Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ICYMI: Obama Advisors Raised Warning Flags Before Solyndra Bankruptcy

Caricato da

Republican National CommitteeCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

ICYMI: Obama Advisors Raised Warning Flags Before Solyndra Bankruptcy

Caricato da

Republican National CommitteeCopyright:

Formati disponibili

September 27, 2011

Obama Advisors Raised Warning Flags Before Solyndra Bankruptcy

From Los Angeles Times

______________________________________________________________________

By Tom Hamburger, Kim Geiger and Matea Gold September 26, 2011 Long before the politically connected California solar firm Solyndra went bankrupt, President Obama was warned by his top economic advisors about the financial and political risks of the Energy Department loan guarantee program that boosted the company's rapid ascent. At a White House meeting in late October, Lawrence H. Summers, then director of the National Economic Council, and Timothy F. Geithner, the Treasury secretary, expressed concerns that the selection process for federal loan guarantees wasn't rigorous enough and raised the risk that funds could be going to the wrong companies, including ones that didn't need the help. Energy Secretary Steven Chu, also at the meeting, had a different view. Under pressure from Congress to speed up the loans, he wanted less scrutiny from the Treasury Department and the Office of Management and Budget, or OMB. The divisions foreshadowed a question that has emerged since Solyndra's bankruptcy: Was the program's vetting process thorough enough? The disagreements also spotlighted an issue that has confronted Obama since he took office: What is the appropriate role of the government in stimulating the private marketplace? Skeptics, noting that taxpayers could now be on the hook for $527 million the federal government loaned Solyndra, said the administration would have been better off making greater use of market incentives, not individual company loan guarantees. "It was completely predictable that there would be a colossal failure among the bets," said one person familiar with the internal debate. In late October 2010, administration officials took their opposing views directly to Obama. In preparation, a memo was drafted by Summers, who remained wary of the program, and two others who were more supportive: then-energy advisor Carol Browner and Ron Klain, then chief of staff to Vice President Joseph Biden. The memo laid out their different concerns and options to fix a "broken process" for getting loans approved.

Paid for by the Republican National Committee. 310 First Street SE - Washington, D.C. 20003 - (202) 863-8500 - www.gop.com Not authorized by any candidate or candidates committee.

Warning that the program could "fail to advance your clean-energy agenda" by investing in companies that didn't need help, the memo proposed alternatives, including diverting the funds into grants available to the entire industry. By contrast, Energy Department officials wanted to end the "deal by deal" reviews by the Treasury and OMB, the memo said. But government audits in recent years have found problems in the implementation of the program. A July 2010 report by the Government Accountability Office found that the department committed to back the loans without completing required studies of market, legal and technical issues. "Without this information, it is not clear that the program could have fully evaluated the risk of the loans it committed to," said Frank Rusco, an analyst for the GAO. To View The Entire Article, Please Visit: http://www.latimes.com/news/nationworld/nation/la-na-energyloans-20110927,0,3517324,print.story

2 Paid for by the Republican National Committee. 310 First Street SE - Washington, D.C. 20003 - (202) 863-8500 - www.gop.com Not authorized by any candidate or candidates committee.

Potrebbero piacerti anche

- Fairy Tale Capitalism: Fact and Fiction Behind Too Big to FailDa EverandFairy Tale Capitalism: Fact and Fiction Behind Too Big to FailNessuna valutazione finora

- Solyndra Bankruptcy FalloutDocumento3 pagineSolyndra Bankruptcy FalloutKarla Eh'BayedNessuna valutazione finora

- Dissent from the Majority Report of the Financial Crisis Inquiry CommissionDa EverandDissent from the Majority Report of the Financial Crisis Inquiry CommissionNessuna valutazione finora

- In The News: New Economic Ills Will Force Winner's HandDocumento3 pagineIn The News: New Economic Ills Will Force Winner's HandNicolet BankNessuna valutazione finora

- January 12, 2012: Final Americans For Prosperity Tv:60 - "Pawns"Documento31 pagineJanuary 12, 2012: Final Americans For Prosperity Tv:60 - "Pawns"Rich MyslinskiNessuna valutazione finora

