Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Asian Bonds - Weekly Debt Highlights

Caricato da

rryan123123Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Asian Bonds - Weekly Debt Highlights

Caricato da

rryan123123Copyright:

Formati disponibili

10 October 2011

onsumer price inflation in Indonesia eased to 4.6% year-on-year (y-o-y) in September as food prices declined. In the Republic of Korea, inflation eased to 4.3% y-o-y in September from 5.3% in August. Consumer price inflation in Thailand also fell in September to 4.0% y-o-y from 4.3% in the previous month due to a slowdown in rising energy prices and transport costs. Meanwhile, inflation in the Philippines inched up to 4.8% y-o-y in September from 4.7% in August. The People's Republic of China's (PRC) purchasing managers' index (PMI) for services rebounded to 59.3 in September from 57.3 in August, indicating a recovery in the services sector. In contrast, Singapore's manufacturing activity contracted for the third straight month in September, with the PMI at 48.3 in September. Indonesia's export growth eased to 37.1% y-o-y in August for total exports of USD18.8 billion after posting revised 39.5% annual growth in July. Indonesia's imports rose 23.7% y-o-y to USD15.1 billion in August, following revised 28.4% growth in the previous month. The trade surplus in August was USD3.8 billion. Malaysia's merchandise exports posted 10.9% growth in August, higher than the 7.1% export growth rate for July. Meanwhile, imports grew 6.9% y-o-y in August. Bank Indonesia (BI) issued new regulations governing export proceeds and foreign debt withdrawals. Under the new policy, exporters will be required to transfer their proceeds from offshore banks into domestic banks within 3 months of the date posted on the Export Declaration Form. Another new BI regulation requires debtors to conduct their foreign borrowing through domestic banks. Net foreign investment outflows from the Republic of Korea's LCY bond market were KRW2.5 billion in September. Net inflows in August totaled KRW134.0 billion. The largest net bond investment inflows in September came from Thailand (KRW726.5 billion), the US (KRW619.3 billion), Malaysia (KRW603.8 billion), and the PRC (KRW 400.3 billion). Thailand plans to begin targeting headline inflation instead of core inflation to attain greater flexibility in conducting monetary policy. The State Bank of Viet Nam raised its refinancing rate, one of its three policy rates, by 100 basis points to 15% effective today. The move is the fifth increase in the refinancing rate for the year.

Key Developments in Asian Local Currency Markets

asianbondsonline.adb.org

Asia Bond Monitor September 2011

10-Year Selected LCY Government Security Yields

Markets

Close of 7 October 2011

basis point change from Previous Week* 1-Jan-11* Latest Closing Previous Day*

2.08 2.00 0.99 3.93 1.25 8.58 6.87 3.70 3.83 5.89 1.63 3.56 12.64 8.92 6.00 1.00 0.00 0.90 0.90 -24.10 0.00 2.00 -5.78 0.00 -5.50 0.00 16.10 16.10 -121.71 11.50 -96.10 11.50 -4.40 -14.00 0.00 2.00 0.00 -1.50 -160.60 15.00 15.00 65.90 -4.80 -73.70 -0.20 -33.80 -12.00 -69.00 3.26 3.26 0.56 1.00 1.00 -108.00 -13.30 -16.70 -2.40 89.30

US EU Japan PR C H ong Kong, C hina India Indones ia Malays ia Korea, R ep. of Philippines Singapore Thailand Viet N am

-4.40

-1.50

-4.80 -0.20 -12.00

-13.30 -2.40

Selected Government Security Yields Benchmark Yield Curves - Local Currency Government Bonds 2-versus-10 Yield Spread Chart Policy Rate versus Inflation Rate Charts Credit Default Swap Spreads & Exchange Rate Indexes Selected Debt Security Issuances Selected Asia Data Releases

In Hong Kong, China, Sinotrans Shipping Inc. priced 3-year CNH bonds with a coupon of 3.3%. In Malaysia, Midciti Resources, which co-owns the Petronas Towers, sold MYR880 million worth of Islamic medium-term notes. The multi-tranche issuance include MYR280 million worth of 3-year notes with a 3.533% annual return, MYR270 million of 5-year notes at 3.919%, MYR240 million of 7-year notes at 4.07%, and MYR90 million of 10-year notes at 4.25%. Government bond yields fell last week for all tenors in the Republic of Korea and Thailand; and for most tenors in Hong Kong, China; and Malaysia, while yields rose for most tenors in Indonesia, the Philippines, Singapore and Viet Nam. The PRC market was closed due to the national holiday. Yield spread between 2- and 10- maturities widened only in Malaysia, while spreads narrowed in other emerging East Asian markets except for the PRC.

....

1

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.........

Summary Text of News Articles

.......................................................................................................................

Consumer Price Inflation Eases in Indonesia, Republic of Korea, and Thailand, Quickens in the Philippines

