Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

N01887estax2007 09

Caricato da

api-3747051Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

N01887estax2007 09

Caricato da

api-3747051Copyright:

Formati disponibili

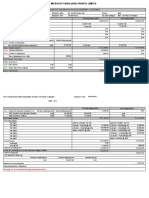

ESTIMATED TAX COMPUTATION SHEET

Date 03 Oct, 2007

Employee Code N01887 Gender M

Name Mohd. Aakil Department GEO - SPATIAL SOLUTIONS

Branch NOIDA PAN No. AJHPA5640C

Year Mon Basic Hra Spl Aln Conv Aln Misc Earn Exgratia LTA Bonus Leave Int Sub Incentive Stipend Other Total

2007 04 6,400 0 27 0 0 0 0 0 0 0 4,480 0 0 10,907

2007 05 6,400 0 27 0 0 0 0 0 0 0 6,400 0 0 12,827

2007 06 6,400 0 27 0 0 0 0 0 0 0 9,920 0 0 16,347

2007 07 6,400 0 27 0 0 0 0 0 0 0 4,800 0 0 11,227

2007 08 6,400 1,471 311 0 0 0 0 0 0 0 5,440 0 0 13,622

2007 09 6,400 1,200 259 0 0 0 0 0 0 0 2,880 0 0 10,739

75,669

Projected earning for balance months on the basis of Last Salary Rate 7,859 X 6.00 47,154

Balance annual benefits 0

Total Estimated Earnings for the year 122,823

Total Estimated Earnings 122,823 Gross Total Income 112,952 Tax Deducted at Source

Earnings from Previous Employer (Form 12B) 0 Less : Deduction Under Section 80 0

Value of Perquisites Section 17 (2) Tax Deducted Amount

Less : Deduction Under Section 80C 9,216

House Perquisites 0 08 2007 9

Other Perquisites 0 Net Taxable Income (rounded off) 103,740 Total 9

Gross Tax on Above 0

Profits in lieu of Salary under section 17(3)

Tax Payable 0

Total Earnings 122,823

Less : Under Section 10 Add : Surcharge On Above 0

Conveyance Rebate 0

HRA Rebate 9,871 Total Tax Payable 0

Education Allowance 0

LTA Rebate 0 Add : Education Cess 0

Sub Total Under section 10 9,871

Total Tax Payable 0

Net Total Earnings 112,952

Less : Tax Deducted at Source 9

Less :

till Current month

Professional Tax 0

0

Professional Tax - Previous Employer 0 Less : Tax Deducted by

Add : Other Income (Form 12 C) 0 Previous employer

Gross Total Income 112,952

Balance Tax Payable / Refundable 0

Tax Computation for Mohd. Aakil

Deduction U/s 80 Employee Considered Proof Other income details : (Form 12 C)

Declaration Amount Submitted

Description Eligible Proof

Amount Submitted

80D-Mediclaim 0 0 0 Income from House Property

80DD-Handicap 0 0 0

80DDB-Chronic disease 0 0 0 Profit/ Gains from Business

80E-Loan Rep Higher Edu 0 0 0 Interest Income

80U-Perm Physical Disability 0 0 Capital Gains

Dividend Income

Total 0 0 Other Income

TDS

Investment U/s 80C

Employee Considered Proof

Declaration Amount Submitted For mid-year joinees only:

( Income from previous employer - Form 12B )

Provident Fund - 9,216 9,216

Life Insurance Premium 0 0 0 1. Total amount of Salary excluding

Public Provident Fund 0 0 0 allowances shown below seperately

National Savings Certificate 0 0 0

2. House rent allowance; conveyance

National Savings Scheme 0 0 0

allowance and other allowance to

ULIP 0 0 0

the extent chargeable to tax

Cont'bn to Notified Annuity 0 0 0

Tuition Fees 0 0 0 3. Value of perquisities

House Loan Repay-Principal 0 0 0

4. Total ( 1 + 2 + 3 )

Mutual Fund 0 0 0 5. Amount deducted in respect of

Deffered Annuity 0 0 0 Life-Insurance Premium;

Mutual Pension 0 0 0 PF contribution etc.

