Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ministry of Corporate Affairs

Caricato da

Azim SamnaniDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ministry of Corporate Affairs

Caricato da

Azim SamnaniCopyright:

Formati disponibili

ROYAL COLLEGE OF ARTS, SCIENCE & COMMERCE

MINISTRY OF CORPORATE AFFAIRS

SEMESTER: VI

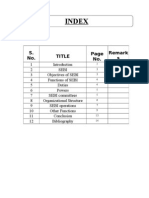

SUBJECT: 4.4 Submitted by: Azim Samnani {37} Ankur Kalani {35} Sunita Gupta {04} Gopi Patel {17}

Submitted to: Prof: Kapil Thakore

MINISRTY OF CORPORATE AFFAIRS

MINISTRY OF CORPORATE AFFAIRS

DEPARTMENT OF COMPANY AFFARS (MINISTRY OF CORPORATE AFFAIRS)

This is a declaration of mission, values, &commitment to achieve excellence in the formulation and implementation of policies and procedures of department of company of affairs for the benefit of the public, investor and corporate sectors, who are partners in progress. o Legal framework for incorporation as well as proper and efficient functioning of companies. Redressal forums for grievances of investors, creditors and other. Dissemination of information by issue of press notes and publication of official journal titled company news and notes. Interaction with professional bodies and business community for continuous feedback regarding general difficulties of corporate sector. Maintaining in the offices of ROC, various documents filed by the companies and making available the same for inspection of the general public. Surveillance over the working of corporate sector by conducting inspection to ensure financial health and compliance with statutory rules. Investigations into the affairs of companies especially where complaints are received. Prescribing the cost audit rules and ordering/approving the appointment under the companies act. Ensuring compliance with the prescribed AS under the companies act. Monitoring the development of the professional bodies, ie. The ICAI, ICSI and ICWAI. Coordination with other government department and other autonomous bodies like SEBI, RBI, and stock exchange, etc. Settlement of disputes through a quasi-judicial forum, ie.CLB regarding mismanagement and oppression of minority. Interaction with MRTP commission and the director general of investigation and trade practices indulged into by unscrupulous companies.

o o o o o o o o o o o o

MINISRTY OF CORPORATE AFFAIRS

(SECURITY EXCHANGE BOARD OF INDIA)SEBI

SEBI is the regulator for the securities market in India. Originally set up by the government of India in 1988, it acquired statutory form in 1992 with SEBI act, 1992 passed by the Indian parliament. Chaired by CB .Behave, Sebi is headquartered in the popular business district of bandra-kurla complex in Mumbai, and has northern, eastern, southern and western regional offices in New Delhi, Kolkata, Chennai, and Ahmadabads B behave is the sixth chairman of the Sebi regulator. Prior to taking charge as chairman Sebi, he had been the chairman of NSDL (national security depository limited) ushering in paperless securities. Prior to his stint at NSDL, he had served Sebi as a senior executive director. He is a former Indian administrative service officer of the 1997 batch. FUNCTION AND RESPONSIBLITIES SEBI has to be responsive to the needs of three groups, which constitute the market: o The investors o The issuer of securities o The market intermediaries Sebi has three functions rolled one body quasi-legislative, quasi-judicial and quasi-executive. It draft regulation in its legislative capacity, it conducts investigation and enforcement action in its executive function and it passes ruling and orders in its judicial capacity. Through this makes it very powerful, there is an appeals process to create accountability. There is a securities appellate tribunal which is a three member tribunal and is presently headed by a former chief justice of a high court- Mr. Justice NK sodhi. a second appeal lies directly to the supreme court. Sebi has enjoyed success as a regulator by pushing systemic reforms aggressively and successively (eg. the quick movement towards making the market electronic and paperless rolling settlement on T+2basis.)Sebi has been active in setting up the regulation as required under law.

