Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Standard Costing

Caricato da

Wong Mei KunDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Standard Costing

Caricato da

Wong Mei KunCopyright:

Formati disponibili

Prof. Zulesh/R.C.C./P.C.C.

/COSTING/STANDARD COSTING

STANDARD COSTING Introduction: It is a tool of cost control. Under standard costing, performance standards are set for all areas of operation within the organisation. This is done in consultation with various departmental heads. When actual performance takes place, actual data is compared with standards. If there is a difference between actuals and standards, the difference is calculated and analysed to find reasons thereof. Deviation of actuals from standards are called variances. Such variances may be favourable or adverse for the business. MATERIAL COST VARIANCES: Material standards are set in relation to material price and material quantity. If more than one material is used, standard is also set as regards the mix ratio between materials. This is done in consultation with production manager and purchase manager. Suppose it is decided that for making one unit of product, 5 kgs of raw materials should be used at Rs.12 per kg. Then, standard material cost = 5 kgs x Rs.12 per kg. = Rs.60 When actual production takes place, actual data is compared with standard. Suppose one unit of product was actually produced using 6.5 kgs of material purchased at Rs.15 per kg. Actual material cost = 6.5 kgs x Rs.15 per kg = Rs.97.5 Total variance = 37.5 (adverse) This variance can be further analysed to find its reasons as under: Y Price

(Rs. Per kg)

AP SP

15 12

5 SQ

6.5 AQ

X Quantity (Kgs.)

Various material variances are calculated as under: 1) Total material cost variance = SQ x SP AQ x AP 2) Material price variance = (SP AP) x AQ 3) Material usage variance = (SQ AQ) x SP In case more than one material is used, Material usage variance is further analysed as: 1. Material yield / sub-usage variance = (SQ SQ in actual input) SP 2. Material mix variance = (SQ in actual input AQ) SP

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

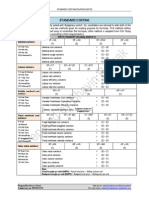

1. Notes: While solving the problem, prepare the following table: Usage

Yield

Mix

Ratio

SQ

SQ in total input

AQ

SP XX XX

AP XX XX

M1 XX XX M2 XX . . XX Input XX Total input Total input XX . XX (-) Loss XX Actual output Actual output Output 2. Given quantity ratios are to be entered in ratio column. 3.

Material is a variable cost and so, given ratios are to be applied to actual output to get standard quantity for actual output. (Standard always depends on actual output) If any of the above variances are negative, they are said to be adverse and if positive, they are said to be positive. Total material cost variance = Material price variance + Material usage variance Material usage variance = Material yield variance + Material mix variance Illustration 1 80 Kgs of material A at a standard price of Rs 2 per Kg and 40 Kgs of material B at a standard price of Rs 5 per Kg were to be used to manufacture 100 Kg of a chemical. During a month 70 Kgs of material A priced at Rs 2.10 per Kg. and 50 Kg. of material B priced at Rs 4.50 per Kg. were actually used and the output of the chemical was 102 Kgs. Find out the material variances. Solution: Usage

4. 5. 6.

Yield

Mix

Ratio

SQ

SQ in total input 80 40 120

AQ

SP

AP

A B Input (-) Loss Output

80 40 120 20 100

81.6 40.8 122.4 20.4 102

70 50 120 18 102

2 5

2.1 4.5

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

Total Material Cost Variance = (SQ X SP) (AQ X AP) A = (81.6 X 2) (70 X 2.1) = 16.2 (Favourable) (Adverse) B = (40.8 X 5) (50 X 4.5) = 21 4.8 (Adverse) Material Price A = B = Variance = (SP AP)AQ (2-2.1) 70 = 7 (Adverse) (Favourable) (5-4.5) 50 = 25 18 (Favourable)

Material usage variance = (SQ AQ) SP A = (81.6 70) 2 = 23.2 (Favourable) B = (40.8 50) 5 = 46 (Adverse) 22.8 (Adverse) Material yield variance/Sub usage variance = (SQ SQ in total input)SP A = (81.6 80) 2 = 3.2 (Favourable) B = (40.8 40) 5 = 4 (Favourable) 7.2 (Favourable) Material Mix Variable = A = (80 70)2 = B = (40 50)5 = (SQ 20 50 30 in total input AQ) SP (Favourable) (Adverse) (Adverse)

Price variance occurs at the time of purchase. It occurs on the entire quantity purchased. However, it may be calculated immediately at the time of purchase on quantity purchased or it may be calculated later, as and when materials are used. If price variance is calculated at the time of purchase, Material price variance = (SP AP of purchases) AQ purchased If price variance is calculated at the time of consumption, Material price variance = (SP AP of consumption) AQ consumed Material usage variance occurs at the time of usage (i.e. consumption) and so it is always calculated at the time of consumption and is based on quantity consumed. Illustration 2 Eskay Ltd. produces an article by blending two basic raw materials. The following standards have been set up for raw materials: Material Standard Mix Standard price per kg. A 40% Rs 4.00 B 60% Rs 3.00 The standard loss in processing is 15% During Sept 1990, the company produced 1,700 Kg of finished output. 3