Fixed Deposit 0 0

6. Professional Tax

Super Annuation 0 0 0

Pension Fund for NHB 0 0 0 7. Tax deducted at source

Previous PF 0 0

Infrastructure Bond 0 0 0

Pension 0 0 0

Voluntary Provident Fund - 0 -

Total 9,216 9,216

Maximum Permissible Limit For Above Investment :

(Lower Of Rs. 1,00,000 or Total Investment as per above)

HRA Rebate Computation

METRO CITY

Year Month Salary Rent Rent Paid Actual 50 % of Least Of The Rent

Paid Over 10% HRA Salary Three ( HRA Receipt

Of Salary REBATE ) Submitted

2007 04 6,400 3,000 2,360 0 3,200 0 0

2007 05 6,400 3,000 2,360 0 3,200 0 0

2007 06 6,400 3,000 2,360 0 3,200 0 0

2007 07 6,400 3,000 2,360 271 3,200 271 0

2007 08 6,400 3,000 2,360 1,200 3,200 1,200 0

2007 09 6,400 3,000 2,360 1,200 3,200 1,200 0

2007 10 6,400 3,000 2,360 1,200 3,200 1,200 0

2007 11 6,400 3,000 2,360 1,200 3,200 1,200 0

2007 12 6,400 3,000 2,360 1,200 3,200 1,200 0

2008 01 6,400 3,000 2,360 1,200 3,200 1,200 0

2008 02 6,400 3,000 2,360 1,200 3,200 1,200 0

2008 03 6,400 3,000 2,360 1,200 3,200 1,200 0

Total HRA Rebate : 9,871

Potrebbero piacerti anche

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- DownloadDocumento1 paginaDownloadJitaram SamalNessuna valutazione finora

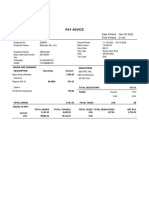

- Payslip For The Month of March 2022: Earnings DeductionsDocumento1 paginaPayslip For The Month of March 2022: Earnings Deductionssunanda singhNessuna valutazione finora

- Payslip For The Month of January 2022: Earnings DeductionsDocumento1 paginaPayslip For The Month of January 2022: Earnings Deductionssunanda singhNessuna valutazione finora

- Adecco India Private Limited: Payslip For The Month of October 2022Documento1 paginaAdecco India Private Limited: Payslip For The Month of October 2022VeereshPammarNessuna valutazione finora

- FF PayslipDocumento1 paginaFF PayslipYviie VANessuna valutazione finora

- ComputationDocumento1 paginaComputationLakshay RajoraNessuna valutazione finora

- Income Tax Calculation For The Period 01/04/2021 To 07/07/2021Documento4 pagineIncome Tax Calculation For The Period 01/04/2021 To 07/07/2021Srinath AllaNessuna valutazione finora

- Apr 2022Documento1 paginaApr 2022Rohit AdnaikNessuna valutazione finora

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocumento1 pagina175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020Nessuna valutazione finora

- Wa0005Documento1 paginaWa0005Ravi KumarNessuna valutazione finora

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Documento1 paginaVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- PAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDDocumento2 paginePAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666Nessuna valutazione finora

- EMP23 Tax Sheet Report202311152219Documento2 pagineEMP23 Tax Sheet Report202311152219SoumyaranjanNessuna valutazione finora

- LatestDocumento3 pagineLatestAman SinghNessuna valutazione finora

- VRCM9179 Feb 2023Documento1 paginaVRCM9179 Feb 2023Alluzz AmiNessuna valutazione finora

- Heads of Income Monthly Actual YTD Projected TotalDocumento2 pagineHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNessuna valutazione finora

- MediaAgility 2019 Form16Documento1 paginaMediaAgility 2019 Form16SiddharthNessuna valutazione finora

- UnknownDocumento1 paginaUnknownsaravananbsnlslm3866Nessuna valutazione finora

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocumento15 paginePricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNessuna valutazione finora

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocumento4 pagineMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANessuna valutazione finora

