Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Steel Industry Update #264

Caricato da

Michael LockerCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Steel Industry Update #264

Caricato da

Michael LockerCopyright:

Formati disponibili

Steel Industry Update/264

July 2011

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

Tel: 212-962-2980

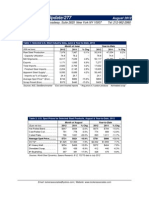

Table 1: Selected U.S. Steel Industry Data, May & Year-to-Date, 2011

Month of May

2011

2010

7,872

8,007

(000 net tons)

Raw Steel Production ...............

% Chg

-1.7%

2011

39,067

Year-to-Date

2010

37,267

% Chg

4.8%

Capacity Utilization .................

72.7

74.8

--

74.1

71.4

--

Mill Shipments ..........................

7,380

7,345

0.5%

37,141

34,941

6.3%

Exports .....................................

1,144

1,055

8.4%

5,313

5,174

2.7%

Total Imports.............................

2,964

2,293

29.3%

11,940

9,671

23.5%

Finished Steel Imports ............

2,011

1,789

12.4%

8,947

7,625

17.3%

Apparent Steel Supply*.............

8,247

8,079

2.1%

40,774

37,392

9.0%

Imports as % of Supply* .........

24.4

22.1

--

21.9

20.4

--

Average Spot Price** ($/ton) ......

$939

$770

22.0%

$923

$717

28.7%

Scrap Price# ($/gross ton) ..........

$427

$343

24.5%

$440

$351

25.2%

Sources: AISI, SteelBenchmarker

*Excl semi-finished imports

**Avg price of 4 carbon products

#shredded scrap

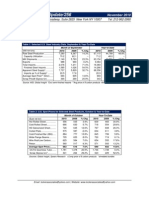

Table 2: U.S. Spot Prices for Selected Steel Products, July & Year-to-Date, 2011

Hot Rolled Band....

Cold Rolled Coil.......

Coiled Plate..................

Month of July

2011

2010

% Chg

735

578

27.2%

826

691

19.5%

1,033

795

29.9%

2011

812

905

1,010

Average Spot Price....

$865

$688

25.7%

$909

$716

27.0%

#1 Heavy Melt...

Shredded...

#1 Busheling.

401

443

483

279

309

394

43.7%

43.4%

22.6%

403

440

474

309

340

415

30.3%

29.3%

14.2%

($ per net ton)

Year-to-Date

2010

638

744

765

Sources: World Steel Dynamics SteelBenchmarker, July 2011

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

% Chg

27.3%

21.6%

32.0%

Steel Industry Update/264

Table 3: World Crude Steel Production, May & Year-to-Date, 2011

Month of May

Year-to-Date

(000 metric tons)

Region

2011

2010

% Chg

2011

2010

European Union.

16,317

16,534

-1.3%

77,609

74,645

Other Europe.

3,119

2,742

13.7%

14,987

12,084

% Chg

4.0%

24.0%

C.I.S.

9,635

9,553

0.9%

47,278

44,806

5.5%

North America

10,078

9,918

1.6%

49,047

46,726

5.0%

South America...

4,495

3,664

22.7%

20,363

17,519

16.2%

Africa...

1,178

1,470

-19.9%

5,755

7,016

-18.0%

Middle East.

1,711

1,650

3.7%

8,694

8,007

8.6%

Asia..

82,694

78,421

5.4%

402,421

372,936

7.9%

Oceania......

638

687

-7.1%

3,437

3,286

4.6%

Total

129,865

124,639

4.2%

629,591

587,026

7.3%

China.......

Japan...

60,245

9,047

55,877

9,724

7.8%

-7.0%

290,345

45,184

267,491

45,221

8.5%

-0.1%

United States..

7,273

7,264

0.1%

35,572

33,808

5.2%

India(e).

5,876

5,860

0.3%

29,610

28,440

4.1%

Russia(e).

5,856

5,192

12.8%

28,201

23,828

18.4%

Country

South Korea....

5,765

5,937

-2.9%

28,837

27,447

5.1%

Germany..

4,116

4,073

1.1%

19,317

18,888

2.3%

Ukraine(e)....

3,165

2,906

8.9%

15,023

14,168

6.0%

Brazil (e).

