Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ECON Fall+2011 Syllabus

Caricato da

Soog Gyung YounDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

ECON Fall+2011 Syllabus

Caricato da

Soog Gyung YounCopyright:

Formati disponibili

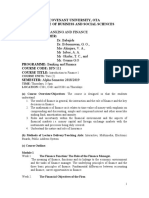

UNIVERSITY OF CALIFORNIA DEPARTMENT OF ECONOMICS ECONOMICS 136 Financial Economics TuTh 8:00-9:30 am Evans Hall #10 Instructor: Professor

Hamid Shomali Evans Hall, Room 520 Office Hours: T Th 9:30-10:00 hamidshomali@yahoo.com Stephen Bianchi Wendy Jin Sung Bin Sohn Yury Yatsynovich

Fall 2011 PROF. H. SHOMALI

GSIs:

sbianchi@econ.berkeley.edu wendyjin@econ.berkeley.edu sungbin@econ.berkeley.edu yyatsyn@econ.berkely.edu

Learning Goals: The objective of this course is to introduce the working of financial markets, explore the characteristics and pricing mechanism of various financial products. The course also introduces the fundamentals of portfolio management and portfolio performance evaluation. Finally, we explore various derivatives, their pricing and their use in hedging and risk management. Course Home Page: Use bspace.berkeley.edu. to go to the home page of this course. Notes, problem sets and solutions as well as some reading material will be posted on course home page. Required Text: Bodie, Zvi, Alex Kane and Alan J Marcus, Investments, 9th. Edition, Irwin/McGraw-Hill, 2011 First MT Second MT Final Homework 20% 20% 40% 20%

Grading:

Grading Scale:

91 - 100 81 90 71 80 61 70 60 & less

A B C D F

If your grade fall in the middle of the range such as (84, 85 and 86), you will get a B. Upper part of the range will be B+ and the lower part will be B-. The same applies to all grades. Supplementary Readings: Brealey, Richard A. and Stewart C. Myers, Principles of Corporate Finance, 9th. Edition, McGraw-Hill, 2008. Brigham, Eugene F., and Phillip R. Daves, Intermediate Financial Management, 10th. Edition, SOUTH-WESTERN, 2007. Fabozzi, Frank J., Franco Modigliani, and Frank J. Jones, Foundations of Financial Markets and Institutions, 4th.. Edition, Prentice Hall, 2009 Malkiel, Burton, A Random Walk Down Wall Street, W.W.Norton, 1999 Shiller, Robert J., Irrational Exuberance, Princeton University Press, 2000. Class Schedule: Week Week 1 Aug 25 Week 2 Aug 30 Sep 1 Week 3 Sep 6 & 9 Week 4 Sep 13 & 15 Week 5 Sep 20 & 22 Topic The Investment Environment Asset Classes Security Trading Chapters Bodie, Chapters 1 Bodie, Chapters 3 & 4

Risk vs. Expected return Capital Allocation Model Optimal Risky Portfolios First MT. Sep 22

Bodie, Chapter 5 Bodie, Chapter 6 Bodie, Chapter 7

Week 6 Sep27 & 29 Week 7 Oct 4 & 6 Week 8 Oct 11 & 13 Week 9 Oct 18 & 20 Week 10 Oct 25 & 27 Week 11 Nov 1 & 3

Index Models Capital Asset Pricing Model APT and Multifactor Models Market Efficiency Behavioral Finance

Bodie, Chapter 8 Bodie, Chapter 9 Bodie, Chapter 10 Bodie, Chapter 11 Bodie, Chapter 12

Bond Prices, Term Structure of Interest Rates Second MT-Nov 3

Bodie, Chapter 14 & 15

Week 12 Nov 8 & 10 Week 13 Nov 15 & 17 Week 14 Nov 22 & 24 Week 15 Nov 29 Dec 1

Bond Portfolio & Industry Analysis Equity Valuation & Options Option Valuation & Futures Swaps and Risk Management Portfolio Performance Evaluation Final Exam- Dec 14

Bodie, Chapters 16 & 17 Bodie, Chapters 18 & 20 Bodie, Chapters 21 & 22 Bodie, Chapter 23 & 24

Potrebbero piacerti anche

- 12 Ways To Beat Your BookieDocumento82 pagine12 Ways To Beat Your Bookieartus1460% (5)

- Econ Un3025 002 Course Syllabus FinalDocumento12 pagineEcon Un3025 002 Course Syllabus FinalBri MinNessuna valutazione finora

