Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Steel Industry Update #266

Caricato da

Michael LockerCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Steel Industry Update #266

Caricato da

Michael LockerCopyright:

Formati disponibili

Steel Industry Update/266

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

September 2011

Tel: 212-962-2980

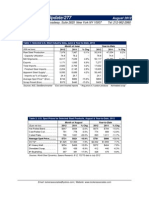

Table 1: Selected U.S. Steel Industry Data, July & Year-to-Date, 2011

(000 net tons)

Raw Steel Production ............... Capacity Utilization ................. Mill Shipments .......................... Exports ..................................... Total Imports............................. Finished Steel Imports ............ Apparent Steel Supply*............. Imports as % of Supply* ......... Average Spot Price** ($/ton) ...... Scrap Price# ($/gross ton) ..........

Sources: AISI, SteelBenchmarker

Month of July 2011 2010 8,122 7,456 75.0 7,409 1,062 2,620 2,095 8,443 24.8 $865 $443 69.6 6,481 896 2,425 1,803 7,388 24.4 $688 $309

% Chg 8.9% -14.3% 18.5% 8.0% 16.2% 14.3% -25.7% 43.4%

2011 55,176 74.5 52,189 7,470 17,266 13,187 57,906 22.8 $909 $440

Year-to-Date 2010 52,539 71.7 48,790 7,119 14,131 10,992 52,663 20.9 $716 $340

% Chg 5.0% -7.0% 4.9% 22.2% 20.0% 10.0% -27.0% 29.3%

*Excl semi-finished imports

**Avg price of 4 carbon products

#shredded

Table 2: U.S. Spot Prices for Selected Steel Products, September & Year-to-Date, 2011

($ per net ton)

Hot Rolled Band.... Cold Rolled Coil....... Coiled Plate.................. Average Spot Price.... OCTG. #1 Heavy Melt... Scrap Steel-Shredded. #1 Busheling.

Month of September 2011 2010 % Chg 697 592 17.7% 800 695 15.1% 1017 779 30.6% $838 1,997 401 444 483 $689 1,854 318 353 404 21.7% 7.7% 26.1% 25.8% 19.6%

2011 783 879 1,012 $891 1,877 403 440 476

Year-to-Date 2010 627 732 768 $709 1,733 310 342 412

% Chg 25.0% 20.0% 31.8% 25.7% 8.3% 29.9% 28.6% 15.4%

Sources: World Steel Dynamics SteelBenchmarker, Spears Research; OCTG data is August, 2011

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Steel Industry Update/266

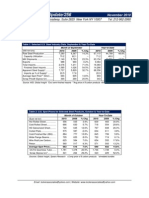

Table 3: World Crude Steel Production, July & Year-to-Date, 2011 Month of July Year-to-Date (000 metric tons) Region 2011 2010 % Chg 2011 2010 European Union. 14,579 13,763 5.9% 108,008 103,509 Other Europe. 3,068 2,595 18.2% 21,167 17,471 C.I.S. North America South America... Africa... Middle East. Asia.. Oceania...... Total Country China....... Japan... United States.. India(e). Russia(e). South Korea.... Germany.. Brazil.. Turkey.. Ukraine(e).... All Others.... 59,300 9,108 7,457 6,160 5,950 5,659 3,669 3,121 2,858 2,730 24,195 51,348 9,223 6,764 5,794 5,505 4,649 3,472 2,885 2,396 2,476 22,336 15.5% -1.2% 10.2% 6.3% 8.1% 21.7% 5.7% 8.2% 19.3% 10.3% 8.3% 410,364 63,180 50,143 41,796 40,692 39,525 26,865 20,948 19,262 20,432 174,118 372,060 63,800 47,662 39,788 38,357 33,236 26,217 19,264 15,917 19,158 162,908 10.3% -1.0% 5.2% 5.0% 6.1% 18.9% 2.5% 8.7% 21.0% 6.6% 6.9% 9,450 10,540 4,297 1,207 1,587 82,187 561 127,477 8,617 9,486 3,835 1,303 1,297 72,738 736 114,372 9.7% 11.1% 12.0% -7.3% 22.3% 13.0% -23.8% 11.5% 66,106 69,858 28,746 8,168 11,943 568,329 4,569 886,893 62,035 65,672 25,071 9,684 10,880 520,176 4,710 819,209