Consumer price inflation in Indonesia eased to 4.6% year-on-year (y-o-y) in September from 4.8% in August as food prices dropped following the end of holiday festivities. Despite slower overall inflation, prices of some goods such as chili, jewelry, and cigarettes remained high. On a month-on-month (m-o-m) basis, consumer price inflation eased to 0.3% in September from 0.9% in the previous month. Meanwhile, core inflation eased to 4.9% in September from 5.2% a month earlier. In the Republic of Korea, consumer price inflation eased to 4.3% y-o-y in September from 5.3% in August. The annual rise in consumer prices was mainly led by an 8.6% increase in transport costs, a 5.0% rise in housing and utility costs, and a 4.6% hike in food and non-alcoholic beverage prices. On a m-o-m basis, consumer prices rose only 0.1% from the previous month. In the Philippines, the headline inflation rate inched up to 4.8% y-o-y in September from 4.7% in August, marginally lower than the consensus estimate of 4.9%. Indices for clothing and footwear; housing, water, electricity, gas and other fuels; health; transport; and recreation and culture all increased on an annual basis. On m-o-m basis, prices of consumer items rose 0.2% in September from 0.1% in August due to escalating food prices for vegetables, fruits, milk, and milk products. Rising prices in many regions for alcoholic beverages, cigarettes, selected construction materials, and firewood also contributed to the uptrend. In Thailand, consumer price inflation weakened to 4.0% y-o-y in September from 4.3% in August. This was led by a slowdown in the rise in energy prices and transport costs, while food price increases remained steady. On a m-o-m basis, consumer prices fell 0.3% in September, with energy prices decreasing 5.7% and transport costs falling 2.4%. For inflation trends in Indonesia, refer to this link: http://asianbondsonline.adb.org/indonesia/data/marketwatch.php?code=policy_rate_and_inflation_trends For inflation trends in the Republic of Korea, refer to this link: http://asianbondsonline.adb.org/korea/data/marketwatch.php?code=policy_rate_and_inflation_trends For inflation trends in the Philippines, refer to this link: http://asianbondsonline.adb.org/philippines/data/marketwatch.php?code=policy_rate_and_inflation_trends For inflation trends in Thailand, refer to this link: http://asianbondsonline.adb.org/thailand/data/marketwatch.php?code=policy_rate_and_inflation_trends

.......................................................................................................................

PRC's Services PMI Rises and Singapore's Manufacturing Activity Contracts in September; Hong Kong, China's Retail Sales Grows 29% in August

The People's Republic of China's (PRC) purchasing managers' index (PMI) for services rebounded to 59.3 in September from 57.3 in August, indicating a recovery in the services sector. In contrast, Singapore's manufacturing activity contracted for the third straight month in September. According to Singapore's Institute of Purchasing and Materials Management, the PMI fell to 48.3 in September from 49.4 in August. A reading above 50 indicates manufacturing expansion, while a reading below 50 indicates a contraction. The PMI for the electronics sector fell to 47.2 in September from 48.0 in the previous month. In Hong Kong, China, retail sales grew strongly at 29.0% y-o-y in September but was still slightly lower than July's 29.1%. The government attributes the robust growth to strong local demand and tourist spending. Growth was highest in the miscellaneous consumer category at 69.3% y-o-y, followed by sales in electrical goods and photographic equipment at 53.7%.

.......................................................................................................................

Export Growth Eases in Indonesia, Increases in Malaysia

Indonesia's export growth eased to 37.1% y-o-y in August for total exports of USD18.8 billion after posting revised 39.5% annual growth in July. Oil and gas exports in August totaled USD4.1 billion, while non-oil and gas exports reached USD14.7 billion. The largest export markets in August were the PRC (USD1.9 billion), Japan (USD1.5 billion),

.......

2

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.........

Summary Text of News Articles

.......................................................................................................................

Export Growth Eases in Indonesia, Increases in Malaysia (cont)

and India (USD1.4 billion). Meanwhile, imports rose 23.7% y-o-y to USD15.1 billion, following revised 28.4% import growth in the previous month. Indonesia's trade surplus in August was USD3.7 billion. Malaysia's merchandise exports posted 10.9% year-on-year (y-o-y) growth in August, higher than the 7.1% growth in July. Meanwhile, imports grew 6.9% y-o-y in August. On a month-on-month basis, exports were lower by 1.2% while imports fell by 4.4%. During the January to August period, total exports expanded by 7.4% y-o-y to MYR454.91 billion and total imports increased by 8.5% y-o-y to MYR375.33 billion. Malaysia's trade surplus reached MYR91.6 billion in the first eight months. For historical data on Indonesia's export growth, refer to this link: http://asianbondsonline.adb.org/indonesia/data/macroeconomic_credit.php For historical data on Malaysia's export growth, refer to this link: http://asianbondsonline.adb.org/malaysia/data/macroeconomic_credit.php

.......................................................................................................................

BI Issues New Regulations

On 30 September Bank Indonesia (BI) issued new regulations governing export proceeds and foreign debt withdrawals. Under the new policies exporters will be required to transfer their proceeds from offshore banks into domestic banks within a period of 3 months after the date included on the Export Declaration Form. This policy will become effective on 2 January 2012. During the transition period exporters will be given up to 6 months from the Export Declaration Form date to comply with the new measure. Another new regulation issued by BI requires debtors to conduct their foreign borrowing through domestic banks. These new regulations apply to borrowing in cash, non-revolving loan agreements, and debt securities. According to BI, the main objective of these new policies is to strengthen macroeconomic stability, particularly exchange rate stability. BI governor Darmin Nasution said that the policies will improve the sustainability of foreign exchange flows into the domestic market by reducing dependence on short-term funding.

.......................................................................................................................

Negative Net Investment in the Republic of Korea's LCY Bond Market in September

Net foreign investment outflows from the Republic of Korea's local currency (LCY) bond market totaled KRW2.5 billion in September following positive net inflows of KRW134.0 billion in August. The largest net bond investment inflows for the month came from Thailand (KRW726.5 billion), the United States (KRW619.3 billion), Malaysia (KRW603.8 billion), and the PRC (KRW400.3 billion). In contrast, the three largest net bond sales were made by investors from the United Kingdom (KRW924.6 billion), France (KRW823.5 billion), and Singapore (KRW816.1).

.......................................................................................................................

Thailand Plans to Target Headline Inflation vs. Core Inflation

Thailand reported last week that it plans to begin targeting headline inflation instead of core inflation to attain greater flexibility in conducting monetary policy. The headline inflation target was set at 3.0% plus or minus 1.5 percentage points.

