Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2004 Annual Report Earnings

Caricato da

Jennifer ZhangDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2004 Annual Report Earnings

Caricato da

Jennifer ZhangCopyright:

Formati disponibili

Press/Analyst Contacts Investor Relations Contact: Mike Saviage Adobe Systems Incorporated 408-536-4416 ir@adobe.

com Public Relations Contact: Holly Campbell Adobe Systems Incorporated 408-536-6401 campbell@adobe.com

FOR IMMEDIATE RELEASE

bc

Adobe Systems Reports Record Quarterly and Annual Revenue

Adobe Acrobat and Adobe Creative Suite Adoption Drives 29 Percent Year-Over-Year Annual Revenue Growth in Fiscal Year 2004

SAN JOSE, Calif. December 16, 2004 Adobe Systems Incorporated (Nasdaq:ADBE) today reported strong nancial results for its fourth quarter and scal year ended December 3, 2004. In the fourth quarter of scal 2004, Adobe achieved record revenue of $429.5 million, compared to $358.6 million reported for the fourth quarter of scal 2003 and $403.7 million reported in the third quarter of scal 2004. On a yearover-year basis, this represents 20 percent revenue growth. Adobes fourth quarter revenue target range, revised upward on October 26, 2004, was $410 to $425 million. Q4 was an outstanding nish to a remarkable year, said Bruce R. Chizen, president and chief executive ofcer. The continued strength of Acrobat and our Creative Suite platform, combined with strong demand for our hobbyist offerings, resulted in record revenue for the quarter. We also achieved more than $100 million in revenue and 50% year-over-year growth in our Intelligent Documents server business during the year. Based on the planned release of a succession of new products throughout scal 2005, as well as the large market opportunities in front of us, we are reafrming our double-digit revenue growth target for scal 2005, Chizen said. GAAP diluted earnings per share for the fourth quarter of scal 2004 were $0.45. Non-GAAP diluted earnings per share, which does not include investment gains from the Companys venture program, were $0.44. Adobes revised GAAP and non-GAAP fourth quarter earnings target range was $0.40 to $0.43 per share. GAAP net income was $113.5 million for the fourth quarter of scal 2004, compared to $83.3 million reported in the fourth quarter of scal 2003, and $104.5 million in the third quarter of scal 2004. On a year-over-year basis, GAAP net income grew 36 percent.

Page 2 of 8 Adobe Systems Reports Record Quarterly and Annual Revenue

Non-GAAP net income, which excludes, as applicable, a partial reversal of prior restructuring charges, and investment gains and losses, was $110.4 million for the fourth quarter of scal 2004, compared to $83.0 million in the fourth quarter of scal 2003, and $105.6 million in the third quarter of scal 2004. On a year-over-year basis, non-GAAP net income grew 33 percent. GAAP diluted earnings per share for the fourth quarter of scal 2004 were $0.45 based on 250.3 million weighted average shares. This compares with GAAP diluted earnings per share of $0.34 reported in the fourth quarter of scal 2003, based on 245.5 million weighted average shares, and GAAP diluted earnings per share of $0.42 reported in the third quarter of scal 2004, based on 247.1 million weighted average shares. Adobes GAAP operating income was $146.4 million in the fourth quarter of scal 2004, compared to $115.3 million in the fourth quarter of scal 2003 and $140.3 million in the third quarter of scal 2004. As a percent of revenue, GAAP operating income in the fourth quarter of scal 2004 was 34.1 percent, compared to 32.1 percent in the fourth quarter of scal 2003 and 34.8 percent in the third quarter of scal 2004. Adobes non-GAAP operating income, which excludes, as applicable, a partial reversal of prior restructuring charges, was $146.4 million in the fourth quarter of scal 2004, compared to $115.2 million in the fourth quarter of scal 2003 and $140.3 million in the third quarter of scal 2004. As a percent of revenue, non-GAAP operating income in the fourth quarter of scal 2004 was 34.1 percent, compared to 32.1 percent in the fourth quarter of scal 2003 and 34.8 percent in the third quarter of scal 2004.