- SheltaDocumento7 pagineSheltaconfused597Nessuna valutazione finora

- Taj Lake PalaceDocumento2 pagineTaj Lake PalaceYASHNessuna valutazione finora

- PRINCIPLES OF BANKING AND FINANCE PrinciDocumento7 paginePRINCIPLES OF BANKING AND FINANCE PrinciEnelyoj TondaNessuna valutazione finora

- SyllabusDocumento2 pagineSyllabusNoviani Mira SariNessuna valutazione finora

- BAC3684 SIPM March 2011Documento7 pagineBAC3684 SIPM March 2011chunlun87Nessuna valutazione finora

- BF SyllabusDocumento6 pagineBF Syllabusnghiep tranNessuna valutazione finora

- BSc3 Financial Intermediation 2020-2021Documento12 pagineBSc3 Financial Intermediation 2020-2021AndrewNessuna valutazione finora

- 202 Eco Maj IIDocumento5 pagine202 Eco Maj IIKunalNessuna valutazione finora

- 136 SylDocumento2 pagine136 SylSajid AliNessuna valutazione finora

- So-Eco 204 - Sem3 - 2020Documento13 pagineSo-Eco 204 - Sem3 - 2020WSLeeNessuna valutazione finora

- FINA 9200: Theory of Finance Course Syllabus: Professor Paul Irvine Finance Department, Room 444 (O) 706.542.3661Documento13 pagineFINA 9200: Theory of Finance Course Syllabus: Professor Paul Irvine Finance Department, Room 444 (O) 706.542.3661teera erwaNessuna valutazione finora

- Course Syllabus API-102B Economic Analysis of Public Policy: International Economics Spring 2014Documento7 pagineCourse Syllabus API-102B Economic Analysis of Public Policy: International Economics Spring 2014gregbaccayNessuna valutazione finora

- Centre For Economic and Financial StudiesDocumento5 pagineCentre For Economic and Financial Studiesngoctraiden1905Nessuna valutazione finora

- Course Outline FIN701Documento11 pagineCourse Outline FIN701Bimal KrishnaNessuna valutazione finora

- AB0901 Principles of Economics. A Singapore PerspectiveDocumento5 pagineAB0901 Principles of Economics. A Singapore PerspectiveGwesf Srfgvs0% (1)

- EBS2033 Blockbook 2016-2017 v1Documento7 pagineEBS2033 Blockbook 2016-2017 v1wayne adjkqheNessuna valutazione finora

- Value Investing With Legends (Santos, Greenwald, Eveillard) SP2015Documento6 pagineValue Investing With Legends (Santos, Greenwald, Eveillard) SP2015ascentcommerce100% (1)

- EC 111 OutlineDocumento2 pagineEC 111 OutlineFred MukondaNessuna valutazione finora

- 09MB305B - Security Analysis and Portfoliio ManagementDocumento4 pagine09MB305B - Security Analysis and Portfoliio Managementjpaladi.2014Nessuna valutazione finora

- BSc2 Principles of Banking and Finance 2021-22Documento8 pagineBSc2 Principles of Banking and Finance 2021-22loNessuna valutazione finora

- ECON 135 SyllabusDocumento2 pagineECON 135 SyllabusStephanie ChanNessuna valutazione finora

- Intermediate Macroeconomics Syllabus - SesconDocumento4 pagineIntermediate Macroeconomics Syllabus - SesconJubert Calamba100% (1)

- Econ 422: Finance, Capital and Investments Winter 2015: InstructorDocumento8 pagineEcon 422: Finance, Capital and Investments Winter 2015: InstructorBelieve ArubiNessuna valutazione finora

- BFN 111 Course Compact 2018-2019Documento3 pagineBFN 111 Course Compact 2018-2019CHIDINMA ONUORAH100% (1)

- ECO 238 - International EconomicsDocumento5 pagineECO 238 - International EconomicsRené HasNessuna valutazione finora

- Eco 100Documento2 pagineEco 100alikaltayNessuna valutazione finora

- BUSE 622 Syllabus - Fall 2013-14 - QADocumento3 pagineBUSE 622 Syllabus - Fall 2013-14 - QAAbdulrahman AlotaibiNessuna valutazione finora

- Course OutlineDocumento2 pagineCourse Outlinemahbubur_phyNessuna valutazione finora

- On Successful Completion of This Module, Students Will Be Able ToDocumento3 pagineOn Successful Completion of This Module, Students Will Be Able ToyebegashetNessuna valutazione finora

- A. Course Summary: Total 65Documento9 pagineA. Course Summary: Total 65Yasodharan KrishnanNessuna valutazione finora

