Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Representative Offices of Foreign Banks in Canada

Caricato da

Dhon LlabresDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Representative Offices of Foreign Banks in Canada

Caricato da

Dhon LlabresCopyright:

Formati disponibili

Representative Offices of Foreign Banks in Canada

Judie K. Jokinen Mendelsohn Rosentzveig Shacter Montreal, Quebec, Canada INTRODUCTION The Bank Act,1 which regulates the Canadian banking industry, generally prohibits foreign banks from carrying out certain activities in Canada, whether directly or through a nominee or an agent. This prohibition encompasses most aspects of the banking business such as issuing letters of credit, lending money or accepting deposits and, to a certain extent, establishing or accepting data from automated banking machines or similar automated services. However, foreign banks may own shares in a foreign bank subsidiary and, with the approval of the Superintendent of Financial Institutions and subject to the requirements of the Foreign Bank Representative Offices Regulations,2 maintain representative offices in Canada. For foreign banks not wishing to incorporate a subsidiary in Canada, but who intend to have a presence in the Canadian banking sector, the establishment of a representative office can prove to be an important part of their marketing strategy. A representative office is an office established by a foreign bank in Canada for the purpose of representing that foreign bank. The office may not be occupied or controlled by an entity incorporated or formed in Canada and its personnel must be employed directly or indirectly by the foreign bank. The business activities of a representative office and its employees are limited to promoting the services of the foreign bank or of its affiliates and acting as a liaison between clients of the foreign bank and other offices of the foreign bank, or of its affiliates. Due to the limitations imposed by the Regulation, a representative office is generally not permitted to take deposits, sign commercial banking agreements or negotiate loan transactions; nor may it open accounts for clients or transfer funds to or on behalf of clients. PROCEDURE FOR MAKING APPLICATION The application for registration of a representative office must be submitted to the Superintendent, together with the financial statements (audited if available) of the foreign bank for its last financial year. The application must be supported with a certificate of good standing from the regulatory authority governing banks in the jurisdiction of the head office of the foreign bank, and a certified copy of the resolution of the board of directors of the foreign bank authorizing the establishment of the representative office.

The application must describe, inter alia, the foreign bank's business, its operations and the manner in which the foreign bank will supervise the operation of the representative office. Once the application is approved, the Superintendent sends the foreign bank a notice of approval. The Superintendent must be advised of changes in the information which accompanied the application for registration. The Regulation provides for certain annual requirements pertaining to representative offices. Each year the foreign bank must pay a registration maintenance fee of CAD $1,000 for each of its representative offices. Also, a representative office must submit to the Superintendent an annual statement of the number of its employees as well as the financial statements (audited if available) of the foreign bank for each financial year. POWERS OF SUPERINTENDENT UNDER THE REGULATIONS The Superintendent has the power to make, at least once in each year, examinations and inquiries into the operations of any representative office and the conduct of the personnel in that office. In this respect, the Superintendent has a right of access to the records of the representative office and may require the directors, officers and auditors of the representative office to provide any information or explanation that may be required regarding the condition and affairs of the representative office. The Superintendent has extended powers to compel the giving of evidence under oath. The cancellation of a registration of a representative office may be ordered by the Minister of Finance who, after consultation with the Superintendent, concludes that the operations of the representative office or the conduct of its personnel are not in accordance with the Regulation. Finally, the contravention of any provision of the Act or the Regulation constitutes an offense for which penal sanctions, including fines of up to CAD $500,000 and imprisonment of up to one year, may be imposed. It is difficult to identify a clear demarcation between acting in a promotional or liaison capacity and participating in certain transactions, or to predict with any degree of certainly whether a specific act by a representative office would constitute, or would be interpreted by the Superintendent to constitute, prohibited banking activities. Indeed, it is possible that a pattern of activities, none of which in itself would be likely to constitute banking activities, could be interpreted by the Superintendent as constituting activities prohibited under the Regulation. However, it should be kept in mind that it is possible to consult with the Superintendent to determine the acceptability of a proposed activity and, thereby, eliminate any uncertainty. ADVANTAGES OF REPRESENTATIVE OFFICES There are significant advantages to be derived by a foreign bank which sets up a representative office. It creates opportunities for the foreign Bank by establishing a presence in the large and diversified Canadian marketplace. Moreover, with the expansion of the exporting sector of the Canadian economy, a representative office can respond to the growing need of Canadian businesses to identify and establish a relationship with banking institutions which provide financial services in the importing countries.

