Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Economic Fact Book Greece: Key Facts

Caricato da

level3assetsDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Economic Fact Book Greece: Key Facts

Caricato da

level3assetsCopyright:

Formati disponibili

Investment Research General Market Conditions

05 October 2011

Economic Fact Book Greece

Following the 2009 general elections it became clear that the statistics on Greek government debt and deficit were flawed (as was also the case when Greece joined the euro area) and the financial markets started to lose confidence in Greece. In early-May 2010 Greece received a EUR110bn rescue package from the EU and the IMF. However, the situation has not improved sufficiently and euro area leaders have endorsed a second bailout. Nevertheless the sixth aid transfer for Greece is currently being delayed, which makes the EU able to keep high reform pressure on Greece, but it also implies continued uncertainty about Greeces fiscal sustainability. Another contributor to uncertainty is a revision of the private sector involvement (PSI) agreement reached in July. Greece is not able to meet its fiscal targets and the government deficit is expected to be 8.5% of GDP in 2011. This implies that a difficult restructuring of government debt is a risk in the shorter term and seems likely in the longer term. Greece has a significant amount of reform potential. In the World Banks business report, it is ranked 109th of 183 countries in terms of how easy it is to do business. This is 100 places below Ireland. Greece scores poorly on the ease of starting a business, registering property and protecting investors. Corruption is another area where there is room for improvement. Transparency Internationals Corruption Perception Index ranks Greece 78th out of 178 countries, putting it on a level with Colombia, Peru and China. The tax collection system is inefficient and has caused all kinds of anecdotes about tax evasion and a large scale black economy. Similarly the social benefit system is flawed. Strikes and protests are common in Greece. Recently protests reflecting disagreement with the harsh but necessary austerity measures have drawn much media attention. Anger is partly directed toward the EU and the IMF, but even more so there is dissatisfaction with the distributional consequences of both implemented and planned measures. Prior to the debt crisis wages grew notably more than productivity and as a result the economy became increasingly uncompetitive. An expanding public sector added to the problem. As a result the trade deficit widened to as much as 20% of GDP in 2008. Exports only amount to a small share of the economy and Greece consequently benefits less from the global recovery than, for example, the very export-oriented Irish economy.

Key facts

Population:10.8m ( 2010). GDP per capita: EUR20,575 12th highest in euro area (2010). Government type: Parliamentary Republic. President: Karolos Papoulias. Majority coalition led by PASOK. Prime Minister: Giorgos (George) A. Papandreou. Next general elections: 2013. Central Bank Governor: Georgios Provopoulos.

Economic characteristics

Unsustainable fiscal situation. Large trade and current account deficits. Uncompetitive economy with much red tape and many protected professions. Fiscal tightening causing the economy to shrink. Inefficient tax collection system.

Outlook for key economic variables

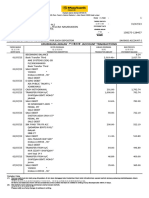

Greece IMF OECD EU (Commission) GDP (1) CPI (1) Unemployment (2) Govt. Budget (3) Govt. Debt (3) 2011 16.5 16.0 15.2 2012 18.5 16.4 15.3 2011 -8.0 -7.5 -9.5 2012 -6.9 -6.5 -9.3 2011 2012

2011 2012 2011 2012 -5.0 -2.9 -3.5 -2.0 0.6 1.1 2.9 2.9 2.4 1.0 0.7 0.5

Senior Economist Frank land Hansen +45 4512 8526 franh@danskebank.dk Analyst Anders Mller Lumholtz +45 4512 8498 andjrg@danskebank.dk Assistant Analyst Pernille Bomholdt Nielsen +45 4512 8229 pernni@danskebank.dk

165.6 189.1 157.1 159.3 n.a. n.a.

1) % y/y. 2) % of labour force. 3) % of GDP.

Sources: OECD, IMF, European Commission, Danske Markets.

