Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Mangeral

Caricato da

midukkanlibuDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Mangeral

Caricato da

midukkanlibuCopyright:

Formati disponibili

Master of Business Administration - MBA Semester I MB0042 Managerial Economics

Q.1 Income elasticity of demand has various applications. Explain each

application with the help of an example.

Ans :Income elasticity of demand may be defined as the ratio or proportionate change in the quantity demanded of a commodity to a given proportion change in the income. In short, it indicates the extent to which demand changes with a variation in consumers income. Thefollowing formula helps to measure the income elasticity (Ey). Or Where Ey is income elasticity of demand D is change in demand D is original demand Y is change in income Y is original income Example Original demand=400 units Original income= 4000 units New demand =700 units New income= 6000 units Change in demand= 700-400= 300 units change in income=6000-4000=2000 Hence Ey=300/2000*4000/400=1.5 Generally speaking Ey is positive. This is because there is a direct relationship between income and demand, i.e. higher the income; higher would be the demand and vice versa. On the basis of the numerical value of the co-efficient, Ey is classified as greater than one, less than one, equal to one, equal to zero and negative. The concept of ey helps us in classifying commodities in to different categories. 1. When Ey is positive, the commodity is normal (used in day-to-day life) 2. When Ey is negative, the commodity is inferior. ( for example jowar, beedi etc) 3. When Ey is positive and greater than one, the commodity is luxury. 4. When Ey is positive but less than one, the commodity is essential. 5. When Ey is zero, the commodity is neutral. E.g. salt, match box etc. Practical application of income elasticity of demand 1. Helps in determining the rate of growth of the firm. If the growth rate of the economy and income growth of the people is reasonable forecasted, in that case it is possible predict expected increase in the sales of a firm and vice versa. 2. Helps in the demand forecasting of a firm. It can be in estimating future demand provided the rate of increase in income and Ey for the products are known. Thus, it helps in demand forecasting activities of a firm. 3. Helps in production planning and marketing. The knowledge of Ey is essential for production planning, formulating marketing strategy, deciding advertising expenditures and nature of distribution channel etc in the long run. 4. Helps in ensuring stability in production. Proper estimation of different degrees of income elasticity of demand for different types of product helps in avoiding over-production or under-production of a firm. One should know whether rise or fall in income is permanent or temporary. 5. Helps in estimating construction of houses. The rate of growth in incomes of people also helps in housing programs in a country. Thus it helps a lot in managerial decisions of a firm.

Q.2 When is the opinion survey method used and what is the effectiveness of the method.

Ans :Survey of buyers intention or preference is one of the important methods of demand forecasting. It is also called Opinion Survey Method. Under this method, consumer buyers are requested to indicate their preference and willingness about a particular product. They are about to reveal their future purchase plans with respect to specific items. They are expected to give answer to question like what items they intends to buy, in what quantity, why, where, what quality they expect, how much they are planning to spend etc. Generally, the field surveys are conducted by the marketing research

departments of the company or hiring the services of outside research organization consisting of learned and highly qualified professionals. The heart of the survey is questionnaire. It is a comprehensive one covering almost all questions either directly or indirectly in a most intelligent manner. It is prepared by an expert body who are specialist in the field or marketing. The questionnaire is distributed among the consumer either through mail or in person by the company. Consumers are requested to furnish all relevant and correct information. The next step is to collect the questionnaire from the consumers for the purpose of evaluation. The materials collected will be classified, edited and analyzed. If any bias prejudices, exaggerations, artificial or excess demand creation are found at the time of answering they would be eliminated. The information so collected will now be consolidated and reviewed by the top executives with lot of experiences. It will be examined thoroughly. Inferences are drawn and conclusions are arrived at. Finally a report is prepared and submitted to the management for taking final decisions. The success of the survey method depends on many factors: 1. The nature of the question asked. 2. The ability of the surveyed. 3. The representative of the sample 4. Nature of the product 5. Characteristics of the market 6. Consumer behavior 7. Techniques of analysis 8. Conclusion drawn etc. The management should not entirely depend on the result of survey reports t project future demand. Consumer may not express their honest and real views and as such they may give only the broad trends in the market. In order to arrive, at right conclusion, field surveys should be regularly checked and supervised. This method is simple and useful to the producers who produce goods in bulk. Here the burden of forecasting is put on the customers. However this method is not much useful in estimating the future demand of the household as they run in a large numbers and also do not freely express their future demand requirements. It is expensive and so difficult. Preparation of questionnaire is not an easy task. At best it can be used for short term forecasting.

