend Market Summary Week Ending 2014 April 13Documento3 pagineWeekend Market Summary Week Ending 2014 April 13Australian Property ForumNessuna valutazione finora

- Lyon Real Estate Press Release April 2012Documento2 pagineLyon Real Estate Press Release April 2012Lyon Real EstateNessuna valutazione finora

- Lyon Real Estate Press Release January 2012Documento2 pagineLyon Real Estate Press Release January 2012Lyon Real EstateNessuna valutazione finora

- Housing Data Wrap-Up: December 2012: Economics GroupDocumento7 pagineHousing Data Wrap-Up: December 2012: Economics GroupAaron MaslianskyNessuna valutazione finora

- JLL Pulse NYC 08Documento4 pagineJLL Pulse NYC 08Anonymous Feglbx5Nessuna valutazione finora

- Full Sal Surv 09Documento12 pagineFull Sal Surv 09Elie Edmond IranyNessuna valutazione finora

- Weekend Market Summary Week Ending 2014 March 2Documento3 pagineWeekend Market Summary Week Ending 2014 March 2Australian Property ForumNessuna valutazione finora

- ColumbiaDocumento2 pagineColumbiaEllie McIntireNessuna valutazione finora

- GBS Group 8Documento20 pagineGBS Group 8AISHWARYANessuna valutazione finora

- ColumbiaDocumento2 pagineColumbiaEllie McIntireNessuna valutazione finora

- Market OverviewDocumento4 pagineMarket OverviewmiguelnunezNessuna valutazione finora

- APM March 2012 Quarter Rental Report FINALDocumento3 pagineAPM March 2012 Quarter Rental Report FINALleithvanonselenNessuna valutazione finora

- July 2011: July Sales and Average Price Up Compared To 2010Documento25 pagineJuly 2011: July Sales and Average Price Up Compared To 2010Steve LadurantayeNessuna valutazione finora

- Onsumer Atch Anada: Canadian Housing Prices - Beware of The AverageDocumento4 pagineOnsumer Atch Anada: Canadian Housing Prices - Beware of The AverageSteve LadurantayeNessuna valutazione finora

- Modest Pick Up in UK House Prices in MayDocumento3 pagineModest Pick Up in UK House Prices in Mayapi-219138607Nessuna valutazione finora

- Weekly Market Update Week Ending 2016 May 29Documento5 pagineWeekly Market Update Week Ending 2016 May 29Australian Property ForumNessuna valutazione finora

- Santa Clara County Market Update - November 2011Documento4 pagineSanta Clara County Market Update - November 2011Gwen WangNessuna valutazione finora

- Weekend Market Summary Week Ending 2014 March 30Documento3 pagineWeekend Market Summary Week Ending 2014 March 30Australian Property ForumNessuna valutazione finora

- Hackett's Special Situation Report: SPDR Gold Trust (GLD) : BUYDocumento36 pagineHackett's Special Situation Report: SPDR Gold Trust (GLD) : BUYInvestor ProtegeNessuna valutazione finora

- Economic Focus 1-16-12Documento1 paginaEconomic Focus 1-16-12Jessica Kister-LombardoNessuna valutazione finora

- What Rising Interest Rates Mean For Singapore Property - This Week in Asia - South China Morning PostDocumento4 pagineWhat Rising Interest Rates Mean For Singapore Property - This Week in Asia - South China Morning PostYunquanNessuna valutazione finora

- REBGV Stats Package, August 2013Documento9 pagineREBGV Stats Package, August 2013Victor SongNessuna valutazione finora

- BBGreater JKT Landed Residential H22011Documento10 pagineBBGreater JKT Landed Residential H22011JarjitUpinIpinJarjitNessuna valutazione finora

- Spring 2015 Survey ReportDocumento39 pagineSpring 2015 Survey ReportMortgage ResourcesNessuna valutazione finora