% Chg 4.3% 21.2% 6.6% 6.4% 14.7% -15.7% 9.8% 9.3% -3.0% 8.3%

Source: World Steel Association, 8/11; e=estimate

Graph 1: World Crude Steel Production

Source: World Steel Association, 8/11; in million metric tons

-2-

Steel Industry Update/266

Graph 2: World Steel Capacity Utilization Ratio

Source: World Steel Association, 8/11; in million metric tons

Table 4: US Stainless Steel Imports and Consumption, June 2011 Imports (in tons) Stainless sheet/strip Stainless plate Stainless bar Stainless rod Stainless wire Total Stainless Alloy tool steel Electrical steel June 2011 June 2010 30,465 34,250 14,150 6,969 12,566 2,628 3,872 63,681 8,258 7,800 9,528 1,577 3,778 56,103 6,964 7,202 Consumption % Chg June 2011 June 2010 -11.1% 119,173 94,118 103.0% 27,608 14,095 31.9% 66.6% 2.5% 13.5% 18.6% 8.3% 23,234 7,397 4,713 182,124 na 22,438 18,551 4,884 4,544 136,191 na 14,336 % Chg 26.6% 95.9% 25.2% 51.5% 3.7% 33.7% -56.5%

Source: American Metal Market, 9/1/11

-3-

Steel Industry Update/266

Table 5: Mega Mergers in 2010 & 2011 Valued at $1 Billion or More Month Aug10 May10 Jul10 Oct10 Apr10 Jun10 Jun10 Dec10 Jun10 Nov10 Mar10 Aug10 Nov10 Mar10 Jul10 Jul10 Oct10 Jan11 Jan11 Mar11 Mar11 Target Name Potash Corp of Saskatchewan Vale SA -- Aluminum Operations Arcelor Mittal NVStainless Division CommScope Inc BSG Resources Hangang Hanbao Iron & Steel Co Ltd Mineracao Usiminas Anshan Iron & Steel Group Corp -- Assets Gerdau Ameristeel Corp Draka Holding NV Rio Tinto PLC Simandou Iron Ore ArcelorMittal South Africa Operations Draka Holding NV Itaminas Comercio de Minerios SA Paranapanema JSW Steel Ltd Draka Holding Consolidated Thompson Iron Elkem AS Cia Brasileira de Mineracao/Metalurg Severstal NA Warren, Wheeling Target Nation Canada Brazil Luxembourg United States Guernsey China Brazil China Canada Netherlands Guinea South Africa Netherlands Brazil Brazil India Netherlands Canada Norway Brazil United States Acquirer Name BHP Billiton Norsk Hydro Shareholders Carlyle Group Vale SA Hebei Iron & Steel Co Ltd Sumitomo Pangang Group Steel Gerdau Steel North America Tianjin Xinmao Science/Tech Aluminum Corp of China Lexshell 771 Investments Prysmian SpA East China Mineral Vale SA JFE Steel Corp Nexans SA Cliffs Natural Resources Inc China National Bluestar Group Investor Group The Renco Group Inc Acquirer Nation United Kingdom Norway na US Brazil China Japan China Canada China China South Africa Italy China Brazil Japan France US China Japan United States Value Status Withdrawn Completed Completed Completed Completed Pending Completed Pending Completed Withdrawn Pending Pending Completed Pending Withdrawn Completed Withdrawn Completed Completed Pending Completed

(US$ Bil)

Category Other Other Other Other Steel Steel Iron Ore Steel Steel Other Iron Ore Steel Other Other Other Steel Other Iron Ore Aluminum Steel Steel

39.8 5.0 3.2 3.0 2.5 2.4 1.9 1.7 1.6 1.4 1.4 1.3 1.3 1.2 1.1 1.0 1.0 4.1 2.2 2.0 1.2

Source: PriceWaterhouseCoopers Forging Ahead Report, 2nd Quarter, 2011

Table 6: Mega Mergers in 2010 & 2011 Valued at $50 Million or More

2008 3Q 4Q 1Q 2009 2Q 3Q 4Q 1Q 2010 2Q 3Q 4Q 2011 1Q 2Q

Number of Deals Total Value (US$ bil) Avg Deal Value (US$ bil)