What is a foreign bank representative office

A foreign bank wishing to establish a representative office in Australia must obtain the written consent of the Australian Prudential Regulation Authority (APRA). Consent is required for a foreign bank to use the word "bank" or its equivalent as part of the bank's corporate name in connection with maintaining a representative office. Minimum entry standards must be met and the representative office must comply with certain operating conditions, set by APRA.

Potrebbero piacerti anche

- TRUSTEE - Docx Transfer Ing Property Trust To KevinDocumento3 pagineTRUSTEE - Docx Transfer Ing Property Trust To KevinKevin Alspach100% (1)

- Harbor Medallion Signature GuaranteeDocumento1 paginaHarbor Medallion Signature Guaranteecsmith9100% (1)

- Jay S. Zeltzer, On Behalf of Himself and All Others Similarly Situated v. Carte Blanche Corporation, 514 F.2d 1156, 3rd Cir. (1975)Documento13 pagineJay S. Zeltzer, On Behalf of Himself and All Others Similarly Situated v. Carte Blanche Corporation, 514 F.2d 1156, 3rd Cir. (1975)Scribd Government DocsNessuna valutazione finora

- FATCA and CRS Self Certification FormDocumento10 pagineFATCA and CRS Self Certification FormsudemanNessuna valutazione finora

- Dissolution Deed FormatDocumento2 pagineDissolution Deed FormatMuslim QureshiNessuna valutazione finora

- Civil Precipe For Subpoena Duces TecumDocumento2 pagineCivil Precipe For Subpoena Duces TecumAnatoly Mazi Moore ElNessuna valutazione finora

- Accounting Instructions 3Documento1 paginaAccounting Instructions 3Ely DanelNessuna valutazione finora

- Self Directed Brokerage Option Mutual FundsxlsxDocumento528 pagineSelf Directed Brokerage Option Mutual FundsxlsxGlenn-anthony Sending-State HortonNessuna valutazione finora

- Sav 0022Documento21 pagineSav 0022MichaelNessuna valutazione finora

- Banking Resolution of CorporationDocumento2 pagineBanking Resolution of Corporationalin99Nessuna valutazione finora

- Act 268 Bills of Sale Act 1950Documento26 pagineAct 268 Bills of Sale Act 1950Adam Haida & CoNessuna valutazione finora

- Creditor VerificationDocumento2 pagineCreditor VerificationWen' George BeyNessuna valutazione finora

- How To Open Letter of CreditDocumento2 pagineHow To Open Letter of Credit✬ SHANZA MALIK ✬Nessuna valutazione finora

- Financial TermsDocumento42 pagineFinancial TermsnimsinNessuna valutazione finora

- CFR 2021 Title31 Vol2 Part351Documento17 pagineCFR 2021 Title31 Vol2 Part351LaLa BanksNessuna valutazione finora

- General POADocumento1 paginaGeneral POAconsuldimoNessuna valutazione finora

- Letter of InstructionDocumento4 pagineLetter of Instructionmptacly9152Nessuna valutazione finora

- Petition For Administration in Case of Intestacy (TRUE)Documento3 paginePetition For Administration in Case of Intestacy (TRUE)Clarence50% (2)

- Chap 6Documento110 pagineChap 6Mukesh Ek Talash100% (1)

- T1 Checklist Establishment of A TrustDocumento4 pagineT1 Checklist Establishment of A TrustRod NewmanNessuna valutazione finora

- AffidavitDocumento8 pagineAffidavitEller-jed M. MendozaNessuna valutazione finora

- Consent FormDocumento1 paginaConsent FormepartheniNessuna valutazione finora

- Types of ColleteralDocumento5 pagineTypes of ColleteralZagham ChNessuna valutazione finora

- Fw8ce PDFDocumento2 pagineFw8ce PDFSpiritually Gifted100% (2)

- Illinois Name Change PetitionDocumento2 pagineIllinois Name Change PetitionhowtochangeyournameNessuna valutazione finora

- Not A CitizenDocumento3 pagineNot A CitizenRosetta Rashid’s McCowan ElNessuna valutazione finora

- How To Register A Corporation With The Securities and Exchange CommmnissionDocumento2 pagineHow To Register A Corporation With The Securities and Exchange CommmnissionAnonymous JqiHOYWmsNessuna valutazione finora

- Indemnity Bond TemplateDocumento3 pagineIndemnity Bond TemplateLance LeoNessuna valutazione finora

- Mechanics LienDocumento3 pagineMechanics LienjdNessuna valutazione finora

- Offering MemorandumDocumento115 pagineOffering MemorandumMigle BloomNessuna valutazione finora

