Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Assessments - Guidebook

Caricato da

biryetegaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Assessments - Guidebook

Caricato da

biryetegaCopyright:

Formati disponibili

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

Uganda Revenue Authority

IMPLEMENTATION OF INTEGRATED TAX ADMINISTRATION

ASSESSMENT MODULE PROCESS GUIDE BOOK

Version 1.0

27th July, 2009

Confidential

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

Notice

This is a controlled document. Unauthorised access, copying, replication or usage for a purpose other than for which it is intended, is prohibited.

Confidential

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

Contents

1. Introduction ............................................................................................................................................ 6 1.1 1.2 1.3 1.4 2. Purpose.................................................................................................................................................. 6 Scope ..................................................................................................................................................... 6 User categories...................................................................................................................................... 6 Document overview............................................................................................................................... 6

Assessments ............................................................................................................................................ 8 2.1. Income Tax ............................................................................................................................................ 8 2.1.1.1. Assessments after an audit .......................................................................................................... 8 2.1.1.2. Details of the assessment task ..................................................................................................... 8 2.1.1.3. Initiation and processing of the interview .................................................................................... 9 2.1.1.4. Approval of assessment task ........................................................................................................ 9 2.1.1.5. Service of Notice for Assessment: .............................................................................................. 10 2.1.1.6. Assessment without audit .......................................................................................................... 10 2.1.1.7. Administrative Estimated Assessment ....................................................................................... 10 2.1.1.8. Details of the assessment task ................................................................................................... 10 2.1.1.9. Initiation and processing of the interview .................................................................................. 11 2.1.1.10. Approval of assessment task .................................................................................................. 11 2.1.1.11. Service of assessment number .............................................................................................. 12 2.1.1.12. Administrative additional assessment ................................................................................... 12 2.1.1.13. Initiation of Assessment task: ................................................................................................ 12 2.1.1.14. Details of Assessment task: .................................................................................................... 12 2.1.1.15. Interview Initiation and Processing: ....................................................................................... 13 2.1.1.16. Approval of Assessment Task:................................................................................................ 13 2.1.1.17. Service of Notice for Assessment: .......................................................................................... 13 2.1.1.18. Administrative Amended Assessment ................................................................................... 13 2.1.1.19. Initiation of Assessment task: ................................................................................................ 13 2.1.1.20. Details of Assessment task: .................................................................................................... 13 2.1.1.21. Interview Initiation and Processing: ....................................................................................... 15 2.1.1.22. Approval of Assessment Task:................................................................................................ 15 2.1.1.23. Service of Notice for Assessment: .......................................................................................... 15 2.2. Value Added Tax.................................................................................................................................. 15 2.2.1.1. Assessments after an audit ........................................................................................................ 16 2.2.1.2. Details of the assessment task ................................................................................................... 16 2.2.1.3. Initiation and processing of the interview .................................................................................. 17 2.2.1.4. Approval of assessment task ...................................................................................................... 17 2.2.1.5. Service of Notice for Assessment: .............................................................................................. 17 2.2.1.6. Assessment without audit .......................................................................................................... 17 2.2.1.7. Administrative Estimated Assessment ....................................................................................... 18 2.2.1.8. Details of the assessment task ................................................................................................... 18 2.2.1.9. Initiation and processing of the interview .................................................................................. 19 2.2.1.10. Approval of assessment task .................................................................................................. 19 2.2.1.11. Service of assessment number .............................................................................................. 19

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.2.1.12. 2.2.1.13. 2.2.1.14. 2.2.1.15. 2.2.1.16. 2.2.1.17. 2.2.1.18. 2.2.1.19. 2.2.1.20. 2.2.1.21. 2.2.1.22. 2.2.1.23.

Administrative additional assessment ................................................................................... 19 Initiation of Assessment task: ................................................................................................ 19 Details of Assessment task: .................................................................................................... 19 Interview Initiation and Processing: ....................................................................................... 21 Approval of Assessment Task:................................................................................................ 21 Service of Notice for Assessment: .......................................................................................... 21 Administrative Amended Assessment ................................................................................... 21 Initiation of Assessment task: ................................................................................................ 21 Details of Assessment task: .................................................................................................... 21 Interview Initiation and Processing: ....................................................................................... 22 Approval of Assessment Task:................................................................................................ 22 Service of Notice for Assessment: .......................................................................................... 22

2.3. Local Excise Duty ................................................................................................................................. 22 2.3.1.1. Assessments after an audit ........................................................................................................ 23 2.3.1.2. Details of the assessment task ................................................................................................... 23 2.3.1.3. Initiation and processing of the interview .................................................................................. 24 2.3.1.4. Approval of assessment task ...................................................................................................... 24 2.3.1.5. Service of Notice for Assessment: .............................................................................................. 24 2.3.1.6. Assessment without audit .......................................................................................................... 24 2.3.1.7. Administrative Estimated Assessment ....................................................................................... 24 2.3.1.8. Details of the assessment task ................................................................................................... 25 2.3.1.9. Initiation and processing of the interview .................................................................................. 27 2.3.1.10. Approval of assessment task .................................................................................................. 27 2.3.1.11. Service of assessment number .............................................................................................. 27 2.3.1.12. Administrative additional assessment ................................................................................... 27 2.3.1.13. Initiation of Assessment task: ................................................................................................ 27 2.3.1.14. Details of Assessment task: .................................................................................................... 27 2.3.1.15. Interview Initiation and Processing: ....................................................................................... 28 2.3.1.16. Approval of Assessment Task:................................................................................................ 28 2.3.1.17. Service of Notice for Assessment: .......................................................................................... 28 2.3.1.18. Administrative Amended Assessment ................................................................................... 28 2.3.1.19. Initiation of Assessment task: ................................................................................................ 28 2.3.1.20. Details of Assessment task: .................................................................................................... 29 2.3.1.21. Interview Initiation and Processing: ....................................................................................... 30 2.3.1.22. Approval of Assessment Task:................................................................................................ 30 2.3.1.23. Service of Notice for Assessment: .......................................................................................... 30 2.4. GPBT .................................................................................................................................................... 30 2.4.1.1. Assessments after an audit ........................................................................................................ 31 2.4.1.2. Details of the assessment task ................................................................................................... 31 2.4.1.3. Initiation and processing of the interview .................................................................................. 32 2.4.1.4. Approval of assessment task ...................................................................................................... 32 2.4.1.5. Service of Notice for Assessment: .............................................................................................. 32 2.4.1.6. Assessment without audit .......................................................................................................... 32 2.4.1.7. Administrative Estimated Assessment ....................................................................................... 32 2.4.1.8. Details of the assessment task ................................................................................................... 32 2.4.1.9. Initiation and processing of the interview .................................................................................. 34 2.4.1.10. Approval of assessment task .................................................................................................. 34

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.4.1.11. 2.4.1.12. 2.4.1.13. 2.4.1.14. 2.4.1.15. 2.4.1.16. 2.4.1.17. 2.4.1.18. 2.4.1.19. 2.4.1.20. 2.4.1.21. 2.4.1.22. 2.4.1.23. 2.5.