3,276

2,856

14.7%

14,753

13,530

9.0%

Turkey..

2,850

2,536

12.4%

13,543

11,006

23.0%

All Others....

22,396

22,414

-0.1%

109,206

103,199

5.8%

Source: World Steel Association, 7/11; e=estimate

Graph 1: World Crude Steel Production

Source: World Steel Association, 7/11; in million metric tons

-2-

Steel Industry Update/264

Graph 2: World Steel Capacity Utilization Ratio

Source: World Steel Association, 7/11

Table 4: Global Steel Output, 2010 Estimate & 2011 Forecast

Region

EU 27

Other Europe

2010e

172.7

2011f

180.0

% Chg

4.2%

33.6

38.5

14.6%

CIS

108.2

113.5

4.9%

NAFTA

111.4

117.9

5.8%

South America

43.9

51.1

16.6%

Africa

16.6

14.5

-12.8%

20.6

22.8

10.8%

672.0

728.0

8.3%

Middle East

MEPS(e) - China

China

626.7

Japan

109.6

110.0

0.4%

Other Asia

166.3

183.4

10.3%

Oceania

MEPS Total

Total

8.1

8.3

1.9%

1,463.0

1,568.0

7.2%

1,417.7*

1,568.0

10.6%

Source: MEPS, 7/13/11; e=estimate, f=forecast

Steel Industry Update (ISSN 1063-4339) published 12 times/year by Locker Associates, Inc. Copyright 2011 by Locker Associates, Inc. All

rights reserved. Reproduction in any form forbidden w/o permission. Locker Associates, Inc., 225 Broadway Suite 2625 New York NY 10007.

-3-

Steel Industry Update/264

Table 5: US Steel Industry Imports, YTD 2011

YTD 2011

838

YTD 2010

584

% Chg

43.5%

EU

1,733

1,677

3.3%

Canada

2,553

2,993

-14.7%

Brazil

1,111

269

313.0%

Korea

1,165

736

58.2%

Mexico

1,402

1,282

9.4%

Russia

493

549

-10.2%

China

392

295

32.9%

Australia

386

258

49.6%

61

33

85.8%

(in mil net tons)

Japan

South Africa

Indonesia

24

200.0%

Turkey

341

255

33.9%

Ukraine

200

21

854.0%

India

317

331

-4.1%

Others

650

380

71.1%

11,667

9,671

20.6%

Total

Source: AIIS, 6/26/11; Year-to-Date is May, 2011

Table 6: US Steel Industry Exports, YTD 2011

(in tonnes)

Canada

YTD 2011

2,211,529

YTD 2010

2,445,811

% Chg

-9.6%

Mexico

978,373

811,987

20.5%

EU

182,636

131,379

39.0%

2,006

4,369

-54.1%

Russia

Turkey

14,414

9,081

58.7%

Brazil

43,945

46,550

-5.6%

Venezuela

18,097

14,570

24.2%

Ecuador

6,841

12,570

-45.6%

Argentina

5,244

6,856

-23.5%

Colombia

27,255

36,323

-25.0%

6,613

1,941

240.7%

Peru

38,413

34,485

11.4%

Chile

12,390

9,567

29.5%

Dominican Republic

65,394

150,572

-56.6%

Panama

39,903

19,799

101.5%

Other W. Hemisphere

82,223

56,576

45.3%

Africa

42,612

19,288

120.9%

Australia

12,060

12,447

-3.1%

China

64,477

38,935

65.6%

Korea

25,261

19,789

27.7%

India

49,293

65,046

-24.2%

240,139

171,159

40.3%

Trinidad & Tobago

Others

Source: AIIS, 6/26/11; Year-to-Date is May, 2011

-4-

Steel Industry Update/264

Table 7:US Exports of Ferrous Scrap by Destination, YTD 2011

(in 000 tonnes)

