Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hpcllubereport Byvaibhav 110623103741 Phpapp02

Caricato da

Roget HartcourtDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Hpcllubereport Byvaibhav 110623103741 Phpapp02

Caricato da

Roget HartcourtCopyright:

Formati disponibili

UNIVERSITY OF PETROLEUM AND ENERGY STUDIES

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

SUMMER INTERNSHIP REPORT

BY: VAIBHAV GODSE, MBA OIL AND GAS- 2009-2011

2010

HINDUSTAN PETROLEUM CORPORATION LTD., MUMBAI(INDIA)

EXECUTIVE SUMMARY

Title of the Project: Success determinants of selected lubricant brands. Objective of the Project: Determining and analyzing the factors responsible for the of brands in diesel engine oil (DEO), passenger car motor oil (PCMO) and four stroke oil (4T) segment based on suggestions obtained from bazaar shops and retail outlets through questionnaire. Further giving possible suggestions to HPCL to gain a competitive edge in its bazaar shops and retail outlets.

This project is an initiative to determine the exact reason for the success of lubricant brands in the Indian market. The segment taken for the study was Diesel engine oil, Passenger car motor oil and Four stroke oil. The objective of the project was:

To portray the lubricant market in India, its historical background, liberalization and current state of competitiveness. To identify the successful lubricant brands launched by Hindustan Petroleum Corporation Limited (HPCL), Bharat Petroleum Corporation Limited (BPCL), Indian Oil Corporation Limited and Castrol India Limited (CIL). To identify the brand success factors of selected lubricant brands launched by HPCL, BPCL, IOCL and Castrol.

Methodology: Literature review through secondary data, then expert opinion by interviewing the brand managers within the industry and interviewing the bazaar shop and retail outlet owners. Findings and Conclusions: Thus the basic reasons for the success of any lubricant brand depends on the seven factors, these are: Brand Name Brand Image Positioning in the mind of consumer Quality of parent brand

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

Proper and longer support Above the Line - Promotion Below the line Promotion These factors are one or the other way of communicating the product to the customers

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

ACKNOWLEDGEMENT

I, Vaibhav Godse, sincerely acknowledge the support and guidance given by my mentors, without whom, the project would not have taken shape in the desired direction. Every single bit put in by my mentors is precious in its own way. I wish to thank and acknowledge Shri. R. Sudhakar Rao, Executive Director, Direct Sales SBU, for his constant support and being the mastermind of this project. I owe him priceless gratitude for making me privilege to work with his talented team in his highly esteemed SBU. I also wish to acknowledge the valuable contributions of Shri. L.N.Maheswari, Dy.General Manager, Consumer Lubes and Shri. A.K Bhan, General Manager, South Zone. I thank Shri. V.Raghunathan, Chief Manager, Retail Lubes and Shri T. Jaya Surya, ESOLubes, Direct Sales SBU. I also acknowledge the efforts put in by Shri Harpreet Ghosal, LSO, Delhi Office for being on filed mentor. The architect of the project and the guide in the true sense of the term, Shri Amit Tandon, Manager, Lubes- Branding, without his guidance this project would never have taken any shape. I wish to sincerely acknowledge to contribution, guidance and support he lent me throughout the course of the project and thank him from the bottom of my heart for the same.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

ABSTRACT

The project is based on success determinant of lubricant brands in diesel engine oil, passenger car motor oil and four stroke oil segments. The companies taken for the study are Hindustan Petroleum Corporation Limited (HPCL), Indian Oil Corporation Limited (IOCL), Bharat Petroleum Corporation Limited (BPCL), and Castrol India Limited (CIL).The brands selected for the study are taken, based on highest sale for the past three years. There were four team members and each one had to study one company. I did the study on success determinants of HPCL automotive lubricant brands. The brands selected for the study are Laal Ghoda and Milcy Turbo in DEO, Cruise and Cruise Classic in PCMO, and Racer 4 in 4T segment. There are about 30 small and big sized players in the market, who produce and market automotive lubes. Bazaar shops and retail outlets are the only market where the lubricant is sold to the consumers. For the survey, four cities were shortlisted Delhi, Mumbai, Pune and Jaipur. For data collection more emphasis was given for DEO in Delhi and Jaipur bazaars, and more emphasis for PCMO and 4T in Pune and Mumbai bazaars. To start with, I got myself acquainted with the lubricant market and the various terminologies used, the specifications required, the standards to be followed, reviewing some articles on lubricant market in India as a part of my ground work by reviewing some literature, and gathering information at HPCLs Marketing Headquarters- Hindustan Bhawan. I reported at office on June 1, 2010 for the first time, and from there on, eventually, collected the necessary data regarding the sales, pricing and packaging. Within company the information gathered formed the platform for my project. Before exploring the market, one must have a clear awareness about the product of research and survey, its specifications, its process and other marketing related issues involved. This was followed by my visit to Delhi Regional office and the Delhi bazaar shops and retail outlet survey was conducted from June 26 to July 10, 2010. Whereas the data from other cities were collected by rest of the project members. After collecting the data from various cities, it was merged and segregated according to the companies under study. Then this was followed by data analysis and interpretation part.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

At the end a presentation was given in front of Mr Arunbalakrishnan (C.M&D), Mr. Sudhakar Rao (E.D) and Mr. Amit Tandon (Manager). Necessary changes were made as guided by respected Sir and a report was submitted thereafter.

Vaibhav Godse UPES Dehradun.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

DECLARATION

Vaibhav Godse hereby declares that the project work entitled Success Determinant of Selected Lubricant Brand is a bona fide work done by me under the guidance and supervision of Mr. Amit Tandoon. The work has not formed part of any earlier studies for the award of degree/ diploma/ fellowship.

Place: Mumbai, (Maharashtra)

Date: 31 July 2010

Signature of the Student.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

CONTENT

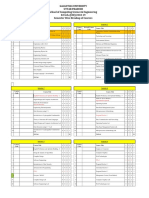

SI.NO. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. TOPIC ABOUT HPCL RESEARCH METHODOLOGY LITERATURE REVIEW INDIAN LUBE MARKET SUCCESS DETERMINANTS STRATEGIES IN LUBRICANT BUSINESS PRODUCT PORTFOLIO AND SPECIFICATION MARKETING CONCEPTS SAMPLE MARKET ANALYSIS CONCLUSION AND RECOMMENDATION ANNEXUREGRAPHS QUESTIONNAIRE LIST OF RETAIL SURVEYED ABBREVATIONS OUTLETS AND BAZAAR PAGE NO. 8-15 16-19 20-30 31-37 38-41 42-44 45-49 50-55 56-67 68-71 72-83 73-83 83 (1-15) SHOPS 84-85

13.

14.

86-87

15.

REFERENCE

88

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

ABOUT HPCL

HPCL is a Fortune 500 company, with an annual turnover of Rs. 1,08,599 Crores and sales/income from operations of Rs 1,14,889 Crores (US$ 25,306 Millions) during FY 2009-10, having about 20% Marketing share in India and a strong market infrastructure.

HPCL operates two major refineries producing a wide variety of petroleum fuels & specialties, one in Mumbai (West Coast) of 6.5 Million Metric Tonnes Per Annum(MMTPA) capacity and the other in Vishakapatnam, (East Coast) with a capacity of 8.3 MMTPA. HPCL holds an equity stake of 16.95% in Mangalore Refinery & Petrochemicals Limited, a state-of-the-art refinery at Mangalore with a capacity of 9 MMTPA. In addition, HPCL is constructing a refinery at Bhatinda, in the state of Punjab, as a Joint venture with Mittal Energy Investments Pte. Ltd.

HPCL also owns and operates the largest Lube Refinery in the country producing Lube Base Oils of international standards, with a capacity of 335 TMT. This Lube Refinery accounts for over 40% of the India's total Lube Base Oil production.

HPCL's vast marketing network consists of 13 Zonal offices in major cities and 101 Regional Offices facilitated by a Supply & Distribution infrastructure comprising Terminals, Aviation Service Stations, LPG Bottling Plants, and Inland Relay Depots & Retail Outlets, Lube and LPG Distributorships. HPCL, over the years, has moved from strength to strength on all fronts. The refining capacity steadily increased from 5.5 MMTPA in 1984/85 to 14.8 MMTPA presently. On the financial front, the turnover grew from Rs. 2687 Crores in 1984-85 to an impressive Rs 1,16,428 Crores in FY 2008-09.