- Chicago Offering DocumentsDocumento280 pagineChicago Offering DocumentsThe Daily LineNessuna valutazione finora

- Example Late PaymentDocumento2 pagineExample Late PaymentZsuzsa TóthNessuna valutazione finora

- Stamp Act 1899Documento75 pagineStamp Act 1899Shreyas VijayNessuna valutazione finora

- Service Alberta LetterDocumento2 pagineService Alberta LetterTeamWildroseNessuna valutazione finora

- Ais FormsDocumento2 pagineAis FormsChris LampleyNessuna valutazione finora

- Constitution 1991Documento81 pagineConstitution 1991tapia4yeabuNessuna valutazione finora

- 2017-06-12 FDCPA Coverage of Debt BuyersDocumento3 pagine2017-06-12 FDCPA Coverage of Debt Buyersdbush1034Nessuna valutazione finora

- CFPB ManualDocumento171 pagineCFPB ManualveereshchiremathNessuna valutazione finora

- Negotiable Instrument Act, 1881Documento24 pagineNegotiable Instrument Act, 1881siddharth devnaniNessuna valutazione finora

- Business LawDocumento464 pagineBusiness LawThiruNessuna valutazione finora

- Official Form 309A (For Individuals or Joint Debtors) : Notice of Chapter 7 Bankruptcy Case No Proof of Claim DeadlineDocumento3 pagineOfficial Form 309A (For Individuals or Joint Debtors) : Notice of Chapter 7 Bankruptcy Case No Proof of Claim DeadlineCarloe Perez100% (1)

- THE 4 HORSES of The RevelationsDocumento1 paginaTHE 4 HORSES of The RevelationsLamario StillwellNessuna valutazione finora

- Guide ON Transfer & Transmission of Shares and DebenturesDocumento10 pagineGuide ON Transfer & Transmission of Shares and DebenturesM. Aqeel SaleemNessuna valutazione finora

- Florida SB 50Documento81 pagineFlorida SB 50PeterBurke100% (1)

- Securities and Exchange Commission (SEC) - Sec1661Documento4 pagineSecurities and Exchange Commission (SEC) - Sec1661highfinanceNessuna valutazione finora

- When VA Says NoDocumento13 pagineWhen VA Says NoMoyo MitchellNessuna valutazione finora

- De 1000 MDocumento2 pagineDe 1000 MAnonymous ghzKEH21fNessuna valutazione finora

- Foreclosure Prevention Process AgreementDocumento3 pagineForeclosure Prevention Process AgreementAnthonyHansenNessuna valutazione finora

- Reclaiming Your Strawman BookDocumento15 pagineReclaiming Your Strawman Bookffnc496m8wNessuna valutazione finora

- ps1583 PDFDocumento3 pagineps1583 PDFowen tsangNessuna valutazione finora

- Bank Guarantee Text d1Documento4 pagineBank Guarantee Text d1Fenny Kusien0% (1)

- Step of FOrensic AuditDocumento3 pagineStep of FOrensic AuditRajat ShahNessuna valutazione finora

- UCC FINANCING STATEMENT AMENDMENT GST© Virtual Bank 1Documento2 pagineUCC FINANCING STATEMENT AMENDMENT GST© Virtual Bank 1Mumbi MwananshikuNessuna valutazione finora

- Management of TrustsDocumento4 pagineManagement of Trustsnikhil jkcNessuna valutazione finora

- DL Standard Terms of Engagement at 1 Nov 22Documento6 pagineDL Standard Terms of Engagement at 1 Nov 22Juliet DewhirstNessuna valutazione finora

- Constitution of the State of Minnesota — 1974 VersionDa EverandConstitution of the State of Minnesota — 1974 VersionNessuna valutazione finora

- Constitution of the State of Minnesota — 1876 VersionDa EverandConstitution of the State of Minnesota — 1876 VersionNessuna valutazione finora

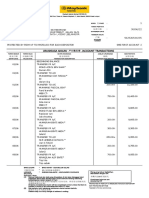

- Latest BillDocumento3 pagineLatest Billrostyn160% (5)

- Challan Form-02 For Clerk-Cum-CashierDocumento1 paginaChallan Form-02 For Clerk-Cum-CashierjatinorbitNessuna valutazione finora

- Final Year Project Chapter 2Documento5 pagineFinal Year Project Chapter 2Vincent JaiNessuna valutazione finora

- AisDocumento6 pagineAisSamonte JemimahNessuna valutazione finora

- Toy World IncDocumento10 pagineToy World IncHàMềm100% (1)