Important disclosures and certifications are contained from page 7 of this report. www.danskeresearch.com

/ Economic Fact Book Greece

Key macroeconomic indicators

Structural indicators

Greece versus the euro area (EMU)

When Greece EMU

GDP(1) Public sector (2) Private cons (2) Investments (2) Exports (2) C/A (2) - 12M av. Unemployment (3) Household loans (2) Q2-11 2010 Q2-11 Q2-11 Q2-11 Q2-11 Jun-11 2010 0.2 49.8 77.4 12.5 24.5 -10.4 16.3 60.0 0.2 GDP per capita (5)

When Greece

2010

EMU

Sovereign ratings

CC Ca CCC

20,575 27,799 S&P 2.9% 2.5 -4.3 87.9 4.2 18.9 Moody's Fitch

50.9 Economic size in EMU (4) 57.7 Inflation - HICP (8) 19.9 Public budget (2) EC fcst 43.7 Public debt (2) EC fcst -0.4 Long-term interest rates 10.0 Manufacturing sector (2,7) 65.0 Aug-11 2011 2011 Aug-11 Q2-11

1.4 -9.5 157.7 15.9 n.a.

Sovereign bond spreads

2Y spread (6) 4442.8

10Y spread (6) 1582.24

1: % q/q, 2: Pct of GDP , 3: % of labour force, 4: based on ECB capital key ratios, 5: EUR per capita, 6: sov spread vs.Germany, bp, 3M av, 7: Weighted average of Germany France, Italy and Spain, 8: % y/y

Sources: Reuters EcoWin and Danske Markets

Public finances

Budget deficit remains elevated

0.0 % of GDP -2.5 -5.0 -7.5 -10.0 General Govt budget, EC forecast -12.5 -15.0 -17.5 00 02 04 06 Euro area 0.0 -2.5 -5.0 -7.5 -10.0 Greece -12.5 -15.0 -17.5 08 10 12

Budget gap

55.0 % of GDP 52.5 Government budget, 50.0 1-year MA 47.5 45.0 42.5 40.0 37.5 35.0 00 01 02 03 04 05 06 07 08 09 10 Revenue Expenditure 55.0 52.5 50.0 47.5 45.0 42.5 40.0 37.5 35.0

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

Sharply increasing government debt

170 160 % of GDP 150 General Govt debt, 140 EC forecast 130 120 110 100 90 80 70 60 00 02 04 06 % of GDP Greece 170 160 150 140 130 120 110 100 90 80 70 60

Government bond spreads

80 pp 70 60 Government bonds spread 2 year to Germany, 20-day MA 50 40 30 20 10 year 10 0 -10 05 06 07 08 09 10 11 80 70 60 50 40 30 20 10 0 -10

Euro area

08

10

12

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

2|

05 October 2011

www.danskeresearch.com

/ Economic Fact Book Greece

National Account

The economy shrinks

140 Index, 2000=100 135 Greece 130 GDP in constant prices 125 120 115 110 Euro area 105 100 95 00 01 02 03 04 05 06 07 08 09 10 140 135 130 125 120 115 110 105 100 95

A large drop in consumption

140 Index, 2000=100 135 Private consumption, 130 constant prices 125 120 115 110 105 100 00 01 02 03 04 05 06 07 08 09 10 Euro area 140 135 Greece 130 125 120 115 110 105 100

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

A large output gap

2.5 % of GDP 0.0 -2.5 -5.0 -7.5 Output gap -10.0 -12.5 00 Greece 02 04 06 08 10 12 -10.0 -12.5 USA Eurozone OECD total 2.5 0.0 -2.5 -5.0 -7.5

Declining investments

130 Index, 2000=100 120 110 100 90 80 70 60 00 01 02 03 04 05 06 07 08 09 10 Gross capital formation, constant prices Greece Euro area 130 120 110 100 90 80 70 60

