Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Mining Brochure

Caricato da

Saris KiDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Mining Brochure

Caricato da

Saris KiCopyright:

Formati disponibili

The Mining Sector in the Kingdom of Saudi Arabia

U.S.-SAUDI ARABIAN BUSINESS COUNCIL

Strengthening Bilateral Business Relations through

U.S.-Saudi Arabian Business Council

Trade and Investment

LETTER FROM THE PRESIDENT

Dear Reader, The U.S.-Saudi Arabian Business Council (USSABC) is pleased to offer you this summary of our recently released Mining Sector in the Kingdom of Saudi Arabia report. Based on extensive research gathered from Saudi Government documents, media agencies, and studies by non-governmental organizations, this report presents a concise yet thorough overview of Saudi Arabias mining sector, including billions of dollars worth of investment opportunities. The report provides an analysis of the most recent statistics and ongoing trends in the industry. It describes the sectors regulatory structure and major developments. More importantly, these topics are discussed within the framework of private and foreign investment opportunities. A current list of key contacts for government ministries and leading Saudi companies in the mining industry is also included. The 2008 Mining Sector Report is a great resource for companies interested in learning more about Saudi Arabias growing mining industry. Combined with the Councils other business development services, the report provides companies with a valuable first step toward breaking into the Saudi market, which boasts a combined $1.4 trillion worth of investment opportunities through 2020. To obtain a complete copy of the report, please see the back cover for additional information. Sincerely,

Edward Burton President and Managing Director U.S.-Saudi Arabian Business Council

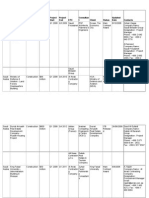

TABLE OF CONTENTS Overview of the Mining Industry Saudi Arabian Mining Company New Mining Code Minerals Projects in Development Phosphates Al Jalamid Phosphate Project Ras Azzour Industrial Complex Other Prospective Phosphate Projects Bauxite Al-Zabirah Bauxite Project Raz Azzour Aluminum Project Chlor Alkali Project Copper and Zinc Gold and Silver Iron Ore Magnesite Tantalum Gypsum and Marble Transportation System Investment Opportunities Key Contacts Saudi Arabian Government Ministries and Agencies U.S.-Saudi Arabian Business Council Member Companies Other Saudi Companies Appendix I: Mining Investment Law Appendix II: Industrial Minerals 1 1 2 3 3 3 4 5 5 5 5 6 6 7 8 9 9 9 10 11 12 12 14 17 19 34

OVERVIEW OF THE MINING SECTOR IN SAUDI ARABIA Saudi Arabia possesses more mineral resources than any other country in the Gulf region. The soil in Saudi Arabia is rich in gold, copper, phosphate, and a wide array of industrial minerals. Development of the mining sector therefore occupies a prominent position in Saudi Arabias program of diversification away from hydrocarbons. In fact, Saudi Arabia hopes to transform its nascent mining industry into the third pillar of the Saudi economy after oil and petrochemicals. To reach this goal, the Saudi Governments strategy includes establishing industries for extracting and processing the minerals, developing the transportation infrastructure to make the minerals accessible for processing, and streamlining procedures for the export of minerals and mineral-derived products. Meeting these objectives will require a significant amount of financial and capital investment. Accordingly, the Saudi Government has earmarked an estimated $11.9 billion (SR44.63 billion) for mining and mineral development through 2020. In 2006, the contribution of the Kingdoms mining sector towards the countrys GDP stood at $747 million (SR2.8 billion), up from $728 million (SR2.73 billion) in 2005. Significantly, non-oil mineral activity in Saudi Arabia is expected to grow at a rate of up to 10 percent. Maaden In 1997, the Saudi Government established the Saudi Arabian Mining Company (Maaden) as a catalyst for private investment in the mining sector. Capitalized at $1 billion (SR3.75 billion), Maaden was entrusted with consolidating the government-owned mining projects and turning them into commercially viable ventures with private sector participation. Since its inception, Maaden has adopted an aggressive exploration and mineral exploitation program, and has focused on the establishment of infrastructure services at the mining sites, including water, electricity, telecommunications, and transportation. The Saudi mining company has actively sought strategic partnerships with the private sector in order to further develop the sector from the exploration stage to the mining and processing stages. In 2004, the Saudi Government approved the initial steps to privatize Maaden. Maaden has thus far completed the restructuring of its precious metals unit and is currently in the process of creating individual companies for its gold, industrial minerals, phosphate, and aluminum interests. Mining Code Saudi Arabia approved a revised mining code in 2004 to further encourage investment in the mining industry. Under the new code, the Ministry of Petroleum and Mineral Resources can issue seven types of licenses. Investors can choose from three non-exploitation licenses and four exploitation licenses. Non exploitation licenses include reconnaissance and material collection licenses, both valid for two years, and exploration licenses, valid for three years. According to the Saudi Arabian Monetary Agencys (SAMA) 43rd Annual Report published in 2007, the number of valid mining licenses for 2006 amounted to 1,269, including 65 for prospecting; 32 for exploration; 28 for small-sized mines; 11 for mining concessions for various metal ores such as gold, copper, and zinc; and 30 mining concessions for exploiting ores of the countrys cement industry.