- Treasury Faults Arbitration Rule Aimed at Protecting ConsumersDocumento4 pagineTreasury Faults Arbitration Rule Aimed at Protecting ConsumersJohanna ArnaezNessuna valutazione finora

- Financial Meltdown Was AvoidableDocumento3 pagineFinancial Meltdown Was AvoidableEkkachai SaenyasiriNessuna valutazione finora

- 11-12-05 Criminality at The Top of A Lawless, Bankrupt NationDocumento5 pagine11-12-05 Criminality at The Top of A Lawless, Bankrupt NationHuman Rights Alert - NGO (RA)Nessuna valutazione finora

- U.S. Bailout Plan Calms Markets, But Struggle Looms Over DetailsDocumento5 pagineU.S. Bailout Plan Calms Markets, But Struggle Looms Over Detailsdavid rockNessuna valutazione finora

- ACE4Documento1 paginaACE4ashish barwadNessuna valutazione finora

- S&P Controversy Fuels Demands For Ratings ReformsDocumento2 pagineS&P Controversy Fuels Demands For Ratings ReformsLai HoesoonNessuna valutazione finora

- Morning News Notes: 2010-03-22Documento2 pagineMorning News Notes: 2010-03-22glerner133926Nessuna valutazione finora

- Out of Lehman's Ashes Rises.....Documento8 pagineOut of Lehman's Ashes Rises.....83jjmackNessuna valutazione finora

- Ex-Im Bank Debate Will Result in Narrow PassageDocumento10 pagineEx-Im Bank Debate Will Result in Narrow Passagepacifist42Nessuna valutazione finora

- My List of Government Pork, Waste and FraudDocumento221 pagineMy List of Government Pork, Waste and FraudIve Haddit100% (1)

- The Volker Rule ND The Need For RegulationDocumento5 pagineThe Volker Rule ND The Need For RegulationIoanna PetreNessuna valutazione finora

- Financial Meltdown Was AvoidableDocumento2 pagineFinancial Meltdown Was Avoidablelynx310Nessuna valutazione finora

- IRA Chrysler GMDocumento4 pagineIRA Chrysler GMDenis OuelletNessuna valutazione finora

- How A Debt Ceiling Crisis Could Do More Harm Than The ShutdownDocumento4 pagineHow A Debt Ceiling Crisis Could Do More Harm Than The Shutdowngangster91Nessuna valutazione finora

- How A Debt Ceiling Crisis CouldDocumento4 pagineHow A Debt Ceiling Crisis Couldgangster91Nessuna valutazione finora

- 11-03-07 Activists Hold Wall Street Accountable For Economic Crisis - TruthoutDocumento6 pagine11-03-07 Activists Hold Wall Street Accountable For Economic Crisis - TruthoutHuman Rights Alert - NGO (RA)Nessuna valutazione finora

- Document (1) : Article: The Consumer Debt Crisis and The Reinforcement of Class Position, 40 Loy. U. Chi. L.J. 557Documento39 pagineDocument (1) : Article: The Consumer Debt Crisis and The Reinforcement of Class Position, 40 Loy. U. Chi. L.J. 557Huyền MinhNessuna valutazione finora

- Global Financial Crisis Causes and Responses in 40 CharactersDocumento9 pagineGlobal Financial Crisis Causes and Responses in 40 CharactersMohit Ram KukrejaNessuna valutazione finora

- The Stimulus Law & Health CareDocumento16 pagineThe Stimulus Law & Health CareTimothyNessuna valutazione finora

- Obama May Press Banks To Cut Mortgage Payments - 2-16-09Documento3 pagineObama May Press Banks To Cut Mortgage Payments - 2-16-09Steve LennoxNessuna valutazione finora

- Center Maryland Exclusive - Maryland Senate President Thomas V. Mike Miller JR.: Criminal Justice Reform & The State's BudgetDocumento10 pagineCenter Maryland Exclusive - Maryland Senate President Thomas V. Mike Miller JR.: Criminal Justice Reform & The State's BudgetAnonymous Feglbx5Nessuna valutazione finora

