Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accounting

Caricato da

Basil BabymDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Accounting

Caricato da

Basil BabymCopyright:

Formati disponibili

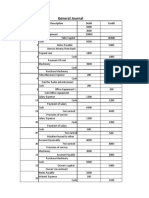

ACCOUNTING FOR MANAGERS ASSIGNMENT-I PREPARATION OF FINANCIAL STATEMENTS (FINAL ACCOUNTS) Submission date: 28.09.2011 (Wednesday) 1.

From the following trial balance of a trader, make out a trading and profit and loss account and Balance sheet as on 31st March 2000. Particulars Sales Purchases Printing charges Wages Salaries Opening stock Carriage Inwards General Expenses Trade Marks Rates and Taxes Capital Discount received Loan Buildings Furniture Machinery Cash Bank Total Debit (Rs.) 1,05,000 2,500 77,500 12,500 2,25,000 8,800 26,250 5,000 2,500 1,74,800 1,250 1,75,000 2,00,000 25,000 50,000 1,000 30,000 7,71,050 Credit(Rs.) 4,20,000

7,71,050

Adjustments: 1. The closing stock was valued at Rs.3,20,000. 2. Outstanding Salaries Rs.10,000. 3. Prepaid rates & taxes Rs.500. (Ans: G.P =Rs.3,23,700, N.P= 2,71,700, B/S=631,500) 2. From the following trial balance of Mr.Bhaskar, make out a trading and profit and loss account and Balance sheet as on 31st March 2003. Particulars Machinery Cash at Bank Cash in Hand Wages Purchases Stock (01.04.2002) Sundry Debtors Bills Receivables Rent Interest on Bank Loan Commission received General Expenses Debit(Rs.) 40,000 10,000 5,000 10,000 80,000 60,000 40,000 29,000 4,000 500 12,000 Credit(Rs.)

3,000

Salaries Discount received Capital Sales Bank Loan Sundry Creditors Purchase returns Sales returns Adjustments: 1. 2. 3.

7,500 4,000 90,000 1,20,000 40,000 40,000 5,000 4,000 3,02,000 3,02,000

Closing stock Rs.80,000 . Interest on Bank loan not yet paid Rs.400. Commission received in advance Rs.1000.

(Ans: G.P =51,000, N.P =32,600 , B/S =2,04,000)

3. The following are the balances extracted from the books of Mrs.Suguna as on 31st March,2004. Debit balances Drawings Cash at Bank Cash in Hand Wages Purchases Stock (31.03.03) Buildings Sundry debtors Bills Receivables Rent Commission General expenses Furniture Suspense account Total Adjustments: 1. 2. 3. 4. 5. 6. Rs. 40,000 17,000 60,000 10,000 20,000 60,000 1,00,000 44,000 29,000 4,500 2,500 8,000 5,000 5,000 4,05,000 Credit Balances Capital Sales Sundry Creditors Rs. 2,00,000 1,60,000 45,000

4,05,000

Closing stock Rs.40,000 valued as on 31.03.04. Interest on capital at 6% to be provided. Interest on Drawings at 5% to be provided. Depreciate buildings at the rate of 10% per annum. Write off Bad debts Rs.1000. Wages yet to be paid Rs.500.

Prepare Trading and profit & loss account and balance sheet as on 31st march 2004.

(Ans: G.P =1,09,500, N.P = 73,500, B/S= 2,89,000)

4. Mr.Senthils book shows the following balances. Prepare his Trading and Profit and loss account for the year ended 31st March 2005 and Balance Sheet as on that date. Particulars Stock on 1.4.2004 Purchases Sales Carriage inwards Salaries Printing and Stationery Drawings Sundry Creditors Sundry Debtors Furniture Capital Postage & Telephone Interest paid Machinery Loan account Suspense A/C Total Adjustments: 1. 2. 3. 4. 5. Debit (Rs.) 1,50,000 1,30,000 2,000 50,000 8,000 17,000 20,000 1,80,000 10,000 2,50,000 7,500 4,000 41,500 25,000 5,000 6,00,000 Credit(Rs.)