35 22.2 0.6

27 16.3 0.6

18 11.8 0.7

17 63.1 3.7

24 7.5 0.3

38 10.6 0.3

24 6.3 0.3

23 17.5 0.8

33 53.4 1.6

25 13.7 0.5

25 13.0 0.5

36 6.9 0.2

Source: PriceWaterhouseCoopers Forging Ahead Report, 2nd Quarter, 2011

-4-

Steel Industry Update/266

Table 7: Steel Industry Fatalities, 2011 Date Feb 4 Feb 12 Feb 14 Feb 15 Feb 16 Feb 28 Mar 8 Mar 31 Apr 1 Apr 19 Apr 20 May 9 May 17 May 23 May 26 Jun 6 Jun 7 Jul 11 Jul 31 Aug 10 Aug 10 Aug 13 Aug 15 Aug 17 Sep 6 Company ArcelorMittal USA Erie Coke Steel Warehouse Republic Engineered Norfolk Iron & Metal Bingham Lake Salvage Allegheny Ludlum AK Steel (coke plant) American Metal Recycling Iron Dynamics Western Metal Recycling Plakos Scrap Processing Iron Ore of Canada Nucor Waccamaw Metal Metalico Acme Galvanizing Alpha Natural Resources Keystone Steel & Wire F&G Recycling Sadoff Iron & Metal Kantner Iron & Steel Arch Coal Hundt's Auto Salvage Commercial Metals Location LaPlace, LA Erie, PA South Bend, IN Canton, OH Norfolk, NE Bingham Lake, MN New Castle, IN Ashland, KY Fontana, CA Butler, IN Pueblo, CO New York, NY Labrador City Memphis, TN Myrtle Beach, SC Rochester, NY Milwaukee, WI Martin County, KY Peoria, IL Enfield, CT Fond du Lac, WI Stoystown, PA Sharples, WV Plymouth, IN Magnolia, AK Alleged Cause Molten metal erupts from ladle Struck by front-end loader Pinned between forklift and truck Crushed by hydraulic truck door Struck by heavy metal tray Hit by vehicle on forklift that was being dismantled Scissor lift collapses, pinning worker Explosion and fire Flash fire erupts as workers use torches to cut metal Fall through roof Worker cut through pressurized tank; explosion Struck by a forklift Not available Accident in storage yard Crushed by dumpster being unloaded Crushed in metal compactor Steel beam fell on worker Crushed between machinery and steel beam Struck steel beam while driving motorized cart Struck by loader Trapped in shear while performing maintenance Torch-cut box filled with gunpowder, which exploded Struck by falling rock Crushed by vehicle being dismantled Safety harness caught on overhead crane pulley

Source: American Metal Market, 9/13/11

Table 8: North American Automotive Suppliers Outlook, 2011 Company Magna International Faurecia 1,2 Cummins Inc TRW Automotive Holdings Delphi Automotive LLP Lear Corp Dana Holding Corp Tenneco Inc American Axle & Manu Martinrea International Inc 3 Sales* $7,340 5,960 4,640 4,230 4,210 3,680 1,930 1,890 690 480 % Chg 24.4% 15.7% 44.5% 15.6% 22.0% 21.1% 26.1% 26.0% 23.2% 14.3% Income* $282.0 264.3 505.0 293.0 298.0 177.5 70.0 50.0 49.2 16.6 % Chg Outlook -4.1% Will add 30 new facilities through 2013 82.4% Steady growth in the 2nd half in all regions 105.3% Global end-market demand strong 29.0% Projects 14% sales growth in third quarter 39.3% na 11.1% Backlogs rose 40% in N. America, 35% in EU 600.0% 2011 revenues to rise 25% over 2010 25.0% Revenue outpacing industry growth 93.7% Ramping up new business backlog 36.1% Prospects bright due to new business awards

Source: Compiled by AMM from company reports, presentations and SEC filings. *Sales and income are in millions. 1. Converted from euros. 2. Sales are second quarter, income is first half. 3. Converted from Canadian dollars. Note: Percent changes are from the second quarter of 2010 to the second quarter of 2011.