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

Export and trade

Current account deficit

2.5 0.0 -2.5 -5.0 -7.5 -10.0 -12.5 -15.0 -17.5 00 02 04 06 08 10 12 % of GDP Euro area, Ecofin forecast Current account, SA Greece, Ecofin forecast 2.5 0.0 -2.5 -5.0 -7.5 -10.0 -12.5 -15.0 -17.5

Exports by commodity

650 EUR bn, per month 600 Exports by commodity, 550 SA, 3-months MA Manufactured 500 goods 450 400 350 Food products 300 250 Chemicals 200 150 Machinery 100 05 06 07 08 09 10 11 650 600 550 500 450 400 350 300 250 200 150 100

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

Not a very export-oriented economy

45 % of GDP 40 35 30 25 20 15 00 01 02 03 04 05 06 07 08 09 10 Euro area Greece Exports as a share of GDP 45 40 35 30 25 20 15

Export growth

25 y/y % Exports, SA 20 15 10 5 0 -5 Euro area -10 -15 Greece -20 -25 00 01 02 03 04 05 06 07 08 09 10 25 20 15 10 5 0 -5 -10 -15 -20 -25

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

3|

05 October 2011

www.danskeresearch.com

/ Economic Fact Book Greece

Industry

Industrial production and orders

110 Index, 2007=100 105 100 95 Production 90 85 80 Manufacturing, 75 SA, 3-month MA New orders 70 65 05 06 07 08 09 10 11 110 105 100 95 90 85 80 75 70 65

Capital goods looking particularly weak

120 Index, 2005=100 110 100 90 80 70 60 50 40 05 06 07 Industrial activity, SA, 3-month MA Consumer goods, durable Capital goods 08 09 10 11 Intermediate goods 120

Consumer goods, non-durable

110 100 90 80 70 60 50 40

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

Leading indicators

Consumers remain pessimistic

30 Diffusion index 20 10 Consumer index, SA 0 Expectations -10 -20 -30 -40 -50 -60 Confidence -70 -80 00 01 02 03 04 05 06 07 08 09 10 30 20 10 0 -10 -20 -30 -40 -50 -60 -70 -80

Low capacity utilisation

90.0 87.5 85.0 82.5 80.0 77.5 75.0 72.5 70.0 67.5 65.0 62.5 % Capacity utilisation, manufacturing sector, s.a. Euro area 90.0 87.5 85.0 82.5 80.0 77.5 75.0 72.5 70.0 67.5 65.0 62.5

Greece 00 01 02 03 04 05 06 07 08 09 10

Sources: Reuters EcoWin and Danske Markets

Sources: OECD

Low manufacturing sector confidence

65 60 55 50 45 40 35 30 00 PMI, Manufacturing, SA Greece Diffusion index 65 Euro area 60 55 50 45 40 35 30 02 04 06 08 10 12

Low service sector confidence

70 Difusion index 60 Business climate 50 Business survey, 40 services 30 20 10 0 -10 -20 -30 Confidence indicator -40 00 01 02 03 04 05 06 07 08 09 10 70 60 50 40 30 20 10 0 -10 -20 -30 -40

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

4|

05 October 2011

www.danskeresearch.com

/ Economic Fact Book Greece

Construction and the housing market

Construction sector has adjusted

8.5 % of GDP Construction sector 8.0 as share of GDP, SA 7.5 7.0 Euro area 6.5 6.0 5.5 5.0 4.5 Greece 4.0 00 01 02 03 04 05 06 07 08 09 10 8.5 8.0 7.5 7.0 6.5 6.0 5.5 5.0 4.5 4.0

House prices decline

200 175 150 125 100 75 50 98 00 02 04 06 08 10 Index, 2000=100 Dwelling prices Athens 200 175 150 125 100 75 50

