Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Retail in India

Caricato da

Gaurav ShahaneDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Retail in India

Caricato da

Gaurav ShahaneCopyright:

Formati disponibili

What is Retail?

In 2004, The High Court of Delhi, defined the term retail as a sale for final consumption in contrast to a sale for further sale or processing (i.e. wholesale). It is a sale to the ultimate consumer. Retailing is the last link that connects the individual consumer with the manufacturing and distribution chain. A retailer is involved in the act of selling goods to the individual consumer at a margin of profit. Organised and Unorganised Retailing: Organised retailing refers to trading activities undertaken by licensed retailers, that is, those who are registered for sales tax, income tax, etc. These include the corporate-backed hypermarkets and retail chains, and also the privately owned large retail businesses. Unorganised retailing, on the other hand, refers to the traditional formats of low-cost retailing, for example, the local kirana shops, owner manned general stores, paan/beedi shops, convenience stores, hand cart and pavement vendors, etc. Retail in India: According to a research report named Retail Sector in India by Research and Markets, Indian retail sector accounts for 22 per cent of the country's gross domestic product (GDP) and contributes to 8 percent of the total employment. The Rs 18,673 billion (US$ 401 billion) Indian retail market entails only 6 per cent of itself as organized retail segment as of 2010, according to Booz and Co (India) Pvt Ltd. Hence, there is a great potential to be explored by domestic and international players. The organized retail however is at a very nascent stage.

Modern retailing has entered India tin form of sprawling malls & huge complexes offerting shopping, entertainment, leisure to the consumer as the retailers experiment with a variety of formats, from discount stores to supermarkets to hypermarkets to specialty chains. However kiranas still continue to score over modern formats mainly due to the convenience factor.

Retail: Key Developments & Major Investments Driven by changing consumption patterns, favourable demographics, expanding middle class and greater government support, retailers are eagerly foraying into untapped avenues of Indian markets by making huge investment plans. Cumulative foreign direct investment (FDI) inflows in single-brand retail trading during April 2000 to June 2011 stood at US$ 69.26 million, according to the Department of Industrial Policy and Promotion (DIPP). For instance- Jubilant FoodWorks Ltd, which operates fast food chain of Dominos Pizza in India, will invest over Rs 70 crore (US$ 15.03 million) in the FY12 on new stores and commissaries. Reliance Industries Reliance Retail (that runs supermarket and hypermarket chains) is planning massive expansion across the country by doubling the number of stores in several specialty formats in 2011. According to a report by research firm CB Richard Ellis India, over 6 million square feet of retail mall space was added across India in the first six months of 2011; primarily due to aggressive expansion by organised retailers. For instance, Kishore Biyani-controlled Pantaloon Retail added 2.26 million square feet (sq. ft.) of retail space during the fiscal 2011 and booked over 9 million sq. ft of retail space to fructify its expansion plans in future. The brand More, operated by Aditya Birla Retail, will open 12 hypermarkets and 150 supermarkets in fiscal 2012. Shoppers Stop Ltd, which has 43 departmental stores and 10 hypermarkets under the brand Hypercity, plans to open four more hypermarkets and 10 departmental stores in 2011. Along with the metros, the retailers are betting big on tier-II and tier-III cities as well. Retailing over Internet: According to a latest report by a leading industry body, online retail segment in India is growing at an annual rate of 35 per cent which would take its value from Rs 2,000 crore (US$ 429.5 million) in 2011 to Rs 7,000 crore (US$ 1.5 billion) in 2015. Tata Group firm Infiniti Retail, that operates consumer durables and electronics chain of stores under 'Croma' brand, is in the process of tapping net savvy consumers. The company is contemplating on options like cash-on-delivery to make online shopping easier for consumers, even for those who do not use debit or credit cards. Similarly, the Future Group, that operates a dedicated portal Futurebazaar.com for online sales, has revealed that it is targeting at least 10 per cent of the company's total retail sales from digital medium.