Adobe Reports Record Annual Revenue in Fiscal Year 2004

In scal 2004, Adobe achieved record revenue of $1.667 billion, compared to $1.295 billion in scal 2003. On a yearover-year basis, annual revenue grew 29 percent. Adobes annual GAAP net income was $450.4 million in scal 2004, compared to $266.3 million in scal 2003. On a year-over-year basis, annual GAAP net income grew 69 percent. Adobes annual non-GAAP net income, which does not, as applicable, include a partial reversal of restructuring charges, and investment gains and losses, was $448.5 million in scal 2004, compared to $275.0 million in scal 2003. On a year-over-year basis, annual non-GAAP net income grew 63 percent. GAAP diluted earnings per share for scal 2004 were $1.82. Non-GAAP diluted earnings per share for scal 2004, which does not include investment gains and losses, were $1.81.

Adobe Provides First Quarter Financial Targets and Reafrms Fiscal 2005 Targets

For the rst quarter of scal 2005, Adobe announced it is targeting revenue of $435 to $455 million, a gross margin of approximately 94 percent, and GAAP and non-GAAP operating margin ranges of approximately 34 to 35 percent. As a percent of revenue, Adobe is targeting rst quarter expenses as follows: Research & Development approximately 19 percent Sales & Marketing approximately 31 to 32 percent General & Administrative approximately 9 percent

Page 3 of 8 Adobe Systems Reports Record Quarterly and Annual Revenue

In addition, Adobe is targeting its share count range to be between 254 and 255 million shares in the rst quarter of scal 2005. The Company also is targeting other income in its rst quarter to be approximately $3.5 million, and a tax rate of 25 percent. These targets lead to rst quarter GAAP and non-GAAP earnings per share target ranges of $0.45 to $0.48. Adobe currently believes targeted non-GAAP earnings per share and non-GAAP operating margin results will not differ materially from targeted GAAP results. For scal 2005, the Company reafrmed its full year target range of $1.85 to $1.9 billion in revenue, with an operating margin target range of approximately 34 to 35 percent. The Adobe Board of Directors declared this quarters cash dividend of $0.0125 per share, payable on January 11, 2005, to stockholders of record as of December 28, 2004.

Forward Looking Statements Disclosure

This press release contains forward looking statements, including those related to revenue, product releases, gross margin, operating margin, operating expenses, share count, tax rate, and earnings per share, which involve risks and uncertainties that could cause actual results to differ materially. Factors that might cause or contribute to such differences include, but are not limited to: adverse changes in general economic or political conditions in any of the major countries in which we do business, delays in development or shipment of our new products or major new versions of existing products, introduction of new products by existing and new competitors, difculties in transitions to new business models or markets, changes in demand for application software, computers and printers, intellectual property disputes and litigation, changes to our distribution channel, the impact of malicious code, such as worms and viruses, on our computer network and applications, interruptions or terminations in our relationships with our turnkey assemblers, uctuations in foreign currency exchange rates, changes in accounting rules, unanticipated changes in tax rates, market risks associated with our equity investments, and our inability to attract and retain key personnel. For further discussion of these and other risks and uncertainties, individuals should refer to the Companys SEC lings, including the 2003 annual report on Form 10-K and quarterly reports on Form 10-Q led in 2004. The Company does not undertake an obligation to update forward looking statements.

About Adobe Systems Incorporated

Adobe is the worlds leading provider of software solutions to create, manage and deliver high-impact, reliable digital content. For more information, visit www.adobe.com. ###

2004 Adobe Systems Incorporated. All rights reserved. Adobe, the Adobe logo, Adobe Acrobat, and Adobe Creative Suite are either registered trademarks or trademarks of Adobe Systems Incorporated in the United States and/or other countries. All other trademarks are the property of their respective owners.