VISION

Market leader in growth and profitability. Most preferred supplier of quality products at right price and time. Delighting the customers by value added services. Professional and empowered team for quick response to customers.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

10

QUALITY POLICY

Total customer satisfaction through quality products by doing it right the first time, every time.

Ensure consistency of quality, and adherence to time deadlines. Strive to achieve excellence in quality through training, motivation, team work and continuous up gradation of technology.

To take appropriate steps to minimize wastage, increase productivity and optimize the quality of products and services in a cost effective manner

PRODUCT COMMITMENT

To provide quality products and services which shall reflect in a growing list of satisfied customers.

To consciously build a quality culture, through employee participation, motivation and training.

To strive for an eco - friendly environment.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

11

HPCL LUBRICANTS

HP Lubes is an integral part of Hindustan Petroleum Corporation Limited, one of India's frontline oil majors, committed to providing energy and fueling g growth in every significant area of development. In pursuit of this vision, there is a sustained emphasis on environment protection and preserving the cultural heritage of India. HPCL Lube market share is around 11%. The HP Engine Oils product range covers over 300 brands of lubricants, gr greases and specialties catering to the automotive as well as the industrial sector. HPCL has six lube blending plants at Mumbai, Kolkata, Chennai and Silvassa. HP Lubricants are borne out of an intense and unrelenting R & D effort, which aims at producing quality products that enhance automotive performance standards. The range of HP Lubes is comprehensive and catering to the minutest needs; from new generation cars to ploughing tractors and industrial machinery. The range conforms strictly to OEM specifica specifications, often taking the initiative in customization of products. The various lubricant segments of HPCL are are:

HP LUBRICANTS AUTOMOTIVE GRADES INDUSTRIAL GRADES INDUSTRIAL SPECIALITIES

GREASES

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

12

Since the study is focused on au automotive lubricants and within automotive lubricant, engine oils lubricant are taken under study within which Diesel engine oil, passenger car motor oil and four stoke oils are taken. The various brands of HPCL in automotive segment are:

HPCL AUTOMOTIVE LUBRICANT

ENGINE OILS

GEAR OILS

TRANSMISSION OILS

AUTOSPECIALITIES

DEFENSE GRADES

DIESEL ENGINE OILS

PETROL ENGINE OILS

NATURAL GAS ENGINE OILS

FIRST FILL ENGINE OILS

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

13

LUBRICANT PRODUCT LINE IN ENGINE OIL SEGMENT

ENGINE OIL

DIESEL ENGINE OIL

PASSENGER CAR MOTOR OIL

FOUR STROKE

LAAL GHODA

CRUISE

RACER 4

MILCY

CRUISE CLASSIC

RACER 4 EXCEL

MILCY TURBO

HP ACE

CHAMPION

HP NO.1

DIESEL ENGINE OIL SEGMENT MILCY 40 SAE 40 API CD LAL GHODA SAE 20W 40 API CF CHAMPION SAE 20W0 40 API CF/SF MILCY TURBO SAE 15W 40 API CF4 HP NO1 SAE 15W 40 API CI4

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

14

PASSENGER CAR MOTOR OIL HP CRUISE - API SG 15W 40 HP ACE - API SL , 15W 40 FOUR STROKE OIL RACER 4 - API SG RACER 4- EXCEL (API SL SL)

GRAPH SHOWING THE HPCL SALES/INCOME FROM OPERATIONS

SALES Rs/Crores

140000 120000 SALES/INCOME FROM OPERATIONS, RS/crores. 100000 80000 60000 SALES Rs/Crores 40000 20000 0 2004-05 2005 2005-06 2006-07 YEAR 2007-08 2008-09

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

15

GRAPH SHOWING HPCL SALES VOLUME OF LUBES AND GREASES

SALES VOLUME

600 SALES VOLUME, 000TONNES 500 400 300 200 100 0 2004-05 2005-06 06 2006-07 YEAR 2007-08 2008-09 SALES VOLUME

GRAPH SHOWING THE NUMBER OF RETAIL OUTLETS

NUMBER OF RETAIL OUTLETS OF HPCL

9000 NUMBER OF RETAIL OUTLETS 8000 7000 6000 5000 4000 3000 2000 1000 0 2004-05 2005-06 2006-07 YEAR 2007-08 2008-09 NUMBER OF RETAIL OUTLETS

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

16

RESEARCH METHODOLOGY

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

17

RESEARCH METHODOLOGY

PROBLEM DEFINITION

DEVELOPMENT OF APPROACH TO THE PROBLEM

RESEARCH DESIGN FORMULATION

FIELD OR DATA COLLECTION

BAZAAR SHOPS

RETAIL OUTLETS

DATA PREPARATION AND ANALYSIS

REPORT PREPARATION AND PRESENTATION

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

18

PROBLEM DEFINATION AND APPROACH TO THE PROBLEM Project is about Success determinants of lubricant brands. To identify the determinants for the success of lubricant brands of HPCL in the diesel engine oil segment, passenger car motor oil segment and four stroke segment. How the market dynamics work for the lubricant brands, which factor influences the most for the sale of any particular brand whether brand name, image, promotion etc. RESEARCH OBJECTIVE To portray the lubricant market in India, its historical background, liberalization and current state of competitiveness. To identify the successful lubricant brands launched by Hindustan Petroleum Corporation Limited (HPCL). To identify the brand success factors of selected lubricant brands launched by HPCL. Applying various marketing models on HPCL lubricant brands- Poters Five Forces, SWOT Analysis etc.

Before starting the research work some of reasons for the success of any lubricant brands were shortlisted through literature review. The basic objective is success determinants of four lubricant brands of HPCL in the three segment- Diesel Engine Oil, Passenger Car Motor Oil and Four Stroke oil. The selections of brands made for the study was based on sale of each brand in the Indian market i.e., highest selling brands for the past three were shortlisted for the study. Two largest selling brands each of diesel engine oil and passenger car motor oil and one for four stroke oil were taken. The brands included were:

Diesel Engine Oil- Laal Ghoda and Milcy Turbo Passenger Car Motor Oil- Cruise and Cruise Classic Four Stroke- Racer 4

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

19

RESEARCH DESIGN At first expert opinion is taken to get the insight of the problem. For the same brand managers were interviewed using a questionnaire based on the determinants shortlisted from literature review. The feedback obtained from experts helped in preparing the questionnaire for bazaar shops and retail outlets. After having the expert opinion and formulating the questionnaire according to the feedback, field work was carried out. Field work included interviewing the bazaar shop and retail outlet owners. FIELD OR DATA COLLECTION Field work was based on collecting the data from bazaar shop and retail outlet. The survey was conducted in four cities- Delhi, Mumbai, Jaipur and Pune. Sampling plan: CITY DEO (laal ghoda and PCMO milcy turbo) Bazaar shop Delhi Mumbai Jaipur Pune 12 12 12 12 Retail outlet 3 3 3 3 (cruise and 4T (racer 4)

cruise classic) Bazaar shop 9 9 3 3 Retail outlet 2 2 1 1 Bazaar shop 3 3 9 9 Retail outlet 1 1 2 2

DATA PREPARATION AND ANALYSIS Data obtained from the field was analyzed. Only those factors were taken which were given highest weight age or which the retailer and bazaar shops has agreed upon. Based on the field data various graphs are plotted. The graphs are plotted between reasons for success versus percentage of people saying yes for the determinant of that particular brand.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

20

LITERATURE REVIEW

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

21

LITERATURE REVIEW

LUBRICANT A lubricant (sometimes referred to as "lube") is a substance (often a liquid) introduced between two moving surfaces to reduce the friction between them, improving efficiency and

reducing wear. It may also have the function of dissolving or transporting foreign particles and of distributing heat. One of the single largest applications for lubricants, in the form of motor oil, is protecting the internal combustion engines in motor vehicles and powered equipment. A lubricant is a blend of base oils and performance enhancing additives as required by engine, gear box and other application areas. At the refinery, the crude oil is refined into gasoline, diesel, kerosene, LPG, naphtha and base stocks (Lube). This base stock is further processed, blended and strengthened with required properties to make different kind of lubricants. Typically lubricants contain 90% base oil (most often petroleum fractions, called mineral oils) and less than 10% additives. Vegetable oils or synthetic liquids such as hydrogenatedpolyolefins, esters, silicones, fluorocarbons and many others are sometimes used as base oils. Additives deliver reduced friction and wear, increased viscosity, improved viscosity index, resistance to corrosion and oxidation, aging or contamination, etc. Lubricants such as 2-cycle oil are also added to some fuels. Sulfur impurities in fuels also provide some lubrication properties, which has to be taken in account when switching to a lowsulfur diesel; biodiesel is a popular diesel fuel additive providing additional lubricity. Non-liquid lubricants include grease, powders (dry graphite, PTFE, Molybdenum

disulfide, tungsten disulfide, etc.), teflon tape used in plumbing, air cushion and others. Dry lubricants such as graphite, molybdenum disulfide and tungsten disulfide also offer lubrication at temperatures (up to 350 C) higher than liquid and oil-based lubricants are able to operate. Limited interest has been shown in low friction properties of compacted oxide glaze layers formed at several hundred degrees Celsius in metallic sliding systems, however, practical use is still many years away due to their physically unstable nature.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

