Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Afghanistan

Caricato da

Kavya SinghviDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Afghanistan

Caricato da

Kavya SinghviCopyright:

Formati disponibili

2009 Minerals Yearbook

AFGHANISTAN [ADVANCE RELEASE]

U.S. Department of the Interior U.S. Geological Survey

October 2010

The Mineral indusTry of afghanisTan

By Chin s. Kuo

Afghanistans economy grew slowly in 2009; the rate of growth in the gross domestic product was estimated to be about the same (3.4%) as in 2008. Agriculture remained the main economic activity. Afghanistan has deposits of barite, copper, gold, iron ore, and natural gas, as well as resources of such gemstones as emerald and ruby. the country also has resources of such industrial minerals as asbestos, celestite, clays, dolomite, fluorite, graphite, gypsum, halite, limestone, magnesite, marble, rare earths, sandstone, sulfur, and talc. the government considered development of the countrys mineral resources to be a priority for economic growth in Afghanistan, including development of its industrial mineral resources, such as gravel, sand, and limestone for cement, for use by the domestic construction industry. investment in infrastructure and transportation projects for mining was a critical aspect of developing the mineral industry. such factors as instability in certain areas of the country and the remote and rugged terrains were significant hindrances to the development of the countrys mineral resources, however. transport infrastructure would enable Afghanistan to import goods from india and Pakistan more easily. two railway lines were being planned: one from the northern border of Afghanistan to torkham near Pakistan, and the other from iran to the northeastern Afghanistan. these planned railway lines would make the extraction and export of iron ore economically feasible (Un news, 2009). Construction of an additional 75-kilometer (km) single-track railway line to Mazar-i-sharif from hayratan near Uzbekistan was slated to proceed with a grant of $165 million from the Asian Development Bank in september 2009. the government would provide the remaining $5 million of the $170 million project, which was to be undertaken by Uzbek Railways and would include the design, procurement, construction, operation, and maintenance of the railway line. Completion of this line was scheduled for June 2011. hayratan was the gateway for almost one-half of Afghanistans imports through termez, Uzbekistan (Railway gazette, 2009). the Amu Darya River in landlocked Afghanistan forms part of the border with turkmenistan, Uzbekistan, and tajikistan. in 2007, the United states funded reconstruction of the shirkan Bandar Bridge across the river, which opened a vital trade route between Afghanistan and tajikistan. Production Owing to the lack of mineral production data published by the government, information about Afghanistans mining activities was not readily available, but they appeared to be limited in scope. in 2009, the countrys production of barite was estimated to be about 1,500 metric tons (t); cement, 50,000 t; chromite, 7,000 t; coal, 150,000 t; crude oil, 20,000 barrels; gypsum, 2,000 t; natural gas, 50 million cubic meters; and salt, 12,000 t. in the process of reconstruction and infrastructure development, output of construction minerals was estimated to have increased to meet the domestic requirements.

AfghAnistAn2009 [ADVAnCE RELEAsE]

Structure of the Mineral Industry Privatization of Afghanistans state-owned companies, which controlled many of the countrys mineral resources, was not complete. investment in the mining sector by private domestic companies and foreign investors was encouraged by the Government, which offered as the first tender the Aynak copper project. the government also put forward iron ore and oil and gas tenders in 2009. the Ministry of Mines is involved in the research, exploration, development, exploitation, and processing of minerals and hydrocarbons. the Ministry also is responsible for protecting the ownership of, and regulating the transportation and marketing of mineral resources in accordance with the countrys new laws. Regulations to clarify the countrys environmental laws were scheduled for adoption in 2009. Mineral production facilities are listed in table 1. Commodity Review Metals Copper.Jiangxi Copper Co. Ltd. (JCL) and China Metallurgical group Corp. (MCC) won a contract in 2008 worth $2.5 billion to develop the Aynak copper deposit, which is located 30 km south-southeast of Kabul in Logar Province. the companies formed Aynak Minerals Co. Ltd., in which MCC held a 75% interest and JCL held a 25% interest, to explore and exploit copper in the central and western mineralized zones of the deposit. Measured reserves were estimated to be 9 million metric tons (Mt) at an average grade of 1.84% copper. the total investment would be $4.39 billion, which would comprise equity funding and loan financing of 30% and 70%, respectively. the companies were expected to pay $200 million per year for 30 years as a royalty to the government. Construction began in July 2009, and the mine would have a designed capacity of 320,000 metric tons per year (t/yr) of copper in concentrate. the project was scheduled to start production by the end of 2011. The first phase of output would reach 180,000 t/yr of copper in concentrate by the end of initial development. Copper concentrate would be provided to MCCs subsidiary huludao Zinc Co. in China for processing; copper production was projected to be between 300,000 and 400,000 t/yr in 4 to 5 years. huludao Zincs copper smelter was expanding to 150,000 t/yr from 100,000 t/yr by late 2010 to accommodate the increased production of copper concentrate. further expansion of the smelters capacity was planned to reach 400,000 t/yr. Construction of a 17-km road to the Aynak project was inaugurated in 2009. Development of a rail link from Aynak to Kabul and a 400-megawatt (MW) coal-fired powerplant also were under consideration (Mining technology, 2009). Iron Ore.the government was offering mineral rights to the hajigak iron ore deposit and the surrounding area through a tender process. Expressions of interest were required to be