Page 4 of 8 Adobe Systems Reports Record Quarterly and Annual Revenue

Condensed Consolidated Statements of Income

(In thousands, except per share data) (Unaudited) Three Months Ended Year Ended December 3, November 28, December 3, November 28, 2004 2003 2004 2003 Revenue: Products Services and support Total revenue Total cost of revenue: Products Services and support Total cost of revenue Gross profit Operating Expenses: Research and development Sales and marketing General and administrative Restructuring and other charges Total operating expenses Operating income Non-operating income: Investment gain (loss) Interest and other income Total non-operating income Income before income taxes Provision for income taxes Net income Basic net income per share Shares used in computing basic net income per share Diluted net income per share Shares used in computing diluted net income per share $ $ $ $ 420,204 9,298 429,502 $ 351,466 7,120 358,586 $ 1,633,959 32,622 1,666,581 $ 1,269,004 25,745 1,294,749

23,887 5,485 29,372 400,130 80,100 140,289 33,362 253,751 146,379 4,158 2,843 7,001 153,380 39,879 113,501 0.47 239,870 0.45 250,310 $ $ $

21,476 3,751 25,227 333,359 73,088 113,543 31,570 (105) 218,096 115,263 379 3,428 3,807 119,070 35,721 83,349 0.35 235,899 0.34 245,512 $ $ $

86,572 17,806 104,378 1,562,203 311,296 521,143 137,970 970,409 591,794 2,506 14,345 16,851 608,645 158,247 450,398 1.89 238,829 1.82 247,813 $ $ $

79,902 13,120 93,022 1,201,727 276,980 423,417 122,427 (544) 822,280 379,447 (12,875) 13,920 1,045 380,492 114,148 266,344 1.14 234,246 1.10 241,450

Page 5 of 8 Adobe Systems Reports Record Quarterly and Annual Revenue

Condensed Consolidated Balance Sheets

(In thousands, except per share data) (Unaudited) December 3, 2004 ASSETS Current assets: Cash and cash equivalents Short-term investments Trade receivables Other receivables Deferred income taxes Other current assets Total current assets Property and equipment, net Goodwill Purchased and other intangibles, net Investment in lease receivable Other assets Total assets $ 376,127 937,094 141,945 25,495 51,751 18,617 1,551,029 99,675 110,287 15,513 126,800 55,328 $ 1,958,632 LIABILITIES AND STOCKHOLDERS EQUITY Current liabilities: Trade and other payables Accrued expenses Income taxes payable Deferred revenue Total current liabilities Other long-term liabilities Deferred income taxes, long-term Stockholders equity: Common stock, $0.0001 par value Additional paid-in-capital Retained earnings Accumulated other comprehensive loss Treasury stock at cost, net of re-issuances Total stockholders equity Total liabilities and stockholders equity $ 43,192 202,762 145,913 59,541 451,408 4,838 78,909 29,576 1,164,643 2,238,807 (2,289) (2,007,260) 1,423,477 $ 1,958,632 $ $ 37,437 160,009 193,484 45,600 436,530 17,715 29,576 874,126 1,800,398 (999) (1,602,301) 1,100,800 1,555,045 $ $ 189,917 906,616 146,311 27,731 35,875 22,578 1,329,028 77,007 95,971 15,318 37,721 1,555,045 November 28, 2003

Page 6 of 8 Adobe Systems Reports Record Quarterly and Annual Revenue

Condensed Consolidated Statements of Cash Flows

(In thousands) (Unaudited) Three Months Ended December 3, November 28, 2004 2003 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Stock compensation expense Deferred income taxes Provision for (recovery of) losses on receivables Tax benefit from employee stock option plans Net gains on sales and impairments of investments Non-cash restructuring and other charges Changes in operating assets and liabilities: Receivables Other current assets Trade and other payables Accrued expenses Accrued restructuring charges Income taxes payable Deferred revenue Net cash provided by operating activities Cash flows from investing activities: Purchases of short-term investments Maturities and sales of short-term investments Acquisitions of property and equipment Purchases of long-term investments and other assets Proceeds from sale of equity securities and other assets Net cash used for investing activities Cash flows from financing activities: Purchase of treasury stock Proceeds from issuance of treasury stock Payment of dividends Net cash provided by financing activities Effect of foreign currency exchange rates on cash and cash equivalents Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period $ $ 113,501 17,802 46 (2,172) (58) 67,822 (4,158) (30,291) 6,424 6,531 33,065 (94) (30,778) 12,393 190,033 (223,471) 223,529 (21,070) (16,262) 2,788 (34,486) (200,015) 221,145 (2,982) 18,148 3,732 177,427 198,700 376,127 $ $ 83,349 12,774 368 19,136 738 25,087 (379) (105) (33,725) 10,191 5,367 10,237 (873) (7,541) 3,991 128,615 (423,963) 222,063 (12,590) (4,840) 4,742 (214,588) (240) 132,321 (2,925) 129,156 2,273 45,456 144,461 189,917