- New Agency Proposed To Oversee Freddie Mac ADocumento3 pagineNew Agency Proposed To Oversee Freddie Mac AjuniorcobraNessuna valutazione finora

- 6 More Republican FailuresDocumento25 pagine6 More Republican FailuresMyranNessuna valutazione finora

- Government Shutdown ThesisDocumento5 pagineGovernment Shutdown ThesisBuyEssaysTulsa100% (1)

- What The Debt Ceiling Means For Social Security and More - The New York TimesDocumento3 pagineWhat The Debt Ceiling Means For Social Security and More - The New York TimesCesar Augusto CarmenNessuna valutazione finora

- Summary of Movie Inside JobDocumento6 pagineSummary of Movie Inside JobabhinavruhelaNessuna valutazione finora

- 240401 Electric car vehicle - nytimes.com-Auto Execs Call for New Measures as EV Wars Heat UpDocumento7 pagine240401 Electric car vehicle - nytimes.com-Auto Execs Call for New Measures as EV Wars Heat UpKetan Dot Iimahd BhattNessuna valutazione finora

- Senate Hearing, 111TH Congress - Congressional Oversight Panel September Oversight ReportDocumento182 pagineSenate Hearing, 111TH Congress - Congressional Oversight Panel September Oversight ReportScribd Government DocsNessuna valutazione finora

- LETTER: Former Gov. Arne Carlson To Minnesota Governor Tim WalzDocumento7 pagineLETTER: Former Gov. Arne Carlson To Minnesota Governor Tim WalzFluenceMediaNessuna valutazione finora

- Inherency Status Quo Solves Obama Is Pushing For HSR. TIME, 2/2011Documento15 pagineInherency Status Quo Solves Obama Is Pushing For HSR. TIME, 2/2011Sam SchwartzNessuna valutazione finora

- Secret Fed LoansDocumento11 pagineSecret Fed LoansEKAI CenterNessuna valutazione finora

- Facing The Economic CrisisDocumento12 pagineFacing The Economic CrisisStathis PapastathopoulosNessuna valutazione finora

- 03-23-08 NYT-In Washington, A Split Over Regulation of WallDocumento4 pagine03-23-08 NYT-In Washington, A Split Over Regulation of WallMark WelkieNessuna valutazione finora

- 20120523145043619Documento106 pagine20120523145043619WisconsinOpenRecordsNessuna valutazione finora

- The Economy Is Booming But Far From Normal, Posing A Challenge For BidenDocumento5 pagineThe Economy Is Booming But Far From Normal, Posing A Challenge For BidenDarrell SuNessuna valutazione finora

- Journal of Banking & FinanceDocumento8 pagineJournal of Banking & FinanceIonuțJderuNessuna valutazione finora

- SEC Accuses Goldman Sachs of Defrauding Investors (AP)Documento6 pagineSEC Accuses Goldman Sachs of Defrauding Investors (AP)Albert L. PeiaNessuna valutazione finora

- Another Financial Meltdown Is Closer Than It Appears.: Source: FREDDocumento14 pagineAnother Financial Meltdown Is Closer Than It Appears.: Source: FREDVidit HarsulkarNessuna valutazione finora

- PPP Loan ReportDocumento47 paginePPP Loan ReportCBS 11 NewsNessuna valutazione finora

- News Excellence Sept 11 A7Documento1 paginaNews Excellence Sept 11 A7Contest PagesNessuna valutazione finora

- Times Leader 03-29-2012Documento41 pagineTimes Leader 03-29-2012The Times Leader100% (1)

- 01-18-09 NYT-Bailout Is A Windfall To Banks, If Not To Borrowers by MIKE McINTIREDocumento2 pagine01-18-09 NYT-Bailout Is A Windfall To Banks, If Not To Borrowers by MIKE McINTIREMark WelkieNessuna valutazione finora

- US Economy Improving But Weak As Jobs Key To GrowthDocumento5 pagineUS Economy Improving But Weak As Jobs Key To GrowthSupre ScrblNessuna valutazione finora

- 7.1 MS and Citi During Crisis (NYT2011)Documento3 pagine7.1 MS and Citi During Crisis (NYT2011)BrianNessuna valutazione finora