- HCL Technologies Ltd.Documento76 pagineHCL Technologies Ltd.Hemendra GuptaNessuna valutazione finora

- Payslip 147988 202311-10Documento1 paginaPayslip 147988 202311-10SUNKARA ISNessuna valutazione finora

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocumento1 paginaPay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENessuna valutazione finora

- LatestDocumento3 pagineLatestAman SinghNessuna valutazione finora

- EMPH2800 TAXSHEET March 2021Documento1 paginaEMPH2800 TAXSHEET March 2021the anonymousNessuna valutazione finora

- Antony Alex A (V12112) - SeptemberDocumento1 paginaAntony Alex A (V12112) - SeptemberindianoxygenltdNessuna valutazione finora

- Payslip 102703 202303 PDFDocumento1 paginaPayslip 102703 202303 PDFAnagha AnuNessuna valutazione finora

- Taxable Earnings Hours/Day S Amount PHP Deductions Amount PHP Amount PHPDocumento1 paginaTaxable Earnings Hours/Day S Amount PHP Deductions Amount PHP Amount PHPKent CantoNessuna valutazione finora

- Earnings Entitled Amt. Earned Amt. Arrears Deductions AmountDocumento5 pagineEarnings Entitled Amt. Earned Amt. Arrears Deductions AmountAditya PLNessuna valutazione finora

- Greytip Software PVT LTD: Payslip For The Month of April - 2021Documento1 paginaGreytip Software PVT LTD: Payslip For The Month of April - 2021vigneshNessuna valutazione finora

- Payslip 59904 202401Documento1 paginaPayslip 59904 202401Sk Imran IslamNessuna valutazione finora

- Fiserv December SalaryDocumento1 paginaFiserv December SalarySiddharthNessuna valutazione finora

- Payslip India June - 2023Documento2 paginePayslip India June - 2023RAJESH DNessuna valutazione finora

- Irp0000006225 1Documento1 paginaIrp0000006225 1Devender RajuNessuna valutazione finora

- FormDocumento1 paginaFormKANHAIYA KUMARNessuna valutazione finora

- 'KS22936'20201214Documento1 pagina'KS22936'20201214Aakash PrajapatiNessuna valutazione finora

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsDocumento1 paginaPay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENessuna valutazione finora

- Projected Income Tax Computation Statement For The Month of Feb 2021Documento2 pagineProjected Income Tax Computation Statement For The Month of Feb 2021LokeswaraRaoNessuna valutazione finora

- Provisional Taxsheet Mar 2020Documento1 paginaProvisional Taxsheet Mar 2020vivianNessuna valutazione finora

- SalaryDocumento1 paginaSalarypankajNessuna valutazione finora

- Concentrix Daksh Services India Private Limited: Income Tax Calculation For The PeriodDocumento5 pagineConcentrix Daksh Services India Private Limited: Income Tax Calculation For The Periodgthapliyal31Nessuna valutazione finora

- 9e1621df KM BUCKET DraftSummaryDocumento4 pagine9e1621df KM BUCKET DraftSummaryAmarnath PNessuna valutazione finora

- Paystub - 202111 2Documento1 paginaPaystub - 202111 2katya surapurajuNessuna valutazione finora

- Global Edge Software Limited: Payslip For The Month of December - 2018Documento1 paginaGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNessuna valutazione finora

- Payslip 147988 202312-27Documento1 paginaPayslip 147988 202312-27SUNKARA ISNessuna valutazione finora

- Salary Slip OctDocumento1 paginaSalary Slip OctRahul RajawatNessuna valutazione finora

- Payslip For The Month of June, 2023: Toyota Kirloskar Motor PVT LTDDocumento2 paginePayslip For The Month of June, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666Nessuna valutazione finora

- Nikhil KotakDocumento2 pagineNikhil Kotaknikhilkadam607Nessuna valutazione finora

- Computationofincome2023 1Documento2 pagineComputationofincome2023 1rtaxhelp helpNessuna valutazione finora

- Earnings Deductions: B9 Beverages LimitedDocumento1 paginaEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNessuna valutazione finora