- Tracking The World Economy - 24/08/2010Documento3 pagineTracking The World Economy - 24/08/2010Rhb InvestNessuna valutazione finora

- Global Legal Advisory Mergers & Acquisitions Rankings 2010Documento48 pagineGlobal Legal Advisory Mergers & Acquisitions Rankings 2010pal2789Nessuna valutazione finora

- San Diego, CA 92154 Market ConditionsDocumento2 pagineSan Diego, CA 92154 Market ConditionsBrian WardNessuna valutazione finora

- SGP MKT Update - Aug 2011Documento2 pagineSGP MKT Update - Aug 2011SG PropTalkNessuna valutazione finora

- Richard Suttmeier's Eleven Themes For 2011 - 1 Through 5Documento2 pagineRichard Suttmeier's Eleven Themes For 2011 - 1 Through 5ValuEngine.comNessuna valutazione finora

- The Wright Report:: Sacramento's Residential Investment AnalysisDocumento26 pagineThe Wright Report:: Sacramento's Residential Investment AnalysisWright Real EstateNessuna valutazione finora

- January Existing Home SalesDocumento1 paginaJanuary Existing Home SalesJessica Kister-LombardoNessuna valutazione finora

- Siena Research Institute: Confidence Down in NY Consumer Recovery StallsDocumento4 pagineSiena Research Institute: Confidence Down in NY Consumer Recovery StallsElizabeth BenjaminNessuna valutazione finora

- Weekly Market Update Week Ending 2016 March 20Documento5 pagineWeekly Market Update Week Ending 2016 March 20Australian Property ForumNessuna valutazione finora

- RP Data-Rismark Home Value IndexDocumento4 pagineRP Data-Rismark Home Value IndexABC News OnlineNessuna valutazione finora

- Big Rock Candy MountainDocumento63 pagineBig Rock Candy MountainrguyNessuna valutazione finora

- Zillow Q3 Real Estate ReportDocumento4 pagineZillow Q3 Real Estate ReportLani RosalesNessuna valutazione finora

- Lyon Real Estate Press Release March 2012Documento2 pagineLyon Real Estate Press Release March 2012Lyon Real EstateNessuna valutazione finora

- Metropolitan Denver Real Estate Statistics AS OF JUNE 30, 2011Documento6 pagineMetropolitan Denver Real Estate Statistics AS OF JUNE 30, 2011Michael KozlowskiNessuna valutazione finora

- What's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013Documento1 paginaWhat's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013jotham_sederstr7655Nessuna valutazione finora

- May 2010 Charleston Market ReportDocumento38 pagineMay 2010 Charleston Market ReportbrundbakenNessuna valutazione finora

- Publication PDFDocumento22 paginePublication PDFlinga2014Nessuna valutazione finora

- Today's Market : Houston-Baytown-Sugar Land Area Local Market Report, Third Quarter 2011Documento7 pagineToday's Market : Houston-Baytown-Sugar Land Area Local Market Report, Third Quarter 2011Kevin ReadNessuna valutazione finora

- Weekend Market Summary Week Ending 2014 April 6Documento3 pagineWeekend Market Summary Week Ending 2014 April 6Australian Property ForumNessuna valutazione finora

- ABS - BoT Nov 2013Documento44 pagineABS - BoT Nov 2013economicdelusionNessuna valutazione finora

- Business Activity Expected To Lift in 2014Documento9 pagineBusiness Activity Expected To Lift in 2014economicdelusionNessuna valutazione finora

- Pmi Dec 2013 Report FinalDocumento2 paginePmi Dec 2013 Report FinaleconomicdelusionNessuna valutazione finora

- Euro PMI March 2013Documento3 pagineEuro PMI March 2013economicdelusionNessuna valutazione finora

- Second Estimate For The Q2 2013 Euro GDPDocumento6 pagineSecond Estimate For The Q2 2013 Euro GDPeconomicdelusionNessuna valutazione finora