- Principles of EconomicsDocumento10 paginePrinciples of EconomicsClaire E JoeNessuna valutazione finora

- Courses Given in English at Seoul Campus07-2Documento86 pagineCourses Given in English at Seoul Campus07-2A.N.M. neyaz MorshedNessuna valutazione finora

- International Finance Xavier Institute of Management (XIMB) Bhubaneswar, OdishaDocumento5 pagineInternational Finance Xavier Institute of Management (XIMB) Bhubaneswar, OdishahardiNessuna valutazione finora

- Fixed Income Asset Pricing: Course Objectives and OverviewDocumento10 pagineFixed Income Asset Pricing: Course Objectives and OverviewSiddharth NandaNessuna valutazione finora

- International Finance RevisedDocumento5 pagineInternational Finance RevisedCarlosNessuna valutazione finora

- Econ 2106 Principles of MicroeconomicsDocumento7 pagineEcon 2106 Principles of MicroeconomicsWalid Asif JanjuaNessuna valutazione finora

- 23 Investment ManagementDocumento40 pagine23 Investment Managementvarun_deppNessuna valutazione finora

- New Era University School of Graduate StudiesDocumento2 pagineNew Era University School of Graduate StudiesZha ZhaNessuna valutazione finora

- WBS Handbook 6FNCE003WDocumento13 pagineWBS Handbook 6FNCE003WThomas HaddadNessuna valutazione finora

- Security Analysis (Mauboussin) SP2016 PDFDocumento14 pagineSecurity Analysis (Mauboussin) SP2016 PDFdarwin12100% (1)

- Syllabus Fall 2018Documento7 pagineSyllabus Fall 2018Ashley WintersNessuna valutazione finora

- Course SyllabiDocumento3 pagineCourse Syllabimalumboluhanga2004Nessuna valutazione finora

- Course Outline: Business Economics (ECO409)Documento2 pagineCourse Outline: Business Economics (ECO409)Ali KhanNessuna valutazione finora

- Course Outline PDFDocumento2 pagineCourse Outline PDFAli KhanNessuna valutazione finora

- Module Information Booklet - FM Aug 2018Documento14 pagineModule Information Booklet - FM Aug 2018Marcus LiawNessuna valutazione finora

- NBA5430 - Financial Markets and Institutions - O'HaraDocumento7 pagineNBA5430 - Financial Markets and Institutions - O'HaraPeng LiuNessuna valutazione finora

- Ise Financial Institutions Management A Risk Management Approach 10Th Edition Anthony Saunders Professor Full ChapterDocumento57 pagineIse Financial Institutions Management A Risk Management Approach 10Th Edition Anthony Saunders Professor Full Chapterkatelyn.willis396100% (4)

- ECD101 Module Outline - 2023Documento4 pagineECD101 Module Outline - 2023normantkanyerere22Nessuna valutazione finora

- WWW - Rafiqulmatin.ac - BD: Investments, Zvi Bodie, Alex Kane, Alan J. Marcus, 10 Edition, MC Graw Hill EducationDocumento1 paginaWWW - Rafiqulmatin.ac - BD: Investments, Zvi Bodie, Alex Kane, Alan J. Marcus, 10 Edition, MC Graw Hill EducationShaoli MofazzalNessuna valutazione finora

- SyllabusDocumento2 pagineSyllabusDuc TranNessuna valutazione finora

- 1027254029106262Documento2 pagine1027254029106262Vano DiehlNessuna valutazione finora

- MIR 508 Syllabus Spring 2021Documento6 pagineMIR 508 Syllabus Spring 2021polat yilmazNessuna valutazione finora

- IB235 2013 OutlineDocumento13 pagineIB235 2013 OutlineBenNessuna valutazione finora

- 1 57871 Ectheory2 4824Documento7 pagine1 57871 Ectheory2 4824Phuoc DangNessuna valutazione finora

- Syllabus DTU HUDocumento24 pagineSyllabus DTU HURushilNessuna valutazione finora

- Course OutlineDocumento3 pagineCourse OutlinesiludassNessuna valutazione finora

- Financial Market: Ms. Sheila May A. FielDocumento21 pagineFinancial Market: Ms. Sheila May A. FielJhoanna Marie MonterolaNessuna valutazione finora

- Financial Market and InstitutionDocumento5 pagineFinancial Market and InstitutionMd MohimanNessuna valutazione finora