MINISRTY OF CORPORATE AFFAIRS

SEBIS RECENT PRIMARY MARKET REFORMS

Sebi in June 2009 announced a slew of reforms to the primary capital markets. The key reforms are as follow: ANCHOR INVESTORS The investor of anchor investors has been introduced in public issue whereby 30%of the institutional (OB) portion will be allocated to anchor investors on a discretionary basis. This is to ensure minimum commitments from key investor that not only boosts the prospects of the offering, but also acts as an indicator to retail investors whose decision to bid or not will follow. Anchor investors are required to bring in a 25% margin along with their application, while the balance 75% of the issue price is required to be paid within 2 days of closure of the public issue. There is also a 30 days lock in on shares issued to anchor investors to ensure that the stock is not volatile immediately upon listing and trading. RIGHT ISSUES

Historically, the offering process in a right for a listed company was far simpler compared to a full-blown public issue such as an IPO. There is some logic to this position because shares of such a company are already traded on a stock exchange and information about the company is available in the public domain. However, over a period of time, the disclosure norms for rights issues were progressively strengthened, so much so that right issue document began resembling public issue documents both in content and size. More recently, there has been a call for simplifying the rights issue process in terms of disclosure requirements as well as the process. Towards that end, sebi has now decided to streamline the disclosure for right issue, does away with disclosures such as summary of the industry and business of the issuer company, promise vs. .performance with respect to earlier/previous issue, management discussion and analysis. Other disclosure has been streamlined. This will help companies tap the right issue avenue for raising funds in a more efficient manner.

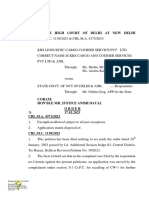

Superior voting rights

SEBI has prohibited the issue of share with superior voting rights by listed companies, in order to avoid the possible misuse by the persons in control to the detriment of public shareholders. The key question that arises is how different the shares with superior voting rights are from shares with differential voting rights, as it is the latter term that has attained some measure of popularity under Indian law and practice. The term differential voting rights emanates from its usage in Section 86 (a) (ii) of the companies Act. The validity of such shares has also been subjected to judicial determination. In Anad Pershad Jaiswal v. Jagatjit Industries Limited, MANU/CL/0002/2009, the Company Law

MINISRTY OF CORPORATE AFFAIRS Board (CLB) upheld the validity of issue of shares with differential voting rights as being valid under Section 86 of the Companies Act as well as the Companies (Issues of Share Capital and Differential Voting Rights) Rules, 2001. Unfortunately, the CLB did not have the opportunity do delve into the details of the issues raised in the matter because it was settled through a consent order. With the current suggestion by SEBI, it appears that while the expression differential voting right is more generic in nature, superior voting rights means any rights that give the shareholder more than one vote per share on a poll, which is the usual norm. this is to prevent persons in control of a company from issuing shares to themselves which provide equal economic benefits with other shareholder (thereby requiring equal outflow of financial resources to obtain those shares), but one which gives greater voting rights and hence better control. Hence, while it is possible for listed companies to issues shares with differential voting rights which provide voting rights below the normal one-share-one-vote rule, conferring voting rights greater than that is proscribed. In a sense, SEBIs current pronouncement goes beyond the general rule of differential voting rights. Even in the Jagatjit case where differential voting rights were approved, the shareholders were approved, the shareholders were conferred rights greater than the oneshare-one-vote rule. Hence, while listed companies will now be allowed to issue differential voting entitlements only with rights inferior to one vote per share, unlisted companies will still be governed by Section 86 and the law laid down in Jagatjit whereby they have greater flexibility in issuing shares with differential voting rights, both superior and inferior.

Other Reforms

1. An unlisted company making an IPO should list on at least one stock exchange providing nation-wide trading terminals, in order to provide a liquid trading platform to investors. 2. The holding period of one year for an offer for sale of shares will include the period when fully-paid convertible instruments have been held prior to conversion into equity shares. 3. No entry load for mutual fund schemes.

MINISRTY OF CORPORATE AFFAIRS

RESERVE BANK OF INDIA (RBI)

The Reserve Bank of India (RBI) is the central bank of India, and was established on April 1, 1935 in accordance with the provisions of the Reserve bank of India Act, 1934. The Central Office of the Reserve Bank was initially established in Kolkatta but was permanently moved to Mumbai in 1937. Though originally privately owned, the RBI has been fully owned by the Government OF India since nationalization in 1949. D Subbarao who succeeded Y v Reddy on September 2, 2008 is the current Governor of RBI. The Reserve Bank of India was set up on the recommendations of the Hilton Young Commission. The commission submitted its report in the year 1926, though the bank was not set up for nine years. The Preamble of the Reserve Bank of India describes the basic functions of the Reserve Bank as to regulate the issues of Bank Notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage. It has 22 regional offices, most of them in state capitals. RBI was started with a paid up share capital of 5 crore on established it took over the function of management of currency from government of India and power of credit control from imperial bank of India.