.......................................................................................................................

Viet Nam Raises Refinance Rate to 15%

The State Bank of Viet Nam raised its refinancing rate, one of its three policy rates by 100 basis points to 15% effective today. The move is the fifth increase in the refinancing rate for the year and the country is currently experiencing substantial inflationary pressure. The inflation rate for September was at 22.4% y-o-y.

...

3

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.........

Summary Text of News Articles

.......................................................................................................................

Sinotrans Prices CNH Bonds; Owner of Petronas Towers Issues Sukuk

In Hong Kong, China, Sinotrans Shipping Inc. priced 3-year CNH bonds with a coupon of 3.3%. The bonds carry an irrevocable guarantee from Sinotrans Shipping (Holdings). In Malaysia, Midciti Resources, which co-owns the Petronas towers, sold MYR880 million worth of Islamic medium-term notes. The multi-tranche issuance includes MYR280 million worth of 3-year notes with a 3.533% annual coupon, MYR270 million of 5-year notes at 3.919%, MYR240 million of 7-year notes at 4.07%, and MYR90 million of 10-year notes at 4.25%. Proceeds from the issuance will be used to refinance existing bonds worth MYR799 million that will mature in November.

...

4

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

Selected Government Security Yields

Tip: Zoom-in on the table using the Acrobat zoom tool

3-Month Selected LCY Government Security Yields

Latest Closing 0.01 0.50 0.10 3.44 0.09 8.42 3.03 3.30 2.70 0.22 3.47 basis point change from Previous Previous 1-Jan-11* Day* Week* -1.52 0.51 -1.52 -11.46 11.40 1.60 11.40 10.10 0.00 0.00 0.00 -2.40 0.00 0.00 0.00 26.00 -2.00 -1.00 -2.00 -19.00 0.00 2.00 0.00 132.00 0.50 0.00 0.50 25.30 -1.00 0.00 -1.00 79.00 -4.50 15.75 -4.50 150.50 0.00 0.00 0.00 -17.00 -1.50 -0.26 -1.50 150.17

Markets US EU Japan PRC Hong Kong, China India Malaysia Korea, Rep. of Philippines Singapore Thailand

Close of 7 October 2011

10-Year Selected LCY Government Bond Yields

Latest Closing 2.08 2.00 0.99 3.93 1.25 8.58 6.87 3.70 3.83 5.89 1.63 3.56 12.64 basis point change from Previous Previous 1-Jan-11* Day* Week* 8.92 16.10 16.10 -121.71 6.00 11.50 11.50 -96.10 -4.40 1.00 -4.40 -14.00 0.00 0.00 0.00 2.00 -1.50 -1.50 0.90 -160.60 15.00 0.90 15.00 65.90 -4.80 -24.10 -4.80 -73.70 -0.20 -0.20 0.00 -33.80 2.00 -12.00 -12.00 -69.00 3.26 -5.78 3.26 0.56 1.00 0.00 1.00 -108.00 -5.50 -13.30 -13.30 -16.70 -2.40 0.00 -2.40 89.30

Markets US EU Japan PRC Hong Kong, China India Indones ia Malays ia Korea, Rep. of Philippines Singapore Thailand Viet Nam

Close of 7 October 2011

Source: Based on data from Bloomberg, LP.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

Indonesia

.......

Benchmark Yield Curves Local Currency Government Bonds

Tip: Zoom-in on the table using the Acrobat zoom tool

China, Peoples Rep. of

4.25 2.0

Hong Kong, China

9.0 8.0

Yield (%)

4.00

Yield (%)

Yield (%)

1.5

7.0 6.0 5.0 4.0

3.75

1.0

3.50

0.5

3.25 0 1 2 3 4 5 6 7 8 9 10 11 12

0.0 0 2 4 6 8 10 12 14 16

12

15

18

21

24

27

30

33

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11

Korea, Republic of

4.25 4.00 3.75 3.50 3.25 3.00 0 2 4 6 8 10 12 14 16 18 20 22 4.2 4.0 3.8

Yield (%)

Yield (%)

Malaysia

8.0 7.0 6.0

Yield (%)

Philippines

3.6 3.4 3.2 3.0 2.8 0 2 4 6 8 10 12 14 16 18 20 22

5.0 4.0 3.0 2.0 1.0 0.0 0 3 6 9 12 15 18 21 24 27

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11 07-Oct-11

Time to maturity (years)

30-Sep-11 23-Sep-11

Singapore

2.5 2.0 1.5 1.0 0.5 0.0 0 3 6 9 12 15 18 21

4.3

Thailand

12.8

Viet Nam

4.0

Yield (%) Yield (%)

12.5

Yield (%)

3.8

12.3

3.5

3.3 0 2 4 6 8 10 12 14 16

12.0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11

US

3.5 3.0 2.5

Yield (%)

3.0 2.5 2.0

EU

2.3 2.0 1.8 1.5

Yield (%)

Japan

Yield (%)

2.0 1.5 1.0 0.5 0.0 0 4 8 12 16 20 24 28 32

1.5 1.0 0.5 0.0 0 5 10 15 20 25 30

1.3 1.0 0.8 0.5 0.3 0.0 0 4 8 12 16 20 24 28 32 36 40

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11

Time to maturity (years)

07-Oct-11 30-Sep-11 23-Sep-11

Source: Based on data from Bloomberg.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

2-versus-10 Yield Spread Chart

Tip: Zoom-in on the table using the Acrobat zoom tool

Yield Spread between the Two- and Ten-Year Government Bonds

China, People's Rep. of

7-Oct-11

Hong Kong, China Indonesia Korea, Rep. of Malaysia Philippines Singapore Thailand Viet Nam U.S. E.U. Japan 0 50 100 150 200 250 300

30-Sep-11 23-Sep-11

350

400

basis points

Source: Based on data from Bloomberg LP.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

India

.......