- Rosner Testimony 72313 Fi CP 0Documento16 pagineRosner Testimony 72313 Fi CP 0Joshua RosnerNessuna valutazione finora

- Momentum Builds For Nationwide Freeze On ForeclosuresDocumento4 pagineMomentum Builds For Nationwide Freeze On ForeclosuresTmr Gitu LoohNessuna valutazione finora

- ARE WALL STREET ARRESTS FINALLY GOING TO HAPPEN? Financial Crisis Commission Referring Law Breakers To Justice Dept.Documento3 pagineARE WALL STREET ARRESTS FINALLY GOING TO HAPPEN? Financial Crisis Commission Referring Law Breakers To Justice Dept.83jjmackNessuna valutazione finora

- Letter To OCCDocumento4 pagineLetter To OCCGeoffrey RowlandNessuna valutazione finora

- Secret Fed Loans Gave Banks $13 Billion Undisclosed To Congress - BloombergDocumento12 pagineSecret Fed Loans Gave Banks $13 Billion Undisclosed To Congress - BloombergMatrica LietuvojeNessuna valutazione finora

- MBF Group AsgnmentDocumento10 pagineMBF Group AsgnmentEshahumayounNessuna valutazione finora

- Michigan Allen Pappdfsas All Fullerton RoundAllDocumento281 pagineMichigan Allen Pappdfsas All Fullerton RoundAllAmie DiazNessuna valutazione finora

- Deregulation Time LineDocumento7 pagineDeregulation Time Lineben3172Nessuna valutazione finora

- Administration Seeks Increase in Oversight of Executive PayDocumento4 pagineAdministration Seeks Increase in Oversight of Executive Paydavid rockNessuna valutazione finora

- National Review) Is Provided The Problem, Here, Is That He Doesn't Upload These Essays Onto TheDocumento24 pagineNational Review) Is Provided The Problem, Here, Is That He Doesn't Upload These Essays Onto TheRobert B. SklaroffNessuna valutazione finora

- AccountingDocumento4 pagineAccountinggodfreykaruku21Nessuna valutazione finora

- Obamas Leaked SOTU Draft 2014Documento3 pagineObamas Leaked SOTU Draft 2014Washington ExaminerNessuna valutazione finora

- Bad ChoicesDocumento47 pagineBad ChoicesRepublican National CommitteeNessuna valutazione finora

- How Obama Failed Your State 10F10-110612Documento94 pagineHow Obama Failed Your State 10F10-110612Barbara EspinosaNessuna valutazione finora

- Obama's Failed Policies Are On The BallotDocumento25 pagineObama's Failed Policies Are On The BallotRepublican National CommitteeNessuna valutazione finora

- Obama by The Numbers: RNC's "Ten For Ten" Ebook SeriesDocumento8 pagineObama by The Numbers: RNC's "Ten For Ten" Ebook SeriesRepublican National CommitteeNessuna valutazione finora

- The Best of BarackwardDocumento4 pagineThe Best of BarackwardRepublican National CommitteeNessuna valutazione finora

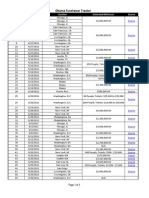

- Obama Golf TrackerDocumento3 pagineObama Golf TrackerRepublican National CommitteeNessuna valutazione finora

- Obama Fundraiser TrackerDocumento5 pagineObama Fundraiser TrackerRepublican National CommitteeNessuna valutazione finora

- The Obama Book: Budget & Tax ChapterDocumento73 pagineThe Obama Book: Budget & Tax ChapterRepublican National CommitteeNessuna valutazione finora

- The Big Squeeze On The Middle Class: RNC "Ten For Ten" Ebook SeriesDocumento24 pagineThe Big Squeeze On The Middle Class: RNC "Ten For Ten" Ebook SeriesRepublican National CommitteeNessuna valutazione finora

- The Obama Book Report - RNC "Ten For Ten" Ebook SeriesDocumento38 pagineThe Obama Book Report - RNC "Ten For Ten" Ebook SeriesRepublican National CommitteeNessuna valutazione finora