MINISRTY OF CORPORATE AFFAIRS

Main objectives

Regulator and supervisor of the financial system Prescribes broad parameters of banking operations within which the countrys banking and financial system functions. Objective: maintain public confidence in the system, protect depositors interest and provide cost-effective banking services to the public. The Banking Ombudsman Scheme has been formulated by the Reserve Bank of India (RBI) for effective redressal of complaints by bank customers.

Manager of exchange control

Manages the Foreign Exchange Management Act, 1999.

Objective: to facilitate external trade and payment and promote orderly development and maintenance of foreign exchange market in India.

Issuer of currency

Issues and exchanges or destroys currency and coins not fit for circulation. Objective: the main objective is to give the public adequate supply of currency of good quality and provide loans to commercial banks to maintain or improve the GDP. The basic objectives of RBI are to issue bank notes, to maintain the currency and credit system of the country to utilize it in its best advantage, and to maintain the reserves. RBI maintains the economic structure of the country so that it can achieve the objective of price stability as well as economic development, because both objectives in themselves.

MINISRTY OF CORPORATE AFFAIRS

Related functions

Banker to the government: performs merchant banking for the central and the state government; also acts as their banker. Bank to banks: maintains banking accounts of all schedule banks. There is now an international consensus about the need to focus the tasks of a country bank upon central banking. RBI is far out of touch with such a principle, owing to the sprawling mandate described above.

IRDA

The Insurance Regulatory and Development Authority {IRDA} is a national agency of the Government of India, based in Hyderabad. It was formed by an act of Indian Parliament known as IRDA Act 1999, which was amended in 2002 to incorporate some emerging requirements. Mission of IRDA as stated in the act is to protect the interest of the policy holder, to regulate, promote and ensure orderly growth of the insurance industry and for matters connected therewith or incidental thereto.

Expectations

The law of India has followed expectations from IRDA 1. To protect the interest of and secure fair treatment to policy holders; 2. To bring about speedy and orderly growth ot the insurance industry {including annuity and superannuation payments}, for the benefit of the common man, and to provide long term funds for accelerating growth of the economy; 3. To set, promote, monitor and enforce high standards of integrity, financial soundness, fair dealing and competence of those it regulates; 4. To ensure that insurance customers receive precise, clear and correct information about products and services and make them aware of their responsibilities and duties in this regards; 5. To ensure speedy settlement of genuine claims, to prevent insurance frauds and other malpractices and put in place effective grievance redressal machinery;

MINISRTY OF CORPORATE AFFAIRS 6. To promote fairness, transparency and orderly conduct in financial markets dealing with insurance and build a reliable management information system to enforce high standards of financial soundness amongst market players; 7. To take action where such standards are inadequate or ineffectively enforced; 8. To bring optimum amount of self-regulation in day to day working of the industry consistent with the requirements of prudential regulation.

COMPTROLLER AND AUDITOR GENERAL OF INDIA {CAG}

The Comptroller and Auditor General {CAG} of India is an authority, established by the Constitution of India, who audits all receipts and expenditure of the government of India and the state governments, including those of bodies and authorities substantially financed by the government. The CAG is also the external auditor of government - owned companies. The reports of the CAG are taken into consideration by the Public Accounts Committees, which are special committees in the Parliament of India and the legislature. The CAG of India is also the head of the Indian Audits and Accounts Service, which has over 58,000 employees across country. The current CAG is Vinod Rai, who was appointed on January 7, 2008. He is the 11th CAG of India.

Scope of audits

Audit of government accounts {including the accounts of the state governments} in India is entrusted to the CAG of India who is empowered to audit all expenditure from the revenues of the union or state governments, whether incurred within India or outside. Specifically, audits include: Transactions relating to debt, deposits, remittances, trading, and manufacturing.

MINISRTY OF CORPORATE AFFAIRS Profit and loss accounts and balance sheets kept under the order of the President or governors. Receipts and stock accounts.

Duties and Powers of the CAG

The Comptroller and Auditor- General shall perform such duties and exercise such powers relation to the accounts of the Union and of the States and of any other authority or body as may be prescribed by or under any law made by parliament and, until provision in that behalf is so made, shall perform such duties and exercise such powers in relation to the accounts of the union and of the States as were conferred on or exercisable by the Auditor-general of India immediately before the commencement of this constitution in relation to the accounts of the Dominion of the India and of the provinces respectively.