Service of assessment number .............................................................................................. 34 Administrative additional assessment ................................................................................... 34 Initiation of Assessment task: ................................................................................................ 34 Details of Assessment task: .................................................................................................... 34 Interview Initiation and Processing: ....................................................................................... 35 Approval of Assessment Task:................................................................................................ 35 Service of Notice for Assessment: .......................................................................................... 35 Administrative Amended Assessment ................................................................................... 36 Initiation of Assessment task: ................................................................................................ 36 Details of Assessment task: .................................................................................................... 36 Interview Initiation and Processing: ....................................................................................... 37 Approval of Assessment Task:................................................................................................ 37 Service of Notice for Assessment: .......................................................................................... 37

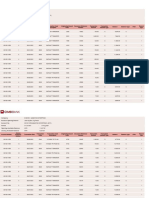

Configuration Parameters ................................................................................................................... 37

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

1. Introduction

The process described in this document provides information and guidance to personnel involved in the assessment process. This guidance is intended to describe the process activities set out for Assessment module version 1 of March 2009. This process guidebook is being produced as one of the items that are required to be supplied by TCS to URA as part of the product s to be supplied. This is made necessary not as functions to be performed by the software but, for example, to ensure proper implementation and operation, or as characteristics of the software product not readily defined in terms of business functionality. For each of the functions in the assessment module, documented procedures are required in the form of business process operating guidebooks for the entire business processes: those directly and indirectly affected by a function listed within the preceding functional requirements and those processes that precede and succeed those functions. The business process operating guidebooks is going to be structured to provide end-to-end process overview and role-specific instructions.

1.1

Purpose

The purpose of this document is to describe the process activities common to all officers that are that obliged to perform the assessment activities

1.2

Scope

The assessment process described in this document is a back office function whose main purpose is to ensure compliance of the taxpayer to his or her obligations.

1.3

User categories

User categories are as hereunder: The Commissioner Generals Commissioners Assistant Commissioners Managers Supervisors Officers

1.4

Document overview

This document is intended to provide an overview of repeatable processes that personnel can use in carrying out their duties as they process any functionality under the assessment process module. This handbook is intended for use by URA officers having the responsibility of operating and maintaining the assessment module. It offers an overview of the roles carried out by the URA personnel. Staff concerned with requirements specification can use this document to guide them through the process. This document may simply be used to assist with specific activities such as obtaining information 6

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

required to raise the assessment, when to initiate the assessment and how to inform the taxpayer. The assessment processes are divided into two categories; i. Self Assessment this has been catered for under the returns processing module.

ii. Administrative Assessment. This caters for estimated assessments, additional and amended assessments.

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2. Assessments

The assessment process refers to both self assessments and administrative assessments. This document will deal with administrative assessment and this includes estimated assessments and additional assessments. Assessments may be carried out either after an audit has been carried out or without an audit being done. The administrative assessments have the following functionalities.

2.1. Income Tax

In the assessment module, assessments under income tax act will cover assessments after an audit and assessments without an audit. 2.1.1.1. Assessments after an audit An audit will be carried out if; i. A taxpayer falls within the audit criteria.

ii. Where the Approving Authority Returns recommends for an audit during return approval. iii. Where there is a need for audit due to other circumstances. 2.1.1.2. Details of the assessment task After the audit has been completed by the audit authority, the system shall create a task for assessment in your (assessment authority) account. The task will display for you the following information; a. Basic details of the taxpayer. This tab will show the TIN, legal name of the taxpayer, business address of the taxpayer, return period and type of assessment to be carried out as per the audit. b. The assessed liability as per the audit c. The penalty details you are required to indicate in this tab, the penalty section and your reasons for the penalty imposition. ETax will auto populate the description of the penalty section and the amount of penalty. d. Payment data for the return period for which the assessment has been initiated and any amounts that the taxpayer has paid.

e. The net outstanding liability You are required to approve the assessment task. However if you need further clarification from the taxpayer before you impose nay penalties, you should initiate the interview with the taxpayer.

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.1.1.3.

Initiation and processing of the interview There will be a facility in the assessment task for you to initiate the notice for interview. You shall provide the following details into the system. i. Date of the interview

ii. Time of the interview iii. Venue of the interview Once you have entered this information into the system, the interview notice shall be generated in the account of the printing authority to print and post it to the taxpayer. After the interview notice has been generated, a task shall be created in the account of the interview authority to carry out the interview. Capturing Interview Details: This shall be done by the interview authority. If you complete the interview in single day, you (the Interview Authority- Assessment) shall capture the findings of interview as final findings. Where the interview has to be postponed due to some reason, you shall state the reason for the delay into the system. You should also indicate the new date on which it is rescheduled. Where the interview has not been completed within one sitting, you should arrange the next meeting and the new date on which the interview will be completed. You should capture the final findings of the interview on the basis of which you shall decide how much penalty will be imposed on the taxpayer. Where the taxpayer does not turn up for the interview or where you think that the interview is not required, you may cancel the interview after you have captured your remarks into the system. Review of Interview: On completion of interview, The Assessment Authority shall receive interview report. There is no separate interview checklist but findings of the interviewing authority will be available to Assessment Authority for his review. He shall verify comments received from the taxpayer and shall make necessary changes, if required. Based on the interview, the Assessment Authority shall decide how much penalty should be imposed on taxpayer. 2.1.1.4. Approval of assessment task You (Assessment Authority) shall approve the assessment task based on the interview findings and a notice for Assessment shall be generated for the taxpayer. Every Notice for Assessment shall have a unique number called Assessment Number. This number can be used for objection in assessed tax or penalty or both. On generation of Notice for Assessment the taxpayers profile will be updated in eTax. 9

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

The Notice for Assessment shall advise the taxpayer of the following: i. ii. iii. iv. v. vi. The tax payable including Penal tax The date the tax is due and payable Type of Assessment An indication of the basis and/or explanation of the assessment The office that raised the assessment The taxpayers right of objection to the assessment and the manner in which this right can be exercised. This shall be clearly and explicitly indicated to the taxpayer. The procedures detailed should include: The Time-frame within which to file the notice of objection The place and officer (use official title) to which the notice of objection should be delivered The fact that the objection should be made in writing and should precisely state the grounds of objection, Refer to Objection Module In the assessment notice the taxpayer, should be advised that where he or she opts to object, 30% of the tax assessed should be paid to the commissioner before the objection can be handled

2.1.1.5.