Identified Minerals To date, over 48 minerals have been identified in the Kingdom of Saudi Arabia, with at least 15 industrial minerals that could become commercially viable. The DMMR (Deputy Minister for Mineral Resources) has identified 1,273 sites of precious metals and 1,171 sites of non-precious metals. Minerals discovered in Saudi Arabia include phosphate; bauxite; bentonite; copper; dolomite; expandable clay; feldspar and nepheline syenite; garnet; gold; zinc; granite; graphite; gypsum; tantalum; high grade silica sand; kaolinitic clays; limestone; magnesium; marble; olivine; pozzolan; rock wool; silver; and zeolites. Infrastructure Given the vast size of the Kingdom, one of the major challenges to making mineral development commercially viable is the availability of the necessary infrastructure to transport ores to processing plants and exporting ports. In 2002, the Supreme Economic Council (SEC) approved the construction of a minerals railway, and in 2004, a $10 million (SR37.5 million) consultancy contract was awarded to a consortium comprising Canarail of Canada, Systra of France, and the Saudi Consolidated Engineering Company to cover railway design, route definition, and feasibility studies for the project. The NorthSouth Railway (NSR), as it has been named, will consist of a 2,400 kilometer rail network with 1,500 kilometers dedicated solely to transporting minerals. In fact, the railway will connect the Al-Jalamid phosphate mine, via Al-Zabirah, to Riyadh, then to Jubail. An additional direct line will also be established between Al-Zabirah Investment Opportunities The Kingdom is a favorable market for investors and joint venture opportunities in the mining industry. The Saudi Government is currently developing six economic cities throughout the Kingdom, heralding a new era of regional development. Together, the cities are estimated to attract over $100 billion worth of investments. Valued at $8 billion, the Prince Abdulaziz bin Musaed Economic City will be developed in the Hail region in the northern part of Saudi Arabia to exploit the local mineral deposits. One of the 12 components of the city will be dedicated to mining services. Opportunities to explore Saudi Arabias mineral resources are not confined to the central and northern parts of the Kingdom. The DMMR has published a list of industrial minerals that can be developed by investors. Some of these deposits have been explored or are in the process of being mined, while others have not. Aside from the countrys mineral endowment and planned industrial projects, a number of other characteristics have given Saudi Arabia a comparative advantage in the mining industry. The most important among these include the availability of low-cost feedstock, sulfur, and ammonia in the Jubail area, and the Kingdoms easy access to world markets via a network of eight ports, the largest in the region.

USSABC MEMBER COMPANIES INVOLVED IN THE MINING SECTOR

Al-Murjan Trading and Industrial Co. Ltd. Website: N/A Alujain Corporation Website: www.alujaincorporation.com Arabian Minerals and Chemicals Company, Subsidiary of Al Rushaid Investment Company Website: www.al-rushaid.com MINTREAT National Factory for Processing and Treating Minerals, Subsidiary of Delmon Co. Website: www.delmon.com.sa Saudi Arabian Mining Company (Maaden) Website: www.maaden.com.sa Saudi Binladin Group Website: www.sbg.com.sa (Under Construction) Zahid Tractor and Heavy Machinery Company Website: www.zahid.com OTHER SAUDI COMPANIES INVOLVED IN THE MINING INDUSTRY