10

Potrebbero piacerti anche

- Role of SEBI in Primary MarketDocumento19 pagineRole of SEBI in Primary MarketTwinkle RajpalNessuna valutazione finora

- Role of SEBI in Primary MarketDocumento19 pagineRole of SEBI in Primary MarketTwinkle RajpalNessuna valutazione finora

- Capital Market VedantDocumento13 pagineCapital Market Vedantrashi bakshNessuna valutazione finora

- Economy Survey TermsDocumento3 pagineEconomy Survey TermsVipul TomarNessuna valutazione finora

- Securities and Exchange Board of India (SEBI) : AboutDocumento3 pagineSecurities and Exchange Board of India (SEBI) : AboutLamheNessuna valutazione finora

- SEBI Act, 1992: Securities LawsDocumento25 pagineSEBI Act, 1992: Securities LawsAlok KumarNessuna valutazione finora

- Indian Capital Market and Regulatory FrameworkDocumento9 pagineIndian Capital Market and Regulatory FrameworkAmitNessuna valutazione finora

- Group10 LABDocumento10 pagineGroup10 LABRADHIKA MUKATINessuna valutazione finora

- Group10 LABDocumento15 pagineGroup10 LABRADHIKA MUKATINessuna valutazione finora

- Index: S. No. Title No. Remark SDocumento17 pagineIndex: S. No. Title No. Remark SSiddhi PatwaNessuna valutazione finora

- Corporate LawDocumento36 pagineCorporate LawJahnnavi SarkhelNessuna valutazione finora

- Difference Between Money Markets and Capital MarketsDocumento4 pagineDifference Between Money Markets and Capital MarketsSachin TiwariNessuna valutazione finora

- Indian Capital Market and Regulatory Framework: Background, Performance and Emerging IssuesDocumento19 pagineIndian Capital Market and Regulatory Framework: Background, Performance and Emerging IssuesNiraj RathiNessuna valutazione finora

- SEBI and Primary MarketDocumento7 pagineSEBI and Primary Marketशुभम डिमरीNessuna valutazione finora

- SSRN Id2293378 PDFDocumento17 pagineSSRN Id2293378 PDFAlisha BhatnagarNessuna valutazione finora

- Introductio 1Documento2 pagineIntroductio 1Anil ShelarNessuna valutazione finora

- Role of SEBI in Capital MarketDocumento6 pagineRole of SEBI in Capital MarketShashank HatleNessuna valutazione finora

- Presentation On Liabilities Under Securities Law 28.11.2011Documento51 paginePresentation On Liabilities Under Securities Law 28.11.2011Vidya AdsuleNessuna valutazione finora

- Role of Sebi in Corporate GoveranceDocumento13 pagineRole of Sebi in Corporate GoveranceTanima RoyNessuna valutazione finora

- Poor Track Record of ShareholdersDocumento8 paginePoor Track Record of ShareholdersPrerna GuptaNessuna valutazione finora

- Role of SebiDocumento3 pagineRole of SebiAnkush PoojaryNessuna valutazione finora

- Group10 LABDocumento10 pagineGroup10 LABRADHIKA MUKATINessuna valutazione finora

- Pradeep BandiDocumento63 paginePradeep BandipradeepbandiNessuna valutazione finora

- SEBIDocumento2 pagineSEBIAkash ShrivastavaNessuna valutazione finora

- IFM&IDocumento3 pagineIFM&IArko GhoshNessuna valutazione finora

- Securities and Exchange Board of India (SEBI) GuidelinesDocumento21 pagineSecurities and Exchange Board of India (SEBI) GuidelinesangelNessuna valutazione finora

- SEBIDocumento25 pagineSEBIsumant singhNessuna valutazione finora

- Financial Markets Assignment Sem-2Documento14 pagineFinancial Markets Assignment Sem-2Prerna BhansaliNessuna valutazione finora

- Co Law IiDocumento15 pagineCo Law IiRitik SharmaNessuna valutazione finora

- Financial ServicesDocumento14 pagineFinancial ServicesChaitanya NandaNessuna valutazione finora

- Formation and Powers of SEBIDocumento20 pagineFormation and Powers of SEBIMohd YasinNessuna valutazione finora

- Company Law ProjectDocumento31 pagineCompany Law ProjectUjjwal JoshiNessuna valutazione finora

- 1 Role of Regulators in Corporate GovernanceDocumento23 pagine1 Role of Regulators in Corporate Governancesana khanNessuna valutazione finora

- Investment and Securities AssignmentDocumento16 pagineInvestment and Securities Assignmentkhusboo kharbandaNessuna valutazione finora