- Handbook of Empirical Corporate Finance: Empirical Corporate FinanceDa EverandHandbook of Empirical Corporate Finance: Empirical Corporate FinanceNessuna valutazione finora

- PZZ - © Aa VQ Gi Ms Kvab Gi Gi Ms KvabDocumento13 paginePZZ - © Aa VQ Gi Ms Kvab Gi Gi Ms KvabFarah DibaNessuna valutazione finora

- Airline TermsDocumento8 pagineAirline TermsVenus HatéNessuna valutazione finora

- Business Environment PPT 2020 PDFDocumento50 pagineBusiness Environment PPT 2020 PDFSatyam AgarwallaNessuna valutazione finora

- Financial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsDocumento7 pagineFinancial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsnikunjNessuna valutazione finora

- Bus Ticket Invoice 1673864116Documento2 pagineBus Ticket Invoice 1673864116SP JamkarNessuna valutazione finora

- Define A Class AssignmentDocumento5 pagineDefine A Class AssignmentRam AdityaNessuna valutazione finora

- Pune Mahanagar Parivahan Mahamandal LimitedDocumento3 paginePune Mahanagar Parivahan Mahamandal Limitedamity2001Nessuna valutazione finora

- Magnit ValuationDocumento50 pagineMagnit ValuationNikolay MalakhovNessuna valutazione finora

- Risk-Profiling - Understanding Your Risk Tolerance Towards InvestingDocumento3 pagineRisk-Profiling - Understanding Your Risk Tolerance Towards InvestingFarhanie NordinNessuna valutazione finora

- QPMC Rate CardsDocumento9 pagineQPMC Rate CardsTarek TarekNessuna valutazione finora

- The IS - LM CurveDocumento28 pagineThe IS - LM CurveVikku AgarwalNessuna valutazione finora

- Project Proposal IN Broiler Production: Maria Sofia B. Lopez Viii-Emerald Mrs. HongeriaDocumento3 pagineProject Proposal IN Broiler Production: Maria Sofia B. Lopez Viii-Emerald Mrs. HongeriaSofiaLopezNessuna valutazione finora

- Weygandt Managerial 6e SM Release To Printer Ch10Documento40 pagineWeygandt Managerial 6e SM Release To Printer Ch10Dave Aguila100% (3)

- Gmail - Your IndiGo Itinerary - M6THHV - Chennai CoimbatoreDocumento3 pagineGmail - Your IndiGo Itinerary - M6THHV - Chennai CoimbatoreVishnu SamyNessuna valutazione finora

- UN SMA 2015 Bahasa InggrisDocumento5 pagineUN SMA 2015 Bahasa InggrisMohammad EfendiNessuna valutazione finora

- AFM Exam Report June 2020Documento6 pagineAFM Exam Report June 2020Mohsin AijazNessuna valutazione finora

- Job Description For Duty Manager / Lobby Manager in Hotels: REPORTS TO: Front Office Manager Position SummaryDocumento2 pagineJob Description For Duty Manager / Lobby Manager in Hotels: REPORTS TO: Front Office Manager Position Summaryajay SinghNessuna valutazione finora

- Chapter 7: Game TheoryDocumento6 pagineChapter 7: Game TheoryPrince DesperadoNessuna valutazione finora

- Ch15 Questions 1Documento4 pagineCh15 Questions 1vietnam0711Nessuna valutazione finora

- Reservation ExerciseDocumento2 pagineReservation ExerciseMutia ChimoetNessuna valutazione finora

- Universiti Teknologi Mara Cawangan Kelantan, Bukit Ilmu, 18500 Machang, Kelantan. Macroeconomics (Eco211) Group Project - (Report) - 10%Documento9 pagineUniversiti Teknologi Mara Cawangan Kelantan, Bukit Ilmu, 18500 Machang, Kelantan. Macroeconomics (Eco211) Group Project - (Report) - 10%robertNessuna valutazione finora

- Marginal CostingDocumento10 pagineMarginal Costinganon_672065362Nessuna valutazione finora

- Sample UploadDocumento14 pagineSample Uploadparsley_ly100% (6)

- 5 Air TransportationDocumento26 pagine5 Air TransportationRahul Singh BaghelNessuna valutazione finora

- Classwork10 06-Chasekinnel 15Documento4 pagineClasswork10 06-Chasekinnel 15api-310965037Nessuna valutazione finora

- DemonetisationDocumento3 pagineDemonetisationKashreya JayakumarNessuna valutazione finora

- Short-Term AnalysisDocumento24 pagineShort-Term AnalysisJhaycob Lance Del RosarioNessuna valutazione finora