Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bookkeeping and Record Keeping Basics

Caricato da

cmwainainaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bookkeeping and Record Keeping Basics

Caricato da

cmwainainaCopyright:

Formati disponibili

Bookkeeping and Record Keeping Basics

Adapted Irom content excerpted Irom the American Express OPEN Small Business Network

Proper bookkeeping is important to sustaining and expanding a business. Without it, you run the

risk oI hitting cash Ilow crunches, wasting money, and missing out on opportunities to expand.

When you are devising or revising your bookkeeping routine, remember that the purpose oI

bookkeeping is to help you manage your business and to enable tax agencies to evaluate your

business activity. As long as your bookkeeping achieves both oI these objectives, it can - and

should - be as simple as possible.

The general guidelines here outline what you must take care oI and provide ideas Ior how to

keep your books in an orderly manner. But beIore making any decisions regarding bookkeeping,

check with your accountant or tax preparer because bookkeeping needs vary dramatically by

business.

Many small business owners choose to use soItware to keep track oI various aspects oI their

business, and resources are provided here to help you institute computer automation. The key to

taking Iull advantage oI bookkeeping soItware is to determine iI it saves you time and Irees you

up to concentrate on running your business. In many cases it will, but be careIul not to Iall into

the trap oI wasting time setting up computer bookkeeping that could be more eIIiciently handled

on paper. The paper bookkeeping Iorms mentioned here can be obtained Irom most stationary

stores.

Some bookkeeping Iunctions are best relegated to an accountant. While it is essential to retain a

thorough knowledge by reviewing your books Irequently, an accountant or bookkeeper can Iree

you up to concentrate on expanding your business. Even a bookkeeping task that takes only a

Iew hours a week may be better relegated to someone else iI that time can be better spent.

Click on the topics below to learn more about what basic records need to be kept by a small

business:

O #evenues and Expenses

O Cash Expenditures

O Inventory #ecords

O Accounts #eceivable

O Accounts Payable

Revenues and Expenses

Your business will use either a #evenue and Expense Journal or a Ledger to keep track oI how

much money is going out, where it is going, and what is coming in.

A #evenue and Expense Journal is used by most small businesses and is single-entry accounting

-- recording receipts and expenditures only. Double entry accounting involves a ledger and

necessitates that each activity be recorded as a debit and a credit on your books. In the past it was

thought that all businesses needed to use the more cumbersome method oI double-entry, but the

single entry system is now used Ior many small business owners. Single-entry accounting can be

kept on paper or computer. Programs that perIorm single-entry accounting include Quicken by

Intuit and MicrosoIt Money among many others.

A ledger is used to record every transaction twice based on the idea that each transaction has two

halves that aIIect your business. For example, iI you sell an item, your books would reIlect a

decrease in inventory (a credit) and a inIlow oI payment (debit). II you use double-entry

accounting you may want to use a computer program or a bookkeeper to keep your ledger up to

date. II you allow anyone else to keep your books be sure you review them regularly. Programs

that do double-entry bookkeeping include: M.Y.O.B by Teleware, Peachtree Accounting by

Peachtree SoItware, and Quickbooks by Intuit.

Your accountant can advise you on which type oI recordkeeping you should choose. Also

consult your tax advisor about whether you should use a cash or accrual-based bookkeeping

system.

|Back to top|

ash Expenditures

Cash spent in your business needs to be accounted Ior iI you want to record all business expenses

in a given year. There are at least two ways to do this: write yourselI reimbursable checks or

keep a petty cash record.

II you choose to pay yourselI back with a check, simply keep track oI all cash receipts and total

them weekly, biweekly or monthly, depending on your volume oI expenses. Keep a log oI each

category oI expense, Ior tax purposes and write yourselI a check Ior the total. Write cash

reimbursable in your check register to diIIerentiate this Irom taxable income. Alternatively, you

can keep a petty cash record by writing a check to petty cash and keeping a log oI each expense

paid out oI petty cash.

|Back to top|

Inventory Records

Keeping on top oI your inventory records will enable you to prevent pilIerage, keep inventory

holdings to a minimum, and track buying trends, among other things.

II you sell a large number oI small-ticket items -- Ior example, as in a stationary store -- you

might want to use a computer system to track inventory or tie your computer system into your

sales by having a POS (point oI sale) inventory system. II you sell larger ticket items you may be

able to do it yourselI on paper.