Al Mihdar Development Co. Mining Division Website: N/A Arabian Geophysical & Surveying Co. (ARGAS) Website: N/A Arabian American Development Company Website: www.arabianamericandev.com Atlas Industrial Equipment Company (ATLASCO) Website: www.atlasindustrial.com Bakheet Company for Machinery, Ltd. Website: www.bakheet.com.sa Red Sea Mining Company, Ltd. Website: www.redseamining.com Saudi Marble Company Website: www.smcalcium.lbgo.com Saudi Oger Ltd. Website: www.saudioger.com Tanhat Mining Company, Ltd. Website: www.tanhatmining.com United Arabian Manajem Co. Website: www.manajem.com (Under Construction)

Note: The complete copy of the Mining Sector in the Kingdom of Saudi Arabia report includes a brief profile, key senior executives, and full contact information for each company.

About the U.S.-Saudi Arabian Business Council The U.S.-Saudi Arabian Business Council (USSABC) is a non-profit organization with offices in the Washington, D.C. metropolitan area and Riyadh, Saudi Arabia. Incorporated in December 1993, our mission is to develop, foster, and expand the strategic business alliance between the U.S. and Saudi Arabia by promoting trade, investment, and sustainable economic development. We are a membershipdriven organization with an impressive member roster that includes some of the most influential companies in the United States and Saudi Arabia. To learn more about the USSABC, please visit us online at www.us-sabc.org.

To purchase a copy of The Mining Sector in the Kingdom of

Saudi Arabia report, please visit the USSABCs website at www.us-sabc.org or contact the Business Council at 703-962-9300. Cost: $200 (SR750) (for non-members of the Business Council)

United States Office 8081 Wolftrap Road Suite 300 Vienna, VA 22182 Telephone: 703-962-9300 Fax: 703-204-0332 Email: ussaudi@us-sabc.org Website: www.us-sabc.org

Saudi Arabia Office 54 Al Ahsa Street, Al-Malaz P.O. Box 27582 Riyadh 11427 Telephone: 966-1-474-2555 / 474-3555 Fax: 966-1-476-7167 / 476-2697 Email: ussaudibc@us-sabc.org Website: www.us-sabc.org

Potrebbero piacerti anche

- The Mining Sector in Kindom of Saudi ArabiaDocumento2 pagineThe Mining Sector in Kindom of Saudi ArabiaNasir Ali BhattiNessuna valutazione finora

- Saudi ProjectsDocumento44 pagineSaudi Projectsdanlb801363Nessuna valutazione finora

- Mining Companies Ye MenDocumento18 pagineMining Companies Ye MenEbrahim Rashad AlzobiryNessuna valutazione finora

- Doing Business in Saudi ArabiaDocumento19 pagineDoing Business in Saudi ArabiaRagesh RajanNessuna valutazione finora

- Mining Industry Prospects in OmanDocumento8 pagineMining Industry Prospects in OmanrajataimurNessuna valutazione finora

- Deloitte Doing Business Guide KSA 2017Documento32 pagineDeloitte Doing Business Guide KSA 2017HunterNessuna valutazione finora

- Neom - Current ProejctsDocumento12 pagineNeom - Current Proejctsazharuddin0% (1)

- Licensed Surveying Companies in The Emirate of Abu Dhabi Feb 2019Documento1 paginaLicensed Surveying Companies in The Emirate of Abu Dhabi Feb 2019Anonymous d8sGHfQNessuna valutazione finora

- PPP Prospectus 8 12 19 1Documento18 paginePPP Prospectus 8 12 19 1Honey Tiwari100% (1)

- A4 9131 Doing Business Saudi ArabiaDocumento50 pagineA4 9131 Doing Business Saudi ArabiameetnaushadNessuna valutazione finora

- Saudi Arabias Renewable Energy Detailed Value Proposition 2018 - 2 PDFDocumento67 pagineSaudi Arabias Renewable Energy Detailed Value Proposition 2018 - 2 PDFRizwan Khan100% (1)

- KSA Top Megaprojects Power, Housing, Medical Cities, Metro Projects Worth $600 BillionDocumento26 pagineKSA Top Megaprojects Power, Housing, Medical Cities, Metro Projects Worth $600 BillionAlaaNessuna valutazione finora