Service of Notice for Assessment: This task will be carried out by the Certificate Printing and Issuing Authority. As the designated authority, you shall ensure that; i. The person collecting the notice for assessment, presents proof of identity.

ii. Minimun information is captured from persons collecting communications from URA DT Station, which shall include the surname, designation , ID no and signature of the person collecting the information. The notice for assessment shall be printed only in collection. 2.1.1.6. Assessment without audit The following types of assessment can be carried out without an audit Administrative Estimated Assessment The task for administrative estimated assessment shall be created automatically if taxpayer has failed to file the return. eTax shall wait for 7+15 working days after the return due date for the taxpayer to file the return, If the taxpayer fails to file the return during this grace period, eTax shall automatically create the task for Administrative Estimated Assessment in your (Approving Authority Returns) account and then you shall be able to assign these tasks to respective Assessment Authorities. Details of the assessment task The task will display for you the following information; a. Basic details of the taxpayer. This tab will show the TIN, legal name of the taxpayer, business address of the taxpayer, return period and type of assessment to be carried out as per the audit. b. Estimation of liability this estimate will be done by you using the following formula. 10

2.1.1.7.

2.1.1.8.

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

i.

For individual income the estimate shall be Last Years Employment Income + Inflation rate for current year Last years employment income shall be populated as per taxpayers return available in eTax for previous year. Inflation rate shall be populated as per data configured in eTax for current year.

ii.

For business income, Taxable income of previous year + Current Year Inflation Rate Taxable income of previous year + current year of inflation ETax shall show the taxable income of the previous year as per taxpayers return data available in eTax. Inflation rate will populate as per data configured in eTax for current year.

Average Taxable income of last n years + Industry growth rate of current year Based on number of years (n) input by you, eTax shall show the average taxable income of the taxpayer as per return data available in eTax. Industry growth rate (as per ISIC code) will populate as per data configured in eTax for current year.

Industry average Taxable Income eTax shall show list of taxpayers and corresponding taxable income for current month for same ISIC code for same location and other locations, you have to select the taxpayers and eTax shall show the average taxable income.

You should decide the estimated chargeable income on the basis of any of the above methods. The system will then apply the appropriate tax rates to the chargeable income and come up with the taxable income; c. Penalty details you are required to indicate in this tab, the penalty section and your reasons for the penalty imposition. ETax will auto populate the description of the penalty section and the amount of penalty. d. Payment data for the return period for which the assessment has been initiated and any amounts that the taxpayer has paid.

e. Other assessment details carried in the same period f. 2.1.1.9. The net outstanding liability

Initiation and processing of the interview You are required to approve the assessment task. However if you need further clarification from the taxpayer before you impose nay penalties, you should initiate the interview with the taxpayer. For details refer to 2.1.1.2 above for details Approval of assessment task Refer to 2.1.1.3 above for details 11

2.1.1.10.

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.1.1.11.

Service of assessment number Refer to 2.1.1.4 above for details.

2.1.1.12. 2.1.1.13.

Administrative additional assessment Initiation of Assessment task: You shall capture the assessment number of the Notice for Assessment issued previously against which additional assessment is to be carried out and click on Generate Assessment button to initiate the Assessment task. Details of Assessment task: The generated assessment task shall show following information in different tabs A. Basic Details of taxpayer This tab will show TIN of the taxpayer Legal Name of the taxpayer Business Address of the taxpayer Return period Type of assessment initiated Administrative Additional Assessment

2.1.1.14.

B. Estimation of Liability This tab shall show you the previous assessment data along with one more column to capture the assessed values for this assessment. If previous assessment was not an estimated assessment, eTax shall show complete return and assessment data along with one more column to capture the additional assessed values. ETax shall auto calculate all the derived fields and show the additional assessed tax payable. If previous return was an estimated assessment, eTax shall show the system generated values based on parameters configured for current Financial Year for calculation of liability amount as per previous assessment along with one more column to capture the additional assessed values. C. Penalty Details This tab shall provide the facility for you (Assessment Authority) to refer the penalty imposed previously and impose additional penalty on taxpayer, it shall show following fields; Penalty Section Description of Penalty Section autopopulated Amount of Penalty System generated for pre-defined penalties as per business rule Otherwise you shall provide the penalty amount. Reasons for imposition penalty 12

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

D. Payment data for the return period for which assessment has been initiated This tab shall show those payments done by taxpayer for Income Tax which have been adjusted against return period for which assessment has been initiated. E. Other Assessment details This tab shall show details of other assessments carried out for the same period. F. Net Outstanding Liability This tab shall show following data for calculation of net amount payable by the taxpayer 2.1.1.15. Opening O/S tax due for Income Tax [a] (as on Assessment period start date) Interest Payable on O/S Income Tax due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

Interview Initiation and Processing: For details refer to 2.1.1.2 above for details. Approval of Assessment Task: Refer to 2.1.1.3 above for details Service of Notice for Assessment: Refer to 2.1.1.4 above for details.

2.1.1.16.

2.1.1.17.

2.1.1.18. 2.1.1.19.

Administrative Amended Assessment Initiation of Assessment task: You (the Assessment Authority) will capture the assessment number of the Notice for Assessment issued previously which is to be amended and click on Generate Assessment button to initiate the Assessment task. Details of Assessment task: The generated assessment task will show following information in different tabs A. Basic Details of taxpayer This tab will show TIN of the taxpayer Legal Name of the taxpayer 13

2.1.1.20.

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

Business Address of the taxpayer Return period Type of assessment initiated Administrative Amended Assessment

B. Estimation of Liability This tab shall show the previous assessment data along with facility to update the assessed values for previous assessment. If previous assessment was not an estimated assessment, it shall show complete return and editable assessment data. ETax shall auto calculate and update all the derived fields and show the amended assessed values. If previous return was an estimated assessment, eTax shall show the system generated values based on parameters configured for current Financial Year for calculation of liability amount as per previous assessment along with facility to update these data to generate the amended values. C. Penalty Details This tab shall provide the facility for Assessment Authority to update the penalty amounts imposed during the assessment which is to be amended, It shall show following fields Penalty Section Description of Penalty Section autopopulated Amount of Penalty System generated for pre-defined penalties as per business rule Otherwise Assessment Authority shall provide the penalty amount. Reasons for imposition penalty

D. Payment data for the return period for which assessment has been initiated This tab shall show those payments done by taxpayer for Income Tax which have been adjusted against return period for which assessment has been initiated. E. Other Assessment details This tab shall show details of other assessments carried out for the same period. F. Net Outstanding Liability This tab shall show following data for calculation of net amount payable by the taxpayer Opening O/S tax due for Income Tax [a] (as on Assessment period start date) Interest Payable on O/S Income Tax due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] 14

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.1.1.21.