-5-

Steel Industry Update/266

Table 9: Top U.S. Service Centers, by Revenue*

Revenue*

(in millions)

Reliance Steel McJunkin Red Man Corp Ryerson Inc. ThyseenKrupp Material Samuel, Son & Co. Russel Metals Inc. O'Neal Steel Inc. Steel Technologies Worthington Steel Macsteel Service Centers Metals USA Holdings Namasco Corp. Alro Steel Corp. A.M. Castle & Co. Marmom/Keystone Steel Warehouse Co. Olympic Steel Inc. Kenwal Steel Corp. Central Steel & Wire Heidtman Steel Triple-S Supply Majestic Steel USA Esmark Steel Group Mill Steel Co. Norfolk Iron & Metal Kelly Pipe Co. McNeilus Steel Inc. Brown-Strauss Steel Ranger Steel Services Contractors Steel Co. Friedman Industries Inc. Magic Steel Sales LLC Eastern Metal Supply Inc. Chicago Tube & Iron Co. Trident Steel Corp. Pacesetter Steel Service Liberty Steel Products Monarch Steel Co. Admiral Metals Cambridge-Lee Industries Friedman Industries Magic Steel Sales LLC Eastern Metal Supply Inc. Chicago Tube & Iron Co. Trident Steel Corp.

$6,310 3,960 3,900 2,400 2,667 2,357 1,900 1,520 1,400 1,300 1,209 1,175 1,050 1,036 925 890 805 750 708 600 500 425 400 400 400 400 260 250 227 226 221 220 200 185 182 180 175 163 160 150 221 220 200 185 182

Aluminum 15%-30% NA 15%-30% >30% 15%-30% 3% 15%-30% NA <15% NA <15% <15% NA 23% <15% NA <15% NA NA NA <15% NA <15% NA NA NA <15% NA NA NA NA NA 100% <15% NA NA 3%- 5% NA >30% NA NA NA 100% <15% NA

Bar/Tubing /Structural 15%-30% NA <15% <15% <15% 28% 15%-30% NA <15% NA 15%-30% 15%-30% NA 37% >30% NA <15% NA NA NA >30% NA <15% NA >30% 95% 15%-30% >30% NA >30% NA NA NA >30% 100% NA NA NA NA NA NA NA NA >30% 100%

Carbon Flat-roll <15% NA 15%-30% 15%-30% >30% 5% <15% >30% >30% NA >30% 15%-30% NA 0% NA 80% >30% >30% NA >30% 15%-30% >30% >30% >30% >30% NA >30% NA NA >30% 15%-30% >30% NA <15% NA >30% 90% 90% NA NA 15%-30% >30% NA <15% NA

Carbon Plate <15% NA <15% <15% 15%-30% 21% 15%-30% NA <15% NA 15%-30% >30% NA 0% NA 20% >30% NA NA NA >30% NA <15% NA 15%-30% NA 15%-30% NA >30% >30% 15%-30% NA NA <15% NA NA NA 10% NA NA 15%-30% NA NA <15% NA

Copper & Brass <15% NA <15% 15%-30% <15% NA <15% NA <15% NA <15% <15% NA 0% NA NA <15% NA NA NA <15% NA NA NA NA NA <15% NA NA NA NA NA NA <15% NA NA NA NA >30% NA NA NA NA <15% NA

Stainless Steel 15%-30% NA 15%- 30% 15%- 30% 15%-30% NA 15%-30% NA <15% NA <15% <15% NA 27% 30% NA <15% NA NA NA <15% NA NA NA NA NA <15% NA NA NA NA NA NA 15%-30% NA NA 5% NA 15%-30% NA NA NA NA 15%-30% NA

Source: American Metal Market, August/September, 2011; *latest 12 month period; non-respondents to this survey not included

-6-

Steel Industry Update/266

Locker Associates Steel Track: Spot Prices

U.S. Flat-Rolled Prices

($ per ton)

1100

500

U.S. Scrap Prices

($ per ton)

Plate

1000

450

#1 Busheling

CR Coil

900

400

#1 Heavy Melt

800

Shredded Scrap Rebar

350

700

300

600

HR Band

500

250

400 '06 '07 '08 '09 1q 2q J A S O N D J F M A M J J A S

200 '07 '08 '09 1q 2q J A S O N D J F M A M J J A S

Locker Associates Steel Track: Performance

10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0 J F M A M J J A S O N D

U.S. Raw Steel Production

(mil net tons)