22

LUBE OIL BASE STOCK MANUFACTURING Lubricating oils need to be viscous, have stability during the heat generated by frication of the machine, and the viscosity should not fall sharply with the rise in temperature due to friction. These qualities are met by vacuum gas oils i.e. high boiling cuts distilled by vacuum distillation of crude oil. These gas oil cuts are cal lubricating oil base stocks (LOBS). All crude oil do not called give good lube base stock. For example waxy crude oils like Mumbai High or some South East Asian crudes oils are not good for lube oil manufacture. Yield of suitable lube base stocks are lower in these cases (as the oil is light) and wax creates a lot of operational problems during lube and extraction process. Some of the medium heavy Middle East Crude oils give good quality lube base stocks.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

23

LUBE OIL MANUFACTURING PROCESS The various processing steps are: De-asphalting Unit: Asphalt from the lube base stocks is removed by solvent extraction process. Aromatics Extraction: Aromatic hydrocarbons are removed by solvent extraction

process to improve viscosity. De-waxing: This is another solvent extraction process which removes wax from the lube base stock. Hydro-finishing: After the series of extraction processes, the lube base stock is treated with hydrogen (hydro-finishing process) to improve color and give stability. Finally additive chemicals in small dozes are added to boost certain properties.

ADDITIVES Plain mineral oils cannot provide all the necessary functional properties that an engine requires. These plain mineral oils need fortification with chemicals/additives which when used in small quantities, import or enhance the desirable functional properties. Some of the types and reasons for their use are as follows:

Dispersants: Keeps sludge, carbon and other deposit- precursors suspended in oil.

Detergents: Keeps the engine parts clean from deposits.

Rust/Corrosion Inhibitors: Prevents or controls oxidation of oil, formation of varnish, sludge and corrosive compounds, limit viscosity increase.

Extreme Pressure (EP), Anti wear and friction modifiers: These form protective film on the engine parts and reduce wear and tear.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

24

Metal deactivators: Forms surface films so that metal surface does not catalyze oil oxidation.

Pour Point Depressant: Lowers freezing point of oils assuring free flow at lower temperatures.

Anti-foamants: Reduces foam in crankcase and blending.

GRADES The Society of Automotive Engineers (SAE) has established a numerical code system for grading lubricants (motor oils) according to their viscosity characteristics. SAE viscosity grading include, from low to high viscosity: 0, 5, 10, 15, 20, 25, 30, 40, 50 or 60. The numbers 0, 5, 10, 15 and 25 are suffixed with the letter W, designating their "winter" (not "weight") or cold-start viscosity, at lower temperature. The number 20 comes with or without a W, depending on whether it is being used to denote a cold or hot viscosity grade. The document SAE J300 defines the viscometrics related to these grades. Kinematic viscosity is graded by measuring the time it takes for a standard amount of oil to flow through a standard orifice, at standard temperatures. The longer it takes, the higher the viscosity and thus higher SAE code. Note that the SAE has a separate viscosity rating system for gear, axle, and manual transmission oils, SAE J306, which should not be confused with engine oil viscosity. The higher numbers of a gear oil (eg 75W-140) do not mean that it has higher viscosity than an engine oil.

Single/ Mono-grade A single-grade engine oil, as defined by SAE J300, cannot use a polymeric Viscosity Index Improver (also referred to as Vicosity Modifier) additive. SAE J300 has established eleven viscosity grades, of which six are considered Winter-grades and given a W designation. The 11 viscosity grades are 0W, 5W, 10W, 15W, 20W, 25W, 20, 30, 40, 50, and 60. These numbers are often referred to as the 'weight' of a motor oil.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

25

For single winter grade oils, the dynamic viscosity is measured at different cold temperatures, specified in J300 depending on the viscosity grade, in units of mPas or the equivalent older nonSI units, centipoises (abbreviated cP), using two different test methods. They are the Cold Cranking Simulator (ASTM D5293) and the Mini-Rotary Viscometer (ASTM D4684). Based on the coldest temperature the oil passes at, that oil is graded as SAE viscosity grade 0W, 5W, 10W, 15W, 20W, or 25W. The lower the viscosity grade, the lower the temperature the oil can pass. For example, if an oil passes at the specifications for 10W and 5W, but fails for 0W, then that oil must be labeled as an SAE 5W. That oil cannot be labeled as either 0W or 10W. For single non-winter grade oils, the kinematic viscosity is measured at a temperature of 100 C (212 F) in units of mm/s or the equivalent older non-SI units, centistokes (abbreviated cSt). Based on the range of viscosity the oil falls in at that temperature, the oil is graded as SAE viscosity grade 20, 30, 40, 50, or 60. In addition, for SAE grades 20, 30, and 40, a minimum viscosity measured at 150 C (302 F) and at a high-shear rate is also required. The higher the viscosity, the higher the SAE viscosity grade is. For some applications, such as when the temperature ranges in use are not very wide, singlegrade motor oil is satisfactory; for example, lawn mower engines, industrial applications, and vintage or classic cars.

Multi-grade The temperature range the oil is exposed to in most vehicles can be wide, ranging from cold temperatures in the winter before the vehicle is started up to hot operating temperatures when the vehicle is fully warmed up in hot summer weather. A specific oil will have high viscosity when cold and a lower viscosity at the engine's operating temperature. The difference in viscosities for most single-grade oil is too large between the extremes of temperature. To bring the difference in viscosities closer together, special polymer additives called viscosity index improvers, or VIIs are added to the oil. These additives are used to make the oil a multi-grade motor oil, however it is possible to have a multi-grade oil without the use of VIIs. The idea is to cause the multi-grade oil to have the viscosity of the base grade when cold and the viscosity of the second grade when hot. This enables one type of oil to be generally used all year. In fact, when multi-grades were initially developed, they were frequently described as all-season oil. The viscosity of a multiSUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

26

grade oil still varies logarithmically with temperature, but the slope representing the change is lessened. This slope representing the change with temperature depends on the nature and amount of the additives to the base oil. The SAE designation for multi-grade oils includes two viscosity grades; for example, 10W30 designates common multi-grade oil. The two numbers used are individually defined by SAE J300 for single-grade oils. Therefore, an oil labeled as 10W-30 must pass the SAE J300 viscosity grade requirement for both 10W and 30, and all limitations placed on the viscosity grades (for example, a 10W-30 oil must fail the J300 requirements at 5W). Also, if an oil does not contain any VIIs, and can pass as a multi-grade, that oil can be labeled with either of the two SAE viscosity grades. For example, very simple multi-grade oil that can be easily made with modern base oils without any VII is a 20W-20. This oil can be labeled as 20W-20, 20W, or 20. Note, if any VIIs are used however, then that oil cannot be labeled as a single grade. The real-world ability of an oil to crank or pump when cold is potentially diminished soon after it is put into service. The motor oil grade and viscosity to be used in a given vehicle is specified by the manufacturer of the vehicle (although some modern European cars now have no viscosity requirement), but can vary from country to country when climatic or fuel efficiency constraints come into play.