Other urban areas

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

5|

05 October 2011

www.danskeresearch.com

/ Economic Fact Book Greece

Labour market and demographics

Unemployment has tripled

15 14 13 12 11 10 9 8 7 94 96 98 00 02 04 06 08 10 Euro area % Unemployment rate, SA Greece 15 14 13 12 11 10 9 8 7 102.5 100.0 00 102.5 100.0 02 04 06 08 10 110.0 107.5 105.0

Employment is declining

115.0 112.5 Employment, SA Index, 2000=100 115.0 Greece 112.5 110.0 Euro area 107.5 105.0

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

Unit labour cost is declining

7 5 3 1 -1 -3 -5 00 Unit labour cost, growth Euro area y/y % Greece 7 5 3 1 -1 -3 -5 02 04 06 08 10 12

Population growth

10.8 Millions 10.7 10.6 10.5 10.4 10.3 10.2 10.1 10.0 90 << Total population, forecast 00 10 20 30 40 Growth in population >> % 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

Other competitiveness indicators

Real effective exchange rate

125 120 115 110 105 100 95 90 85 00 02 Greece Euro area Index, 2000=100 125 120 115 110 105 100 95 90 85 04 06 08 10

Price developments

150 Index, 2000=100 145 Greece 140 Harmonized consumer 135 prices, SA 130 125 120 Euro area 115 110 105 100 00 01 02 03 04 05 06 07 08 09 10 150 145 140 135 130 125 120 115 110 105 100

Real effective exchange rate

Sources: Reuters EcoWin and Danske Markets

Sources: Reuters EcoWin and Danske Markets

6|

05 October 2011

www.danskeresearch.com

/ Economic Fact Book Greece

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank"). The author of the research report is Frank land Hansen, Senior Analyst. Analyst certification Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analysts personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report. Regulation Danske Bank is authorized and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request. The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts rules of ethics and the recommendations of the Danish Securities Dealers Association. Conflicts of interest Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. Employees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank. Research analysts are remunerated in part based on the over-all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions. Financial models and/or methodology used in this research report Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request. Risk warning Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text. First date of publication Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments"). The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report. The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not

7|

05 October 2011

www.danskeresearch.com

/ Economic Fact Book Greece

undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report. This research report is not intended for retail customers in the United Kingdom or the United States. This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Banks prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to U.S. institutional investors. Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction. Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.

8|

05 October 2011

www.danskeresearch.com

Potrebbero piacerti anche

- Economic Fact Book: Spain: Key FactsDocumento8 pagineEconomic Fact Book: Spain: Key FactssovacapNessuna valutazione finora

- Banco Sabadell CEO Discusses Economic Outlook and Bank FundamentalsDocumento35 pagineBanco Sabadell CEO Discusses Economic Outlook and Bank FundamentalsseyviarNessuna valutazione finora

- The Global Debt ProblemDocumento3 pagineThe Global Debt Problemrichardck61Nessuna valutazione finora

- MRE121016Documento3 pagineMRE121016naudaslietas_lvNessuna valutazione finora

- What Is The Economic Outlook For OECD Countries?: Angel GurríaDocumento22 pagineWhat Is The Economic Outlook For OECD Countries?: Angel GurríaJohn RotheNessuna valutazione finora

- A Casual Observers Guide To The Greek EconomyDocumento24 pagineA Casual Observers Guide To The Greek EconomyChatzianagnostou GeorgeNessuna valutazione finora

- Barclays Capital Tuesday Credit Call 20 September 2011Documento22 pagineBarclays Capital Tuesday Credit Call 20 September 2011poitrenacNessuna valutazione finora

- The Greek Economy Under Reform: Turning The TideDocumento16 pagineThe Greek Economy Under Reform: Turning The TideNicholas VentourisNessuna valutazione finora

- Sovereign Risk and Euro Area Debt SustainabilityDocumento66 pagineSovereign Risk and Euro Area Debt SustainabilityVivian Vy LêNessuna valutazione finora