Canada

China

Hong Kong

India

Japan

Malaysia

Mexico

South Korea

Taiwan

Thailand

Turkey

Others

Totals

May

148

362

10

140

86

72

22

337

323

75

660

346

2,580

2011

April

149

427

13

81

11

176

30

445

312

119

361

130

2,254

March

159

364

17

49

43

118

61

281

236

109

318

135

1,889

Year-to-Date

2010

596

1,202

39

426

83

405

296

1,408

903

239

1,528

813

7,939

% Chg

17.0%

45.0%

40.5%

-23.0%

83.3%

15.9%

-17.8%

5.2%

48.3%

83.8%

27.2%

18.3%

24.1%

Year-to-Date

2011

2010

464

373

53

26

220

216

206

152

8

13

3,141

2,060

402

384

438

319

82

80

3,314

2,864

245

342

41

40

1,241

1,071

9,854

7,939

% Chg

24.3%

103.1%

1.6%

35.5%

-33.3%

52.5%

4.7%

37.5%

3.2%

15.7%

-28.4%

0.7%

15.9%

24.1%

2011

697

1,743

55

328

152

470

244

1,482

1,339

439

1,944

961

9,854

Source: American Metal Market, 7/15/11

Table 8: US Exports of Ferrous Scrap by Grade, YTD 2011

(in 000 tonnes)

Alloys

Borings

Cast Iron

No. 1 Bundles

No. 2 Bundles

No. 1 Heavy

No. 2 Heavy

Plate/Structural

Shavings

Shredded

Stainless

Tinned

Unspecified

Totals

May

97

9

47

45

2

880

115

77

16

939

59

10

285

2,580

2011

April

108

14

48

55

3

761

115

130

21

602

45

11

340

2,254

Source: American Metal Market, 7/15/11

-5-

March

107

13

45

38

2

555

70

110

19

669

54

7

198

1,889

Steel Industry Update/264

Table 9: World Trade in Ferrous Scrap, 2009 & 2010

Exports

Country

Imports

2009

2010

2009

2010

Austria

Belgium-Luxembourg

1.7

3.4

1.0

3.8

1.7

5.5

1.0

7.0

Bulgaria

0.5

0.9

0.2

0.7

Czech Republic

1.4

1.8

0.4

0.6

Germany

7.3

9.2

3.9

5.6

Finland

0.3

0.2

0.5

0.8

France

5.1

6.7

2.4

2.8

Greece

0.0

0.1

1.2

1.0

Italy

0.3

0.4

3.3

4.8

Netherlands

4.3

5.1

1.9

2.1

Poland

0.9

1.3

0.6

0.5

Slovak Republic

0.3

0.5

0.2

0.3

Spain

0.3

0.3

4.6

5.7

Sweden

1.4

1.3

0.2

0.5

United Kingdom

6.0

7.5

0.2

2.0

Other EU

6.3

7.9

1.3

4.8

European Union (27)

39.6

47.9

28.0

40.3

Turkey

Others

0.1

1.4

0.1

2.4

15.7

0.8

19.2

1.7

Other Europe

1.5

2.5

16.4

20.9

Belarus

Kazakhstan

0.0

0.9

0.0

0.8

1.3

0.0

1.6

0.2

Russia

1.2

2.4

0.0

1.1

Ukraine

0.9

0.7

0.0

0.3

Other CIS

0.4

0.6

0.5

0.4

CIS

0.4

0.6

0.5

0.4

Canada

Mexico

4.8

0.7

5.2

1.0

1.4

0.9

4.0

1.1

United States

22.4

20.6

3.0

10.5

NAFTA

27.9

26.7

5.3

15.6

0.1

0.3

0.1

0.5

0.0

0.2

0.2

0.5

Brazil

Other Central & S. America

Central & South America

0.4

0.6

0.2

0.7

South Africa

Other Africa

1.1

2.0

1.2

2.7

0.0

1.6

0.9

3.8

Africa

3.2

3.9

1.6

4.7

Middle East

0.3

0.4

0.0

0.0

China

Japan

0.0

9.4

0.4

6.5

13.7

0.2

5.9

0.5

South Korea

0.5

0.5

7.8

8.1

Taiwan, China

0.2

0.1

3.9

5.4

Other Asia

1.4

1.8

4.7

4.1

11.5

9.2

30.3

24.0

2.2

2.0

0.0

1.3

87.8

94.8

82.5

107.9

Asia

Australia & New Zealand

World

Source: Worldsteel Associations World Steel in Figures 2011; in million metric tons

