Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Stockholder'S Equity: Composition

Caricato da

alfred_gabriel_1Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Stockholder'S Equity: Composition

Caricato da

alfred_gabriel_1Copyright:

Formati disponibili

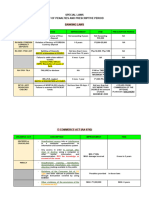

STOCKHOLDERS EQUITY

Composition: 1. Contributed Capital/Paid-in Capital a. Share Capital Aggregate Par or Stated Value of i. Shares Issued ii. Subscribed b. Additional Paid-in Capital (Share Premium) contributions from stockholders other than the aggregate par or stated value of shares. This category includes: i. APIC or Share Premium from excess over par or stated ii. Treasury stock transactions (reissuance and retirement) iii. Ordinary share warrants and Ordinary share option outstanding iv. Others 2. Unearned Capital/Other Comprehensive Income/Losses a. Revaluation Surplus/Revaluation increment in properties b. Translation Reserves c. Unrealized holding gain or loss from Available-for-sale securities d. Unrealized gain or loss on derivatives (Swaps) e. Actuarial gain or loss on Accumulated Benefit Obligation or Plan Asset under the direct recognition approach 3. Accumulated Profits or Retained Earnings a. Un-appropriated (free of dividends distribution) b. Appropriated i. Voluntary (e.g. Plant expansion) ii. Contractual (e.g. Sinking fund) iii. Legal (e.g. Treasury stock) Share Issue Issuance of Share Capital for Cash Preference or ordinary shares are created equal to par and the excess to paid-in capital. 1. Share Issuance Costs include registration fees, underwriter commissions, legal fees, accounting fees, share certificate cost, promotional costs and postage. Generally, for subsequent issuances charged to APIC relative to that particular issue. For initial issuance charged to Organizational Expense. 2. Issuance of Preference and Ordinary Shares for a Lump-sum Price This is accounted as follows: a. If preference are effectively equity securities, use pro-rata approach in reference to the aggregate market value of preference and ordinary shares. b. If preference are effective debt securities (e.g. redeemable), use residual definition approach assigning the fair value of preference and ordinary shares. 3. Issuance of Share Capital on a Subscription Basis the agreed purchase price is debited to APIC. Upon its full payment, the Share Capital Subscribed is closed to Share Capital. The Subscriptions Receivable is presented as a current asset if collection is expected within one year of the balance sheet date. If there is no definite due date set for subscription receivable, it is shown as a contra to stockholders equity, an offset against the Ordinary Shares Subscribed account. Default on Subscriptions a. Shares are offered in an auction. b. The entire amount collected is returned to the defaulting subscriber. c. The entire amount collected is returned to the defaulting subscriber less any cost incurred by the corporation in reissuing the shares. d. A corresponding number of shares is issued to the defaulting subscriber based upon the total amount collected; or, e. The entire amount collected is forfeited. 4. Issuance of Share Capital for Non-cash Consideration (PFRS 2) Non-cash consideration (Asset or Services) received shall be valued at their fair market value, unless the fair values of shares are more clearly determinable.

Treasury Shares 1. Acquisition of Treasury Shares, use cost model Treasury Stock at Cost Cash 2.

xx xx

Sale of Treasury Shares When treasury shares are reissued, the journal entry is: a. Sold at a price higher than the cost, resulting in a capital gain Cash xx Treasury shares (at cost) APIC from TS Transactions/Reacquired Shares (gain) b. At a price less than the cost resulting in a capital loss Cash xx (1) APIC from Treasury Shares xx Transactions (until balance is exhausted) (2) Retained Earnings xx Treasury shares at cost

xx xx

xx

*Note: When treasury shares are acquired at different costs, specific shares may be identified. Otherwise a FIFO or Average Cost Per Share is used to determine the cost of treasury shares sold. 3. Retirement of Treasury Shares Retire Treasury Shares at their carrying value, which is the original issue price: a. If OIP > COST (Original issue price/Carrying Value>Cost of Treasury Share: Capital Gain) Ordinary Share (at par) Paid in Capital in Excess of Par (pro-rata) Treasury Shares (at cost) APIC from Treasury Shares Transactions/Retirement b. If OIP < COST (Capital Loss) Ordinary Share (at par) Paid in Capital in Excess of Par (pro-rata) (1)Paid-in Capital from Treasury Shares Transactions (until exhausted) (2)APIC from Treasury Shares Transactions/Retirement Treasury Shares (at cost)

xx xx xx xx xx xx xx xx xx

4.