3,00,000

6,00,000

Closing stock Rs.1,20,000 Provide 5% for bad & doubtful debts on debtors. Depreciate machinery& furniture by 5% Allow interest on capital at 5% Prepaid printing charges Rs.2,000.

(Ans: G.P = 1,38,000, N.P= 46425, B/S=3,41,925)

5. From the trial balance of Mr.Raghuraman as on 31st March, 2003 prepare Final accounts. Particulars Debit (Rs.) Credit (Rs.)

Capital Drawings Stock (1.4.2002) Purchases Sales Sales returns Wages Insurance Premium Packing Expenses Postage Advertisement Carriage outwards Bad debts Commission received Bills Payable Bank Overdraft Land & Buildings Plant & Machinery Sundry Debtors Sundry Creditors Total Adjustments: 1. 2. 3.

3,60,000 6,400 18,000 1,29,000 2,38,000 4,000 32,000 3,000 4,000 200 2,000 16,000 600 1,000 18,000 6,000 2,61,000 1,80,000 50,800 7,07,000 84,000 7,07,000

Closing stock as on 31.03.2003 Rs.15000. Write off bad debts Rs.800 and make provision for bad & doubtful debts @ 5% on Sundry Debtors. Commission accrued but not received Rs.2,000. (Ans: G.P = 66,000, N.P =43,900, B/S=5,05,500)

6. From the following trial balance of Mrs.Sulochana, make out a trading and profit and loss account and Balance sheet as on 31st March 2004. Particulars Capital Cash Buildings Salary Rent & taxes Opening stock Machinery Drawings Purchases Sales Carriage inwards Fuel , gas Sundry Debtors Sundry creditors Bills Receivables Dividend Loan Bad debts Advertisement Debit (Rs.) 40,000 4,00,000 1,10,000 21,000 1,20,000 1,20,000 40,000 5,00,000 7,50,000 5,000 37,000 2,50,000 1,20,000 53,000 28,000 60,000 2,000 16,000 Credit (Rs.) 7,50,000

Provision for Bad & Doubtful debts Total

6000 17,14,000 17,14,000

Adjustments: 1. Closing stock Rs.1,40,000. 2. Write off Rs.10,000 as bad debts; Provide 5% for Bad and Doubtful debts. 3. Make provision for discount on Debtors @ 2%. 4. Provision for discount on creditors @ 2%. (Ans: G.P =2,28,000, N.P =88,840, B/S =9,76,440) 7. From the trial balance of Mr.Imran as on 31st March, 2005 prepare Final accounts. Particulars Capital Bank Overdraft Sales Furniture Business Premises Creditors Opening stock Debtors Rent Purchases Discount Insurance Wages Salaries Advertisement Carriage on purchases Provision for bad and doubtful debts Bad debts Income tax Total Adjustments: 1. Closing stock on 31.03.2005 was Rs.1,20,000. 2. Make a provision of 5% on debtors for Bad and Doubtful debts. 3. Rent received in advance Rs.2,000. 4. Provide 10% depreciation on Furniture and Business premises. (Ans:G.P = 1,96,200, N.P = 1,05,140, B/S= 3,58,140) Debit (Rs.) Credit(Rs.) 1,50,000 25,200 9,03,000

30,600 1,20,000 79,800 1,32,000 1,08,000 6,000 6,60,000 2,400 16,000 24,000 54,000 13,200 10,800 7,000 800 4,000 11,73,4000

11,73,4000

8. From the following trial balance make out a trading and profit and loss account and Balance sheet as on 31st March 1981. Debit Balances Rs. Credit Balances Rs.

Purchases Debtors Return inwards Bank deposit Rent Salaries Travelling expenses Cash Stock (1.4.1980) Discount allowed Drawings Adjustments: 1. 2. 3. 4.