Net payable for the assessment period [f] = [a+b+c+d-e]

Interview Initiation and Processing: For details refer to 2.1.1.2 above for details. Approval of Assessment Task: Refer to 2.1.1.3 above for details Service of Notice for Assessment: Refer to 2.1.1.4 above for details.

2.1.1.22.

2.1.1.23.

2.2. Value Added Tax

In the assessment module, assessments under VAT Act will cover administrative assessments. Administrative assessments in VAT arise in the following instances; a. Estimated assessments under section 32 (1) of the VAT Act. This will arise where the following occur; i. Where a person fails to lodge a return as required by Section 31; or

ii. Where the Commissioner General has reasonable grounds to believe that a person will become liable to pay tax but is unlikely to pay the amount due, b. Assessment under section 32(1)(b) of the VAT Act - Where the Commissioner General is not satisfied with a return lodged by a person. This has been handled under Returns Processing Module(refer to modified return advice); c. Assessment arising out of an application to make alterations or additions to a return previously submitted by the taxpayer - Section 32(4)& (6) VAT Act Where a taxpayer is dissatisfied with a return that he or she previously submitted, he may apply to add to or alter it. After the application has been considered, the Commissioner General is required to make an assessment of the amount which in his or her opinion is payable under the Act. This has been handled under the Returns Processing Module. d. Imposition of penalties under section 65 of the VAT Act. This section deals with imposition of penal tax. Penal tax will be imposed in the following situations; i. A tax payer who is eligible for registration but fails to apply for registration. The penalty in this case is double the amount of tax payable from the date the person became eligible to register up to the date the person applied for registration or was registered by the Commissioner. See s. 65(1) VAT Act; ii. Failure to lodge a return within the required time see section 65(2) VAT Act; the penalty for failure to file a return by the due date is the greater of two hundred thousand shillings or 2% (per month compounded) of the tax payable for the period the return is late. This has been covered under the Returns Processing Module. 15

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

iii. Failure to pay tax by the due date (whether in relation to a payment return or an administrative assessment), a penal tax on the unpaid tax is imposed at a rate of 2% per month (compounded) for the period the amount has remained outstanding see section 65(3) VAT Act. This has been handled under the Payments Processing Module. iv. Failure to maintain proper records (the penalty is double the amount of tax payable by the person for the tax period) - see section 65(5) VAT Act. This will be handled under the Audit Module as this can only be ascertained after an audit has been carried out on the taxpayer. v. Where the taxpayer Knowingly or recklessly a. Makes a statement to an officer of the Uganda Revenue Authority that is false or misleading in a material particular; or b. omits from a statement made to an officer of the Uganda Revenue Authority any matter or thing without which the statement is misleading in a material particular, and the tax properly payable by the person exceeds the tax that was assessed as payable based on the false or misleading information, the person is liable to pay penal tax equal to double the amount of the excess. This will be handled in the audit module. e. Additional and Amended VAT Assessments. Additional assessments in VAT arise in the following instances; Under section 32(8) of the VAT Act where the Commissioner General may, within the time limits set out in sub-section (9), amend an assessment as the he or she considers necessary. A notice of the amended assessment shall be served on the person assessed. An amended assessment is treated in all respects as an assessment under this Act. ii. Additional assessments may also arise where the taxpayers return has been modified by URA and a modified return advice has been issued to the taxpayer. This has been dealt with under returns processing module. iii. Assessments may also be amended where the tax payer has objected to the assessment raised refer to section 33B(4) of the VAT Act. This process will be handled under the objections module. These above assessments will be made either after an audit or without an audit. i.

2.2.1.1.

Assessments after an audit An audit will be carried out if; i. A taxpayer falls within the audit criteria.

ii. Where the Approving Authority Returns recommends for an audit during return approval. iii. Where there is a need for audit due to other circumstances. 2.2.1.2. Details of the assessment task After the audit has been completed by the audit authority, the system shall create a task for assessment in your (assessment authority) account. The task will display for you the following information; 16

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

a. Basic details of the taxpayer. This tab will show the TIN, legal name of the taxpayer, business address of the taxpayer, return period and type of assessment to be carried out as per the audit. b. The assessed liability as per the audit. This tab shall show the VAT return for tax period along with one more non editable column for assessed return data as per Audit. ETax shall show the final assessed tax liability of taxpayer after Audit. c. The penalty details you are required to indicate in this tab, the penalty section and your reasons for the penalty imposition. ETax will auto populate the description of the penalty section and the amount of penalty. d. Payment data for the return period for which the assessment has been initiated and any amounts that the taxpayer has paid.

e. The net outstanding liability This tab shall show following data for calculation of net amount payable by the taxpayer Opening O/S tax due for VAT [a] (as on Assessment period start date) Interest Payable on O/S VAT due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

You are required to approve the assessment task. However if you need further clarification from the taxpayer before you impose nay penalties, you should initiate the interview with the taxpayer. 2.2.1.3. Initiation and processing of the interview Refer to 2.1.1.2 above for details. Approval of assessment task Refer to 2.1.1.3 above for details Service of Notice for Assessment: Refer to 2.1.1.4 above for details. Assessment without audit The following types of assessment can be carried out without an audit 17

2.2.1.4.

2.2.1.5.

2.2.1.6.

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.2.1.7.

Administrative Estimated Assessment The task for administrative estimated assessment shall be created automatically if taxpayer has failed to file the return. eTax shall wait for 7+15 working days after the return due date for the taxpayer to file the return, If the taxpayer fails to file the return during this grace period, eTax shall automatically create the task for Administrative Estimated Assessment in your (Approving Authority Returns) account and then you shall be able to assign these tasks to respective Assessment Authorities. Details of the assessment task The task will display for you the following information; a. Basic details of the taxpayer. This tab will show the TIN, legal name of the taxpayer, business address of the taxpayer, return period and type of assessment to be carried out as per the audit. b. Estimation of liability this estimate will be done by you using the following formula. Previous month Turnover + Previous Year Inflation Rate ETax shall show the turnover of the previous month as per taxpayers return data available in eTax. Inflation rate will populate as per data configured in eTax for previous year. Average Turnover of last n months + Industry growth rate of previous year Based on number of months (n) input by you, eTax shall show the average turnover of the taxpayer as per return data available in eTax. Industry growth rate (as per ISIC code) will populate as per data configured in eTax for previous year. Industry average Turnover of current month The eTax shall show list of all taxpayers and corresponding VAT turnover for current month for same ISIC code along with average turnover. The e-Tax shall also provide the facility to select location wise and turnover wise top n taxpayers for same ISIC code and consider the average of the selected taxpayers during calculation of average turnover. You shall decide the Taxable turnover of the taxpayer based on above mentioned criterion. Tax payable shall be calculated as 18% of estimated Turnover. c. Penalty details you are required to indicate in this tab, the penalty section and your reasons for the penalty imposition. ETax will auto populate the description of the penalty section and the amount of penalty. d. Payment data for the return period for which the assessment has been initiated and any amounts that the taxpayer has paid.