-6-

Steel Industry Update/264

Table 10: World Apparent Steel Use, 2004-2010

Country

Austria

Belgium-Luxembourg

Czech Republic

2004

3.3

4.8

2005

3.5

4.6

2006

4.1

5.5

2007

4.1

5.6

2008

4.0

5.4

2009

3.2

3.8

2010

3.7

4.5

5.2

5.2

6.0

6.6

6.5

4.5

5.5

France

16.7

14.8

16.2

16.6

15.3

10.9

12.8

Germany

36.3

35.3

39.2

42.7

42.4

28.2

36.3

Italy

33.2

31.6

36.4

35.9

33.3

20.1

25.5

3.5

3.6

3.5

4.1

4.3

2.9

3.3

9.7

Netherlands

Poland

8.5

8.4

10.7

12.1

11.5

8.2

Romania

3.3

3.5

4.2

5.1

4.8

2.8

2.9

21.1

20.9

23.6

24.5

18.0

11.9

13.1

Spain

Sweden

United Kingdom

Other EU (27)

4.0

4.1

4.5

4.9

4.3

2.9

4.1

13.2

11.4

12.9

12.8

11.8

7.0

8.8

19.5

18.6

21.7

23.0

20.9

13.1

14.6

172.4

165.5

188.4

198.0

182.6

119.5

144.8

Turkey

Others

15.2

6.2

18.4

6.4

21.2

7.5

23.8

7.9

21.5

7.4

18.0

5.9

23.6

6.0

Other Europe

21.4

24.8

28.7

31.6

28.9

23.9

29.6

Russia

Ukraine

26.3

5.8

29.3

5.6

34.9

6.6

40.4

8.1

35.4

6.9

24.9

4.0

35.7

5.5

European Union (27)

Other CIS

6.1

6.7

7.3

7.9

7.8

7.2

7.3

CIS

38.1

41.5

48.9

56.3

50.0

36.1

48.5

Canada

Mexico

17.4

16.0

16.8

15.3

18.1

17.1

15.5

17.1

14.7

16.4

9.5

14.2

14.1

16.1

United States

117.4

105.4

119.6

108.0

98.4

59.2

80.1

NAFTA

150.8

137.5

154.9

140.6

129.5

82.9

110.3

3.6

18.3

3.7

16.8

4.5

18.5

4.6

22.1

4.8

24.0

3.2

18.6

4.6

26.6

Argentina

Brazil

Venezuela

2.4

2.4

3.2

3.6

3.4

2.7

2.3

Others

9.0

9.3

10.9

11.0

11.9

9.1

12.3

Central and S America

33.3

32.3

37.2

41.3

44.2

33.6

45.8

Egypt

South Africa

3.8

4.9

5.0

4.7

4.6

6.0

5.5

6.0

6.5

6.1

9.4

4.5

8.6

5.0

Other Africa

8.9

10.0

10.0

10.5

11.6

13.0

12.3

Africa

17.7

19.6

20.6

22.0

24.3

26.8

25.9

Iran

Other Middle East

14.5

17.6

15.6

20.3

14.6

23.0

19.1

25.1

14.9

30.8

17.2

25.1

17.1

28.1

Middle East

32.1

35.9

37.7

44.2

45.7

42.2

45.3

China

India

275.8

35.3

347.5

39.9

377.7

45.6

422.5

51.5

434.7

51.4

548.1

55.3

576.0

60.6

Japan

76.8

76.7

79.0

81.2

77.9

52.8

63.8

South Korea

47.2

47.1

50.2

55.2

58.6

45.4

52.4

Taiwan, China

22.1

19.9

19.8

18.1

16.9

11.3

17.8

Other Asia

45.8

48.4

45.4

52.8

52.7

50.3

55.6

503.0

579.6

617.6

681.3

692.2

763.2

826.1

8.0

7.9

7.9

8.4

8.5

6.1

7.5

976.7

1,044.7

1,141.9

1,223.7

1,205.9

1,134.2

1,283.6

Asia

Australia & New Zealand

World

Source: Worldsteel Associations World Steel in Figures 2011; in million metric tons of finished steel products

-7-

Steel Industry Update/264

Source: Midrex World Direct Reduction Statistics, 2010

Source: Midrex World Direct Reduction Statistics, 2010

-8-

Steel Industry Update/264

Locker Associates Steel Track: Spot Prices

U.S. Flat-Rolled Prices

U.S. Scrap Prices

($ per ton)