FDI in Indian Retail Industry: FDI refers to capital inflows from abroad that is invested in or to enhance the production capacity of the economy. At present, India permits 100% FDI in cash & carry and wholesale trading (which is businessto-business) and 51% in single-brand stores (such as Gucci or Apple). The government has moved a step closer to allow FDI in multi brand retailing in India after the committee of secretaries (CoS) gave its nod to permit 51 per cent of FDI in the sector. The recommendation will now head to the cabinet committee on economic affairs, which will take a final decision on rules to be imposed and the level of FDI to be allowed. However, the CoS approval, which is yet to go to the Cabinet for its consideration, was given with several conditions. These included a minimum FDI of USD 100 million for large format retail operations, which will be allowed only in cities with minimum one million population. It also suggested that 50 per cent of FDI component has to be deployed in the back-end infrastructure, like warehousing and cold storage. he worlds two biggest retailers Wal-Mart and Carrefour, who already operate wholesale outlets in India, seek to sell in a market that Business Monitor International estimates will be worth $396 billion this year and may double to $785 billion in 2015. Permitting FDI (foreign direct investment) in retail in a phased manner beginning with metros and incentivizing the existing retail shops to modernize could help address the concerns of farmers and consumers. FDI in retail may also help bring in technical know-how to set up efficient supply chains which could act as models of development But a lack of political will is seen as the main reason for the government not taking up the proposal actively, even two months after the in-principle nod by the CoS. The government is under pressure for several reasons, and it is not in a mood to open a new front, according to sources in the know. Another reason being cited is the absence of a consensus between ministries over the policy riders. But the regulation may soon pave way for foreign players like Wal-Mart, Carrefour and Cheshunt, who have been vying for an opportunity to enter India.

Road Ahead The Business Monitor International (BMI) India Retail Report for the fourth-quarter of 2011 forecasts that the total retail sales will grow from US$ 411.28 billion in 2011 to US$ 804.06 billion by 2015. The report has underlined factors like economic growth, population expansion, increasing wealth of individuals and rapid construction of organized retail infrastructure as major drivers for the optimistic forecast figures.

Potrebbero piacerti anche

- Foreign Direct Investment in IndiaDocumento5 pagineForeign Direct Investment in IndiaDisha JaniNessuna valutazione finora

- Advertising and Promotional Strategies of DmartDocumento31 pagineAdvertising and Promotional Strategies of DmartUmesh Naik100% (1)

- Retail Investors in India Indian Retail SectorDocumento10 pagineRetail Investors in India Indian Retail Sectorjayesh_joshi537321Nessuna valutazione finora

- Foreign Direct Investment in Multi-Brand RetailDocumento16 pagineForeign Direct Investment in Multi-Brand RetailVinay ArtwaniNessuna valutazione finora

- Sector ProfDocumento3 pagineSector ProfAdmis SreeNessuna valutazione finora

- Final Globus - ProjectDocumento72 pagineFinal Globus - Projectravi_sms001Nessuna valutazione finora

- FDI in RetailDocumento12 pagineFDI in RetailVignesh Arun S KNessuna valutazione finora

- ReportDocumento65 pagineReportyamunabankaraioramNessuna valutazione finora

- A Study On Consumer and Preferences For Multi Brand Retailing. OverviewDocumento7 pagineA Study On Consumer and Preferences For Multi Brand Retailing. OverviewVaibhav SharmaNessuna valutazione finora

- GIS Converted - EditedDocumento43 pagineGIS Converted - EditedManish sharmaNessuna valutazione finora

- FDI in Retail Boon or BaneDocumento7 pagineFDI in Retail Boon or BaneShreya pawdeNessuna valutazione finora

- Final Report OSDDocumento25 pagineFinal Report OSDNikita GuptaNessuna valutazione finora

- Fdi DataaDocumento3 pagineFdi DataaSagar SatujaNessuna valutazione finora

- All ChaptersDocumento8 pagineAll ChaptersDrShailly SinghNessuna valutazione finora

- Managing Retailing by AarushiDocumento35 pagineManaging Retailing by AarushiAarushi SinghNessuna valutazione finora

- India's Retail Industry Accounts for 10% of GDPDocumento9 pagineIndia's Retail Industry Accounts for 10% of GDPuttkarshNessuna valutazione finora