2.2.1.8.

e. Other assessment details carried in the same period f. VAT Return and Payment data for previous return period 18

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

In this tab eTax shall show the return and payment details of previous return period for reference of Assessment Authority. g. The net outstanding liability This tab shall show following data for calculation of net amount payable by the taxpayer Opening O/S tax due for VAT [a] (as on Assessment period start date) Interest Payable on O/S VAT due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

2.2.1.9.

Initiation and processing of the interview You are required to approve the assessment task. However if you need further clarification from the taxpayer before you impose nay penalties, you should initiate the interview with the taxpayer. For details refer to 2.1.1.2 above for details Approval of assessment task Refer to 2.1.1.3 above for details Service of assessment number Refer to 2.1.1.4 above for details. Administrative additional assessment Initiation of Assessment task: You shall capture the assessment number of the Notice for Assessment issued previously against which additional assessment is to be carried out and click on Generate Assessment button to initiate the Assessment task. Details of Assessment task: The generated assessment task shall show following information in different tabs A. Basic Details of taxpayer This tab will show TIN of the taxpayer Legal Name of the taxpayer Business Address of the taxpayer Return period 19

2.2.1.10.

2.2.1.11.

2.2.1.12. 2.2.1.13.

2.2.1.14.

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

Type of assessment initiated Administrative Additional Assessment

B. Estimation of Liability This tab shall show the previous assessment data along with one more column to capture the assessed values for this assessment. If previous assessment was not an estimated assessment, eTax shall show complete return and assessment data along with one more column to capture the additional assessed values. ETax shall auto calculate all the derived fields and show the additional assessed tax payable. If previous return was an estimated assessment, eTax shall show the system generated values based on parameters configured for current Financial Year for calculation of liability amount as per previous assessment along with one more column to capture the additional assessed values. C. Penalty Details This tab shall provide the facility for you (Assessment Authority) to refer the penalty imposed previously and impose additional penalty on taxpayer, it shall show following fields. Penalty Section Description of Penalty Section autopopulated Amount of Penalty System generated for pre-defined penalties as per business rule Otherwise you shall provide the penalty amount. Reasons for imposition penalty

D. Payment data for the return period for which assessment has been initiated This tab shall show those payments done by taxpayer for VAT which have been adjusted against return period for which assessment has been initiated. E. Other Assessment details This tab shall show details of other assessments carried out for the same period. F. Net Outstanding Liability This tab shall show following data for calculation of net amount payable by the taxpayer Opening O/S tax due for VAT [a] (as on Assessment period start date) Interest Payable on O/S VAT due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

20

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.2.1.15.

Interview Initiation and Processing: For details refer to 2.1.1.2 above for details.

2.2.1.16.

Approval of Assessment Task: Refer to 2.1.1.3 above for details Service of Notice for Assessment: Refer to 2.1.1.4 above for details.

2.2.1.17.

2.2.1.18. 2.2.1.19.

Administrative Amended Assessment Initiation of Assessment task: You (the Assessment Authority) will capture the assessment number of the Notice for Assessment issued previously which is to be amended and click on Generate Assessment button to initiate the Assessment task. Details of Assessment task: The generated assessment task will show following information in different tabs A. Basic Details of taxpayer This tab will show TIN of the taxpayer Legal Name of the taxpayer Business Address of the taxpayer Return period Type of assessment initiated Administrative Amended Assessment

2.2.1.20.

B. Estimation of Liability This tab shall show the previous assessment data along with facility to update the assessed values for previous assessment. If previous assessment was not an estimated assessment, it shall show complete return and editable assessment data. ETax shall auto calculate and update all the derived fields and show the amended assessed values. If previous return was an estimated assessment, eTax shall show the system generated values based on parameters configured for current Financial Year for calculation of liability amount as per previous assessment along with facility to update these data to generate the amended values. C. Penalty Details This tab shall provide the facility for Assessment Authority to update the penalty amounts imposed during the assessment which is to be amended, it shall show following fields 21

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

Penalty Section Description of Penalty Section autopopulated Amount of Penalty System generated for pre-defined penalties as per business rule Otherwise Assessment Authority shall provide the penalty amount. Reasons for imposition penalty

D. Payment data for the return period for which assessment has been initiated This tab shall show those payments done by taxpayer for VAT which have been adjusted against return period for which assessment has been initiated. E. Other Assessment details This tab shall show details of other assessments carried out for the same period. F. Net Outstanding Liability This tab shall show following data for calculation of net amount payable by the taxpayer 2.2.1.21. Opening O/S tax due for VAT [a] (as on Assessment period start date) Interest Payable on O/S VAT due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

Interview Initiation and Processing: For details refer to 2.1.1.2 above for details. Approval of Assessment Task: Refer to 2.1.1.3 above for details Service of Notice for Assessment: Refer to 2.1.1.4 above for details.

2.2.1.22.

2.2.1.23.