2.1

submitted by the end of April 2009. the tender had drawn interest from such international mining companies as BhP Billiton Ltd. of Australia, Rio tinto plc of the United Kingdom, and Vale s.A. of Brazil. the deposit is located 130 km west of Kabul in Bamyan Province. the iron-bearing formations were in a sequence of sedimentary and volcanic rocks of Proterozoic age. the primary ore contained magnetite and pyrite with minor amounts of chalcopyrite, and the oxidized ore consisted of hematite. the measured and indicated reserves were 111 Mt of iron ore. the ore had a high iron content of 62%, and the deposit was suitable for open pit mining. there were 16 ore bodies extending for 5 km and to depths of more than 500 meters. An iron ore mine, processing facilities, and transport infrastructure for iron ore and iron ore pellets were envisioned (thomson Reuters, 2009). Industrial Minerals Gemstones.Afghanistans gemstones that were present in pegmatite deposits included aquamarine, garnet, kunzite, ruby, and tourmaline. those in non-pegmatite deposits were emerald, lapis lazuli, sapphire, and spinel. the worlds leading producer of lapis lazuli was the sary-sang Mine in Badakhshan Province in the north of the country. Estimated production was 9,000 kilograms per year, and estimated reserves were 1,300 t (international Mining, 2009). Mineral Fuels Natural Gas and Petroleum.in April 2009, Afghanistan launched a licensing round to award exploration and production-sharing contracts for oil and gas for three blocks in the northwest of the country. the exploration and

production-sharing contracts would be evaluated according to royalties, additional work commitment, and technical competence. the three blocks were the 1,999-square-kilometer (km2) Jangalikalan Block, which has natural gas reserves of 11 billion cubic meters; the 1,861-km2 Juma-Bashikurd Block, which has natural gas reserves of 33 billion cubic meters; and the 1,723-km2 Kashkari Block, which includes the Angoat, the Aqdarya, and the Kashkari oilfields and contained recoverable reserves of 64.4 million barrels of oil equivalent. the blocks held hydrocarbon accumulations in Cretaceous and Jurassic formations that had been discovered in the 1970s. Eleven oil and gas companies expressed interest in the bidding process. the U.s. geological survey estimated that between 600 and 700 billion cubic meters of natural gas and 25 Mt of oil were found in four basins in northern Afghanistan (Oil & gas Journal, 2009). References Cited

international Mining, 2009, Afghanistan: Mining is a way to rebuild the economy: international Mining, v. 5, no. 10, October, p. 3. Mining technology, 2009, MCC sets 2011 production target for its Afghan copper mine: Mining technology, september 29. (Accessed september 30, 2009, at http://www.mining-technology.com/news/ news65423.html.) Oil & gas Journal, 2009, Afghanistan to launch oil, gas licensing round in April: Oil & gas Journal, March 19. (Accessed March 24, 2009, at http://www.ogj.com/display_article/356771/7.) Railway gazette, 2009, Afghan railway to go ahead with ADB funding: Railway gazette, september 30. (Accessed October 5, 2009, at http://www.railwaygazette.com/news/single-view/view/10.) thomson Reuters, 2009, Afghanistan opens giant iron ore deposit to tender: thomson Reuters, April 4. (Accessed April 20, 2009, at http://communities.thomsonreuters.com/basemetals/pages/print/ posts/?bid=ec26c1b6.) Un news, 2009, infrastructure critical to stimulate Afghan economic growth: Un news, June 29, 1 p.

tABLE 1 AfghAnistAn: stRUCtURE Of thE MinERAL inDUstRY in 2009 (Metric tons unless otherwise specified) Annual capacitye nA 360 180,000 9,000 36,000

Commodity Aluminum: Extrusion and powder coating Manufacture Copper, in concentrate Lapis lazuli steel, manufacture

e

Major operating companies and major equity owners Qader najib Ltd. salam Bilal Ltd. Aynak Minerals Co. Ltd. (Jiangxi Copper Co. Ltd., 75%, and China Metallurgical group Corp., 25%) government owned Khalil najeeb steel Mills Ltd.

Location of main facilities Kabul Kandahar Aynak, Logar1 sary-sang, Badakhshan Jalalabad, Kabul, and Mazar-i-sharif

kilograms

Estimated; estimated data are rounded to no more than three significant digits. nA not available. the Aynak Mine is expected to start production in 2011.