Q.3 Show how price is determined by the forces of demand and supply, by using forces of equilibrium.

Ans The word equilibrium is derived from the Latin word aequilibrium which means equal balance. It means a state of even balance in which opposing forces or tendencies neutralize each other. It is a position of rest characterized by absence of change. It is a state where there is complete agreement of the economic plans of the various market participants so that no one has a tendency to revise or alter his decision. In the words of professor Mehta: Equilibrium denotes in economics absence of change in movement. Market Equilibrium There are two approaches to market equilibrium viz., partial equilibrium approach and the general equilibrium approach. The partial equilibrium approach to pricing explains price determination of a single commodity keeping the prices of other commodities constant. On the other hand, the general equilibrium approach explains the mutual and simultaneous determination of the prices of all goods and factors. Thus it explains a multi market equilibrium position. Earlier to Marshall, there was a dispute among economists on whether the force of demand or the force of supply is more important in determining price. Marshall gave equal importance to both demand and supply in the determination of value or price. He compared supply and demand to a pair of scissors We might as reasonably dispute whether it is the upper or the under blade of a pair of scissors that cuts a piece of paper, as whether value is governed by utility or cost of production. Thus neither the upper blade nor the lower blade taken separately can

cut the paper; both have their importance in the process of cutting. Likewise neither supply alone, nor demand alone can determine the price of a commodity, both are equally important in the determination of price. But the relative importance of the two may vary depending upon the time under consideration. Thus, the demand of all consumers and the supply of all firms together determine the price of a commodity in the market. Equilibrium between demand and supply price: Equilibrium between demand and supply price is obtained by the interaction of these two forces. Price is an independent variable. Demand and supply are dependent variables. They depend on price. Demand varies inversely with price, a rise in price causes a fall in demand and a fall in price causes a rise in demand. Thus the demand curve will have a downward slope indicating the expansion of demand with a fall in price and contraction of demand with a rise in price. On the other hand supply varies directly with the changes in price, a rise in price causes a rise in supply and a fall in price causes a fall in supply. Thus the supply curve will have an upward slope.At a point where these two curves intersect with each other the equilibrium price is established. At this price quantity demanded is equal to the quantity demanded. This we can explain with the help of a table and a diagram Price in rs Demand in units 30 25 20 10 5 5 10 15 20 30 25 20 15 10 5 Supply in units State of market D<S D<S D=S D>S D>S Pressure on price P decreases P decreases Neutral P increases P increases In the table at Rs.20 the quantity demanded is equal to the quantity supplied. Since the price is agreeable to both the buyer and sellers, there will be no tendency for it to change; this is called equilibrium price. Suppose the price falls to Rs.5 the buyer will demand 30 units while the seller will supply only 5 units. Excess of demand over supply pushes the price upward until it reaches the equilibrium position supply is equal to the demand. On the other hand if the price rises to Rs.30 the buyer will demand only 5 units while the sellers are ready to supply 25 units. Sellers compete with each other to sell more units of the commodity. Excess of supply over demand pushes the price downward until it reaches the equilibrium. This process will continue till the equilibrium price of Rs.20 is reached. Thus the interactions of demand and supply forces acting upon each other restore the equilibrium position in the market. In the diagram DD is the demand curve, SS is the supply curve. Demand and supply are in equilibrium at point E where the two curves intersect each other. OQ is the equilibrium output. OP is the equilibrium price. Suppose the price OP2 is higher than the equilibrium price OP. at this point price quantity demanded is P2D2. Thus D2S2 is the excess supply which the seller wants to push into the market, competition among the sellers will bring down the price to the equilibrium level where the supply is equal to the demand. At price OP1, the buyers will demand P1D1 quantity while the sellers are ready to sell P1S1. Demand exceeds supply. Excess demand for goods pushes up the price; this process will go until equilibrium is reached where supply becomes equal to demand. Q.4 Distinguish between fixed cost and variable cost using an example.