- EU Barroso PresDocumento117 pagineEU Barroso PresVlaki Lek VasdNessuna valutazione finora

- Euro Area Economic Situation and The Foundations For GrowthDocumento15 pagineEuro Area Economic Situation and The Foundations For GrowthXavier StraussNessuna valutazione finora

- How Vulnerable Is ItalyDocumento26 pagineHow Vulnerable Is ItalyCoolidgeLowNessuna valutazione finora

- 2012-03-19 Greece Is Changing Updated Mar 2012Documento64 pagine2012-03-19 Greece Is Changing Updated Mar 2012guiguichardNessuna valutazione finora

- Today's Calendar: Friday 15 November 2013Documento9 pagineToday's Calendar: Friday 15 November 2013api-239816032Nessuna valutazione finora

- 2010 June What You Get For 750bn JSDocumento7 pagine2010 June What You Get For 750bn JSmanmohan_9Nessuna valutazione finora

- Greece Country Strategy Black Sea Bank's 2011-2014 Strategy for GreeceDocumento19 pagineGreece Country Strategy Black Sea Bank's 2011-2014 Strategy for GreeceBeeHoofNessuna valutazione finora

- The Pensford Letter - 7.30.12Documento4 pagineThe Pensford Letter - 7.30.12Pensford FinancialNessuna valutazione finora

- Less Developed Giants Cannot Be Restrained From Catching Up and Overtaking The Most Developed Ones, and The "Tired" EUDocumento7 pagineLess Developed Giants Cannot Be Restrained From Catching Up and Overtaking The Most Developed Ones, and The "Tired" EUStanko RadmilovicNessuna valutazione finora

- Erste Group ResearchDocumento18 pagineErste Group ResearchCatalin CroitoruNessuna valutazione finora

- Beta SecuritiesDocumento5 pagineBeta SecuritiesZSNessuna valutazione finora

- Greek Default Drawing Closer: Morning ReportDocumento3 pagineGreek Default Drawing Closer: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Monthly: La Reforma Del Sector Servicios OUTLOOK 2012Documento76 pagineMonthly: La Reforma Del Sector Servicios OUTLOOK 2012Anonymous OY8hR2NNessuna valutazione finora

- SocGen New World OrderDocumento18 pagineSocGen New World Ordera_sarosh7050Nessuna valutazione finora

- PB 2013 03Documento8 paginePB 2013 03BruegelNessuna valutazione finora

- New Debt Solution in Place For Greece: Morning ReportDocumento3 pagineNew Debt Solution in Place For Greece: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Capital Economics European Economics Focus Euro Zone Break Up 11282011Documento13 pagineCapital Economics European Economics Focus Euro Zone Break Up 11282011Jose BescosNessuna valutazione finora

- Uk Trade StatisticsDocumento7 pagineUk Trade Statisticsapi-53255207Nessuna valutazione finora

- EUR Interest Rate Outlook - Jul11Documento4 pagineEUR Interest Rate Outlook - Jul11timurrsNessuna valutazione finora

- Unele Aspecte Ale Ajustarii Macroeconomice Din RomaniaDocumento32 pagineUnele Aspecte Ale Ajustarii Macroeconomice Din RomaniaIulia FlorescuNessuna valutazione finora

- MRE120514Documento3 pagineMRE120514naudaslietas_lvNessuna valutazione finora

- Greece Debt Crisis Impact & SolutionsDocumento42 pagineGreece Debt Crisis Impact & SolutionsAnurag AsawaNessuna valutazione finora

- Economic Update Nov201Documento12 pagineEconomic Update Nov201admin866Nessuna valutazione finora

- Ekonomika V Evropě Je Na Začátku Období Velmi Slabého Růstu (Dokument V AJ)Documento1 paginaEkonomika V Evropě Je Na Začátku Období Velmi Slabého Růstu (Dokument V AJ)Ivana LeváNessuna valutazione finora