11,870 7,580 450 2,750 360 850 300 210 2450 40 600 27,460

Capital Bad debts recovered Creditors Return outwards Bank Overdraft Sales Bills Payable

8,000 250 1,250 350 1,570 14,690 1,350

27,460

The closing stock on 31.3.81 was Rs.4,200. Write off Rs.80 as bad debts. Create a provision for bad and doubtful debts @ 5% on debtors. Rent outstanding Rs.120. (Ans: G.P =9,700, N.P = 5890, B/S=42,190)

9. From the trial balance of Mr.Ravi as on 31 st March, 2002 prepare Final accounts. Particulars Capital Sales Purchases Salaries Rent Insurance Drawings Machinery Bank Balance Cash Stock (1.4.2001) Debtors Creditors Adjustments: Debit (Rs.) Credit (Rs.) 40,000 25,000

15,000 2,000 1,500 300 5,000 28,000 4,500 2,000 5,200 2,500 1,000

1. 2. 3. 4.

Stock on 31.3.02 Rs.4,900. Salaries unpaid Rs.300 Rent paid in advance Rs.200. Insurance prepaid Rs.90.

(Ans: G.P = 4470, N.P = 2595, B/S = 14,285)

10. The following are the balances extracted from the books of Mrs.Nandhini as on 31.03.2002. prepare Trading and Profit and Loss Account and balance sheet as on 31.3.2002. Debit Balances Drawings Cash in Hand Cash at Bank Wages Purchases Stock (1.4.2001) Buildings Sundry debtors Bills Receivables Rent Commission General Expenses Furniture Rs. 40,000 17,000 65,000 10,000 20,000 60,000 1,00,000 44,000 29,000 4,500 2,500 8,000 5,000 4,05,000 Credit balances Capital Sales Sundry Creditors Rs. 2,00,000 1,60,000 45,000

4,05,000

Adjustments: 1. 2. 3. 4. 5. Closing stock Rs.40,000. Interest on Capital @ 6% to be provided. Interest on Drawings @ 5% to be provided. Wages yet to be paid Rs.1000. Rent prepaid Rs.900.

(Ans: G.P = 1,09,000, N.P = 84,900, B/S = 3,00,900)

********************------------------*******************

Potrebbero piacerti anche

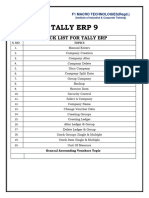

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyDa EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyValutazione: 5 su 5 stelle5/5 (1)

- Accounting BasicsDocumento21 pagineAccounting BasicsasifparwezNessuna valutazione finora

- Accountancy XiiDocumento122 pagineAccountancy XiiNancy Ekka100% (1)

- Tally Assignment Yash ComDocumento9 pagineTally Assignment Yash Comraj S.NNessuna valutazione finora

- Ap (Accounts Payable) ProcessDocumento10 pagineAp (Accounts Payable) ProcessRabin DebnathNessuna valutazione finora

- Grdae 9 - Ems - Financial Literacy SummaryDocumento17 pagineGrdae 9 - Ems - Financial Literacy SummarykotolograceNessuna valutazione finora

- Basics of Accounting - QBDocumento7 pagineBasics of Accounting - QBsujanthqatarNessuna valutazione finora

- Tally 036Documento191 pagineTally 036anjalishah7Nessuna valutazione finora

- Tally Final ExamDocumento4 pagineTally Final ExamsatyajitNessuna valutazione finora

- Tax FinalDocumento23 pagineTax FinalJitender ChaudharyNessuna valutazione finora

- Advanced Tally MCQ Original - WatermarkDocumento90 pagineAdvanced Tally MCQ Original - WatermarkVinod RathodNessuna valutazione finora

- FA1 General JournalDocumento5 pagineFA1 General JournalamirNessuna valutazione finora

- D2K-Report6i-by Dinesh Kumar S PDFDocumento98 pagineD2K-Report6i-by Dinesh Kumar S PDFallumohanNessuna valutazione finora

- General Journal: Date Description Debit CreditDocumento7 pagineGeneral Journal: Date Description Debit CreditAmanuel DemekeNessuna valutazione finora

- Accountancy Handout RevisionDocumento181 pagineAccountancy Handout RevisionSIMARNessuna valutazione finora

- Personal Finance and Planning: Skill Enhancement Course (SEC)Documento37 paginePersonal Finance and Planning: Skill Enhancement Course (SEC)Babita DeviNessuna valutazione finora

- Test 2Documento10 pagineTest 2himanshuNessuna valutazione finora

- GST Practical Record 40-50Documento48 pagineGST Practical Record 40-50Aditya raj ojhaNessuna valutazione finora