- LSS Quality TrainingDocumento103 pagineLSS Quality TrainingSMAKNessuna valutazione finora

- Top100 Projects in The MEDocumento30 pagineTop100 Projects in The MEKhalid Shaikh100% (1)

- Swot Analysis of Saudi Arabia Market Overview: ContinuityDocumento10 pagineSwot Analysis of Saudi Arabia Market Overview: ContinuityManish KumarNessuna valutazione finora

- 2 Maaden PDFDocumento29 pagine2 Maaden PDFAnonymous q9eCZHMuSNessuna valutazione finora

- OmanObserver - 08 03 11Documento28 pagineOmanObserver - 08 03 11Anjan MohapatroNessuna valutazione finora

- Top Steel Fabrication Companies in DubaiDocumento5 pagineTop Steel Fabrication Companies in DubaiRashid AlminNessuna valutazione finora

- KSA Projects UpdateDocumento9 pagineKSA Projects Updateitpro2005Nessuna valutazione finora

- Aikah ProfileDocumento20 pagineAikah ProfileMohammad ZeeshanNessuna valutazione finora

- Fragrances in Saudi ArabiaDocumento5 pagineFragrances in Saudi Arabiaaurelie1611Nessuna valutazione finora

- Rites of Hajj and Umrah AlbaneeDocumento27 pagineRites of Hajj and Umrah AlbaneebooksofthesalafNessuna valutazione finora

- Saudi Arabias Vision 2030 Oil Policy and The Evolution of The Energy SectorDocumento12 pagineSaudi Arabias Vision 2030 Oil Policy and The Evolution of The Energy SectorsamNessuna valutazione finora

- Saudi Defence ProjectsDocumento7 pagineSaudi Defence ProjectsAnonymous 9My514Rl3SNessuna valutazione finora

- Co. Saudi ArabiaDocumento6 pagineCo. Saudi ArabiasolittaNessuna valutazione finora

- Top Contractors in KSADocumento5 pagineTop Contractors in KSAeason insightsNessuna valutazione finora

- Saudi Aramco q2 2021 Interim Report EnglishDocumento37 pagineSaudi Aramco q2 2021 Interim Report English既夹Nessuna valutazione finora

- Intertec Asset Management 200+ Saudi - 26 FEB 2024 - All DeliverableDocumento5 pagineIntertec Asset Management 200+ Saudi - 26 FEB 2024 - All DeliverableMohammad AslamNessuna valutazione finora

- Interior &buildex 2009 Market ReportDocumento81 pagineInterior &buildex 2009 Market ReportJames KentNessuna valutazione finora

- Touristic - Investment in SAUDI ARABIADocumento60 pagineTouristic - Investment in SAUDI ARABIAanazifl100% (2)

- RAKEZ Brochure EnglishDocumento9 pagineRAKEZ Brochure EnglishSazid AzadNessuna valutazione finora

- Supplier Contact - Neom DubaDocumento3 pagineSupplier Contact - Neom DubaAbanob eidNessuna valutazione finora

- Saudi Arabia Projects 2013Documento1 paginaSaudi Arabia Projects 2013chandirandelhi100% (1)

- Emails MEA - Sheet1.Documento6 pagineEmails MEA - Sheet1.Deepa JadhavNessuna valutazione finora

- Name and Address: No. Name of Contact and Phone / Fax NumbersDocumento1 paginaName and Address: No. Name of Contact and Phone / Fax NumbersmohammedNessuna valutazione finora

- Car Rental Abu DhabiDocumento2 pagineCar Rental Abu Dhabirenshi123Nessuna valutazione finora

- Gulf Business - October 2010Documento116 pagineGulf Business - October 2010motivatepublishingNessuna valutazione finora

- Saudi Construction ProjectsDocumento85 pagineSaudi Construction Projectsdheebhack0% (1)

- Saudi Arabia Infrastructure Report Q2 2008Documento47 pagineSaudi Arabia Infrastructure Report Q2 2008qwertyuiop19880% (1)

- List of Telecom Companies in Saudi ArabiaDocumento2 pagineList of Telecom Companies in Saudi ArabiaMehak Noor50% (2)