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

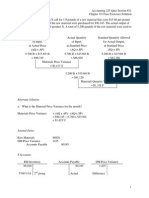

The position of stock and purchases for the month of Sept 1990 is as under: stock on Purchased during Material Stock on 1.9.90 30.9.90 Sept, 90. Kg Kg Kg Cost Rs A 35 5 800 3,400 B 40 50 1,200 3,000 Calculate the materials variances. Assume first in first out method for the issue of material. The opening stock is to be valued at standard price. Solution: A Qty CPU Amount 35 4 140 800 4.25 3400 835 3540 5 4.25 21.25 830 3518.75 Usage Qty 40 1200 1240 50 1190 B CPU Amount 3 120 2.5 3000 3120 2.5 125 2995

Op. Stock (+) Purchases (-) Clg. Stock Consumed

Yield

Mix

Ratio

SQ

A B Input (-) loss Output

40 60 100 15 85

800 1200 2000 300 1700

SQ in total Input 808 1212 2020

AQ

SP

AP

830 1190 2020 320 1700

4 3518.75/830 3 2995/1190

Total Material cost variance = SQ X SP AQ x AP A = (800 X 4) (830 X 3518.75/830) = 318.75 (Adverse) B = (1200 X 3) (1190 X 2995/1190) = 605 (Favourable) 286.25 (Favourable) Material Price Variance: (A)If calculated at the time of purchase=(SPAP of purchase)AQ purchased. A = (4 4.25) 800 = 200 (Adverse) B = (3 2.5) 1200 = 600 (Favourable) 400 (Favourable) (B) If calculated at the time of consumption=(SPAP of consumption)AQ Consumed A = (4 3518.75/830) 830 = 198.75 (Adverse) B = (3 2995/1190) 1190 = 575 (Favourable) 376.25 (favourable) 4

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

Materials usage variable = (SQ AQ) SP A = (800 830) 4 = 120 (Adverse) (Favourable) B = (1200 1190)3 = 30 90 (Adverse) Material yield variance = (SQ SQ in total input) SP A = (800 808)4 = 32 (Adverse) B = (1200 1212)3 = 36 (Adverse) 68 (Adverse) Material Mix variance= (SQ in total Input AQ) SP A = (808 830) 4 = 88(Adverse) B = (1212 - 1190) 3 = 66 (Favourable) 22 (Adverse)

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

LABOUR COST VARIANCES: Labour standards are set as regard time and wage rate. If there are more than one type of worker, standards are also made for the composition of the various types of workers. This is done in consultation with production manager and personnel manager. Suppose it is decided that to manufacture one unit of a product, a worker should take 6 hours and he should be paid at Rs.2.50 per hour. So, standard labour cost per unit = 6 hours x Rs.2.5 per hour = Rs.15 When actual production takes place, actual data is compared with standard. Suppose one unit of product was actually produced in 8 hours paid at Rs.3 per hour. Actual labour cost per unit = 8 hours x Rs.3 per hour = Rs.24. Total labour cost variance = 15-24 = Rs.9 (adverse) This variance can be further analysed as follows: Y Wage rate

(Rs. Per hr)

AR 3 SR 2.5

6 SH

8 AH

X Time (hours)

Various labour variances are calculated as under: 1. 2. 3. Total labour cost variance = SH x SR AHp x AR Labour Wage rate variance = (SR AR) AHp Labour usage variance = (SH AHp) SR If idle time has taken place, then labour usage variance is further divided into labour efficiency variance and labour idle time variance. If there are more than one category of workers, usage variance is further divided into efficiency variance, mix variance (and also idle time variance, if there be). This is done as under: Labour efficiency/yield/sub-usage variance = (SH SH in total AHw) SR Labour mix variance = (SH in total AHw - AHw) SR Labour idle time variance = (AHw AHp) SR = idle time x SR

1. 2. 3.

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

NOTES: 1. Prepare the following table: Usage

Yield Ratio SH SH in total AHW .

Total AHw

Mix AHw

Idle time Idle time XX XX XX AHp SR AR

I II Total Output 2.

XX XX XX XX

. .

Actual output

XX XX

Total AHw

XX XX XX

Actual output

XX XX

XX XX

The ratio of time in which workers should be utilised to manufacture a product is entered in the ratio column. Labour is a variable cost and so, given ratios are to be applied to actual output to get standard time for actual output. (standard always depends upon actual output) Labour time is measured in terms of labour hours and not hours. Labour hours = number of workers x number of hours. If any of the above variances are negative, they are said to be adverse and if positive, they are said to be favourable. Total labour cost variance = Labour rate variance + labour usage variance Labour usage variance = Labour efficiency variance + Labour mix variance + Labour idle time variance. Mix variance is also called gang variance Efficiency variance is also called yield variance or sub-usage variance Idle time is calculated based on standard ratio of workers and not actual ratio of workers. In absence of idle time, AHw = AHp Illustration 3. The following was the composition of a gang of workers in a factory during a particular month, in one of the production departments. The standard composition of workers and wage rate per hour were as below:

3.