($ per ton)

500

1100

#1 Busheling

Plate

1000

450

900

400

800

Shredded Scrap

350

Rebar

CR Coil

700

#1 Heavy Melt

300

600

HR Band

250

500

200

400

'06 '07 '08 '09 1q 2q

S O

N D

M A M

'07 '08 '09 1q 2q

Locker Associates Steel Track: Performance

U.S. Raw Steel Production

10.0

(mil net tons)

9.0

2011

80%

7.0

70%

6.0

60%

5.0

50%

4.0

40%

2010

90%

8.0

3.0

U.S. Capacity Utilization

100%

2011

2010

30%

2011 7.9 7.4 8.1 7.8 7.9

2011 73% 75% 75% 74% 73%

2010 6.9 6.9 7.8 7.7

2010 64% 71% 73% 74% 75%

Steel Mill Products: US Imports, May & Year-to-Date

Imports: Country of Origin

(000 net tons)

Canada..

Mexico

Other W. Hemisphere..

European Union

Other Europe*..

Asia.

Oceania.

Africa..

Total

Imports: Customs District

Atlantic Coast

Gulf Coast/Mexican Border

Pacific Coast.

Gr Lakes/Canadian Border.

Off Shore

Month of May

2011

2010

% Chg

591

591

0.0%

286

233

22.7%

406

107

279.4%

483

430

12.3%

369

253

45.8%

720

603

19.4%

98

63

55.6%

11

14

-21.4%

2,964

2,294

29.2%

456

1,167

589

726

25

386

802

368

727

10

Source: AISI; *includes Russia

Update #264

-9-

18.1%

45.5%

60.1%

-0.1%

150.0%

Year-to-Date

2011

2010

% Chg

2,582

2,993

-13.7%

1,404

1,282

9.5%

1,251

356

251.4%

1,830

1,677

9.1%

1,131

846

33.7%

3,227

2,190

47.4%

447

292

53.1%

69

34

102.9%

11,940

9,671

23.5%

1,562

5,003

2,360

2,918

97

1,400

3,130

1,714

3,332

95

11.6%

59.8%

37.7%

-12.4%

2.1%

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the

competitiveness of businesses and industries on behalf of unions, corporate and government

clients. By combining expert business and financial analysis with a sensitivity to labor issues,

the firm is uniquely qualified to help clients manage change by:

leading joint labor/management business improvement initiatives;

facilitating ownership transitions to secure the long-term viability of a business;

conducting strategic industry studies to identify future challenges and opportunities;

representing unions in strategic planning, workplace reorganization and bankruptcy

formulating business plans for turnaround situations; and

performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing,

transportation, distribution and mining industries. Typical projects involve in-depth analysis of a

firms market, financial and operating performance on behalf of a cooperative labormanagement effort. Locker Associates also produces a widely read monthly newsletter, Steel

Industry Update that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers

Bank of Boston

Congress Financial

Santander Investment Securities

AEIF-IAM/AK Steel Middletown

Prudential Securities

US Steel Joint Labor-Mgmt Comm

LTV Steel Joint Labor-Mgmt Committee

Intl Union of Electrical Workers

Bethlehem Joint Labor-Mgmt Comm

Inland Steel Joint Labor-Mgmt Comm

Northwestern Steel and Wire

Boilermakers

American Federation of Musicians

USS/KOBE

Sysco Food Services of San Francisco

International Brotherhood of Teamsters

Development Bank of South Africa

J&L Structural Steel

Air Line Pilots Association/Delta Air Lines MEC

Sharpsville Quality Products

IPSCO

International Association of Machinists

CSEA/AFSCME

United Auto Workers

Service Employees International Union

American Fed of Television & Radio Artists

Supervalu

United Mine Workers

Algoma Steel

North American Refractories

UNITE/HERE

AFL-CIO George Meany Center

Watermill Ventures

Wheeling-Pittsburgh Steel

Canadian Steel Trade & Employment Congress

Minn Gov's Task Force on Mining

Special Metals

RECENT PROJECTS

Business Plan for High-Tech Startup (2009-present): drafted detailed business plan to

raise capital and promote a new hydrogen battery technology

IBT-Supervalu (2010): assist union and management to identify major operational problems

impacting warehouse performance and provide recommendations for joint improvement