- UAE Cost Benchmarking Q4 2016Documento4 pagineUAE Cost Benchmarking Q4 2016RajasekarNessuna valutazione finora

- Final (WF-025220) 02-0000100324-069-IN-Technical - IFR-PDTDocumento2 pagineFinal (WF-025220) 02-0000100324-069-IN-Technical - IFR-PDTgokul anand100% (1)

- Post Event Report - Asset KSA - CompressedDocumento17 paginePost Event Report - Asset KSA - CompressedRahulNessuna valutazione finora

- Advertising Companies IndividualsDocumento20 pagineAdvertising Companies Individualszahid_497Nessuna valutazione finora

- Tabuk - Current ProjectsDocumento12 pagineTabuk - Current ProjectsazharuddinNessuna valutazione finora

- Projects in Saudi ArabiaDocumento3 pagineProjects in Saudi ArabiaNajjubhaiNessuna valutazione finora

- Buiz in UAEDocumento75 pagineBuiz in UAEnishithathiNessuna valutazione finora

- The Saudi Arabia Construction Projects MarketDocumento16 pagineThe Saudi Arabia Construction Projects MarketAnupam Asthana67% (3)

- Doing Business in The Kingdom of Saudi Arabia: A Tax and Legal GuideDocumento26 pagineDoing Business in The Kingdom of Saudi Arabia: A Tax and Legal GuideDiwakar RoyNessuna valutazione finora

- 3929587015final 2018 SmallDocumento448 pagine3929587015final 2018 SmallRaoof Smko100% (2)

- Oman CompanyDocumento7 pagineOman CompanyReetikaNessuna valutazione finora

- Vision 2030 Saudi ArabiaDocumento4 pagineVision 2030 Saudi ArabiaKristin MuriukiNessuna valutazione finora

- Sparklink: Trading Company W.L.LDocumento49 pagineSparklink: Trading Company W.L.LmNessuna valutazione finora

- Oil Companies DataDocumento30 pagineOil Companies Dataarunaediriweera85Nessuna valutazione finora

- PPE - PL - GCC Oil and GasDocumento65 paginePPE - PL - GCC Oil and Gasاريت ينرذرذNessuna valutazione finora

- GTC New ProfileDocumento23 pagineGTC New ProfileRajat Tiwari0% (1)

- RAK Maritime City: UAE's Newest Maritime Free ZoneDocumento8 pagineRAK Maritime City: UAE's Newest Maritime Free ZoneAnonymous 95dlTK1McNessuna valutazione finora

- Saudi Arabia's Mineral Industry in 2014Documento12 pagineSaudi Arabia's Mineral Industry in 2014red reddNessuna valutazione finora

- Summary Sheet G.9 SSA (2) Term 3Documento3 pagineSummary Sheet G.9 SSA (2) Term 3Muhammed RafelNessuna valutazione finora

- Reco Newsletter Spring 2012Documento8 pagineReco Newsletter Spring 2012Ljubomir JocicNessuna valutazione finora

- Soils ClassificationDocumento1 paginaSoils ClassificationLjubomir JocicNessuna valutazione finora

- Designing MSE Walls at Pile-Supported BridgesDocumento15 pagineDesigning MSE Walls at Pile-Supported BridgesLjubomir JocicNessuna valutazione finora

- Loading To Box-CulvertsDocumento20 pagineLoading To Box-CulvertsLjubomir JocicNessuna valutazione finora

- TechSpan Arch - North Kiama Case StudyDocumento2 pagineTechSpan Arch - North Kiama Case StudyLjubomir JocicNessuna valutazione finora

- Telco XPOL MIMO Industrial Class Solid Dish AntennaDocumento4 pagineTelco XPOL MIMO Industrial Class Solid Dish AntennaOmar PerezNessuna valutazione finora

- Handout Tematik MukhidDocumento72 pagineHandout Tematik MukhidJaya ExpressNessuna valutazione finora

- The Impact of Employees' Commitment Towards Food Safety at Ayana Resort, BaliDocumento58 pagineThe Impact of Employees' Commitment Towards Food Safety at Ayana Resort, Balirachelle agathaNessuna valutazione finora

- Fake News Poems by Martin Ott Book PreviewDocumento21 pagineFake News Poems by Martin Ott Book PreviewBlazeVOX [books]Nessuna valutazione finora