100% 90% 80% 70% 60% 50% 40% 30%

U.S. Capacity Utilization

2011 2010

2011 2010

2011 7.9 7.4 8.1 7.8 7.9 8.0 8.1 2010 6.9 6.9 7.8 7.7 8.0 7.8 7.5

2011 73% 75% 75% 74% 73% 76% 75% 2010 64% 71% 73% 74% 75% 75% 70%

Steel Mill Products: US Imports, July & Year-to-Date Imports: Country of Origin

(000 net tons)

Canada.. Mexico Other W. Hemisphere.. European Union Other Europe*.. Asia. Oceania. Africa.. Total Imports: Customs District Atlantic Coast Gulf Coast/Mexican Border Pacific Coast. Gr Lakes/Canadian Border. Off Shore

Source: AISI; *includes Russia

Month of July 2011 2010 454 630 251 183 300 49 417 453 238 355 820 651 122 96 18 8 2,620 2,425 249 1,214 515 628 14 302 816 503 778 26

% Chg -27.9% 37.2% 512.2% -7.9% -33.0% 26.0% 27.1% 125.0% 8.0% -17.5% 48.8% 2.4% -19.3% -46.2%

2011 3,562 1,866 1,819 2,618 1,737 4,895 655 114 17,266 2,123 7,452 3,346 4,226 119

Year-to-Date 2010 % Chg 4,151 -14.2% 1,718 8.6% 596 205.2% 2,471 5.9% 1,403 23.8% 3,292 48.7% 444 47.5% 57 100.0% 14,131 22.2% 1,933 4,593 2,704 4,772 129 9.8% 62.2% 23.7% -11.4% -7.8%

Update #266 -7-

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the competitiveness of businesses and industries on behalf of unions, corporate and government clients. By combining expert business and financial analysis with a sensitivity to labor issues, the firm is uniquely qualified to help clients manage change by: leading joint labor/management business improvement initiatives; facilitating ownership transitions to secure the long-term viability of a business; conducting strategic industry studies to identify future challenges and opportunities; representing unions in strategic planning, workplace reorganization and bankruptcy formulating business plans for turnaround situations; and performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing, transportation, distribution and mining industries. Typical projects involve in-depth analysis of a firms market, financial and operating performance on behalf of a cooperative labormanagement effort. Locker Associates also produces a widely read monthly newsletter, Steel Industry Update that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers Bank of Boston Congress Financial Santander Investment Securities AEIF-IAM/AK Steel Middletown Prudential Securities US Steel Joint Labor-Mgmt Comm LTV Steel Joint Labor-Mgmt Committee Intl Union of Electrical Workers Bethlehem Joint Labor-Mgmt Comm Inland Steel Joint Labor-Mgmt Comm Northwestern Steel and Wire Boilermakers American Federation of Musicians USS/KOBE Sysco Food Services of San Francisco International Brotherhood of Teamsters Development Bank of South Africa J&L Structural Steel Air Line Pilots Association/Delta Air Lines MEC Sharpsville Quality Products IPSCO International Association of Machinists CSEA/AFSCME United Auto Workers Service Employees International Union American Fed of Television & Radio Artists Supervalu United Mine Workers Algoma Steel North American Refractories UNITE/HERE AFL-CIO George Meany Center Watermill Ventures Wheeling-Pittsburgh Steel Canadian Steel Trade & Employment Congress Minn Gov's Task Force on Mining Special Metals

RECENT PROJECTS

Business Plan for High-Tech Startup (2009-present): drafted detailed business plan to raise capital and promote a new hydrogen battery technology IBT-Supervalu (2010): assist union and management to identify major operational problems impacting warehouse performance and provide recommendations for joint improvement Institute of Scrap Recycling Industries (2010): presented a status report on the U.S. steel market before the Institute of Scrap Recycling Industries Commodities roundtable

Save the World Air-Marketing (2009-present): developed a marketing plan to help drive

sales of a green technology product, ELEKTRA, an electronic fuel device for trucks that increases fuel economy (mpg's), reduces exhaust emissions and improves engine performance