- TYBCom Sem VI Financial Accounting and Auditing Paper IX Financial AccountingDocumento181 pagineTYBCom Sem VI Financial Accounting and Auditing Paper IX Financial Accountingarbazshaha121Nessuna valutazione finora

- Trading, Profit & Loss Acct.sDocumento14 pagineTrading, Profit & Loss Acct.sSudheer SirangulaNessuna valutazione finora

- Tally - Business Accounts Question BankDocumento9 pagineTally - Business Accounts Question BankBhaskar bhaskarNessuna valutazione finora

- 42 Implementation of Tds in Tallyerp 9Documento171 pagine42 Implementation of Tds in Tallyerp 9P VenkatesanNessuna valutazione finora

- Excise For ManufacturersDocumento160 pagineExcise For ManufacturersPraveen CoolNessuna valutazione finora

- Oracle Apps Course ContentsDocumento12 pagineOracle Apps Course ContentsRabindra P.SinghNessuna valutazione finora

- Tally Record NoteDocumento74 pagineTally Record NoteBarani DharanNessuna valutazione finora

- Short Cut Keys in Tally 9Documento10 pagineShort Cut Keys in Tally 9Partha1962Nessuna valutazione finora

- Tally E Book 2Documento154 pagineTally E Book 2anjali44499Nessuna valutazione finora

- LLB Hon. Intergrated Law Sem 1 To 8 Syllabus May 2019Documento104 pagineLLB Hon. Intergrated Law Sem 1 To 8 Syllabus May 2019shah zavidNessuna valutazione finora

- Tally Interview Questions PDFDocumento6 pagineTally Interview Questions PDFRuqaya AhadNessuna valutazione finora

- 874 Taxation HandbookDocumento170 pagine874 Taxation HandbookYingYiga100% (1)

- GB Training & Placement Centre: Tally ERP 9 Certificate CourseDocumento2 pagineGB Training & Placement Centre: Tally ERP 9 Certificate CourseswayamNessuna valutazione finora

- AMFI - Investor Awareness Presentation - Jul'23Documento69 pagineAMFI - Investor Awareness Presentation - Jul'23padmaniaNessuna valutazione finora

- Chapter 1Documento5 pagineChapter 1palash khannaNessuna valutazione finora

- Self Study - Week 1 - Journal RevisionDocumento7 pagineSelf Study - Week 1 - Journal RevisionMehak Gupta100% (1)

- STUDY MATERIAL AccountingcomClass XIDocumento144 pagineSTUDY MATERIAL AccountingcomClass XImalathi SNessuna valutazione finora

- PL SQL - Training - PpsDocumento106 paginePL SQL - Training - PpsAnuNessuna valutazione finora

- Journalise The Following TransactionsDocumento1 paginaJournalise The Following Transactionshamidalikhanscorpion50% (2)

- Tally - Erp 9 - Post-Dated Voucher of Accounting & Inventory Vouchers Creation, Modification, DeletionsDocumento5 pagineTally - Erp 9 - Post-Dated Voucher of Accounting & Inventory Vouchers Creation, Modification, DeletionsHeemanshu ShahNessuna valutazione finora

- Oops TutorialDocumento20 pagineOops TutorialRajesh MandadapuNessuna valutazione finora

- GST Section ListDocumento7 pagineGST Section ListRahul ThapaNessuna valutazione finora

- Tally QuizDocumento9 pagineTally QuizSureshBadigerNessuna valutazione finora

- Villamor FinalDocumento25 pagineVillamor FinalRinconada Benori ReynalynNessuna valutazione finora

- Problem 1Documento3 pagineProblem 1karthikeyan01Nessuna valutazione finora

- Final AssignmentDocumento42 pagineFinal AssignmentRoopesh PandeNessuna valutazione finora

- Dma Module 1 Oracle SQL PL SQL IacDocumento110 pagineDma Module 1 Oracle SQL PL SQL IacK T Hoq Himel100% (1)

- Tally - ERP9 Book With GSTDocumento1.843 pagineTally - ERP9 Book With GSThatimNessuna valutazione finora