Institute of Scrap Recycling Industries (2010): presented a status report on the U.S. steel

market before the Institute of Scrap Recycling Industries Commodities roundtable

Save the World Air-Marketing (2009-present): developed a marketing plan to help drive

sales of a green technology product, ELEKTRA, an electronic fuel device for trucks that

increases fuel economy (mpg's), reduces exhaust emissions and improves engine performance

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Potrebbero piacerti anche

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Steel Industry Update #278Documento9 pagineSteel Industry Update #278Michael LockerNessuna valutazione finora

- Steel Industry Update 283Documento9 pagineSteel Industry Update 283Michael LockerNessuna valutazione finora

- Steel Industry Update #282Documento9 pagineSteel Industry Update #282Michael LockerNessuna valutazione finora

- CWA-CVC Investor Briefing Presentation 4-15-13Documento20 pagineCWA-CVC Investor Briefing Presentation 4-15-13Michael LockerNessuna valutazione finora

- Steel Industry Update #281Documento6 pagineSteel Industry Update #281Michael LockerNessuna valutazione finora

- Steel Industry Update #276Documento7 pagineSteel Industry Update #276Michael LockerNessuna valutazione finora

- Steel Industry Update #279Documento8 pagineSteel Industry Update #279Michael LockerNessuna valutazione finora

- Steel Industry Update #280Documento10 pagineSteel Industry Update #280Michael LockerNessuna valutazione finora

- Steel Industry Update #277Documento9 pagineSteel Industry Update #277Michael LockerNessuna valutazione finora

- Steel Industry Update #268Documento13 pagineSteel Industry Update #268Michael LockerNessuna valutazione finora

- Steel Industry Update #275Documento9 pagineSteel Industry Update #275Michael LockerNessuna valutazione finora

- Steel Industry Update #274Documento8 pagineSteel Industry Update #274Michael LockerNessuna valutazione finora

- Steel Industry Update #273Documento8 pagineSteel Industry Update #273Michael LockerNessuna valutazione finora

- Steel Industry Update #272Documento7 pagineSteel Industry Update #272Michael LockerNessuna valutazione finora

- Steel Industry Update #270Documento9 pagineSteel Industry Update #270Michael LockerNessuna valutazione finora

- Steel Industry Update #271Documento9 pagineSteel Industry Update #271Michael LockerNessuna valutazione finora

- Steel Industry Update #269Documento8 pagineSteel Industry Update #269Michael LockerNessuna valutazione finora

- Steel Industry Update #260Documento6 pagineSteel Industry Update #260Michael LockerNessuna valutazione finora

- Steel Industry Update #267Documento9 pagineSteel Industry Update #267Michael LockerNessuna valutazione finora

- Locker RPA Transcript 6-9-11Documento2 pagineLocker RPA Transcript 6-9-11Michael LockerNessuna valutazione finora

- Steel Industry Update #265Documento7 pagineSteel Industry Update #265Michael LockerNessuna valutazione finora

- Steel Industry Update #266Documento8 pagineSteel Industry Update #266Michael LockerNessuna valutazione finora

- Steel Industry Update #261Documento8 pagineSteel Industry Update #261Michael LockerNessuna valutazione finora

- Steel Industry Update #263Documento10 pagineSteel Industry Update #263Michael LockerNessuna valutazione finora

- Steel Industry Update #259Documento10 pagineSteel Industry Update #259Michael LockerNessuna valutazione finora

- Steel Industry Update #262Documento7 pagineSteel Industry Update #262Michael LockerNessuna valutazione finora

- Steel Industry Update #258Documento8 pagineSteel Industry Update #258Michael LockerNessuna valutazione finora

- Steel Industry Update #257Documento8 pagineSteel Industry Update #257Michael LockerNessuna valutazione finora

- Steel Industry Update #256Documento11 pagineSteel Industry Update #256Michael LockerNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Analyze The Development of Kazakh Socio-Political Thought in The Early Twentieth CenturyDocumento23 pagineAnalyze The Development of Kazakh Socio-Political Thought in The Early Twentieth CenturyZulfi AnnurNessuna valutazione finora

