Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Lease Accounting Rules

Caricato da

Madhumita SinhaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Lease Accounting Rules

Caricato da

Madhumita SinhaCopyright:

Formati disponibili

Lease accounting rules

The regulations in the United States that specify how leases should be accounted for are issued by the Financial Accounting Standards Board (FASB), a Norwalk, CT, based private organization that is officially recognized by the United States government and the accounting profession as the rule-making body for accounting. Any company with publicly-traded stock or bonds must comply in full with GAAP (generally accepted accounting principles), which means complying with the FASB's regulations. FASB rules are known by their number. For instance, the main statement on leases was number 13, issued in 1976. It is generally known as FAS 13 (also called SFAS 13 or FASB 13). It has been amended several times, for instance by FAS 22, FAS 23, FAS 27, FAS 28, FAS 29, FAS 98, and FAS 121. In addition, numerous interpretations and technical bulletins have been issued giving additional guidance. Previously labeled as section L10 in the FASB Current Text, the new FASB Codification uses section ASC 840 for all of the lease accounting rules and guidelines. The discussion below primarily focuses on lessee accounting (i.e., the accounting for those who use the asset and pay the rent), since FCS works primarily with lessees. Canadian lease accounting regulations are essentially identical to United States regulations. The controlling regulation in Canada is known as CICA 3065 (promulgated by the Canadian Institute of Chartered Accountants). United States governmental accounting for leases is almost the same as for corporations, although the Governmental Accounting Standards Board's GAS 13 (the number is only coincidentally the same as FAS 13) prescribes different handling of some operating leases with scheduled rent increases. Currently, the standards of the International Accounting Standards Board (IASB) vary somewhat; follow this linkfor a list of differences between FAS 13 and IAS 17.

NOTE: The FASB's current project to revise lease accounting proposes to change many aspects of lease accounting. See our project review pages and our blog for the latest updates.

The basic concept of lease accounting is that some leases are merely rentals, whereas others are effectively purchases. For instance, if you rent office space for a year, the space is worth nearly as much at the end of the year as when you started; you are simply using it for a short period of time. This rental is called an operating lease. If you lease a computer for five years, however, at the end of the lease the computer is nearly worthless. The lessor (the person who receives the rents) anticipates this, and charges the lessee (the person who uses the asset) a rent that will recover all of the lease's costs, with a profit built in. This is essentially a purchase with a loan, which is called a capital lease, and an asset and liability must be set up on the lessee's primary financial statements. Rental payments are considered repayments of the loan; depreciation and interest expense, rather than rent expense, are shown on the income statement. For further explanation of terms used in lease accounting, see the glossary. Operating leases do not normally affect a company's balance sheet. There is, however, one exception. If a lease has scheduled changes in the rent (for instance, a planned increase for inflation, or a rent holiday for the first six months), the rent expense is to be recognized on an equal basis over the life of the lease. The difference between the rent expense recognized and the rent actually paid is considered a deferred liability (for the lessee, if the rents are increasing) or asset (if decreasing). You can look at an example of the accounting for an operating lease. Whether capital or operating, the future minimum rent commitments must also be disclosed as a footnote to the primary financials. This commitment is broken out by year for the first five years, then all remaining rents are combined. A lease is capital if any one of the following four tests is met: 1) The lease conveys ownership to the lessee at the end of the lease term; 2) 3) 4) The lessee has an option to purchase the asset at a bargain price at the end of the lease term The term of the lease is 75% or more of the economic life of the asset. The present value of the rents, using the lessee's incremental borrowing rate, is 90% or more of the fair market value of the asset.

Each of these criteria, and their components, is described in more detail in FAS 13 (codified as section L10 of the FASB Current Text or ASC 840 of the Codification). Once a lease is set up as a capital lease, the asset is depreciated, over the asset's economic life if there is an ownership transfer or bargain purchase option; otherwise, over the term of the lease. The liability is amortized using the "interest method:" Interest is accrued on the remaining liability, and paid off with each rental payment; the excess payment goes to liability reduction, with a constant interest rate maintained throughout the life of the lease. This is the same method of repayment as is used for a standard home mortgage. You can look at an example of the accounting for a capital lease. Proper FAS 13 accounting can be tremendously complex. In fact, FAS 13 was the most complex accounting standard issued up to its time. Financial Computer Systems takes the mystery out of lessee lease accounting. We offer two different solutions to lease accounting: EZ13 provides a low-cost lease accounting solution that runs on a PC, whereas our full-featured lease accounting service provides the ultimate in flexibility, expert assistance, and reporting options.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- Rental Agreement TermsDocumento3 pagineRental Agreement TermsBambi Buna Depasucat100% (3)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Puyallup Mall CaseDocumento5 paginePuyallup Mall Casecarlosev110% (1)