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Potrebbero piacerti anche

- Steel Industry Update #282Documento9 pagineSteel Industry Update #282Michael LockerNessuna valutazione finora

- Steel Industry Update 283Documento9 pagineSteel Industry Update 283Michael LockerNessuna valutazione finora

- CWA-CVC Investor Briefing Presentation 4-15-13Documento20 pagineCWA-CVC Investor Briefing Presentation 4-15-13Michael LockerNessuna valutazione finora

- Steel Industry Update #277Documento9 pagineSteel Industry Update #277Michael LockerNessuna valutazione finora

- Steel Industry Update #279Documento8 pagineSteel Industry Update #279Michael LockerNessuna valutazione finora

- Steel Industry Update #280Documento10 pagineSteel Industry Update #280Michael LockerNessuna valutazione finora

- Steel Industry Update #281Documento6 pagineSteel Industry Update #281Michael LockerNessuna valutazione finora

- Steel Industry Update #278Documento9 pagineSteel Industry Update #278Michael LockerNessuna valutazione finora

- Steel Industry Update #271Documento9 pagineSteel Industry Update #271Michael LockerNessuna valutazione finora

- Steel Industry Update #273Documento8 pagineSteel Industry Update #273Michael LockerNessuna valutazione finora

- Steel Industry Update #275Documento9 pagineSteel Industry Update #275Michael LockerNessuna valutazione finora

- Steel Industry Update #272Documento7 pagineSteel Industry Update #272Michael LockerNessuna valutazione finora

- Steel Industry Update #270Documento9 pagineSteel Industry Update #270Michael LockerNessuna valutazione finora

- Steel Industry Update #276Documento7 pagineSteel Industry Update #276Michael LockerNessuna valutazione finora

- Steel Industry Update #274Documento8 pagineSteel Industry Update #274Michael LockerNessuna valutazione finora

- Steel Industry Update #269Documento8 pagineSteel Industry Update #269Michael LockerNessuna valutazione finora

- Steel Industry Update #261Documento8 pagineSteel Industry Update #261Michael LockerNessuna valutazione finora

- Steel Industry Update #259Documento10 pagineSteel Industry Update #259Michael LockerNessuna valutazione finora

- Steel Industry Update #267Documento9 pagineSteel Industry Update #267Michael LockerNessuna valutazione finora

- Steel Industry Update #265Documento7 pagineSteel Industry Update #265Michael LockerNessuna valutazione finora

- Steel Industry Update #256Documento11 pagineSteel Industry Update #256Michael LockerNessuna valutazione finora

- Locker RPA Transcript 6-9-11Documento2 pagineLocker RPA Transcript 6-9-11Michael LockerNessuna valutazione finora

- Steel Industry Update #263Documento10 pagineSteel Industry Update #263Michael LockerNessuna valutazione finora

- Steel Industry Update #268Documento13 pagineSteel Industry Update #268Michael LockerNessuna valutazione finora

- Steel Industry Update #264Documento10 pagineSteel Industry Update #264Michael LockerNessuna valutazione finora

- Steel Industry Update #262Documento7 pagineSteel Industry Update #262Michael LockerNessuna valutazione finora

- Steel Industry Update #257Documento8 pagineSteel Industry Update #257Michael LockerNessuna valutazione finora

- Steel Industry Update #258Documento8 pagineSteel Industry Update #258Michael LockerNessuna valutazione finora

- Steel Industry Update #260Documento6 pagineSteel Industry Update #260Michael LockerNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Harrah'S Entertainment Inc Section - A' - Group - 7Documento6 pagineHarrah'S Entertainment Inc Section - A' - Group - 7Venkatesh MundadaNessuna valutazione finora

- 3G Ardzyka Raka R 1910631030065 Assignment 8Documento3 pagine3G Ardzyka Raka R 1910631030065 Assignment 8Raka RamadhanNessuna valutazione finora

- Case Study ExamplesDocumento18 pagineCase Study ExamplesSujeet Singh BaghelNessuna valutazione finora

- 18mba0044 SCM Da2Documento4 pagine18mba0044 SCM Da2Prabhu ShanmugamNessuna valutazione finora