Turbine Turbine motor oils are designed somewhat differently than reciprocating engine oils traditionally used in automobiles. Deposit control and corrosion are not significant issues when formulating turbine oil, and the shear stresses that turbine oils are exposed to are minimal in light of the fact that turbines are naturally balanced rotating machines unlike reciprocating engines. Turbine oils tend to have the ISO VG range 32, 46, and 68 (cst at 40 C/104 F), and make extensive use of diester, polyolester, polyalphaolefin and Group II as base stock due to the high temperatures they must withstand. Some jet turbine oils contain an amount of polyglycols. Varnish is one of the most problematic contaminants, leading to sticking components, reduced oil flow and increased wear. Most routine oil analysis tests cannot determine the formation of varnish. The most widely accepted process for measuring varnish formation is with Membrane Patch Colorimetry testing although the ultra centrifuge test is also run by a few laboratories.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

27

In most aviation gas turbine applications, peak lubricant temperatures are not reached during engine operation, but after shutdown, when heat has been able to migrate from the combustor cans and the compressors into the regions of the engine with lubricated bearings and gearboxes. The gas flow associated with running the turbine provides significant convective cooling that disappears when the engine is shutdown, leaving residual heat that causes temperatures within the turbine to rise dramatically, an often-misunderstood phenomenon.

SPECIFICATION: The lubricant is said to meet a certain specification. In the consumer market, this is often supported by a logo, symbol or words that inform the consumer that the lubricant marketer has obtained independent verification of conformance to the specification. Examples of these include the APIs donut logo or the NSF tick mark. The most widely perceived is SAE viscosity specification, like SAE 10W-40. Lubricity specifications are institute and manufacturer based. In the U.S. institute: API S for petrol engines API C for diesel engines. The current specs are API SM and API CJ. Higher second letter marks better oil properties, like lower engine wear supported by tests. In EU the ACEA specifications are used. There are classes A, B, C, E with number following the letter. Japan introduced the JASO specification for motorbike engines.

SOCIETIES AND INDUSTRY BODIES FOR STANDARDIZATION OF LUBES:

API American Petroleum Institute STLE Society of Tribologists and Lubrication Engineers

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

28

NLGI National Lubricating Grease institute SAE Society of Automotive Engineers ILMA Independent lubricant manufacturer association ACEA European Automobile Manufacturers Association JASO Japanese Automotive Standards Organization APPLICATION OF LUBES: Lubricants are mainly used is three sectors automotive, industrial and aviation. There are numerous application of lubes in these sectors, some of these applications are listed below: Automotive Engine oils Petrol (Gasoline) engine oils Diesel engine oils Automatic transmission fluid Gearbox fluids Brake fluids Hydraulic fluids Tractor (one lubricant for all systems) Universal Tractor Transmission Oil UTTO Super Tractor Oil Universal STOU includes engine Other motors 2-stroke engine oils

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

29

Industrial Hydraulic oils Air compressor oils Gas Compressor oils Gear oils Bearing and circulating system oils Refrigerator compressor oils Steam and gas turbine oils Aviation Gas turbine engine oils Piston engine oils Marine Crosshead cylinder oils Crosshead Crankcase oils Trunk piston engine oils Stern tube lubricants

LUBRICANT COMPANIES: Public Sector Undertakings (PSUs): Indian Oil Corporation Limited (IOCL) Hindustan Petroleum Corporation Limited (HPCL) Bharat Petroleum Corporation Limited (BPCL) Private Players: Reliance Petroleum Castrol Elf Total-Fina

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

30

Gulf Shell Oil Caltex Pennzoil Mobil

MARKETING CHANNELS: The marketing channels for automotive lubricants in India consist of the following, Petrol Stations Wholesale Distributors Lube Oil Shops Auto Spare Shops Authorized Service Stations Garages Rural & Agricultural dealers Super Markets.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

31

INDIAN LUBE MARKET

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

32

MARKET STRUCTURE

ERA OF LIBERALIZATION Prior to 1992 the lube industry in India was controlled by the 4 major Public Sector Oil companies namely Indian Oil, HPC,BPC & IBP and a handful of private companies like Castrol, Gulf, Tidewater & others. With the distribution & canalization of base oil import being controlled by the Government of India, the PSU Oil Companies controlled 90% of the market share. The decanalization of the lube base oil imports in 1993 by the Govt. of India followed by reduction of import duty on lube base oils from 85% to 25% and gradual scrapping of administered pricing observed the announcement of almost a new lube venture every month during 1994. Most of the new entrants formed associations with Indian companies both in the Private and Public sectors. INDIAN AUTOMOTIVE LUBRICANT MARKET Total demand for finished lubricants in India is estimated at over 1,600 kilo tones. The Lube market consists of two major segments, automotive and industrial. The Indian automotive lubricants market is largely price sensitive and volume growth is stagnating due to longer lasting lubricants. The market is fragmented with over 22 big and small manufacturers and with the spate of mergers and acquisitions (M&A), only a handful of big companies enjoy a major market share. Companies are adopting a more customer-oriented approach where they are likely to focus on creating brand awareness through print and visual media. For example promotional campaigns and trade shows offering gifts to their customers are methods of driving sales of automotive lubricants. The original equipment segment and retail trade are the two major marketing channels in the Indian automotive lubricants market. Due to the growing competition, tie-ups with original equipment manufacturers (OEM) are becoming important as they reinforce the value proposition of a particular brand.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

33

Petrol pumps form a major distribution channel in retail trade, however sales of lubricants through retail outlets (also called the bazaar trade) has transformed the Indian automotive lubricants market into a fast moving consumer goods (FMCG) sector. The other marketing channels are authorized service stations, garages, rural and agricultural dealers, super markets, and wholesale distributors Public sector unit (PSU) companies, that manufacture their own base oil, follow different distribution strategies as compared to private participants that solely dependent on imports. While PSUs sell through their own wide spread network of petrol stations private manufacturers prefer retail outlets. Engine oil, which accounted for over 70.0 percent market share in 2004 in the Indian automotive lubricants market, plays the most crucial role in deciding the market share of manufacturers. Increase in demand for four stroke motorcycles, tie ups with original equipment manufacturers, and implementation of new pollution norms are just some of the key drivers of the engine oil segment. The brake oil and coolant is the next largest segment in the Indian automotive lubricants market. Demand for coolants is increasing due to continuous growth in heavy commercial vehicles, increasing awareness among the customers, new cooling system technologies, and OEM tie-ups. In brake oil segment, increasing growth in light commercial vehicles, introduction of new brake systems, and consumption of lubes by commercial passenger vehicles, and changing customer mindset regarding specialty lubricants are expected to push demand further. The market for gear oils is also growing rapidly and has a high potential due to the increasing number of vehicles on the road. New generation vehicles with advanced gear system technologies and automatic transmission systems require special type of lubricants resulting in greater demand for multi axel gear oil and API synthetic gear oil, API GL-5, API MT-1, and ultra-Matic, which reduce the oil changing intervals. In the long term, the overall outlook for the automotive lubricants market is expected to be positive due to the growing Indian economy along with the increased purchasing power of consumers.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

34

MARKET SIZE AND GROWTH RATE ZE Segment wise market share

LUBE MARKET SHARE

AUTOMOTIVE SEGMENT INDUSTRIAL SEGMENT

40%

60%

MARKET SHARE

4- stroke 7% PCMO CNG Oils 2% 6%

2- stroke 14% Diesel engine oil 71%

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

35

Indian Lubricant market comprises about 0.90 MMTPA of the automotive segment and 0.60 MMTPA of the industrial/direct segment. The Indian automotive lubricant market is the sixth largest market in the world with revenues of approximately $1.30 billion. Total production of automotive lubricants in India is approximately 8 to 10 percent of global lube production. Indian lube industry has an annual demand of 1 million tones. Unlike other countries where lubricant demand has witnessed stagnation, the Indian market has been growing at approximately 7 percent per annum for the past 2 years. The public sector contributes to over 60 percent of the revenues for this market. MNCs have 5 percent market share and the remaining share is held by the unorganized sector. Automotive lubricants are further divided into diesel lubes and petrol lubes. Diesel lubes comprise 70 percent of the market and petrol based lubricants cover the rest. As diesel lubes are used by commercial vehicles, which have to cover greater distances, their market share is higher. Engine oil constitutes around 83 percent of total sales volumes. Gear oils, transmission fluids, hydraulic brake fluids, and engine coolants contribute to the balance. MARKET TERND In the recent past, the Indian lubricant market has witnessed a phase of consolidation. Multinationals with better technology, brand name and finances have the power to launch themselves on their own in the market. However, with increasing number of competitors it is not possible for everyone to carve a niche in the market. This sector has witnessed considerable amount of mergers and acquisitions. British Petroleums not so recent acquisition of Castrol is one example. The Indian lubes market is a combative market place and lubricant companies find themselves fighting a tough battle for survival. In the OE sector also lubricant manufacturing, companies are entering into collaborations with vehicle manufactures. Maruti Udyog, Hyundai Motors, Hindustan Motors, TAFE, Toyota, and Skoda have entered into collaboration with IOC and Castrol for some of their models

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

36

AUTOMOTIVE INDUSTRY The growth of lubricant industry is directly linked with the growth of automobile industry. Therefore to grow in lubricant market one has to keep the growth record of automobile industry. India is the 4th largest car market in Asia (after Japan, Korea & China). For commercial vehicles, it holds 5th spot in the world. Whereas, for 2-wheelers, India is the second largest market, next only to China, with both countries accounting of over 50% of global two wheeler production and sales. The Tractor segment is also making steady progress in India. According to McKinsey Report Auto Components Industry: Vision 2015, the Indian Auto Components Industry is envisaging to grow to US$ 33-40 Billion, by 2015 from around US$ 7 Billion, at present.