4.

5.

6. 7.

8. 9. 10.

11.

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

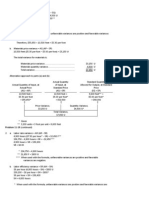

Skilled: Two workers at a standard rate of Rs.20 per hour each. Semi-skilled: Four workers at a standard rate of Rs.12 per hour each. Unskilled: Four workers at a standard rate of Rs.8 per hour each. The standard output of the gang was four units per hour, of the product. During the month in question, however, the actual composition of the gang and hourly wage rates paid were as under: Nature of workers No. of workers Wage rate paid per worker per hour engaged Skilled 2 Rs.20 Semi-skilled 3 Rs.14 Unskilled 5 Rs.10 The gang was engaged for 200 hours during the month, which included 12 hours when no production was possible due to machine break-down.810 units of the product were recorded as output of the gang during the month. You are required to compute the total variance in labour cost during the month and analyse the variance into sub-variances. Solution: Usage

Yield Ratio Skilled Semiskilled Unskilled Total Output 2x1=2 4x1=4 4x1=4 10 4 SH 405 810 810 2025 810

SH in total AHw

Mix AHW 376 552 952 1880

Idle time Idle Time 2x12=24 4x12=48 4x12=48 120 AHP 2x200=400 3x200=600 5x200=1000 2000 810 SR AR 20 12 8 20 14 10

376 752 752 1880

Total Labour Cost variance = SH X SR AHP X AR Skilled = 405 X 20 400 X 20 = 100 (Favourable) Semi-skilled = 810 X 12 600 X 14 = 1320 (Favourable) Unskilled = 810 X 8 1000 X 10 = 3520 (Adverse) 2100 (Adverse) Labour wage rate variance = (SR AR) AHp Skilled = (20 20) 400 = 0 SemiSkilled = (12 -14) 600 = 1200 (Adverse) Unskilled = (8 10) 1000 = 2000 (Adverse) 3200 (Adverse) Labour usage variance = (SH AHp) SR Skilled = (405 400)20 = SemiSkilled = (810 600)12 = Unskilled = (810 1000)8 = 100 (Favourable) 2520 (Favourable) 1520 (Adverse) 1100 (Favourable)

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

Labour Yield / Efficiency variance = (SH SH in total AHw) SR Skilled = (405 376) 20 = 580 (Favourable) Semiskilled = (810 752) 12 = 696 (Favourable) Unskilled = (810 - 752) 8 = 464 (Favourable) 1740 (Favourable) Labour Mix / Gang Variance = (SH in total AHw AHw)SR Skilled = (376 376) 20 = 0 Semi-Skilled = (752 552) 12 = 2400 (Favourable) Unskilled = (752 952) 8 = 1600 (Adverse) 800 (Favourable) Labour Idle time variance = (AHw AHp)SR OR Idle time x SR Skilled = 24 x 20 = 480 (Adverse) Semi-skilled = 48 x 12 = 576 (Adverse) Unskilled = 48 x 8 = 384 (Adverse) 1440 (Adverse)

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

FIXED OVERHEADS VARIANCES: Before the start of the year, budget for fixed overheads and output is prepared and recovery rate is determined as follows: Fixed overheads recovery rate = Budgeted fixed overheads Budgeted output When actual production takes place, fixed overheads are recovered in the cost books based on fixed overheads recovery rate. Fixed overheads recovered = Fixed overheads recovery rate x Actual output The actual fixed overheads may not match with budgeted fixed overheads as well as recovered fixed overheads. Hence variances arise. Cost Volume Fixed overheads Recovered (R) Expenditure/Budget Budgeted fixed overheads (B) Actual fixed overheads (A)

Fixed overheads cost variance = (R) (A) Fixed overheads volume variance = (R) (B) Fixed overheads expenditure/budget variance = (B) (A) If information about budgeted and actual hours is also given: In such case, volume variance can be further divided into efficiency and capacity variance. Find standard hours for actual output. Find standard rate per hour. Efficiency Capacity

Standard hours for actual output

actual hours

budgeted hours

Fixed overheads efficiency variance = (standard hours for actual output actual hours) Std. rate / hour Fixed overheads capacity variance = (Actual hours budgeted hours) Std. rate / hour If information about budgeted and actual days is given: In such case also, volume variance can be further divided into efficiency and capacity variance. Find standard days for actual output. Find standard rate per day.