Page 7 of 8 Adobe Systems Reports Record Quarterly and Annual Revenue

Non-GAAP Results

(In thousands, except per share data) The following tables show the Companys non-GAAP results reconciled to GAAP results included in this release. The Companys non-GAAP results do not, as applicable, include restructuring and other charges or investment gains and losses. Three Months Ended December 3, November 28, September 3, 2004 2003 2004 GAAP operating income Restructuring and other charges Non-GAAP operating income $ $ 146,379 146,379 113,501 (3,077) 110,424 $ 115,263 $ (105) $ 115,158 $ $ 83,349 $ 140,314 140,314 104,461 1,106 105,567

GAAP net income $ Restructuring and other charges, net of tax Investment (gain) loss, net of tax Non-GAAP net income $ Diluted net income per share: GAAP net income $ Restructuring and other charges, net of tax Investment (gain) loss, net of tax Non-GAAP net income $ Shares used in computing diluted net income per share

(74) (265) 83,010 $

0.45 (0.01) 0.44 250,310

0.34 0.34 245,512

0.42 0.01 0.43 247,113

Year Ended December 3, November 28, 2004 2003 GAAP net income $ Restructuring and other charges, net of tax Investment (gain) loss, net of tax Non-GAAP net income $ Diluted net income per share: GAAP net income $ Restructuring and other charges, net of tax Investment (gain) loss, net of tax Non-GAAP net income $ Shares used in computing diluted net income per share 1.82 (0.01) 1.81 247,813 $ 1.10 0.04 1.14 241,450 450,398 (1,854) 448,544 $ 266,344

(381) 9,013 $ 274,976

Page 8 of 8 Adobe Systems Reports Record Quarterly and Annual Revenue

Adobe continues to provide all information required in accordance with GAAP, but it believes that evaluating its ongoing operating results may not be as useful if an investor is limited to reviewing only GAAP financial measures. Accordingly, Adobe uses non-GAAP financial information to evaluate its ongoing operations and for internal planning and forecasting purposes. Adobes management does not itself, nor does it suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Adobe presents such non-GAAP financial measures in reporting its financial results to provide investors with an additional tool to evaluate Adobes operating results in a manner that focuses on what Adobe believes to be its ongoing business operations. Adobes management believes it is useful for itself and investors to review both GAAP information that includes charges and investment gains and losses discussed below and the non-GAAP measures that exclude such charges and investment gains and losses in order to assess the performance of Adobes business and for planning and forecasting in subsequent periods. Adobes non-GAAP operating income excludes, as applicable, restructuring and other charges. Non-GAAP net income and non-GAAP diluted earnings per share exclude, as applicable, restructuring and other charges and investment gains and losses. Management believes that the inclusion of these non-GAAP financial measures provides consistency and comparability with past reports of financial results and has historically provided comparability to similar companies in Adobes industry, many of which present the same or similar non-GAAP financial measures to investors. Whenever Adobe uses such a non-GAAP financial measure, it provides a reconciliation of the non-GAAP financial measure to the most closely applicable GAAP financial measure. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measure as detailed above. Adobe excludes restructuring and other charges, including (i) employee severance and other termination benefits, (ii) lease termination costs and other expenses associated with exiting facilities, and (iii) other costs associated with terminating contracts, from its non-GAAP financial measure of operating income and net income. Adobes management does not consider these restructuring costs as a normal component of its expenses related to ongoing operations as such charges have occurred only periodically and have not been directly linked to the level of Adobes business activities in the quarter in which such charges occur. As a result, Adobes management believes it is useful for itself and investors to review both GAAP information that includes such charges and non-GAAP measures of operating income and net income that exclude these charges to have a better understanding of the overall performance of Adobes ongoing business operations and its performance in the periods presented. In accordance with GAAP, Adobe records investment gains and losses from its venture program. These charges are otherwise unrelated to Adobes ongoing business operations and are excluded from its non-GAAP financial information.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Follow Fibonacci Ratio Dynamic Approach in TradeDocumento4 pagineFollow Fibonacci Ratio Dynamic Approach in TradeLatika DhamNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- 201FIN Tutorial 3 Financial Statements Analysis and RatiosDocumento3 pagine201FIN Tutorial 3 Financial Statements Analysis and RatiosAbdulaziz HNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- KSIE OsDocumento73 pagineKSIE OsAnush PrasannanNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Company Name: Starting Date Cash Balance Alert MinimumDocumento3 pagineCompany Name: Starting Date Cash Balance Alert MinimumdantevariasNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- 1059 155846588 Fab's Verified Response To Defendants Claims of ExemptionDocumento17 pagine1059 155846588 Fab's Verified Response To Defendants Claims of Exemptionlarry-612445Nessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Enron Case StudyDocumento14 pagineEnron Case Studyvlabrague6426Nessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- MyTW Bill 475525918821 12 12 2022Documento1 paginaMyTW Bill 475525918821 12 12 2022lapenbNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Merger and Acquisition of BanksDocumento1 paginaMerger and Acquisition of Banksstithi aggarwalNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Lecture3 Sem2 2023Documento35 pagineLecture3 Sem2 2023gregNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Daily Report MonitoringDocumento9 pagineDaily Report MonitoringMaasin BranchNessuna valutazione finora