LUBRICANT INDUSTRY SEGMENTATION

The lubricant industry can be divided into two major categories i.e., Automotive & Industrial brand of lubricants. The industrial segment basically comprises of Core Sector industries like Defense, Railways, State Transport Undertakings, Steel Plants, Coal Mines, Fertilizers, Power Houses, and Chemicals & Heavy Engineering Industries. In the industrial segment, the PSUs could successfully maintain their stronghold due to the reasons that the requirement is most end use specific, customer focused, productivity linked & service oriented. Here, price, quality, performance track record, R&D infrastructure for technology up gradation and product development for end use specific application & after sales service play the most significant role & FMCG techniques of promotion and creating illusions takes a back seat. The automotive segment which accounts for major share i.e., 67% of the lubricant market became soft target for new entrants and here private sector players could immediately consolidate their market share by adopting FMCG techniques. PSU oil companies initially restricted their channel of distribution through their large infrastructure of marketing network i.e, petrol stations & distributor network.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

37

The focus happened to be on ensuring quality & customer accountability and restrict mushrooming of spurious trade in bazaar through the marketing channels where some kind of control could be exercised by the company. The major thrust put by Industry leader like Indian Oil at this juncture was to promote brand visibility and creation of brand image through endorsement, TV advertisements & image building at Retail sites.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

38

SUCCESS DETERMINANTS

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

39

KEY SUCCESS FACTORS FOR LUBRICANTS Brand Name A word, group of words, letters, or numbers that represent a product or service; also known as a product brand. Name used to distinguish one product from its competitors. It can apply to a single product, an entire product line, or even a company. Brand Image With lubricants becoming a fast moving consumer good and the brand preference of the consumers witnessing a change, brand image plays a key role in affecting the consumers decision to buy a lubricant. In a recent study by Frost & Sullivan, it was found that vehicles owners decision to buy a certain lubricant is affected by a garage mechanic, retail storeowner, or the advertisements. Hence, it becomes important to have a good brand name in the market, which can affect the customers decision to buy a certain brand. Proper and Longer Support- Distribution Channels With increasing number of players in the market, it is vital for the companies to reach a wider segment of customers. The lubricants market in India is very highly fragmented and complex. Public limited companies selling primarily through petrol pumps manage to achieve a deeper penetration. Most of the MNCs have tied up with oil majors to market their brands like Castrol with Escorts, Tata BP with Telco. This will help the private companies to establish a wider access, brand awareness, as well as preference. good or bad quality, high or low price. Quality of parent brand Any product in its start has a parent or the initial product and then further modification or up gradation is seen in the upcoming new product. If the initial product or the parent had good quality then this would in turn affect the success of the product in the market.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

40

New Technology Any up gradation done in the existing product would reflect its success or not. Introducing new features to the existing lubricant whether in lube itself or packaging would affect its market share. Prices and Promotion The transformation from the administered pricing mechanism to free pricing has increased the importance of providing cost effective product to the users. Thus product costing and competitive pricing are key factors affecting the market. Above the line (ATL) ATL is a type of advertising through media such as television, cinema, radio, print, web banners and web search engines to promote brands. This type of communication is conventional in nature and is considered impersonal to customers. It differs from BTL advertising, which uses unconventional brand-building strategies, such as direct mail and printed media (and usually involves no motion graphics). It is much more effective when the target group is very large and difficult to define. The term comes from top business managers and involves the way in which Procter & Gamble, one of the worlds biggest advertising clients, was charged for its media in the 1950s and 1960s. Advertising agencies made so much commission from booking media for clients that the creative generation and actual production costs of making TV ads was free hence above the line. Everything else they paid for and were therefore below the line. Below the line promotion (BTL) BTL sales promotion is an immediate or delayed incentive to purchase, expressed in cash or in kind, and having short duration. It is efficient and cost-effective for targeting a limited and specific group. It uses less conventional methods than the usual ATL channels of advertising, typically focusing on direct means of communication, most commonly direct mail and e-mail, often using highly targeted lists of names to maximize response rates. BTL services may include those for which a fee is agreed upon and charged up front.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

41

BTL is a common technique used for "touch and feel" products (consumer items where the customer will rely on immediate information rather than previously researched items). BTL techniques ensure recall of the brand while at the same time highlighting the features of the product. Another BTL technique involves sales personnel deployed at retail stores near targeted products. This technique may be used to generate trials of newly launched products. Private companies mostly sell their products through stockiest, dealers, distributors, mechanics, and retail stores. Maximum sales are achieved through mechanics and retail stores. Margins and discount schemes offered to the storeowners and mechanics prompt them to sell and promote a particular brand. Tie Up with OEMs Among the PSU Oil Companies Indian Oil is one company who has all along given utmost importance on tie ups with Original Equipment Manufacturers (OEMs) after signing agreements with major OEMs like Maruti Udyog Ltd, TELCO, Bajaj Auto, Kinetic Engineering, SKODA etc. Even initial fill & warranty fill agreements were also signed with TELCO & Hindustan Motors. In fact, the Japanese vehicle manufacturers prefer to tie up with one or two major oil manufacturers for use of engine oils as `Genuine Spare Part' of the vehicle whereas the American vehicle manufacturers prefer to follow the American Petroleum Institute who defines the performance parameters of engine oils. The Indian vehicle manufacturers follow a route which is combination of both. These inner strengths of PSUs and the quality policy adopted by them, even attracted major multinational players like Shell, Mobil, Exxon & Caltex to enter into tie up with one or the other PSU to have access to their well established marketing network.

Environment Friendly Now a days environment awareness is increasing a lot, therefore providing the lubes in environment friendly packaging could be one factor for success. This is basically the factor which relates to the packaging, whether providing the lubricant in environment friendly packaging would affect its success or not.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

42

STRATEGIES IN LUBRICANT BUSINESS

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

43

LUBE BUSINESS STRATEGY To compete with dominant public sector distribution, concepts like "Bazaars" and "Super Stores" have also been developed. Castrol developed the concept of "Bazaars." These are outlets meant only for lubricant sales. The concept of "User Outlet" is another new concept developed by Castrol. In this, the consumer selects his own brand of lube after giving his vehicle for service in the same outlet. Convenient stores and highway stops for vehicles are being built from where the vehicle owners can get their vehicles repaired and get their supply of lubricants. In this front Indian Oil after emerging as India's largest commercial organization and being the only company in the country to feature in the Fortune Global 500 listing has adopted structured business plan approach to strike a balance between conventional marketing channels (petrol stations)/distribution network and parallel marketing channels (bazaar trade). The parallel marketing channels chosen by the Company also adopted the path of brand image, customer focus & customer accountability. Mergers and acquisitions is another way of increasing market share for any industry. British Petroleums acquisition of Castrol is one example. The Indian lubes market is a combative market place and lubricant companies find themselves fighting a tough battle for survival. In the OE sector also lubricant manufacturing, companies are entering into collaborations with vehicle manufactures. Maruti Udyog, Hyundai Motors, Hindustan Motors, TAFE, Toyota, and Skoda have entered into collaboration with IOC and Castrol for some of their models.