10

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

Efficiency Standard days for actual output actual days Capacity budgeted days

Fixed overheads efficiency variance = (standard days for actual output actual days) Std. rate / day Fixed overheads capacity variance = (Actual days budgeted days) Std. rate / day If information about budgeted and actual hours as well as days is given: In such case, volume variance can be further divided into efficiency, capacity and calendar variance. Find standard hours for actual output. Find standard hours in actual days. Find standard rate per hour. Efficiency Standard hours for actual output Capacity Calendar budgeted hours

Actual hours

Standard hours in actual days

Fixed overheads efficiency variance = (standard hours for actual output actual hours) Std. rate / hour Fixed overheads capacity variance = (Actual hours Standard hours in actual days) Std. rate / hour Fixed overheads calendar variance = (standard hours in actual days Budgeted hours) std. rate / hour Illustration 4. The following information is available from the records of a factory: Budget Actual Fixed overhead for June Rs 10,000 Rs 12,000 Production in June (units) 2,000 2,100 Standard time per unit(hours) 10 Actual hours worked in June 22,000 Compute: Fixed overhead cost variance ii) Expenditure variance Volume variance iv) Capacity Variance Efficiency variance.

i) iii) v)

11

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

Solution: Budget Fixed overheads (Rs.) 10,000 Output (units) 2,000 Hours 2000 x 10 = 20,000 Step 1 Actual 12,000 2,100 22,000

Step 2

Fixed overheads recovery rate = Budgeted fixed overheads Budgeted output = Rs. 10000 = Rs.5/unit 2000 units Fixed overhead recovered = Recovery rate x Actual output = Rs.5/unit x 2,100 units = Rs.10,500 Cost Volume Expenditure (Budgeted Fixed overheads) Rs.10,000 (Actual fixed overheads) Rs.12,000

(Recovered Fixed overheads) Rs.10,500 Step 3

Std. hrs for actual output Output 1 2,100

std hrs. 10 ?(21,000)

Step 4

Std. rate per hour = Budgeted fixed overheads Budgeted hours = Rs.10,000 = Rs.0.5/hr. 20,000hrs. Efficiency Capacity

Standard hours for actual output 21,000

actual hours 22,000

budgeted hours 20,000

Fixed overheads cost Variance = Recovered fixed overheads Actual fixed Overheads = 10,500 12,000 = 1,500 (Adverse). Fixed overheads Volume Variance = Recovered fixed overheads Budgeted fixed overheads = 10,500 - 10,000 = 500 (Favourable) Fixed overheads expenditure/Budget variance 12

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

= Budgeted fixed overheads Actual fixed overhead = 10,000 12,000 = 2,000 (Adverse) Fixed overheads efficiency Variance = (Std hrs actual output Actual hrs) std rate per hr. = (21,000 22,000) 0.5 = 500 (Adverse) Fixed overheads capacity variance = (Actual hrs. Budgeted hrs.) Std. rate per hour = (22,000 - 20,000) 0.5 = 1000 (Favourable)

13

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

VARIABLE OVERHEADS VARIANCE: In case of variable overheads, budgets or standards are set on per unit basis. Thus, if in the question, we are given that variable cost of Rs.10000 is budgeted for an output of 500 units, it is to be understood that the variable overheads budgeted is Rs.20 per unit and not Rs.10000 in total. Thus, if the actual quantity is not 500 units, standard will be revised for actual output. Hence, first find budgeted variable overheads per unit Budgeted variable overheads per unit = budgeted variable overheads Budgeted output Find standard variable overheads for actual output Standard variable overheads for actual output = Budgeted variable overheads per unit x actual output Variable overheads cost variance =Standard variable overheads for actual output Actual variable overheads Illustration 5. AB company Ltd is having Standard Costing system in operation for quite some time. The following data relating to the month of April, 1994 is available from the cost records: Budgeted Actual Output (in units) 30,000 32,500 Variable overheads (Rs) 60,000 68,000 You are required to work out the relevant variance (on the basis of output) Solution: Budgeted variable overheads per unit = Budgeted variable overheads Budgeted output = Rs.60000 = Rs.2/unit 30,000 units Standard variable overheads for actual output = Rs.2/unit x 32,500 units = Rs.65,0000. Variable overheads cost variance =Standard variable overheads for actual output Actual variable overheads = 65,000 68,000 = 3,000 (Adverse)

14

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

SALES VARIANCES: Sales budgets are prepared for the period in respect of sales quantity and selling price. The actual sales for the period are directly compared with budgeted sales. However, while comparing, it is to be checked that the length of the period of budget and actual data is same. i.e. if budgeted sales are given for one year but actual sales are only for a quarter, then they cannot be directly compared and hence, budgets are adjusted for actual period and then compared. Notes: Prepare the following table: Volume

1.