- Solved Exercises 2Documento10 pagineSolved Exercises 2ScribdTranslationsNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Generally Accepted Accounting PrinciplesDocumento12 pagineGenerally Accepted Accounting PrinciplesMARIA ANGELICA100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Internship Report On ZahidJee Textile Mills LimitedDocumento81 pagineInternship Report On ZahidJee Textile Mills LimitedDoes it Matter?100% (11)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Strategy With MACD and ADX 21 5 2017Documento3 pagineStrategy With MACD and ADX 21 5 2017Anant MalaviyaNessuna valutazione finora

- CH 21 TBDocumento18 pagineCH 21 TBJessica Garcia100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Project Report LissstDocumento6 pagineProject Report LissstShivareddyNessuna valutazione finora

- PRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012Documento4 paginePRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012tilshilohNessuna valutazione finora

- ReceiptDocumento3 pagineReceiptAhsan KhanNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Bpo 102 Part 1Documento30 pagineBpo 102 Part 1Mary Lynn Dela PeñaNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Answer BookDocumento8 pagine2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Answer BookChantelle IsaksNessuna valutazione finora

- 2316 Jan 2018 ENCS FinalDocumento2 pagine2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- POP DetailsDocumento15 paginePOP DetailsJitender KumarNessuna valutazione finora

- Credit Risk Modelling Literature ReviewDocumento5 pagineCredit Risk Modelling Literature Reviewea3h1c1p100% (1)

- Cost of Capital ChapterDocumento26 pagineCost of Capital Chapteremon hossainNessuna valutazione finora

- Suggested Solutions/ Answers Fall 2016 Examinations 1 of 8: Business Taxation (G5) - Graduation LevelDocumento8 pagineSuggested Solutions/ Answers Fall 2016 Examinations 1 of 8: Business Taxation (G5) - Graduation LevelQadirNessuna valutazione finora

- Class 12 Accountancy Practice Paper 02Documento6 pagineClass 12 Accountancy Practice Paper 02Ankit Kumar100% (1)

- Efr 2011 - 2012Documento2 pagineEfr 2011 - 2012webassistant-sbeNessuna valutazione finora

- Tata Corus DealDocumento39 pagineTata Corus DealdhavalkurveyNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

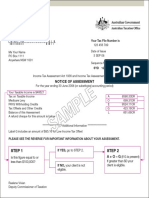

- Step 1 Step 2: Notice of AssessmentDocumento1 paginaStep 1 Step 2: Notice of Assessmentabinash manandharNessuna valutazione finora

- Asset Declaration RahimaDocumento3 pagineAsset Declaration RahimaMukhlesur RahmanNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)