- Proposed Kansas City Ordinance 231019Documento19 pagineProposed Kansas City Ordinance 231019The Kansas City Star100% (1)

- 50 SMMA Niche IdeasDocumento4 pagine50 SMMA Niche IdeasAnonymous tyszmiMEgkNessuna valutazione finora

- How To Open Your Own Agency - PittardDocumento98 pagineHow To Open Your Own Agency - PittardRangpur ServicesNessuna valutazione finora

- Allied Rental ModarabaDocumento18 pagineAllied Rental ModarabaSaif Ullah QureshiNessuna valutazione finora

- 2023 Jan 052 G.k.quahDocumento10 pagine2023 Jan 052 G.k.quahSheera IsmawiNessuna valutazione finora

- Ohio Residential Lease AgreementDocumento8 pagineOhio Residential Lease AgreementSantonio CarterNessuna valutazione finora

- Shuckers StudyDocumento50 pagineShuckers Studythe kingfishNessuna valutazione finora

- ACRON HELVETIA VII Verkaufsbroschuere EnglischDocumento84 pagineACRON HELVETIA VII Verkaufsbroschuere EnglischpierrefrancNessuna valutazione finora

- Minnesota Rental Application FormDocumento2 pagineMinnesota Rental Application FormJonathan McNallyNessuna valutazione finora

- Car Rental Dataset PresentationDocumento11 pagineCar Rental Dataset Presentationvban200Nessuna valutazione finora

- 7B - Simple and Compound InterestDocumento12 pagine7B - Simple and Compound InterestcaddiesNessuna valutazione finora

- AC Minimart Vs VillarealDocumento2 pagineAC Minimart Vs VillarealShane FulguerasNessuna valutazione finora

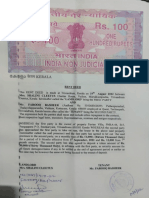

- 5100 Hundred Rupees: Indea Non JudicialDocumento4 pagine5100 Hundred Rupees: Indea Non JudicialLol AnNessuna valutazione finora

- 06-28 Staff Report W AttachDocumento125 pagine06-28 Staff Report W AttachMatthew JensenNessuna valutazione finora

- Pecson vs. CA G.R. No. 115814 May 29, 1995Documento8 paginePecson vs. CA G.R. No. 115814 May 29, 1995lassenNessuna valutazione finora

- Jobs in QatarDocumento5 pagineJobs in QatarYorymaoNessuna valutazione finora

- English TaskDocumento13 pagineEnglish TaskDebi Rizki AjanaNessuna valutazione finora

- Underwriting Collateral ReviewDocumento60 pagineUnderwriting Collateral ReviewHimani SachdevNessuna valutazione finora

- Crown Castle Presentation NAREIT 2014 ReportDocumento33 pagineCrown Castle Presentation NAREIT 2014 ReportSafe Tech For SchoolsNessuna valutazione finora

- Car Rental Agreement 06Documento14 pagineCar Rental Agreement 06Veronica Halili100% (1)

- Imamia JantriDocumento8 pagineImamia JantriaroosazardariNessuna valutazione finora

- Nickel's Worth Issue Date 12-6Documento44 pagineNickel's Worth Issue Date 12-6nickelsworthNessuna valutazione finora

- Janice V Harpaul Resume 2015webDocumento2 pagineJanice V Harpaul Resume 2015webapi-243041350Nessuna valutazione finora

- Reyes Vs AlmanzorDocumento1 paginaReyes Vs AlmanzorBenedick LedesmaNessuna valutazione finora

- Notes - Sale of GoodsDocumento11 pagineNotes - Sale of GoodsSadun UdaraNessuna valutazione finora

- CFO or VP Finance or Finance DirectorDocumento3 pagineCFO or VP Finance or Finance Directorapi-121431336Nessuna valutazione finora

- Ac Ac290Documento14 pagineAc Ac290tushar2001Nessuna valutazione finora

- McDowell Homefinder March 2013Documento11 pagineMcDowell Homefinder March 2013MarshaGreeneNessuna valutazione finora