Policy Rate versus Inflation Rate Charts

Tip: Zoom-in on the table using the Acrobat zoom tool

China, Peoples Rep. of

10 8 6 4 2 2 0 0 -2 -4 Jan-06 Inflation Rate -2 -4 Jan-06 1-year Lending Rate 6.56 6.20 6 4 8

Hong Kong, China

12 10 8 6 4 Inflation Rate 2 0 -2 Jan-06 Repurchase Cut-off Yield

5.7 HKMA Base Rate Inflation Rate

9.78 8.25

0.5

Dec-06

Dec-07

Nov-08

Nov-09

Oct-1 0

Oct-1 1

Dec-06

Dec-07

Nov-08

Nov-09

Oct-1 0

Oct-1 1

Dec-06

Dec-07

Nov-08

Nov-09

Oct-1 0

Oct-1 1

PRC uses 1-year lending rate as one of its policy rates. Source: Bloomberg LP.

The Hong Kong Monetary Authority maintains a Discount Window Base Rate. Source: Bloomberg LP.

The Reserve Bank of India uses the repurchase (repo) cutoff yield as its policy rate. Source: Bloomberg LP.

Indonesia

20 18 16 14 12 10 8 6 4 2 0 Jan-06 Dec-06 Dec-07 Nov-08 Nov-09 Oct-1 0 Oct-1 1 0 Jan-06 Dec-06 Inflation Rate 6.75 4.61 2 4 BI Rate 6 8

Korea, Republic of

10

c

Malaysia

7-Day Repo Rate

8 6 4 2 0

Overnight Policy Rate

4.30 3.25

3.30 3.00

Inflation Rate

-2 -4 Jan-06

Inflation Rate

Dec-07

Nov-08

Nov-09

Oct-1 0

Oct-1 1

Dec-06

Dec-07

Nov-08

Nov-09

Oct-1 0

Oct-1 1

Bank Indonesia uses its reference interest rate (BI rate) as its policy rate. Source: Bloomberg LP.

The Bank of Korea shifted its policy rate from the overnight repurchase (repo) rate to the 7-day repo rate in March 2008. Source: Bloomberg LP.

Bank Negara Malaysia uses the overnight policy rate (OPR) as its policy rate. Source: Bloomberg LP.

Philippines

12 10 8 6 4.80 4 2 0 Jan-06 4.50 0 -2 Overnight Reverse Repo Rate 10 8 Inflation Rate 6 4 2 1-Day Repo Rate

Thailand

30 Inflation Rate 27 24 4.03 3.50 21 18 15 12 9 6 -4 -6 Jan-06 3 Dec-06 Dec-07 Nov-08 Nov-09 Oct-1 0 Oct-1 1 0 Jan-06 Dec-06 Dec-07 Prime Lending Rate

Viet Nam

Inflation Rate 22.42

9.00

Dec-06

Dec-07

Nov-08

Nov-09

Oct-1 0

Oct-1 1

Nov-08

Nov-09

Oct-1 0

Oct-1 1

Bangko Sentral uses the Philippine overnight reverse repurchase agreement rate as one of its policy instruments. Source: Bloomberg LP.

The Bank of Thailand replaced the 14-day repurchase rate with the 1-day repurchase rate in January 2007 as its policy rate. Source: Bloomberg LP.

The State Bank of Viet Nam uses a benchmark prime lending rate as its policy rate. Source: Bloomberg LP.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

Credit Default Swap Spreads & Exchange Rate Indexes

Tip: Zoom-in on the table using the Acrobat zoom tool

Credit Default Swap Spreads - Senior 5-year*

1,400

C hina , P e ople 's R e p. of

H ong K ong, C hina

1,200

Indone s ia

K ore a , R e p. of

1,000

Mid spread in basis points

J a pa n

M a la ys ia

800

P hilippine s

600

Tha ila nd

400

200

* In USD currency and based on sovereign bonds Source: Thomson Reuters

0 Dec-07

Dec-08

No v-09

O ct-10

O ct-11

Exchange Rate Indexes (vis--vis US$, 2 January 2007=100)

130 130

China , P e ople 's R e p. of

Indone s ia

120

120

Ma la ys ia

P hilippine s

110

110

Tha ila nd

100

100

S inga pore

Kore a , Re p. of

90

90

V ie t N a m

80

80

70

70

60

60

Source: ADB-OREI staff calculations based on Bloomberg data.

50 Jan - 07

A u g -07

M ar- 08

O ct-08

M ay-09

D ec-09

Ju l- 10

F eb -11

50 O ct- 11

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

Selected Debt Security Issuances (3 7 October 2011)

Tip: Zoom-in on the table using the Acrobat zoom tool

Mark ets

HK ID

A u c tio n D ate

4-Oct 4-Oct

T y p e o f S ec u rity

90-day Exchange Fund Bills 182 day Exchange Fund Bills 3-month Treasury Bills 1-year Treasury Bills 6-year Treasury Bonds 11-year Treasury Bonds 21-year Treasury Bonds

A v erag e C o u p o n A m o u n t O ffered A m o u n t Is s u ed (in % ) Y ield (% ) L C Y B illio n s L C Y B illio n s