- Securities and Exchange Board of India: Navigation SearchDocumento7 pagineSecurities and Exchange Board of India: Navigation SearchAshish ThengariNessuna valutazione finora

- Companies BillDocumento3 pagineCompanies BillAshutosh SinghNessuna valutazione finora

- Corporate Social ResponsibilityDocumento9 pagineCorporate Social Responsibilityperumbhuduru manoharNessuna valutazione finora

- Corporate LawDocumento20 pagineCorporate LawNaimish TripathiNessuna valutazione finora

- Regulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Documento12 pagineRegulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2ramanNessuna valutazione finora

- SEBI PPT by SripatiDocumento11 pagineSEBI PPT by Sripatimanoranjanpatra100% (3)

- Roles Functions OF: & SebiDocumento24 pagineRoles Functions OF: & SebiGourav GuptaNessuna valutazione finora

- SEBI Act, 1992Documento26 pagineSEBI Act, 1992saif aliNessuna valutazione finora

- Roles Functions OF: & SebiDocumento24 pagineRoles Functions OF: & SebiGourav GuptaNessuna valutazione finora

- SebiDocumento9 pagineSebiAnirudh VictorNessuna valutazione finora

- Biitm-IFSS-Module2-S14-Cap MarketDocumento48 pagineBiitm-IFSS-Module2-S14-Cap Marketshubham kumarNessuna valutazione finora

- Raji Full ProjectDocumento90 pagineRaji Full ProjectswtybothraNessuna valutazione finora

- Demutualisation & Corporatization of Stock ExchangesDocumento29 pagineDemutualisation & Corporatization of Stock ExchangesMayank Jain100% (10)

- Security and Exchange Board of IndiaDocumento7 pagineSecurity and Exchange Board of IndiaBharath BangNessuna valutazione finora

- Prohibiting Insider TradingDocumento8 pagineProhibiting Insider TradingBhumi ShahNessuna valutazione finora

- Sebi'S Background: Securities and Exchange Board of IndiaDocumento15 pagineSebi'S Background: Securities and Exchange Board of IndiaAnjaliNessuna valutazione finora

- Write A Note On Doctrine of Indoor ManagementDocumento5 pagineWrite A Note On Doctrine of Indoor ManagementAvinash GurjarNessuna valutazione finora

- Becg M 6Documento20 pagineBecg M 6CH ANIL VARMANessuna valutazione finora

- Securities and Exchange Board of India: Regulator Securities SEBI Act, 1992Documento6 pagineSecurities and Exchange Board of India: Regulator Securities SEBI Act, 1992Pawan LohanaNessuna valutazione finora

- Cms PPT 1Documento10 pagineCms PPT 1rashi bakshNessuna valutazione finora

- Simran Khuran - InvestmentDocumento3 pagineSimran Khuran - InvestmentSimran Kaur KhuranaNessuna valutazione finora

- Arnav 245 (Sebi)Documento14 pagineArnav 245 (Sebi)ArnavNessuna valutazione finora

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Da EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Nessuna valutazione finora

- Corporate Governance: A practical guide for accountantsDa EverandCorporate Governance: A practical guide for accountantsValutazione: 5 su 5 stelle5/5 (1)

- Various Instruments in Capital MarketDocumento31 pagineVarious Instruments in Capital MarketAzim SamnaniNessuna valutazione finora

- Marketing Mix in ICICI BankDocumento24 pagineMarketing Mix in ICICI BankAzim SamnaniNessuna valutazione finora

- Risk Management in Banking Sector Main01Documento42 pagineRisk Management in Banking Sector Main01Azim Samnani0% (1)

- Bancassurance: Under The Guidance of Prof. JalpaDocumento37 pagineBancassurance: Under The Guidance of Prof. JalpaAzim SamnaniNessuna valutazione finora

- Time Value of MoneyDocumento29 pagineTime Value of MoneyAzim Samnani100% (1)

- Marginal Costing FinalDocumento29 pagineMarginal Costing FinalAzim Samnani50% (2)

- Wires Assisting Financial Markets & Banking - For MergeDocumento25 pagineWires Assisting Financial Markets & Banking - For MergeAzim SamnaniNessuna valutazione finora

- Organisational Culture and ClimateDocumento53 pagineOrganisational Culture and ClimateAzim Samnani100% (3)

- HDFC Bank Final ProjectDocumento48 pagineHDFC Bank Final ProjectAzim SamnaniNessuna valutazione finora