STRENGTH OF OIL COMPANY

Manufacturing of quality lubricants is guided by two important parameters i.e., resourcing of consistent premium quality base oils and incorporation of cost & performance effective additive technology which is privy to the oil company and is an effective tool to establish superiority over competitors. In this area R & D effort plays a significant role as it has to be end use specific, location specific, environment specific & at the same time cost effective. Just bringing in

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

44

imported technology without any own & defined resource of quality inputs like base oil may not be suitable for Indian road/market conditions. Today, technology has become so demanding and requirement is so stringent that leading institutes like API (American Petroleum Institute) gives performance approval on the basis of identification & sourcing of base oils. Their approval is on crude specific, Refinery specific & base oil specific considerations. Bringing in base oils taking leverage of decanalisation of imports & reduction of duty, putting up blending plants at Tax holiday locations to remain in the cut throat competition & dumping may or may not yield far reaching benefits. The need of the hour is long term commitment and not sheer opportunism and with more competition expected in the coming years, customers will also realize impact of such approach. The automotive lubricant trade is gradually becoming wiser today. The traders now understand the benefits of stocking fast moving & familiar brands instead of overcrowding the shelf space because there are very few companies in India, who can make the entire range of automotive products available. It has also been found by the trade that because of working capital constraints the new entrants are increasing cash discounts resulting in price war and reduction of dealer margins. For making all the products available at all times a company would need to keep a high inventory commensurate with the sales volume for which an additional working capital of at least 35% would be necessary.

OUTLOOK

In the future, growth in the automotive lubricants industry will largely depend on the overall performance of the economy. In the past one and a half years, the scenario has improved with higher sales of commercial vehicles and two-wheelers. However, in the future volume growth will be affected because of use of better quality, long drain lubes. This will increase the replacement cycle for lubes. In the shorter term, one will witness intense competition in a slow growing market marked by a consolidation activity, which has the potential to change the face of the lubricant industry. Given the rising competition, success of a product would largely depend how well it is branded and distributed

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

45

PRODUCT PORTFOLIO AND SPECIFICATION

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

46

PRODUCT PORTFOLIO AND SPECIFICATION

LAAL GHODA 20W40

HP laal ghoda is a multigrade diesel engine oil and economy range diesel engine oil. It meets API CF and US military MIL-L-2104B, IS:13656:1993 specification. It is recommended for, use in all types of diesel engines in truck, bus, muv, tractor, taxi, pump set and DG set. Characteristics / Features: All round performance Engine cleanliness Efficient lubrication

Specification: Kinematic Viscosity cSt @40 deg C Kinematic Viscosity cSt @100 deg C Viscosity Index, MIN Flash point, (COC) C,MIN Pour Point, C , MAX Sulphated Ash,%WT,MAX TBN ,mgKOH/g,MIN Colour 130 13.5-16 110 200 -18 0.8 4.4 Red

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

47

MILCY TURBO 15W 40

HP Milcy Turbo is a premium quality multi grade Diesel Engine Oil with enhanced soot remium handling capacity which keeps engine clean and reduces soot induced wear. Excellent oxidation Excel control and sludge control helps to keep the engine in healthier condition. It meets API CF-4, m MB 228.1 & EDL-5 of IS 13656 requirements 5

Recommended for: Diesel engines of heavy duty as well as light duty service of both Naturally Aspirated and Turbocharged Engines- heavy & light commercial vehicles, tractors, multi utility vehicles, cars & jeeps.

Characteristics / Features: Long drain & Prolonged engine life Good control over soot reduces engine wear d High temperature stability reduces oxidative oil thickening Reduced oil consumption

Specification: Kinematic Viscosity cSt @100 deg C Viscosity Index, MIN Flash point, (COC) C,MIN Pour Point, C , MAX TBN, mg KOH/g, MIN 14- 15.2 120 190 -21 9

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

48

CRUISE

HP Cruise is premium quality multi grade engine oil which provides outstanding performance in all petrol engine passenger cars. It meets API SJ/CD, MIL-L-46152D & E-PL 3/ E-DL 2 of IS: 13656:1993. Recommended as engine oil for all Passenger cars running on petrol.

Characteristics / Features: Outstanding engine cleanliness & enhanced engine life Excellent lubrication over a wide temperature range Improved fuel economy Compatible with catalytic converter. Recommended for: M/s Hyundai Motors India M/s Mahindra & Mahindra Ltd. Specification: Kinematic Viscosity cSt @100 deg C Viscosity Index, MIN Flash point, (COC) deg C,MIN Pour Point, deg C , MAX Sulphated Ash,%WT,MAX TBN ,mgKOH/g,MIN Colour 14-16 120 200 -24 1.03 6.0 Orange

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

49

CRUISE CLASSIC HP Cruise Classic is red color superior quality multi grade engine oil for cars made from high quality base stocks and additives. It meets API SF/CC, MIL-L-46152B & E-PL 2/ E-DL 1 of engine oil for all passenger cars running on petrol.

Characteristics / Features: Outstanding engine cleanliness Excellent oxidation stability Improved wear protection & extended engine life Improved fuel economy Compatible with catalytic converter.

Specification: 20W40 Kinematic Viscosity cSt @100 14-16 deg C Viscosity Index, MIN Flash C,MIN Pour Point, deg C , MAX Sulphated Ash,%WT,MAX TBN ,mgKOH/g,MIN Colour -21 1 4.19 Red -21 1 5.4 Red point, (COC) 110 deg 200 118 200 20W50 18-20

Approved by: M/s Maruti Udyog Ltd. M/s Hindustan Motors Ltd.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

50

RACER 4

HP Racer 4 (20W40) is multipurpose engine oil for lubrication of engine, gear box and wet clutches in 4- stroke two wheelers. it meets API SG and JASO T903: MA specifications. It is recommended for use in all 4 stroke motorcycles, scooters, mopeds and scootteretes. Characteristics / Features: Optimized co-efficient of friction Excellent oxidation stability Sludge and Varnish control Gear anti wear and extreme pressure properties. Specification: Kinematic Viscosity cSt @100 deg C Viscosity Index, MIN Flash point, (COC) deg C,MIN Pour Point, deg C , MAX Sulphated Ash,%WT,MAX TBN ,mgKOH/g,MIN 1.5-15.5 110 200 -21 0.82 5.9

Approved by: M/s Escorts Yamaha Motors ltd. M/s Royal Enfield Motors. M/s Bajaj Auto.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

51

MARKETING CONCEPTS

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

52

POTERS FIVE FORCES

THREAT OF NEW ENTRANTS

BARGAINING POWER OF SUPPLIER

RIVALRY AMONG EXSISTING COMPETITORS

BARGAINING POWER OF BUYER

THREAT OF SUBTITUTE PRODUCTS

EXSISTING RIVALRY AMONG COMPETITORS Lubricant market is highly competitive, with more than 30 players in the market more Major competitors are Castrol, BPCL IOCL, Gulf, Valvoline BPCL, Strong product promotions through advertisements for example Castrol is doing for its PCMO and FOUR STOKE (Castrol magnetec) segment Quality of parent brand- quality of first brand launched by the competitors have good impact on customers mind, therefore driving the customer to buy the current brand Strong distribution channel Castrol has strong hold on bazaar shops channelBARGAINING POWER OF SUPPLIE SUPPLIER Lube base stock is obtained from its own (HPCL) refinery, hence have some control over refinery, bargaining power May or may not depend on IOCL and BPCL

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

53

BARGAINING POWER OF BUYER Bargaining power of consumer in high because of large number of competitors, therefore consumer has many choices. Margins for retailers and bazaar shop owners Schemes provided for retailers, mechanics. Product variety/ differentiation based on pack size, based on quality or specification Quantity/ volume purchased (KL) per month by buyer- Based on the amount ordered the schemes can be provided to the retailers and bazaar shop owners. Importance of product to the buyer- Whether the brand is providing all the benefits or not Credit period to the buyer, whether the period is 1 month or more Quality of pack- Attractive packaging (sticker, labeling), packaging material Cost of lubes is low as compared to Castrol, Valvoline, Gulf etc.

THREAT OF SUBTITUTE PRODUCTS No substitutes THREAT OF NEW ENTRANTS Government policies- Decanalization of lubricant industry in 1993, gave entry to private players. New technology- IOCL to launch biodegradable lubricant. Cost advantage- Provide same segment lubricant brand at lower price. Entry barrier- Brand name and image of existing brand and distribution network.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

54

SWOT ANALYSIS

STRENGTH

WEAKNESS

OPPORTUNITY

THREATS

STRENGTH Prices are comparatively low low. Consumer have good image about the company company. Laal ghoda has made position as low price DEO, which is competitive as per cost of product is concerned. Schemes offered to consumers are good good. Manufactures raw material (LOBS) for lubricants thus having control over margins margins. Retail outlet as strong distributional channel.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

55

WEAKNESS Low above the line (ATL) activities such as advertisements through media, hoardings, bill boards etc. Since lubricant marketing is same as that of FMCG products therefore requires continuous media promotion as a reminder to the customers. Packaging of Racer 4 is not attractive specially the label and sticker.