- Payslip-Apr AvinashDocumento1 paginaPayslip-Apr AvinashCash monkeyNessuna valutazione finora

- Soria Twinkle R. FPCDocumento1 paginaSoria Twinkle R. FPCJack Daniel BalbuenaNessuna valutazione finora

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocumento1 paginaTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNessuna valutazione finora

- Payslip 2022 2023 1 Aso8807 SOAGBALICDocumento1 paginaPayslip 2022 2023 1 Aso8807 SOAGBALICRamesh Kumar PrasadNessuna valutazione finora

- SALNONEXEMPT 20221105 366924 PayslipDocumento1 paginaSALNONEXEMPT 20221105 366924 PayslipMarie LizaNessuna valutazione finora

- EPF Universal Account Number: LIC ID / Policy IDDocumento2 pagineEPF Universal Account Number: LIC ID / Policy IDBiswajit DasNessuna valutazione finora

- Payslip Sep 2022Documento1 paginaPayslip Sep 2022GloryNessuna valutazione finora

- May 2019 PDFDocumento2 pagineMay 2019 PDFVinodhkumar ShanmugamNessuna valutazione finora

- May 2019Documento2 pagineMay 2019Vinodhkumar ShanmugamNessuna valutazione finora

- Windows Server 2003 As A Workstation - FullDocumento60 pagineWindows Server 2003 As A Workstation - Fullapi-3747051Nessuna valutazione finora

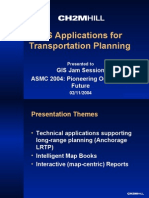

- Vagis 2006Documento20 pagineVagis 2006api-3747051Nessuna valutazione finora

- Microsoft Exchange Server 2003 Administration GuideDocumento503 pagineMicrosoft Exchange Server 2003 Administration Guide9480785203Nessuna valutazione finora

- ESRI Editing Tips TricksDocumento58 pagineESRI Editing Tips Tricksapi-3747051100% (2)

- Feb1104 Transp GISDocumento24 pagineFeb1104 Transp GISapi-3747051Nessuna valutazione finora

- Using Dialog ToolsDocumento29 pagineUsing Dialog Toolsapi-3747051Nessuna valutazione finora

- Feb1204GDBPanel MuniDocumento17 pagineFeb1204GDBPanel Muniapi-3747051Nessuna valutazione finora

- Interview TipsDocumento13 pagineInterview Tipsmasaaki suga100% (23)

- DocumentationDocumento16 pagineDocumentationapi-3747051Nessuna valutazione finora

- Tell Me About YourselfDocumento23 pagineTell Me About Yourselfapi-3747051100% (3)

- Arc ToolboxDocumento15 pagineArc Toolboxapi-3747051100% (1)

- Customizing Arc Gis DesktopDocumento49 pagineCustomizing Arc Gis Desktopapi-3747051100% (5)

- Microsoft Exchange Server 2003 Administration GuideDocumento503 pagineMicrosoft Exchange Server 2003 Administration Guide9480785203Nessuna valutazione finora

- Administration Guide For Microsoft Exchange Server 2003Documento477 pagineAdministration Guide For Microsoft Exchange Server 2003api-3731341Nessuna valutazione finora

- Module 1Documento45 pagineModule 1jsdoodnathNessuna valutazione finora

- Wlan Mac SpoofDocumento20 pagineWlan Mac Spoofsmanne7Nessuna valutazione finora

- CCNA InterviewDocumento3 pagineCCNA Interviewapi-3747051Nessuna valutazione finora

- WP Mays PingDocumento6 pagineWP Mays Pingapi-3747051Nessuna valutazione finora

- TCP IpDocumento2 pagineTCP Ipapi-3747051Nessuna valutazione finora

- Ccna 503001Documento8 pagineCcna 503001api-3747051Nessuna valutazione finora

- Week 6 Lecture MaterialDocumento115 pagineWeek 6 Lecture MaterialRAJAT . 20GSOB1010459Nessuna valutazione finora

- Employees Benefit PalnDocumento60 pagineEmployees Benefit PalnHimanshu GaurNessuna valutazione finora