Ans: Fixed cost:

These costs are incurred on fixed factors like land, building, equipments, plants, superior types of labour, top management etc. fixed costs in the short run remains constant because the firm does not change the size of plant and the amount of the fixed factors employed. Fixed costs do not vary with either expansion or contraction in output. These cost are to be incurred by a firm even output is zero. Even if the firm close down its operation for some time temporarily in the short run, but remains in business, these cost have

to be borne by it. Hence, these costs are independent of output and are referred to as unavoidable contractual cost. Prof. Marshall called fixed cost as supplementary costs. They include such items as contractual rent payments, interest on capital borrowed, insurance premium, depreciation and maintenance allowance, administrative expenses like managers salary or salary of the permanent staff, property and business taxes, license fees, etc. They are called as over- head costs because these costs are to incurred whether there is production or not. These costs are to be distributed on each units of output produced by a firm. Hence, they are called as indirect costs. Variable Costs: The costs corresponding to variable factors are described as variable costs. These costs are incurred on raw materials, ordinary labour, transport, power, fuel, water etc, which directly vary in the short runs. Variable costs are directly and proportionately increases or decreases with the level of output. If a firm shut down for some times in the short run; then it will not use the variable factors of production and will not therefore incurs any variable costs. Variable costs are incurred only when some amount of output is produced. Total variable cost increases with the level of increase in the level of production and viceversa. Prof. Marshall called variable costs as prime costs or direct costs because the volume of output produced by a firm depends directly upon them. It is clear from the above description that a production cost consists of both fixed as well as variable costs. The difference between the two is meaningful and relevant only in the short run. In the long run all costs become variable because all factors of production become adjustable and variable in the long run. However, the distinction between the fixed and variable costs is very important in theshort because it influences the average costs behavior of the firm. In the short run, even if a firm wants to close down its operation but wants to remain in the business, it will have to incur fixed costs but it must cover at least its variable costs.

Q.5 Discuss Marris Growth Maximization model ?

Profit maximization is traditional objective of a firm. Sales maximization objective is explained by Prof. Boumal. On similar lines, Prof. Marris has developed another alternative growth maximization model in recent years. It is a common factor to observe that each firm aims at maximizing its growth rate as this goal would answer many of the objectives of a firm. Marris points out that a firm has to maximize its balanced growth rate over a period of time. Marris assumes that the ownership and control of the firm is in the hands of two groups of people, i.e. owner and managers. He further points out that both of them have two distinctive goals. Managers have a utility function in which the amount of salary, status, position, power, prestige and security of job etc are the most import variable where as in case of are more concerned about the size of output, volume of profits, market shares and sales maximization. Utility function of the manager and that the owner are expressed in the following mannerUo= f [size of output, market share, volume of profit, capital, public esteem etc.] Um= f [salaries, power, status, prestige, job security etc.] In view of Marris the realization of these two functions would depend on the size of the firm. Larger the firm, greater would be the realization of these functions and vice-versa. Size of the firm according to Marris depends on the amount of corporate capital which includes total volume of the asset, inventory level, cash reserve etc. He further points out that the managers always aim at maximizing the rate of growth of the firm rather than growth in absolute size of the firms. Generally managers like to stay in a grouping firm. Higher growth rate of the

firm satisfy the promotional opportunity of managers and also the share holders as they get more dividends.

