Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Business Pan Critique - Final

Caricato da

Fernando HuertaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Business Pan Critique - Final

Caricato da

Fernando HuertaCopyright:

Formati disponibili

Business Pan Critique: EA Needle (Moot Corp Business Plan Competition) 1.

- Team work: The presentation was mainly performed by only one person, the rest of the team most of the time did not speak, that generates a perception of one people work rather than a team work. 2.- Lack of video Testimonials: They talk a lot about the positive feedback and support from prestigious medical centers but they did not show any video with an interview with those persons, I think that could gave a lot of credibility about the idea and the product instead of showing a video where a EA needle is going through yellow and grape. 3.- Institutional Support vs Personal Support: Most of the positive feedback is related to the willing to make beta test through a prestigious hospitals like John Hopkins and prestigious senior Radiologist, but in my experience top tier institutions and persons always want to be in safe ground, is not clear if they are supported by the institutions or persons who work in the institution. 4.- Lack of branding Strategy: Most of the intellectual property and patents are under the risk that a company or a person can turn around the legal stuff in order to modify the patent and submit a patent of their own. Companies specially in the Medical and Pharma industry also develop a very aggressive branding strategy in order establish a stronger relation with target market and I did not see during the presentation a branding strategy. 5.- Customer definition: During the presentation was not very clear, they say the marketing efforts will be applied to the senior radiologist in top institutions because the purchasing department thinks that problems does not exist with biopsies, however in my experience the purchasing department has a big role in this type of purchasing such as payment, delivery, warranty terms, etc. I think is very risky if they do not have the assumptions related to the commercial terms of the Hospitals because that can affect things as working capital as an instance. 6.- Economical benefit dilemma: The hospital will decrease their cost but also their revenues, and also the senior radiologist will take less time and could collect less money for this type of procedures. Is this convenient for the Hospital and the Radiologist? I think the document and the presentation has a lack of a clear analysis in terms of total revenue and profit why this technology is going to benefit the Radiologist and the Hospital because with current technology they are allowed to charge more specially the readiologist. 7.- Time frame for FDA approval and LOI with Medrad: They mention that they have one year to achieve a lot of things specially the 510(k) approval in order to execute the license however that is a lot of legal work to do seems to be not very realistic to me to achieve this goal.

8.- Relationship with J&J and Medrad: I think is not clear what will happen if Merad want to start a negotiation with other organization or entrepreneur and why this team do not have the exclusivity during the launching of the project in terms that block Medrad to start negotiations with other entity. Additionally they have mention that the current relation with Jonson & Jonson started via a person who works in the sales team but any contract is signed and they are under negotiation however is not clear what is the value for a company like J&J to establish a relationship with an entrepreneurial team, in my experiences big companies have big problems and priorities are based in order to find big solutions, so with the information provided is not clear why this is a great opportunity for J&J and what is going to stop them to start a negotiation directly with Medrad. 9.- Documented Sources: There are a lot of data mentioned on the witten report that is not well referenced metion the source name, report name and date, in my experience that is not a good point because make the written plan weaker in terms of credibility. 10.- Product Life Cycle vs Projected Revenue: During the presentation they explain that in this industry J&J launch a new product every 3 years but here is not clear how are they going to sustain the advantage during five years what happen if a new technology is obsolete, in the report they explain that they are not worried by new technologies for me is the same case as skype vs traditional telephone companies. 11.- Financial statements R&D expenses: Companies of this nature Medical Devices they strongly invest in R&D in order to sustain product competitiveness and positioning in the market and in the Financial statements they are assuming that in 5 years the product and the technology remains very competitive and with goods expectations after 5 years in my experience the reality says the opposite companies need to invest heavily in R&D. 12.- Product adoption: In my experience product adoptions of new technology takes time, they say that they are going to focus initially to 2 or four customers and those hospitals most of the procedures are going to be conducted by this type of product, I think that in a Hospital are several Radiologist and they have convince one by one and that takes time I think the adoption rate is very aggressive. 13. Positive Cash-Flow: Very aggressive I have never seen in my experience companies with this numbers, quick positive cash-flow and low deficit this only happens in an ideal world. 14.- Competitor reactions: The risk and the scenarios of competitors reactions are very underestimated , competition sales they equipment at $100,000 in my experience no-one let scape opportunities like that what happen if for a company is profitable a hospital because they acquire a lot of equipment from them and this company do not want to lose the hospital letting a new company goes in this competitor can subsidies the equipment because they have a stronger position.