Restrictions of Retained Earnings for Treasury Shares has to appropriate Retained Earnings equal the balance of its Treasury Shares (Appropriation=cost of TS)

RIGHTS, WARRANTS, AND OPTIONS Similarity is that these securities entitle holders to acquire shares at an exercise rate ordinarily lower than the prevailing market rate. The difference however lies on how to account for the issuance, exercise and expiration of such, to wit: Distinction Rights Are issued to entitle the general stockholders in relation to their preemptive rights, to protect their proportional interest whenever corporations issue fresh new shares. Normally issued attached to a principal security (Bond or Preference Shares) as an inducement to buyers of the principal securities. Issuance No entry (memo entry only) 1 right for every 1 stock issued Exercise Normal entry for issuance of shares: Cash xx OS xx Share Prem xx Expiration No entry (memo entry only)

Warrants

PS with warrants: Cash xx PS xx Share Prem xx OSWO xx *Use pro-rata or residual approach Bonds with warrants: Cash xx Discount xx Prem xx Bonds Payable xx OSWO xx

Cash (Ex P) xx OSWO** xx OS xx Share Prem xx **debit OSWO at the carrying value of the warrants exercised.

OSWO** xx Share Prem xx From expired warrants

*Use residual approach Options Normally issued to key executives and officers as additional compensation for either past or future services provided to the company. Comp exp xx OSOO xx At FMV of options or the intrinsic value, whichever is appropriate (see note below) Cash (Ex P) xx OSOO** xx OS xx Share Prem xx **debit OSOO at the carrying value of the warrants exercised. OSOO** xx Share Prem xx From expired warrants

Notes on Accounting for Option Issuance (Equity-settled share based payment): 1. Determine if options vest immediately or do not vest immediately a. If options vest immediately (dr. comp expense for the entire valuation of the options) 2. If options do not vest immediately, determine if option plan is fixed or variable. a. If options are under FIXED OPTION PLAN (the only vesting condition is the vesting period), charge compensation expense to the vesting period by allocating the valuation of the options to the said vesting period (Options/VP) b. In estimating the compensation expense for each period, always consider in the analysis the estimated number of employees who shall remain within the companys employs until the end of the vesting period. Any changes in the number of employees remaining with the company until the options vest shall be accounted for as a mere change in estimate. 3. If options are under VARIABLE OPTION PLAN (if apart from the besting period, there is an additional vesting condition), determine what is the nature of the additional vesting condition (MARKET-BASED OR NON-MARKET-BASED) a. If additional vesting condition is MARKET-BASED (e.g. share price), account for the option as if it is fixed. That is, options shall vest regardless whether the additional market condition is achieved or not. This is because the determination of the fair valuation of the options considers the probability that market-based condition will be achieved or not achieved. In addition, market-based condition cannot be directly influenced by key employees. 4. If additional vesting condition is NON-MARKET-BASED (e.g. target sales, earnings, increase in sales etc), consider whether the additional nonmarket based condition is achieved or not in vesting the options. This means that the options shall only become exerciseable if the additional vesting condition (apart from the cesting period) is achieved. In addition, ascertain which among the following items are variable/varies in response to the non-market-based condition: a. Number of options b. Vesting period c. Fair value of options If non-market-based vesting condition is not achieved,the option shall revert to the company. Retained Earnings Retained Earnings RE, Beginning Prior period adjustments: (a) PP errors (b) Change in policies (c) Capital lossed from TST (d) Capital loss from recapitulation (e) Dividends declared from earnings (f) Appropriations (legal, contractual Voluntary) (h) Net loss 1. (a) PP errors (b) Change in policies RE, beg as adjusted

(g) Reversal on appropriations (i) Net income RE, end

2. 3.