- Theoretical and Actual CombustionDocumento14 pagineTheoretical and Actual CombustionErma Sulistyo R100% (1)

- Rotary Twin Scew Brochure UK HRDocumento20 pagineRotary Twin Scew Brochure UK HRNguyễn Hữu DũngNessuna valutazione finora

- CP 343-1Documento23 pagineCP 343-1Yahya AdamNessuna valutazione finora

- Handouts For TLG 3 1Documento5 pagineHandouts For TLG 3 1Daniela CapisnonNessuna valutazione finora

- Aortic Stenosis, Mitral Regurgitation, Pulmonary Stenosis, and Tricuspid Regurgitation: Causes, Symptoms, Signs, and TreatmentDocumento7 pagineAortic Stenosis, Mitral Regurgitation, Pulmonary Stenosis, and Tricuspid Regurgitation: Causes, Symptoms, Signs, and TreatmentChuu Suen TayNessuna valutazione finora

- GIS AccidentsDocumento5 pagineGIS Accidentsali110011Nessuna valutazione finora

- LTE EPC Technical OverviewDocumento320 pagineLTE EPC Technical OverviewCristian GuleiNessuna valutazione finora

- A Compilation of Thread Size InformationDocumento9 pagineA Compilation of Thread Size Informationdim059100% (2)

- Usjr Temfacil Balance of Work Schedule Aug 25, 2022Documento5 pagineUsjr Temfacil Balance of Work Schedule Aug 25, 2022Maribeth PalumarNessuna valutazione finora

- Validation Master PlanDocumento27 pagineValidation Master PlanPrashansa Shrestha85% (13)

- Background of The Study Statement of ObjectivesDocumento4 pagineBackground of The Study Statement of ObjectivesEudelyn MelchorNessuna valutazione finora

- 11 Baby Crochet Cocoon Patterns PDFDocumento39 pagine11 Baby Crochet Cocoon Patterns PDFIoanaNessuna valutazione finora

- Space DynamicsDocumento37 pagineSpace Dynamicspurushottam KashyapNessuna valutazione finora

- Gautam Samhita CHP 1 CHP 2 CHP 3 ColorDocumento22 pagineGautam Samhita CHP 1 CHP 2 CHP 3 ColorSaptarishisAstrology100% (1)

- Who will buy electric vehicles Segmenting the young Indian buyers using cluster analysisDocumento12 pagineWho will buy electric vehicles Segmenting the young Indian buyers using cluster analysisbhasker sharmaNessuna valutazione finora

- FP-XH PGRG eDocumento936 pagineFP-XH PGRG ebvladimirov85Nessuna valutazione finora

- Oral Nutrition Support NotesDocumento28 pagineOral Nutrition Support Notesleemon.mary.alipao8695Nessuna valutazione finora

- Sri Radhakrishna SwamijiDocumento43 pagineSri Radhakrishna SwamijiNarayana IyengarNessuna valutazione finora

- Conjoint Analysis Basic PrincipleDocumento16 pagineConjoint Analysis Basic PrinciplePAglu JohnNessuna valutazione finora

- Rectifiers and FiltersDocumento68 pagineRectifiers and FiltersMeheli HalderNessuna valutazione finora

- 1"a Study On Employee Retention in Amara Raja Power Systems LTDDocumento81 pagine1"a Study On Employee Retention in Amara Raja Power Systems LTDJerome Samuel100% (1)

- ADDRESSABLE 51.HI 60854 G Contoller GuideDocumento76 pagineADDRESSABLE 51.HI 60854 G Contoller Guidemohinfo88Nessuna valutazione finora

- 2 Scour VentDocumento8 pagine2 Scour VentPrachi TaoriNessuna valutazione finora

- Abdomen - FRCEM SuccessDocumento275 pagineAbdomen - FRCEM SuccessAbin ThomasNessuna valutazione finora

- Antonovsky (1979)Documento280 pagineAntonovsky (1979)M.Fakhrul Kurnia100% (1)

- Laser Surface Treatment ProcessesDocumento63 pagineLaser Surface Treatment ProcessesDIPAK VINAYAK SHIRBHATENessuna valutazione finora