The crucial inventory inIormation you need to capture is: date purchased, stock number oI item

purchased, purchase price, date sold, and sale price.

|Back to top|

ccounts Receivable

II your products or services are paid Ior at time oI delivery, you will not need an accounts

receivable tracking system. However, iI you provide services or products Ior which people pay

you at a later date, your accounts receivable records keep track oI what is owed to you. You can

monitor accounts receivable by holding on to a copy oI all invoices sent out or by keeping an

accounts receivable record. Either way, the inIormation you need to capture includes: invoice

date, invoice number, invoice amount, terms, date paid, amount paid, and the name oI the entity

being billed.

Many soItware programs are available to help you generate invoices and track hours and

expenses incurred Ior each client. These programs can save hours oI time Ior a business owner

and create proIessional-looking invoices. But, according to Ed Slott, author oI "Your Tax

Questions Answered", (Plymouth Press) keeping your accounts receivable on computer is

sensible iI it enables you to collect payment more quickly or get a better handle on where your

money comes Irom. Otherwise a paper system is very eIIective. SoItware programs that will

create invoices or track hours include: QuickInvoice by Intuit soItware; Timeslips and

WinInvoice by Good SoItware; and PerForm Pro Plus Irom Delrina.

|Back to top|

ccounts Payable

Accounts payable are debts owed by your company Ior goods and services. Keeping track oI

what you owe and when it is due will enable you to establish good credit and hold onto your

money as long as possible.

Business owners with Iew accounts payable items use accordion Iile Iolders labeled with dates to

keep track. Other small Iirms simply pay bills twice per month and keep all bills in a "To Pay"

Iolder. Larger companies use accounts payable paper records organized by creditor. #egardless

oI the system you choose, you should retain the Iollowing inIormation about accounts payable:

invoice date, invoice number, invoice amount, terms, date paid, amount paid, balance (iI

applicable), and clients names and address.

Wbat is Casb Flow?

Cash Ilow is an expense or revenue stream that changes a cash account over a given period Ior a

business, a project, or a Iinancial product. There are two entries made Ior each category; Cash in

& cash out. Activities such as operation income, Iinancing, investing, donations & giIts bring in

cash, while investments, expenses and donations take cash out oI your cash Ilow. This can be

said Ior both businesses and personal accounts.

Wbat is Casb Flow Statement?

A 'cash Ilow statement or a 'statement oI cash Ilows represents the amount oI cash used &

generated by a company, a person or a project within a given time period.

Cash Ilow statement is calculated by adding non-cash charges such as depreciation to net income

aIter taxes. Cash Ilow is an important indicator oI Iinancial strength. Financial analysts use cash

Ilow statements to measure a company`s Iinancial strength and perIormance.

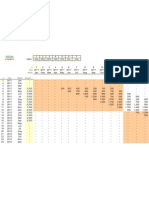

Free Casb Flow Statement Template

Here is a Iree cash Ilow statement excel template. I usually use this cash Ilow statement template

to brainstorm new project ideas. When I have a new project or a business idea, Iirst thing I do is

to look at worst case & base case scenario cash Ilow projections by entering projected numbers

in this excel sheet.

So, Ieel Iree to download the Cash Flow Statement I`ve been using and use it Ior your needs.

I have created this cash Ilow statement excel template to use as a quick and dirty cash Ilow

projection tool Ior my ideas/projects. In no means, it is supposed to replace a well thought,

quality cash Ilow statement. II you are preparing a cash Ilow statement Ior an important reason,

such as presentation to potential investors, please use a proIessional business plan soItware. I use

Palo Alto to create all oI my own and my clients` business plans.