Quantity

Mix

SSQ A B C TOTAL 2. XX XX XX XX

SSQ in total ASQ

ASQ XX XX XX TOTAL ASQ

SSP XX XX XX

ASP XX XX XX

TOTAL ASQ

Various sales variances are calculated as under: a) Total sales variance = SSQ x SSP ASQ x ASP b) Sales price variance = (SSP ASP) ASQ c) Sales volume variance = (SSQ ASQ) SSP If there are more than one product being sold, sales volume variance is further divided into the following: a) Sales quantity / sub-volume variance = (SSQ SSQ in total ASQ) SSP b) Sales mix variance = (SSQ in total ASQ ASQ) SSP Total sales variance = sales price variance + sales volume variance Sales volume variance = Sales quantity variance + sales mix variance Since sales is an income, negative variance denotes favourable variance and positive variance denotes adverse variance. Illustration 6. PH Ltd furnishes the following information relating to budgeted sales and actual sales for April 1991 : Product Sales Quantity Selling Price Per unit Units Rs Budgeted Sales: A 1,200 15 B 800 20 C 2,000 40 15

3.

4. 5. 6.

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

Actual Sales A 880 18 B 880 20 C 2,640 38 Calculate the following variances: Sales Quantity Variances ii) Sales Mix Variances Sales Price Variance iv) Total Sales Variance. Solution: Volume Quantity Mix

i) iii)

SSQ in Actual ASQ SSP sales A 1200 1320 880 15 B 800 880 880 20 C 2000 2200 2640 40 4000 4400 4400 Total Sales Variance = SSQ x SSP ASQ x ASP A = (1200 x 15) (880 x 18) = 2160 (Adverse) B = (800 x 20) - (880 x 20) = 1600 (Favourable) C = (2000 x 40) (2640 x 38) = 20320 (Favourable) 19760 (Favourable) Sales price Variance = (SSP ASP) ASQ. A = (15 18) 880 = 2640 (Favourable) B = (20 20) 880 = 0 C = (40 38) 2640= 5280 (Adverse) 2640 (Adverse) Sales Volume variance = (SSQ ASQ) SSP. A = (1200 880) 15 = 4800 (Adverse) B = ( 800 880) 20 = 1600 (Favourable) C = (2000 2640) 40 = 25600 (Favourable) 22400 (Favourable)

SSQ

ASP 18 20 38

Sales Qty/Sale Volume variance = (SSQ SSQ in Actual Sales) SSP. A = (1200 1320) 15 = 1800 (Favourable) B = (800 880) 20 = 1600 (Favourable) C = (2000 2200) 40 = 8000 (Favourable) 11400 (Favourable) Sales mix Variance = (SSQ in Actual Sales ASQ) SSP. A = (1320 880) 15 = 6600 (Adverse) B = ( 880 880) 20 = 0 C = (2200 2640) 40 = 17600 (Favourable) 11000 (Favourable)

16

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

PROFIT VARIANCES: Variance in profit arises due to cost as well as sales. Let us consider the following example: 2000 units were budgeted to be sold @ Rs.30 each. Cost budgeted was Rs.24 per unit. 1900 units were sold @ Rs.32 each. Cost incurred was Rs.25 Budgeted profit = 2000 (30 24) = Rs.12000 Actual profit = 1900 (32 25) = Rs.13300 Increase in Profit = Rs.1,300 Variance in profit = Rs.1300 (favourable) This variance in profit of Rs.1,300 is due to cost factor and sales. To analyse the effect of cost on profit, keep selling price constant. Budget Actual Selling Price 30 30 - Cost 24 25 Profit 6 5 Therefore, if cost increases by Re. 1, profit decreases by Re.1. Increase in cost is Re.1 (adverse) and decrease in profit is also Re.1 (adverse). This means that profit variance due to cost is same as cost variance. In the above example, Profit variance due to cost = cost variance=(2425) X 1900* = 1900 (adverse) * In all the cost variances, the given ratio was always revised for actual output. Variance in profit due to sale can be analysed in two parts Selling price and sales volume. Let us analyse the effect of change in selling price on profit. For this, keep the cost constant. Budget Actual Selling Price 30 32 Cost 24 24 Profit 6 8 Therefore, if selling price increases by Rs.2, profit also increases by Rs.2. Change in selling price is Rs.2 (favourable) and change in profit is also Rs.2 (favourable). Thus, profit variance due to selling price is same as selling price variance. Profit variance due to selling price = sales price variance = (SSP ASP) X ASQ. = (30 32) X 1900 = 3800 (favourable) Effect of change in sales volume on profit: Keep cost and selling price constant. Let us analyse the effect of change in sales quantity on profit. 1 unit 2 units Selling price (@ Rs.30 p.u.) 30 60 Cost (@ Rs.24 p.u.) 24 48 Profit 6 12 Increase in sales due to change in quantity is Rs.30 but increase in profit is Rs.6 only. Thus sales volume variance is Rs.30 (Favourable) but profit variance due to sales volume is Rs.6 (favourable) and so not the same. 17