- Examination Handbook NewDocumento97 pagineExamination Handbook Newdtr17Nessuna valutazione finora

- ABE College Manila. 2578 Legarda Avenue Sampaloc, ManilaDocumento11 pagineABE College Manila. 2578 Legarda Avenue Sampaloc, ManilaRonalie SustuedoNessuna valutazione finora

- Chapter 9 PowerPointDocumento33 pagineChapter 9 PowerPointYusrah JberNessuna valutazione finora

- Revision Question 2023.11.21Documento5 pagineRevision Question 2023.11.21rbaambaNessuna valutazione finora

- Identifying Social Engineering Attacks - Read World ScenarioDocumento4 pagineIdentifying Social Engineering Attacks - Read World Scenarioceleste jonesNessuna valutazione finora

- (OBIEE11g) Integrating Oracle Business Intelligence Applications With Oracle E-Business Suite - Oracle Bi SolutionsDocumento11 pagine(OBIEE11g) Integrating Oracle Business Intelligence Applications With Oracle E-Business Suite - Oracle Bi SolutionsVenkatesh Ramiya Krishna MoorthyNessuna valutazione finora

- Banking DictionaryDocumento499 pagineBanking DictionaryVanessa Jenkins100% (4)

- Netflix AccountsDocumento2 pagineNetflix AccountsjzefjbjeNessuna valutazione finora

- Cladding & Hardfacing ProcessesDocumento16 pagineCladding & Hardfacing ProcessesMuhammed SulfeekNessuna valutazione finora

- Pearce v. FBI Agent Doe 5th Circuit Unpublished DecisionDocumento6 paginePearce v. FBI Agent Doe 5th Circuit Unpublished DecisionWashington Free BeaconNessuna valutazione finora

- Practice Ch3Documento108 paginePractice Ch3Agang Nicole BakwenaNessuna valutazione finora

- NCP Ineffective Breathing PatternDocumento1 paginaNCP Ineffective Breathing PatternMarc Johnuel HumangitNessuna valutazione finora

- PT-E - Fundamentals of Process Plant Layout and Piping DesignDocumento14 paginePT-E - Fundamentals of Process Plant Layout and Piping DesignNofrizal HasanNessuna valutazione finora

- Introduction To Circuit LabDocumento8 pagineIntroduction To Circuit LabDaudKhanNessuna valutazione finora

- Bus 102 QuestionsDocumento4 pagineBus 102 Questionsali2aliyuNessuna valutazione finora

- 280Documento6 pagine280Alex CostaNessuna valutazione finora

- Liftoff: Guide To Duo Deployment Best Practices: Version 2.1 Published October 3, 2019Documento14 pagineLiftoff: Guide To Duo Deployment Best Practices: Version 2.1 Published October 3, 2019Johana RNessuna valutazione finora

- Introduction To TQMDocumento24 pagineIntroduction To TQMSimantoPreeom100% (1)

- Three Column Cash BookDocumento3 pagineThree Column Cash Bookahmad381Nessuna valutazione finora

- Cs 2032 Data Warehousing and Data Mining Question Bank by GopiDocumento6 pagineCs 2032 Data Warehousing and Data Mining Question Bank by Gopiapi-292373744Nessuna valutazione finora

- Boiler Automation Using PLCDocumento91 pagineBoiler Automation Using PLCKishor Mhaske100% (1)

- Affidavit of Citizenship-Generic BDocumento4 pagineAffidavit of Citizenship-Generic Bdsr_prophetNessuna valutazione finora

- Business Process Reengineering and Performance Improvement in The BankDocumento12 pagineBusiness Process Reengineering and Performance Improvement in The BankYakut Rumani SultanNessuna valutazione finora

- PM and Presidential Gov'ts Differ Due to Formal Powers and AppointmentDocumento3 paginePM and Presidential Gov'ts Differ Due to Formal Powers and AppointmentNikeyNessuna valutazione finora

- MAINTENANCE AND RELIABILITY ENGINEERING - Lecture 1Documento24 pagineMAINTENANCE AND RELIABILITY ENGINEERING - Lecture 1K ULAGANATHANNessuna valutazione finora

- Material SelectionDocumento99 pagineMaterial SelectionRaj Bindas100% (8)