Projecting ash Flow

Adapted Irom content excerpted Irom the American Express OPEN Small Business Network

Cash Ilow problems oIten catch small business owners by surprise. An accurate cash Ilow

projection can protect entrepreneurs against this situation. A cash Ilow projection charts the

amounts oI money your business expects to receive and pay out each month in a rolling six- or

12-month period. This Iorecast takes into account the lag time between billing your clients and

getting paid; incurring an expense and paying Ior it; and collecting taxes that aren't due to the

government until a later date. A well-prepared cash Ilow projection will allow you to plot

anticipated cash Ilow positions over time. It will help you anticipate shortIalls in time to do

something about them, protecting you Irom a cash Ilow crisis. Also, a cash Ilow projection can

help you spot sales trends, tell you iI your customers are taking too long to pay, and help you

plan Ior major asset purchases. In addition, should you decide to seek a loan, banks will ask to

see one-year cash Ilow projections by month, and three- to Iive-year projections by quarter. The

Iollowing step-by-step process will guide you through preparation oI a cash Ilow projection:

$tep 1: ash on hand

Count your cash at the beginning oI the Iirst month oI your projection. This amount is your "cash

on hand." In succeeding months, the ending cash balance Irom one month will be carried over as

the beginning cash balance oI the next month.

$tep 2: ash receipts

#ecord cash sales, credit card sales, collections Irom credit accounts, and any interest income.

The key to doing this successIully is recording receipts in the months you actually expect to get

the money, not the month a sale is made.

$tep 3: ccounts receivable

#ecord anticipated receivables in the months you expect them to be paid. II you have not kept

records that show you how long it takes individual customers to pay their bills, calculate your

"average collection period" by dividing your total sales Ior the previous year by 365. That gives

you your average daily sales volume. Then, divide the KES value oI your current accounts

receivable by the average daily sales volume. That number is the average number oI days it takes

you to collect on a bill. Using that number as a guide, record payments as they will come in over

the next year.

$tep 4: Miscellaneous cash

Account Ior anticipated miscellaneous cash inIusions, including new loans Irom banks or Iamily

members, or stock oIIerings.

$tep 5: Total cash available

For each month in your projection, add the amounts in steps one through Iour. This Iigure shows

the total cash available to you in each month.

$tep 6: ash paid out

Now it's time to calculate how much cash you anticipate spending in each month oI your rolling

projection.

First, assess operating expenses. Again, the secret is to note every expense in the month it will be

paid, not the month it is incurred. Be sure to include the Iollowing items in your list oI operating

expenses:

O Gross wages, including anticipated overtime

O Monthly stipends to owners

O Payroll taxes and beneIits, including paid vacations, paid sick leave, health insurance, and

unemployment insurance

O Subcontracting and outside services, including the cost oI labor and materials

O Purchases oI materials Ior use in making your product or service, or Ior resale

O Supplies Ior use in the business

O #epairs and maintenance (be sure to include occasional large expenses Ior remodeling,

renovation, etc.)

O Packaging, shipping and delivery costs

O Travel, car, and parking costs

O Advertising and promotion, including Iliers, direct mail, print or TV ads, yellow pages

listings, web site maintenance and design

O ProIessional services such Iees paid to attorneys, bookkeepers, accountants, consultants,

etc.

O #ent

O Telecommunications such as phone, Iax, Internet Service Provider

O Utilities such as water, heat, electricity, gas

O Insurance including Iire, liability, workers' compensation, etc.

O Taxes

O Interest due on loans

O Other expenses Iocusing on costs speciIic to your business

O Miscellaneous (include a small cushion Ior miscellaneous expenditures)

When you're Iinished recording these, subtotal your operating expenses.

$tep 7: Other costs

Calculate the other ongoing costs oI doing business. Be sure to include the Iollowing items:

O Loan principal payments - vehicles, equipment purchases, etc.

O Capital expenditures - depreciable expenditures such as equipment, vehicles, construction

oI new or improvements to existing buildings, and improvements to leased Iacilities and

oIIices

O Start-up costs - expenses incurred prior to the Iirst month oI operation and paid Ior over

the course oI the Iollowing year(s)

O #eserve or escrow - money set aside monthly Ior taxes paid at the end oI the year, plus

any money escrowed to help make payments on large insurance or machinery bills, Ior

example

O Owner's withdrawal - payment oI owner's income tax, health and executive liIe

insurance, etc.

$tep 8: Total cash paid out

Once you have listed all other costs oI doing business, add them to your subtotal Ior operating

expenses. This Iigure is your "total cash paid out," and reIlects your estimates Ior the total cash

you will have to spend each month.

$tep 9: Determine your monthly cash flow

Subtract your total cash paid out (Step 8) Irom your total cash available (Step 5). The diIIerence

is your monthly cash position or cash Ilow. As you plot your projected cash Ilow, check to be

sure your cash position at the end oI each month is positive. II it is not, take steps early to cover

these anticipated shortIalls.