0.12 0.13 5.46 5.76 6.43 7.20 7.70 0.10 1.00 0.10 3.40 3.52 3.52 3.59 3.04 3.03 3.02 3.02 0.16 3.49 3.50 3.58 3.63 1.00 3,500.00 2,200.00 5,100.00 1,200.00 500.00 1,000.00 1,800.00 1.50 1.00 1.50 1.50 3.90 17.00 17.00 15.00 60.00 27.47 9.00 27.47 9.00 750.00 3,000.00 950.00 950.00 350.00 3,499.92 2,198.99 5,059.97 1,050.00 500.00 1,000.00 1,800.00 1.50 1.00 1.50 1.50 3.90 17.00 17.00 15.00 60.00

JP

4-Oct 5-Oct

6-month Treasury Discount Bills 10-year Japan Government Bonds 3-month Treasury Discount Bills 91-day Monetary Stabilization Bonds 182-day Monetary Stabilization Bonds 3-year Treasury Bonds

KR

4-Oct

5-Oct MY 3-Oct 5-Oct SG TH 3-Oct 4-Oct

2-year Treasury Bonds 65-day BNM Islamic Notes 93-day BNM Notes 91-day BNM Islamic Notes 210-day BNM Notes 91-day Treasury Bills 28-day BOT Bills 91-day BOT Bills 182-day BOT Bills 365-day BOT Bills

Sources: Local market sources and Bloomberg, LP.

10

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

Selected Asia Data Releases (11 - 17 October 2011)

Tip: Zoom-in on the table using the Acrobat zoom tool

C o u n tr y / a r ia b le V

Indone s ia BI Re fe r e nce Rate % OCT 11 Japan Tr ade Balance BOP bas is JPY billion A UG M alays ia Indus tr ial Pr oduction y-o-y, % A UG M alays ia M anufactur ing Sale s V alue y-o-y, % A UG Philippine s Total Exports y-o-y, % A UG Philippine s M 3 M one y Supply y-o-y, % A UG Singapor e GDP y-o-y, % 3Q Pe ople s Re public of China Exports y-o-y, % SEP Pe ople s Re public of China Tr ade Balance USD billion SEP Re public of Kore a 7-Day Re pur chas e Rate % OCT 13 Japan M 3 M one y Supply y-o-y, % SEP Philippine s Ove r s e as Re m ittance s y-o-y, % A UG Singapor e Non-Oil Dom e s tic Expor ts y-o-y, % SEP

R e le a s e D a te

10/11

H is to r ic a l D a ta

09/10: 6.50% 10/10: 6.50% 08/11: 6.75% 09/11: 6.75% 07/10: 897.1 08/10: 170.6 06/11: 131.5 07/11: 123.3 07/10: 3.4% 08/10: 3.9% 06/11: 1.0% 07/11: 0.6% 07/10: 8.8% 08/10: 8.9% 06/11: 12.9% 07/11: 10.8% 07/10: 36.0% 08/10: 37.5% 06/11: 9.4% 07/11: 1.7% 07/10: 10.2% 08/10: 8.6% 06/11: 11.4% 07/11: 8.3% 2Q10: 19.4% 3Q10: 10.5% 1Q11: 9.3% 2Q11: 0.9% 2Q10: 19.4% 3Q10: 10.5% 1Q11: 9.3% 2Q11: 0.9% 08/10: 20.0 09/10: 16.9 07/11: 31.5 08/11: 17.8 09/10: 2.25% 10/10: 2.25% 08/11: 3.25% 09/11: 3.25% 08/10: 2.1% 09/10: 2.1% 07/11: 2.4% 08/11: 2.2% 07/10: 8.2% 08/10: 9.8% 06/11: 7.0% 07/11: 6.1% 08/10: 30.8% 09/10: 22.6% 07/11: 2.8% 08/11: 5.1%

R ec en t T ren d s

Bank Indonesia (BI) has kept its benchmark rate steady at 6.75% since February.

10/11

Japans trade balanceon a balance of payments (BOP) basisf ell to JPY 123.3 billion in July f rom JPY 131.5 billion in June.

10/11

Industrial production in Malaysia declined 0.6% year-on-year (y-o-y) in July af ter posting 1.0% grow th in June.

10/11

Grow th in Malaysias manuf acturing sales value eased to 10.8% y-o-y in July f rom 12.9% in the previous month.

10/11

Philippine exports contracted 1.7% y-o-y in July f ollow ing a much larger decline of 9.4% in June.

10/11

Grow th in the M3 money supply of the Philippines slow ed to 8.3% y-o-y in July f rom 11.4% in June.

10/12-10/14

Singapores gross domestic product (GDP) grow th slow ed signif icantly to 0.9% y-o-y in 2Q11 f rom 9.3% in 1Q11.

10/13

The Peoples Republic of Chinas export grow th rose in A ugust to 24.5% y-o-y f rom 20.4% in July.

10/13

The Peoples Republic of Chinas trade surplus in A ugust f ell to $17.8 billion f rom $31.5 billion in July.

10/13

The Bank of Koreas Monetary Policy Committee held the 7-day repurchase rate steady at 3.25% at its 8 September meeting.

10/14

The grow th rate of Japans M3 money supply tapered to 2.2% y-o-y in A ugust f rom a high of 2.4% in July.

10/17

Grow th in overseas Filipino w orkers remittances to the Philippines eased to 6.1% yo-y in July f rom 7.0% in June.

10/17

Singapores non-oil domestic exports grew 5.1% y-o-y in A ugust, a reversal of the 2.8% drop registered in July.

Source: AsianBondsOnline, Bloomberg LP, and Reuters.