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

Thus, Sales volume variance = (SSQ ASQ) x SSP Profit variance due to sales volume = (SSQ ASQ) x Std. Profit In the above example, Profit variance due to sales volume = (2000 1900) 6 = 600 (adverse) Total variance in profit = profit variance due to cost + profit variance due to selling price + profit variance due to sales volume = 1900 (adverse) + 3800 (favourable) + 600 (adverse) = 1300 (Favourable) Illustration 7 The standard cost data of three products X, Y and Z manufactured by a company are given below together with the budgeted sales and unit selling price for 1995-96: X Y Z Budgeted sales (Units) 25,000 20,000 15,000 Selling price per unit ( Rs) 40 60 80 Cost per Unit(Rs) 28 48 64 The cost department of the company gathered the following details for 199596: X Y Z Actual Sales (Units) 20,000 22,000 16,000 Average sales realisation per unit (Rs) 42 56 81 Actual cost per unit (RS) 30 50 63 You are required to determine: the Budgeted profit and the actual profit for 1995-96; the variance in profit analysed into Cost Variance; Sales Price Variance Sales Volume Variance. Solution X Y Z SSP 40 60 80 Std. cost 28 48 64 Std. Profit SSQ Profit 12 25000 300000 12 20000 240000 16 15000 240000 Budgeted profit 780000 Actual profit 12 6 18 ASQ 20000 22000 16000 Actual profit Profit 240000 132000 288000 660000

a) b) i) ii) iii)

ASP X Y Z 42 56 81

Actual cost 30 50 63

Profit variance due to cost = (Std. cost Actual cost) ASQ X = (28-30) 20000 = 40000 (Adverse) Y = (48-50) 22000 = 44000 (Adverse) Z = (64-63) 16000 = 16000 (favourable) 68000 (Adverse) 18

Prof. Zulesh/R.C.C./P.C.C./COSTING/STANDARD COSTING

Profit variance due to sales price=Sales price variance=(SSPASP) ASQ X = (40-42) 20000 = 40000 (favourable) Y = (60-56) 22000 = 88000 (Adverse) Z = (80-81) 16000 = 16000 (Favourable) 32000 (Adverse) Profit variance due to sales volume = (SSQ ASQ) Std. profit X = (25000-20000)12= 60000 (Adverse) Y = (20000-22000)12= 24000 (Favourable) Z = (15000-16000)16= 16000 (Favourable) 20000 (Adverse) Statement reconciling budgeted and actual profit Particulars Rs. Rs. Budgeted profit 7,80,000 (-) decrease in profit due to Adverse profit variance due to cost 68000 Adverse profit variance due to sales price 32000 Adverse profit variance due to sales volume 20000 120000 Actual profit 660000

19

Potrebbero piacerti anche

- Standard Costing: QUANTITY Standard - Indicates The Quantity of Raw Materials orDocumento19 pagineStandard Costing: QUANTITY Standard - Indicates The Quantity of Raw Materials orMarielle Mae Burbos100% (2)

- Synth 1 (STD COSTING)Documento11 pagineSynth 1 (STD COSTING)Hassan AdamNessuna valutazione finora

- Standard Costing & Variance AnalysisDocumento29 pagineStandard Costing & Variance Analysisadityaraj143143Nessuna valutazione finora

- Chapter 10 PDFDocumento84 pagineChapter 10 PDFSyed Atiq TurabiNessuna valutazione finora

- Standard Costing: by - Ankit Kumar JainDocumento32 pagineStandard Costing: by - Ankit Kumar JainHendri Wahyu KurniawanNessuna valutazione finora

- Module 4Documento4 pagineModule 4mark fernandezNessuna valutazione finora

- Problems On Standard CostingDocumento10 pagineProblems On Standard CostingAbid Siddiq MurtazaiNessuna valutazione finora

- STANDARD COSTING and Variance AnalysisDocumento28 pagineSTANDARD COSTING and Variance AnalysisDanica VillaganteNessuna valutazione finora

- Standard Costing and Variance AnalysisDocumento38 pagineStandard Costing and Variance AnalysisAlexis Kaye DayagNessuna valutazione finora

- Lecture Notes - STD Costing and Variance AnalysisDocumento6 pagineLecture Notes - STD Costing and Variance AnalysisBarby Angel100% (4)

- Accg200 L12Documento11 pagineAccg200 L12Nikita Singh DhamiNessuna valutazione finora

- Chapter 5 Standard CostingDocumento48 pagineChapter 5 Standard CostingNitin BurlaNessuna valutazione finora

- CH00 Standard Costing and Variance AnalysisDocumento75 pagineCH00 Standard Costing and Variance AnalysisDimple AtienzaNessuna valutazione finora

- Cost VarianceDocumento10 pagineCost VariancesurendarNessuna valutazione finora

- Variance AnalysisDocumento9 pagineVariance AnalysisAnand PatilNessuna valutazione finora

- 02.12.21 Variance AnalysisDocumento25 pagine02.12.21 Variance Analysisejazahmad5Nessuna valutazione finora

- Standard Costs AnalysisDocumento5 pagineStandard Costs AnalysisMohamed ShaabanNessuna valutazione finora

- Analysis of VarianceDocumento6 pagineAnalysis of VarianceBhavna SharmaNessuna valutazione finora

- STANDARD COSTING and Variance AnalysisDocumento30 pagineSTANDARD COSTING and Variance AnalysisAlthon JayNessuna valutazione finora