Cash Dividend Computation of Cash dividends payable: Number of shares outstanding and subscribed * (% of cash dividend * Par per share) Property Dividends measured at fair market value of the asset declared as dividends. Stock Dividends or Capitalization or Bonus Issue an ordinary stock dividend is a stock dividend of the same class; i.e. ordinary shares to ordinary shareholders. A special stock dividend is a stock dividend of a different class; i.e. preference shares to ordinary shareholders. a. Less than 20% of the shares previously outstanding and subscribed, the stock dividend is termed small, in which case the amount to be charged to Retained Earnings is equal to its current market value.

b. 4.

5.

At least 20% of the shares previously outstanding and subscribed, the stock dividend is termed large in which case the amount charged against Retained Earnings is equal to par value. Scrip Dividends A corporation may declare a scrip dividend by issuing promissory notes called scrip. This arises when the corporation may have adequate Retained Earnings to meet the legal dividend requirements but has insufficient funds to disburse. If the promissory note bears interest this is charged to Interest Expense. Balance Sheet Classification Dividends Payable, Property Dividends Payable and Scrip Dividends Payable re classifies as liabilities whereas Stock Dividends Distributable is an addition in the Stockholders Equity.

Potrebbero piacerti anche

- SPECIAL LAWS - NotesDocumento13 pagineSPECIAL LAWS - NotesKittenNessuna valutazione finora

- Heimlich ManeuverDocumento2 pagineHeimlich ManeuverKhalid233Nessuna valutazione finora

- Addressing Ways of Social InequalitiesDocumento28 pagineAddressing Ways of Social InequalitiesSherra Mae NarcisoNessuna valutazione finora

- Tuna Processing, Inc. vs. Philippine Kingford, Inc., 667 SCRA 287, February 29, 2012 PDFDocumento23 pagineTuna Processing, Inc. vs. Philippine Kingford, Inc., 667 SCRA 287, February 29, 2012 PDFJane BandojaNessuna valutazione finora

- PP Vs PascualDocumento2 paginePP Vs PascualKeisha Yna V. RamirezNessuna valutazione finora

- Concrete 19 (FDN 6) Nov 2020Documento1 paginaConcrete 19 (FDN 6) Nov 2020Dale MalazzabNessuna valutazione finora

- Cases LaborDocumento10 pagineCases LaborAizer LorenaNessuna valutazione finora

- A Political Analysis Extra Judicial Execution in PhilippinesDocumento7 pagineA Political Analysis Extra Judicial Execution in PhilippinesMa. Nicca CericosNessuna valutazione finora

- CE Board Nov 2020 - RCD - Set 2 ColoredDocumento2 pagineCE Board Nov 2020 - RCD - Set 2 ColoredDale MalazzabNessuna valutazione finora

- BIOMOLECULES HandoutsDocumento4 pagineBIOMOLECULES HandoutsJemuel Bucud LagartoNessuna valutazione finora

- The Law On Alternative Dispute Resolution: Private Justice in The PhilippinesDocumento4 pagineThe Law On Alternative Dispute Resolution: Private Justice in The PhilippinesNicco AcaylarNessuna valutazione finora

- MS Last Minute by HerculesDocumento6 pagineMS Last Minute by HerculesFranklin ValdezNessuna valutazione finora

- NGO and Phil DemocracyDocumento14 pagineNGO and Phil DemocracyEmiliana Kampilan0% (1)

- Format of Financial Statment As Per Revised Schedule III of Companies Act 2013Documento11 pagineFormat of Financial Statment As Per Revised Schedule III of Companies Act 2013Mayank ParekhNessuna valutazione finora