11

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

News Articles: Sources for Further Reading

Tip: Click on link to open a new browser (Acrobat Reader 8); for lower versions right-click to open a new browser) Consumer Price Inflation Eases in Indonesia, Republic of Korea, and Thailand, Quickens in the Philippines Indonesia September Inflation Slows, Rate Seen on Hold The Jakarta Globe (03 October 2011) Consumer Price Index in September 2011 Statistics Korea (06 October 2011) SUMMARY INFLATION REPORT National Statistics Office (05 October 2011) Thailands Inflation Eases to Six-Month Low as Falling Fuel Counters Food Bloomberg (06 October 2011) Viet Nam Raises Refinance Rate to 15% UPDATE 1-Vietnam raises refinance rate to 15 pct central bank Reuters (07 October 2011)

Sinotrans Prices CNH Bonds; Owner of Petronas Towers Issues Sukuk Twin towers go private in return to ringgit paper IFR Asia (01 October 2011) BONDS: Sinotrans Shipping raises Rmb2.6bn via 3-yr Dim Sum IFRAsia (04 October 2011)

PRCs Services PMI Rises and Singapores Manufacturing Activity Contracts in September; Hong Kong, Chinas Retail Sales Grows 29% in AugustChina Manufacturing Counters Hard Landing China Services Indexes Increased in September, Pointing to Faster Growth Bloomberg (04 October 2011) Singapore manufacturing activity slows Channel News Asia (04 October 2011) Provisional statistics of retail sales for August 2011 Census and Statistics Department (03 October 2011)

Export Growth Eases in Indonesia, Rises in Malaysia Indonesia's total exports in August read us$18.81 billion Antara News (03 October 2011) Preliminary Release of Malaysia External Trade Statistics August 2011 Department of Statistics Malaysia (07 October 2011)

BI Issues New Regulations Bank Indonesia Published a New Policy on Export Proceeds and Foreign Debt Withdrawal Bank Indonesia (03 October 2011)

Negative Net Investment in the Republic of Koreas LCY Bond Market in September Foreign Investments in Domestic Securities in September 2011 Financial Supervisory Service (06 October 2011)

Thailand Plans to Target Headline Inflation vs. Core Inflation Thailand May Target Headline Inflation Rather than Core Reuters (06 October 2011)

12

Disclaimer: AsianBondsOnline Newsletter is available to users free of charge. The ADB provides no warranty or undertaking of any kind in respect to the information and materials found on, or linked to, AsianBondsOnline Newsletter. The ADB accepts no responsibility for the accuracy of the material posted or linked to the publication, or the information contained therein, or for any consequences arising from its use and does not invite or accept reliance being placed on any materials or information so provided. Views expressed in articles marked with AsianBondsOnline are those of the authors, and not ADB. This disclaimer does not derogate from, and is in addition to, the general terms and conditions regarding the use of the AsianBondsOnline Web Site, which also apply.

Potrebbero piacerti anche

- Asian Development Bank - Weekly HighlightsDocumento13 pagineAsian Development Bank - Weekly Highlightsrryan123123Nessuna valutazione finora

- Asian Weekly Debt Highlights - September 05, 2011Documento12 pagineAsian Weekly Debt Highlights - September 05, 2011rryan123123Nessuna valutazione finora

- Asian Weekly Debt HighlightsDocumento12 pagineAsian Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- Asia Bonds - Debt Highlights - August 08, 2011Documento12 pagineAsia Bonds - Debt Highlights - August 08, 2011rryan123123Nessuna valutazione finora

- Asia - Weekly Debt HighlightsDocumento13 pagineAsia - Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- Key Developments in Asian Local Currency Markets: Asia Bond Monitor March 2011 Read MoreDocumento12 pagineKey Developments in Asian Local Currency Markets: Asia Bond Monitor March 2011 Read Morerryan123123Nessuna valutazione finora

- Asian Development Bank - Weekly Debt HighlightsDocumento13 pagineAsian Development Bank - Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- Asia Bonds Weekly Highlights - August 15, 2011Documento12 pagineAsia Bonds Weekly Highlights - August 15, 2011rryan123123Nessuna valutazione finora

- Tracking The World Economy... - 01/09/2010Documento4 pagineTracking The World Economy... - 01/09/2010Rhb InvestNessuna valutazione finora

- Asian Bonds - Weekly Debt HightlightsDocumento11 pagineAsian Bonds - Weekly Debt Hightlightsrryan123123Nessuna valutazione finora

- The World Economy... - 15/7/2010Documento3 pagineThe World Economy... - 15/7/2010Rhb InvestNessuna valutazione finora

- News 11th Jul 2008Documento3 pagineNews 11th Jul 2008DeepakJadhavNessuna valutazione finora

- Tracking The World Economy... - 04/08/2010Documento3 pagineTracking The World Economy... - 04/08/2010Rhb InvestNessuna valutazione finora

- Main Indicators: GDP, State Budget, Foreign Trade, Exchange Rate, InflationDocumento5 pagineMain Indicators: GDP, State Budget, Foreign Trade, Exchange Rate, InflationUrtaBaasanjargalNessuna valutazione finora

- MTI Maintains 2016 GDP Growth Forecast at 1.0 To 3.0 Per CentDocumento4 pagineMTI Maintains 2016 GDP Growth Forecast at 1.0 To 3.0 Per CentEdmundKerNessuna valutazione finora

- Emerging Markets Overview Jun2011Documento3 pagineEmerging Markets Overview Jun2011Abhishek DwivediNessuna valutazione finora

- The World Economy... - 15/04/2010Documento3 pagineThe World Economy... - 15/04/2010Rhb InvestNessuna valutazione finora

- ScotiaBank JUL 16 Asia - Oceania Weekly OutlookDocumento3 pagineScotiaBank JUL 16 Asia - Oceania Weekly OutlookMiir ViirNessuna valutazione finora

- Bandhan Debt-Market-Monthly-Outlook-Nov-2023Documento3 pagineBandhan Debt-Market-Monthly-Outlook-Nov-2023Shivani NirmalNessuna valutazione finora