- Chapter 9 Standard CostDocumento10 pagineChapter 9 Standard CostMorrisNessuna valutazione finora

- 5-Standard Costing and GP Variance AnalysisDocumento16 pagine5-Standard Costing and GP Variance AnalysisMelybelle LaurelNessuna valutazione finora

- Unit 7-Standard CostingDocumento5 pagineUnit 7-Standard Costingkevin75108Nessuna valutazione finora

- 4 Th. Sem. Standard Costing Problems SolutionsDocumento12 pagine4 Th. Sem. Standard Costing Problems SolutionsCh Sam100% (2)

- MBA 504 Ch11 SolutionsDocumento31 pagineMBA 504 Ch11 Solutionschawlavishnu100% (1)

- Chapter Eleven: Standard Costs and Variance AnalysisDocumento43 pagineChapter Eleven: Standard Costs and Variance AnalysisnnonscribdNessuna valutazione finora

- Standard Costing: SUPER SUMMARY (Reading Method 1) Material VarianceDocumento5 pagineStandard Costing: SUPER SUMMARY (Reading Method 1) Material VarianceWinnieOngNessuna valutazione finora

- QS11 - Class Exercises SolutionDocumento8 pagineQS11 - Class Exercises Solutionlyk0tex100% (2)

- Costing Notes Chapter - Standard Costing: MCV Muv + MPV and Muv Myv + MMVDocumento12 pagineCosting Notes Chapter - Standard Costing: MCV Muv + MPV and Muv Myv + MMVSocial SectorNessuna valutazione finora

- Accounting Group AssigmnetDocumento9 pagineAccounting Group AssigmnetABNETNessuna valutazione finora

- Standard Costing: Output (Eg. Pieces Per Unit)Documento4 pagineStandard Costing: Output (Eg. Pieces Per Unit)glcpaNessuna valutazione finora

- 06 Standard Costing PDFDocumento5 pagine06 Standard Costing PDFMarielle CastañedaNessuna valutazione finora

- Standard Costing & Variance AnalysisDocumento38 pagineStandard Costing & Variance AnalysisJagseer SinghNessuna valutazione finora

- Analyzing Financial - Performance ReportDocumento29 pagineAnalyzing Financial - Performance ReportjatimTV webNessuna valutazione finora

- Material Cost VarianceDocumento4 pagineMaterial Cost Variancesunil kumarNessuna valutazione finora

- Material Cost VarianceDocumento4 pagineMaterial Cost Variancesunil kumarNessuna valutazione finora

- Chapter 10-Advanced VariancesDocumento36 pagineChapter 10-Advanced VariancesKevin Kausiyo100% (5)

- It Will Be Recalled From The Previous Section That A Variance Is The Difference Between Standard Cost and Actual CostDocumento4 pagineIt Will Be Recalled From The Previous Section That A Variance Is The Difference Between Standard Cost and Actual CostBisag AsaNessuna valutazione finora

- Ch09 - Standard Costing A Managerial Control ToolDocumento46 pagineCh09 - Standard Costing A Managerial Control Toolachmad rezaNessuna valutazione finora

- VariancesDocumento16 pagineVariancesaroridouglas880Nessuna valutazione finora

- Mas 07Documento14 pagineMas 07Christine Jane AbangNessuna valutazione finora

- SCM Discussion 6Documento10 pagineSCM Discussion 6M4ZONSK1E OfficialNessuna valutazione finora

- Standard Costing 8Documento12 pagineStandard Costing 8suraj banNessuna valutazione finora

- Unit 3 Part 3 - Standard CostingDocumento8 pagineUnit 3 Part 3 - Standard CostingPrarthana R Industrial EngineeringNessuna valutazione finora

- Standard Costing 1Documento19 pagineStandard Costing 1class12podarcommerceNessuna valutazione finora

- Standard CostingDocumento36 pagineStandard CostingParamjit Sharma96% (24)

- Materials Variance FormulasDocumento2 pagineMaterials Variance FormulasMary100% (1)

- Tugas Praktika Akmen TM 9Documento6 pagineTugas Praktika Akmen TM 9Rayhan Dewangga SaputraNessuna valutazione finora

- Standard Costing & Variance AnalysisDocumento43 pagineStandard Costing & Variance Analysis21-51749Nessuna valutazione finora

- CH 09Documento43 pagineCH 09Binar Arum NurmawatiNessuna valutazione finora

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Documento13 pagineReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNessuna valutazione finora

- Standard Costing - Problem SolutionsDocumento10 pagineStandard Costing - Problem Solutionsallen1191919Nessuna valutazione finora

- Acct Bah WDocumento4 pagineAcct Bah WAbby Sta AnaNessuna valutazione finora

- Management Information CLASS (L-05 & 06) : Prepared By: A.K.M Mesbahul Karim FCADocumento30 pagineManagement Information CLASS (L-05 & 06) : Prepared By: A.K.M Mesbahul Karim FCASohag KhanNessuna valutazione finora