- Mste 5Documento4 pagineMste 5Lynea AlbaytarNessuna valutazione finora

- SOSC5 - Lesson 4Documento20 pagineSOSC5 - Lesson 4Rhan RanNessuna valutazione finora

- Alejandro 6 MsteDocumento2 pagineAlejandro 6 MsteBack UpNessuna valutazione finora

- Statement of Financial Position (Balance Sheet) : Lopez, Erica BS Accountancy 2Documento8 pagineStatement of Financial Position (Balance Sheet) : Lopez, Erica BS Accountancy 2Erica LopezNessuna valutazione finora

- CE Board Nov 2020 - RCD - Set 13Documento4 pagineCE Board Nov 2020 - RCD - Set 13Dale MalazzabNessuna valutazione finora

- TAX-303 (Input VAT)Documento8 pagineTAX-303 (Input VAT)Fella GultianoNessuna valutazione finora

- Worksheet Imperfect CompetitionDocumento2 pagineWorksheet Imperfect CompetitionMuskaanNessuna valutazione finora

- Party To Facilitate The Borrowing Activities BetweenDocumento7 pagineParty To Facilitate The Borrowing Activities BetweenMikaela Amigan Evangelista100% (1)

- Audit of Inv Property, NCA HFS and Disc OpDocumento32 pagineAudit of Inv Property, NCA HFS and Disc OpPaula BitorNessuna valutazione finora

- Sale and Leaseback: The Benefits of SLB Transactions Are As FollowsDocumento2 pagineSale and Leaseback: The Benefits of SLB Transactions Are As FollowsJoan BartolomeNessuna valutazione finora

- CorporationDocumento64 pagineCorporationJanaisa BugayongNessuna valutazione finora

- CHP 10 - Long Term Financing DecisionsDocumento15 pagineCHP 10 - Long Term Financing DecisionsHarvey AguilarNessuna valutazione finora

- Raiborn Kinney On Joint CostsDocumento18 pagineRaiborn Kinney On Joint CostsClrk RoxassNessuna valutazione finora

- Compound Financial Instruments Pas 32 Pfrs 9Documento14 pagineCompound Financial Instruments Pas 32 Pfrs 9SamNessuna valutazione finora

- CE Board Nov 2020 - RCD - Set 8 and 9Documento6 pagineCE Board Nov 2020 - RCD - Set 8 and 9Dale MalazzabNessuna valutazione finora

- Sustainable Marketing: Social Responsibility and EthicsDocumento30 pagineSustainable Marketing: Social Responsibility and EthicsMaria Jesus Jerez JerezNessuna valutazione finora

- Purposive CommunicationDocumento5 paginePurposive CommunicationRiri KimmyNessuna valutazione finora

- ACTBFAR Work Text Chapter 11 2T1920 FormattedDocumento11 pagineACTBFAR Work Text Chapter 11 2T1920 FormattednuggsNessuna valutazione finora

- Activity PostingDocumento3 pagineActivity PostingApril BalsitaNessuna valutazione finora

- FAR Financial Liabilities BERNARTE ReviewerDocumento5 pagineFAR Financial Liabilities BERNARTE ReviewerMarjorie AugustoNessuna valutazione finora

- 3 - QMT425-T3 Linear Programming (29-74)Documento46 pagine3 - QMT425-T3 Linear Programming (29-74)Ashraf RadzaliNessuna valutazione finora

- RBG Corporation Code ComparisonDocumento30 pagineRBG Corporation Code ComparisonLakbay BiyaheroNessuna valutazione finora

- Pas 36 Impairment of AssetsDocumento2 paginePas 36 Impairment of AssetsR.A.Nessuna valutazione finora

- Corporation - Formation and Share Capital TransactionsDocumento3 pagineCorporation - Formation and Share Capital TransactionsPrincess NozalNessuna valutazione finora

- Inventories NotesDocumento7 pagineInventories NotesJessel Ann MontecilloNessuna valutazione finora