Update your cash Ilow projection monthly, making adjustments whenever you encounter an

unexpected expense or income. As actual sales and disbursements are made, list the actual

amounts next to the estimates on your cash Ilow projection. Check Ior accuracy in your Iorecast,

and make adjustments to Iuture months as needed. As one month ends, add another month to the

end oI your rolling projection.

ash Flow Triage

Adapted Irom content excerpted Irom the American Express OPEN Small Business Network

It's Monday morning and you don't have enough cash on hand to make Friday's payroll. What

options do you have? Cash Ilow crunches aIIect every company. Ideally, you can weather these

crises by accessing a line oI credit or revolving loan you've already set up with your bank, or

tapping into cash reserves you've put aside Ior such an occasion. But what can you do iI you've

Iailed to plan ahead? Here are some triage techniques to help get you through such an

emergency:

O Factors

O Target unpaid receivables

O Ask a supplier Ior a loan

O Lease-back your assets

O Credit cards

O Juggle bills

Factors

Factors will quickly buy your receivables Ior cash -- oIten within 24 hours. You pay a high price,

oIten as much as 15 percent oI the value oI the receivables, but you can get cash literally

overnight. And once Iactors purchase receivables, they generally take over all the paperwork and

accounting aspects oI managing them. Since sales to Iactors are usually conIidential, you can

keep your cash Ilow woes quiet. To Iind a Iactor, look in the yellow pages under "commercial

Iinance companies."

|Back to top|

Target unpaid receivables

Turn Iirst to reliable, long-term customers who have historically paid on time. Ask a couple oI

your best customers iI they'd be willing to pay their bills, or a portion oI them, early. Be upbeat

and honest -- tell them that you're tight on cash and would appreciate it iI they could pay you

now. Consider oIIering the customer an incentive Ior early payment -- perhaps 1 or 2 percent oII

the total bill.

For clients with very old debts, oIIer to Iorgive 15 or even 25 oI their outstanding balance iI they

pay within the week. This is not a cheap solution, but no more expensive than some debt options.

And it may net you money you'd never see otherwise.

|Back to top|

sk a supplier for a loan

Is your business a major account Ior any oI its suppliers? II so, consider asking the supplier Ior a

loan. Go to regular, longtime suppliers (who aren't also competitors) Iirst, and emphasize that

this is a blip. Because you are a steady customer Ior their goods and services, suppliers have a

built-in incentive to help you stay in business. Show your appreciation by paying them promptly

once the crisis has passed.

|Back to top|

Lease-back your assets

While your oIIice Iurniture, computers, phone system or other equipment has cash value, you

can't just sell it oII and still operate your business. What you can do, however, is Iind a leasing

company that is willing to buy it and lease it back to you. The money you get will be based on

the value oI your assets, and you can expect the leasing company to charge you a high premium.

Use this option careIully. Since the leasing company -- not your business -- will own the

equipment, it probably won't hesitate to take it back should you miss payments.

|Back to top|

redit cards

SkillIully managed, credit cards can eke you through a cash Ilow crisis. But be careIul:

entrepreneurs who have successIully bootstrapped their companies on credit card debt are more

the exception than the rule. Credit card debt carries much steeper interest rates than bank loans or

lines oI credit. And unless you repay the money quickly, heIty monthly payments will put Iuture

cash Ilow in jeopardy. II you have no other choice, treat credit card debt as a short-term loan and

repay it within a Iew weeks.

|Back to top|

uggle bills

II you Iail to pay your employees, chances are they'll quickly start to look Ior work elsewhere.

Suppliers, on the other hand, may be quick to Iorgive a late payment or two. Call your creditors

and ask Ior a grace period, or arrange to pay only a part oI the outstanding balance this month.

Closely examine your bills to determine which ones you must pay and which ones can wait. Pay

those creditors who are most crucial to the continuation oI your business Iirst, and others later.

Don't, however, simply skip a payment; be sure to explain your predicament to the creditor Iirst.