- OpTransactionHistory11 10 2021Documento2 pagineOpTransactionHistory11 10 2021X HureNessuna valutazione finora

- ADB Agriculture Value Chain FinancingDocumento56 pagineADB Agriculture Value Chain Financingradakan298Nessuna valutazione finora

- MBBcurrent 562526534235 2022-06-30 PDFDocumento6 pagineMBBcurrent 562526534235 2022-06-30 PDFmuhamad faidzalNessuna valutazione finora

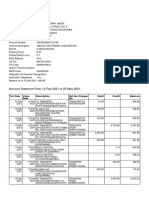

- Account Statement From 1 Nov 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento3 pagineAccount Statement From 1 Nov 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMukesh SharmaNessuna valutazione finora

- Property - 493 Balite Vs LimDocumento5 pagineProperty - 493 Balite Vs LimXing Keet LuNessuna valutazione finora

- Module 5 Managing Liabilities: Types of DepositDocumento9 pagineModule 5 Managing Liabilities: Types of DepositAnna-Clara MansolahtiNessuna valutazione finora

- White Refined Cane Sugar ICUMSA 45 RBU: Your Company Name XXXXDocumento2 pagineWhite Refined Cane Sugar ICUMSA 45 RBU: Your Company Name XXXXNeharu KherNessuna valutazione finora

- Comparative Analysis of Two Small Finance BanksDocumento19 pagineComparative Analysis of Two Small Finance BanksSneha SharmaNessuna valutazione finora

- Access Devices Regulation Act of 1998: Disclosure Requirements During Application and Solicitation ExceptionsDocumento9 pagineAccess Devices Regulation Act of 1998: Disclosure Requirements During Application and Solicitation ExceptionsJustin CebrianNessuna valutazione finora

- Functions of Five Departments of Bangladesh BankDocumento32 pagineFunctions of Five Departments of Bangladesh BankFarhad RezaNessuna valutazione finora

- ING-Vysya Summer Training ReportDocumento112 pagineING-Vysya Summer Training Reportmukhargoel9096Nessuna valutazione finora

- High School Graduation SpeechDocumento11 pagineHigh School Graduation SpeechEmma MulletNessuna valutazione finora

- Account Statement From 12 Feb 2021 To 25 May 2021Documento14 pagineAccount Statement From 12 Feb 2021 To 25 May 2021Kiran KumarNessuna valutazione finora

- Maxim Bay Al SalamDocumento17 pagineMaxim Bay Al SalamNaim ARNessuna valutazione finora

- Program For FinTECH Summit 2021 1639535495Documento4 pagineProgram For FinTECH Summit 2021 1639535495ArisNessuna valutazione finora

- The Financial Account. What Are The Primary Sub-Components of The Financial Account? Analytically, What Would Cause Net Deficits or Surpluses in These Individual Components?Documento5 pagineThe Financial Account. What Are The Primary Sub-Components of The Financial Account? Analytically, What Would Cause Net Deficits or Surpluses in These Individual Components?Khaleedd MugeebNessuna valutazione finora

- National Internal Revenue Code of The Philippines (NIRC)Documento195 pagineNational Internal Revenue Code of The Philippines (NIRC)Jennybabe PetaNessuna valutazione finora

- Sukhchain Aggarwal: Financial Statement Analysis of ICICI BankDocumento1 paginaSukhchain Aggarwal: Financial Statement Analysis of ICICI Banksandy_jadhaoNessuna valutazione finora

- 3c. Journal, Ledger Trial Balance - Practice File 2Documento11 pagine3c. Journal, Ledger Trial Balance - Practice File 2Bhai ho to dodoNessuna valutazione finora

- Shimeles Asaminew Research Final-NewDocumento70 pagineShimeles Asaminew Research Final-NewKalkidan ZerihunNessuna valutazione finora

- Plastic MoneyDocumento9 paginePlastic Moneyraj sharmaNessuna valutazione finora

- BRM ProjectDocumento58 pagineBRM ProjectKirti BafnaNessuna valutazione finora

- Kotak Prime: About Kotak Mahindra GroupDocumento11 pagineKotak Prime: About Kotak Mahindra GrouptrishlaNessuna valutazione finora

- Remittance Activities of Janata Bank Ltd.Documento61 pagineRemittance Activities of Janata Bank Ltd.Hannanur Omar100% (1)

- Investment Banking Firms (Handouts)Documento2 pagineInvestment Banking Firms (Handouts)Joyce Ann SosaNessuna valutazione finora