- Leading From Behind - RNC's "Ten For Ten" Ebook SeriesDocumento47 pagineLeading From Behind - RNC's "Ten For Ten" Ebook SeriesRepublican National CommitteeNessuna valutazione finora

- Obamacare: When "Hope & Change" Died - RNC "Ten For Ten" Ebook SeriesDocumento41 pagineObamacare: When "Hope & Change" Died - RNC "Ten For Ten" Ebook SeriesRepublican National CommitteeNessuna valutazione finora

- Profiles in Cronyism: RNC "Ten For Ten" Ebook SeriesDocumento44 pagineProfiles in Cronyism: RNC "Ten For Ten" Ebook SeriesRepublican National CommitteeNessuna valutazione finora

- Obama's War On Coal - RNC "Ten For Ten" Ebook SeriesDocumento26 pagineObama's War On Coal - RNC "Ten For Ten" Ebook SeriesRepublican National CommitteeNessuna valutazione finora

- Obama HydeParkHeraldDocumento24 pagineObama HydeParkHeraldRepublican National CommitteeNessuna valutazione finora

- Busted: The Obama Housing Briefing BookDocumento25 pagineBusted: The Obama Housing Briefing BookRepublican National CommitteeNessuna valutazione finora

- A Failure To Change: RNC "Ten For Ten" Ebook SeriesDocumento31 pagineA Failure To Change: RNC "Ten For Ten" Ebook SeriesRepublican National CommitteeNessuna valutazione finora

- Wrong For Virginia Briefing BookDocumento11 pagineWrong For Virginia Briefing BookRepublican National CommitteeNessuna valutazione finora

- Obama's Record of Broken Promises: RNC "Ten For Ten" Ebook SeriesDocumento53 pagineObama's Record of Broken Promises: RNC "Ten For Ten" Ebook SeriesRepublican National CommitteeNessuna valutazione finora

- Obama Debate MatrixDocumento130 pagineObama Debate MatrixRepublican National CommitteeNessuna valutazione finora

- Promises Made, Promises Broken: The Obama Debate Briefing BookDocumento27 paginePromises Made, Promises Broken: The Obama Debate Briefing BookRepublican National CommitteeNessuna valutazione finora

- The Obama Record: Shipping Jobs & Money To ChinaDocumento7 pagineThe Obama Record: Shipping Jobs & Money To ChinaRepublican National CommitteeNessuna valutazione finora

- Wrong For Florida Briefing BookDocumento7 pagineWrong For Florida Briefing BookRepublican National CommitteeNessuna valutazione finora

- Wrong For New Hampshire Briefing BookDocumento8 pagineWrong For New Hampshire Briefing BookRepublican National CommitteeNessuna valutazione finora

- Wrong For North CarolinaDocumento10 pagineWrong For North CarolinaRepublican National CommitteeNessuna valutazione finora

- Wrong For Iowa Briefing BookDocumento7 pagineWrong For Iowa Briefing BookRepublican National CommitteeNessuna valutazione finora

- Obama: Wrong For OhioDocumento20 pagineObama: Wrong For OhioRepublican National CommitteeNessuna valutazione finora

- Failed Promise - Obama and LobbyistsDocumento3 pagineFailed Promise - Obama and LobbyistsRepublican National CommitteeNessuna valutazione finora

- OBAMA'S War On COAL, JOBS, ENERGY and INDUSTRYDocumento25 pagineOBAMA'S War On COAL, JOBS, ENERGY and INDUSTRYBarbara EspinosaNessuna valutazione finora

- Syllabus For The Post of ASI - Traffic - WardensDocumento2 pagineSyllabus For The Post of ASI - Traffic - WardensUbaid KhanNessuna valutazione finora

- Cheese Making: A 7-Step ProcessDocumento18 pagineCheese Making: A 7-Step ProcessshivaNessuna valutazione finora

- Final DSL Under Wire - FinalDocumento44 pagineFinal DSL Under Wire - Finalelect trsNessuna valutazione finora