- Lecture 18 - PFRS 16 LeasesDocumento21 pagineLecture 18 - PFRS 16 LeasesManuel H. Uyammi Jr.Nessuna valutazione finora

- Chapter 14-Performance Measurement, Balanced Scorecards, and Performance RewardsDocumento40 pagineChapter 14-Performance Measurement, Balanced Scorecards, and Performance RewardsJazehl ValdezNessuna valutazione finora

- Civil SocietyDocumento6 pagineCivil SocietyBethel DizonNessuna valutazione finora

- CFLM 2 Post TestDocumento8 pagineCFLM 2 Post TestMaby ButconNessuna valutazione finora

- Absorption and Variable CostingDocumento15 pagineAbsorption and Variable CostingApril Pearl VenezuelaNessuna valutazione finora

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocumento6 pagineManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNessuna valutazione finora

- Sales&Credit ReviewerDocumento87 pagineSales&Credit ReviewerJessicaNessuna valutazione finora

- The Budget ProcessDocumento86 pagineThe Budget ProcessLeah Dianne SegunialNessuna valutazione finora

- Hasselback Company Acquired A Plant Asset at The Beginning of PDFDocumento1 paginaHasselback Company Acquired A Plant Asset at The Beginning of PDFAnbu jaromiaNessuna valutazione finora

- Reviewer Engg EconDocumento17 pagineReviewer Engg EconLEMUEL ADANessuna valutazione finora

- Standard Costing and Variance Analysis FormulasDocumento2 pagineStandard Costing and Variance Analysis FormulasRashid HussainNessuna valutazione finora

- Calculator Techniques PERCDCDocumento54 pagineCalculator Techniques PERCDCSharelyn Nebreja100% (1)

- Transpo Printable Lecture2Documento31 pagineTranspo Printable Lecture2Jabin Sta. TeresaNessuna valutazione finora

- CE Board Nov 2020 - RCD - Set 6 ColoredDocumento3 pagineCE Board Nov 2020 - RCD - Set 6 ColoredDale MalazzabNessuna valutazione finora

- TOPIC 6 - Accounting For OHDocumento2 pagineTOPIC 6 - Accounting For OHAnna WilliamsNessuna valutazione finora

- Final Marketing Plan TemoxDocumento26 pagineFinal Marketing Plan TemoxSumin SeongNessuna valutazione finora

- Cv2d Ej2 Starex03f ArdanDocumento7 pagineCv2d Ej2 Starex03f ArdanIna Therese ArdanNessuna valutazione finora

- October 2010 Business Law & Taxation Final Pre-BoardDocumento9 pagineOctober 2010 Business Law & Taxation Final Pre-BoardPatrick ArazoNessuna valutazione finora

- #1 Shareholders' Equity & Retained Earnings PDFDocumento8 pagine#1 Shareholders' Equity & Retained Earnings PDFjanus lopezNessuna valutazione finora

- 14 Shareholders' EquityDocumento10 pagine14 Shareholders' Equityrandomlungs121223Nessuna valutazione finora

- Classroom Notes 6385 and 6386Documento3 pagineClassroom Notes 6385 and 6386Mary Grace Galleon-Yang OmacNessuna valutazione finora

- Valuation of Bonds and Shares: Prepared by Priyanka GohilDocumento74 pagineValuation of Bonds and Shares: Prepared by Priyanka GohilSunil Pillai100% (1)

- Strat Cost 8-24Documento4 pagineStrat Cost 8-24Vivienne Rozenn LaytoNessuna valutazione finora

- GE - Authorization FormDocumento2 pagineGE - Authorization FormYiki TanNessuna valutazione finora

- Chap 02-Analyzing TransactionsDocumento51 pagineChap 02-Analyzing TransactionsJean Coul100% (1)

- DullDocumento3 pagineDullHelplineNessuna valutazione finora

- Ifsfm M2Documento98 pagineIfsfm M2Cally CallisterNessuna valutazione finora

- Final Settlement PageDocumento6 pagineFinal Settlement Pagemohammad zubairNessuna valutazione finora