10 Ways to Help Increase Your ash Flow

Adapted Irom content excerpted Irom the American Express OPEN Small Business Network

As any small business owner knows, maintaining smooth cash Ilow requires juggling nearly

every Iacet oI a business, Irom staying on top oI accounts receivable, to extending lines oI credit,

to managing inventory. The essence oI successIul cash Ilow management is regulating the money

Ilowing in and out oI your business. Increasing your cash Ilow reduces the amount oI Iixed

capital that you need to support the given level oI your business. An increased, consistent cash

Ilow also creates a predictable business pattern, making it easier to plan and budget Ior Iuture

growth. Here are 10 things you can do to increase your cash Ilow:

O Organize your billing schedule

O Stretch out your payables

O Take advantage oI early payment incentives

O Balance your client base

O Check your pricing

O Don't buy all in one place

O Form a buying cooperative

O #enegotiate your insurance and supplier policies

O Tighten your inventory

O Consider leasing instead oI buying

Organize your billing schedule

The Iaster your receivables turn over, the more capital you'll be able to spend on growing your

business. To help you bill early and oIten, put yourselI on a billing schedule with an accounting

soItware program like Intuit's Quickbooks Pro or Peachtree SoItware's Peachtree Complete Plus

Time & Billing. These two programs can automatically classiIy the age oI accounts receivable --

Iewer than 30 days old, between 30 and 59 days, between 60 and 90 days, etc. This kind oI

automated Ilagging system allows you to act immediately on overdue accounts.

|Back to top|

$tretch out your payables

Take the maximum amount oI time allotted (oIten 60 or 90 days) to pay your suppliers. Think oI

these terms as an interest-Iree line oI credit Irom your supplier. It gives you suIIicient time to

collect receivables without spending money on short term credit lines

|Back to top|

Take advantage of early payment incentives

II your suppliers oIIer you a discount Ior paying early (usually within two weeks oI receiving the

bill), take them up on it. Think oI it this way: a 2 on a 30-day invoice is equal to a 24 annual

return iI the money was invested. II your suppliers don't oIIer this kind oI incentive, ask Ior it;

they may be willing to oIIer the discount in return Ior speeding up their receivables.

|Back to top|

Balance your client base

Many service and proIessional companies -- such as advertising or P# agencies, accountants,

attorneys, real estate management Iirms, etc. -- work with certain clients on a project-by-project

basis. Look Ior ways to convert some oI these clients to a retainer relationship, where they pay

you a set amount oI money per month Ior a certain number oI services. You might want to oIIer

them some kind oI incentive -- value-added services, a discount -- to encourage them to shiIt to a

retainer. This might reduce your proIit margin, but it will help make your cash Ilow more

predictable.

|Back to top|

heck your pricing

Have your prices kept pace with your rising costs? When was the last time you raised your

prices? Many small businesses hesitate to increase their rates because they're aIraid they'll lose

customers. However, customers actually expect their suppliers to institute small, regular price

hikes. Also, be sure to check out your competition on a consistent basis. II they're charging

higher prices, you should too.

|Back to top|

Don't buy all in one place

You can save money by splitting your business between suppliers. Closely examine where you

need to pay Ior added service, and where you can save money by paying commodity prices. For

example, you might want to buy your computer hardware Irom a value-added reseller who can

help you choose the right system to meet your business needs, while you can purchase other

items -- such as printer cartridges, cables, or oII-the-shelI soItware -- Irom a mail order catalog

or other price merchant. To make certain you're paying competitive rates, you can compare

prices oI typical oIIice equipment (such as computers, printer supplies, or postage meters) at

Beacon #esearch Group's BuyerZone.

|Back to top|

Form a buying cooperative

Save money on supplies by rounding up a Iew colleagues and buying supplies like Iloppy disks

and printer paper in bulk, then divvying them up amongst yourselves.

|Back to top|

Renegotiate your insurance and supplier policies

Are you getting the best possible deal on insurance, phone service, and other regular business

expenses? #eview each oI your insurance policies annually and get three quotes Ior each to

ensure you're getting the most Ior your money. Keep a close eye on price sensitive services such

as your long distance phone service or your Internet access service. #egularly examine these

bills and call around to make sure you're getting the lowest available rate.

|Back to top|

Tighten your inventory

Overstocking inventory can tie up signiIicant amounts oI cash. #egularly gauge your inventory

turns to make sure they are within industry norms. You can do this by calculating your inventory

turnover ratio (cost oI goods sold divided by the average value oI your inventory). Avoid buying

more than you know you need when suppliers lure you with big discounts; this can tie up cash.