2.2 [ADVAnCE RELEAsE]

U.s. gEOLOgiCAL sURVEY MinERALs YEARBOOK2009

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Latin America Confronts The Great Depression: Brazil and ArgentinaDocumento24 pagineLatin America Confronts The Great Depression: Brazil and ArgentinaEnriqueNessuna valutazione finora

- Horasis Global India Business Meeting 2010 - Programme BrochureDocumento32 pagineHorasis Global India Business Meeting 2010 - Programme BrochuresaranshcNessuna valutazione finora

- López Quispe Alejandro MagnoDocumento91 pagineLópez Quispe Alejandro MagnoAssasin WildNessuna valutazione finora

- Nashik CDPDocumento8 pagineNashik CDPSaurav AgrawalNessuna valutazione finora

- LC DraftDocumento3 pagineLC DraftNRVision Exim100% (3)

- RTI Data Item Guide 20-21 v1-1Documento57 pagineRTI Data Item Guide 20-21 v1-1chethanNessuna valutazione finora

- MODULE 6-Economics: Applied Economics Grade Level/Section: GAS-11A Subject Teacher: Joan A. MalaDocumento5 pagineMODULE 6-Economics: Applied Economics Grade Level/Section: GAS-11A Subject Teacher: Joan A. MalaJOHN PAUL LAGAONessuna valutazione finora

- Book by Sadiku Link For ItDocumento6 pagineBook by Sadiku Link For ItShubhamNessuna valutazione finora

- 2014 Albany County Executive BudgetDocumento339 pagine2014 Albany County Executive BudgetJohn PurcellNessuna valutazione finora

- Business Economics Chapter 2 - Demand AnalysisDocumento44 pagineBusiness Economics Chapter 2 - Demand Analysissharukh kapadiaNessuna valutazione finora

- Types of Raw MaterialsDocumento27 pagineTypes of Raw MaterialsAppleCorpuzDelaRosaNessuna valutazione finora

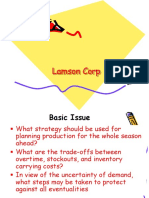

- Day 2 - Lamson CorpDocumento21 pagineDay 2 - Lamson CorpFrans AdamNessuna valutazione finora

- P3 - Basic Revision Q & A Selected TopicsDocumento96 pagineP3 - Basic Revision Q & A Selected TopicsZin Tha100% (1)

- Daily Renewables WatchDocumento2 pagineDaily Renewables WatchunitedmanticoreNessuna valutazione finora

- Amartya Sen PPT FinDocumento28 pagineAmartya Sen PPT FinTaher DahodwalaNessuna valutazione finora

- Travel Green Guide 2009Documento185 pagineTravel Green Guide 2009Yunran100% (1)

- Written Address Submitted by The Counsel To The RespondentDocumento17 pagineWritten Address Submitted by The Counsel To The RespondentsaharaReporters headlinesNessuna valutazione finora

- Failure and Resurgence of The Barbie DollDocumento23 pagineFailure and Resurgence of The Barbie DollrknanduriNessuna valutazione finora

- Akrigg, Population and Economy in Classical Athens PDFDocumento286 pagineAkrigg, Population and Economy in Classical Athens PDFJulian Gallego100% (3)

- National Agriculture PolicyDocumento3 pagineNational Agriculture PolicyImran AfizalNessuna valutazione finora

- Tax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacDocumento2 pagineTax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacBhavnaben PanchalNessuna valutazione finora

- Taipei Artist VillageDocumento3 pagineTaipei Artist VillageErianne DecenaNessuna valutazione finora

- Securitization of Trade ReceivablesDocumento2 pagineSecuritization of Trade ReceivablesBhavin PatelNessuna valutazione finora

- Procurement Statement of WorkDocumento4 pagineProcurement Statement of WorkAryaan RevsNessuna valutazione finora

- Dry Coal ProcessingDocumento16 pagineDry Coal ProcessingmosesmattekkNessuna valutazione finora

- African Tourism Strategic Framework 2019-2028 Executive Summary PDFDocumento9 pagineAfrican Tourism Strategic Framework 2019-2028 Executive Summary PDFdllb vidzNessuna valutazione finora

- Bank of Kigali Receives Best East African BankDocumento1 paginaBank of Kigali Receives Best East African BankBank of KigaliNessuna valutazione finora

- RAtex PresentationsDocumento10 pagineRAtex PresentationsDian Ayunita Nugraheni Nurmala Dewi100% (1)

- Fin - 515 - Smart - Chapter 1 Overview of Corporate Finance - Tute Solutions - 1Documento3 pagineFin - 515 - Smart - Chapter 1 Overview of Corporate Finance - Tute Solutions - 1Ray Gworld50% (2)

- One Region: Promoting Prosperity Across RaceDocumento70 pagineOne Region: Promoting Prosperity Across RaceCenter for Social InclusionNessuna valutazione finora