Laal Ghoda is used only for top-up purpose. Also, most of customers use this brand for pressure jack oil, not as engine oil. Has lower percentage occupancy of lubes in bazaar shop shelf, which is around 10-12%. OPPORTUNITY Tie ups with OEMs (original equipment manufacturers) such as with Eicher Motors, Tata Motors, Volvo etc. specifically in DEO segment.

Expansion in rural India, auto firms have begun tapping the countryside. For instance, Maruti Suzuki generates 10 per cent of its sales from rural sales, amounting to 32,000 cars. THREATS Increasing market share of Valvoline and IOCL in Delhi NCR region. High duplicity in market leads to low pull for product.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

56

SAMPLE MARKET ANALYSIS

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

57

SAMPLING PLAN In the project two types of sampling techniques are used judgmental and convenience sampling. Judgmental sampling through expert opinions within HPCL. Convenience sampling was done during field survey based on convenience of bazaar shops and retail outlets. Survey was conducted in Delhi, Mumbai, Pune and Jaipur. Data was collected from both bazaar shops and retail outlets. Table showing number of sample collected from each city: CITY DEO (laal ghoda and PCMO milcy turbo) Bazaar shop Delhi Mumbai Jaipur Pune 7 10 12 12 Retail outlet 3 3 3 2 (cruise and 4T (racer 4)

cruise classic) Bazaar shop 6 7 1 3 Retail outlet 2 2 1 1 Bazaar shop 3 3 9 9 Retail outlet 1 1 2 2

Therefore a total of 105 questionnaires for HPCL are collected, out of which 82 are from bazaar shop and 23 from retail outlets. Survey data collected for Diesel engine oil segment are 41, for passenger car motor oil are 17 and four stroke oil are 24.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

58

SAMPLE DATA AND ANALYSIS Response of managers across various strategic dimensions within HPCL

Strategic Dimensions Degree to which you focus your effort in terms of: Width of your product line. Target customer segment. Geographic spread of markets served. Price

Hindustan Petroleum Corporation Ltd. Medium to high Medium to high High Medium to high Medium Medium to high Medium Low to Medium Medium to high

The degree to which you seek brand identification rather competition based on: Other variables Degree to which you seek to Directly on your own develop brand identification Through distributional channel with end consumer: The choice of distributional channel based on: Bazaar Trade Petrol pumps

Level of product quality:

Raw materials Features

Low to medium Medium to high Medium to High

Degree to which you provide ancillary services, schemes etc. with your product line Price position of your product in market relative to:

Cost position Product Quality

Medium to high Low

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

59

Data collected from bazaar shops and retail outlets is represented in form of percentage of people agreeing for the reason for success of that particular brand. This data obtained is plotted between percentages of people agreeing versus reasons for success of the brand. Delhi bazaar shops Reasons For success Laal ghoda(%) 71.4 71.4 42.8 71.4 Milcy Turbo% 85.7 85.7 42.8 85.7 Cruise% Cruise classic% 100 100 83.3 66.6 Racer 4(%) 66.6 100 66.6 66.6

Brand name Brand Image Quality of parent brand Positioning of brand in the mind of consumer Proper and longer support (distributional channel) Quality of pack Variety of pack New Technology Making product environment friendly Brand promotion- ATL Brand promotion- BTL Accreditations/ Recommendations

100 100 83.3 66.6

28

71.4

50

50

33.3

14.2 85.7 0 0

85.7 42.8 42.8 0

83.3 66.6 16.6 0

83.3 66.6 16.6 0

33.3 33.3 33.3 0

42.8 14.2 -

71.4 14.2 -

83.3 66.6 16.6

83.3 66.6 16.6

66.6 33.3 25

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

60

Analysis of Delhi bazaar shop The table clearly shows that for Laal Ghoda the key success factors are brand name, brand image, positioning in the mind of customer and variety of pack, whereas for Milcy Turbo it is the brand name, brand image, positioning in the mind of consumer, quality of pack, proper and longer support, and above the line promotion are dominant factor for its success. For Cruise and Cruise Classic brand name, brand image, quality of parent brand, positioning of brand in the mind of consumer, variety of pack, quality of pack, above the line promotion and below the line promotion are the success determinants. For Racer 4 brand name, brand image, quality of parent brand, positioning in the mind of consumer, and above the line promotion are the reasons for its success.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

61

Jaipur Bazaar Shop Reasons For success Laal ghoda Milcy Turbo 100 `100 91.6 100 Cruise Cruise classic 100 100 100 100 Racer4

Brand name Brand Image Quality of parent brand Positioning of brand in the mind of consumer Proper and longer support Quality of pack Variety of pack New Technology Making product environment friendly Brand promotion- ATL Brand promotion- BTL Accreditations/ Recommendations

83.3 83.3 75 91.6

100 100 100 100

88.8 88.8 77.7 88.8

91.6 16.6 83.3 8.3 0

100 66.6 25 8.3 0

100 0 100 0 0

100 0 100 0 0

88.8 77.7 25 0 0

75 83.3 -

100 100 -

100 100 16.6

100 100 16.6

100 100 -

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

62

Analysis of Jaipur bazaar shop The table clearly shows that for Laal Ghoda the key success factors are brand name, brand image, quality of parent brand, positioning in the mind of customer, proper and longer support variety of pack, above the line and below the line promotion, whereas for Milcy Turbo it is the brand name , brand image, quality of parent brand, positioning in the mind of consumer, quality of pack, proper and longer support, above the line promotion and below the line promotion are dominant factor for its success. For Cruise and Cruise Classic brand name, brand image, quality of parent brand, positioning of brand in the mind of consumer, proper and longer support, above the line promotion and below the line promotion are the success determinants. For Racer 4 brand name, brand image, quality of parent brand, positioning in the mind of consumer, proper and longer support, quality of pack and above the line promotion and below the line promotion are the reasons for its success.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

63

Mumbai Bazaar Shop Reasons For success Laal ghoda Milcy Turbo 100 90 80 80 Cruise Cruise classic 100 85.7 85.7 100 Racer4

Brand name Brand Image Quality of parent brand Positioning of brand in the mind of consumer Proper and longer support Quality of pack Variety of pack New Technology Making product environment friendly Brand promotion- ATL Brand promotion- BTL Accreditations/ Recommendations

88 80 70 70

85.7 100 85.7 100

100 100 100 100

60 30 70 0 0

90 70 30 10 0

85.7 42.8 28.5 0 0

71.4 57.1 14.2 0 0

100 100 0 0 0

30 40 -

90 80 -

100 85.7 17

100 85.7 17

100 100 -

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

64

Analysis of Mumbai bazaar shop The table clearly shows that for Laal Ghoda the key success factors are brand name, brand image, quality of parent brand, positioning in the mind of customer, proper and longer support and variety of pack, whereas for Milcy Turbo it is the quality of parent brand, positioning in the mind of consumer, quality of pack, above the line promotion and below the line promotion proper and longer support are dominant factor for its success. For Cruise and Cruise Classic brand name, brand image, quality of parent brand, positioning of brand in the mind of consumer, proper and longer support, above the line promotion and below the line promotion are the success determinants. For Racer 4 brand name, brand image, quality of parent brand, positioning in the mind of consumer, proper and longer support, above the line promotion and below the line promotion are the reasons for its success.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

65

Pune Bazaar Shop Reasons For success Laal ghoda Milcy Turbo 58.3 58.3 83.3 58.3 Cruise Cruise classic 100 100 100 66.6 Racer4

Brand name Brand Image Quality of parent brand Positioning of brand in the mind of consumer Proper and longer support Quality of pack Variety of pack New Technology Making product environment friendly Brand promotion- ATL Brand promotion- BTL Accreditations/ Recommendations