2.3. Local Excise Duty

In the assessment module, assessments under LED will cover administrative assessments. Administrative assessments in LED arise in the following instances; a. Estimated assessments where the taxpayer does not file a return of income within the required time limit. b. Where the taxpayers return is found to be unsatisfactory this has been covered under Returns Processing Module (e.g. where a modified return advise is issued to the taxpayer an assessment will be generated for the taxpayer.) 22

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

c. Late payment or non payment of duty under section 56A(1)of the East African Excise Management Act of 1970. This process will be handled in the Payments Processing Module. d. Where there has been a short levy this will only be determined after an audit and will therefore be handled in the Audit Module. Time limit for raising an assessment A demand for tax that was short levied must be made within twelve months from the date on which a return was submitted. In any other case, the law is silent on the time limit. Additional and Amended Local Excise Duty Assessments: Additional or amended assessments arise where the Assessment Authority has obtained other information about the taxpayers activities for a tax period in which an assessment has already been raised and issued to the taxpayer. This information should be indicating a different liability from that indicated in the existing assessment. The law does not specifically provide for additional assessments to be made but section 58 of the East African Excise Management Act of 1970 provides for a demand of duty to be made where there was a short levy of duty. Additional assessments may also arise where the taxpayers return has been modified by URA and a modified return advice has been issued to the taxpayer. This has been dealt with under returns processing module. Limits in making a demand for duty that was short levied; A demand for duty that was short levied must be made within twelve months from the date on which a return was submitted unless such short levy was caused by fraud on the part of the person who should have paid the amount so short-levied. 2.3.1.1. Assessments after an audit An audit will be carried out if; i. A taxpayer falls within the audit criteria.

ii. Where the Approving Authority Returns recommends for an audit during return approval. iii. Where there is a need for audit due to other circumstances. 2.3.1.2. Details of the assessment task After the audit has been completed by the audit authority, the system shall create a task for assessment in your (assessment authority) account. The task will display for you the following information;

23

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

a. Basic details of the taxpayer. This tab will show the TIN, legal name of the taxpayer, business address of the taxpayer, return period and type of assessment to be carried out as per the audit. b. The assessed liability as per the audit. This tab shall show the LED return for tax period along with one more non editable column for assessed return data as per Audit. ETax shall show the final assessed tax liability of taxpayer after Audit. c. The penalty details you are required to indicate in this tab, the penalty section and your reasons for the penalty imposition. ETax will auto populate the description of the penalty section and the amount of penalty. d. Payment data for the return period for which the assessment has been initiated and any amounts that the taxpayer has paid.

e. The net outstanding liability This tab shall show following data for calculation of net amount payable by the taxpayer Opening O/S tax due for Excise Duty [a] (as on Assessment period start date) Interest Payable on O/S Excise Duty due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

You are required to approve the assessment task. However if you need further clarification from the taxpayer before you impose nay penalties, you should initiate the interview with the taxpayer. 2.3.1.3. Initiation and processing of the interview Refer to 2.1.1.2 above for details. Approval of assessment task Refer to 2.1.1.3 above for details Service of Notice for Assessment: Refer to 2.1.1.4 above for details. Assessment without audit The following types of assessment can be carried out without an audit Administrative Estimated Assessment The task for administrative estimated assessment shall be created automatically if taxpayer has failed to file the return. eTax shall wait for 7+15 working days after the return due date 24

2.3.1.4.

2.3.1.5.

2.3.1.6.

2.3.1.7.

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

for the taxpayer to file the return, If the taxpayer fails to file the return during this grace period, eTax shall automatically create the task for Administrative Estimated Assessment in your (Approving Authority Returns) account and then you shall be able to assign these tasks to respective Assessment Authorities. 2.3.1.8. Details of the assessment task The task will display for you the following information; a. Basic details of the taxpayer. This tab will show the TIN, legal name of the taxpayer, business address of the taxpayer, return period and type of assessment to be carried out as per the audit. b. Estimation of liability this estimate will be done by you using the following formula. (Previous month total delivery units for the product + Industry growth rate)X(Previous months exfactory price of product+ Previous Year Inflation Rate) ETax shall show the turnover of the previous month as per taxpayers return data available in eTax. Inflation rate will populate as per data configured in eTax for previous year. Average Turnover of last n months + Industry growth rate of current year Based on number of months (n) input by the Assessment Authority, eTax shall show the average turnover of the taxpayer as per return data available in eTax. Industry growth rate (as per ISIC code) will populate as per data configured in eTax for previous year. Industry average Turnover of current month e-tax shall show product wise average turnover from the current months excise returns filed by all the taxpayers dealing in manufacturing of products which this taxpayer has declared during local excise duty registration. The e-Tax shall also provide the facility to select location wise and turnover wise top n taxpayers and consider the average of the selected taxpayers during calculation of average turnover. The estimation of turnover for excise duty taxpayers who provide services, e-tax shall consider the turnover for airtime on mobile phones and airtime on landline separately. Now excise duty payable per Product shall be calculated as excise duty applied to estimated taxable deliveries of the product. Total Estimated Excise Duty shall be calculated as sum of excise duty payable per Product. Previous month Turnover + Previous Year Inflation Rate ETax shall show the turnover of the previous month as per taxpayers return data available in eTax. Inflation rate will populate as per data configured in eTax for previous year. 25

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

Average Turnover of last n months + Industry growth rate of previous year Based on number of months (n) input by you, eTax shall show the average turnover of the taxpayer as per return data available in eTax. Industry growth rate (as per ISIC code) will populate as per data configured in eTax for previous year.

Industry average Turnover of current month e-tax shall show average turnover per product from the current months excise returns filed by all the taxpayers dealing in manufacturing of products which this taxpayer has declared during local excise duty registration. The e-Tax shall also provide the facility to select location wise and turnover wise top n taxpayers and consider the average of the selected taxpayers during calculation of average turnover. The estimation of turnover for excise duty taxpayers who provide services, e-tax shall consider the turnover for airtime on mobile phones and airtime on landline separately.

Now Excise Duty payable per product shall be calculated as excise duty applied to estimated taxable deliveries per product. The total Estimated Excise Duty shall be calculated as sum of Excise duty per product. c. Penalty details you are required to indicate in this tab, the penalty section and your reasons for the penalty imposition. ETax will auto populate the description of the penalty section and the amount of penalty. d. Payment data for the return period for which the assessment has been initiated and any amounts that the taxpayer has paid.

e. Other assessment details carried in the same period f. LED Return and Payment data for previous return period In this tab eTax shall show the return and payment details of previous return period for reference of Assessment Authority. g. The net outstanding liability This tab shall show following data for calculation of net amount payable by the taxpayer Opening O/S tax due for Excise Duty [a] (as on Assessment period start date) Interest Payable on O/S Excise Duty due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

26

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.3.1.9.

Initiation and processing of the interview You are required to approve the assessment task. However if you need further clarification from the taxpayer before you impose nay penalties, you should initiate the interview with the taxpayer. For details refer to 2.1.1.2 above for details Approval of assessment task Refer to 2.1.1.3 above for details Service of assessment number Refer to 2.1.1.4 above for details.

2.3.1.10.

2.3.1.11.

2.3.1.12. 2.3.1.13.

Administrative additional assessment Initiation of Assessment task: You shall capture the assessment number of the Notice for Assessment issued previously against which additional assessment is to be carried out and click on Generate Assessment button to initiate the Assessment task. Details of Assessment task: The generated assessment task shall show following information in different tabs A. Basic Details of taxpayer This tab will show TIN of the taxpayer Legal Name of the taxpayer Business Address of the taxpayer Return period Type of assessment initiated Administrative Additional Assessment

2.3.1.14.