- Topic 11 A181 - Variance AnalysisDocumento38 pagineTopic 11 A181 - Variance AnalysisEngku FarahNessuna valutazione finora

- Standard CostingDocumento2 pagineStandard CostingJon LeinsNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- MS Excel Bible, Save Your Time With MS Excel!: 8 Quality Excel Books in 1 PackageDa EverandMS Excel Bible, Save Your Time With MS Excel!: 8 Quality Excel Books in 1 PackageNessuna valutazione finora

- Project Management Professional (PMP) Training &NEWDocumento792 pagineProject Management Professional (PMP) Training &NEWAmer Rahmah100% (7)

- Assignment Unit1Documento2 pagineAssignment Unit1Akhil DayaluNessuna valutazione finora

- Options Trading Strategies: Understanding Position DeltaDocumento4 pagineOptions Trading Strategies: Understanding Position Deltasubash1983Nessuna valutazione finora

- Swink Chapter 1Documento4 pagineSwink Chapter 1Milo MinderbenderNessuna valutazione finora

- Credit Application 2023Documento1 paginaCredit Application 2023Jean Pierre PerrierNessuna valutazione finora

- 2006 Cpbi PrimerDocumento5 pagine2006 Cpbi PrimerkatherineNessuna valutazione finora

- Ecommerce SrsDocumento14 pagineEcommerce SrsVikram ShekhawatNessuna valutazione finora

- CAPITAL ASSET PRICING MODEL - A Study On Indian Stock MarketsDocumento78 pagineCAPITAL ASSET PRICING MODEL - A Study On Indian Stock Marketsnikhincc100% (1)

- Resume Formats: Choose The Best... !!Documento10 pagineResume Formats: Choose The Best... !!Anonymous LMJCoKqNessuna valutazione finora

- Regional IntegrationDocumento6 pagineRegional IntegrationPeter DePointNessuna valutazione finora

- Advertising (MNT Dew)Documento10 pagineAdvertising (MNT Dew)Yash GopalkaNessuna valutazione finora

- De Guzman, Marie Pauline C. BSA 3-2 Transaction: ST ST ND NDDocumento10 pagineDe Guzman, Marie Pauline C. BSA 3-2 Transaction: ST ST ND NDMakoy BixenmanNessuna valutazione finora

- Regional Sales Account Manager in Scottsdale Phoenix AZ Resume Frank BortelDocumento2 pagineRegional Sales Account Manager in Scottsdale Phoenix AZ Resume Frank BortelFrankBortelNessuna valutazione finora

- 02 Bustamante V Rosel AbanDocumento2 pagine02 Bustamante V Rosel AbanAlec VenturaNessuna valutazione finora

- GreenpeaceDocumento6 pagineGreenpeacePankaj KolteNessuna valutazione finora

- Ebooks The Smart Way PDFDocumento35 pagineEbooks The Smart Way PDFanabenedushNessuna valutazione finora

- BWI 6th Synthesis Report v3.2 FINAL enDocumento5 pagineBWI 6th Synthesis Report v3.2 FINAL enJulio Best Setiyawan100% (1)

- Yuksel (2001) The Expectancy Disconfirmation ParadigmDocumento26 pagineYuksel (2001) The Expectancy Disconfirmation ParadigmMariana NunezNessuna valutazione finora

- Meetings For Merger & DemergerDocumento4 pagineMeetings For Merger & Demergerjinesh331Nessuna valutazione finora

- English CVDocumento8 pagineEnglish CVdragos_roNessuna valutazione finora

- Mitel SemiconductorDocumento14 pagineMitel Semiconductorkomaltagra100% (1)

- 4 Differences Between Japanese and German Approaches To WorkDocumento3 pagine4 Differences Between Japanese and German Approaches To WorkParmpreet KaurNessuna valutazione finora

- NBFC Project Report by MS. Sonia JariaDocumento34 pagineNBFC Project Report by MS. Sonia JariaSonia SoniNessuna valutazione finora

- Marriott Promo Codes 2014Documento4 pagineMarriott Promo Codes 2014Dave Ortiz100% (1)

- 10 AxiomsDocumento6 pagine10 AxiomsJann KerkyNessuna valutazione finora

- Price List Scorpio NDocumento1 paginaPrice List Scorpio NSHITESH KUMARNessuna valutazione finora

- HScodes - TariffDocumento123 pagineHScodes - Tariff0716800012Nessuna valutazione finora

- Class On Pay Fixation in 8th April.Documento118 pagineClass On Pay Fixation in 8th April.Crick CompactNessuna valutazione finora

- A Question of Ethics - Student Accountant Magazine Archive - Publications - Students - ACCA - ACCA Global f1 PDFDocumento5 pagineA Question of Ethics - Student Accountant Magazine Archive - Publications - Students - ACCA - ACCA Global f1 PDFvyoung1988Nessuna valutazione finora

- Kellogs Case StudyDocumento22 pagineKellogs Case StudyAshish Kumar Banka100% (1)