Q.6 Explain how fiscal policy is used to achieve economic stability.

Ans: In order to achieve a stable economic condition, fiscal policy has to play a positive and constructive role both in developed and developing nations. The specific role to be played by fiscal policy can be discussed as follows: To act as optimum allocator of resources: As most of the resources are scarce in their supply, careful planning is needed in its allocation so as to achieve the set targets. Rational allocation would ensure fulfillment of various objectives. To act as a saver: 1. It should follow a rational consumption policy reduces the MPC and raises the MPS. 2. Taxation policy has to be modified to raise the rates of old taxes, introduces new additional taxes, and extends the tax-nets. 3. Profit earning capacity of public sector units are to be raise substantially to mopup financial resources. 4. The government should borrow more money both in the country and outside the country. 5. Higher the rate of interest are to be offered for government bonds and security. To act as an investor: Mere mobilization of financial resources is not an end in itself. It should result in the creation of real resources which are more important in accelerating the growth process. Rapid economic growth depends upon the volume of investment. Hence, fiscal policies have to be ensuring higher volume of investment in both private and public sectors. To act as price stabilizer: price stability is of paramount of importance in an economy.Extreme levels of both inflation and deflation would disrupt and disturb the normal and regular working of an economic system. This would come in the way of stable and persistent growth. Hence all measures are to be taken to check these two dangerous situations so as to create necessary congenial atmosphere to prepare the background for rapid economic growth. To act as an economic stabilizer: Price stability would create the necessary background for over all economics stability. Upswing and downswing in the level of economic activities are to be avoided. If an economy is subject to frequent fluctuation in the form of trade cycle, certainly, it would undermine and disturb the growth process. Instability would come in the way of persistent and consistent growth in a country. Hence all measure to be taken to ensure economic stability. To act as an employment generator: Fiscal policy should help in mobilizing more financial resources, convert them in to investment and create more employment opportunity to absorb the huge unemployed man power. To act as balancer: There must be proper balance between aggregate saving and aggregate investment, demand and supply, income and output and expenditure, economic overhead capital and social overhead capital etc. Any sort of imbalance would result in either surpluses or scarcity in different sectors of the economy leading to fast growth in some sectors followed by lagging of some other sectors. To act as growth promoter: The basic objective of any economic policy is to ensure higher economic growth rates. This is possible when there is higher national savings, investment, production, employment and income. Hence, fiscal policy is to be designed in such a manner so as to promote higher growth in an economy. To act as in come redistribute: Fiscal policy has to minimize inequalities and ensure distributive justice in an economy. This is possible when a rational taxation and public expenditure policy is adopted. More money is collected from richer section of the society through various imaginative taxation policies and a larger amount of money is to be spent in favor of poorer sections of the society. Thus, inequality is

to be reduced to the minimum. To act as stimulator of living standards of people: the final objective is to raise the level of living standards of the people. This is possible when there is higher output, income and employment leading to higher purchasing power in the hands of common man. Hence, fiscal policy should help in creating more wealth in the economy. If there is economic prosperity, then it is possible to have a satisfactory, contended and peaceful life. Thus, fiscal policy has to play a major role in promoting economic growth in a country.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- MMMDocumento6 pagineMMMReet KanjilalNessuna valutazione finora

- How To Attain Success Through The Strength of The Vibration of NumbersDocumento95 pagineHow To Attain Success Through The Strength of The Vibration of NumberszahkulNessuna valutazione finora

- Sika Saudi Arabia: Safety Data SheetDocumento4 pagineSika Saudi Arabia: Safety Data Sheetusman khalid100% (1)

- Qa-St User and Service ManualDocumento46 pagineQa-St User and Service ManualNelson Hurtado LopezNessuna valutazione finora