B. Estimation of Liability This tab shall show the previous assessment data along with one more column to capture the assessed values for this assessment. If previous assessment was not an estimated assessment, eTax shall show complete return and assessment data along with one more column to capture the additional assessed values. ETax shall auto calculate all the derived fields and show the additional assessed tax payable. If previous return was an estimated assessment, eTax shall show the system generated values based on parameters configured for current Financial Year for calculation of liability amount as per previous assessment along with one more column to capture the additional assessed values. C. Penalty Details 27

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

This tab shall provide the facility for you (Assessment Authority) to refer the penalty imposed previously and impose additional penalty on taxpayer, it shall show following fields. Penalty Section Description of Penalty Section autopopulated Amount of Penalty System generated for pre-defined penalties as per business rule Otherwise you shall provide the penalty amount. Reasons for imposition penalty

D. Payment data for the return period for which assessment has been initiated This tab shall show those payments done by taxpayer for VAT which have been adjusted against return period for which assessment has been initiated. E. Other Assessment details This tab shall show details of other assessments carried out for the same period. F. Net Outstanding Liability This tab shall show following data for calculation of net amount payable by the taxpayer 2.3.1.15. Opening O/S tax due for Excise Duty [a] (as on Assessment period start date) Interest Payable on O/S Excise Duty due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

Interview Initiation and Processing: For details refer to 2.1.1.2 above for details. Approval of Assessment Task: Refer to 2.1.1.3 above for details

2.3.1.16.

2.3.1.17.

Service of Notice for Assessment: Refer to 2.1.1.4 above for details.

2.3.1.18. 2.3.1.19.

Administrative Amended Assessment Initiation of Assessment task: You (the Assessment Authority) will capture the assessment number of the Notice for Assessment issued previously which is to be amended and click on Generate Assessment button to initiate the Assessment task. 28

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.3.1.20.

Details of Assessment task: The generated assessment task will show following information in different tabs A. Basic Details of taxpayer This tab will show TIN of the taxpayer Legal Name of the taxpayer Business Address of the taxpayer Return period Type of assessment initiated Administrative Amended Assessment

B. Estimation of Liability This tab shall show the previous assessment data along with facility to update the assessed values for previous assessment. If previous assessment was not an estimated assessment, it shall show complete return and editable assessment data. ETax shall auto calculate and update all the derived fields and show the amended assessed values. If previous return was an estimated assessment, eTax shall show the system generated values based on parameters configured for current Financial Year for calculation of liability amount as per previous assessment along with facility to update these data to generate the amended values. C. Penalty Details This tab shall provide the facility for Assessment Authority to update the penalty amounts imposed during the assessment which is to be amended, it shall show following fields Penalty Section Description of Penalty Section autopopulated Amount of Penalty System generated for pre-defined penalties as per business rule Otherwise Assessment Authority shall provide the penalty amount. Reasons for imposition penalty

D. Payment data for the return period for which assessment has been initiated This tab shall show those payments done by taxpayer for VAT which have been adjusted against return period for which assessment has been initiated. E. Other Assessment details This tab shall show details of other assessments carried out for the same period. F. Net Outstanding Liability 29

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

This tab shall show following data for calculation of net amount payable by the taxpayer 2.3.1.21. Opening O/S tax due for Excise Duty [a] (as on Assessment period start date) Interest Payable on O/S Excise Duty due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

Interview Initiation and Processing: For details refer to 2.1.1.2 above for details.

2.3.1.22.

Approval of Assessment Task: Refer to 2.1.1.3 above for details Service of Notice for Assessment: Refer to 2.1.1.4 above for details.

2.3.1.23.

2.4. GPBT

In the assessment module, assessments under GPBT will cover administrative assessments. Administrative assessments in GPBT arise in the following instances; a. Estimated assessments This will arise where the taxpayer has not submitted a return for a given tax period. b. Assessment arising out of the imposition of penalties under the Act. i. Where the taxpayer has not paid the whole of the tax due from him or her at the time prescribed by the law,(see section 5 of the Gaming and pool betting control and taxation Act). This procedure will be handled in the Payments Processing Module.

ii. Where the taxpayer, Not being a holder of permit sends money out of Uganda for purpose of making a gaming or pool bet. Knowingly or recklessly keeps false records. This will be covered in the Audit Module. Person who knowingly commits any act with the view to Fraudulent evasion of any tax, penalty or license fee is payable under the Act. See section 10 of the Gaming and pool betting control and taxation Act. This will be covered in the Audit Module. Time limits for raising an assessment There is no time limit provided for by the law. 30

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

The process described below will only cover an assessment in the following instances; a. Where the taxpayer who does not hold a permit, sends money out of Uganda for the purpose of making a gaming or pool bet. b. Where a tax payer has not filed his or her return within the required time. Additional and Amended Gaming and Pool Betting Tax Assessments: Additional or amended assessments arise where the Assessment Authority has obtained other information about the taxpayers activities for a tax period in which an assessment has already been raised and issued to the taxpayer. This information should be indicating a different liability from that indicated in the existing assessment. The respective law does not specifically provide for an additional assessment to be raised for a taxpayer where an assessment is existing for a particular tax period. Additional assessments may also arise where the taxpayers return has been modified by URA and a modified return advice has been issued to the taxpayer. This has been dealt with under returns processing module. 2.4.1.1. Assessments after an audit An audit will be carried out if; i. A taxpayer falls within the audit criteria.

ii. Where the Approving Authority Returns recommends for an audit during return approval. iii. Where there is a need for audit due to other circumstances. 2.4.1.2. Details of the assessment task After the audit has been completed by the audit authority, the system shall create a task for assessment in your (assessment authority) account. The task will display for you the following information; a. Basic details of the taxpayer. This tab will show the TIN, legal name of the taxpayer, business address of the taxpayer, return period and type of assessment to be carried out as per the audit. b. The assessed liability as per the audit. This tab shall show the GPBT return for tax period along with one more non editable column for assessed return data as per Audit. ETax shall show the final assessed tax liability of taxpayer after Audit. c. The penalty details you are required to indicate in this tab, the penalty section and your reasons for the penalty imposition. ETax will auto populate the description of the penalty section and the amount of penalty. d. Payment data for the return period for which the assessment has been initiated and any amounts that the taxpayer has paid. 31

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

e. The net outstanding liability This tab shall show following data for calculation of net amount payable by the taxpayer Opening O/S tax due for GPBT [a] (as on Assessment period start date) Interest Payable on O/S GPBT due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