- JBCPLDocumento32 pagineJBCPLanujagrajNessuna valutazione finora

- Russia and CIS Wind Energy Report - PWDocumento155 pagineRussia and CIS Wind Energy Report - PWHakan BilgehanNessuna valutazione finora

- Glosario MultilingüeDocumento181 pagineGlosario MultilingüeFernando Plans100% (1)

- The South Caucasus Between Integration and FragmentationDocumento110 pagineThe South Caucasus Between Integration and FragmentationGIPNessuna valutazione finora

- M2 Post-Task Regional Economic IntegrationDocumento10 pagineM2 Post-Task Regional Economic IntegrationJean SantosNessuna valutazione finora

- Education Equity Now!: Summary BrochureDocumento36 pagineEducation Equity Now!: Summary Brochureelenamarin1987Nessuna valutazione finora

- The Commonwealth of Independent StatesDocumento3 pagineThe Commonwealth of Independent StatesБегимай Нурланбекова МНКОNessuna valutazione finora

- National Agency on Holding and Preparation of Euro 2012 investment projectsDocumento200 pagineNational Agency on Holding and Preparation of Euro 2012 investment projectsAndrey KlitsunovNessuna valutazione finora

- Tajikistan Strengthens Ties with Kuwait and KazakhstanDocumento6 pagineTajikistan Strengthens Ties with Kuwait and KazakhstanParvinaNessuna valutazione finora

- Geccon ReviewDocumento33 pagineGeccon ReviewCailah MarieNessuna valutazione finora

- Cis CountriesDocumento19 pagineCis CountriesMucharla Praveen KumarNessuna valutazione finora

- Evaluation of Regional Environmental Centers in Caucasus, Moldova, Russia and Central AsiaDocumento156 pagineEvaluation of Regional Environmental Centers in Caucasus, Moldova, Russia and Central AsiaIna CoseruNessuna valutazione finora

- Visio-Configuration Management 2.1.1Documento1 paginaVisio-Configuration Management 2.1.1Manish TomarNessuna valutazione finora

- Eurasia DrillingDocumento178 pagineEurasia DrillingdhoomketuNessuna valutazione finora

- UKRAINIAN FOOD AT ANUGA 2017Documento13 pagineUKRAINIAN FOOD AT ANUGA 2017Anna BondarchukNessuna valutazione finora

- Eu EnlargementDocumento62 pagineEu EnlargementNeculai CatanaNessuna valutazione finora

- EUR Doc 001 - EANPG Handbook (En) - Edition 1, Amd 1Documento66 pagineEUR Doc 001 - EANPG Handbook (En) - Edition 1, Amd 1बासुदेव अर्यालNessuna valutazione finora

- Glossary of Political GeographyDocumento144 pagineGlossary of Political GeographyAngelo AlbanNessuna valutazione finora

- Annual Report Highlights Bank of Zambia's Role in 2011 Economic GrowthDocumento146 pagineAnnual Report Highlights Bank of Zambia's Role in 2011 Economic GrowthSamNessuna valutazione finora

- Chapter 10 Europe, Africa and The Middle EastDocumento45 pagineChapter 10 Europe, Africa and The Middle EastDonald Picauly100% (1)

- ImfDocumento208 pagineImfBhami IlyasNessuna valutazione finora

- 1409 Grand StrategyDocumento207 pagine1409 Grand StrategyLa Cruna Dell'ago100% (1)

- TurkmenistanDocumento136 pagineTurkmenistanSembei NorimakiNessuna valutazione finora

- Identities and Foreign Policies in Russia, Ukraine and BelarusDocumento356 pagineIdentities and Foreign Policies in Russia, Ukraine and BelarusMarina DiaconescuNessuna valutazione finora

- Tsygankov-Russia's Foreign Policy (2015) PDFDocumento336 pagineTsygankov-Russia's Foreign Policy (2015) PDFDaniel Marin100% (2)

- International-Organisation List NotesDocumento62 pagineInternational-Organisation List NotesVINOD KUMARNessuna valutazione finora

- 2.end of BipolarityDocumento8 pagine2.end of Bipolaritygunjan sahotaNessuna valutazione finora

- The End of BipolarityDocumento6 pagineThe End of BipolarityRamita Udayashankar74% (23)

- LeaDocumento86 pagineLeaPatrick Marz Avelin33% (3)