- Other Long-Term Investments: Sinking Fund Requirements Maturitie SDocumento3 pagineOther Long-Term Investments: Sinking Fund Requirements Maturitie SXiena0% (1)

- 11-Inventory Cost FlowDocumento28 pagine11-Inventory Cost FlowPatrick Jayson VillademosaNessuna valutazione finora

- Financial Report Analyses: Intania Aisha MelatiDocumento19 pagineFinancial Report Analyses: Intania Aisha MelatiShia ZenNessuna valutazione finora

- Overview of Financial Reporting Environment Environment: FRS Course DR Sudershan Kuntluru IIM KozhikodeDocumento35 pagineOverview of Financial Reporting Environment Environment: FRS Course DR Sudershan Kuntluru IIM KozhikodeKumar PrashantNessuna valutazione finora

- Green Banking Practices in BangladeshDocumento6 pagineGreen Banking Practices in BangladeshIOSRjournal100% (1)

- Treasury ManagementDocumento6 pagineTreasury ManagementJanzel NuñezNessuna valutazione finora

- ToolKit Roads&Highways Low-ResDocumento896 pagineToolKit Roads&Highways Low-ResAbd Aziz MohamedNessuna valutazione finora

- Government Owned and Controlled CorporationsDocumento34 pagineGovernment Owned and Controlled CorporationsKenneth Delos SantosNessuna valutazione finora

- SFS SCO JP54 Only For Rusas Kostas RotterdamPROTDocumento4 pagineSFS SCO JP54 Only For Rusas Kostas RotterdamPROTDeby Aprilucia FarahdeviraNessuna valutazione finora

- Auditing A Risk Based Approach To Conducting A Quality Audit 10th Edition Johnstone Solutions ManualDocumento26 pagineAuditing A Risk Based Approach To Conducting A Quality Audit 10th Edition Johnstone Solutions ManualDebraPricemkw100% (47)

- Chattel Mortgage Without Separate Promissory NoteDocumento2 pagineChattel Mortgage Without Separate Promissory NoteJson GalvezNessuna valutazione finora

- Top 100 CompaniesDocumento148 pagineTop 100 CompaniesNavin ChandarNessuna valutazione finora

- Vdocuments - MX - Obligations Contracts Memory AidDocumento24 pagineVdocuments - MX - Obligations Contracts Memory AidMarie Lourence AngelesNessuna valutazione finora

- Investments and Portfolio ManagementDocumento5 pagineInvestments and Portfolio ManagementFedrick BuenaventuraNessuna valutazione finora

- Bitcoin To $1M, Ethereum To $180,000 by 2030 ARKDocumento1 paginaBitcoin To $1M, Ethereum To $180,000 by 2030 ARKOwen HalpertNessuna valutazione finora

- Tutorial 7 Petty Cash Book QuestionsDocumento3 pagineTutorial 7 Petty Cash Book QuestionsKubenderarubban BalachantharNessuna valutazione finora

- BH - eFM3 - PPT - ch05 - Part 1Documento19 pagineBH - eFM3 - PPT - ch05 - Part 1LIM HUI YI / UPMNessuna valutazione finora

- Report Financial ManagementDocumento30 pagineReport Financial ManagementRishelle Mae C. AcademíaNessuna valutazione finora

- Financial Institutions and MarketDocumento19 pagineFinancial Institutions and MarketNilesh MotwaniNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)rajuNessuna valutazione finora

- RbiDocumento1 paginaRbikhajabaigNessuna valutazione finora

- General LedgerDocumento4 pagineGeneral Ledger21-53070Nessuna valutazione finora

- PitchBook 4Q 2019 Analyst Note Overview of Tech Focused PE FundsDocumento16 paginePitchBook 4Q 2019 Analyst Note Overview of Tech Focused PE FundsDNessuna valutazione finora