You are required to approve the assessment task. However if you need further clarification from the taxpayer before you impose nay penalties, you should initiate the interview with the taxpayer. 2.4.1.3. Initiation and processing of the interview Refer to 2.1.1.2 above for details. Approval of assessment task Refer to 2.1.1.3 above for details Service of Notice for Assessment: Refer to 2.1.1.4 above for details. Assessment without audit The following types of assessment can be carried out without an audit Administrative Estimated Assessment The task for administrative estimated assessment shall be created automatically if taxpayer has failed to file the return. eTax shall wait for 7+15 working days after the return due date for the taxpayer to file the return, If the taxpayer fails to file the return during this grace period, eTax shall automatically create the task for Administrative Estimated Assessment in your (Approving Authority Returns) account and then you shall be able to assign these tasks to respective Assessment Authorities. Details of the assessment task The task will display for you the following information; a. Basic details of the taxpayer. This tab will show the TIN, legal name of the taxpayer, business address of the taxpayer, return period and type of assessment to be carried out as per the audit. b. Estimation of liability this estimate will be done by you using the following formula. Taxable gross receipt of previous month + Previous Year Inflation Rate 32

2.4.1.4.

2.4.1.5.

2.4.1.6.

2.4.1.7.

2.4.1.8.

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

ETax shall show the taxable gross receipt of the previous month as per taxpayers return data available in eTax. Inflation rate will populate as per data configured in eTax for previous year. Average Taxable gross receipts of last n months + Industry growth rate of previous year Based on number of months (n) input by the Assessment Authority, eTax shall show the average taxable gross receipt of the taxpayer as per return data available in eTax. Industry growth rate (as per ISIC code) will populate as per data configured in eTax for previous year. Industry average Taxable Income

eTax shall show list of all taxpayers registered for GPBT and corresponding taxable gross receipt for current month, Assessment Authority has to select the taxpayers and eTax shall show the average taxable gross receipt .

c. Penalty details you are required to indicate in this tab, the penalty section and your reasons for the penalty imposition. ETax will auto populate the description of the penalty section and the amount of penalty. d. Payment data for the return period for which the assessment has been initiated and any amounts that the taxpayer has paid.

e. Other assessment details carried in the same period. f. GPBT Return and Payment data for previous return period In this tab eTax shall show the return and payment details of previous return period for reference of Assessment Authority. g. The net outstanding liability This tab shall show following data for calculation of net amount payable by the taxpayer Opening O/S tax due for GPBT [a] (as on Assessment period start date) Interest Payable on O/S GPBT due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

33

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.4.1.9.

Initiation and processing of the interview You are required to approve the assessment task. However if you need further clarification from the taxpayer before you impose nay penalties, you should initiate the interview with the taxpayer. For details refer to 2.1.1.2 above for details Approval of assessment task Refer to 2.1.1.3 above for details Service of assessment number Refer to 2.1.1.4 above for details.

2.4.1.10.

2.4.1.11.

2.4.1.12. 2.4.1.13.

Administrative additional assessment Initiation of Assessment task: You shall capture the assessment number of the Notice for Assessment issued previously against which additional assessment is to be carried out and click on Generate Assessment button to initiate the Assessment task. Details of Assessment task: The generated assessment task shall show following information in different tabs A. Basic Details of taxpayer This tab will show TIN of the taxpayer Legal Name of the taxpayer Business Address of the taxpayer Return period Type of assessment initiated Administrative Additional Assessment

2.4.1.14.

B. Estimation of Liability This tab shall show the previous assessment data along with one more column to capture the assessed values for this assessment. If previous assessment was not an estimated assessment, eTax shall show complete return and assessment data along with one more column to capture the additional assessed values. ETax shall auto calculate all the derived fields and show the additional assessed tax payable. If previous return was an estimated assessment, eTax shall show the system generated values based on parameters configured for current Financial Year for calculation of liability amount as per previous assessment along with one more column to capture the additional assessed values. C. Penalty Details 34

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

This tab shall provide the facility for you (Assessment Authority) to refer the penalty imposed previously and impose additional penalty on taxpayer, it shall show following fields. Penalty Section Description of Penalty Section autopopulated Amount of Penalty System generated for pre-defined penalties as per business rule Otherwise you shall provide the penalty amount. Reasons for imposition penalty.

D. Payment data for the return period for which assessment has been initiated This tab shall show those payments done by taxpayer for VAT which have been adjusted against return period for which assessment has been initiated. E. Other Assessment details This tab shall show details of other assessments carried out for the same period. F. Net Outstanding Liability This tab shall show following data for calculation of net amount payable by the taxpayer 2.4.1.15. Opening O/S tax due for GPBT [a] (as on Assessment period start date) Interest Payable on O/S GPBT due [b] (as on Assessment period start date) Net Assessed Libaility for the return period [c] Total Penal tax tax imposed [d] Total Payments by the taxpayer which have been adjusted against the return period [e] Net payable for the assessment period [f] = [a+b+c+d-e]

Interview Initiation and Processing: For details refer to 2.1.1.2 above for details. Approval of Assessment Task: Refer to 2.1.1.3 above for details Service of Notice for Assessment: Refer to 2.1.1.4 above for details.

2.4.1.16.

2.4.1.17.

35

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK

2.4.1.18. 2.4.1.19.

Administrative Amended Assessment Initiation of Assessment task: You (the Assessment Authority) will capture the assessment number of the Notice for Assessment issued previously which is to be amended and click on Generate Assessment button to initiate the Assessment task. Details of Assessment task: The generated assessment task will show following information in different tabs A. Basic Details of taxpayer This tab will show TIN of the taxpayer Legal Name of the taxpayer Business Address of the taxpayer Return period Type of assessment initiated Administrative Amended Assessment

2.4.1.20.

B. Estimation of Liability This tab shall show the previous assessment data along with facility to update the assessed values for previous assessment. If previous assessment was not an estimated assessment, it shall show complete return and editable assessment data. ETax shall auto calculate and update all the derived fields and show the amended assessed values. If previous return was an estimated assessment, eTax shall show the system generated values based on parameters configured for current Financial Year for calculation of liability amount as per previous assessment along with facility to update these data to generate the amended values. C. Penalty Details This tab shall provide the facility for Assessment Authority to update the penalty amounts imposed during the assessment which is to be amended, it shall show following fields Penalty Section Description of Penalty Section autopopulated Amount of Penalty System generated for pre-defined penalties as per business rule Otherwise Assessment Authority shall provide the penalty amount. Reasons for imposition penalty

D. Payment data for the return period for which assessment has been initiated 36

URA DTD - ASSESSMENTS PROCESS GUIDE BOOK