- Comparing the economies of France and UAEDocumento16 pagineComparing the economies of France and UAEuowdubaiNessuna valutazione finora

- Inside Debt: U.S. Markets Today Chart of The DayDocumento8 pagineInside Debt: U.S. Markets Today Chart of The DaydmaximNessuna valutazione finora

- Country Report Egypt January 2021Documento43 pagineCountry Report Egypt January 2021vipul khemkaNessuna valutazione finora

- Highlights: Economy and Strategy GroupDocumento33 pagineHighlights: Economy and Strategy GroupvladvNessuna valutazione finora

- MACRO ASSIGNMENT ABAS HASSAN ALI Mid Ka Saxda AhDocumento14 pagineMACRO ASSIGNMENT ABAS HASSAN ALI Mid Ka Saxda AhCabaas XasanNessuna valutazione finora

- PHP 4 e JCIuDocumento5 paginePHP 4 e JCIufred607Nessuna valutazione finora

- Aqa Econ4 W QP Jun11Documento8 pagineAqa Econ4 W QP Jun11api-247036342Nessuna valutazione finora

- Interview For El ConfidentialDocumento9 pagineInterview For El ConfidentialsmavroNessuna valutazione finora

- Greek Debt Crisis "An Introduction To The Economic Effects of Austerity"Documento19 pagineGreek Debt Crisis "An Introduction To The Economic Effects of Austerity"Shikha ShuklaNessuna valutazione finora

- The Greece Meltdown: An Effort To Understand Its Impact On Euro Union and The WorldDocumento12 pagineThe Greece Meltdown: An Effort To Understand Its Impact On Euro Union and The WorldarpitloyaNessuna valutazione finora

- Brazil: Economic Outlook and Perspectives: Henrique de Campos MeirellesDocumento35 pagineBrazil: Economic Outlook and Perspectives: Henrique de Campos MeirellesFelisa DingNessuna valutazione finora

- International Monetary Fund: Hina Conomic UtlookDocumento10 pagineInternational Monetary Fund: Hina Conomic UtlooktoobaziNessuna valutazione finora

- Weekly Market Commentary 06012015Documento4 pagineWeekly Market Commentary 06012015dpbasicNessuna valutazione finora

- Greek Financial Crisis May 2011Documento5 pagineGreek Financial Crisis May 2011Marco Antonio RaviniNessuna valutazione finora

- Global & Macroeconomic Environment Assignment-V2Documento17 pagineGlobal & Macroeconomic Environment Assignment-V2ranjanNessuna valutazione finora

- Patience: Bad News Will Become Good News: SG Multi AssetDocumento51 paginePatience: Bad News Will Become Good News: SG Multi AssetBurj CapitalNessuna valutazione finora

- MRE121015Documento3 pagineMRE121015naudaslietas_lvNessuna valutazione finora

- House View: June 7, 2012Documento15 pagineHouse View: June 7, 2012techkasambaNessuna valutazione finora

- Mre121213 PDFDocumento3 pagineMre121213 PDFnaudaslietas_lvNessuna valutazione finora

- Daily Comment RR 06jul11Documento3 pagineDaily Comment RR 06jul11timurrsNessuna valutazione finora

- CEPS Greek MultipliersDocumento5 pagineCEPS Greek MultipliersDimitris YannopoulosNessuna valutazione finora

- Emerging Developed Markets Corporates Risk ComparisonDocumento23 pagineEmerging Developed Markets Corporates Risk Comparisonmarius2806Nessuna valutazione finora

- Austerity Measures & Euro Crisis: TeamDocumento4 pagineAusterity Measures & Euro Crisis: Teamankushkumar2000Nessuna valutazione finora

- The Greek Economy & Its Stability Programme: Written byDocumento44 pagineThe Greek Economy & Its Stability Programme: Written bypapaki2Nessuna valutazione finora