Periodically check your inventory Ior old or outdated stock, and either deIer upcoming orders to

use that stock or sell it at cost to improve your liquidity.

|Back to top|

onsider leasing instead of buying

Leasing generally costs more than buying, but these costs oIten can be justiIied by the cash Ilow

beneIits. By leasing computer equipment, cars, or other tools you need to expand your business,

you will avoid tying up cash or lines oI credit that might better be used Ior running your business

day-to-day. Lease payments are also considered a business expense, so the tax beneIits are

maintained even though the items are not purchased.

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- MACN-A006 - Updated Lien Nypd Midtown South PCTDocumento8 pagineMACN-A006 - Updated Lien Nypd Midtown South PCTsandyNessuna valutazione finora

- General Counsel Chief Legal Officer in San Francisco Bay CA Resume Thomas McKeeverDocumento3 pagineGeneral Counsel Chief Legal Officer in San Francisco Bay CA Resume Thomas McKeeverThomas McKeeverNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Need For Big Data Governance Collibra MaprDocumento8 pagineThe Need For Big Data Governance Collibra Maprsayhi2sudarshanNessuna valutazione finora

- Symbion, Inc. Sued For Anti-Kickback Whistleblower Retaliation!Documento58 pagineSymbion, Inc. Sued For Anti-Kickback Whistleblower Retaliation!Mark Anchor AlbertNessuna valutazione finora

- RA 10142 Financial Rehabilitation and Insolvency ActDocumento25 pagineRA 10142 Financial Rehabilitation and Insolvency ActCharles DumasiNessuna valutazione finora

- Job Order CostingDocumento49 pagineJob Order CostingKuroko71% (7)

- 2011 Q4 - McKinsey Quarterly - Big Data, You Have It, Now Use It PDFDocumento124 pagine2011 Q4 - McKinsey Quarterly - Big Data, You Have It, Now Use It PDFBayside BlueNessuna valutazione finora

- Pa em TendenciaDocumento21 paginePa em Tendenciasander10100% (1)

- Maharashtra Industries Directory PDFDocumento2 pagineMaharashtra Industries Directory PDFmanisha50% (2)

- Supply Chain Management and Its Impact On PurchasingDocumento10 pagineSupply Chain Management and Its Impact On PurchasingcmwainainaNessuna valutazione finora

- AVCD Dairy PRDocumento46 pagineAVCD Dairy PRcmwainainaNessuna valutazione finora

- Agriculture Supply Chain: A Systematic Review of Literature and Implications For Future ResearchDocumento54 pagineAgriculture Supply Chain: A Systematic Review of Literature and Implications For Future ResearchcmwainainaNessuna valutazione finora

- Purchasing Supply Chain Management and SDocumento4 paginePurchasing Supply Chain Management and ScmwainainaNessuna valutazione finora

- 4.1 Effect Sizes Cohens D and RDocumento12 pagine4.1 Effect Sizes Cohens D and RcmwainainaNessuna valutazione finora

- Milk Regulation in Kenya PDFDocumento6 pagineMilk Regulation in Kenya PDFJohn P. BandoquilloNessuna valutazione finora

- Usda 06 1991Documento201 pagineUsda 06 1991BazithNessuna valutazione finora

- 34Documento74 pagine34aria woohooNessuna valutazione finora

- Cash Flow MatrixDocumento3 pagineCash Flow MatrixcmwainainaNessuna valutazione finora

- Lommers MA MB PDFDocumento88 pagineLommers MA MB PDFcmwainainaNessuna valutazione finora

- Usda 06 1991 PDFDocumento201 pagineUsda 06 1991 PDFcmwainainaNessuna valutazione finora

- 2122Documento20 pagine2122cmwainainaNessuna valutazione finora

- 1025-Article Text-4051-1-10-20110110Documento20 pagine1025-Article Text-4051-1-10-20110110cmwainainaNessuna valutazione finora

- Usda 06 1991 PDFDocumento201 pagineUsda 06 1991 PDFcmwainainaNessuna valutazione finora

- Coffee Sector Climate Smart Awareness and Decision MakingDocumento10 pagineCoffee Sector Climate Smart Awareness and Decision MakingcmwainainaNessuna valutazione finora