- List of Ledgers and It's Under Group in TallyDocumento5 pagineList of Ledgers and It's Under Group in Tallyrachel KujurNessuna valutazione finora

- Accountancy NCERT P2 (WWW - Ssctube.com)Documento305 pagineAccountancy NCERT P2 (WWW - Ssctube.com)Priyankesh ChourasiyaNessuna valutazione finora

- Intermediate Paper 11 PDFDocumento456 pagineIntermediate Paper 11 PDFjesurajajNessuna valutazione finora

- A Revisit On The Fundamentals of AccountingDocumento53 pagineA Revisit On The Fundamentals of AccountingGonzalo Jr. Ruales100% (1)

- Accounting Equation Imp 1Documento5 pagineAccounting Equation Imp 1hiritik gupta100% (1)

- Resume: Saravana Kumar V 8754598732 - Career ObjectiveDocumento3 pagineResume: Saravana Kumar V 8754598732 - Career ObjectiveporurNessuna valutazione finora

- Worksheet Ledger and Trial BalanceDocumento4 pagineWorksheet Ledger and Trial BalanceRajni Sinha VermaNessuna valutazione finora

- Extra Journal QuestionsDocumento3 pagineExtra Journal QuestionsMba BNessuna valutazione finora

- Questions On Trial Balance To StudentsDocumento6 pagineQuestions On Trial Balance To Studentsveraji3735Nessuna valutazione finora

- Accountancy Higher Secondary - Second Year Volume IDocumento132 pagineAccountancy Higher Secondary - Second Year Volume Iakvssakthivel100% (1)

- Accounting and Finance Numericals Problems and AnsDocumento11 pagineAccounting and Finance Numericals Problems and AnsPramodh Kanulla0% (1)

- Final AccountsDocumento5 pagineFinal AccountsGopal KrishnanNessuna valutazione finora

- Department of Business AdministrationDocumento9 pagineDepartment of Business AdministrationKannan NagaNessuna valutazione finora

- Final AccountsDocumento12 pagineFinal Accountsanandm1986100% (1)

- Suncor Energy IncDocumento1 paginaSuncor Energy IncBasil BabymNessuna valutazione finora

- UGMalayalam Online InstructionsDocumento3 pagineUGMalayalam Online InstructionsBasil BabymNessuna valutazione finora

- An Analysis of Financial Operations of Uniroyal Marine Exports LTD, Vengalam, CalicutDocumento49 pagineAn Analysis of Financial Operations of Uniroyal Marine Exports LTD, Vengalam, CalicutBasil BabymNessuna valutazione finora

- LimitationsDocumento2 pagineLimitationsBasil BabymNessuna valutazione finora

- Jerome4 Sample Chap08Documento58 pagineJerome4 Sample Chap08Basil Babym100% (7)

- Classification of MNCDocumento16 pagineClassification of MNCBasil Babym91% (22)

- Festival Bonanza Ad 2011 SepDocumento1 paginaFestival Bonanza Ad 2011 SepBasil BabymNessuna valutazione finora

- Call RoutingDocumento42 pagineCall RoutingRogelio Ramirez MillanNessuna valutazione finora

- Paper IndustryDocumento8 paginePaper IndustryBasil BabymNessuna valutazione finora

- The Full Paper Making ProcessDocumento7 pagineThe Full Paper Making Processnapachaya100% (1)

- WellaPlex Technical 2017Documento2 pagineWellaPlex Technical 2017Rinita BhattacharyaNessuna valutazione finora

- Coc 1 ExamDocumento7 pagineCoc 1 ExamJelo BioNessuna valutazione finora

- Understanding Culture Society, and PoliticsDocumento3 pagineUnderstanding Culture Society, and PoliticsVanito SwabeNessuna valutazione finora

- IELTS Material Writing 1Documento112 pagineIELTS Material Writing 1Lê hoàng anhNessuna valutazione finora

- DR Afwan Fajri - Trauma - Juli 2023Documento82 pagineDR Afwan Fajri - Trauma - Juli 2023afwan fajriNessuna valutazione finora

- Editor Attach 1327138073 1832Documento59 pagineEditor Attach 1327138073 1832Monther Al DebesNessuna valutazione finora