- Innovation investment in Central, Eastern and South-Eastern Europe: Building future prosperity and setting the ground for sustainable upward convergenceDa EverandInnovation investment in Central, Eastern and South-Eastern Europe: Building future prosperity and setting the ground for sustainable upward convergenceNessuna valutazione finora

- EIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeDa EverandEIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeNessuna valutazione finora

- The Reform of Europe: A Political Guide to the FutureDa EverandThe Reform of Europe: A Political Guide to the FutureValutazione: 2 su 5 stelle2/5 (1)

- Privatisation ProgrammeDocumento27 paginePrivatisation ProgrammeCostas EfimerosNessuna valutazione finora

- Endeavor Greece Entrepreneurship and Investment OpportunitiesDocumento23 pagineEndeavor Greece Entrepreneurship and Investment Opportunitieslevel3assetsNessuna valutazione finora

- GREECE Memorandum of Understanding On Specific Economic Policy ConditionalityDocumento74 pagineGREECE Memorandum of Understanding On Specific Economic Policy Conditionalitylevel3assetsNessuna valutazione finora

- CS Research WeeklyDocumento15 pagineCS Research Weeklylevel3assetsNessuna valutazione finora

- Greek Sovereign Debt Q&A: Definitions Can Be Obtained From ISDA'sDocumento4 pagineGreek Sovereign Debt Q&A: Definitions Can Be Obtained From ISDA'sGordon MoatNessuna valutazione finora

- Debt Brakes For Euroland A Progress ReportDocumento11 pagineDebt Brakes For Euroland A Progress Reportlevel3assetsNessuna valutazione finora

- CS Research MonthlyDocumento24 pagineCS Research Monthlylevel3assetsNessuna valutazione finora

- Draft EFSF Guideline On Precautionary ProgrammesDocumento5 pagineDraft EFSF Guideline On Precautionary Programmeslevel3assetsNessuna valutazione finora

- Greece: Defining The New Program: Reform To Be Discussed)Documento10 pagineGreece: Defining The New Program: Reform To Be Discussed)24gr_info4093Nessuna valutazione finora

- EFSF20111020 PrimaryMarketPurchases1Documento6 pagineEFSF20111020 PrimaryMarketPurchases1linkiestaNessuna valutazione finora

- Draft EFSF Guideline On Interventions in The Secondary MarketDocumento4 pagineDraft EFSF Guideline On Interventions in The Secondary Marketlevel3assetsNessuna valutazione finora

- The Economic Adjustment Programme For Greece - Fifth Review October 2011 - DraftDocumento106 pagineThe Economic Adjustment Programme For Greece - Fifth Review October 2011 - Draftlevel3assetsNessuna valutazione finora

- Debt Restructuring, Ramifications For The Euro Area - European ParliamentDocumento16 pagineDebt Restructuring, Ramifications For The Euro Area - European Parliamentlevel3assetsNessuna valutazione finora

- Roland Berger EURECA Project 20110927Documento7 pagineRoland Berger EURECA Project 20110927linkiestaNessuna valutazione finora

- Assignment On:: Financial AnalysisDocumento5 pagineAssignment On:: Financial AnalysisMd. Mustafezur Rahaman BhuiyanNessuna valutazione finora

- Chapter 1 - IntroductionDocumento37 pagineChapter 1 - IntroductionTâm Lê Hồ HồngNessuna valutazione finora

- Principal and Agent: Joseph E. StiglitzDocumento13 paginePrincipal and Agent: Joseph E. StiglitzRamiro EnriquezNessuna valutazione finora

- M2U SA 128457 Jul 2023Documento5 pagineM2U SA 128457 Jul 2023syafiqah.mohdali38Nessuna valutazione finora

- Enterprise Valuation FINAL RevisedDocumento45 pagineEnterprise Valuation FINAL Revisedchandro2007Nessuna valutazione finora

- Position Trading Plan TemplateDocumento2 paginePosition Trading Plan TemplateEmmanuel MasindaNessuna valutazione finora