- Sample Filled Form 12BDocumento3 pagineSample Filled Form 12BSanjay sharma50% (2)

- Axa - Pillar 2Documento20 pagineAxa - Pillar 2suciocerdoNessuna valutazione finora

- Mock Question I II III IV VDocumento24 pagineMock Question I II III IV Vapi-381455783% (6)

- CA+ +ESU Nanyang+Technological+University+ +2013071Documento28 pagineCA+ +ESU Nanyang+Technological+University+ +2013071Aloysius TobiasNessuna valutazione finora

- Goya EDA MemoDocumento6 pagineGoya EDA MemoNew Jersey Policy PerspectiveNessuna valutazione finora

- Notes On Withholding Tax and Income Tax FilingDocumento20 pagineNotes On Withholding Tax and Income Tax FilingnengNessuna valutazione finora

- Unit 8 - Compensation - PPTX 5th Sem - HRMDocumento12 pagineUnit 8 - Compensation - PPTX 5th Sem - HRMPrabal ShresthaNessuna valutazione finora

- Case Study On Human Behavior of OrganizationsDocumento3 pagineCase Study On Human Behavior of OrganizationsNeed Jan YapNessuna valutazione finora

- Fixed Term Employment Agreement: Page 1 of 11Documento11 pagineFixed Term Employment Agreement: Page 1 of 11Nandan SarkarNessuna valutazione finora

- User FileDocumento9 pagineUser Filesaireddy4b1Nessuna valutazione finora

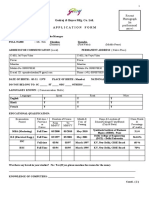

- Application Form GodrejDocumento3 pagineApplication Form GodrejUpendra ChauhanNessuna valutazione finora

- Accounting For Architecture FirmsDocumento6 pagineAccounting For Architecture FirmsAsmaa Farouk100% (2)

- EMPLOYEE BENEFITS - Written ReportDocumento20 pagineEMPLOYEE BENEFITS - Written ReportGerha Marie Bugtay PabutawanNessuna valutazione finora

- Call Letter Leh 12122023Documento9 pagineCall Letter Leh 12122023Imtiyaz HarkariNessuna valutazione finora

- Income Tax (Ranjan Sir)Documento76 pagineIncome Tax (Ranjan Sir)Mizanur Rahman Babla100% (2)

- Confederation For Unity, Recognition and Advancement of Government EmployeesDocumento2 pagineConfederation For Unity, Recognition and Advancement of Government EmployeesBenjie SalesNessuna valutazione finora

- PLM Faculty Manual v1Documento142 paginePLM Faculty Manual v1Akira YukiNessuna valutazione finora

- Form 16: Wipro LimitedDocumento5 pagineForm 16: Wipro LimitedIbrahim MohammadNessuna valutazione finora

- Pensions ExplainedDocumento5 paginePensions ExplainedEnock Sekamanje KasasaNessuna valutazione finora

- Total Reward and Employee Engagement ReportDocumento58 pagineTotal Reward and Employee Engagement Reportvvishaljaswa100% (1)

- HR PolicyDocumento119 pagineHR PolicyRaghu SharmaNessuna valutazione finora

- Training, Motivating, Compensating, and Leading The SalesforceDocumento35 pagineTraining, Motivating, Compensating, and Leading The SalesforceVikasNessuna valutazione finora

- Revenue Regulations No. 02-98: April 17, 1998Documento130 pagineRevenue Regulations No. 02-98: April 17, 1998Christine de VeraNessuna valutazione finora

- Financial Management ManualDocumento65 pagineFinancial Management ManualReggie LattimoreNessuna valutazione finora

- Voluntary Retirement Scheme AnalysisDocumento7 pagineVoluntary Retirement Scheme AnalysisKapilGhanshaniNessuna valutazione finora

- Ex-Gratia Payment by KPMGDocumento4 pagineEx-Gratia Payment by KPMGs_baishyaNessuna valutazione finora

- REG NotesDocumento119 pagineREG NotesYash MhatreNessuna valutazione finora