- MAY-2006 International Business Paper - Mumbai UniversityDocumento2 pagineMAY-2006 International Business Paper - Mumbai UniversityMAHENDRA SHIVAJI DHENAKNessuna valutazione finora

- CV Finance GraduateDocumento3 pagineCV Finance GraduateKhalid SalimNessuna valutazione finora

- ! Sco Global Impex 25.06.20Documento7 pagine! Sco Global Impex 25.06.20Houssam Eddine MimouneNessuna valutazione finora

- Iron FoundationsDocumento70 pagineIron FoundationsSamuel Laura HuancaNessuna valutazione finora

- A1. Coordinates System A2. Command Categories: (Exit)Documento62 pagineA1. Coordinates System A2. Command Categories: (Exit)Adriano P.PrattiNessuna valutazione finora

- Group Assignment Topics - BEO6500 Economics For ManagementDocumento3 pagineGroup Assignment Topics - BEO6500 Economics For ManagementnoylupNessuna valutazione finora

- School of Architecture, Building and Design Foundation in Natural Build EnvironmentDocumento33 pagineSchool of Architecture, Building and Design Foundation in Natural Build Environmentapi-291031287Nessuna valutazione finora

- Jurnal Manajemen IndonesiaDocumento20 pagineJurnal Manajemen IndonesiaThoriq MNessuna valutazione finora

- Simple Future Vs Future Continuous Vs Future PerfectDocumento6 pagineSimple Future Vs Future Continuous Vs Future PerfectJocelynNessuna valutazione finora

- DODAR Analyse DiagramDocumento2 pagineDODAR Analyse DiagramDavidNessuna valutazione finora

- House & Garden - November 2015 AUDocumento228 pagineHouse & Garden - November 2015 AUHussain Elarabi100% (3)

- Unofficial Transcript - Printer FriendlyDocumento4 pagineUnofficial Transcript - Printer Friendlyapi-251794642Nessuna valutazione finora

- It ThesisDocumento59 pagineIt Thesisroneldayo62100% (2)

- Grade 1 English For KidsDocumento4 pagineGrade 1 English For Kidsvivian 119190156Nessuna valutazione finora

- Emergency Order Ratification With AmendmentsDocumento4 pagineEmergency Order Ratification With AmendmentsWestSeattleBlogNessuna valutazione finora

- Lesson Plan Maam MyleenDocumento7 pagineLesson Plan Maam MyleenRochelle RevadeneraNessuna valutazione finora

- Cover Me: Music By: B. Keith Haygood Arranged By: BKH Lyrics By: Based On Exodus 33Documento8 pagineCover Me: Music By: B. Keith Haygood Arranged By: BKH Lyrics By: Based On Exodus 33api-66052920Nessuna valutazione finora

- Information BulletinDocumento1 paginaInformation BulletinMahmudur RahmanNessuna valutazione finora

- Kristine Karen DavilaDocumento3 pagineKristine Karen DavilaMark anthony GironellaNessuna valutazione finora

- Electric Vehicles PresentationDocumento10 pagineElectric Vehicles PresentationKhagesh JoshNessuna valutazione finora

- The Butterfly Effect movie review and favorite scenesDocumento3 pagineThe Butterfly Effect movie review and favorite scenesMax Craiven Rulz LeonNessuna valutazione finora

- FS2 Learning Experience 1Documento11 pagineFS2 Learning Experience 1Jona May BastidaNessuna valutazione finora

- Reduce Home Energy Use and Recycling TipsDocumento4 pagineReduce Home Energy Use and Recycling Tipsmin95Nessuna valutazione finora

- Solar Presentation – University of Texas Chem. EngineeringDocumento67 pagineSolar Presentation – University of Texas Chem. EngineeringMardi RahardjoNessuna valutazione finora

- APPSC Assistant Forest Officer Walking Test NotificationDocumento1 paginaAPPSC Assistant Forest Officer Walking Test NotificationsekkharNessuna valutazione finora

- PRI Vs SIP Trunking WPDocumento3 paginePRI Vs SIP Trunking WPhisham_abdelaleemNessuna valutazione finora