- Chap 06 Ans Part 2Documento18 pagineChap 06 Ans Part 2Janelle Joyce MuhiNessuna valutazione finora

- MPPWD 2014 SOR CH 1 To 5 in ExcelDocumento66 pagineMPPWD 2014 SOR CH 1 To 5 in ExcelElvis GrayNessuna valutazione finora

- Saic-M-2012 Rev 7 StructureDocumento6 pagineSaic-M-2012 Rev 7 StructuremohamedqcNessuna valutazione finora

- Tank Emission Calculation FormDocumento12 pagineTank Emission Calculation FormOmarTraficanteDelacasitosNessuna valutazione finora

- Consultancy Services For The Feasibility Study of A Second Runway at SSR International AirportDocumento6 pagineConsultancy Services For The Feasibility Study of A Second Runway at SSR International AirportNitish RamdaworNessuna valutazione finora

- How Can You Achieve Safety and Profitability ?Documento32 pagineHow Can You Achieve Safety and Profitability ?Mohamed OmarNessuna valutazione finora

- Vylto Seed DeckDocumento17 pagineVylto Seed DeckBear MatthewsNessuna valutazione finora

- Change Language DynamicallyDocumento3 pagineChange Language DynamicallySinan YıldızNessuna valutazione finora

- Payment Plan 3-C-3Documento2 paginePayment Plan 3-C-3Zeeshan RasoolNessuna valutazione finora

- National Senior Certificate: Grade 12Documento13 pagineNational Senior Certificate: Grade 12Marco Carminé SpidalieriNessuna valutazione finora

- SCHEDULE OF FEES - FinalDocumento1 paginaSCHEDULE OF FEES - FinalAbhishek SunaNessuna valutazione finora

- Emco - Unimat 3 - Unimat 4 LathesDocumento23 pagineEmco - Unimat 3 - Unimat 4 LathesEnrique LueraNessuna valutazione finora

- BS As On 23-09-2023Documento28 pagineBS As On 23-09-2023Farooq MaqboolNessuna valutazione finora

- Province of Camarines Sur vs. CADocumento8 pagineProvince of Camarines Sur vs. CACrisDBNessuna valutazione finora

- scx4521f SeriesDocumento173 paginescx4521f SeriesVuleticJovanNessuna valutazione finora

- Eclipsecon MQTT Dashboard SessionDocumento82 pagineEclipsecon MQTT Dashboard Sessionoscar.diciomma8446Nessuna valutazione finora

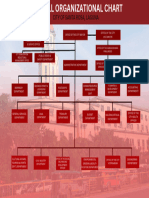

- Org ChartDocumento1 paginaOrg Chart2021-101781Nessuna valutazione finora

- Enumerator ResumeDocumento1 paginaEnumerator Resumesaid mohamudNessuna valutazione finora

- Civil NatureDocumento3 pagineCivil NatureZ_Jahangeer100% (4)

- Medical Devices RegulationsDocumento59 pagineMedical Devices RegulationsPablo CzNessuna valutazione finora

- E OfficeDocumento3 pagineE Officeஊக்கமது கைவிடேல்Nessuna valutazione finora

- Apst GraduatestageDocumento1 paginaApst Graduatestageapi-253013067Nessuna valutazione finora

- Bondoc Vs PinedaDocumento3 pagineBondoc Vs PinedaMa Gabriellen Quijada-TabuñagNessuna valutazione finora

- Mathematical Geophysics: Class One Amin KhalilDocumento13 pagineMathematical Geophysics: Class One Amin KhalilAmin KhalilNessuna valutazione finora

- Drug Study TemplateDocumento2 pagineDrug Study TemplateKistlerzane CABALLERONessuna valutazione finora

- Key Features of A Company 1. Artificial PersonDocumento19 pagineKey Features of A Company 1. Artificial PersonVijayaragavan MNessuna valutazione finora