- The World Economy - 3/5/2010Documento3 pagineThe World Economy - 3/5/2010Rhb InvestNessuna valutazione finora

- Mets September 2010 Ver4Documento44 pagineMets September 2010 Ver4bsa375Nessuna valutazione finora

- The World Economy... - 26/05/2010Documento3 pagineThe World Economy... - 26/05/2010Rhb InvestNessuna valutazione finora

- Inflation Rate of The Philippines in 2019Documento11 pagineInflation Rate of The Philippines in 2019Jzedrick mackyNessuna valutazione finora

- South Korea - Economic Situation, June 2014 by MOSFDocumento4 pagineSouth Korea - Economic Situation, June 2014 by MOSFEduardo PetazzeNessuna valutazione finora

- Asia Economic Monitor - July 2004Documento27 pagineAsia Economic Monitor - July 2004Asian Development BankNessuna valutazione finora

- Pakistan Economic Survey 2011-12 PDFDocumento286 paginePakistan Economic Survey 2011-12 PDFAli RazaNessuna valutazione finora

- The World Economy... - 21/5/2010Documento3 pagineThe World Economy... - 21/5/2010Rhb InvestNessuna valutazione finora

- Conomic: The Impending Signs of Global UncertaintyDocumento16 pagineConomic: The Impending Signs of Global UncertaintyS GNessuna valutazione finora

- Ado2010 Update InoDocumento4 pagineAdo2010 Update InoArwiyanto AsroriNessuna valutazione finora

- JLL Asia Pacific Property Digest 4q 2015Documento76 pagineJLL Asia Pacific Property Digest 4q 2015limpuppyNessuna valutazione finora

- Employment Trends Survey - MaFoi Consultancy 2011Documento24 pagineEmployment Trends Survey - MaFoi Consultancy 2011MTC Global TrustNessuna valutazione finora

- Employment Trends Survey: Ma Foi RandstadDocumento24 pagineEmployment Trends Survey: Ma Foi RandstadNavneet GuptaNessuna valutazione finora

- WeeklyDocumento16 pagineWeeklySeema GusainNessuna valutazione finora

- Proposed Report: Public FinancesDocumento15 pagineProposed Report: Public FinancesChetan KhannaNessuna valutazione finora

- The World Economy - 16/04/2010Documento3 pagineThe World Economy - 16/04/2010Rhb InvestNessuna valutazione finora

- ECO Scan April'11Documento13 pagineECO Scan April'11itzprasuNessuna valutazione finora

- GDP GrowthDocumento9 pagineGDP GrowthAmit Kumar SashiNessuna valutazione finora

- Statement by DR - Bimal Jalan, Governor, Reserve Bank of India On Mid-Term Review of Monetary and Credit Policy For The Year 2000-2001Documento45 pagineStatement by DR - Bimal Jalan, Governor, Reserve Bank of India On Mid-Term Review of Monetary and Credit Policy For The Year 2000-2001gsss dukheriNessuna valutazione finora

- ScotiaBank JUL 30 Asia - Oceania Weekly OutlookDocumento3 pagineScotiaBank JUL 30 Asia - Oceania Weekly OutlookMiir ViirNessuna valutazione finora

- The World Economy... - 01/04/2010Documento3 pagineThe World Economy... - 01/04/2010Rhb InvestNessuna valutazione finora

- Tracking The World Economy... - 02/08/2010Documento3 pagineTracking The World Economy... - 02/08/2010Rhb InvestNessuna valutazione finora

- Nomura China Activity 23-08-15Documento9 pagineNomura China Activity 23-08-15AlfreGonNessuna valutazione finora

- Macroeconomic Indicators of FMCGDocumento13 pagineMacroeconomic Indicators of FMCGArpita PatnaikNessuna valutazione finora

- QTR ReportDocumento98 pagineQTR ReportMichael AshenafiNessuna valutazione finora

- Key Developments in Asian Local Currency Markets: Asia Bond Monitor March 2010 Read MoreDocumento12 pagineKey Developments in Asian Local Currency Markets: Asia Bond Monitor March 2010 Read Moreapi-26045138Nessuna valutazione finora

- Ias Prelim 2011 Current Affairs Notes Economic Survey 2010 11Documento13 pagineIas Prelim 2011 Current Affairs Notes Economic Survey 2010 11prashant_kaushal_2Nessuna valutazione finora

- The World Economy - 12/03/2010Documento2 pagineThe World Economy - 12/03/2010Rhb InvestNessuna valutazione finora

- FICC Times 12 April 2013Documento5 pagineFICC Times 12 April 2013r_squareNessuna valutazione finora

- The World Economy - 03/03/2010Documento3 pagineThe World Economy - 03/03/2010Rhb InvestNessuna valutazione finora

- OPEC - Monthly Oil Market ReportDocumento75 pagineOPEC - Monthly Oil Market Reportrryan123123Nessuna valutazione finora

- IEA - Monthly Oil Market ReportDocumento67 pagineIEA - Monthly Oil Market Reportrryan123123Nessuna valutazione finora

- Monthly Monetary Trends (St. Louis Fed)Documento20 pagineMonthly Monetary Trends (St. Louis Fed)rryan123123Nessuna valutazione finora

- R qt1112Documento93 pagineR qt1112Lyubomir SirkovNessuna valutazione finora

- FullDocumento65 pagineFullAraldqNessuna valutazione finora

- European Comission 2011 6 enDocumento248 pagineEuropean Comission 2011 6 enEGUVNessuna valutazione finora

- US Financial Data Weekly - St. Louis FedDocumento24 pagineUS Financial Data Weekly - St. Louis Fedrryan123123Nessuna valutazione finora