- ECB Monetary Policy Developments Dec 2012Documento6 pagineECB Monetary Policy Developments Dec 2012economicdelusionNessuna valutazione finora

- Walking Back From CyprusDocumento3 pagineWalking Back From CypruseconomicdelusionNessuna valutazione finora

- Pci Dec12 Final ReportDocumento2 paginePci Dec12 Final ReporteconomicdelusionNessuna valutazione finora

- Euro Area Unemployment Rate at 11.8%Documento4 pagineEuro Area Unemployment Rate at 11.8%economicdelusionNessuna valutazione finora

- IMF Working Paper - Jan. 2013Documento43 pagineIMF Working Paper - Jan. 2013Spiros GanisNessuna valutazione finora

- US Budget and Debt - OI #1 2013Documento2 pagineUS Budget and Debt - OI #1 2013economicdelusionNessuna valutazione finora

- Search Results For "Certification" - Wikimedia Foundation Governance Wiki PDFDocumento2 pagineSearch Results For "Certification" - Wikimedia Foundation Governance Wiki PDFAdriza LagramadaNessuna valutazione finora

- 80G CertificateTax ExemptionDocumento56 pagine80G CertificateTax ExemptionskunwerNessuna valutazione finora

- United States Court of Appeals, Fifth CircuitDocumento10 pagineUnited States Court of Appeals, Fifth CircuitScribd Government DocsNessuna valutazione finora

- 10000000296Documento132 pagine10000000296Chapter 11 DocketsNessuna valutazione finora

- Thrifts by StateDocumento5 pagineThrifts by StateCrypto SavageNessuna valutazione finora

- Draft Develop Bankable Transport Infrastructure Project 24sep1 0Documento158 pagineDraft Develop Bankable Transport Infrastructure Project 24sep1 0lilikwbs9334Nessuna valutazione finora

- Chapter 17 - Incomplete RecordsDocumento55 pagineChapter 17 - Incomplete RecordsK60 Triệu Thùy LinhNessuna valutazione finora

- Anti Take Over Tactics Merger and AcquisitionDocumento29 pagineAnti Take Over Tactics Merger and AcquisitionMuhammad Nabeel Muhammad0% (1)

- CH 16Documento28 pagineCH 16Michelle LindsayNessuna valutazione finora

- Coc Model Level Iv ChoiceDocumento22 pagineCoc Model Level Iv ChoiceBeka Asra100% (3)

- 15 Annual Report: ONGC Petro Additions LimitedDocumento121 pagine15 Annual Report: ONGC Petro Additions Limitedarjun SinghNessuna valutazione finora

- Building Blocks For Community InvestmentsDocumento5 pagineBuilding Blocks For Community Investmentsnatasha mukukaNessuna valutazione finora

- Argus European ProductsDocumento14 pagineArgus European ProductsMihaElla_07Nessuna valutazione finora

- New Microsoft Word DocumentDocumento28 pagineNew Microsoft Word Documentjaz143Nessuna valutazione finora

- Invoice Original 1882427818115Documento1 paginaInvoice Original 1882427818115Anno DominiNessuna valutazione finora

- Climate Resilience - World Resources InstituteDocumento13 pagineClimate Resilience - World Resources Institutegilberto777Nessuna valutazione finora

- ObligationDocumento143 pagineObligationPierreNessuna valutazione finora

- 2018 - CSP - Sustainable Finance Capabilities of Private Banks - Report - #2Documento47 pagine2018 - CSP - Sustainable Finance Capabilities of Private Banks - Report - #2AllalannNessuna valutazione finora

- Abhishek ReportDocumento67 pagineAbhishek ReportAbhishek KarNessuna valutazione finora

- Business Risk Measurement MethodsDocumento2 pagineBusiness Risk Measurement MethodsSahaa NandhuNessuna valutazione finora

- FHFA Housing ProjectionDocumento13 pagineFHFA Housing Projectionooo5770Nessuna valutazione finora