- Retail Sector in India PDFDocumento12 pagineRetail Sector in India PDFjayNessuna valutazione finora

- Bibi L OgraphyDocumento51 pagineBibi L Ographydivyaa76Nessuna valutazione finora

- Retail in India : Click To Edit Master Subtitle StyleDocumento30 pagineRetail in India : Click To Edit Master Subtitle StyleCintoomoni HazarikaNessuna valutazione finora

- Retail Sector in IndiaDocumento7 pagineRetail Sector in IndiaShoeb MansuriNessuna valutazione finora

- Future Prospects of Organized Retail Sector in IndiaDocumento2 pagineFuture Prospects of Organized Retail Sector in IndiaMamatha KerpudeNessuna valutazione finora

- FDI in Retail A Necessary Evil October 2012.Documento4 pagineFDI in Retail A Necessary Evil October 2012.Praveen Kumar ThotaNessuna valutazione finora

- PP PP: C PCPPP PPPPPPDocumento5 paginePP PP: C PCPPP PPPPPPAchal ManchandaNessuna valutazione finora

- Assingnment:-2 Health Care Sector: Challenges & Opportunity To Private InvestorsDocumento6 pagineAssingnment:-2 Health Care Sector: Challenges & Opportunity To Private InvestorsBhavin MandaliyaNessuna valutazione finora

- FDI in Retail Boost Indian EconomyDocumento8 pagineFDI in Retail Boost Indian EconomyJacky ShamdasaniNessuna valutazione finora

- Implications of FDI in Indian RetailDocumento8 pagineImplications of FDI in Indian RetailAvishkarzNessuna valutazione finora

- E-Retailing Project Report Captures Existing Indian MarketDocumento27 pagineE-Retailing Project Report Captures Existing Indian MarketSayed HabibullaNessuna valutazione finora

- Pantaloon Retail Industry AnalysisDocumento18 paginePantaloon Retail Industry AnalysisRahulKumbhare100% (1)

- The Indian Kaleidoscope: Emerging Trends in RetailDocumento52 pagineThe Indian Kaleidoscope: Emerging Trends in RetailSwati Agarwal100% (1)

- Impact of Fdi On India Retail TradeDocumento18 pagineImpact of Fdi On India Retail TradeRaja SekharNessuna valutazione finora

- Indian Retail ScenarioDocumento10 pagineIndian Retail ScenarioSubodh KantNessuna valutazione finora

- Retail DataaDocumento3 pagineRetail DataaSagar SatujaNessuna valutazione finora

- Nishant ValseDocumento44 pagineNishant ValseNishant ValseNessuna valutazione finora

- Foreign Direct Investment in Indian Retail Sector - A SWOT AnalysisDocumento2 pagineForeign Direct Investment in Indian Retail Sector - A SWOT Analysissandesh2429Nessuna valutazione finora

- RETAIL INDIA INDUSTRY GROWTHDocumento14 pagineRETAIL INDIA INDUSTRY GROWTHRahul ChitkaraNessuna valutazione finora

- Consumer Satisfaction of Service Quality at Big BazaarDocumento56 pagineConsumer Satisfaction of Service Quality at Big BazaarAnsh100% (2)

- India's Growing Retail Industry Market Size and FutureDocumento6 pagineIndia's Growing Retail Industry Market Size and FutureLamhe YasuNessuna valutazione finora

- Marketing Research ProjectDocumento39 pagineMarketing Research ProjectR Rama Koteswara RajuNessuna valutazione finora

- India Is in The Mark of Developed CountryDocumento8 pagineIndia Is in The Mark of Developed CountryGargi ChawlaNessuna valutazione finora

- Future Group DetailsDocumento6 pagineFuture Group DetailssenuriteledramaNessuna valutazione finora

- introduction:: Watches TitanDocumento15 pagineintroduction:: Watches TitanThirumalesh MkNessuna valutazione finora

- Retail MarketingDocumento19 pagineRetail MarketingLuv PrakashNessuna valutazione finora