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Wells Fargo Preferred CheckingDocumento3 pagineWells Fargo Preferred CheckingAarón CantúNessuna valutazione finora

- Ch7 HW AnswersDocumento31 pagineCh7 HW Answerscourtdubs78% (9)

- Kingfisherairlines ORGANISATION CHARTDocumento5 pagineKingfisherairlines ORGANISATION CHARTAhmad Yani S NoorNessuna valutazione finora

- PepsiCo Changchun Joint Venture Helpful HintsDocumento2 paginePepsiCo Changchun Joint Venture Helpful HintsLeung Hiu Yeung50% (2)

- ch01 Introduction Acounting & BusinessDocumento37 paginech01 Introduction Acounting & Businesskuncoroooo100% (1)

- M N DasturDocumento2 pagineM N DasturAnonymous 5lZJ470Nessuna valutazione finora

- Demand LetterDocumento45 pagineDemand LetterBilly JoeNessuna valutazione finora

- Moana Sands To Open New Resort in RarotongaDocumento3 pagineMoana Sands To Open New Resort in RarotongaPR.comNessuna valutazione finora

- Market & Competitor Analysis Template inDocumento25 pagineMarket & Competitor Analysis Template inSlidebooks Consulting87% (31)

- L Oréal Travel Retail Presentation SpeechDocumento6 pagineL Oréal Travel Retail Presentation Speechsaketh6790Nessuna valutazione finora

- FGH60N60SFD: 600V, 60A Field Stop IGBTDocumento9 pagineFGH60N60SFD: 600V, 60A Field Stop IGBTManuel Sierra100% (1)

- For: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXDocumento2 pagineFor: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXLiza L. PadriquezNessuna valutazione finora

- 1 .Operating Ratio: Year HUL Nestle Britannia MaricoDocumento17 pagine1 .Operating Ratio: Year HUL Nestle Britannia MaricoSumith ThomasNessuna valutazione finora

- Major Recessionary Trends in India and Ways To Overcome It: Presented byDocumento34 pagineMajor Recessionary Trends in India and Ways To Overcome It: Presented byYogesh KendeNessuna valutazione finora

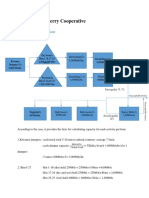

- National Cranberry Case SolutionDocumento4 pagineNational Cranberry Case SolutionAli Umer MughalNessuna valutazione finora

- Return, Risk, and The Security Market LineDocumento45 pagineReturn, Risk, and The Security Market Lineotaku himeNessuna valutazione finora

- Republic of The Philippines: Department of Transportation Land Transportation Office Regional Office No. VIIDocumento1 paginaRepublic of The Philippines: Department of Transportation Land Transportation Office Regional Office No. VIIJay SuarezNessuna valutazione finora

- 1 Rural Indebtedness, Assets and Credit: Inter-State Variations in IndiaDocumento4 pagine1 Rural Indebtedness, Assets and Credit: Inter-State Variations in IndiaashwatinairNessuna valutazione finora

- Irfz 48 VDocumento8 pagineIrfz 48 VZoltán HalászNessuna valutazione finora

- Tata-Corus Acquisition: Group2Documento25 pagineTata-Corus Acquisition: Group2Bharti GuptaNessuna valutazione finora

- Sybcom PpiDocumento6 pagineSybcom PpiMaxson Miranda100% (2)

- Prospects and Challenges of The Emerging Oil and Gas Industry in GhanaDocumento8 pagineProspects and Challenges of The Emerging Oil and Gas Industry in GhanaEsther AdutwumwaaNessuna valutazione finora

- BenihanaDocumento6 pagineBenihanaaBloomingTreeNessuna valutazione finora

- L3Industrysegmentation 2014Documento27 pagineL3Industrysegmentation 2014albertfisher100% (1)

- CA PracticeDocumento2 pagineCA PracticeNatalia CalaNessuna valutazione finora

- Income Statement PDFDocumento4 pagineIncome Statement PDFMargarete DelvalleNessuna valutazione finora

- Build, Operate and TransferDocumento11 pagineBuild, Operate and TransferChloe OberlinNessuna valutazione finora

- Model Project For Milk Processing Plant - NABARDDocumento39 pagineModel Project For Milk Processing Plant - NABARDPraneeth Cheruvupalli0% (1)

- Interweave Knits Sum13Documento124 pagineInterweave Knits Sum13Michelle Arroyave-Mizzi100% (25)

- Drink Recipe Guide 2009Documento63 pagineDrink Recipe Guide 2009Joel Suraci100% (1)