- 2022 NEDA Annual Report Pre PubDocumento68 pagine2022 NEDA Annual Report Pre PubfrancessantiagoNessuna valutazione finora

- Products ListDocumento11 pagineProducts ListPorag AhmedNessuna valutazione finora

- Beng (Hons) Telecommunications: Cohort: Btel/10B/Ft & Btel/09/FtDocumento9 pagineBeng (Hons) Telecommunications: Cohort: Btel/10B/Ft & Btel/09/FtMarcelo BaptistaNessuna valutazione finora

- NJEX 7300G: Pole MountedDocumento130 pagineNJEX 7300G: Pole MountedJorge Luis MartinezNessuna valutazione finora

- PEA Comp Study - Estate Planning For Private Equity Fund Managers (ITaback, JWaxenberg 10 - 10)Documento13 paginePEA Comp Study - Estate Planning For Private Equity Fund Managers (ITaback, JWaxenberg 10 - 10)lbaker2009Nessuna valutazione finora

- Multi-Media Approach To Teaching-LearningDocumento8 pagineMulti-Media Approach To Teaching-LearningswethashakiNessuna valutazione finora

- PRINCIPLES OF TEACHING NotesDocumento24 paginePRINCIPLES OF TEACHING NotesHOLLY MARIE PALANGAN100% (2)

- DLL in Health 7 3rd QuarterDocumento2 pagineDLL in Health 7 3rd QuarterJuna Lyn Hermida ArellonNessuna valutazione finora

- Landcorp FLCC Brochure 2013 v3Documento6 pagineLandcorp FLCC Brochure 2013 v3Shadi GarmaNessuna valutazione finora

- Black Hole Safety Brochure Trifold FinalDocumento2 pagineBlack Hole Safety Brochure Trifold Finalvixy1830Nessuna valutazione finora

- 2021-01-01 - Project (Construction) - One TemplateDocumento1.699 pagine2021-01-01 - Project (Construction) - One TemplatemayalogamNessuna valutazione finora

- Lecture 1 Electrolyte ImbalanceDocumento15 pagineLecture 1 Electrolyte ImbalanceSajib Chandra RoyNessuna valutazione finora

- Text Extraction From Image: Team Members CH - Suneetha (19mcmb22) Mohit Sharma (19mcmb13)Documento20 pagineText Extraction From Image: Team Members CH - Suneetha (19mcmb22) Mohit Sharma (19mcmb13)suneethaNessuna valutazione finora

- NATO Obsolescence Management PDFDocumento5 pagineNATO Obsolescence Management PDFluisNessuna valutazione finora

- The Impact of Personnel Behaviour in Clean RoomDocumento59 pagineThe Impact of Personnel Behaviour in Clean Roomisrael afolayan mayomiNessuna valutazione finora

- Activity Based Costing TestbanksDocumento18 pagineActivity Based Costing TestbanksCharlene MinaNessuna valutazione finora

- USTH Algorithm RecursionDocumento73 pagineUSTH Algorithm Recursionnhng2421Nessuna valutazione finora

- Vtoris 100% Clean Paypal Transfer Guide 2015Documento8 pagineVtoris 100% Clean Paypal Transfer Guide 2015Sean FrohmanNessuna valutazione finora

- Heat Pyqs NsejsDocumento3 pagineHeat Pyqs NsejsPocketMonTuberNessuna valutazione finora

- Credit CardDocumento6 pagineCredit CardJ Boy LipayonNessuna valutazione finora

- Medical Equipment Quality Assurance For Healthcare FacilitiesDocumento5 pagineMedical Equipment Quality Assurance For Healthcare FacilitiesJorge LopezNessuna valutazione finora

- The Chassis OC 500 LE: Technical InformationDocumento12 pagineThe Chassis OC 500 LE: Technical InformationAbdelhak Ezzahrioui100% (1)

- Carbonate Platform MateriDocumento8 pagineCarbonate Platform MateriNisaNessuna valutazione finora

- Technology 6 B Matrixed Approach ToDocumento12 pagineTechnology 6 B Matrixed Approach ToNevin SunnyNessuna valutazione finora