- Evolution of Indian Retail IndustryDocumento7 pagineEvolution of Indian Retail IndustryAniket BhideNessuna valutazione finora

- Mini Project of Project and Operations Research ManagementDocumento11 pagineMini Project of Project and Operations Research ManagementSagar KattimaniNessuna valutazione finora

- Multi Brand Retailing in IndiaDocumento30 pagineMulti Brand Retailing in IndiasupriyaNessuna valutazione finora

- Objective: Customer Reach StrategiesDocumento31 pagineObjective: Customer Reach StrategiesHrishikesh RumdeNessuna valutazione finora

- Indian Retailing Scenario EvolvesDocumento12 pagineIndian Retailing Scenario EvolvesAditi PareekNessuna valutazione finora

- INDIAN RETAIL SECTOR OVERVIEWDocumento12 pagineINDIAN RETAIL SECTOR OVERVIEWDUSHYANT GUPTANessuna valutazione finora

- Retail Industry OverviewDocumento2 pagineRetail Industry OverviewSahila MahajanNessuna valutazione finora

- Project Report On Organized Retail Sector in IndiaDocumento50 pagineProject Report On Organized Retail Sector in IndiaYogesh Bhatt100% (1)

- Introduction to the Indian Retail IndustryDocumento50 pagineIntroduction to the Indian Retail IndustryPriyanka KhannaNessuna valutazione finora

- Retail! Retail! Retail! Why Is There So Much Talk About This Industry, Which Is ProbablyDocumento127 pagineRetail! Retail! Retail! Why Is There So Much Talk About This Industry, Which Is ProbablySanjay RamaniNessuna valutazione finora

- Chapter-4 Industry Analysis: A Brief Definition of RetailingDocumento17 pagineChapter-4 Industry Analysis: A Brief Definition of RetailingShivam GuptaNessuna valutazione finora

- Introduction To Fdi: Control in A CompanyDocumento4 pagineIntroduction To Fdi: Control in A Companymahesh_sawant2007Nessuna valutazione finora

- Top 10 Trends in the Indian Retail IndustryDocumento20 pagineTop 10 Trends in the Indian Retail IndustryNitin GoyalNessuna valutazione finora

- Chapter - 2 Review of Literature: 2.1) Private Labels' Business in Retail Is OverhypedDocumento26 pagineChapter - 2 Review of Literature: 2.1) Private Labels' Business in Retail Is OverhypedAmeesha DharamshiNessuna valutazione finora

- Retail ProjectDocumento102 pagineRetail ProjectViraj WadkarNessuna valutazione finora

- A Practical Approach to the Study of Indian Capital MarketsDa EverandA Practical Approach to the Study of Indian Capital MarketsNessuna valutazione finora

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsDa EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNessuna valutazione finora

- Appetite for Convenience: How to Sell Perishable Food Direct to ConsumersDa EverandAppetite for Convenience: How to Sell Perishable Food Direct to ConsumersNessuna valutazione finora

- ANOVA: Analysis of VarianceDocumento5 pagineANOVA: Analysis of VarianceGaurav ShahaneNessuna valutazione finora

- Job Description StatisticianDocumento2 pagineJob Description StatisticianAjay BagariaNessuna valutazione finora

- NexusDocumento30 pagineNexusGaurav ShahaneNessuna valutazione finora

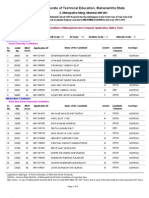

- Application Form: Student SSC DetailsDocumento3 pagineApplication Form: Student SSC DetailsGaurav ShahaneNessuna valutazione finora

- Retail in IndiaDocumento3 pagineRetail in IndiaGaurav ShahaneNessuna valutazione finora

- Top 10 Movies About Life, Love and LossDocumento1 paginaTop 10 Movies About Life, Love and LossGaurav ShahaneNessuna valutazione finora

- Capr-Ii MB6195Documento3 pagineCapr-Ii MB6195sandeshm1990Nessuna valutazione finora

- Consumer Behavior Models and Consumer Behavior in TourismDocumento42 pagineConsumer Behavior Models and Consumer Behavior in TourismAstrit1971100% (6)