- EIA - Short Term Energy OutlookDocumento43 pagineEIA - Short Term Energy Outlookrryan123123Nessuna valutazione finora

- Asian Development Bank - Weekly Debt HighlightsDocumento13 pagineAsian Development Bank - Weekly Debt Highlightsrryan123123Nessuna valutazione finora

- Asian Bonds - Weekly Debt HightlightsDocumento11 pagineAsian Bonds - Weekly Debt Hightlightsrryan123123Nessuna valutazione finora

- Swiss National Bank Quarterly Bulletin - September 2011Documento54 pagineSwiss National Bank Quarterly Bulletin - September 2011rryan123123Nessuna valutazione finora

- Bank of International Settlements Quorterly Review, September 2011 - Public DocumentDocumento74 pagineBank of International Settlements Quorterly Review, September 2011 - Public DocumentARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanNessuna valutazione finora

- DBT Cope Ahead PlanDocumento1 paginaDBT Cope Ahead PlanAmy PowersNessuna valutazione finora

- Taxation: Presented By: Gaurav Yadav Rishabh Sharma Sandeep SinghDocumento32 pagineTaxation: Presented By: Gaurav Yadav Rishabh Sharma Sandeep SinghjurdaNessuna valutazione finora

- Cabot - Conductive Carbon Black For Use in Acrylic and Epoxy CoatingsDocumento2 pagineCabot - Conductive Carbon Black For Use in Acrylic and Epoxy CoatingsLin Niu0% (1)

- The Nature of Mathematics: "Nature's Great Books Is Written in Mathematics" Galileo GalileiDocumento9 pagineThe Nature of Mathematics: "Nature's Great Books Is Written in Mathematics" Galileo GalileiLei-Angelika TungpalanNessuna valutazione finora

- HDFC Bank-Centurion Bank of Punjab: Presented By: Sachi Bani Perhar Mba-Ib 2010-2012Documento40 pagineHDFC Bank-Centurion Bank of Punjab: Presented By: Sachi Bani Perhar Mba-Ib 2010-2012Sumit MalikNessuna valutazione finora

- AMUL'S Every Function Involves Huge Human ResourcesDocumento3 pagineAMUL'S Every Function Involves Huge Human ResourcesRitu RajNessuna valutazione finora

- Book TurmericDocumento14 pagineBook Turmericarvind3041990100% (2)

- Iii. The Impact of Information Technology: Successful Communication - Key Points To RememberDocumento7 pagineIii. The Impact of Information Technology: Successful Communication - Key Points To Remembermariami bubuNessuna valutazione finora

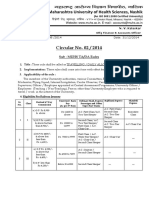

- Circular No 02 2014 TA DA 010115 PDFDocumento10 pagineCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- A - Persuasive TextDocumento15 pagineA - Persuasive TextMA. MERCELITA LABUYONessuna valutazione finora

- Ikramul (Electrical)Documento3 pagineIkramul (Electrical)Ikramu HaqueNessuna valutazione finora

- Final Test General English TM 2021Documento2 pagineFinal Test General English TM 2021Nenden FernandesNessuna valutazione finora

- Haloperidol PDFDocumento4 pagineHaloperidol PDFfatimahNessuna valutazione finora

- Barangay AppointmentDocumento2 pagineBarangay AppointmentArlyn Gumahad CahanapNessuna valutazione finora

- Food Combining PDFDocumento16 pagineFood Combining PDFJudas FK TadeoNessuna valutazione finora

- Pea RubricDocumento4 paginePea Rubricapi-297637167Nessuna valutazione finora

- LR 7833Documento11 pagineLR 7833Trung ĐinhNessuna valutazione finora

- Best Interior Architects in Kolkata PDF DownloadDocumento1 paginaBest Interior Architects in Kolkata PDF DownloadArsh KrishNessuna valutazione finora

- CALIDocumento58 pagineCALIleticia figueroaNessuna valutazione finora

- Rudolf Steiner - Twelve Senses in Man GA 206Documento67 pagineRudolf Steiner - Twelve Senses in Man GA 206Raul PopescuNessuna valutazione finora

- English 10-Dll-Week 3Documento5 pagineEnglish 10-Dll-Week 3Alyssa Grace Dela TorreNessuna valutazione finora

- Group 2 Lesson 2 DramaDocumento38 pagineGroup 2 Lesson 2 DramaMar ClarkNessuna valutazione finora

- Information: Republic of The Philippines Regional Trial Court 8 Judicial Region Branch VIDocumento2 pagineInformation: Republic of The Philippines Regional Trial Court 8 Judicial Region Branch VIlossesaboundNessuna valutazione finora

- Digestive System LabsheetDocumento4 pagineDigestive System LabsheetKATHLEEN MAE HERMONessuna valutazione finora

- Zoonotic Diseases From HorsesDocumento12 pagineZoonotic Diseases From HorsesSandra Ximena Herreño MikánNessuna valutazione finora

- End of Semester Student SurveyDocumento2 pagineEnd of Semester Student SurveyJoaquinNessuna valutazione finora

- Duterte Vs SandiganbayanDocumento17 pagineDuterte Vs SandiganbayanAnonymous KvztB3Nessuna valutazione finora

- Specification - Pump StationDocumento59 pagineSpecification - Pump StationchialunNessuna valutazione finora

- 1 Piling LaranganDocumento3 pagine1 Piling LaranganHannie Jane Salazar HerreraNessuna valutazione finora

- Spitzer 1981Documento13 pagineSpitzer 1981Chima2 SantosNessuna valutazione finora