- Megaworld Corporation: Liabilities and Equity 2010 2009 2008Documento9 pagineMegaworld Corporation: Liabilities and Equity 2010 2009 2008Owdray CiaNessuna valutazione finora

- Micro-Finance Management & Critical Analysis in IndiaDocumento47 pagineMicro-Finance Management & Critical Analysis in IndiaSABUJ GHOSH100% (1)

- Summary of The Contents (#1 To 10) As BelowDocumento22 pagineSummary of The Contents (#1 To 10) As BelowRajesh UjjaNessuna valutazione finora

- ISO 9001:2000 Goat Production Profitability AnalysisDocumento38 pagineISO 9001:2000 Goat Production Profitability AnalysisJay AdonesNessuna valutazione finora

- Statement of AccountDocumento2 pagineStatement of Accountmdyakubhnk85Nessuna valutazione finora

- Mercado vs. Allied Banking Corp. - Extinguishment of agency by revocationDocumento1 paginaMercado vs. Allied Banking Corp. - Extinguishment of agency by revocationk santosNessuna valutazione finora

- BarclaysDocumento23 pagineBarclaysAhmed AwaisNessuna valutazione finora

- Invoice 1524940931Documento3 pagineInvoice 1524940931Grand Malaka Ethical HotelNessuna valutazione finora

- Liquidity of Siddhartha Bank Limited: A Summer Project Report Submitted ToDocumento35 pagineLiquidity of Siddhartha Bank Limited: A Summer Project Report Submitted Tosumeet kcNessuna valutazione finora

- Employee Stock Option PlanDocumento7 pagineEmployee Stock Option Plankrupalee100% (1)

- Jaiib Previous Year Question PapersDocumento3 pagineJaiib Previous Year Question PapersAbhijeet RawatNessuna valutazione finora

- Malawi Taxation Exam QuestionsDocumento15 pagineMalawi Taxation Exam QuestionsCean Mhango100% (1)

- Intengan v. CA DigestDocumento2 pagineIntengan v. CA DigestCaitlin KintanarNessuna valutazione finora

- Marketing of Financial ServicesDocumento10 pagineMarketing of Financial ServicesRohit SoniNessuna valutazione finora

- IAS 36 - Impairment of Assets - 2020Documento17 pagineIAS 36 - Impairment of Assets - 2020ayman el-saidNessuna valutazione finora

- DBP v. Arcilla Ruling on Loan Disclosure ComplianceDocumento3 pagineDBP v. Arcilla Ruling on Loan Disclosure ComplianceKarenliambrycejego RagragioNessuna valutazione finora

- FAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018Documento5 pagineFAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018kai luvNessuna valutazione finora

- Audit of Cash and Cash Equivalent Problem 1 (Adapted)Documento6 pagineAudit of Cash and Cash Equivalent Problem 1 (Adapted)Robelyn Asuna LegaraNessuna valutazione finora

- NOTESDocumento12 pagineNOTESBhea Irish Joy BuenaflorNessuna valutazione finora

- Ch30 Money Growth and InflationDocumento16 pagineCh30 Money Growth and InflationMộc TràNessuna valutazione finora

- JAVIER - RLA - CWTS103 - A72 - Project Financial ReportDocumento2 pagineJAVIER - RLA - CWTS103 - A72 - Project Financial ReportRome Lauren JavierNessuna valutazione finora

- Easypaisa-All Pricing and CommissioningDocumento17 pagineEasypaisa-All Pricing and Commissioningqaisar_murtaza50% (4)

- Phil. Home Assurance Corp vs. CADocumento1 paginaPhil. Home Assurance Corp vs. CACaroline A. LegaspinoNessuna valutazione finora

- General Principles of Income Taxation in The PHDocumento1 paginaGeneral Principles of Income Taxation in The PHJm CruzNessuna valutazione finora