- Aftab Automobiles LTD - Surveillance Report 2015Documento13 pagineAftab Automobiles LTD - Surveillance Report 2015Mehedi Hasan RimonNessuna valutazione finora

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesDa EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNessuna valutazione finora

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteDa EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteValutazione: 4.5 su 5 stelle4.5/5 (16)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismDa EverandReading the Constitution: Why I Chose Pragmatism, not TextualismNessuna valutazione finora

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpDa EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpValutazione: 4.5 su 5 stelle4.5/5 (11)

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryDa EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryValutazione: 4 su 5 stelle4/5 (6)

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldDa EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldValutazione: 3.5 su 5 stelle3.5/5 (9)

- The Courage to Be Free: Florida's Blueprint for America's RevivalDa EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNessuna valutazione finora

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonDa EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonValutazione: 4.5 su 5 stelle4.5/5 (21)

- Blood Money: Why the Powerful Turn a Blind Eye While China Kills AmericansDa EverandBlood Money: Why the Powerful Turn a Blind Eye While China Kills AmericansValutazione: 4.5 su 5 stelle4.5/5 (10)

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityDa EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityNessuna valutazione finora

- The Quiet Man: The Indispensable Presidency of George H.W. BushDa EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushValutazione: 4 su 5 stelle4/5 (1)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeDa EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeValutazione: 4 su 5 stelle4/5 (572)

- Resistance: How Women Saved Democracy from Donald TrumpDa EverandResistance: How Women Saved Democracy from Donald TrumpNessuna valutazione finora

- Second Class: How the Elites Betrayed America's Working Men and WomenDa EverandSecond Class: How the Elites Betrayed America's Working Men and WomenNessuna valutazione finora

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaDa EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaValutazione: 4.5 su 5 stelle4.5/5 (4)

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicDa EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNessuna valutazione finora

- An Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordDa EverandAn Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordValutazione: 4 su 5 stelle4/5 (5)

- Profiles in Ignorance: How America's Politicians Got Dumb and DumberDa EverandProfiles in Ignorance: How America's Politicians Got Dumb and DumberValutazione: 4.5 su 5 stelle4.5/5 (80)

- Making a Difference: Stories of Vision and Courage from America's LeadersDa EverandMaking a Difference: Stories of Vision and Courage from America's LeadersValutazione: 3 su 5 stelle3/5 (2)

- Trumpocracy: The Corruption of the American RepublicDa EverandTrumpocracy: The Corruption of the American RepublicValutazione: 4 su 5 stelle4/5 (68)

- Reagan Diaries, Volume 2: November 1985–January 1989Da EverandReagan Diaries, Volume 2: November 1985–January 1989Nessuna valutazione finora

- To Make Men Free: A History of the Republican PartyDa EverandTo Make Men Free: A History of the Republican PartyValutazione: 4.5 su 5 stelle4.5/5 (20)

- Democracy in One Book or Less: How It Works, Why It Doesn't, and Why Fixing It Is Easier Than You ThinkDa EverandDemocracy in One Book or Less: How It Works, Why It Doesn't, and Why Fixing It Is Easier Than You ThinkValutazione: 4.5 su 5 stelle4.5/5 (10)

- The Science of Liberty: Democracy, Reason, and the Laws of NatureDa EverandThe Science of Liberty: Democracy, Reason, and the Laws of NatureNessuna valutazione finora

- Crimes and Cover-ups in American Politics: 1776-1963Da EverandCrimes and Cover-ups in American Politics: 1776-1963Valutazione: 4.5 su 5 stelle4.5/5 (26)

- The Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushDa EverandThe Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushValutazione: 4 su 5 stelle4/5 (6)

- Corruptible: Who Gets Power and How It Changes UsDa EverandCorruptible: Who Gets Power and How It Changes UsValutazione: 4.5 su 5 stelle4.5/5 (44)

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismDa EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismValutazione: 4.5 su 5 stelle4.5/5 (42)

- The Invisible Bridge: The Fall of Nixon and the Rise of ReaganDa EverandThe Invisible Bridge: The Fall of Nixon and the Rise of ReaganValutazione: 4.5 su 5 stelle4.5/5 (32)