- QuartzDocumento5 pagineQuartzKannaTaniyaNessuna valutazione finora

- BSBMGT516 Facilitate Continuous Improvement: Summative Assessment 1Documento4 pagineBSBMGT516 Facilitate Continuous Improvement: Summative Assessment 1Mmc MixNessuna valutazione finora

- About FW TaylorDocumento9 pagineAbout FW TaylorGayaz SkNessuna valutazione finora

- 20779A ENU CompanionDocumento86 pagine20779A ENU Companionmiamikk204Nessuna valutazione finora

- 101 Union of Filipro Employees Vs Vivar (Labor)Documento1 pagina101 Union of Filipro Employees Vs Vivar (Labor)Kayelyn Lat100% (1)

- July2020 Month Transaction Summary PDFDocumento4 pagineJuly2020 Month Transaction Summary PDFJason GaskillNessuna valutazione finora

- 173089Documento22 pagine173089aiabbasi9615100% (1)

- Method Statement For Backfilling WorksDocumento3 pagineMethod Statement For Backfilling WorksCrazyBookWorm86% (7)

- History of BRAC BankDocumento7 pagineHistory of BRAC Bankrayhan555Nessuna valutazione finora

- Impact of Carding Segments On Quality of Card Sliver: Practical HintsDocumento1 paginaImpact of Carding Segments On Quality of Card Sliver: Practical HintsAqeel AhmedNessuna valutazione finora

- F5 - LTM TrainingDocumento9 pagineF5 - LTM TrainingAliNessuna valutazione finora

- APCJ Directory 2019Documento34 pagineAPCJ Directory 2019Anonymous Pu3OF7100% (3)

- Gabuyer Oct13Documento72 pagineGabuyer Oct13William Rios0% (1)

- Brief On Safety Oct 10Documento28 pagineBrief On Safety Oct 10Srinivas EnamandramNessuna valutazione finora

- David Sm15 Inppt 06Documento57 pagineDavid Sm15 Inppt 06Halima SyedNessuna valutazione finora

- Application Rebuilding Kits: Kit BulletinDocumento2 pagineApplication Rebuilding Kits: Kit Bulletinhidraulic100% (1)

- 2018 Master Piping Products Price ListDocumento84 pagine2018 Master Piping Products Price ListSuman DeyNessuna valutazione finora

- GK Test-IiDocumento11 pagineGK Test-IiDr Chaman Lal PTNessuna valutazione finora

- Standard Wiring Colors - Automation & Control Engineering ForumDocumento1 paginaStandard Wiring Colors - Automation & Control Engineering ForumHBNBILNessuna valutazione finora

- Arvind Textiles Internship ReportDocumento107 pagineArvind Textiles Internship ReportDipan SahooNessuna valutazione finora

- Arab Open University B326: Advanced Financial Accounting TMA - Spring 2022-2023 V2Documento7 pagineArab Open University B326: Advanced Financial Accounting TMA - Spring 2022-2023 V2samiaNessuna valutazione finora

- Feed Water Heater ValvesDocumento4 pagineFeed Water Heater ValvesMukesh AggarwalNessuna valutazione finora

- Pharmacology NCLEX QuestionsDocumento128 paginePharmacology NCLEX QuestionsChristine Williams100% (2)

- Hw5 MaterialsDocumento2 pagineHw5 MaterialsmehdiNessuna valutazione finora

- Group 7 - Mountain DewDocumento18 pagineGroup 7 - Mountain DewRishabh Anand100% (1)

- Response LTR 13 330 VielmettiDocumento2 pagineResponse LTR 13 330 VielmettiAnn Arbor Government DocumentsNessuna valutazione finora

- Muster List: Vessel: M/T "Stena President" Call Sign: ZCDR6 Master: YURIY YASHINDocumento9 pagineMuster List: Vessel: M/T "Stena President" Call Sign: ZCDR6 Master: YURIY YASHINwwaallNessuna valutazione finora

- A Survey Report On The Preferred RestaurDocumento22 pagineA Survey Report On The Preferred RestaurEIGHA & ASHLEIGH EnriquezNessuna valutazione finora

- 0601 FortecstarDocumento3 pagine0601 FortecstarAlexander WieseNessuna valutazione finora

- In The High Court of Delhi at New DelhiDocumento3 pagineIn The High Court of Delhi at New DelhiSundaram OjhaNessuna valutazione finora