66.6 33.3 58.3 83.3

100 100 100 66.6

100 100 88.8 77.7

75 8.3 0 0 0

83.3 0 16.6 33.3 0

100 33.3 33.3 33.3 0

100 33.3 33.3 33.3 0

100 22.2 22.2 11.1 0

41.6 58.3 -

33.3 75 -

33.3 100 100

33.3 100 100

66.6 77.7 22.2

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

66

Analysis of Pune bazaar shop The table clearly shows that for Laal Ghoda the key success factors are brand name, positioning in the mind of customer and proper and longer support, whereas for Milcy Turbo it is the quality of parent brand, proper and longer support and below the line activity is dominant factor for its success. For Cruise and Cruise Classic brand name, brand image, quality of parent brand, positioning of brand in the mind of consumer, proper and longer support and below the line promotion are the success determinants. For Racer 4 brand name, brand image, quality of parent brand, positioning in the mind of consumer, proper and longer support, above the line promotion and below the line promotion are the reasons for its success.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

67

CONCLUSION

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

68

CONCLUSION

Those determinants are taken as a success determinant, which the bazaar shop owners and retailers have agreed up to 60%. Thus conclusion is obtained brand wise for the reasons for the success of that particular brand. Key determinants from bazaar shop survey are:

Laal Ghoda Brand name Brand image Quality of parent brand Positioning of brand in the mind of consumer Proper and longer support Variety of packs

Milcy Turbo Brand name Brand image Quality of parent brand Positioning of brand in the mind of consumer Proper and longer support Brand promotionATL Brand PromotionBTL

Cruise Brand name Brand image Quality of parent brand Positioning of brand in the mind of consumer Quality of pack

Cruise Classic Brand name Brand image Quality of parent brand Positioning of brand in the mind of consumer Proper and longer support Quality of pack

Racer 4 Brand name Brand image Quality of parent brand Positioning of brand in the mind of consumer Proper and longer support Brand promotionATL Brand PromotionBTL

Brand promotionATL Brand PromotionBTL

Brand promotionATL Brand PromotionBTL

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

69

Key determinants from retail outlet survey are:

Laal Ghoda Brand name Brand image Quality of parent brand Positioning brand in mind consumer of the of

Milcy Turbo Brand name Brand image Quality of parent brand Positioning of brand in the mind of consumer

Cruise Brand name Brand image Quality of parent brand Positioning of brand in the mind of consumer

Cruise Classic Brand name Brand image Quality of parent brand Positioning of brand in the mind of consumer

Racer 4 Brand name Brand image Quality of parent brand Positioning of brand in the mind of consumer

Proper and longer support

Proper and longer support Quality of pack

Brand ATL Brand BTL

promotion-

Brand ATL Brand BTL

promotion-

Brand promotionATL Brand PromotionBTL

Promotion-

Promotion-

Brand promotionATL Brand PromotionBTL

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

70

RECOMMENDATIONS / CONCLUSIONS Thus the basic reasons for the success of any brand depends on the seven factors, these are: Brand Name Brand Image Positioning in the mind of consumer Quality of parent brand Proper and longer support Above the Line - Promotion Below the line Promotion These factors are one or the other way of communicating the product to the customers.

For Example: HP Milcy Toofan to HP Milcy Turbo, the change in brand name relates that brand name should able to convey or able to communicate to the customer the type of segment it is meant for. Media promotion, showing a Oil man with a tag line your engines engineer Promotion through sponsorship like Castrol has done in FIFA world cup.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

71

OTHER RECOMMENDATIONS For DEO Aggressive media promotion. Increase visibility of the brand. For PCMO Strategic Alliance: More tie-ups with OEMs, which would help in increasing the sale at retail outlets through service stations. Introducing free service programs at retail outlets. New Distribution system: Making product available at OEM workshops and service stations. For FOUR STROKE Below the line promotion should be aggressive- through mechanics. Awareness among mechanics for the brand- through schemes. Sponsorships- Sponsoring the events like sports, T.V. program (MTV roadies) would increase publicity. Celebrity branding.

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

72

ANNEXURE

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

73

GRAPHS

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

74

GRAPHS FOR BAZAAR SHOPS FOR DIESEL ENGINE OIL LAAL GHODA

90 80 70 60 50 40 30 20 10 0 17.1 2 0 0 47 42 77.3 67 61.5 79 63.7 65.7

Percentage of retailer agreeing for the reasons behind the success of Laal Ghoda

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

75

MILCY TURBO

100 90 80 70 60 50 40 30 20 10 0 0 0 28 23 55 84 70 74 86 80.7 73 67

Percentage of retailer agreeing for the reasons behind the success of Milcy Turbo

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

76

FOR PASSENGER CAR MOTOR OIL CRUISE

120 100 80 60 40 20 0 58 96 100 92 83 64 79 87

31 12 0

33.3

Percentage of retailer agreeing for the reasons behind the success of Cruise

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

77

CRUISE CLASSIC

120 100 100 80 60 40 20 0 33.3 12.4 0 96 92 83 80 68 79

88

28.4

Percentage of retailer agreeing for the reasons behind the success of Cruise Classic

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

78

FOUR STROKE

120 97 88.5 80 58 88.5 82.7 80 83 77.5

100

60

55

40 20 20 11.1 0 0

Percentage of retailer agreeing for the reasons behind the success of Racer 4

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

79

GRAPHS FOR RETAIL OUTLET FOR DIESEL ENGINE OIL

100 90 80 70 60 50 40 30 20 10 0 81 81 72.7

90.9

63.3 54.5 45.45 36.6 18.18 11 0 0

Percentage of retailer agreeing for the reasons behind the success of Laal Ghoda

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

80

MILCY TURBO

100 90 80 70 60 50 40 30 20 10 0 0 0 27.2 45.4 63.3 90.9 90.9 81 72.7 72.7 90.9 90.9

Percentage of retailer agreeing for the reasons behind the success of Milcy Turbo

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

81

PASSENGER CAR MOTOR OIL CRUISE

90 80 70 60 50 50 40 30 20 10 0 0 33.3 50 50 50 66.6 66.6 83.3 83.3 83.3 83.3

Percentage of retailer agreeing for the reasons behind the success of Cruise

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

82

CRUISE CLASSIC

90 80 70 60 50 50 40 30 20 10 0 0 33.3 50 50 66.6 66.6 57 83.3 83.3 83.3 83.3

Percentage of retailer agreeing for the reasons behind the success of Cruise Classic

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

83

FOUR STROKE

90 80 70 60 66.6

83.3 66.6

83.3

83.3

83.3 66.6 50

50 40 30 20 10 0 0 16.6 33.3 33.3

Percentage of retailer agreeing for the reasons behind the success of Racer 4

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

84

LIST OF RETAILERS AND BAZAAR SHOPS

BAZAAR SHOPS AND RETAIL OUTLET SURVEYED Aggrawal Petrochem Goyal Sales corporation G.S.Lubes Hindustan Lube oil Co. Om Motors Universal Oil Aggrawal oil Co. Vinsol Oil Co. Laxmi Oil Lubricants Satnam Automobile M/S Olympic Oil S.M Motors Bunty Auto parts Darshan Motors Singh automobiles Kholi Autoparts Jungpura motors Store M/S Garg oilCo. M/s Barkat laal & Roshan Laal Navkar trading Co. Sanchit Trading Co. Malhotra Petrochem Hindon Motors & Spares Varinder Motors & repairs Sahni Petroleums Vadhera oil Co. Paras lubricants

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

85

Jain motors & repairs Winstrol Petrochemical Mittal Oil Co. Arihant energy Solutions Prakash oil Coorp. Prem oil Company Hindustan service station Chadha oil company Anand service station Ever green service station Angara H.P centre Dhaulakuan service station

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

86

ABBREVATIONS

DEO- Diesel Engine Oil PCMO- Passenger Car Motor Oil 4T- Four Stroke ATL- Above The Line BTL- Below The line OEM- Original Equipment Manufacturer MRP- Maximum Retail Price API- American Petroleum Institute STLE- Society of Tribologists and Lubrication Engineers NLGI- National Lubricating Grease institute SAE- Society of Automotive Engineers ILMA- Independent lubricant manufacturer association ACEA- European Automobile Manufacturers Association JAS0- Japanese Automotive Standards Organization HPCL- Hindustan Petroleum Corporation BPCL- Bharat Petroleum Corporation IOCL- Indian oil Corporation CIL- Castrol India Limited PSU- Public Sector Undertaking MNC- Multinational Company

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

87

MMTPA- Million Metric Tonnes Per Annum MGO- Maruti Genuine Oil AMA- American Marketing association MBA- Master of Business Administration

SUCCESS DETERMINANTS OF SELECTED LUBRICANT BRANDS

88

REFERENCE