- CHAPTER3-RESEARCHMETHODOLOGY DatacollectionmethodandResearchtoolsDocumento10 pagineCHAPTER3-RESEARCHMETHODOLOGY DatacollectionmethodandResearchtoolscmwainainaNessuna valutazione finora

- Budget & Projection System v1.32Documento67 pagineBudget & Projection System v1.32cmwainainaNessuna valutazione finora

- Cash Flow MatrixDocumento3 pagineCash Flow MatrixcmwainainaNessuna valutazione finora

- Workshop Training ProgramDocumento1 paginaWorkshop Training ProgramcmwainainaNessuna valutazione finora

- Agricultural Credit Ratin 2Documento13 pagineAgricultural Credit Ratin 2cmwainainaNessuna valutazione finora

- India Learning Experience ReportDocumento3 pagineIndia Learning Experience ReportcmwainainaNessuna valutazione finora

- The Effect of Portfolio Divesification On Risk and ReturnDocumento12 pagineThe Effect of Portfolio Divesification On Risk and ReturncmwainainaNessuna valutazione finora

- Agricultural Credit Ratin 2Documento13 pagineAgricultural Credit Ratin 2cmwainainaNessuna valutazione finora

- YASHDocumento15 pagineYASHyashNessuna valutazione finora

- List Journal Int Handelsblattliste Journals 2015Documento50 pagineList Journal Int Handelsblattliste Journals 2015Ferry PrasetyiaNessuna valutazione finora

- Profit and LossDocumento8 pagineProfit and Losschitos100% (1)

- Mallari - BolinaoDocumento5 pagineMallari - BolinaoJustine M.Nessuna valutazione finora

- Mtell Previse DatasheetDocumento4 pagineMtell Previse DatasheetSense4Things DWC-LLCNessuna valutazione finora

- Business Process ReengineeringDocumento2 pagineBusiness Process ReengineeringHarold Dela FuenteNessuna valutazione finora

- MGT657 Jan2013 PDFDocumento5 pagineMGT657 Jan2013 PDFAthirah Hassan0% (1)

- Hibernate Reference EnversDocumento42 pagineHibernate Reference EnverslifedjNessuna valutazione finora

- T1 PERKI - Alexander Veraro Tarigan - 175010100111024Documento4 pagineT1 PERKI - Alexander Veraro Tarigan - 175010100111024AlexanderTariganNessuna valutazione finora

- Entrepreneurship Challenges & Way ForwardDocumento17 pagineEntrepreneurship Challenges & Way ForwardDr Pranjal Kumar PhukanNessuna valutazione finora

- OD328636244353646100Documento3 pagineOD328636244353646100ankit ojhaNessuna valutazione finora

- Performance Analysis of Vishal Mega MartDocumento17 paginePerformance Analysis of Vishal Mega Martsunnysonal_123Nessuna valutazione finora

- Nike From Concept To CustomerDocumento9 pagineNike From Concept To CustomerJigyasa GautamNessuna valutazione finora

- Albright Stonebridge Group Newsletter ArticlesDocumento4 pagineAlbright Stonebridge Group Newsletter Articlesanurag_sikder2703Nessuna valutazione finora

- SyllabusDocumento42 pagineSyllabusvasudevprasadNessuna valutazione finora

- Wolfgang Fritz Haug Critique of Commodity Aesthetics vs. "Unconditional Affirmation" (Wyss)Documento6 pagineWolfgang Fritz Haug Critique of Commodity Aesthetics vs. "Unconditional Affirmation" (Wyss)Dan ScatmanNessuna valutazione finora

- BST Choice SAL Redemption Form2Documento2 pagineBST Choice SAL Redemption Form2malchukNessuna valutazione finora

- The Nathan Cummings Foundation 2008 990Documento89 pagineThe Nathan Cummings Foundation 2008 990TheSceneOfTheCrimeNessuna valutazione finora

- Limited Liability Partnership 01111Documento20 pagineLimited Liability Partnership 01111Akhil khannaNessuna valutazione finora

- Heidi RoizenDocumento2 pagineHeidi RoizenAthena ChowdhuryNessuna valutazione finora

- Chinese Accounting VocabDocumento3 pagineChinese Accounting Vocabzsuzsaprivate7365100% (1)